Boron Carbide Nozzles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437917 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Boron Carbide Nozzles Market Size

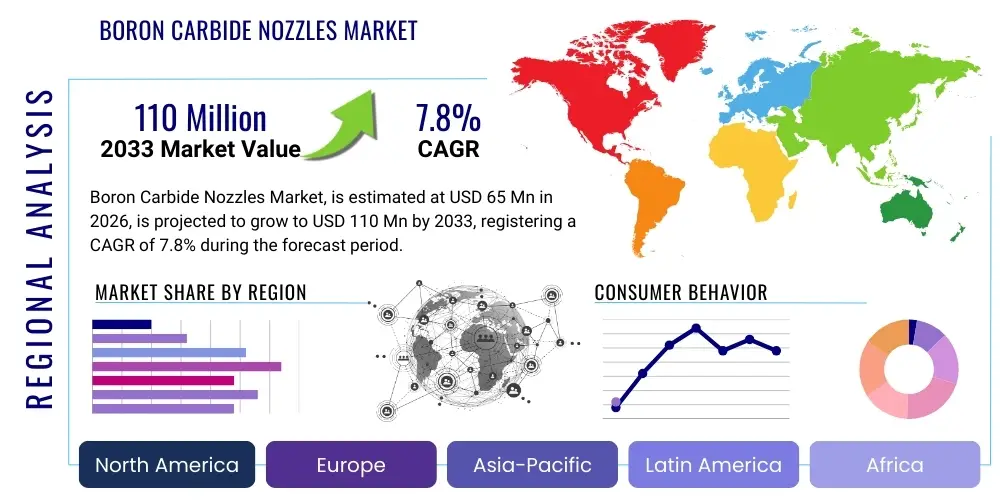

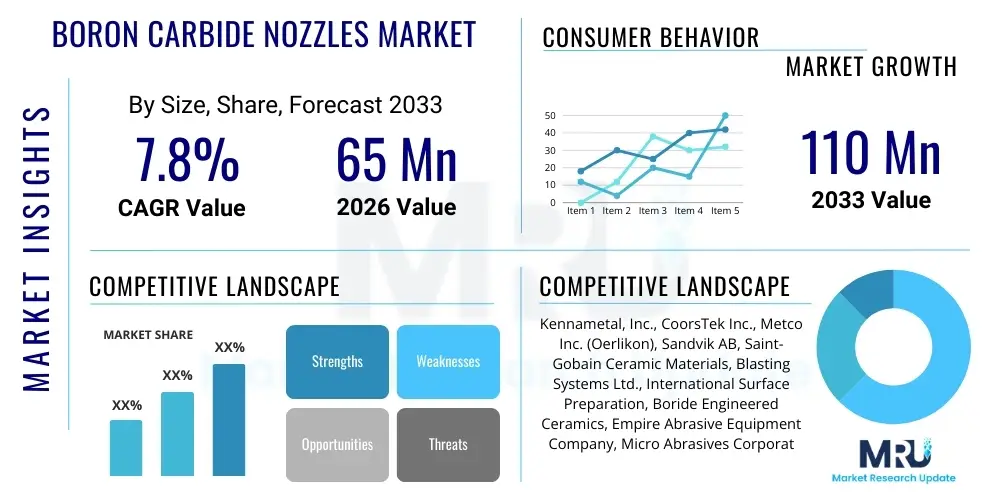

The Boron Carbide Nozzles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 65 Million in 2026 and is projected to reach USD 110 Million by the end of the forecast period in 2033.

Boron Carbide Nozzles Market introduction

The Boron Carbide Nozzles Market encompasses the production, distribution, and consumption of nozzles fabricated from boron carbide (B4C), a ceramic material renowned for its exceptional hardness, low density, and high melting point, making it one of the most durable materials available for industrial applications. These nozzles are primarily utilized in severe wear environments where conventional materials like tungsten carbide, stainless steel, or aluminum oxide rapidly degrade. Boron carbide is chemically inert, offering superior resistance to corrosion and erosion, which is crucial for maximizing operational lifespan and efficiency in demanding sectors such as aerospace, infrastructure, and heavy manufacturing. The inherent properties of B4C, including a Mohs hardness of approximately 9.3, position these nozzles as the preferred solution for highly abrasive processes, significantly reducing downtime and maintenance costs associated with nozzle replacement.

Boron carbide nozzles serve critical functions across diverse industrial applications, most notably in abrasive blasting, where they deliver compressed air and abrasive media (such as sand, steel grit, or garnet) at high velocities for surface preparation, cleaning, and etching. Furthermore, they are extensively used in high-pressure fluid applications, including water jet cutting, slurry transportation, and specialized spraying systems, owing to their ability to maintain precise internal geometry despite continuous material impingement. The major applications driving market growth include shipyard maintenance, infrastructure repair (bridge and road maintenance), foundry operations for deburring and cleaning castings, and petrochemical processing where highly resilient components are mandatory. The shift toward sustainable manufacturing processes that require optimized material usage and increased energy efficiency further promotes the adoption of B4C nozzles.

The market benefits significantly from several inherent driving factors, central among which is the demand for components with extended operational lifecycles in harsh operating conditions. The primary benefit derived from utilizing boron carbide nozzles is their unparalleled wear resistance, offering operating longevity often ten to twenty times greater than that of tungsten carbide or ceramic alternatives, thereby substantially lowering the total cost of ownership. The increasing global investment in infrastructure renewal projects, coupled with the stringent quality requirements in industries like aerospace and medical device manufacturing that rely on precise surface finishes, fuels the sustained demand for high-performance blasting and spraying equipment incorporating these advanced ceramic nozzles. Technological advancements in powder metallurgy and sintering techniques further enhance the consistency and quality of B4C nozzle manufacturing.

Boron Carbide Nozzles Market Executive Summary

The Boron Carbide Nozzles Market is characterized by robust growth driven by escalating demand from critical heavy industries prioritizing operational durability and efficiency. Business trends indicate a strong focus on manufacturing innovation, specifically in hot isostatic pressing (HIP) and pressureless sintering techniques, which enhance the structural integrity and uniformity of B4C components, allowing for the creation of more complex nozzle geometries tailored to specific flow dynamics. Strategic mergers, acquisitions, and partnerships are prevalent as companies seek to consolidate expertise in advanced ceramics production and expand their global distribution networks, particularly targeting emerging industrial hubs in Asia Pacific. Furthermore, there is a distinct trend toward customization, offering bespoke nozzle solutions optimized for specific abrasive media sizes and pressures, moving away from standardized products to maximize user benefits regarding blast pattern precision and reduced media consumption. Supply chain resilience, ensuring a steady supply of high-purity boron raw materials, remains a key focus area for market leaders.

Regionally, the market exhibits varied maturity levels. North America and Europe currently represent the largest consumption bases, underpinned by established heavy machinery sectors, rigorous industrial maintenance schedules, and significant investments in aerospace and defense, where performance metrics are non-negotiable. However, the Asia Pacific region is projected to register the fastest growth rate, fueled by rapid industrialization, large-scale infrastructure development projects, especially in China and India, and the burgeoning shipbuilding and automotive sectors adopting advanced surface treatment technologies. Latin America and the Middle East & Africa are emerging markets showing gradual adoption, primarily driven by investments in oil and gas infrastructure, mining, and general construction activities. Trade policies and raw material tariffs also influence regional competitive landscapes, impacting the final cost structure for end-users across these geographies.

Segmentation trends highlight the dominance of the Abrasive Blasting Nozzles segment, which accounts for the largest market share due to the widespread use of B4C in surface preparation across metal fabrication and corrosion control industries. By application type, general maintenance and construction remain pivotal segments, though specialized segments like aerospace component finishing and semiconductor manufacturing are demonstrating accelerated growth due to the need for ultra-high precision and contamination control. In terms of size, medium-sized nozzles (bore diameter between 6mm and 10mm) are highly consumed for general industrial applications, but the demand for larger nozzles used in heavy-duty blasting chambers is steadily increasing. The market dynamics are shifting toward performance-based selling, where the longevity guarantee and efficiency gains of B4C nozzles outweigh the initial premium pricing compared to inferior material alternatives.

AI Impact Analysis on Boron Carbide Nozzles Market

User queries regarding the impact of Artificial Intelligence (AI) on the Boron Carbide Nozzles Market predominantly center around three core areas: how AI can optimize the complex ceramic manufacturing process, its role in predictive maintenance for industrial equipment utilizing these nozzles, and its potential in automating the demanding applications like abrasive blasting. Users are seeking clarity on whether AI-driven quality control can reduce defects inherent in B4C sintering and pressing, thereby lowering production costs and improving consistency. Furthermore, there is significant interest in using machine learning algorithms to analyze nozzle wear patterns in real-time industrial settings, allowing operators to predict optimal replacement times precisely, maximizing nozzle lifespan, and minimizing unplanned downtime—a critical factor for industries relying on continuous operations, such as shipbuilding and large-scale pipeline maintenance. The expectation is that AI integration will not only streamline production and maintenance but also facilitate the development of novel, performance-enhanced nozzle designs through simulation and material informatics.

- AI-driven optimization of sintering profiles: Machine learning algorithms analyze parameters (temperature, pressure, duration) to achieve optimal density and hardness in B4C production, reducing material defects.

- Predictive wear modeling: AI analyzes operational data (blast pressure, media type, environmental temperature, vibration) to forecast remaining useful life (RUL) of the nozzle, enabling just-in-time replacement.

- Automated quality control systems: Computer vision and AI detect micro-cracks and geometric deviations post-machining with greater accuracy than traditional inspection methods, ensuring stringent product quality.

- Enhanced material informatics: AI accelerates the research and development of composite B4C materials by simulating the performance characteristics of new additives or binder systems.

- Optimization of abrasive blasting processes: AI analyzes sensor data during blasting to dynamically adjust the stand-off distance and angle, optimizing surface finish consistency and reducing media consumption, thus extending nozzle life indirectly.

- Supply chain risk mitigation: AI models predict demand fluctuations and potential raw material shortages (boron sources), improving inventory management for manufacturers.

DRO & Impact Forces Of Boron Carbide Nozzles Market

The Boron Carbide Nozzles Market is influenced by a dynamic interplay of Drivers (D), Restraints (R), Opportunities (O), and structural Impact Forces. Key drivers include the overwhelming need for long-lasting, reliable components in highly erosive environments, particularly in large-scale infrastructure maintenance, and the operational cost savings realized through extended product lifecycles compared to inferior materials. Restraints largely center on the high initial manufacturing cost associated with B4C due to complex processing requirements (high-temperature sintering and diamond grinding), coupled with the limited global availability and cost volatility of high-purity boron raw materials. Opportunities reside in technological advancements, such as the development of B4C composites to improve fracture toughness, and the penetration of B4C nozzles into niche, high-value applications like additive manufacturing post-processing and specialized chemical dosing systems. These internal market dynamics are further amplified by external impact forces like stringent environmental regulations pushing industries toward cleaner and more efficient surface preparation methods, which B4C supports by reducing dust and waste, along with global industrial output and capital expenditure cycles.

Segmentation Analysis

The Boron Carbide Nozzles Market is segmented based on application type, bore size, material purity, and end-use industry, providing a granular view of consumption patterns and growth pockets. The segmentation highlights the critical difference between the requirements of general industrial maintenance and highly specialized applications like semiconductor etching or nuclear energy component cleaning, each demanding specific nozzle geometries and material characteristics. Application segmentation, such as abrasive blasting, pressure washing, and specialty fluid handling, dictates the flow rate and pressure tolerance specifications, with abrasive blasting dominating volume demand. Bore size segmentation is crucial for matching the nozzle to the required media flow and coverage area. The end-use industry analysis reveals significant market dependency on cyclical sectors like construction, shipbuilding, and oil and gas maintenance, emphasizing the need for robust supply chains capable of meeting fluctuating demand.

- By Application Type:

- Abrasive Blasting Nozzles (Pressure Blasting, Suction Blasting)

- Liquid Spraying Nozzles (High-Pressure Water/Slurry)

- Specialty Dosing and Chemical Handling Nozzles

- Atomizing Nozzles

- By Bore Size:

- Small Bore (Under 5mm)

- Medium Bore (5mm to 10mm)

- Large Bore (Above 10mm)

- By Material Purity/Grade:

- Standard Industrial Grade Boron Carbide

- High Purity Grade Boron Carbide (Used for highly sensitive applications)

- Boron Carbide Composites (e.g., B4C reinforced with SiC)

- By End-Use Industry:

- Construction and Infrastructure

- Shipbuilding and Marine Maintenance

- Aerospace and Defense

- Automotive

- Oil and Gas/Petrochemicals

- Foundry and Metal Fabrication

- Mining and Quarrying

- General Industrial Maintenance

Value Chain Analysis For Boron Carbide Nozzles Market

The value chain for the Boron Carbide Nozzles Market begins with the upstream sourcing of raw materials, predominantly high-purity boron (either elemental boron or boric acid derivatives) and carbon, which are necessary for synthesizing B4C powder. This stage is highly capital-intensive and geographically concentrated, with a few specialized chemical companies controlling the supply of high-grade boron compounds essential for robust ceramic fabrication. The synthesized B4C powder then enters the manufacturing phase, involving complex powder metallurgy techniques, including mixing, pressing, and high-temperature sintering or hot isostatic pressing (HIP). This conversion phase adds significant value, determining the final structural integrity and performance characteristics of the nozzle. The complexity of B4C machining, typically requiring diamond grinding due to extreme hardness, further contributes to the manufacturing cost structure. Efficiency in managing energy consumption during high-temperature processing is a critical determinant of manufacturing profitability.

The downstream analysis focuses on the distribution and end-user engagement. Boron carbide nozzle manufacturers typically employ a mixed distribution channel strategy. Direct sales are often preferred for large, customized orders to major industrial clients (e.g., naval maintenance facilities or large pipeline contractors) where technical consultation is required to specify the correct nozzle geometry and material grade. Indirect distribution relies heavily on specialized industrial equipment distributors, blasting equipment resellers, and maintenance, repair, and overhaul (MRO) suppliers. These intermediaries provide local inventory, technical support, and logistical services to a fragmented base of small to medium-sized end-users. Effective inventory management at the distributor level is vital, given that nozzles are consumables critical to maintaining industrial operation uptime.

The flow of products often moves from specialized B4C powder manufacturers to nozzle fabricators, then through global or regional distributors, eventually reaching the end-users who integrate them into their blasting or spraying systems. The increasing prevalence of e-commerce platforms and digital catalogs is streamlining the process for smaller buyers, but direct technical engagement remains crucial for high-value contracts. Overall market efficiency is highly dependent on stabilizing the volatile raw material supply and optimizing the energy-intensive sintering process. Successful companies often vertically integrate to control material purity and optimize their production yields, thereby maximizing margins across the value chain. Customer feedback regarding wear characteristics and performance is continuously looped back to the R&D stage, driving incremental product improvements.

Boron Carbide Nozzles Market Potential Customers

Potential customers and end-users of Boron Carbide Nozzles span various heavy and precision industries that require high-performance components for surface preparation, material conveyance, and fluid dynamics control under erosive or corrosive conditions. The largest consumer base comprises companies involved in maintenance, repair, and overhaul (MRO) within the maritime, construction, and oil & gas sectors, where extensive abrasive blasting is required to clean large metal structures, ships, pipelines, and bridges prior to protective coating application. Other major buyers include original equipment manufacturers (OEMs) of blasting cabinets and equipment who integrate B4C nozzles into their systems as standard components due to their superior longevity. Foundries and metal fabricators use these nozzles daily for cleaning castings and removing scale or burrs, minimizing operational downtime associated with frequent nozzle changes, justifying the higher initial expenditure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65 Million |

| Market Forecast in 2033 | USD 110 Million |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kennametal, Inc., CoorsTek Inc., Metco Inc. (Oerlikon), Sandvik AB, Saint-Gobain Ceramic Materials, Blasting Systems Ltd., International Surface Preparation, Boride Engineered Ceramics, Empire Abrasive Equipment Company, Micro Abrasives Corporation, Ceradyne Inc. (3M), Industrial Process Products, Airblast Eurospray, Problast Technologies, Washington Mills, Vesta, Changsha Borun Advanced Material, SinterPro Advanced Ceramics, H. B. M. Trading & Blasting Equipment, and Advanced Ceramic Manufacturing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Boron Carbide Nozzles Market Key Technology Landscape

The core technology landscape of the Boron Carbide Nozzles Market revolves around advanced powder metallurgy and ceramic manufacturing processes essential for achieving high density, low porosity, and precise geometry. The initial synthesis of B4C powder typically involves carbothermic reduction of boron oxide, demanding extremely high temperatures and precise stoichiometry control. Crucially, the subsequent consolidation phase dictates the final product quality. Pressureless sintering is widely used due for its scalability, but it often requires sintering aids to achieve optimal density, which can sometimes compromise purity. The superior technological method, hot pressing or hot isostatic pressing (HIP), involves simultaneous application of high temperature and pressure, yielding nozzles with near-theoretical density and exceptional structural integrity, minimizing internal defects that could lead to premature failure under high stress. Manufacturers are continuously refining these parameters to reduce energy consumption and improve material throughput without sacrificing performance attributes like hardness and fracture toughness.

Beyond material consolidation, precision finishing techniques represent another critical technological area. Given the extreme hardness of B4C, conventional machining is impossible; therefore, diamond grinding and lapping are mandatory for shaping the nozzle’s intricate internal bore geometry and external threads. Advancements in Computer Numerical Control (CNC) diamond machining technology allow for the creation of complex venturi, double-venturi, or straight bore profiles with extremely tight tolerances, which are essential for controlling the blast pattern and ensuring optimal material flow dynamics. Furthermore, the incorporation of advanced non-destructive testing (NDT) techniques, such as ultrasonic testing and micro-computed tomography (Micro-CT), is becoming standard practice to detect internal flaws and guarantee product reliability before deployment in high-stakes industrial environments. These technologies ensure that the inherent material benefits of B4C are fully realized in the final product.

Emerging technologies focus on material enhancement and functionality integration. Research into Boron Carbide composites, often involving the incorporation of silicon carbide (SiC) or titanium diboride (TiB2), aims to increase the thermal shock resistance and fracture toughness of the nozzles, thereby extending their useful life in applications involving rapid temperature changes or high impact loads. Another significant trend is the development of sensor-enabled, smart nozzles. These integrated systems incorporate micro-sensors, facilitated by miniature electronics, to monitor operational parameters like pressure drop, temperature, and material flow rate in real time. This integration supports AI-driven predictive maintenance strategies, providing valuable data back to the operator and contributing to a more efficient and optimized industrial process landscape, marking a shift from passive components to active, data-generating tools. These technological leaps are crucial for maintaining the competitive edge against alternative nozzle materials.

Regional Highlights

The global Boron Carbide Nozzles Market displays distinct characteristics across major geographical regions, influenced by localized industrial activities, infrastructure investment levels, and regulatory frameworks governing industrial maintenance.

- North America: A mature market characterized by stringent industrial safety standards and high adoption rates of advanced blasting equipment, particularly within aerospace maintenance, military, and oil and gas infrastructure. The presence of key market players and a robust MRO sector ensure sustained demand for premium B4C nozzles, driving innovation in advanced geometries and composite materials.

- Europe: Driven by established manufacturing economies (Germany, Italy, UK) and strong maritime sectors (shipbuilding and port maintenance). European environmental regulations favor efficient, low-waste blasting solutions, increasing the appeal of durable B4C nozzles that maintain precise blast patterns and minimize media usage. Eastern Europe shows growing demand linked to infrastructure modernization.

- Asia Pacific (APAC): The fastest-growing region globally, propelled by massive industrialization, infrastructure construction booms, particularly in China and India, and expanding shipbuilding and automotive production capacities. Although price sensitivity is higher, the increasing focus on operational efficiency and adoption of Western maintenance standards is rapidly accelerating the transition from metallic nozzles to B4C alternatives.

- Latin America (LATAM): Growth is primarily concentrated in sectors related to mining, agriculture, and oil production (especially Brazil and Mexico). Demand is characterized by large, often state-backed, projects requiring robust components capable of handling high volumes of abrasive slurry and corrosive media, presenting opportunities for large-bore B4C nozzles.

- Middle East and Africa (MEA): Market growth is intrinsically linked to the immense investments in oil and gas infrastructure, pipeline maintenance, and general construction (especially in the GCC countries). The severe desert climate and exposure to harsh chemicals necessitate the extreme durability offered by boron carbide, making it a critical choice for mission-critical applications in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Boron Carbide Nozzles Market.- Kennametal, Inc.

- CoorsTek Inc.

- Metco Inc. (Oerlikon)

- Sandvik AB

- Saint-Gobain Ceramic Materials

- Blasting Systems Ltd.

- International Surface Preparation

- Boride Engineered Ceramics

- Empire Abrasive Equipment Company

- Micro Abrasives Corporation

- Ceradyne Inc. (3M)

- Industrial Process Products

- Airblast Eurospray

- Problast Technologies

- Washington Mills

- Vesta

- Changsha Borun Advanced Material

- SinterPro Advanced Ceramics

- H. B. M. Trading & Blasting Equipment

- Advanced Ceramic Manufacturing

Frequently Asked Questions

Analyze common user questions about the Boron Carbide Nozzles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using Boron Carbide nozzles over Tungsten Carbide?

Boron Carbide (B4C) nozzles offer superior wear resistance, typically lasting 5 to 10 times longer than Tungsten Carbide (WC) nozzles in abrasive blasting applications, primarily due to B4C’s much higher intrinsic hardness, translating to significantly reduced equipment downtime and lower lifetime operating costs.

Which industries are the largest consumers of B4C nozzles globally?

The largest consuming sectors are heavy industrial maintenance, including shipbuilding, maritime maintenance, infrastructure (bridges and pipelines), and the oil and gas industry, all requiring high-performance surface preparation for corrosion control and protective coating application.

How is the pricing of Boron Carbide nozzles determined, and why are they expensive?

B4C nozzles command a premium price due to the high cost and limited supply of pure boron raw materials, coupled with the energy-intensive, complex manufacturing processes involved, such as high-temperature sintering (hot pressing) and costly precision diamond grinding required for shaping the extremely hard ceramic.

What is the role of advanced sintering technologies like Hot Isostatic Pressing (HIP) in B4C nozzle manufacturing?

HIP is used to produce nozzles with near-theoretical density and minimal internal porosity. This process significantly enhances the structural integrity, hardness, and ultimate wear resistance of the B4C material, ensuring consistent performance under extreme operational pressures and flow conditions.

What emerging material alternatives or composites threaten the dominance of pure Boron Carbide in high-wear applications?

Emerging alternatives include Silicon Carbide (SiC) and specialized ceramic matrix composites (CMCs) often incorporating B4C with binders like TiB2 or SiC. These composites aim to improve the fracture toughness and thermal shock resistance of the nozzle while maintaining high wear resistance, offering optimized performance for specific, highly specialized uses.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager