Bottled Spring Water Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432721 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Bottled Spring Water Market Size

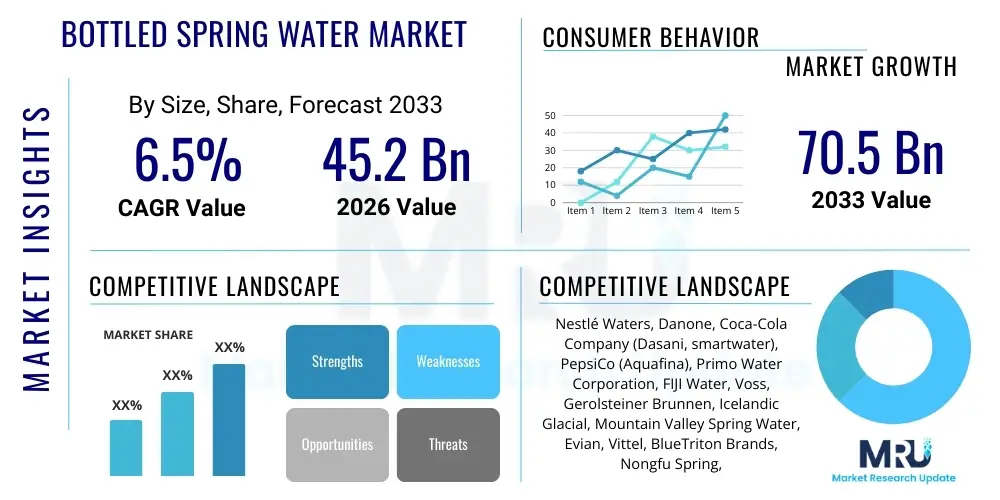

The Bottled Spring Water Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 70.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by escalating consumer awareness regarding the health advantages associated with natural spring water, coupled with global trends of increasing preference for clean hydration sources over carbonated or sugary beverages. Furthermore, advancements in sustainable packaging solutions are mitigating environmental concerns, thereby supporting sustained market growth across developed and emerging economies.

Bottled Spring Water Market introduction

The Bottled Spring Water Market encompasses the sale of water derived directly from natural springs, characterized by its naturally filtered mineral content and distinct purity, packaged in various sizes and materials for consumer convenience. Unlike purified or distilled water, spring water is collected at the point where it flows naturally to the Earth's surface or through a borehole tapping the underground source, maintaining its inherent composition. Major applications span direct consumer consumption, institutional use in corporate offices and educational facilities, and integration into the hospitality sector, where premium water offerings are standard. The robust market performance is primarily fueled by shifting consumer preferences toward wellness and preventative health measures, making bottled spring water a staple product globally.

The core benefits driving this market include the convenience of immediate, portable hydration, guaranteed safety and quality assurance through rigorous bottling processes, and the presence of naturally occurring minerals vital for bodily functions. Key driving factors include the rapid pace of urbanization, which limits access to reliable tap water sources in many areas, sustained marketing efforts emphasizing the source purity and health benefits of spring water, and the development of cost-effective, high-speed bottling technologies that allow for efficient distribution across vast geographic landscapes. The market structure is highly competitive, dominated by large multinationals who leverage extensive distribution networks and strong brand recognition to maintain market share, while smaller regional players focus on niche, premium, or highly localized spring sources.

The product description highlights water sourced from an underground formation from which water flows naturally to the surface, distinguished by mandatory requirements that mandate the water be collected either at the natural opening or through a borehole accessing the underground formation, provided the water pressure causes the water to rise naturally. The increasing global concerns regarding the quality of municipal tap water, often exacerbated by aging infrastructure and localized contamination events, serve as a persistent underlying driver for the sustained demand for certified bottled spring water. Additionally, the growing popularity of premium and flavored spring water variants caters to a diversified consumer base seeking both health and taste attributes, further solidifying the market's trajectory.

Bottled Spring Water Market Executive Summary

The Bottled Spring Water Market exhibits dynamic business trends characterized by intense focus on environmental sustainability, driving rapid innovation in biodegradable and recycled packaging materials (rPET). Major corporations are heavily investing in circular economy initiatives to reduce their carbon footprint, responding directly to heightened consumer scrutiny regarding plastic waste. Regionally, the Asia Pacific (APAC) market is projected to experience the fastest growth, underpinned by demographic expansion, rising disposable incomes, and insufficient public water infrastructure in burgeoning urban centers. North America and Europe, while mature, maintain strong market values driven by premiumization and the consistent demand for convenient, trusted hydration options, with a growing segment focusing on locally sourced and artisanal spring water brands.

Segment trends reveal a significant shift toward smaller, on-the-go packaging formats (500ml or less) for individual consumption, catering to busy lifestyles, alongside sustained demand for large format dispensers (10L and above) utilized in homes and offices. The distribution segment is witnessing a digital transformation, with e-commerce and direct-to-consumer (D2C) channels gaining substantial traction, especially post-pandemic, offering new avenues for brand interaction and loyalty building. Furthermore, the market is segmenting based on source—with glacial, mountain, and volcanic spring waters commanding premium price points due to perceived superior mineral profiles and unique origins, distinguishing them from standard regional spring water offerings.

Overall, the market landscape is defined by the ongoing struggle between volume efficiency and sustainability requirements. Key strategic moves include acquisitions aimed at securing pristine water sources and optimizing distribution logistics through advanced technological integration. Companies are leveraging data analytics to better predict demand fluctuations across various climates and seasonal peaks, ensuring product availability and minimizing inventory costs. The imperative for clean labeling, transparency regarding sourcing, and verifiable sustainability certifications remains paramount for maintaining consumer trust and driving long-term competitive advantage in this essential consumer goods sector.

AI Impact Analysis on Bottled Spring Water Market

Users commonly question how Artificial Intelligence (AI) can revolutionize the supply chain transparency, predict localized demand surges, and personalize marketing efforts within the Bottled Spring Water market. Key concerns revolve around the ethical use of consumer data collected through smart packaging and D2C platforms, and the potential for AI-driven automation to impact employment in manufacturing and logistics roles. Expectations center on AI significantly improving operational efficiencies, particularly in optimizing water resource management to minimize waste and predicting equipment failure in high-speed bottling lines. The analysis indicates that users anticipate AI primarily serving as a tool for sustainability monitoring and personalized consumer engagement, fostering brand loyalty through tailored recommendations and automated communication based on purchasing habits and geolocation data.

AI’s influence extends profoundly into demand forecasting and inventory management, critical for perishable and bulky FMCG products like bottled water. By processing vast datasets, including localized weather patterns, social media trends, and regional event schedules, AI algorithms can predict demand with unprecedented accuracy, leading to reduced stockouts and minimized waste from overstocking. This optimization capability is crucial for enhancing the financial viability of expansive global distribution networks. Moreover, AI-powered quality control systems, utilizing computer vision, can monitor bottling processes in real-time, identifying defects or contamination much faster and more reliably than traditional human oversight, thereby ensuring compliance with stringent health and safety regulations and maintaining the brand's integrity.

- AI optimizes supply chain logistics, reducing transportation costs and carbon emissions through intelligent route planning and warehouse management.

- Predictive maintenance using machine learning minimizes downtime in bottling plants by accurately forecasting equipment failures.

- AI-driven consumer personalization targets marketing campaigns based on hydration habits, increasing engagement and conversion rates for premium brands.

- Advanced image recognition software (AI vision) enhances quality control checks for packaging integrity and labeling accuracy on production lines.

- AI models analyze regional water usage and climate data to improve source resilience and ethical resource management, a key sustainability metric.

DRO & Impact Forces Of Bottled Spring Water Market

The Bottled Spring Water Market is shaped by powerful Drivers, significant Restraints, persistent Opportunities, and overarching Impact Forces that dictate its evolution. Primary drivers include global health consciousness and the lack of reliable municipal water quality in emerging economies, alongside strong consumer preference for the taste and perceived purity of spring water. Restraints often center on environmental pressures stemming from plastic consumption, high regulatory barriers related to water sourcing and purity standards, and the increasing cost volatility of raw materials, particularly PET resin. Opportunities are vast in sustainable innovation, including the adoption of fully biodegradable or aluminum packaging, and expansion into functional water categories enriched with vitamins or electrolytes. These elements together define the competitive landscape and strategic direction for market players.

A key set of Impact Forces acts as a multiplier on these factors. Government regulatory shifts globally, particularly those related to single-use plastics taxes and Extended Producer Responsibility (EPR) schemes, significantly increase operational costs and push manufacturers toward sustainable alternatives. Consumer activism and heightened transparency demands regarding water sourcing ethics and environmental impact exert continuous pressure on branding and corporate social responsibility efforts. Technological advancements in filtration, energy-efficient bottling, and logistics management serve as positive impact forces, enabling better cost control and quality assurance, simultaneously addressing the efficiency and sustainability paradox inherent in the industry. The interplay between stringent environmental policy and consumer-driven ethical sourcing forms the core dynamics governing market growth.

Furthermore, socioeconomic dynamics, such as rising global middle-class populations, particularly in Asia, amplify the demand side, providing fertile ground for market penetration. Conversely, macroeconomic forces like inflation or supply chain disruptions (e.g., disruptions to resin supply) can temporarily restrain profitability and pricing strategy flexibility. Successful market players are those that can effectively mitigate the environmental restraints through aggressive technological investment while capitalizing on the health and convenience drivers, ensuring their operations are resilient against geopolitical and economic volatility. Maintaining robust relationships with key regulatory bodies and proactively engaging in sustainable practices are no longer optional but foundational for long-term viability in this saturated but growing market.

Segmentation Analysis

The Bottled Spring Water Market is segmented based on critical parameters including Product Type (Still, Carbonated, Flavored), Packaging Material (PET, Glass, Aluminum Cans, Bioplastics), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, E-commerce, HORECA), and Volume (Small, Medium, Bulk). This detailed segmentation allows manufacturers to tailor marketing strategies, product innovation, and pricing based on specific consumer needs and purchasing environments. For example, glass packaging often targets the premium or HORECA (Hotel, Restaurant, Catering) segments due to its perceived elegance and purity preservation, while PET remains dominant in volume and convenience retail channels due to its low cost and durability. The fastest-growing segment currently is often the flavored or functional spring water category, appealing to consumers seeking alternatives to traditional soft drinks.

- By Product Type: Still Spring Water, Carbonated Spring Water, Flavored Spring Water, Functional Spring Water (Vitamin/Mineral Enhanced).

- By Packaging Material: PET Bottles, Glass Bottles, Aluminum Cans, Bioplastics/Recycled PET (rPET).

- By Distribution Channel: Supermarkets and Hypermarkets, Convenience and Grocery Stores, Online Retail/E-commerce, Foodservice/HORECA.

- By Volume: Single Serve (Under 1 Liter), Family Size (1 to 5 Liters), Bulk/Dispenser Size (5 Liters and Above).

Value Chain Analysis For Bottled Spring Water Market

The value chain for bottled spring water is complex, starting with rigorous upstream analysis focused on securing and maintaining pristine water sources. Upstream activities involve hydrogeological surveying, land acquisition, establishing sustainable extraction rights, and implementing advanced filtration and testing infrastructure to ensure water quality consistency. The security and long-term viability of the source are paramount, often requiring significant initial capital investment and adherence to strict environmental regulatory frameworks. Ethical sourcing and resource management transparency are increasingly scrutinized upstream components, influencing brand reputation and market acceptance, especially among environmentally conscious consumer groups.

Midstream processing involves bottling, which includes sanitization, high-speed filling, sealing, and labeling. This stage relies heavily on technology and automation to achieve efficiency and scale. Packaging procurement, often the highest variable cost outside of distribution, is a critical midstream focus, with intense pressure to shift from virgin PET to rPET, bioplastics, or alternative materials like aluminum. Downstream analysis focuses entirely on distribution, channel management, and retail placement. Given the product’s weight and low intrinsic value relative to volume, logistical efficiency is crucial. Direct and indirect distribution channels coexist: direct distribution often services large corporate clients or uses proprietary D2C e-commerce platforms, offering greater control over pricing and customer experience. Indirect channels, relying on third-party logistics (3PL) providers and vast retail networks (supermarkets, convenience stores), provide the necessary market penetration and reach.

The distribution channel dynamics are rapidly evolving, with digital transformation playing a key role. E-commerce platforms minimize traditional retail middlemen, offering faster replenishment cycles and specialized subscription services, especially for bulk office and home delivery. Traditional retail remains the dominant volume channel, requiring robust shelf-space management and promotional strategies. Successfully managing the value chain requires seamless integration between source management (ensuring sustainability), manufacturing (optimizing production speed and minimizing defects), and logistics (reducing transportation costs and delivery lead times). Value is added at each stage through purification, quality certification, effective branding, and convenient access points for the end consumer.

Bottled Spring Water Market Potential Customers

The potential customers for the Bottled Spring Water Market are highly diversified, extending across various demographic and institutional segments driven primarily by convenience, health awareness, and necessity. Key end-users include health-conscious millennials and Gen Z consumers who prioritize clean label products and environmental sustainability, often preferring premium or functional water variants. Another significant customer base comprises families and households in areas with unreliable or poorly tasting municipal water supplies, relying on bottled water for daily consumption. The corporate sector, including offices and manufacturing facilities, represents a substantial segment due to the requirement for hydration stations and standardized drinking water solutions for employees and visitors.

The hospitality, restaurant, and catering (HORECA) industry constitutes a major buyer segment, where bottled spring water, particularly in branded glass bottles, is a standard offering expected by patrons. Furthermore, the travel and tourism industry relies heavily on packaged water to service travelers, both domestically and internationally. Geographically, consumers in rapidly developing urban centers, where infrastructure often lags behind population growth, form a critical, rapidly expanding customer demographic. The purchasing decisions of these potential customers are heavily influenced by brand trust, verified sourcing claims, aesthetic packaging, and perceived value relative to pricing tiers (budget, mid-range, premium).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 70.5 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé Waters, Danone, Coca-Cola Company (Dasani, smartwater), PepsiCo (Aquafina), Primo Water Corporation, FIJI Water, Voss, Gerolsteiner Brunnen, Icelandic Glacial, Mountain Valley Spring Water, Evian, Vittel, BlueTriton Brands, Nongfu Spring, Bisleri International, S.Pellegrino, Perrier, La Croix, Talking Rain Beverage Company, Volvic |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bottled Spring Water Market Key Technology Landscape

The technological landscape of the Bottled Spring Water market is heavily focused on three primary areas: optimizing sourcing purity, enhancing production efficiency, and achieving sustainable packaging goals. In sourcing and purification, advanced membrane filtration techniques, such as reverse osmosis coupled with ozone disinfection (though RO is often avoided for true spring water to maintain mineral content, advanced UV and ozonation are standard), ensure microbial safety while preserving the natural mineral profile. Continuous monitoring technologies, often employing IoT sensors and AI algorithms, are deployed at the source to track water parameters, predicting potential shifts in quality or availability due to environmental factors. This technological investment guarantees regulatory compliance and maintains consumer trust in the product's origin and quality.

In manufacturing, the focus is on ultra-high-speed aseptic bottling lines capable of minimizing human contact and maximizing throughput while reducing energy consumption. Blow molding technology, used for PET bottles, is rapidly evolving to produce lighter weight packaging, reducing both material costs and transportation fuel consumption. Furthermore, the integration of robotics for palletizing and warehousing ensures precision and speed in handling large volumes. These production technologies are critical for maintaining competitive pricing in a highly commoditized segment of the market, allowing companies to balance high output with rigorous quality standards required for consumables.

The most significant technological shift is in packaging innovation. The development of food-grade rPET (recycled PET) capabilities is central, allowing companies to meet self-imposed and regulatory mandates for utilizing recycled content, thereby closing the loop on plastic usage. Beyond plastics, novel technologies include thin-film bioplastics derived from renewable sources and the rapid adoption of aluminum canning for carbonated and flavored spring water variants, favored for its infinite recyclability. Smart packaging technologies, incorporating QR codes or NFC tags, are also emerging, allowing consumers to trace the water's source and view detailed sustainability reports, driving transparency and enhancing brand value through digital engagement.

Regional Highlights

The Bottled Spring Water Market demonstrates significant regional variation in growth rates and consumption patterns, influenced by economic development, climate conditions, and existing water infrastructure reliability. North America and Europe represent mature markets characterized by high per capita consumption and strong demand for premium and flavored spring water. In these regions, growth is driven less by population increase and more by the shift away from sugary drinks, coupled with a willingness to pay a premium for verified pure sources and sustainable packaging. Regulatory compliance around plastic waste strongly shapes product offerings in Europe, pushing innovation towards rPET and alternative materials.

The Asia Pacific (APAC) region is the engine of future market growth, fueled by rapid urbanization, significant population size, and burgeoning middle-class purchasing power in economies such as China and India. The lack of guaranteed quality tap water in many urban and semi-urban areas makes bottled spring water a necessity rather than a luxury. Local players in APAC often dominate, capitalizing on region-specific distribution channels and consumer loyalty to local spring sources. However, international brands are aggressively entering the market, focusing on the premium segment to differentiate themselves from inexpensive local alternatives.

Latin America and the Middle East & Africa (MEA) exhibit diverse consumption dynamics. In Latin America, economic volatility can restrain growth, but strong demand persists due to climate factors and water quality concerns. The MEA region, particularly the Gulf Cooperation Council (GCC) states, features some of the highest per capita consumption rates globally, driven by arid climate conditions and high disposable income. In these markets, convenience and brand reputation are crucial, with substantial demand for bulk delivery services to homes and offices due to the year-round heat.

- Asia Pacific (APAC): Highest expected growth rate due to urbanization, infrastructure deficit, and increasing disposable income; focus on both large format and single-serve packaging.

- North America: Mature market dominated by premiumization, functional water variants, and a strong regulatory push towards recycled content (rPET).

- Europe: Driven by strict environmental regulations regarding single-use plastics; high market share for naturally carbonated and artisanal regional spring water brands.

- Latin America: Growth driven by necessity and climate, with pricing sensitivity impacting market entry strategies for international brands.

- Middle East & Africa (MEA): High consumption driven by climate and reliance on imported or high-quality local brands; strong demand for bulk home and office delivery services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bottled Spring Water Market.- Nestlé Waters

- Danone

- The Coca-Cola Company (Dasani, smartwater)

- PepsiCo (Aquafina)

- Primo Water Corporation

- FIJI Water

- Voss

- Gerolsteiner Brunnen

- Icelandic Glacial

- Mountain Valley Spring Water

- Evian

- Vittel

- BlueTriton Brands

- Nongfu Spring

- Bisleri International

- S.Pellegrino

- Perrier

- La Croix

- Talking Rain Beverage Company

- Volvic

Frequently Asked Questions

Analyze common user questions about the Bottled Spring Water market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between bottled spring water and bottled purified water?

Bottled spring water must originate from an underground source that naturally flows to the surface, retaining its inherent mineral content. Purified water, conversely, is municipal or groundwater that has been treated (e.g., reverse osmosis) to remove all solids and impurities, regardless of its original source, often having minerals added back for taste.

How is the focus on sustainable packaging affecting the Bottled Spring Water market?

Sustainability is profoundly impacting the market, driving a rapid shift towards 100% recycled PET (rPET), biodegradable polymers, and aluminum packaging. Consumers and regulators demand reduced plastic footprint, forcing brands to invest heavily in circular economy solutions and transparent sourcing/recycling commitments to maintain market relevance.

Which geographical region exhibits the fastest growth potential for bottled spring water?

The Asia Pacific (APAC) region is projected to register the fastest growth rate. This acceleration is attributed to massive urbanization, significant population expansion, rising middle-class affluence, and persistent issues concerning the reliability and quality of public drinking water infrastructure in rapidly developing economies.

What are the key technological advancements utilized in bottled spring water production?

Key technologies include advanced non-chemical disinfection methods (e.g., UV and ozonation) to preserve natural mineral profiles, high-speed aseptic bottling machinery for efficiency, and AI-driven predictive maintenance systems to minimize production line downtime and ensure consistent quality control.

What is driving the premiumization trend in the bottled water industry?

Premiumization is driven by consumer demand for unique source origins (e.g., volcanic or glacial), enhanced mineral content, superior packaging design (often glass), and verifiable claims regarding ethical sourcing and low environmental impact. This trend caters to health-conscious consumers seeking specialized, high-quality hydration options.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager