Box IPC Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435694 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Box IPC Market Size

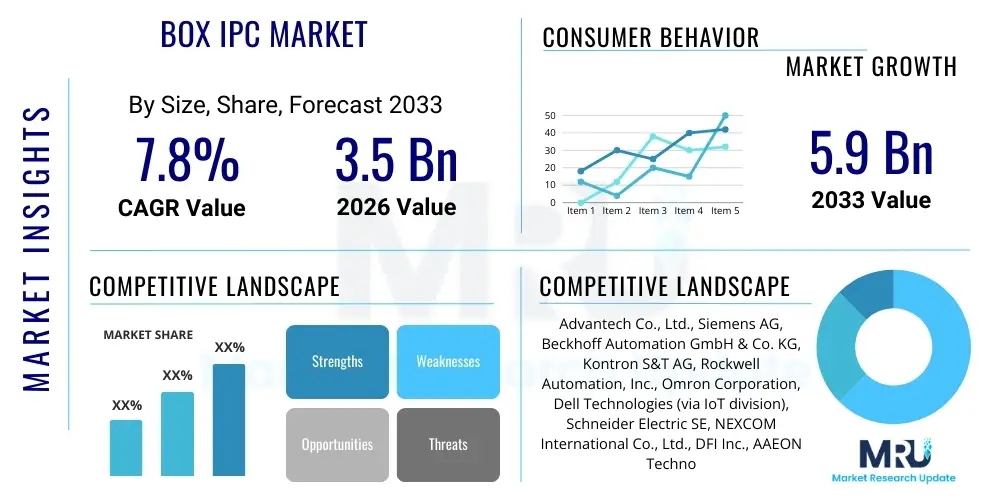

The Box IPC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.9 Billion by the end of the forecast period in 2033.

Box IPC Market introduction

The Box Industrial PC (IPC) market defines the segment of industrial computing characterized by compact, ruggedized, and often fanless enclosures, specifically engineered to operate reliably in highly challenging operational technology (OT) environments. These devices represent the backbone of modern industrial control systems, serving as powerful computing nodes for data acquisition, real-time control, edge processing, and gateway functions between sensors and enterprise cloud systems. Unlike standard commercial PCs, Box IPCs feature specialized componentry—including wide-temperature tolerance processors (such as Intel Atom, Core i, or specialized ARM SoCs), highly durable solid-state storage, and advanced thermal dissipation systems—ensuring high availability and minimal maintenance requirements across diverse applications ranging from deep sea monitoring to intense factory automation floors.

Box IPCs are fundamentally defined by their flexibility and resilience. They typically incorporate rich, highly customizable I/O interfaces, allowing them to communicate effectively across proprietary industrial protocols (like PROFINET, Modbus, EtherCAT) and modern standards (Gigabit Ethernet, 5G). This essential feature allows manufacturers to integrate new digital capabilities without completely dismantling entrenched legacy infrastructure. The robust design includes high levels of ingress protection (IP ratings), shielding against dust, moisture, vibration, and electromagnetic interference, attributes crucial for sectors like oil and gas, utilities, transportation, and heavy manufacturing. The inherent modularity, supporting quick integration of AI accelerators, specialized vision processing cards, or additional communication modules, positions the Box IPC as the critical pivot point in Industry 4.0 deployments.

The market trajectory is powerfully driven by the global imperative for digital transformation, specifically the migration toward decentralized processing architectures required by the Industrial Internet of Things (IIoT). Companies are moving data processing closer to the source (the edge) to minimize latency, a requirement that Box IPCs optimally satisfy. Key driving factors include the escalating demand for high-speed automated quality control leveraging machine vision, the necessity for sophisticated predictive maintenance solutions relying on localized AI inference, and global regulatory compliance demanding more accurate and auditable data logging from industrial processes. These drivers, combined with the inherent benefits of low power consumption and extended product lifecycles (often exceeding 10 years), ensure Box IPCs are indispensable for mission-critical industrial applications globally.

Box IPC Market Executive Summary

The Box IPC market is characterized by intense technological evolution and a competitive landscape dominated by established industrial automation conglomerates and specialized embedded computing firms. Current business trends emphasize the development of highly optimized software stacks integrated with hardware, focusing on containerization and virtualization capabilities to manage multiple workloads (control, visualization, AI) concurrently on a single Box IPC unit. Geopolitical factors, particularly trade tensions and supply chain risks, are accelerating regionalization of manufacturing and prompting end-users to prioritize vendors who offer robust supply continuity and component lifecycle assurances, favoring providers known for vertical integration or strong regional manufacturing bases. Moreover, market profitability is increasingly linked to offering comprehensive lifecycle services, including cloud-based device management and mandatory cybersecurity updating protocols.

From a geographical perspective, Asia Pacific maintains its lead in volume consumption, propelled by large-scale capital expenditure in new industrial capacity, especially across robotics, EV production, and semiconductor fabrication. This region's demand profile leans towards cost-competitive, high-performance systems. Contrastingly, North America and Western Europe focus on quality, complexity, and specialized certifications (e.g., ATEX for hazardous environments). These mature markets are driving innovation in specific high-margin niches, such as high-performance computing for advanced medical equipment and defense applications, prioritizing systems with superior cybersecurity resilience and adherence to strict functional safety standards (e.g., IEC 61508). Emerging markets, while smaller, offer rapid growth opportunities linked to infrastructure modernization in telecommunications and energy sectors.

Segment trends confirm the definitive shift toward fanless Box IPCs, which are now standard across most industrial environments due to maintenance and reliability benefits. Performance-wise, there is a clear segmentation emerging: low-power ARM-based systems for simple IIoT gateway functions, and high-performance x86 systems (utilizing Intel Core i7/i9 or similar high-TDP processors) augmented with dedicated accelerators to handle complex AI workloads. The most influential end-user segment growth is forecast in automotive (due to complex EV battery manufacturing demands) and the energy sector (driven by smart grid rollout and renewable energy plant automation). This structural evolution necessitates that manufacturers continually shrink form factors while simultaneously boosting computational density and thermal efficiency.

AI Impact Analysis on Box IPC Market

The primary architectural challenge users face when implementing AI in operational environments is bridging the gap between computational necessity and environmental robustness. Users frequently inquire about the feasibility of running large, sophisticated neural networks (like complex vision transformers or recurrent neural networks for time-series analysis) directly on a compact Box IPC, asking specifically about the trade-offs between utilizing general-purpose CPU cores, integrated GPUs, or dedicated hardware accelerators (such as FPGAs or custom ASICs). Key themes also revolve around model deployment and lifecycle management: how can models be securely updated and optimized over-the-air in vast fleets of geographically dispersed Box IPCs, and what is the required software overhead for deploying standardized AI frameworks (e.g., TensorFlow, PyTorch) within constrained industrial operating systems?

AI’s influence is moving Box IPCs beyond simple controllers into sophisticated decision-making engines. The market is seeing accelerated demand for systems capable of handling specific AI tasks: firstly, in industrial inspection, where high-resolution machine vision requires multi-gigabit camera inputs and rapid GPU-accelerated processing for flaw detection; and secondly, in predictive maintenance, where complex algorithms analyze vibration, temperature, and current draw data streams to forecast equipment wear. These applications demand Box IPCs equipped with high-throughput data buses (PCIe Gen4) and robust cooling to ensure sustained peak performance, especially crucial for continuous, high-speed production lines where a momentary processing lag can lead to significant quality control failures or catastrophic equipment breakdown. This shift mandates substantial investment in AI-ready hardware platforms by leading manufacturers.

Furthermore, the integration of AI directly impacts system complexity and, consequently, security. As Box IPCs become repositories for intellectual property (in the form of proprietary AI models) and controllers for critical infrastructure, they become prime targets for cyber threats. Manufacturers are responding by embedding advanced security features, including AI-specific protection layers, secure boot mechanisms, and comprehensive endpoint detection and response (EDR) capabilities directly into the industrial-grade operating system layer. The future success of AI in the Box IPC domain hinges on developing standardized, secure, and easily deployable software ecosystems that simplify the transition for industrial engineers accustomed to legacy programming environments like ladder logic and functional block diagrams. The complexity of model quantization and optimization for edge deployment remains a significant technical hurdle that market leaders are actively addressing through specialized SDKs.

- Enhanced Edge Inference Capabilities: Box IPCs equipped with dedicated VPUs or GPUs to perform real-time machine learning inference locally, crucial for low-latency decision-making in manufacturing.

- Predictive Maintenance Adoption: AI analyzing multi-modal sensor data on the IPC to forecast equipment failure with greater accuracy than traditional statistical methods, dramatically reducing unplanned downtime and optimizing asset utilization.

- Advanced Machine Vision Integration: Utilizing powerful Box IPCs for complex visual inspection, defect classification, and 3D volume measurement, enabling superior production accuracy and reduced false positives in quality control systems.

- Development of AI-Optimized Form Factors: Designing thermal management systems within compact boxes to reliably accommodate high-TDP AI chips (up to 100W TDP) necessary for sustained high-performance AI inference in enclosed industrial cabinets.

- Increased Data Security Demand: AI models and sensitive industrial data processed at the edge necessitate advanced cybersecurity measures, including Trusted Platform Module (TPM) 2.0 integration and encrypted communication links (e.g., TLS 1.3).

- Shift from Cloud to Fog Computing: AI driving the need for decentralized, collaborative processing architectures where multiple Box IPCs communicate locally (fog layer) to share computational load and sensor data, optimizing overall network efficiency.

- Support for High-Bandwidth Interfaces: Demand for high-speed interfaces like 10 Gigabit Ethernet (10GbE) and high-speed USB standards (e.g., USB 3.2) to accommodate the massive data throughput from high-resolution industrial cameras and advanced sensor arrays used by AI applications.

DRO & Impact Forces Of Box IPC Market

The Box IPC market growth engine is driven primarily by the global strategic prioritization of industrial automation, underpinned by technological advancements in silicon design that allow greater processing power in smaller, more thermally efficient packages. Drivers include the increasing adoption of robotics, which requires powerful, low-latency control systems, and the strict requirement for data integrity and archival in highly regulated industries such as pharmaceuticals and energy. The inherent reliability and extended maintenance cycles offered by ruggedized Box IPCs provide a strong ROI justification compared to maintaining less durable commercial hardware in demanding environments, making them a default choice for greenfield industrial projects seeking optimal operational expenditure over time.

However, market expansion is significantly constrained by structural challenges, most notably the high initial acquisition cost, which is difficult for small and mid-sized enterprises (SMEs) to absorb, despite the long-term benefits. A persistent restraint is the skill gap within the industrial workforce; deploying and maintaining complex, AI-enabled IPCs requires specialized IT/OT convergence expertise that is often scarce, slowing down adoption rates, particularly in developing regions. Furthermore, the reliance on proprietary operating systems and vendor-specific configuration tools can create vendor lock-in, posing integration risks and flexibility issues for large corporations managing diverse industrial asset portfolios. The rapidly evolving cybersecurity threat landscape poses a perpetual restraint, as interconnected IPCs present new attack vectors into previously isolated industrial control networks, demanding constant and costly security updates.

The key opportunities lie in capitalizing on future infrastructure upgrades. The large-scale deployment of 5G across industrial campuses will unlock new use cases for wireless monitoring and mobile robotics, significantly broadening the operational scope of Box IPCs. The integration of Time-Sensitive Networking (TSN) is poised to standardize deterministic communication, allowing Box IPCs to replace numerous dedicated hardware controllers with fewer, more flexible, and software-defined units, optimizing system architecture and reducing hardware costs in the long run. Moreover, focusing on modular Box IPC designs that allow hot-swappable components and simple field upgrades offers vendors a competitive edge by lowering the total cost of ownership and extending system utility, particularly appealing to industries with very long equipment replacement cycles.

Segmentation Analysis

The Box IPC market is structurally segmented based on crucial technological and application criteria, including type, component, technology, end-user industry, and region. Analyzing these segments provides a granular view of market dynamics, revealing where investment and innovation are concentrated. Key segment drivers include the shift toward higher processing power components to support edge AI, the increasing preference for fanless and ultra-ruggedized designs in harsh environments, and the dominant adoption rates seen within the discrete and process manufacturing sectors. The market differentiation is increasingly defined by the ability of vendors to deliver highly customizable, modular, and cyber-secure solutions tailored precisely to specific industrial standards and regulatory compliance requirements.

The distinction between component segmentation, such as CPU architecture (e.g., x86 vs. ARM), is critical as end-users select processors based on the balance between power consumption, thermal efficiency, and raw computational demand. The fastest-growing segments are those facilitating advanced automation, particularly within automotive manufacturing (driven by the EV transition) and the semiconductor industry, which requires extreme precision and minimal operational variability. Geographic segmentation highlights the strategic importance of the APAC region as a manufacturing superpower, dictating global volume, while North America and Europe lead in terms of technological adoption of high-value, high-margin, specialized Box IPC deployments for highly regulated or safety-critical applications.

- By Type:

- Compact Box IPCs (Focus on space saving and entry-level IIoT gateways)

- Standard Box IPCs (Mid-range performance for automation control)

- Modular Box IPCs (Highly configurable systems allowing easy component upgrades)

- By Component:

- Processor (x86 architecture dominated by Intel; rising share for power-efficient ARM SoCs)

- Memory (Industrial-grade DDR modules, ECC memory for high reliability)

- Storage (High-durability Industrial SSDs and eMMCs)

- I/O Interfaces (A focus on multiple Gigabit Ethernet, USB 3.0/3.2, RS-232/485, and specialized Fieldbus controllers)

- Chassis/Enclosures (Rated for IP protection and thermal dissipation)

- By Technology:

- Fanless Box IPCs (Dominant segment due to superior reliability and durability)

- Fan-Based Box IPCs (Used where high-TDP components (e.g., high-end GPUs) require active cooling)

- Hybrid Cooling Systems (Combining passive dissipation with internal heat pipes or liquid cooling in extreme high-performance applications)

- By End-User Industry:

- Industrial Automation & Control (Largest segment, including PLC and SCADA integration)

- Automotive Manufacturing (High growth driven by EV battery production lines and complex assembly)

- Energy & Power (Used for smart grid infrastructure, substation automation, and renewable energy monitoring)

- Oil & Gas (Deployment in remote, hazardous, and high-temperature environments for monitoring)

- Transportation & Logistics (Onboard vehicle computing, traffic management, rail systems)

- Healthcare & Medical (Imaging equipment control, remote diagnostics platforms)

- Aerospace & Defense (Testing, simulation, and secure embedded applications)

- Semiconductor & Electronics (Ultra-precise process control and machine vision inspection)

- By Region:

- North America (Focus on high-value, secure, and regulatory-compliant systems)

- Europe (Driven by Industry 4.0 and advanced manufacturing standards)

- Asia Pacific (APAC) (Highest volume and rapid growth due to manufacturing expansion)

- Latin America (Emerging market focused on resource extraction and infrastructure)

- Middle East & Africa (MEA) (Growth linked to smart city and energy modernization)

Value Chain Analysis For Box IPC Market

The Box IPC market value chain begins with upstream activities involving foundational component suppliers, predominantly semiconductor manufacturers (Intel, AMD, ARM), memory providers (Samsung, Micron), and specialized sensor manufacturers. This upstream segment is highly concentrated and dictates the pace of technological advancement, particularly concerning processing power and efficiency. Suppliers in this phase face intense R&D pressure to produce ruggedized, long-lifecycle components that meet industrial standards, requiring rigorous quality control and specialized industrial grade material selection, distinct from consumer electronics components.

Midstream activities involve the Box IPC manufacturers themselves (e.g., Advantech, Siemens, Beckhoff). These players are responsible for system integration, industrial design (focusing on heat dissipation and ingress protection, such as IP ratings), specialized BIOS/firmware development, and rigorous industrial testing and certification. This stage adds significant value through proprietary engineering, offering customizable configurations and ensuring the hardware integrates seamlessly with standard industrial operating systems (e.g., Windows IoT, real-time Linux distributions). Distribution channels are critical in delivering the final product. Direct sales channels are often used for major industrial accounts requiring extensive technical consultation and customized solutions. Indirect channels, involving specialized industrial distributors and system integrators (SIs), facilitate wider market penetration, particularly for smaller clients or standard product configurations, with SIs adding value through installation, software integration, and post-sales support.

Downstream activities include the deployment of Box IPCs by end-users (e.g., automotive factories, utility companies) and the subsequent service and maintenance phases. The downstream relies heavily on System Integrators (SIs) who tailor the hardware to specific application requirements, integrating it into complex OT networks, and developing application-specific software. Post-deployment services, including long-term technical support, warranty services, and lifecycle management (often extending beyond ten years), are vital, cementing the relationship between the manufacturer and the end-user. The overall value chain emphasizes robustness, customization, technical support, and extended product availability over pure cost minimization, reflecting the mission-critical nature of the applications.

Box IPC Market Potential Customers

Potential customers for Box IPCs are organizations operating within demanding, data-intensive industrial or harsh physical environments where standard commercial computers are unreliable or fail to meet necessary performance and durability metrics. The primary end-users are large multinational manufacturing corporations involved in discrete processes, such such as automotive assembly, electronics fabrication, and aerospace manufacturing, where high uptime and real-time control are paramount. These customers utilize Box IPCs as dedicated machine controllers, quality inspection systems running AI/vision algorithms, and secure data aggregation points for plant-wide monitoring.

Beyond traditional manufacturing, significant adoption comes from critical infrastructure sectors. Energy companies (power generation, smart grid operators) and utility providers (water treatment, distribution networks) require rugged IPCs for remote monitoring, substation automation, and SCADA system optimization in environments prone to electromagnetic interference and extreme weather. Similarly, the transportation sector, including rail, marine, and complex logistics hubs, uses Box IPCs for rolling stock control, trackside monitoring, and onboard telematics due to their vibration and shock resistance and ability to withstand wide temperature fluctuations typical of outdoor deployment locations.

A growing segment includes specialized technology integrators and OEMs (Original Equipment Manufacturers) who embed Box IPCs directly into their proprietary machinery, such as medical imaging devices, sophisticated robotics, and specialized telecommunications infrastructure. These customers prioritize long product lifecycles and guaranteed component availability to maintain the integrity and certification of their core products over many years. The core characteristic defining a potential customer is the need for industrial-grade reliability, extended operational temperature ranges, high computational performance at the network edge, and mandatory compliance with specific functional safety and environmental certifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Advantech Co., Ltd., Siemens AG, Beckhoff Automation GmbH & Co. KG, Kontron S&T AG, Rockwell Automation, Inc., Omron Corporation, Dell Technologies (via IoT division), Schneider Electric SE, NEXCOM International Co., Ltd., DFI Inc., AAEON Technology Inc., Arbor Technology Corp., ADLINK Technology Inc., Lanner Electronics Inc., IEI Integration Corp., Phoenix Contact GmbH & Co. KG, Mitac International Corp., Avalue Technology Inc., B&R Industrial Automation GmbH, Fuji Electric Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Box IPC Market Key Technology Landscape

The core technological evolution in the Box IPC market centers on improving compute density while maintaining or enhancing durability. A significant trend is the utilization of hardware-assisted virtualization technologies, such as hypervisors, enabling a single Box IPC to concurrently run multiple operating systems or real-time control applications alongside general-purpose HMI or data logging tasks. This consolidation reduces hardware footprint and simplifies network architecture, moving the industry towards software-defined control. Furthermore, standardizing interfaces, moving towards ubiquitous deployment of PCIe 4.0 and future PCIe 5.0 buses, ensures the necessary high-speed connectivity between the CPU, memory, and increasingly powerful peripheral accelerators like dedicated neural processing units (NPUs) or high-end GPUs tailored for edge AI processing.

Material science and specialized engineering are equally critical. The transition to advanced fanless thermal management relies on optimized chassis materials (often proprietary aluminum alloys) and sophisticated internal heat pipe configurations to efficiently dissipate heat generated by multi-core processors, maintaining performance stability without relying on moving parts that could introduce failures. The adherence to rigorous industry standards—such as IP67 ratings for complete dust and water immersion protection, MIL-STD-810G for shock and vibration resilience, and various regulatory certifications (e.g., CE, FCC, UL, ATEX/IECEx)—is mandatory, establishing a high technical barrier to entry for new competitors and underpinning customer confidence in reliability.

Connectivity remains paramount, demanding Box IPCs integrate both advanced wireless capabilities (Wi-Fi 6/6E, 5G NR modules) and high-speed, wired industrial communication protocols. The maturation of Time-Sensitive Networking (TSN) represents a fundamental technological shift, guaranteeing bandwidth and synchronization crucial for critical, distributed control applications. Additionally, the move toward open standards and interoperable platforms, supported by organizations like the Open Compute Project (OCP) and collaborative industrial foundations, is influencing design choices, promoting greater compatibility between different vendors' hardware and software components, thereby easing the burden of integration for large industrial end-users seeking flexible, multi-vendor solutions. Crucially, the embedded security suite utilizing hardware roots of trust and secure execution environments defines the technology barrier in highly sensitive industrial installations.

Regional Highlights

Geographical dynamics are essential to understanding the Box IPC market, reflecting the varying rates of technological adoption and industrial capacity across the globe. Each major region is driven by unique sectoral demands and regulatory requirements, influencing the specific Box IPC architectures purchased.

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, contributing the dominant share of market volume. Growth is robust across automotive, high-tech electronics, and general manufacturing, driven by government incentives for automation and the expansion of smart infrastructure. Countries like China and India are prioritizing localized production, increasing demand for cost-effective, high-volume Box IPCs used primarily for machine control, basic HMI functions, and data logging in large-scale assembly operations. Japan and South Korea lead the region in adopting high-end, AI-enabled Box IPCs for advanced robotics and precision manufacturing. The rapid construction of new factory complexes and integrated logistics centers sustains exponential market growth.

- North America: North America commands a high market value, focusing on sophisticated, ruggedized, and high-margin systems for specialized industries. Demand is characterized by strict compliance requirements (e.g., FDA validation in medical devices, NERC/CIP compliance in utilities) driving the need for Box IPCs with robust security features (TPM, secure boot) and certified extended temperature ratings. The market is primarily driven by modernization efforts, retrofitting legacy systems, and utilizing advanced IPCs for complex data analytics, optimizing supply chains, and integrating advanced cybersecurity layers into OT infrastructure.

- Europe: The European market, particularly Germany and the Nordic countries, emphasizes quality, energy efficiency, and functional safety standards. The core driver is the ongoing execution of Industry 4.0 strategies, promoting digital integration and vertical connectivity. Demand is strong for modular Box IPCs that integrate seamlessly with proprietary European automation ecosystems (e.g., PROFINET, EtherCAT), focusing heavily on precision manufacturing, complex automotive lines (EV and component manufacturing), and advanced process control in chemicals and pharmaceuticals. Regulatory emphasis on data privacy and local processing also boosts the preference for high-performance edge computing solutions.

- Latin America (LATAM): LATAM is an emerging market experiencing steady growth, largely dependent on foreign investment and raw material processing sectors. The market is highly price-sensitive, yet demands durability for applications in harsh environments like mining, oil extraction (particularly Brazil and Mexico), and agricultural processing. Adoption is concentrated in basic automation, monitoring, and remote terminal units (RTUs) functions, often favoring standard, mid-range Box IPCs that balance cost and ruggedness for infrastructure projects and resource management.

- Middle East & Africa (MEA): MEA is a niche but rapidly expanding market, centered around significant government-backed infrastructure development projects, including smart city initiatives (e.g., NEOM in Saudi Arabia) and massive renewable energy investments. The extreme environmental conditions dictate a demand for ultra-rugged, passively cooled Box IPCs (IP67 or higher) capable of operating reliably at very high ambient temperatures. The oil and gas sector remains a critical consumer, using Box IPCs for pipeline monitoring, remote drilling control, and processing data in isolated, explosive environments (requiring specialized ATEX/IECEx certifications).

- The Competitive Landscape within Regions: The regional dynamics also influence the competitive structure. In APAC, local manufacturers often compete effectively on cost and volume, while North America and Europe typically prioritize established global players (like Siemens and Rockwell) who offer extensive service networks and integration support required for complex, mission-critical deployments. The trend toward customized, localized manufacturing of IPCs is rising globally due to the geopolitical desire to mitigate supply chain concentration risk, further influencing regional procurement decisions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Box IPC Market.- Advantech Co., Ltd.

- Siemens AG

- Beckhoff Automation GmbH & Co. KG

- Kontron S&T AG

- Rockwell Automation, Inc.

- Omron Corporation

- Dell Technologies (via IoT division)

- Schneider Electric SE

- NEXCOM International Co., Ltd.

- DFI Inc.

- AAEON Technology Inc.

- Arbor Technology Corp.

- ADLINK Technology Inc.

- Lanner Electronics Inc.

- IEI Integration Corp.

- Phoenix Contact GmbH & Co. KG

- Mitac International Corp.

- Avalue Technology Inc.

- B&R Industrial Automation GmbH

- Fuji Electric Co., Ltd.

- WAGO Kontakttechnik GmbH & Co. KG

- Supermicro Computer, Inc.

- Hewlett Packard Enterprise (HPE)

- ASRock Industrial Computer Corp.

- Eurotech S.p.A.

Frequently Asked Questions

Analyze common user questions about the Box IPC market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of fanless Box IPCs over traditional industrial computers?

Fanless Box IPCs utilize passive cooling, eliminating mechanical failure points and reducing maintenance needs significantly. This design prevents dust and contaminants from entering the system, making them highly reliable and durable in harsh industrial environments with high ingress protection (IP) requirements, thereby ensuring extended mean time between failures (MTBF). They also operate silently and consume less power.

How is the adoption of Industry 4.0 influencing Box IPC product development?

Industry 4.0 mandates the shift toward smart manufacturing, requiring Box IPCs to integrate enhanced edge computing capabilities, support real-time communication protocols like TSN, and incorporate AI/ML acceleration hardware (GPUs/VPUs) to process massive datasets locally for quality control and predictive analytics. This necessitates smaller, more powerful, and network-centric designs.

Which geographical region exhibits the highest growth potential for the Box IPC Market?

Asia Pacific (APAC), particularly driven by industrial modernization in China, India, and South Korea, shows the highest growth potential due to massive investments in smart factories, expanding electronics manufacturing, and government support for industrial automation initiatives across the region, leading to high volume demand.

What role does Time-Sensitive Networking (TSN) play in the latest Box IPC implementations?

TSN ensures deterministic, guaranteed latency for critical control loops, enabling real-time communication and synchronized machine control across the factory floor. Box IPCs equipped with TSN support are essential for advanced, multi-axis robotic systems and crucial centralized automation tasks where nanosecond precision is required, allowing IPCs to replace legacy fieldbus architectures.

What is the typical lifecycle support duration offered for Box IPC components?

Unlike commercial PCs, Box IPCs offer extended product lifecycles, typically guaranteeing component availability and support for 7 to 15 years. This longevity is critical for industrial customers who need to maintain system integrity, reduce re-certification costs, and avoid hardware obsolescence in long-term deployment scenarios, ensuring stable operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- BOX IPC Market Size Report By Type (Standalone Industrial Box PC, Embedded Industrial Box PC), By Application (Rail transit construction, Industrial automation, Intelligent service, Electric power and energy, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- BOX IPC Market Statistics 2025 Analysis By Application (Rail transit construction, Industrial automation, Intelligent service, Electric power and energy), By Type (Standalone Industrial Box PC, Embedded Industrial Box PC), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager