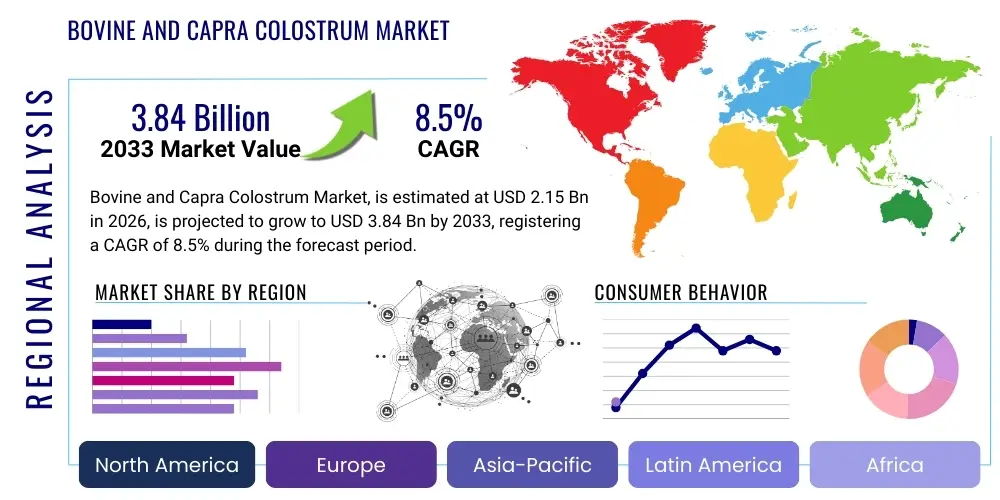

Bovine and Capra Colostrum Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434866 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Bovine and Capra Colostrum Market Size

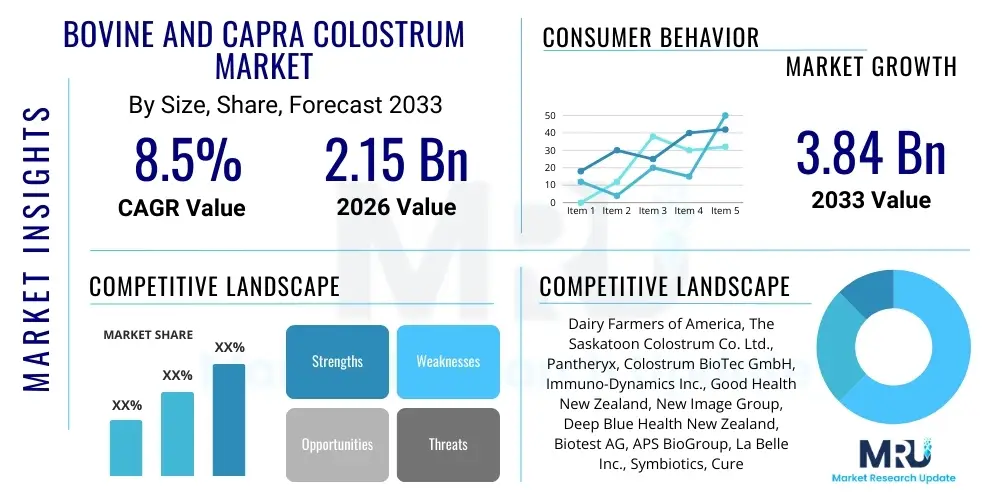

The Bovine and Capra Colostrum Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 3.84 Billion by the end of the forecast period in 2033.

Bovine and Capra Colostrum Market introduction

The Bovine and Capra Colostrum Market encompasses the production, processing, and distribution of colostrum derived from cows (bovine) and goats (capra), utilized primarily for its rich concentration of immunoglobulins, growth factors, and antimicrobial peptides. These products are sourced from the first milk produced immediately after parturition, ensuring maximum biological activity and nutritional density. Bovine colostrum currently dominates the market due to higher availability and established processing infrastructure, while Capra colostrum is gaining traction owing to its smaller fat globules and perceived better digestibility, particularly in specialized infant and therapeutic nutritional segments.

Major applications for colostrum include dietary supplements targeted at enhancing athletic performance, boosting immune function, and improving gut health. Furthermore, it is a crucial component in functional foods, medical nutrition, and high-value animal feed supplements, especially for newborn livestock (calves and kids) to ensure passive immunity transfer. The inherent benefits, such as high levels of IgG, IgA, and IgM antibodies, alongside various essential micronutrients, position colostrum as a premium ingredient in the rapidly expanding nutraceutical and functional ingredient industry. The demand is further amplified by increasing consumer awareness regarding preventative healthcare and natural immune boosters.

Driving factors for this market include the global surge in demand for immune-modulating ingredients following global health crises, compelling research validating colostrum's efficacy in clinical settings, and technological advancements in processing, such as low-heat pasteurization and spray-drying, which preserve the bioactive components. Moreover, the aging global population and the concurrent rise in interest in sports nutrition supplements necessitate the inclusion of highly bioavailable protein and immune-support ingredients, cementing colostrum’s role in the high-growth wellness sector.

Bovine and Capra Colostrum Market Executive Summary

The Bovine and Capra Colostrum Market is experiencing robust growth fueled by shifting consumer focus towards proactive health management and natural immune defense. Current business trends indicate a vertical integration by major dairy processors into specialized colostrum collection and purification, aiming for standardized high-potency products, particularly high IgG content preparations. There is a noticeable trend towards product diversification, extending beyond traditional powders and capsules into liquid formats, specialized chewables, and inclusion in fortified beverages and protein bars, enhancing consumer convenience and appeal. Furthermore, sustainability and ethical sourcing practices are becoming critical competitive differentiators, driving investment in transparent supply chains and certified organic production methods to meet stringent consumer and regulatory demands in key global markets.

Regional trends highlight North America and Europe as the dominant consumers, driven by high disposable income, established nutraceutical industries, and significant expenditure on dietary supplements. However, the Asia Pacific (APAC) region is poised for the highest growth rate, primarily due to burgeoning population health awareness, rising penetration of infant formula incorporating colostrum for immune benefits, and strong economic development in countries like China, India, and Japan. Governments in these regions are increasingly supporting research into functional foods, further accelerating market penetration. Regulatory frameworks, particularly regarding the categorization of colostrum as a food ingredient versus a therapeutic substance, continue to shape market access across diverse geographical locations.

Segmentation trends reveal that Bovine Colostrum remains the largest segment by source, attributed to its large supply base from the global dairy industry. By application, Dietary Supplements and Functional Foods command the majority share, reflecting direct consumer uptake for general wellness. However, the Infant Formula segment is projected to show accelerated growth, given the increasing clinical evidence supporting colostrum's benefits for neonatal gut development and immunity. The powdered form remains the preferred product format due to its extended shelf life and ease of incorporation into diverse end products, although liquid and specialized frozen formats are capturing niche markets requiring maximum bioactivity preservation for clinical applications.

AI Impact Analysis on Bovine and Capra Colostrum Market

User queries regarding the impact of Artificial Intelligence (AI) on the Bovine and Capra Colostrum Market frequently center on optimizing supply chain efficiency, enhancing quality assurance (QA) protocols, and accelerating new product development. Key user themes involve understanding how AI-driven predictive analytics can forecast demand variations, thus minimizing waste associated with perishable raw materials, and how machine learning (ML) algorithms can be employed to standardize colostrum quality, which naturally varies based on the donor animal's diet, genetics, and environment. Concerns also revolve around the potential for AI to optimize specialized feeding regimens for donor animals to maximize IgG concentrations and other bioactive components, linking farm-level management directly to processing outcomes, thereby driving premiumization and greater consistency in the final product offering.

- AI-powered predictive analytics optimize colostrum harvesting windows based on animal health data, maximizing bioactive component yields.

- Machine learning algorithms enhance quality control by rapidly analyzing complex compositional data (IgG levels, microbial contamination) in raw and processed colostrum.

- Robotics and AI vision systems improve efficiency in large-scale processing plants, reducing manual labor and contamination risks during drying and packaging.

- AI-driven demand forecasting supports better inventory management for perishable liquid colostrum, reducing spoilage and operational costs.

- Genomic AI assists in breeding selection for dairy herds, favoring animals with genetic predispositions for higher-quality colostrum production.

DRO & Impact Forces Of Bovine and Capra Colostrum Market

The market dynamics for Bovine and Capra Colostrum are highly influenced by a complex interplay of compelling health drivers and restrictive supply-side challenges. The primary driver is the scientifically validated role of colostrum in providing passive immunity and supporting gastrointestinal integrity, which resonates strongly with health-conscious consumers and healthcare professionals alike. Regulatory shifts are generally favorable, particularly in regions where colostrum is classified as a Generally Recognized as Safe (GRAS) ingredient, facilitating its incorporation into a wide array of food and supplement matrices. Furthermore, increasing research and development investment is continually uncovering new therapeutic applications, such as managing inflammatory bowel conditions and improving recovery post-exercise, broadening the market appeal beyond basic immunity support.

Restraints largely revolve around sourcing limitations and the inherent variability of the raw material. Colostrum collection is time-sensitive, often dictated by strict ethical guidelines and farm management protocols which limit the available volume, especially the premium first-milking colostrum. High processing costs associated with purification, standardization, and preservation of bioactive components without denaturation contribute to the final product's premium price point, potentially limiting mass-market adoption in price-sensitive economies. Regulatory hurdles related to labeling claims and potential contamination risks, though mitigated by modern testing, require continuous vigilance and high compliance costs, acting as a structural constraint on rapid market expansion.

Opportunities are abundant, particularly in emerging product categories such as personalized nutrition, where colostrum-derived peptides can be tailored for specific health conditions, and in the development of therapeutic biopharmaceuticals derived from concentrated colostrum components. The growing trend of pet nutrition and specialized animal feed represents a substantial untapped opportunity, particularly for high-value livestock protection. Additionally, technological innovations in encapsulation and targeted delivery systems are expected to enhance the efficacy and stability of colostrum ingredients, enabling their use in new pharmaceutical and cosmetic applications. The market is also propelled by the rising necessity for natural, non-antibiotic solutions in healthcare and animal husbandry, positioning colostrum as a vital alternative.

Segmentation Analysis

The Bovine and Capra Colostrum Market is meticulously segmented based on Source, Form, and Application to cater to diverse end-user requirements and maximize ingredient efficacy. Understanding these segmentations is crucial for strategic market positioning, as each segment faces unique supply chain, processing, and regulatory challenges. The Source segmentation highlights the dominant position of Bovine Colostrum, benefiting from established infrastructure and scalability, versus the niche but growing Capra Colostrum market, valued for its specific compositional advantages related to allergy profiles and digestibility. Segmentation by Form reflects processing preferences, with powder dominating due to logistical advantages, while specialized liquid and capsule forms address specific therapeutic needs requiring maximal bioactivity preservation. The Application segment defines the ultimate utility, with human consumption—dietary supplements and functional foods—being the largest category, driven by increasing consumer expenditure on wellness products and preventative medicine.

- By Source:

- Bovine Colostrum

- Capra (Goat) Colostrum

- By Form:

- Powder

- Liquid

- Capsules/Tablets

- Chewables

- By Application:

- Dietary Supplements

- Functional Foods & Beverages

- Infant Formula

- Medical Nutrition

- Animal Nutrition (Pet Food, Livestock Feed)

- Cosmetics

- By Distribution Channel:

- Online Retail

- Pharmacies/Drug Stores

- Specialty Stores

- Direct Sales (B2B)

Value Chain Analysis For Bovine and Capra Colostrum Market

The value chain for the Bovine and Capra Colostrum market begins at the upstream level with dairy farming and ethical sourcing practices. Critical activities here include optimizing animal health, timely collection of first-milking colostrum, and rapid chilling or freezing to prevent bacterial proliferation and maintain IgG potency. The efficiency of upstream logistics significantly dictates the quality and cost structure for the entire chain. Effective relationship management with certified dairy farms adhering to high standards (e.g., antibiotic-free collection) is paramount, especially for premium, high-IgG products. Challenges at this stage involve ensuring consistent supply volume while adhering to animal welfare guidelines, as well as minimizing the time lapse between collection and initial processing.

The midstream focuses on sophisticated processing, including low-temperature pasteurization, filtration, concentration (ultrafiltration/diafiltration), and final drying (spray or freeze-drying) to produce stable powder formats. This processing stage requires high capital investment in specialized equipment designed to preserve temperature-sensitive bioactive proteins. Quality testing and standardization, including rigorous testing for contaminants and quantification of immunoglobulins, are essential for compliance and market acceptance. The choice of preservation technology directly impacts the stability, shelf life, and final efficacy of the colostrum ingredient, influencing its application suitability, whether for supplements or sensitive infant formulas.

Downstream activities involve distribution, marketing, and sales to various end-user markets. Direct channels (B2B sales) often serve large manufacturers of infant formula, functional foods, and animal feed, requiring high-volume supply and specific technical specifications. Indirect channels utilize established networks of distributors, retailers, and e-commerce platforms to reach individual consumers (B2C). E-commerce is rapidly gaining importance due to the global nature of supplement sales and the need for detailed product information dissemination. Successful downstream performance relies heavily on effective scientific marketing, highlighting clinical research, and maintaining brand trust concerning purity and potency.

Bovine and Capra Colostrum Market Potential Customers

The market for Bovine and Capra Colostrum is highly diversified, serving both human and animal health sectors globally. The primary and fastest-growing customer base consists of consumers focused on dietary and nutritional supplements, particularly athletes seeking improved recovery, elderly individuals requiring enhanced immune resilience, and general wellness consumers looking for comprehensive digestive health support. These customers typically purchase through pharmacies, specialty health stores, and direct-to-consumer websites, prioritizing products with high IgG concentrations and transparent sourcing claims. The increasing prevalence of autoimmune disorders and chronic digestive issues also drives demand from patients seeking supportive nutritional interventions, often recommended by naturopaths or functional medicine practitioners.

A second major customer segment includes large-scale manufacturers of specialized nutritional products, notably infant formula companies that incorporate colostrum to mimic the immune benefits of human breast milk, aiming to improve neonatal gut maturation and reduce early life infections. These B2B customers demand high-purity, standardized, and internationally certified ingredients that meet stringent food safety standards, particularly in regulated markets like the EU and North America. Their procurement decisions are heavily influenced by clinical efficacy data, scalability of supply, and competitive pricing for bulk ingredients, often requiring customized specifications regarding protein profiles or fat content.

Furthermore, the animal nutrition sector represents a significant B2B customer base. This includes manufacturers of high-value veterinary supplements and livestock feed, especially for newborn calves and piglets, where colostrum is vital for providing immediate passive immunity against infectious diseases, significantly reducing mortality rates in commercial farming operations. Pet food manufacturers, focusing on premium and geriatric pet nutrition, are also emerging as key buyers, incorporating colostrum to support canine and feline joint health and immunity. These customers seek reliable, cost-effective sources of feed-grade or veterinary-grade colostrum powder, valuing efficacy and consistent biological activity over aesthetic or flavor attributes, which are crucial in the human supplement domain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.84 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dairy Farmers of America, The Saskatoon Colostrum Co. Ltd., Pantheryx, Colostrum BioTec GmbH, Immuno-Dynamics Inc., Good Health New Zealand, New Image Group, Deep Blue Health New Zealand, Biotest AG, APS BioGroup, La Belle Inc., Symbiotics, Cure International, Vitacaps, Fonterra Co-operative Group, Westland Milk Products, Tatura Milk Industries, NOW Foods, Jarrow Formulas, Manna Pro Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bovine and Capra Colostrum Market Key Technology Landscape

The technological landscape of the Bovine and Capra Colostrum Market is primarily defined by sophisticated processing methods aimed at maximizing the yield and bioactivity of fragile components. Key innovations focus on non-thermal or low-heat pasteurization techniques, such as High-Pressure Processing (HPP) and membrane filtration systems (like ultrafiltration and microfiltration), which effectively reduce microbial load while ensuring minimal denaturation of critical proteins, particularly immunoglobulins and growth factors. These advanced separation technologies allow processors to standardize the final product, achieving guaranteed IgG concentrations—a crucial factor for both B2B buyers and consumer trust. Continuous investment in these stabilization technologies is essential, given that the therapeutic efficacy of colostrum is highly dependent on the integrity of its complex biological structure.

Another crucial area of technological advancement is related to the drying and encapsulation process. Spray drying remains the dominant method for producing stable powder, but optimization is constantly sought to reduce heat exposure. Freeze-drying (lyophilization), while more expensive, is utilized for high-end, clinically focused colostrum products where the absolute preservation of native structure is non-negotiable. Furthermore, microencapsulation technologies are being increasingly employed to protect colostrum components from harsh digestive environments, improving targeted delivery and bioavailability within the human gut. This is particularly relevant for applications in medical nutrition and supplements targeting lower gastrointestinal health, ensuring that the bioactive peptides reach the colon intact and functional.

Beyond core processing, the integration of traceability and authentication technologies is transforming the supply chain. Advanced sensor technology and IoT devices are being used on farms to monitor animal health and milk quality in real-time, immediately flagging optimal collection times and ensuring stringent sanitary conditions. Blockchain technology is also gaining traction, offering immutable records of the colostrum’s origin, processing parameters, and testing results. This enhances transparency and combats counterfeit products, crucial for maintaining regulatory compliance and building consumer confidence in a premium ingredient market, thereby justifying the higher production costs associated with quality assurance and ethical sourcing.

Regional Highlights

North America

North America currently holds the largest share of the Bovine and Capra Colostrum Market, driven by high consumer spending on health and wellness products, a mature and competitive dietary supplement industry, and widespread acceptance of colostrum as a natural immune booster. The U.S. market, in particular, benefits from a clear regulatory environment (GRAS status) and strong distribution networks, including major retailers and direct-to-consumer digital channels. The demand here is heavily concentrated in sports nutrition, catering to professional and amateur athletes seeking natural recovery aids and performance enhancers, as well as the growing demand from the geriatric population for immune maintenance and anti-aging products. Canada also contributes significantly, though its regulatory landscape can sometimes be stricter regarding specific health claims, necessitating focused scientific substantiation for marketing materials.

The region is characterized by continuous product innovation, with leading domestic manufacturers frequently introducing new formulations, such as liposomal colostrum for enhanced absorption or specialized blends targeting specific health outcomes like joint mobility or cognitive function. High levels of awareness regarding gut-brain axis health drive the consumption of colostrum for its prebiotic and gut-lining repair properties. Competition is intense, leading to significant investment in clinical trials to differentiate premium products and support efficacious dosing recommendations. The strong presence of key market players and a robust dairy infrastructure provide a stable base for raw material sourcing, often focusing on traceable, pasture-raised cattle.

Europe

The European market for colostrum is highly sophisticated, characterized by stringent quality standards set by the European Food Safety Authority (EFSA) and a consumer base that values natural, sustainably sourced ingredients. Germany, the UK, and the Scandinavian countries are key markets, showing strong uptake in pharmaceuticals and medical nutrition applications, in addition to traditional dietary supplements. The acceptance of colostrum in veterinary medicine is also notably high in Europe, particularly in addressing calf health challenges without relying solely on antibiotics, aligning with broader European initiatives on antimicrobial resistance reduction. However, achieving approval for specific health claims under EFSA regulations remains a constant challenge, which can slow the pace of product introduction compared to North America.

Market growth is being propelled by the aging population structure, which necessitates products supporting chronic disease management and maintaining immune function into later life. Furthermore, there is a distinct preference for locally sourced, high-quality, traceable dairy products, favoring European suppliers who can demonstrate clear provenance and superior ethical farming practices. The incorporation of colostrum into functional dairy products, such as specialized yogurts and milk drinks, is a rising trend, integrating the supplement into daily dietary habits rather than solely relying on pill formats. Regulatory clarity and scientific consensus on bioavailability are driving factors for expansion in this discerning market.

Asia Pacific (APAC)

APAC is projected to be the fastest-growing regional market, largely attributable to the massive consumer bases in China and India, rapidly improving economic conditions, and a dramatic shift towards Western-style dietary supplements. The demand is exceptionally high in the Infant Formula segment, where colostrum is perceived by affluent urban parents as a critical additive for boosting their children's foundational immunity and gastrointestinal health, often driving premium pricing. South Korea and Japan also exhibit strong demand, primarily for anti-aging and beauty-from-within applications, utilizing colostrum for skin health benefits due to its growth factor content.

Challenges in the APAC market include navigating complex and fragmented regulatory landscapes across various countries, controlling the risk of counterfeit products due to high demand, and establishing reliable, high-quality supply chains to meet rapidly escalating needs. Foreign suppliers often face high import duties and requirements for localized safety testing. Despite these hurdles, strategic partnerships between international colostrum producers and local distributors are common, aiming to leverage regional marketing expertise and streamline regulatory approvals. The increasing emphasis on preventative traditional medicine and natural health remedies in countries like India further supports the penetration of colostrum products among a broader population base, moving beyond just urban centers.

Latin America (LATAM)

The Latin American market is nascent but shows steady growth potential, primarily driven by expanding middle classes, particularly in Brazil and Mexico, and increasing health expenditure. Demand is currently centered on basic dietary supplements for general immune support. The region possesses significant dairy farming capabilities, offering potential for local production and reduced import reliance, although processing technology adoption remains slower than in developed regions. Market penetration is often constrained by economic volatility, which affects consumer purchasing power for premium health products, and less developed regulatory frameworks specific to nutraceutical ingredients, creating uncertainty for international entrants.

Middle East and Africa (MEA)

The MEA market is highly diverse, with demand concentrated in affluent Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) where high disposable income supports the import of premium European and North American colostrum supplements. Key applications include sports nutrition and general immunity products. The regulatory landscape is generally favorable toward high-quality imported supplements but requires extensive documentation for Halal certification, which is mandatory for wide acceptance across the region. Growth in the African continent is focused primarily on critical animal nutrition applications, aiming to improve livestock immunity and viability, particularly in high-value dairy and beef production sectors where disease prevention is economically crucial.

- North America: Dominates due to strong supplement culture, high consumer awareness, and established sports nutrition market. Focus on high IgG content.

- Europe: Driven by medical nutrition, stringent quality control, and emphasis on ethical, traceable sourcing. Strong growth in Germany and UK.

- Asia Pacific (APAC): Fastest growing market, powered by infant formula demand in China and general wellness trends in India and Southeast Asia.

- Latin America: Emerging market potential in Brazil and Mexico, hampered by economic volatility but supported by local dairy production capacity.

- Middle East and Africa (MEA): Growth concentrated in GCC states for premium human supplements; vital application in livestock health across Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bovine and Capra Colostrum Market.- Dairy Farmers of America

- The Saskatoon Colostrum Co. Ltd.

- Pantheryx

- Colostrum BioTec GmbH

- Immuno-Dynamics Inc.

- Good Health New Zealand

- New Image Group

- Deep Blue Health New Zealand

- Biotest AG

- APS BioGroup

- La Belle Inc.

- Symbiotics

- Cure International

- Vitacaps

- Fonterra Co-operative Group

- Westland Milk Products

- Tatura Milk Industries

- NOW Foods

- Jarrow Formulas

- Manna Pro Products

Frequently Asked Questions

Analyze common user questions about the Bovine and Capra Colostrum market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Bovine and Capra Colostrum?

The core difference lies in the source and composition; Bovine colostrum is more widely available and used, while Capra (goat) colostrum contains smaller fat globules, potentially aiding digestibility, and may have a different immunological profile favored by consumers with sensitivities to cow dairy. Both are rich in immunoglobulins.

What are the key health benefits driving the demand for Colostrum?

The primary health benefits include potent immune system support due to high immunoglobulin (IgG) content, significant promotion of gut health and repair (leaky gut syndrome), and accelerated muscle recovery and athletic performance enhancement due to growth factors like IGF-1.

How is the quality of commercial Colostrum standardized?

Commercial colostrum quality is standardized primarily by measuring the guaranteed percentage of immunoglobulins, specifically IgG. High-quality products also adhere to strict testing protocols for purity, absence of antibiotics, and use low-heat processing methods (like flash pasteurization and low-temperature drying) to preserve bioactivity.

Which application segment holds the largest market share?

The Dietary Supplements and Functional Foods segment holds the largest market share globally, driven by widespread direct consumer use for preventative health, immune boosting, and targeted gastrointestinal support, particularly in North America and Europe.

What are the main supply chain challenges in the Bovine Colostrum market?

The main challenges involve the strict time-sensitive nature of raw material collection (first 6–8 hours post-calving), ensuring ethical and antibiotic-free sourcing from dairy farms, and maintaining the bioactivity of fragile components during large-scale processing, drying, and global distribution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager