Braided Packing Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434490 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Braided Packing Sales Market Size

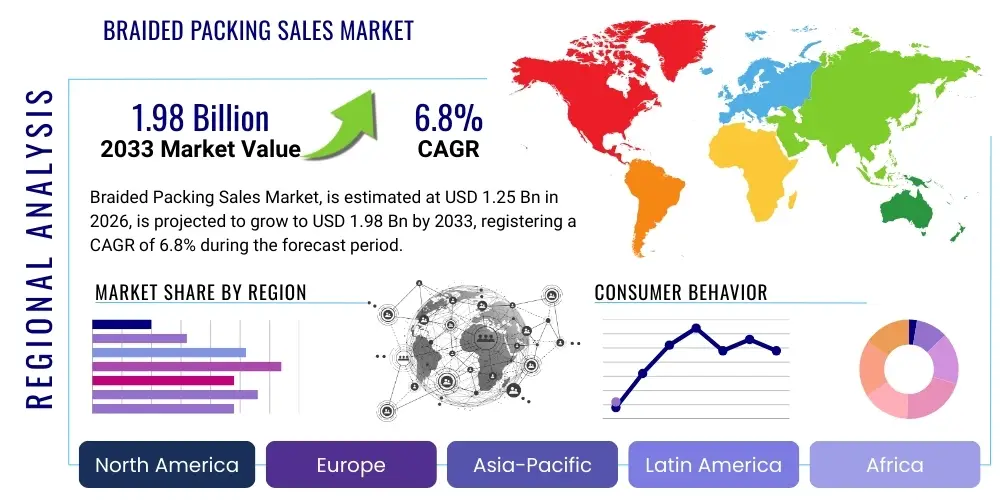

The Braided Packing Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.25 Billion USD in 2026 and is projected to reach $1.98 Billion USD by the end of the forecast period in 2033.

Braided Packing Sales Market introduction

The Braided Packing Sales Market encompasses the manufacturing, distribution, and utilization of flexible, fibrous materials woven into square or rectangular cross-sections, primarily employed as static or dynamic seals in industrial equipment. These critical components are integral to maintaining the operational efficiency and integrity of rotating and reciprocating machinery such as pumps, valves, agitators, and mixers, preventing the leakage of process fluids or gases. Braided packings are formulated from a variety of high-performance materials including PTFE, graphite, carbon fiber, aramid, and various synthetic or natural fibers, often enhanced with lubricants or blocking agents to optimize performance under extreme conditions.

Major applications driving market demand span heavy industries, including oil and gas extraction, chemical processing, power generation (both thermal and nuclear), wastewater treatment, and marine engineering. The principal benefits offered by modern braided packings include superior chemical resistance, high-temperature stability, low friction coefficients, and adaptability across a wide range of pressure conditions. This adaptability makes them essential for sealing critical infrastructure where environmental compliance and operational uptime are paramount. Furthermore, the inherent resilience and cost-effectiveness of these sealing solutions contribute significantly to their enduring market relevance compared to alternative sealing technologies.

Driving factors for sustained market growth include the continuous expansion of the global chemical and petrochemical sectors, ongoing investments in maintenance, repair, and overhaul (MRO) activities across mature industrial economies, and the increasing regulatory scrutiny demanding zero-emission sealing solutions. Technological advancements, particularly in developing non-asbestos and environmentally compliant materials, are also stimulating demand for premium, high-integrity braided packing products capable of meeting the rigorous operational standards of modern industrial facilities.

Braided Packing Sales Market Executive Summary

The Braided Packing Sales Market demonstrates robust growth, primarily fueled by sustained industrial expansion in emerging economies and the critical need for reliable sealing solutions in aging infrastructure across developed regions. Key business trends indicate a definitive shift toward specialty, high-performance materials such as expanded PTFE and flexible graphite, driven by end-users seeking enhanced chemical inertness and prolonged service life in demanding applications, especially within the volatile chemical and energy sectors. Strategic market movements involve increased vertical integration among key manufacturers aiming to control raw material supply and ensure material quality consistency, alongside heightened Merger and Acquisition (M&A) activities focused on acquiring niche technology providers specializing in advanced braiding techniques and surface treatments.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, attributed to rapid industrialization, extensive investments in new power generation capacity, and the substantial build-out of chemical processing plants in countries like China and India. North America and Europe, while growing at a slower pace, maintain significant market shares due to the high replacement rate within established refineries and the strict adherence to stringent emission control regulations, necessitating continuous upgrades to existing sealing systems. This regional dichotomy highlights a demand structure split between new installations (APAC) and essential MRO activities coupled with regulatory compliance (West).

Segmentation trends confirm the dominance of PTFE and Graphite-based packings by material type, favored for their versatility and thermal properties. Application-wise, the Valve segment maintains the largest market share, given the sheer volume and operational criticality of valves in controlling fluid flow throughout industrial systems. Furthermore, there is a distinct trend favoring customized and application-specific product lines over generic packing, indicating that end-users prioritize sealing system reliability and performance tailoring to specific operational parameters, thereby bolstering the premium segment of the market.

AI Impact Analysis on Braided Packing Sales Market

User inquiries regarding AI's impact on the Braided Packing Sales Market commonly revolve around process optimization, predictive maintenance integration, and supply chain efficiency. Users seek clarification on how AI can enhance the quality control of braided products, specifically addressing the consistency of density and fiber alignment during the braiding process, which is critical for sealing performance. Furthermore, there is significant interest in utilizing machine learning algorithms for predictive maintenance scheduling in end-user industries; this involves analyzing sensor data (vibration, temperature, pressure) from sealed equipment to predict potential packing failure, thereby shifting the industry from reactive replacement to proactive servicing. Concerns also focus on the potential for AI-driven automation to disrupt traditional manufacturing employment and the challenges associated with integrating legacy industrial equipment with modern smart monitoring systems necessary for successful predictive modeling.

- AI algorithms optimize raw material usage, minimizing scrap rates during the complex braiding process.

- Machine Vision Systems (MVS) powered by AI ensure real-time quality inspection of finished packings, verifying dimensional tolerance and weave integrity.

- Predictive Maintenance (PdM) models, deployed in pumps and valves, analyze operational data to estimate the Remaining Useful Life (RUL) of installed braided packings, reducing unplanned downtime.

- AI-enhanced inventory management systems forecast demand for specific packing types based on historical MRO cycles and regional industrial output, optimizing supply chain logistics.

- Generative AI assists R&D by simulating material behavior and optimizing fiber combinations for enhanced sealing properties and chemical compatibility.

- Automated robotics guided by AI improve the precision and speed of intricate cutting and molding operations required for customized sealing rings.

DRO & Impact Forces Of Braided Packing Sales Market

The Braided Packing Sales Market is significantly influenced by powerful Drivers related to industrial necessity and stringent regulatory compliance, counterbalanced by Restraints centered on technological limitations and competition from alternative sealing solutions. Opportunities largely stem from technological innovation in material science and geographic expansion into high-growth industrial clusters. These forces collectively shape the market's trajectory, determining investment priorities and manufacturing strategies across the value chain. The primary impact force remains the unrelenting demand for operational uptime and safety across process industries, where sealing integrity is non-negotiable for environmental and economic reasons. Environmental regulations, such as those governing fugitive emissions (e.g., EPA mandates), act as a major external driver, pushing industries to adopt premium, reliable sealing technologies.

Key drivers include the global resurgence in Oil & Gas downstream refining capacity and substantial investment in the chemical and petrochemical sectors, particularly in Asia and the Middle East, requiring large volumes of sealing materials for new installations. Furthermore, the massive installed base of aging industrial assets worldwide necessitates continuous, high-volume MRO demand for braided packings. Restraints primarily involve the rising adoption of mechanical seals, which often offer superior leakage control in critical high-speed applications, posing a competitive threat. Additionally, the volatility in raw material prices, specifically synthetic fibers like aramid and high-purity graphite, can compress profit margins for manufacturers and lead to price instability in the finished product market, hindering uniform market growth.

Opportunities are strongly concentrated in the development of hybrid packings that combine the best attributes of multiple materials (e.g., PTFE with carbon fiber reinforcement) to achieve superior performance under extreme pH or pressure conditions. Geographic expansion into underdeveloped industrial markets in Africa and specific Latin American countries also presents untapped potential. The overarching impact forces dictate that manufacturers must continuously innovate to achieve zero-leakage performance while maintaining cost efficiency. Success in the market depends critically on product certification (e.g., API 622 for low-emission packing) and establishing strong distribution networks capable of providing immediate MRO support globally.

Segmentation Analysis

The Braided Packing Sales Market is systematically segmented based on material type, end-user industry, and product application, allowing for a detailed analysis of demand dynamics and growth pockets within specific niches. Understanding these segments is crucial for manufacturers to tailor product development and marketing strategies. The market structure reflects the varied operational requirements across different industrial sectors, where factors such as fluid compatibility, operating temperature, and pressure dictate the selection of appropriate packing materials. The segmentation breakdown provides clear insights into which materials dominate specific applications, such as the preference for graphite in high-temperature boiler systems versus PTFE in chemically aggressive environments.

Material segmentation reveals a mature market dominated by traditional, high-volume materials, but with significant growth observed in advanced materials designed for specialized, extreme conditions. The end-user segmentation clearly identifies the Oil & Gas and Chemical sectors as the financial backbone of the market, driven by their critical infrastructure and intense MRO needs. Furthermore, the application segmentation highlights the prominence of valve sealing, which requires continuous maintenance and replacement due to the high frequency of movement and exposure to harsh conditions, distinguishing it from static pump seals or flange gaskets.

- By Material Type:

- Graphite Packing (Flexible Graphite, Reinforced Graphite)

- PTFE Packing (Virgin PTFE, Expanded PTFE, PTFE Filaments)

- Aramid Packing (Kevlar, Nomex)

- Carbon and Carbon Fiber Packing

- Synthetic Fiber Packing (Acrylic, Glass Fiber)

- Natural Fiber Packing (Cotton, Flax – shrinking share)

- By Application:

- Valve Sealing

- Pump Sealing (Centrifugal, Reciprocating)

- Mixers and Agitators Sealing

- Expansion Joints

- By End-User Industry:

- Oil & Gas (Upstream, Midstream, Downstream Refining)

- Chemical and Petrochemical Processing

- Power Generation (Thermal, Nuclear, Renewables)

- Pulp & Paper

- Mining & Metallurgy

- Water and Wastewater Treatment

- Marine and Shipbuilding

- By Sales Channel:

- Direct Sales

- Distributors and Third-Party Channel Partners

Value Chain Analysis For Braided Packing Sales Market

The value chain for the Braided Packing Sales Market begins upstream with the procurement of specialized raw materials. This stage is highly critical, involving the sourcing of high-purity graphite foils, sophisticated PTFE resins, and premium synthetic fibers such as aramid and carbon. The stability and quality of the upstream supply significantly impact the cost structure and the final performance characteristics of the braided packing. Raw material providers, often operating in concentrated markets, possess considerable leverage due to the specialized nature of these industrial fibers and chemicals. Manufacturers must maintain robust relationships with these suppliers and invest in thorough material inspection protocols to ensure compliance with demanding technical specifications necessary for high-pressure, high-temperature applications.

The midstream process involves complex manufacturing activities, specifically braiding, saturation, and finishing. The braiding process utilizes precision machinery to interlock the fibers, determining the packing's density, flexibility, and anti-extrusion properties. Saturation, which involves impregnating the braided material with lubricants (like PTFE dispersions, oil, or grease) and blocking agents, is crucial for reducing friction, enhancing sealing integrity, and improving thermal dissipation. Post-processing includes molding, cutting, and quality control. Distribution channels bridge the gap between manufacturers and diverse end-users. Direct sales are common for large, strategic accounts like multinational oil companies or major power utilities, where technical consultation and customized solutions are required. However, the vast majority of transactions, particularly MRO sales, flow through specialized industrial distributors and sealing house partners who maintain local inventory and provide immediate technical support and installation services.

Downstream analysis focuses on the end-user application across industrial sectors such as Oil & Gas, Chemical Processing, and Power Generation. Demand is characterized by replacement cycles rather than initial equipment purchases, positioning the MRO market as the primary revenue generator. The decision-making process at the downstream level is heavily influenced by total cost of ownership (TCO), regulatory compliance (e.g., fugitive emissions standards), and the need for zero-leakage operation. The effectiveness of the indirect distribution channel is paramount here, as timely delivery of highly specific packing sizes and materials is essential to minimize critical equipment downtime. Furthermore, successful manufacturers often provide extensive technical training to their distributor network, ensuring that the correct packing is selected, installed, and maintained across varied industrial environments, thereby reinforcing brand loyalty and recurring sales.

Braided Packing Sales Market Potential Customers

Potential customers for braided packing products are predominantly heavy industrial entities engaged in process manufacturing where critical fluids (liquids, gases, steam) must be contained under dynamic or static conditions. The largest consumer segment consists of the Oil & Gas industry, including upstream drilling facilities, midstream pipeline operations, and downstream refineries and petrochemical plants. These facilities utilize thousands of valves and pumps operating under extremely high pressures and temperatures, often handling hazardous or corrosive media. Reliable sealing is mandatory not only for operational efficiency but also for meeting stringent environmental regulations concerning volatile organic compounds (VOCs) and hazardous air pollutants (HAPs).

The Chemical and Petrochemical Processing sectors represent another core customer base, characterized by their high demand for chemically inert packings, such as those made from expanded PTFE, capable of resisting aggressive acids, solvents, and alkalis. Within this sector, customers often require custom-engineered solutions tailored to specific media and operational cycles of reactors, mixers, and specialized chemical pumps. Similarly, the Power Generation industry, encompassing coal-fired, gas-turbine, and nuclear power plants, relies heavily on high-temperature graphite packing for sealing steam valves and boiler feedwater pumps, where operational temperatures can exceed 500°C, making thermal stability the paramount purchasing criterion.

Beyond these primary sectors, substantial demand is generated by the maintenance, repair, and overhaul (MRO) market across secondary industries. This includes Pulp & Paper mills, which require packings resistant to abrasive slurries and caustic chemicals; Mining and Metallurgy, where durability against particulate contamination is key; and Water/Wastewater Treatment facilities, focusing on economical, reliable seals for large volume pumps. The purchasing decision for MRO customers is often driven by the product's longevity, ease of installation, and proven field performance, leading to a strong preference for branded products supported by comprehensive technical documentation and local stock availability provided by robust distribution partners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion USD |

| Market Forecast in 2033 | $1.98 Billion USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garlock Sealing Technologies, John Crane (Smiths Group), Chesterton, Klinger Group, Teadit, Aesseal, James Walker, Flexitallic, Seal & Design Inc., Lamons, Trelleborg AB, Burgmann Industries, Flowserve Corporation, GrafTech International, Nippon Pillar Packing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Braided Packing Sales Market Key Technology Landscape

The technology landscape governing the Braided Packing Sales Market is characterized by continuous refinement in material science and significant advancements in precision manufacturing processes aimed at maximizing service life and minimizing friction and leakage. A primary area of technological focus involves the evolution of low-emission (Low-E) packing materials, driven by global mandates like API 622 certification. This necessitates the use of high-density flexible graphite and specialized reinforced carbon fibers, incorporating advanced corrosion inhibitors to protect vulnerable valve stems. Furthermore, manufacturers are investing heavily in producing advanced expanded PTFE (ePTFE) yarns that offer greater resilience and creep resistance compared to traditional PTFE, ensuring performance stability in fluctuating temperature and pressure environments inherent in modern industrial processes.

Manufacturing technology emphasizes sophisticated braiding techniques. Modern braiding machines utilize computerized numerical control (CNC) to achieve extremely consistent fiber alignment and packing density. Techniques such as diagonal or square plait braiding are continuously optimized to improve the structural integrity and uniformity of the packing cross-section, which is paramount for effective sealing and reduced shaft wear. The saturation technology has also advanced significantly, moving away from simple oil-based lubricants to high-performance, solid-block lubricants and specialty proprietary compounds (often PTFE or non-migrating synthetic substances) that are chemically inert and designed to resist washout or degradation during operation, ensuring long-term low-friction sealing performance.

Innovation extends into the development of hybrid and composite packings, representing a critical technological shift. These products strategically combine materials, such as incorporating aramid fibers at the corners (for anti-extrusion strength) and graphite or PTFE in the body (for chemical and thermal stability), effectively balancing mechanical strength with sealing performance. This composite approach addresses the multi-faceted challenges faced in complex sealing applications, particularly those involving high peripheral speeds or severely abrasive media. The technology landscape is thus defined by the strategic integration of superior raw materials, highly precise automated manufacturing, and application-specific material engineering, all targeted towards achieving highly reliable, low-maintenance sealing solutions that minimize environmental impact and maximize operational lifespan for end-users.

Regional Highlights

The global Braided Packing Sales Market exhibits distinct consumption patterns influenced by industrial maturity, regulatory frameworks, and economic growth rates across different regions. Asia Pacific (APAC) currently dominates the market both in terms of volume and growth rate. This supremacy is attributed to the unprecedented industrial expansion, particularly in China, India, and Southeast Asian nations, where extensive infrastructure projects are underway in chemicals, refining, and power generation sectors. This region primarily drives demand for new installation applications. Investment in robust MRO activities is also accelerating as the installed industrial base ages, making APAC a critical strategic region for global manufacturers focusing on capacity expansion and local technical support.

North America and Europe represent mature markets characterized by stringent regulatory environments, particularly concerning fugitive emissions (e.g., API 622, TA-Luft standards). Demand in these regions is heavily focused on premium, high-integrity, low-emission sealing solutions for replacement purposes within existing facilities. Manufacturers in these areas prioritize technological innovation, specifically the development of advanced graphite and carbon-based packings capable of meeting increasingly demanding leakage specifications. The high degree of automation and the prevalence of complex processes in petrochemicals and pharmaceuticals ensure consistent demand for specialized, certified sealing products, often commanding higher average selling prices than generalized products.

The Middle East and Africa (MEA) region, particularly the Gulf Cooperation Council (GCC) countries, showcases significant growth potential driven by substantial government investments in oil and gas infrastructure expansion and diversification into downstream processing (petrochemicals). The harsh operating environment (high heat and sand exposure) necessitates highly resilient packings. Latin America presents a mixed demand profile; while large industrial operations in countries like Brazil and Mexico contribute steady demand, economic volatility often affects large-scale capital expenditure, making the MRO market the most reliable revenue stream. Overall, regional success hinges on tailoring product portfolios to specific regulatory compliance needs and establishing rapid-response distribution networks capable of servicing critical MRO requirements.

- Asia Pacific (APAC): Leads in market growth due to rapid industrialization, high volume of new refinery and chemical plant construction, and increasing emphasis on MRO in countries like China and India.

- North America: Mature market driven by regulatory mandates (fugitive emissions control) and high investment in premium, certified low-emission packings for the aging installed base in the O&G sector.

- Europe: Focuses on sustainability and high-performance sealing, particularly driven by chemical manufacturing and stringent environmental standards such as REACH compliance and TA-Luft regulations in Germany.

- Middle East & Africa (MEA): High growth potential fueled by massive energy infrastructure projects; demand centered on packings that withstand extreme temperatures and corrosive environments common in oil production.

- Latin America (LATAM): Steady MRO market fueled by existing mining and energy assets, but new projects are often subject to regional economic and political stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Braided Packing Sales Market.- Garlock Sealing Technologies

- John Crane (Smiths Group)

- Chesterton

- Klinger Group

- Teadit

- Aesseal

- James Walker

- Flexitallic

- Seal & Design Inc.

- Lamons

- Trelleborg AB

- Burgmann Industries

- Flowserve Corporation

- GrafTech International

- Nippon Pillar Packing

- Leader Gasket Technologies

- Mezger Inc.

- Sterling Seals & Engineering

- Donkey Seals

- Lempco Sealing Solutions

Frequently Asked Questions

Analyze common user questions about the Braided Packing Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Braided Packing Sales Market?

The primary factor driving demand is the consistent requirement for Maintenance, Repair, and Overhaul (MRO) activities across mature industrial sectors, particularly in the oil and gas and chemical processing industries, coupled with stringent global regulations mandating control of fugitive emissions from sealed equipment.

How are environmental regulations impacting the adoption of new braided packing materials?

Environmental regulations, such as API 622 standards for valve sealing, are accelerating the adoption of advanced low-emission (Low-E) materials, predominantly high-purity flexible graphite and specialty reinforced PTFE packings, replacing traditional, less effective sealing solutions to ensure compliance.

Which material segment holds the largest market share in braided packing?

Graphite-based packing holds a significant share due to its superior thermal stability and chemical resistance, making it essential for high-temperature and high-pressure applications in power generation and petrochemical refining, although PTFE is rapidly gaining ground in aggressive chemical environments.

What role does digitalization or Industry 4.0 play in the braided packing sector?

Digitalization primarily impacts the sector through the integration of braided packing performance data into predictive maintenance (PdM) systems. This allows end-users to forecast failure points and optimize replacement schedules, moving away from time-based maintenance to condition-based servicing, supported by smart sensor technologies.

Is the market threatened by the proliferation of mechanical seals?

While mechanical seals offer superior leakage control in certain critical, high-speed applications, braided packing remains competitive and essential in diverse industrial settings due to its lower cost, easier installation, greater tolerance for shaft runout, and suitability for applications involving abrasive or highly viscous media, ensuring market resilience.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager