Borosilicate Glass Tubes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438830 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Borosilicate Glass Tubes Market Size

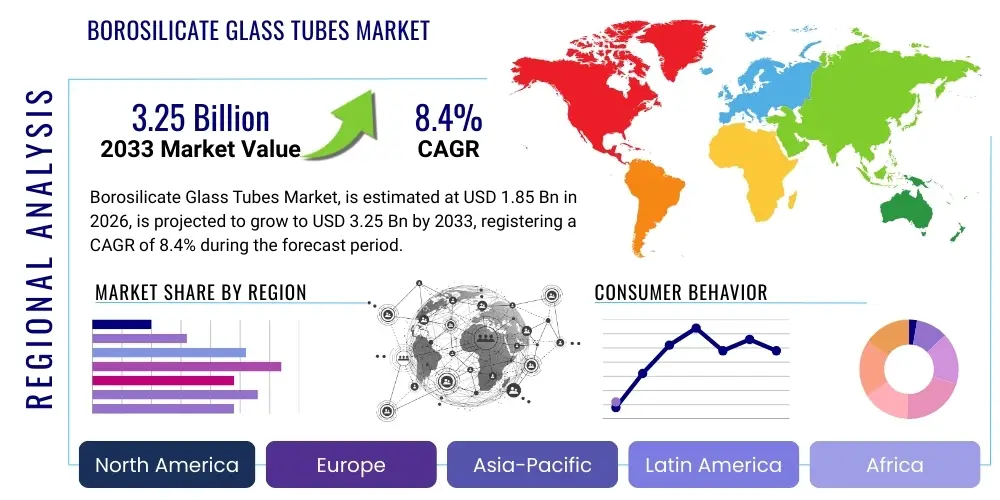

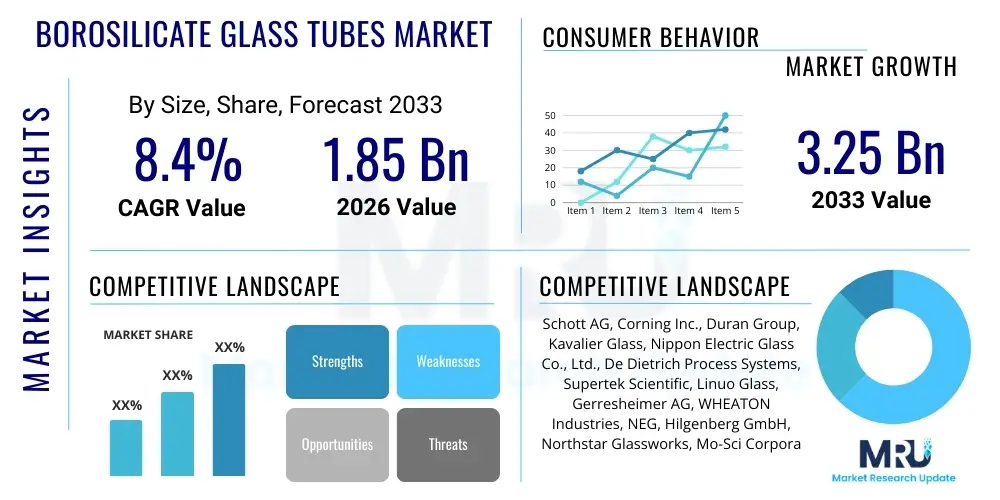

The Borosilicate Glass Tubes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.4% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.25 Billion by the end of the forecast period in 2033.

Borosilicate Glass Tubes Market introduction

The Borosilicate Glass Tubes Market encompasses the production and distribution of specialty glass tubing known for its low coefficient of thermal expansion, making it highly resistant to thermal shock. This type of glass, often sold under brand names like Pyrex or Duran, is composed primarily of silica and boron trioxide. Boron oxide content grants the glass its exceptional chemical durability and stability against high temperatures, features critical for demanding industrial and scientific applications. The intrinsic properties of borosilicate glass tubes—high chemical resistance to acids and alkalis, optical clarity, and mechanical strength—drive their indispensable use across various high-value sectors globally. The foundational nature of this material means that growth is inherently tied to capital expenditure in manufacturing, research, and infrastructure development, particularly within emerging economies focused on advanced manufacturing.

Major applications for borosilicate glass tubes span the pharmaceutical and healthcare industries, where they are essential for manufacturing vials, syringes, and laboratory glassware due to their inert nature which prevents contamination. In chemical processing, these tubes are utilized in heat exchangers, reaction vessels, and piping systems where aggressive chemicals and high temperatures are commonplace. Furthermore, the market benefits significantly from the expansion of the Concentrated Solar Power (CSP) sector, where vacuum receiver tubes made of borosilicate glass are crucial for efficient light absorption and thermal insulation. The increasing regulatory emphasis on material quality and purity in medical devices and drug packaging further solidifies the demand trajectory for high-grade borosilicate glass tubes.

Key benefits driving market adoption include the material's superior thermal stability compared to standard soda-lime glass, ensuring operational safety in high-stress environments. Its durability extends the lifespan of laboratory equipment and industrial components, offering a strong return on investment. The market growth is principally driven by the burgeoning pharmaceutical sector, especially the demand for precise primary packaging materials following global health crises, and significant investments in scientific research and development infrastructure, particularly in the Asia Pacific region. The ongoing development of specialized glass compositions tailored for extreme environments, such as those found in semiconductor manufacturing or aerospace, continues to open new avenues for market penetration.

Borosilicate Glass Tubes Market Executive Summary

The Borosilicate Glass Tubes Market is poised for substantial growth, characterized by strong business trends centered around technological advancements in manufacturing processes, such as continuous draw technology, which enhances production efficiency and quality consistency. Demand is increasingly segmented towards specialized applications requiring ultra-high purity and tight dimensional tolerances, particularly evident in biotech packaging and high-performance chemical reactors. Regional trends show Asia Pacific as the dominant and fastest-growing region, fueled by massive investments in domestic pharmaceutical manufacturing capabilities in countries like China and India, coupled with widespread adoption of solar thermal technologies. Conversely, mature markets in North America and Europe emphasize innovation in sustainable manufacturing practices and the development of specialized, low-extractable glass formats for complex parenteral drugs.

Segment trends reveal that the Pharmaceutical and Healthcare application segment maintains the largest market share, driven by rising chronic disease prevalence and stringent regulatory standards for drug containment. Within the Type segmentation, heavy-wall borosilicate tubes are gaining traction due to increased requirements for robustness in industrial piping systems and high-pressure chemical processes. The market structure remains moderately consolidated, with key players focusing on strategic mergers, acquisitions, and long-term supply agreements to secure raw material access and expand geographical reach. Furthermore, the push towards digitalization in manufacturing is enabling better quality control and reduced material waste, contributing positively to profitability across the value chain, addressing key supply chain vulnerabilities exposed during recent global disruptions.

Overall market dynamics indicate a shift towards customized material solutions, moving away from standardized products, particularly as end-users require specific thermal or chemical profiles. The sustained growth of the laboratory glassware market, driven by academic and private research funding globally, also acts as a critical demand stabilizer. Strategic challenges include managing the high energy consumption inherent in glass manufacturing and securing a stable supply of high-purity raw materials. Successful companies in this environment are those integrating vertical manufacturing processes and demonstrating clear compliance with global pharmacopeial standards (USP, EP, JP), ensuring their product quality aligns with the highly regulated nature of the primary end-use sectors.

AI Impact Analysis on Borosilicate Glass Tubes Market

Common user questions regarding AI's impact on the borosilicate glass tubes market often revolve around how artificial intelligence can enhance quality assurance, optimize energy consumption during high-temperature manufacturing, and improve complex supply chain logistics. Users are keen to understand if AI-driven predictive maintenance can reduce costly downtime associated with glass tube drawing machinery and annealing processes. Key themes include the implementation of machine vision systems for real-time defect detection—a critical concern given the stringent quality requirements for medical packaging—and the use of AI algorithms to predict raw material pricing volatility and inventory needs. The overall expectation is that AI will primarily serve as an optimization tool, making the production of high-precision borosilicate tubes more efficient, sustainable, and compliant with increasingly demanding industrial standards.

- AI-powered Machine Vision: Enhancing real-time, non-contact defect detection (cracks, bubbles, inclusions) in glass tubing, exceeding human inspection capabilities.

- Predictive Maintenance: Utilizing sensor data and machine learning to forecast equipment failure in glass drawing lines, minimizing unscheduled downtime and maximizing throughput.

- Energy Optimization: Implementing AI algorithms to modulate furnace temperatures and energy inputs, reducing the substantial energy costs associated with melting borosilicate glass.

- Supply Chain Forecasting: Improving accuracy in predicting demand shifts and optimizing raw material (silica, boron oxide) inventory management and logistics, addressing geopolitical supply risks.

- Process Control: Applying advanced control systems based on AI to maintain extremely tight dimensional tolerances required for high-precision applications like pharmaceutical vials and specialized optics.

- R&D Acceleration: Using generative AI models to simulate and test new borosilicate compositions for enhanced chemical resistance or thermal properties before expensive physical prototyping.

DRO & Impact Forces Of Borosilicate Glass Tubes Market

The dynamics of the Borosilicate Glass Tubes Market are heavily influenced by robust Drivers, critical Restraints, and significant Opportunities, which collectively create a substantial impact force driving market trajectory. The foremost driver is the exponential growth in the global pharmaceutical and biotech sectors, which require highly inert and stable primary packaging for sensitive drug formulations, including vaccines and advanced biologics. This demand is intrinsically linked to global health spending and demographic shifts, particularly the aging population, ensuring sustained growth. Furthermore, the expanding adoption of Concentrated Solar Power (CSP) technology, driven by renewable energy mandates and decreasing solar project costs, provides a significant industrial application niche. These driving forces create a sustained upward pressure on demand for high-quality, specialty tubing, particularly in regions undergoing rapid infrastructure development.

However, the market faces notable restraints, primarily related to the high energy intensity required for glass production, which makes manufacturing costs susceptible to volatile energy prices and increasing carbon taxation. Regulatory scrutiny concerning manufacturing emissions adds compliance complexity and operational expense. Furthermore, the emergence and increasing adoption of substitute materials, particularly high-grade specialty plastics and polymers in specific lower-stress applications, pose a competitive threat, limiting price elasticity. The manufacturing process itself requires substantial capital investment in highly specialized, complex machinery and skilled labor, creating significant barriers to entry for new market participants, thereby focusing production in the hands of a few established global leaders.

Opportunities for growth are concentrated in the development of specialized, next-generation glass compositions and miniaturization trends in medical diagnostics. The increasing global focus on sustainability presents opportunities for manufacturers who can implement energy-efficient production methods or utilize recycled content without compromising purity. Geographically, emerging economies in APAC and LATAM represent substantial untapped potential, fueled by massive government investment in healthcare infrastructure and rapid industrialization. The combined impact of these forces—strong inherent material advantages countered by high manufacturing costs and substitution risk—results in a market environment where technological innovation in process optimization is paramount for competitive differentiation and long-term viability, positioning the market for steady, quality-focused expansion.

Segmentation Analysis

The Borosilicate Glass Tubes Market segmentation provides a crucial framework for understanding the diverse applications and end-user demands that characterize the industry. Segmentation is primarily based on the dimensional and structural properties of the tubes (Type and Diameter) and the primary sector utilizing the material (Application and End-Use Industry). The fundamental differentiating factor among tube types is the wall thickness, which determines the tube's suitability for high-pressure or high-thermal shock applications. The application landscape is heavily skewed towards highly regulated industries, necessitating specialized production standards and stringent quality control measures across all segments. Analyzing these segments helps manufacturers tailor product specifications and target investment efficiently.

- By Type

- Standard Wall Borosilicate Glass Tubes

- Heavy Wall Borosilicate Glass Tubes

- Thin Wall Borosilicate Glass Tubes

- By Diameter

- Up to 10 mm (Small Diameter)

- 10 mm to 50 mm (Medium Diameter)

- Above 50 mm (Large Diameter)

- By Application

- Pharmaceutical & Healthcare (Vials, Ampoules, Syringes)

- Chemical Processing (Piping, Reactors, Heat Exchangers)

- Laboratory & Scientific Research (Beakers, Test Tubes, Condensers)

- Solar Energy (Concentrated Solar Power/CSP Receiver Tubes)

- Lighting (High-intensity discharge lamps, Halogen lamps)

- Others (Cosmetics Packaging, Aerospace Components)

- By End-Use Industry

- Consumer Goods

- Industrial Manufacturing

- Medical and Diagnostic Centers

- Research Institutions and Academia

- Energy and Utilities

Value Chain Analysis For Borosilicate Glass Tubes Market

The Borosilicate Glass Tubes market value chain begins with upstream activities, focusing on the procurement and preparation of high-purity raw materials, notably silica sand, boron trioxide, aluminum oxide, and other oxides used for stabilizing the composition. Quality control at this initial stage is paramount, as impurities can severely compromise the thermal stability and chemical inertness of the final product, especially critical for pharmaceutical applications. Key suppliers in the upstream segment specialize in mineral processing and chemical synthesis, providing the foundational components necessary for the demanding glass melting process. Given the highly technical requirements, relationships between glass manufacturers and specialized raw material providers are often long-term and strategic, focusing on consistent quality delivery.

The core manufacturing stage involves the high-temperature melting of raw materials followed by highly automated processes such as vertical or horizontal draw technology to form seamless tubing. This stage is capital-intensive and requires highly specialized machinery and stringent process controls to ensure tight dimensional tolerances (e.g., outer diameter, wall thickness) and excellent optical properties. Distribution channels for borosilicate glass tubes are bifurcated into direct sales and indirect sales. Direct channels dominate high-volume sales to major pharmaceutical companies, large industrial chemical manufacturers, and EPC contractors involved in solar power projects. This allows for customized delivery schedules and specifications, often involving specialized packaging and handling to prevent contamination or damage during transit.

Indirect channels primarily utilize specialized distributors and resellers who cater to smaller laboratory institutions, academic bodies, and local industrial buyers, offering a diversified inventory and smaller order quantities. Downstream analysis reveals the material's integration into final products across diverse end-use sectors. For the pharmaceutical industry, the tubes are processed into vials, ampoules, and cartridges; for the energy sector, they are assembled into vacuum-insulated solar receiver tubes. The final segment of the value chain is the end-user application, where the material's performance characteristics are tested under real-world conditions, providing crucial feedback that drives future innovation and material modification.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.25 Billion |

| Growth Rate | 8.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schott AG, Corning Inc., Duran Group, Kavalier Glass, Nippon Electric Glass Co., Ltd., De Dietrich Process Systems, Supertek Scientific, Linuo Glass, Gerresheimer AG, WHEATON Industries, NEG, Hilgenberg GmbH, Northstar Glassworks, Mo-Sci Corporation, AGC Inc., Technical Glass Products, Hubei Aokai Glass, Sichuan Shubo Co., Ltd., Swift Glass Company, Pacific Science & Engineering |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Borosilicate Glass Tubes Market Key Technology Landscape

The manufacturing of borosilicate glass tubes relies on sophisticated melting and drawing technologies designed to maintain exceptional purity and precision. The primary technological approach is the continuous drawing process, including both vertical (Vello or Danner processes) and horizontal drawing methods. Vertical drawing, particularly the Vello method, is highly favored for producing large volumes of high-quality tubes with consistent wall thickness and diameter. Advancements in these drawing technologies focus on increasing pull rates while minimizing internal stress in the glass structure, which is critical for preventing thermal or mechanical failure in end-use applications. Furthermore, furnace technology is continuously evolving, moving toward electric melting and hybrid systems to reduce reliance on traditional fossil fuels, addressing sustainability concerns and volatile energy costs.

A second critical technological area involves precision cutting and forming processes. After the continuous tube is drawn, it requires highly accurate cold-end processing, including laser cutting and grinding, to achieve the specific lengths and end treatments (such as fire polishing or flanging) required by applications like pharmaceutical vial production. Modern high-speed laser processing systems allow manufacturers to achieve extremely tight tolerances, often down to micrometers, which is non-negotiable for automated filling and sealing lines in the pharmaceutical industry. The integration of advanced computer numerical control (CNC) systems ensures repeatability and minimizes material waste during these finishing stages, significantly enhancing overall manufacturing efficiency and product quality consistency.

Finally, quality control technologies are essential components of the technological landscape. Inline inspection systems utilizing machine vision, laser micrometers, and ultrasonic testing are implemented directly on the production line to monitor tube dimensions, surface quality, and internal defects in real time. These sophisticated quality assurance systems, often coupled with AI-driven analytics, ensure that tubes meet strict pharmacopeial standards (such as USP Type I) or industrial pressure ratings. The convergence of advanced material science (optimizing the glass composition for specific extraction profiles) and digital manufacturing processes characterizes the current technological trajectory, aiming for zero-defect production in highly regulated application areas.

Regional Highlights

Regional dynamics play a crucial role in shaping the Borosilicate Glass Tubes Market, driven by differential rates of pharmaceutical R&D spending, industrial capital expenditure, and governmental regulatory frameworks. The market is broadly categorized into five major regions, each presenting unique demand and supply characteristics. Asia Pacific (APAC) currently dominates the global market both in consumption and production capacity, while North America and Europe represent mature markets focused on high-value, specialized products and compliance.

- Asia Pacific (APAC): Expected to be the fastest-growing region, driven by rapid expansion of the domestic pharmaceutical manufacturing sector (especially in China and India), significant governmental investment in solar energy infrastructure (CSP), and rising capital expenditure in laboratory research facilities. The presence of major global manufacturers expanding their footprint here to capitalize on lower operational costs and proximity to high-growth end-user markets further accelerates regional dominance.

- North America: Characterized by high demand for ultra-premium borosilicate glass tubes, primarily driven by the massive biotechnology and specialized medical device industries. Emphasis here is on innovative glass solutions, such as low-extractable glass for biologics and advanced diagnostics, supported by strong private and public research funding. Regulatory stringency from the FDA dictates extremely high-quality requirements, maintaining premium pricing.

- Europe: A mature market defined by established chemical processing industries and leading pharmaceutical hubs, particularly in Germany and Switzerland. The region focuses heavily on sustainable manufacturing practices, high automation, and compliance with strict environmental regulations. Demand is stable, centered on replacing older industrial piping systems and serving the rigorous requirements of European Pharmacopoeia (EP) standards.

- Latin America (LATAM): Exhibits promising growth, albeit from a smaller base, primarily fueled by improving healthcare access and increased investment in local generic drug manufacturing in Brazil and Mexico. Infrastructure development projects, including moderate solar energy expansion, also contribute to industrial demand for tubes.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by ambitious diversification strategies away from oil, leading to investments in large-scale solar thermal power plants and emerging pharmaceutical manufacturing capabilities focused on regional self-sufficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Borosilicate Glass Tubes Market.- Schott AG

- Corning Inc.

- Duran Group

- Kavalier Glass

- Nippon Electric Glass Co., Ltd. (NEG)

- De Dietrich Process Systems

- Supertek Scientific

- Linuo Glass (Shandong Linuo Technical Glass Co., Ltd.)

- Gerresheimer AG

- WHEATON Industries (now part of DWK Life Sciences)

- Hilgenberg GmbH

- Northstar Glassworks

- Mo-Sci Corporation

- AGC Inc.

- Technical Glass Products

- Hubei Aokai Glass

- Sichuan Shubo Co., Ltd.

- Swift Glass Company

- Pacific Science & Engineering

- Tianjin Feiya Glass Products Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Borosilicate Glass Tubes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is borosilicate glass and why is it preferred over soda-lime glass in medical applications?

Borosilicate glass is a type of glass containing boron trioxide, which gives it a very low coefficient of thermal expansion, making it highly resistant to thermal shock. It is preferred in medical applications (USP Type I) due to its superior chemical stability and inertness, preventing the leaching of alkali ions into drug formulations, ensuring drug safety and efficacy.

Which application segment holds the largest market share for borosilicate glass tubes?

The Pharmaceutical and Healthcare application segment holds the largest market share. This dominance is driven by the global requirement for high-quality primary packaging, such as vials, syringes, and ampoules, which must adhere to stringent international regulatory standards for drug containment and stability.

What are the primary restraints affecting the growth of the borosilicate glass tubes market?

The primary restraints include the high energy consumption and resultant operational costs associated with melting and drawing borosilicate glass, increasing vulnerability to volatile energy prices. Additionally, competition from advanced specialty polymers and strict capital requirements for manufacturing present significant hurdles.

How does the demand for Concentrated Solar Power (CSP) influence the borosilicate glass market?

The CSP industry is a major industrial driver, as borosilicate glass is essential for manufacturing the vacuum receiver tubes used in solar collectors. Its high thermal stability and excellent transparency maximize the efficiency of converting solar energy into heat, directly linking CSP investment to industrial tube demand.

Which geographical region is projected to exhibit the fastest growth in this market?

Asia Pacific (APAC) is projected to show the fastest growth rate. This accelerated expansion is attributed to large-scale government investments in developing domestic pharmaceutical capabilities, expanding healthcare infrastructure, and robust adoption of solar energy solutions across countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Borosilicate Glass Tubes Market Size Report By Type (Medium Borosilicate Glass Tubes, High Borosilicate Glass Tubes), By Application (Solar Energy Tubes, Laboratory Apparatus, Heat Glassware, Chemical Tubes, Pharmaceutical Packaging, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Pharmaceutical Borosilicate Glass Tubes Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (5.0 Borosilicate Glass Tubes, 7.0 Borosilicate Glass Tubes, 3.3 Borosilicate Glass Tubes), By Application (Ampoules, Vials, Syringes, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager