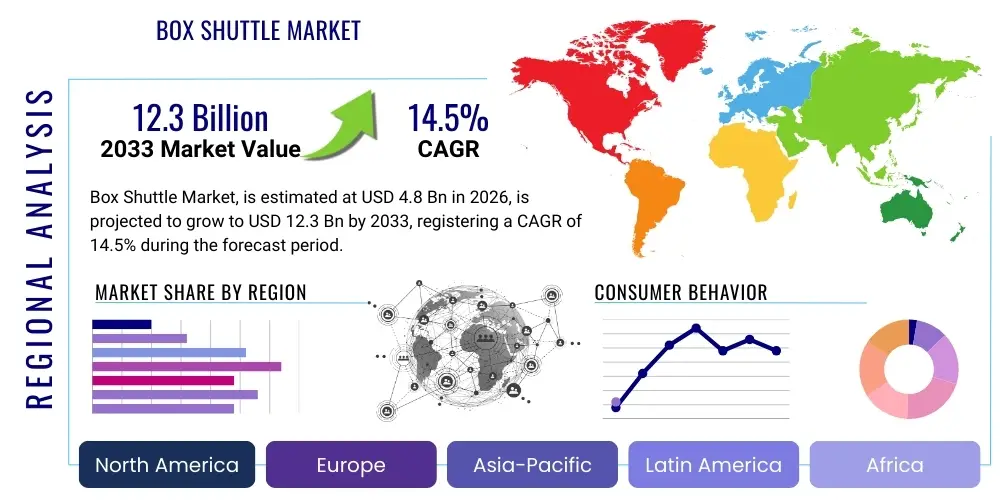

Box Shuttle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439082 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Box Shuttle Market Size

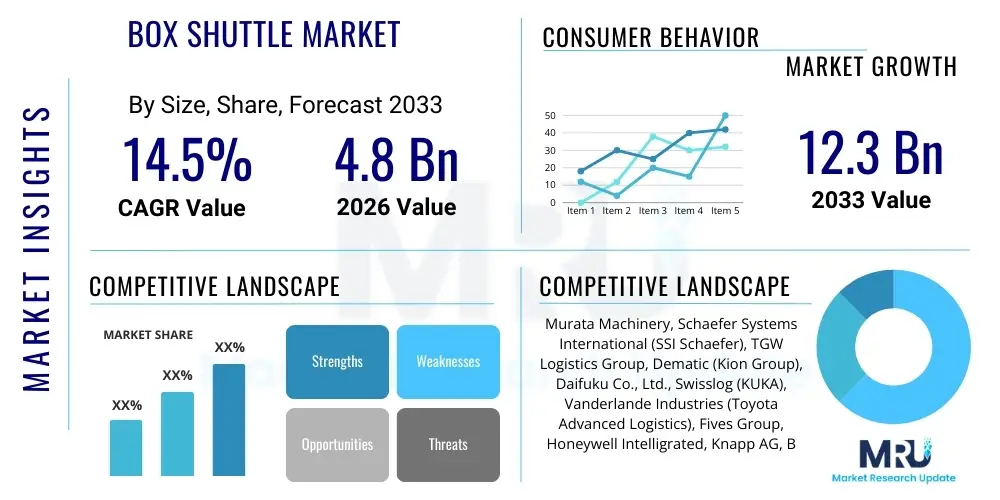

The Box Shuttle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 12.3 Billion by the end of the forecast period in 2033. This robust expansion is fundamentally driven by the escalating demand for highly efficient, dense storage solutions necessary to manage the complexity of modern e-commerce fulfillment and intralogistics operations across global supply chains. The need for rapid order processing and high throughput in warehouses and distribution centers has positioned Box Shuttle systems as crucial infrastructure investments, offering superior space utilization compared to conventional material handling technologies.

Box Shuttle Market introduction

The Box Shuttle Market encompasses advanced automated storage and retrieval systems (AS/RS) specifically designed for handling standardized storage units such as cartons, boxes, or totes. These highly dynamic systems utilize specialized shuttles, often running on defined rail structures across single or multiple levels, to move inventory items to and from designated pickup or drop-off points (P&D stations) or workstations for tasks like picking, packing, or sequencing. The core product description centers on high-speed robotic vehicles (shuttles), racking infrastructure, lifting mechanisms (vertical conveyors or elevators), and sophisticated control software (WCS/WMS interfaces) that coordinate thousands of movements simultaneously within a defined cube of storage space, maximizing throughput rates dramatically.

Major applications for Box Shuttle technology span diverse sectors, prominently including e-commerce fulfillment centers requiring enormous inventory accessibility, third-party logistics (3PL) providers managing multi-client inventories, and manufacturing facilities implementing buffer storage or work-in-progress (WIP) sequencing. These systems are instrumental in facilitating Goods-to-Person (GTP) picking methodologies, which significantly reduce labor costs and improve operational accuracy compared to traditional person-to-goods methods. Furthermore, they are extensively utilized in micro-fulfillment centers (MFCs) located in urban areas, enabling ultra-fast delivery options for groceries and general merchandise where real estate footprint is severely limited.

The primary benefits driving market adoption include unparalleled storage density, allowing organizations to store significantly more inventory per square meter, scalability through modular design, high operational reliability, and substantial energy efficiency improvements due to optimized movement algorithms. Key driving factors are the globalization of e-commerce, which necessitates faster and more accurate delivery cycles; severe labor shortages in logistics, prompting greater automation investment; and technological advancements in robotics, sensor fusion, and machine learning that enhance system intelligence and fault tolerance. These systems offer a competitive advantage by transforming conventional warehouses into flexible, high-density automation hubs capable of meeting unpredictable demand spikes efficiently.

Box Shuttle Market Executive Summary

The global Box Shuttle Market is characterized by vigorous growth, primarily fueled by sustained robust investment in global supply chain resilience and digitalization across key end-user segments, notably e-commerce, retail, and 3PL services. Current business trends indicate a strong move toward highly flexible and modular AS/RS solutions, capable of handling mixed media and integrating seamlessly with other warehouse automation technologies such as Automatic Guided Vehicles (AGVs) and collaborative robots (Cobots). A critical trend involves the shift from strictly proprietary systems toward open architectural platforms, facilitating easier integration and lifecycle management for complex intralogistics environments. Furthermore, companies are prioritizing systems with superior energy efficiency and enhanced predictive maintenance capabilities, recognizing the long-term operational cost implications associated with large-scale automation deployments. Consolidation among system integrators and increased specialization among component manufacturers also defines the competitive landscape, pushing innovation in shuttle speeds and load capacity.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market due to massive expansion in consumer internet penetration, rapid development of regional e-commerce giants, and supportive government initiatives promoting industrial automation in countries like China, Japan, and South Korea. North America maintains the largest market share in terms of current adoption value, driven by the immediate need to modernize aging infrastructure and counter acute labor market tightness, particularly in the US. Europe demonstrates mature market dynamics, focusing on optimizing existing logistics networks through retrofit projects and adhering to strict sustainability mandates, favoring systems offering quantifiable reductions in carbon footprint and energy consumption. The adoption rate in Latin America and the Middle East and Africa (MEA) is accelerating, albeit from a smaller base, primarily focused on establishing foundational logistics infrastructure to support urbanization and growing retail distribution networks.

Segmentation trends reveal that multi-level shuttle systems are experiencing the fastest uptake, specifically those designed for deep-lane or multi-deep storage, as they offer the highest density required for handling fast-moving consumer goods (FMCG) and high-volume e-commerce stock keeping units (SKUs). By application, e-commerce and 3PL segments continue to dominate system deployment, dictated by the urgent demand for flexible order fulfillment methodologies, including Buy Online, Pick Up In Store (BOPIS) and Ship from Store operations. Within the healthcare sector, specialized shuttle systems catering to regulated temperature control and high inventory visibility for pharmaceuticals and medical devices are also seeing pronounced growth. The software and controls segment, encompassing Warehouse Control Systems (WCS) and advanced optimization algorithms, represents a critical differentiator, enabling superior system performance and adaptability to dynamic operational demands, thereby driving market value higher than the hardware alone.

AI Impact Analysis on Box Shuttle Market

Common user questions regarding AI’s influence on the Box Shuttle Market frequently revolve around performance optimization, failure prediction, and autonomous decision-making within complex AS/RS environments. Users are primarily concerned with how AI can transcend conventional programmed logistics by dynamically adapting storage strategies (slotting optimization), enhancing throughput in real-time by preemptively adjusting shuttle paths to avoid congestion, and accurately forecasting maintenance needs to minimize system downtime. Key themes emphasize AI’s role in managing system complexity, particularly in large-scale multi-level installations, and ensuring that the initial heavy capital investment translates into maximized operational longevity and efficiency, moving the industry beyond reactive monitoring toward true predictive and prescriptive intralogistics management.

- AI-powered predictive maintenance drastically reduces unplanned downtime by analyzing sensor data (vibration, temperature, power consumption) to forecast component failure in shuttles and vertical conveyors.

- Real-time dynamic slotting optimization utilizes machine learning algorithms to adjust product placement based on fluctuating demand patterns and order profiles, minimizing shuttle travel time and maximizing pick efficiency.

- Advanced swarm robotics and coordination algorithms, enabled by AI, optimize the flow and pathing of multiple shuttles operating in the same aisle, eliminating bottlenecks and improving overall system throughput capacity.

- Enhanced vision systems integrated with shuttles use deep learning for accurate item verification, reducing picking errors (misships) and improving inventory audit accuracy, critical for high-value goods.

- AI-driven energy management systems modulate shuttle speed and acceleration profiles based on current load and energy pricing, leading to significant reductions in operational power consumption and increased sustainability scores.

- Simulation and digital twin technology, often underpinned by AI, allow logistics managers to test operational changes and system expansions virtually before physical deployment, mitigating risk and optimizing system design.

DRO & Impact Forces Of Box Shuttle Market

The Box Shuttle Market’s growth trajectory is strongly influenced by a robust set of Drivers, moderated by specific Restraints, and presents significant Opportunities, which together define the competitive dynamics and future potential of the sector. The primary drivers revolve around the irreversible trend of e-commerce expansion and the persistent labor scarcity plaguing warehousing operations worldwide, compelling businesses toward full automation solutions. These positive forces are countered by restraints such as the substantial upfront capital expenditure required for sophisticated AS/RS deployments, the complexity involved in integrating these proprietary systems with existing legacy WMS infrastructure, and the need for specialized technical expertise for ongoing maintenance and operations. Despite these hurdles, vast opportunities exist in modular system design, leveraging IoT and AI for optimization, and penetrating emerging markets where logistics infrastructure is undergoing rapid modernization.

The key Impact Forces dictating market trajectory include the accelerating speed of technology iteration, where newer shuttle designs offer higher velocity and greater payload capacity, rapidly obsolescing older systems. Furthermore, global geopolitical shifts and supply chain disruptions emphasize the necessity for regionalized or localized fulfillment centers (micro-fulfillment), which inherently rely on space-saving automation like Box Shuttles. Competitive pressure among logistics automation providers forces continuous innovation in software control systems, leading to more flexible and scalable solutions. Regulatory standards concerning workplace safety and increasing corporate sustainability goals also act as impact forces, favoring automated systems that reduce manual labor risks and offer verifiable energy efficiency metrics.

Drivers

- Explosive growth of the global e-commerce sector necessitating high throughput and rapid fulfillment capabilities.

- Acute shortage and increasing cost of manual labor in warehousing and logistics operations across developed economies.

- Demand for maximizing storage density and optimizing cubic space utilization, particularly in urban logistics hubs and expensive real estate locations.

- Technological advancements in robotics, controls, and battery technology improving shuttle performance and reliability.

Restraints

- High initial capital investment and complexity associated with installing and commissioning multi-level AS/RS systems.

- Challenges related to seamless integration with existing legacy Warehouse Management Systems (WMS) and IT infrastructure.

- Requirement for highly specialized technical expertise for system maintenance, troubleshooting, and programming.

- Potential vulnerability to single points of failure, though mitigated by redundancy design, which can severely impact operations if not managed proactively.

Opportunities

- Expansion into emerging markets (e.g., Southeast Asia, Latin America) undergoing rapid logistics modernization.

- Development of standardized, modular, and scalable systems tailored for Small and Medium Enterprises (SMEs) via Robotics-as-a-Service (RaaS) models.

- Integration of Box Shuttle systems with other advanced mobile robotics (AGVs/AMRs) for end-to-end automation workflows.

- Growing adoption of micro-fulfillment center (MFC) concepts in retail and grocery for last-mile delivery efficiency.

Segmentation Analysis

The Box Shuttle Market is comprehensively segmented based on Type, Application, and End-User, providing granular insights into varying demand patterns and technological preferences across the global logistics ecosystem. Segmentation by Type primarily distinguishes between single-level and multi-level (or multi-deep) shuttle architectures, reflecting different requirements for throughput versus storage density. Multi-level systems, which are inherently more complex and costly, dominate large-scale distribution centers due to their capacity to deliver massive stockkeeping unit (SKU) counts and high order processing rates, crucial for mass market fulfillment.

Application-based segmentation reveals the primary functional deployment scenarios, with e-commerce and 3PL segments serving as the core revenue drivers, utilizing shuttles for complex multi-channel fulfillment and returns processing. The manufacturing segment utilizes shuttles largely for buffer storage, kitting, and sequencing parts for production lines, while the healthcare sector leverages their precision and traceability for pharmaceuticals. End-User segmentation provides the final layer of detail, identifying retail (general merchandise and grocery) as the most aggressive adopter, driven by the shift towards omnichannel retailing which demands flexible and highly accurate inventory access across the entire network.

- By Type:

- Single-Level Shuttles

- Multi-Level Shuttles (Deep-Lane, Multi-Deep, and Conventional)

- By Application:

- E-commerce Fulfillment

- Third-Party Logistics (3PL)

- Manufacturing & Automotive

- Healthcare & Pharmaceutical

- Food & Beverage Distribution

- By End-User:

- Retail & Consumer Goods

- Grocery & Fresh Food

- General Manufacturing

- Postal & Courier Services

Value Chain Analysis For Box Shuttle Market

The Value Chain for the Box Shuttle Market begins with Upstream Analysis, focusing on the procurement of critical raw materials and sophisticated components. This involves key suppliers of high-precision motors, sensor arrays (LIDAR, encoders), specialized lightweight structural metals, durable plastics for shuttle bodies, and advanced battery technology (Lithium-ion). Component manufacturing is highly specialized, demanding rigorous quality control, and is often dominated by global niche suppliers, making supply chain resilience a significant consideration for system integrators. The integration phase involves the design, manufacturing, and assembly of the shuttle vehicles, racking infrastructure, and complex vertical transfer units, where intellectual property related to proprietary control systems is the main value driver, establishing core competency and differentiation among top manufacturers.

Downstream analysis centers on the installation, deployment, and lifecycle management of these systems at the end-user site. This phase includes extensive site surveys, customizing the system layout to fit specific facility constraints, integrating the Warehouse Control System (WCS) with the client’s existing WMS/ERP, and conducting rigorous performance testing. Distribution channels are predominantly Direct, leveraging internal sales forces and specialized project management teams due to the high capital cost and complexity of the deployment. Indirect channels, involving select global partners or certified regional system integrators, are used to extend market reach, particularly in geographies where direct sales and support infrastructure are costly to maintain, though the core system expertise remains centralized with the manufacturer.

The value generated is not only derived from the hardware sale but increasingly from the long-term service agreements (LSAs) covering maintenance, software upgrades, and performance tuning. This shift towards service revenue stabilizes profitability and locks in customer relationships. The direct channel ensures maximum control over the highly technical installation process and allows for close collaboration with the customer on solution design, which is essential given the bespoke nature of many large-scale Box Shuttle deployments. The indirect approach helps system providers scale their implementation capacity globally, relying on local expertise for localized support while retaining oversight on core system components and software licenses.

Box Shuttle Market Potential Customers

The primary end-users and buyers of Box Shuttle systems are organizations facing immense pressure to accelerate fulfillment speed while simultaneously reducing operational costs and maximizing the use of available physical space. These systems are most critical for large-scale e-commerce retailers, such as general merchandise giants and specialized online apparel vendors, who require access to millions of inventory items instantaneously. Third-Party Logistics (3PL) providers represent another crucial customer base, as they must handle fluctuating volumes and diverse inventory profiles across multiple clients, demanding the inherent flexibility and scalability that modern shuttle systems offer to quickly onboard new business without major infrastructure overhaul.

Beyond traditional logistics, major grocery retailers are becoming high-priority customers, investing heavily in Box Shuttle technology for their centralized dark stores or highly localized micro-fulfillment centers (MFCs) to efficiently manage perishable and high-turnover items for same-day delivery or curbside pickup. Furthermore, large multinational manufacturers in the automotive and high-tech electronics sectors utilize Box Shuttles for buffering and sequencing parts, ensuring just-in-time (JIT) delivery to assembly lines, thus acting as essential cogs in modern manufacturing automation strategies. Any enterprise dealing with high SKU volume, tight deadlines, and premium real estate costs is a prime candidate for adopting these high-density automated solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 12.3 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Murata Machinery, Schaefer Systems International (SSI Schaefer), TGW Logistics Group, Dematic (Kion Group), Daifuku Co., Ltd., Swisslog (KUKA), Vanderlande Industries (Toyota Advanced Logistics), Fives Group, Honeywell Intelligrated, Knapp AG, Beumer Group, MHS Global, System Logistics (Krones), Pteris Global, E&K Automation, Savoye (Haas Group), Korber AG, Witron, OPEX Corporation, Locus Robotics (Integration partners) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Box Shuttle Market Key Technology Landscape

The Box Shuttle Market is underpinned by sophisticated electro-mechanical and software technologies designed to ensure high-speed, reliable, and space-efficient operation. Key hardware innovations include highly energy-efficient motor technologies (often servo or synchronous motors) for rapid acceleration and deceleration, advanced lithium-ion battery management systems providing longer runtimes and quick charging capabilities via contact or induction methods, and lightweight composite materials used in shuttle construction to maximize payload ratio and minimize energy consumption per cycle. Precision guiding systems, including sensors and encoders, are essential for accurate positioning, particularly in multi-deep storage configurations where tolerances are extremely tight, ensuring smooth transitions between racking and vertical lifting mechanisms, which themselves are becoming faster and more intelligent.

Software control constitutes the critical differentiator in the modern Box Shuttle landscape. Advanced Warehouse Control Systems (WCS) are vital for coordinating thousands of simultaneous shuttle movements, dynamically assigning tasks, and managing complex inventory profiles across the system's storage cube. These WCS platforms utilize sophisticated optimization algorithms, often incorporating Artificial Intelligence (AI) and Machine Learning (ML) elements, to determine optimal storage locations (slotting), sequencing of orders, and real-time pathfinding to prevent traffic congestion. Furthermore, robust IoT connectivity enables constant data transmission from onboard sensors for crucial predictive maintenance diagnostics, allowing operators to monitor the health of individual shuttles and plan preemptive servicing before operational failures occur, maintaining peak system uptime, which is paramount.

The development of standardized communication protocols and open integration interfaces (APIs) is also a significant technological trend, allowing Box Shuttle systems to communicate effectively with adjacent automation equipment, such as Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), and high-speed sortation equipment. This interoperability transforms the Box Shuttle system from a siloed component into an integral part of an integrated, fluid automation ecosystem. Future technological developments are focused on increasing shuttle speeds, expanding payload capabilities to handle heavier or bulkier totes, and further miniaturization of components to increase storage density without compromising robustness or safety standards, reinforcing the market’s technological maturity and competitive edge in intralogistics.

Regional Highlights

Geographically, the Box Shuttle Market exhibits distinct consumption patterns and growth drivers across major global regions. North America currently dominates the market in terms of deployed value, driven primarily by the high cost and scarcity of labor, necessitating immediate and comprehensive automation investments in e-commerce and 3PL warehousing. The region, particularly the United States, is characterized by large-scale, high-volume distribution centers that require multi-level, high-speed shuttle systems to manage expansive inventory ranges and meet consumer expectations for expedited shipping, fueling intense competitive infrastructure investment among major retailers and logistics players.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This explosive growth is attributable to rapid urbanization, immense growth in the digital economy (e-commerce penetration rates are skyrocketing, especially in China, India, and Southeast Asia), and significant government investments promoting industrial automation and smart logistics hubs. Furthermore, the limited availability and high cost of land in densely populated urban centers throughout APAC make the space-saving density of Box Shuttle systems an especially attractive solution for new fulfillment center construction and expansion projects.

Europe represents a mature but stable market, focusing heavily on optimizing existing infrastructure through modular retrofits and system upgrades. European adoption is influenced by stringent environmental and sustainability regulations, favoring suppliers who can demonstrate superior energy efficiency and long-term serviceability of their systems. Germany and the UK remain core centers for advanced manufacturing and retail logistics innovation, driving demand for tailored Box Shuttle solutions that integrate smoothly into complex, established supply chain networks with a strong emphasis on operational safety and reducing total cost of ownership (TCO).

- North America: Largest market share, driven by labor shortage mitigation, high labor costs, and mature e-commerce infrastructure supporting rapid deployment of large-scale, automated mega-centers.

- Asia Pacific (APAC): Fastest growth region, spurred by vast e-commerce expansion, urbanization, government support for automation, and the critical need for high-density storage solutions in land-constrained areas.

- Europe: Stable growth focused on optimization, retrofit projects, adherence to high sustainability standards, and strong demand from the advanced manufacturing and automotive sectors for JIT sequencing.

- Latin America (LATAM): Emerging market with increasing adoption tied to foreign direct investment in retail and consumer goods infrastructure, aiming to establish modern regional distribution hubs.

- Middle East and Africa (MEA): Growing investment in logistics infrastructure as part of economic diversification programs (e.g., UAE, Saudi Arabia), focusing on establishing large automated facilities for regional trade and modernizing port logistics operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Box Shuttle Market.- Murata Machinery, Ltd.

- Schaefer Systems International (SSI Schaefer)

- TGW Logistics Group GmbH

- Dematic (Kion Group)

- Daifuku Co., Ltd.

- Swisslog (KUKA AG)

- Vanderlande Industries (Toyota Advanced Logistics)

- Fives Group

- Honeywell Intelligrated

- Knapp AG

- Beumer Group

- MHS Global

- System Logistics S.p.A. (Krones Group)

- Pteris Global Limited

- E&K Automation GmbH

- Savoye (Haas Group)

- Korber AG (through various subsidiaries)

- Witron Logistik + Informatik GmbH

- OPEX Corporation

- A-SIS (Groupe Savoye)

Frequently Asked Questions

Analyze common user questions about the Box Shuttle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Box Shuttle Market?

The primary driver is the exponential expansion of global e-commerce, which mandates highly efficient, rapid order fulfillment systems and increased storage density to manage vast and complex SKU inventories, coupled with widespread labor shortages in logistics sectors globally.

How does a Box Shuttle system differ from traditional AS/RS or Mini-Load systems?

Box Shuttle systems offer superior flexibility and parallelism compared to traditional Mini-Load AS/RS, which often uses cranes in a single aisle. Shuttles are designed for high-speed, independent movement across multiple levels, significantly increasing throughput and providing inherent redundancy for continuous operation.

What is the typical Return on Investment (ROI) timeframe for implementing a Box Shuttle system?

While dependent on scale and complexity, the typical ROI timeframe for a large-scale Box Shuttle system ranges from three to five years, primarily realized through substantial reductions in labor costs, significant increases in inventory accuracy, and maximized utilization of warehouse real estate.

Which industry segment is expected to be the fastest adopter of Box Shuttle technology?

The Asia Pacific e-commerce and logistics sectors are expected to be the fastest adopters, followed closely by the global grocery retail segment due to increasing demand for ultra-fast localized fulfillment solutions like Micro-Fulfillment Centers (MFCs).

How does AI contribute to the efficiency of Box Shuttle systems?

AI significantly enhances efficiency by enabling predictive maintenance, optimizing real-time shuttle pathing to prevent congestion, and dynamically managing storage location (slotting) based on demand forecasts, maximizing system uptime and overall throughput performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager