Book Publishing Paper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437131 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Book Publishing Paper Market Size

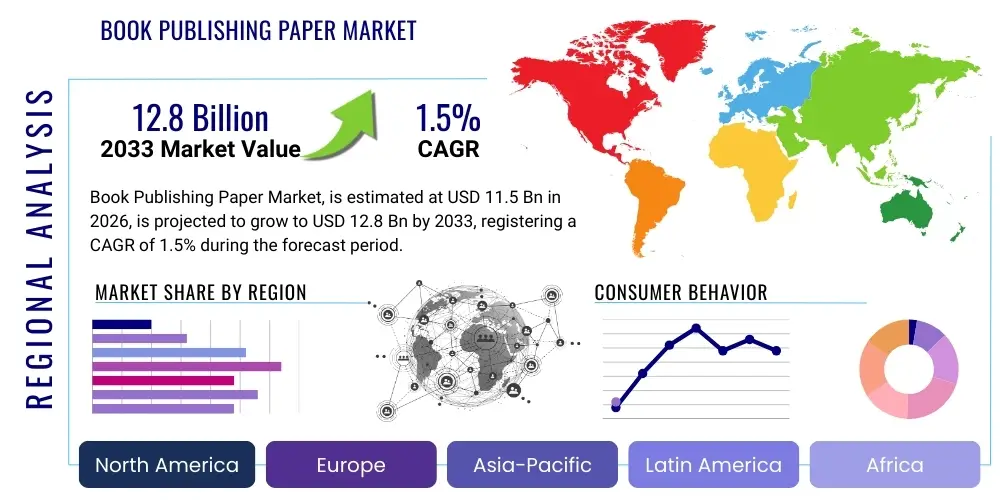

The Book Publishing Paper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 1.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 12.8 Billion by the end of the forecast period in 2033.

Book Publishing Paper Market introduction

The Book Publishing Paper Market encompasses the global trade and utilization of various grades of paper specifically manufactured for the printing and binding of books, including textbooks, novels, trade publications, and specialty books. This market segment is characterized by specialized requirements concerning bulk, opacity, brightness, texture, and durability, differentiating it from standard printing and writing papers. Products range from high-quality coated papers used for art books and glossy magazines to uncoated, high-bulk mechanical or chemical pulp papers preferred for mass-market novels and educational texts. Major applications include educational publishing, trade fiction and non-fiction, reference materials, and customized print-on-demand services. The primary benefit of specialized book paper is the optimization of the reading experience and production efficiency, specifically by reducing weight (through higher bulk) and minimizing show-through (high opacity). Key driving factors include continued global literacy initiatives, demand for physical textbooks in developing economies, and the resurgence of vinyl and physical media consumption preferences among niche demographics in mature markets, although offset by digital substitution pressures.

Book Publishing Paper Market Executive Summary

The Book Publishing Paper Market is navigating a complex landscape defined by secular decline in some segments, coupled with resilient demand in niche and educational sectors. Business trends show a strategic consolidation among major paper manufacturers, focusing on operational efficiency and sustainable fiber sourcing (FSC/PEFC certification) to meet stringent publisher requirements. The integration of specialty papers, such as those optimized for digital inkjet printing (catering to Print-on-Demand models), represents a significant segment trend mitigating volume losses from traditional offset printing. Regionally, the market is shifting; while North America and Europe face declining demand due to rapid digital migration, the Asia Pacific region, particularly India and China, is experiencing robust growth driven by massive educational programs and increasing middle-class consumption of printed media. Overall, the market remains sensitive to fluctuations in pulp prices, energy costs, and evolving environmental regulations concerning deforestation and mill emissions, necessitating continuous innovation in lightweight, high-opacity paper grades to maintain profitability and sustainability compliance.

AI Impact Analysis on Book Publishing Paper Market

User queries regarding AI's impact typically center on two major themes: efficiency in the print supply chain and the future volume of printed books. Users frequently ask if AI-driven content creation will lead to an explosion of new titles requiring physical printing, or conversely, if AI text-to-speech technologies will accelerate the shift towards digital formats. There is also significant interest in how AI can optimize paper procurement (predictive demand forecasting, inventory management) and enhance quality control in manufacturing (detecting paper defects). The general expectation is that while AI will not directly replace physical paper, it will profoundly optimize the print ecosystem. AI tools are expected to streamline editorial processes, leading to quicker publishing cycles, which necessitates more flexible and responsive paper supply models, especially favoring Print-on-Demand (PoD) capabilities. Furthermore, AI-enhanced personalization in textbook creation could drive demand for customized, shorter-run physical books, counterbalancing the overall digital shift.

- Supply Chain Optimization: AI algorithms enhance predictive modeling for paper demand, reducing inventory waste and optimizing logistics between paper mills and book printers.

- Enhanced Print-on-Demand (PoD): AI drives efficient micro-segmentation and personalization, increasing the viability and volume of short-run printing, often relying on specialized inkjet-compatible paper stocks.

- Content Generation Efficiency: AI accelerates book manuscript creation and translation, potentially increasing the number of titles entering the market that require physical manifestation.

- Manufacturing Quality Control: AI vision systems monitor paper production lines in real-time, instantly identifying flaws related to texture, color, and coating, thereby improving consistency and reducing defects.

- Digital Substitution Acceleration: While positive impacts exist, AI tools for enhanced e-book reading experiences, accessibility features, and sophisticated audiobook production could accelerate the long-term migration away from physical books in certain segments.

- Sustainability Tracking: AI provides advanced tools for tracing the origin of wood pulp, ensuring compliance with strict sustainability standards (e.g., FSC/PEFC tracking) required by major publishers.

DRO & Impact Forces Of Book Publishing Paper Market

The Book Publishing Paper Market is shaped by significant drivers such as robust demand in emerging markets for educational materials and a growing consumer preference for tactile reading experiences over digital formats among specific demographics in mature markets. These drivers are tempered by major restraints, primarily the ongoing, structural shift towards e-books and digital content consumption, coupled with volatile raw material (pulp) and energy costs that compress manufacturer profit margins. Opportunities are present in the expansion of high-bulk, lightweight paper grades designed for optimal postal efficiency, the integration of advanced digital printing papers (inkjet and toner), and strategic investments in sustainable, recycled fiber production. The primary impact forces include the increasing global emphasis on sustainability and circular economy principles, which compels paper mills to invest heavily in de-inking and recycling infrastructure, and the persistent technological substitution force exerted by tablets and reading devices, which constantly threatens the foundational volume of the market.

Segmentation Analysis

The Book Publishing Paper Market is primarily segmented by Paper Type, Application, and Pulp Source, reflecting the diverse requirements of the publishing industry and the manufacturing differences in specialized paper production. Segmentation based on paper type is critical, as it dictates the end-use and pricing structure, ranging from high-volume mechanical papers used in mass-market fiction to premium, acid-free papers required for archival editions. Application segmentation helps analyze demand shifts between the resilient educational sector and the more volatile trade publishing sector. Further, the reliance on virgin or recycled pulp source defines the environmental footprint and influences procurement decisions by environmentally conscious publishers.

- By Paper Type

- Coated Paper (Matte, Gloss)

- Uncoated Paper (Antique, Smooth, Textured)

- Lightweight Printing Paper (LWP)

- Digital Printing Paper (Inkjet optimized, Toner optimized)

- By Application

- Trade Publishing (Fiction, Non-Fiction)

- Educational Publishing (Textbooks, Workbooks)

- Religious Publishing

- Specialty & Reference Books

- By Pulp Source

- Virgin Fiber (Chemical Pulp, Mechanical Pulp)

- Recycled Fiber

- Alternative Fibers (Bamboo, Hemp)

- By Format Type

- Hardcover

- Softcover (Paperback)

Value Chain Analysis For Book Publishing Paper Market

The Book Publishing Paper value chain is intricate, beginning with the upstream sourcing of raw materials, primarily virgin or recovered wood fiber, and extending through complex manufacturing processes before reaching downstream distributors and end-users. Upstream analysis focuses on sustainable forest management (FSC/PEFC certified sourcing) and the procurement of specific pulp grades (e.g., groundwood, bleached chemical thermal mechanical pulp - BCTMP). The cost and availability of these raw materials are highly sensitive to global commodity cycles and environmental compliance costs. Midstream activities involve high-capital paper milling, including pulping, sheeting, coating, and calendering processes, which require significant energy inputs and sophisticated chemical handling to achieve the precise technical specifications demanded by publishers, such particularly for opacity and bulk.

Downstream activities are dominated by specialized distributors and logistics providers who handle massive paper rolls or pallets, managing complex inventory systems to serve large commercial printers and regional printing hubs. The distribution channel structure is bifurcated: direct sales channels involve paper manufacturers contracting directly with large multinational publishers (e.g., Pearson, Penguin Random House) for standardized, high-volume orders. This ensures tight quality control and favorable pricing. Conversely, smaller and mid-sized printing houses often rely on indirect channels, utilizing paper merchants and distributors who provide varied stock keeping units (SKUs) and localized, just-in-time delivery services.

The efficiency of the distribution network is crucial in managing the high logistics costs associated with paper. Direct channels benefit from streamlined supply chains but require significant commitment from both parties. Indirect channels, while offering flexibility, introduce additional margin layers. A notable trend is the increasing dominance of digitally integrated distribution models, where printers use software platforms to track paper inventory and consumption, placing automated orders with mills or merchants to support responsive Print-on-Demand fulfillment models, thereby minimizing paper waste and obsolescence.

- Upstream Analysis: Sustainable forestry, pulp production (chemical/mechanical), waste paper collection, and specialized chemical supply (coating, sizing agents).

- Midstream Manufacturing: Paper milling (forming, pressing, drying), coating application, calendering, slitting, and quality assurance testing (opacity, bulk, brightness).

- Downstream Distribution: Paper merchants, specialized logistics providers, regional warehouses, and direct sales channels to large commercial book printers.

- End-Users: Publishers (Trade, Educational, Religious), independent authors utilizing PoD services, and government printing offices.

Book Publishing Paper Market Potential Customers

The primary potential customers and end-users of the Book Publishing Paper Market are the various entities involved in the creation, production, and distribution of physical books. This includes major multinational trade publishing houses, which require vast quantities of diverse paper types for their fiction and non-fiction catalogs, ranging from low-cost mechanical papers for mass-market paperbacks to premium coated papers for gift books. Educational publishers represent another critical customer segment, characterized by cyclical demand tied to academic calendars and governmental textbook procurement cycles, often demanding specific bulk and archival properties for heavy, repeated use.

Beyond traditional publishing giants, the market serves numerous smaller, niche publishers specializing in high-quality limited editions, religious texts, or academic journals, who prioritize specialty papers like high-opacity cream-wove or acid-free stocks. Furthermore, the rapid growth of the Print-on-Demand (PoD) sector has established digital printing service providers and self-publishing platforms (e.g., IngramSpark, Amazon KDP Print) as substantial customers. These PoD customers require flexible, high-quality digital printing papers that can be efficiently processed through modern inkjet and toner presses, often placing smaller, but highly frequent, orders that necessitate sophisticated supply chain management from the paper mills.

Finally, governmental agencies and non-profit organizations constitute a steady, though often price-sensitive, customer base. Governments regularly purchase paper for state-sponsored educational programs, public libraries, and official records. The buying criteria for these customers are typically stringent regarding environmental certifications (e.g., minimum recycled content mandates) and must meet international standards for durability and color stability. Understanding the unique logistical and quality requirements of each customer segment—from the massive volume needs of trade publishers to the specialized short-run needs of PoD services—is essential for paper manufacturers to tailor their production capabilities and distribution strategies effectively.

- Major Trade Publishing Houses: Large multinational corporations (e.g., Hachette, HarperCollins) driving volume demand for fiction and general non-fiction.

- Educational & Academic Publishers: Companies focused on K-12, higher education textbooks, and scholarly journals (e.g., McGraw Hill, Elsevier).

- Print-on-Demand (PoD) Service Providers: Digital printing hubs and platforms fulfilling customized, short-run orders (e.g., Lightning Source).

- Religious and Specialty Presses: Publishers requiring durable, thin paper with high opacity (e.g., Bible paper).

- Commercial Book Printers: Direct buyers of bulk paper rolls used in high-speed offset and web presses.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 12.8 Billion |

| Growth Rate | 1.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | International Paper, Resolute Forest Products, Domtar Corporation, Smurfit Kappa Group, Stora Enso, Nippon Paper Industries, UPM-Kymmene Oyj, Oji Holdings Corporation, Asia Pulp & Paper (APP), Mondi Group, Ahlstrom-Munksjö, Metsä Group, Packaging Corporation of America (PCA), Kruger Inc., Sylvamo Corporation, Sun Paper Group, Chenming Paper, Nine Dragons Paper, Shanying International, Heinzel Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Book Publishing Paper Market Key Technology Landscape

The Book Publishing Paper market is heavily influenced by manufacturing process innovations aimed at improving paper characteristics while reducing material usage and environmental impact. A core technological focus is the development of High-Bulk, Low-Weight (HBLW) papers. These papers utilize specialized fiber treatments and fillers (such as calcium carbonate) to create a sheet with high thickness (bulk) relative to its basis weight, which is critical for reducing book shipping costs without making the book feel insubstantial. Advanced calendering and surface finishing techniques are employed to maintain acceptable smoothness and print quality on these low-density substrates, ensuring they perform reliably on high-speed web offset presses.

Another pivotal technological area is the rise of specialized papers for digital printing, particularly inkjet technology. As publishers increasingly transition to Print-on-Demand (PoD) models to manage inventory risks, the demand for paper optimized for high-speed digital presses has surged. These papers require specific coatings or surface treatments to control ink absorption, prevent feathering, and ensure rapid drying times, which are essential for the economic viability of industrial inkjet presses. Manufacturers are investing heavily in water-based chemistry solutions for these coatings, balancing superior print performance with environmental compatibility, addressing publisher demands for greener production methods.

Furthermore, technology is playing a crucial role in enhancing the sustainability profile of the industry. This includes improvements in de-inking and recycling processes, allowing mills to incorporate higher percentages of high-quality post-consumer waste (PCW) without compromising brightness or strength, thereby reducing reliance on virgin fiber. Innovations in closed-loop water systems and increased automation in mill operations are also standard technological upgrades, aimed at minimizing waste, lowering energy consumption, and improving overall cost-efficiency in a market pressured by declining volume and rising input costs. These technological shifts are mandatory for maintaining relevance and competitiveness, particularly in regions with stringent environmental regulations like Europe.

- High-Bulk, Low-Weight (HBLW) Production: Techniques to maximize paper thickness while reducing basis weight, optimizing postal and freight costs for publishers.

- Digital Inkjet Optimization: Development of specialized coatings and surface chemistries to ensure quick drying, high resolution, and color fidelity on high-speed industrial inkjet presses for PoD.

- Advanced Calendering and Finishing: Precision manufacturing processes used to control paper smoothness and bulk consistently across large production runs.

- Chemical Pulping Innovations: Implementation of enhanced bleaching processes (e.g., elemental chlorine-free, TCF) and chemical recovery systems to improve environmental compliance.

- Sustainable Fiber Certification & Tracking: Digital systems used to track and verify FSC/PEFC certified wood fiber throughout the supply chain, mandatory for major publishing contracts.

Regional Highlights

- North America

The North American Book Publishing Paper Market is characterized by maturity and ongoing contraction, driven primarily by the strong penetration of digital reading platforms, particularly in the trade segment. However, this market remains the global leader in adopting technologically advanced papers optimized for digital printing and PoD fulfillment, reflecting a strategic shift by publishers to minimize inventory risk. Demand for physical textbooks, although facing competition from digital curricula, remains a stabilizing factor, particularly in Canada and the U.S. school systems. Environmental regulation and publisher mandates for certified sustainable papers are exceptionally strict here, leading to high procurement standards focused on FSC certification and high recycled content percentages. Manufacturers in this region prioritize cost efficiency and product differentiation through specialty paper grades.

Market dynamics in North America are heavily influenced by the large-scale consolidation of printing operations and the need for responsive, efficient supply chains to service major retail chains and online distributors. The shift away from massive offset runs towards smaller, customized digital runs means regional paper mills must adjust their inventory management and product lines to support faster turnover and higher complexity in SKUs. Furthermore, the increasing popularity of high-end, aesthetically pleasing physical books (often referred to as 'book as object') among consumers is driving a niche demand for premium coated and specialty uncoated stocks, counteracting some of the broader volumetric decline.

- Europe

Europe represents a highly segmented and environmentally conscious market for book publishing paper. The region is a leader in sustainability, with robust regulatory frameworks regarding recycled content, mill emissions, and forest management (e.g., EU Timber Regulation). Demand is stable but slow-growing, supported by resilient literary culture in countries like Germany and the UK, where physical book consumption remains strong. European publishers often favor aesthetic qualities, demanding high opacity, low-acid, and naturally colored papers, frequently utilizing cream-wove and antique finishes for literary fiction and specialized academic texts. The regional market is highly competitive, often sourced locally from major European pulp and paper manufacturers known for their certified sustainable practices.

A crucial factor in the European market is the implementation of innovative logistics models to service a fragmented market structure comprising many smaller, independent publishers alongside global giants. Digital printing adoption is widespread, mirroring North America, but with a greater emphasis on specialized, high-fidelity papers suitable for printing complex, multi-lingual educational materials and graphic novels. The reliance on imported energy and the strict carbon pricing mechanisms within the EU significantly influence manufacturing costs, compelling regional paper producers to invest continually in energy efficiency improvements and biomass utilization.

- Asia Pacific (APAC)

The Asia Pacific region is the primary engine of growth for the Book Publishing Paper Market, fueled by massive population bases, rising literacy rates, and rapid economic development, especially in South Asia and Southeast Asia. Countries like India, China, and Indonesia have immense, government-driven demand for educational textbooks and supplementary materials, leading to high-volume orders for commodity-grade, cost-effective printing papers. The educational sector here significantly outweighs the trade publishing sector in terms of paper consumption volume, making price competitiveness and consistent supply critical market determinants.

While the demand for physical books is robust, the region also faces supply chain complexity due to vast geographical distances and inconsistent infrastructure. Sustainability standards are varied; while advanced economies like Japan and South Korea adhere to global standards, emerging markets are prioritizing volume and cost effectiveness, although environmental compliance pressure is steadily increasing. Local paper mills, often large-scale integrated producers, dominate the supply, focusing on maximizing throughput and optimizing efficiency to meet explosive regional educational needs. The rapid urbanization and growth of the middle class also contribute to growing demand for higher-quality trade books and specialty publications.

- Latin America

The Latin American Book Publishing Paper Market shows moderate, but often volatile, growth, heavily influenced by regional economic stability and fluctuating import duties. Educational demand remains substantial, particularly in countries like Brazil and Mexico, where public sector procurement drives significant paper volume. However, the market is highly susceptible to exchange rate volatility, as many specialty papers and advanced printing equipment must be imported, significantly affecting publisher costs and paper purchasing power. Local paper manufacturing capacity exists, focusing mainly on common grades, but dependence on international suppliers for high-quality coated and digital papers is common.

Market strategies in Latin America often involve managing complex logistical challenges and navigating trade agreements. Publishers are increasingly exploring localized printing solutions and PoD to mitigate inventory risk related to economic instability. The cultural importance of physical books, particularly fiction and religious texts, maintains a stable baseline demand. Focus areas for paper manufacturers serving this region include offering competitive pricing structures and ensuring a reliable supply chain despite macroeconomic uncertainties.

- Middle East and Africa (MEA)

The MEA region presents a diverse market landscape. In the Middle East, demand is characterized by high requirements for educational and religious texts (often requiring specialized thin, high-opacity papers), supported by government spending on education. Quality standards are high, often relying on imported European and Asian specialty papers. In contrast, the African continent represents a rapidly expanding opportunity, driven by demographic growth and urgent needs for educational infrastructure development. This market is highly price-sensitive, with significant volume required for basic textbooks, often sourced from large-scale manufacturers in Asia.

Key challenges across MEA include underdeveloped distribution infrastructure, political instability in certain sub-regions, and currency fluctuation impacting import costs. Opportunities lie in partnering with international development organizations and government agencies focusing on literacy programs. Sustainability requirements are less standardized than in Europe, but manufacturers are increasingly required to provide proof of ethical sourcing to secure major international tenders, particularly those funded by aid organizations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Book Publishing Paper Market.- International Paper

- Resolute Forest Products

- Domtar Corporation

- Smurfit Kappa Group

- Stora Enso

- Nippon Paper Industries

- UPM-Kymmene Oyj

- Oji Holdings Corporation

- Asia Pulp & Paper (APP)

- Mondi Group

- Ahlstrom-Munksjö

- Metsä Group

- Packaging Corporation of America (PCA)

- Kruger Inc.

- Sylvamo Corporation

- Sun Paper Group

- Chenming Paper

- Nine Dragons Paper

- Shanying International

- Heinzel Group

Frequently Asked Questions

Analyze common user questions about the Book Publishing Paper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Book Publishing Paper Market?

The primary factor driving significant growth is the sustained, high-volume demand for educational materials, particularly textbooks and workbooks, in rapidly developing and populous economies across the Asia Pacific region, offsetting structural declines in Western trade publishing markets.

How is the rise of Print-on-Demand (PoD) affecting paper manufacturers?

The shift to PoD necessitates a pivot by paper manufacturers towards producing high-performance, specialized papers optimized for industrial digital inkjet and toner printing technologies. This model favors smaller, more frequent orders and requires flexible, faster supply chain fulfillment capabilities rather than large, infrequent bulk orders.

What are High-Bulk, Low-Weight (HBLW) papers and why are they important?

HBLW papers are engineered to have high thickness (bulk) relative to their light basis weight. They are crucial because they reduce the overall weight of the finished book, significantly lowering shipping and postal costs for publishers, which is a major operational expense.

Which paper certifications are most critical for securing major publishing contracts?

Forest Stewardship Council (FSC) and Programme for the Endorsement of Forest Certification (PEFC) certifications are critical. Major publishers mandate these standards to verify that the pulp originates from sustainably and ethically managed forests, aligning with corporate sustainability goals and consumer expectations.

How do fluctuating pulp prices impact the profitability of the Book Publishing Paper Market?

Pulp represents the largest single cost component in paper manufacturing. Significant volatility in pulp prices, often driven by global commodity cycles and energy costs, directly compresses the profit margins of paper manufacturers, necessitating continuous investments in operational efficiency and cost pass-through mechanisms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager