Brake Override System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433401 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Brake Override System Market Size

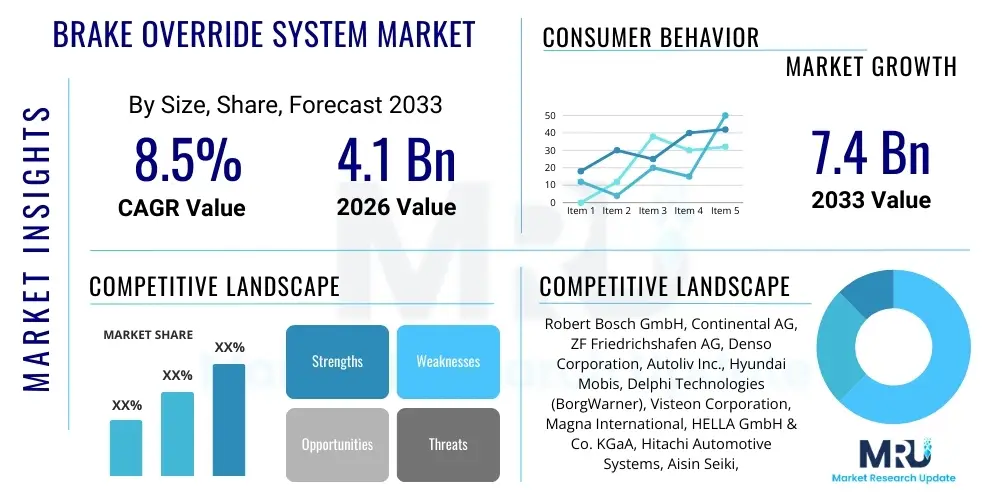

The Brake Override System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $4.1 Billion in 2026 and is projected to reach $7.4 Billion by the end of the forecast period in 2033.

Brake Override System Market introduction

The Brake Override System (BOS), often referred to as Smart Pedal technology, is an advanced automotive safety feature designed to prevent unintended acceleration. This system prioritizes the brake pedal input over the accelerator pedal input when both are depressed simultaneously, ensuring that the vehicle slows down or stops even if the driver mistakenly presses the throttle. The integration of BOS has become a standard requirement or strongly recommended feature in many global automotive manufacturing guidelines, driven primarily by stringent regulatory mandates concerning vehicle safety and accident prevention, particularly in high-traffic urban environments.

The core product mechanism involves sophisticated electronic sensors and control units that monitor pedal positions and driver intent. Key applications of BOS span across all major vehicle classes, including passenger vehicles (sedans, SUVs), light commercial vehicles, and increasingly, electric and hybrid vehicles where pedal mapping is managed electronically. The fundamental benefit of BOS is the significant enhancement of driver confidence and overall vehicle safety by mitigating human error associated with pedal misapplication, a scenario often leading to catastrophic unintended acceleration incidents. This technology acts as a final fail-safe layer within the vehicle's electronic control architecture.

The primary driving factors propelling this market include the global trend toward mandatory safety features adoption, increasing consumer awareness regarding vehicle safety ratings, and the continuous evolution of Electronic Stability Control (ESC) and Advanced Driver-Assistance Systems (ADAS), into which BOS is often seamlessly integrated. Furthermore, the rising penetration of drive-by-wire technology, which facilitates precise electronic control over throttle and braking mechanisms, provides a robust technical foundation for the widespread implementation and optimization of Brake Override Systems across the global automotive fleet. Regulatory bodies in regions such as North America, Europe, and Asia Pacific are consistently updating safety standards, forcing Original Equipment Manufacturers (OEMs) to adopt these sophisticated systems.

Brake Override System Market Executive Summary

The Brake Override System market is characterized by robust growth, primarily fueled by global harmonization of vehicle safety standards and the increasing production volume of vehicles featuring electronic control architectures. Current business trends indicate a strong focus among leading Tier 1 suppliers on developing highly reliable, cost-effective, and rapidly deployable BOS modules that can be integrated across diverse vehicle platforms, including traditional Internal Combustion Engine (ICE) vehicles and emerging Electric Vehicles (EVs). Key strategic moves involve partnerships between software providers and hardware manufacturers to enhance the responsiveness and diagnostic capabilities of the BOS, ensuring compliance with ISO 26262 functional safety standards. The competitive landscape is moving towards solutions offering predictive capabilities and seamless integration with other ADAS features like Autonomous Emergency Braking (AEB).

Regionally, the Asia Pacific (APAC) market is witnessing the fastest expansion, driven by massive vehicle production growth in China and India, coupled with rising middle-class consumer demand for safety-enhanced vehicles. North America and Europe, while mature, maintain dominance in terms of technology adoption and premium component usage, largely due to stringent existing regulations mandated by organizations like the National Highway Traffic Safety Administration (NHTSA) and Euro NCAP. Latin America and the Middle East & Africa (MEA) are emerging growth pockets, motivated by urbanization and improving road safety initiatives, although adoption rates are still heavily dependent on government incentives and import policies.

In terms of segmentation, the Passenger Vehicle segment commands the largest market share owing to high sales volumes and early regulatory mandates. However, the commercial vehicle segment is projected to exhibit a significantly high growth rate as fleet operators increasingly prioritize safety and regulatory compliance to minimize liabilities and insurance costs. Technology-wise, the market is shifting from purely mechanical linkages toward fully electronic BOS solutions, leveraging sophisticated electronic control units (ECUs) that offer faster reaction times and better diagnostic feedback, positioning electronic systems as the primary growth catalyst over the forecast period.

AI Impact Analysis on Brake Override System Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Brake Override System (BOS) market primarily revolve around three key themes: predictive failure diagnostics, integration with autonomous driving levels, and enhancement of human-machine interface (HMI) interpretation. Users frequently question how AI algorithms could move BOS beyond a reactive failsafe mechanism to a proactive system capable of anticipating driver errors or sensor malfunctions before they occur. There is significant interest in understanding how AI-driven sensor fusion—combining data from pedal sensors, steering angle, speed, and surrounding environmental sensors (Lidar/Radar)—can make the BOS decision-making process more context-aware and less prone to false activations. Furthermore, expectations are high regarding AI’s role in ensuring functional safety and redundancy in Level 3 and Level 4 autonomous vehicles, where the transition of control back to the driver must be managed flawlessly, necessitating AI oversight of all critical safety systems, including BOS.

AI's primary influence will transform BOS from a deterministic, rule-based safety feature into an adaptive, cognitive safety component. Machine learning models, trained on vast datasets of real-world driving scenarios and failure modes, can refine the threshold algorithms that determine genuine pedal misapplication versus intentional complex maneuvers. This enhancement reduces nuisance braking events while improving reaction time in critical situations. Moreover, AI integration facilitates predictive maintenance, identifying subtle degradation in pedal sensor readings or ECU performance, allowing for preemptive service interventions long before the system fails. This transition to intelligent, predictive safety systems enhances overall vehicle reliability and contributes significantly to achieving zero-accident targets pursued by major OEMs and regulatory bodies.

- AI-powered sensor fusion enhances context awareness, distinguishing true emergencies from aggressive driving patterns.

- Predictive diagnostics utilizing machine learning models anticipate BOS component failure based on real-time operational data.

- Optimization of braking thresholds for diverse road conditions and driver profiles using adaptive AI algorithms.

- AI ensures functional safety redundancy and manages control handovers in higher levels of autonomous driving (L3, L4).

- Development of sophisticated anomaly detection to identify malicious interference or software bugs affecting pedal inputs.

- Integration with telematics data to analyze regional driving habits and refine system parameters globally.

DRO & Impact Forces Of Brake Override System Market

The Brake Override System market dynamics are fundamentally shaped by the interplay of stringent global regulatory pressures and the continuous demand for enhanced automotive safety features, balanced against implementation costs and technological integration challenges. The market is primarily driven by mandates from major economies compelling manufacturers to install these systems in all new vehicles, alongside increasing consumer willingness to pay a premium for enhanced safety ratings (a core driver). Restraints largely center around the added complexity and cost introduced into the vehicle's electronic architecture, particularly for entry-level and budget vehicle segments, and the potential for system glitches or false activations which can erode consumer trust. Opportunities lie in integrating BOS functionalities into centralized domain controllers (DCUs) within new electrical/electronic (E/E) architectures, specifically optimizing for speed and reliability in the burgeoning EV market. Impact forces include high bargaining power of suppliers for sophisticated ECUs and sensors, moderate threat of substitutes (as BOS is generally mandated), and intense rivalry among Tier 1 component manufacturers vying for long-term OEM contracts.

The functional safety aspect (ISO 26262 compliance) acts as a powerful barrier to entry, demanding significant investment in validation and verification processes, which favors established suppliers. However, this same high standard also acts as a primary market driver, ensuring that BOS technology remains relevant and crucial. The trend towards electric and hybrid vehicles provides a unique growth opportunity; since these vehicles rely entirely on drive-by-wire systems, the BOS can be integrated natively and optimized within the powertrain control software, simplifying hardware needs and improving overall performance response time compared to retrofitting systems onto traditional mechanical linkages. This technological synergy is a significant force shaping future market direction.

Crucially, public perception and media attention following high-profile unintended acceleration incidents significantly influence regulatory speed and severity. When major accidents occur, the political impetus to implement and enforce BOS technology strengthens rapidly, accelerating market adoption irrespective of short-term cost pressures on OEMs. The necessity for zero-defect component supply chains, especially regarding mission-critical safety systems, ensures that quality and reliability remain the highest priority, translating into stable demand for advanced BOS components that meet rigorous Automotive Safety Integrity Level (ASIL) standards, typically ASIL C or D.

- Drivers:

- Mandatory safety regulations adoption across major automotive markets (North America, Europe, Asia Pacific).

- Increasing consumer demand for vehicles with high safety ratings (e.g., 5-star NCAP ratings).

- Rising penetration of drive-by-wire and electronic throttle control systems in all vehicle segments.

- Reduction in legal and liability risks for OEMs and fleet operators due to accidental acceleration incidents.

- Restraints:

- High initial installation and validation costs, particularly for complex software components.

- Potential for software bugs or electromagnetic interference causing system malfunctions or false positives.

- Complexity in retrofitting BOS onto older vehicle platforms or integrating with legacy mechanical components.

- Opportunities:

- Integration into next-generation centralized vehicle computing platforms (domain controllers).

- Expansion into niche markets such as heavy-duty commercial vehicles and off-road industrial equipment.

- Development of predictive BOS systems utilizing sensor fusion and AI/ML capabilities.

- Impact Forces:

- Supplier Bargaining Power: High (Specialized ECU and sensor manufacturers hold strong negotiation leverage).

- Buyer Bargaining Power: Moderate to High (OEMs demand customization and highly competitive pricing).

- Threat of Substitutes: Low (BOS is generally a mandated minimum requirement, difficult to substitute).

- Threat of New Entrants: Moderate to Low (High capital investment and compliance barriers).

- Competitive Rivalry: High (Intense competition among Tier 1 suppliers like Bosch, Continental, and ZF).

Segmentation Analysis

The Brake Override System market is extensively segmented based on key criteria including component type, vehicle type, and the degree of technological integration. This segmentation reflects the diverse needs of automotive manufacturers across different price points and regulatory environments. Component segmentation, covering sensors, ECUs, and software, is critical as the market shifts toward integrated software solutions rather than solely relying on proprietary hardware. The ECU segment, responsible for interpreting sensor data and issuing the override command, dominates revenue due to the complexity and functional safety requirements inherent in its design. Accurate segmentation allows market players to tailor their offerings, focusing either on high-volume, cost-optimized solutions for passenger vehicles or robust, durable systems for heavy commercial applications.

Vehicle type segmentation highlights the structural dominance of the passenger car segment, driven by sheer volume and widespread regulatory coverage. However, the rapidly expanding adoption within commercial vehicles, including trucks and buses, presents a lucrative high-growth niche. Commercial fleet operators are increasingly seeking BOS installations to comply with stricter safety standards and reduce operational risk, viewing these systems as essential investments in fleet management integrity. Furthermore, the emerging distinction between ICE vehicles and EV/HEVs is becoming crucial, as electric vehicles utilize fully electronic systems that facilitate simpler and more reliable BOS integration, often leading to performance advantages.

Technological segmentation, though less explicitly defined in traditional reports, separates pure hardware override mechanisms from software-defined, intelligent systems. The future market trajectory strongly favors advanced, software-centric BOS platforms that are updateable Over-the-Air (OTA) and are integrated into the vehicle's centralized safety domain controller. This shift underscores the increasing importance of software development capabilities for market participants, moving the value proposition from physical components to sophisticated algorithms and certified functional safety software stacks. This move towards standardization and centralized control enhances maintainability and diagnostic efficiency across the entire vehicle lifecycle.

- By Component:

- Pedal Sensors (Accelerator and Brake Position Sensors)

- Electronic Control Units (ECUs)

- Actuators and Solenoids

- Software and Calibration Modules

- By Technology:

- Electronic BOS (E-BOS)

- Mechanical/Hydraulic Assisted BOS

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (LCVs, HCVs, Buses)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Brake Override System Market

The value chain for the Brake Override System market is complex, spanning from specialized raw material providers to end-user installation and maintenance services, with significant value concentration at the Tier 1 manufacturing and integration stages. Upstream activities involve the procurement of highly reliable semiconductors, specialized sensor components (e.g., Hall effect sensors or magnetostrictive sensors for pedal position), and robust enclosures capable of withstanding harsh automotive environments. Key upstream suppliers include semiconductor giants and specialized sensor companies whose bargaining power is substantial due to the high safety integrity level (ASIL D) requirements for these components. Strict quality control and certification processes dominate this initial phase, ensuring materials meet automotive-grade standards and minimize latent defects that could compromise safety functionalities downstream.

The core value addition occurs at the Tier 1 supplier level, where raw components are transformed into certified, integrated BOS modules (ECUs and pedal assemblies). These manufacturers, such as Bosch and Continental, invest heavily in R&D for proprietary algorithms, functional safety software validation, and miniaturization of electronic control units. The integration of the BOS module with the vehicle's central gateway and engine management system is paramount, requiring extensive validation and calibration tailored to specific vehicle models. Distribution is predominantly direct, utilizing the long-term supply agreements between Tier 1 suppliers and Original Equipment Manufacturers (OEMs), characterized by Just-In-Time (JIT) logistics and continuous quality auditing. Indirect channels, primarily focused on the aftermarket for replacement parts or retrofitting older vehicles, represent a smaller but growing segment handled through authorized distributors and specialized repair garages.

Downstream activities center on vehicle assembly, consumer sales, and post-sale service. The OEMs integrate the validated BOS modules into the final vehicle platform, and the system’s performance becomes a critical factor in vehicle safety ratings and consumer perception. The final stages involve authorized dealerships and independent service centers providing diagnostics, maintenance, and mandatory software updates for the BOS. The trend towards Software-Defined Vehicles (SDVs) means that downstream value is increasingly captured through remote diagnostics and Over-the-Air (OTA) updates, ensuring that the BOS performance and safety algorithms remain current throughout the vehicle's operational life, fostering a continuous service relationship with the end-user.

Brake Override System Market Potential Customers

Potential customers for the Brake Override System market are overwhelmingly dominated by Original Equipment Manufacturers (OEMs) across the global automotive industry, representing the primary end-users and buyers of integrated BOS components and systems. This category encompasses major global automotive conglomerates producing mass-market passenger vehicles, luxury manufacturers focusing on advanced safety redundancy, and commercial vehicle producers specializing in trucks, buses, and specialized vocational fleets. For OEMs, the purchasing decision is driven not just by cost, but critically by regulatory compliance, reliability metrics (zero defects), ease of integration into existing vehicle platforms, and the supplier's capability to provide global support and certified functional safety documentation (ASIL compliance). The sheer volume of new vehicle production makes the OEM segment the cornerstone of market demand.

A rapidly expanding segment of potential customers includes specialized fleet operators and leasing companies. These entities, while not manufacturing vehicles, exercise significant influence over vehicle specifications. Fleet buyers, particularly those involved in sensitive transport (e.g., school buses, corporate fleets, logistics firms), prioritize safety features like BOS to mitigate liability risks, reduce insurance premiums, and protect valuable assets and personnel. They often mandate the inclusion of the latest safety technology, sometimes exceeding minimum regulatory requirements, thereby driving demand for premium or advanced BOS configurations that offer superior diagnostic capabilities and reliability. This segment is growing in importance due to the high utilization rates of commercial vehicles, making safety system longevity a key purchasing criterion.

Furthermore, the aftermarket segment represents potential customers focused on retrofitting and replacement. This includes independent garages, authorized service centers, and vehicle owners seeking to upgrade or repair existing systems. While smaller in scale than the OEM segment, the aftermarket provides steady demand for replacement sensors, ECUs, and system calibration services, particularly for older vehicles where the BOS component might reach its end-of-life or require an upgrade to meet evolving functional safety standards. The rise of DIY vehicle enthusiasts and specialized modification shops also contributes to the aftermarket demand for high-quality, certified BOS kits, although volume remains comparatively low against OEM procurement cycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.1 Billion |

| Market Forecast in 2033 | $7.4 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Denso Corporation, Autoliv Inc., Hyundai Mobis, Delphi Technologies (BorgWarner), Visteon Corporation, Magna International, HELLA GmbH & Co. KGaA, Hitachi Automotive Systems, Aisin Seiki, Valeo SA, Knorr-Bremse AG, Mando Corporation, Aptiv PLC, Infineon Technologies, NXP Semiconductors, Sensata Technologies, Lear Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Brake Override System Market Key Technology Landscape

The technological evolution within the Brake Override System market is characterized by a definitive shift from purely mechanical safety mechanisms to highly integrated, software-defined electronic systems (E-BOS). Earlier generations relied on simpler mechanical linkages or specialized pedal geometry to physically prevent simultaneous depression, but modern systems utilize redundant pedal position sensors that feed data directly to a dedicated Electronic Control Unit (ECU) or increasingly, a centralized Domain Controller. The primary technological focus is on achieving near-instantaneous processing and decision-making capabilities (typically within milliseconds) to execute the override command, ensuring functional safety integrity level (ASIL) standards are met, most commonly ASIL D, which dictates extremely low probability of random hardware or systematic failure.

Current technological innovation centers on sensor redundancy and sophisticated algorithms. Modern E-BOS utilizes multiple sensor types (e.g., potentiometer, Hall effect, non-contact inductive sensors) for both the accelerator and brake pedals, cross-checking inputs to prevent false readings due to sensor failure or electromagnetic interference. The ECU employs proprietary calibration matrices that consider vehicle speed, engine torque, and transmission status before initiating the override sequence. Furthermore, integrating BOS functionalities with the vehicle's traction control and electronic stability control (ESC) systems allows for a harmonized safety response, leveraging existing actuation hardware (such as ABS hydraulic pumps) to rapidly reduce engine power and apply controlled braking pressure, thus maximizing efficiency and minimizing the total weight and complexity of the installed components.

The future technology landscape is heavily influenced by the rise of electric vehicles and autonomous driving. In EVs, the BOS functionality is inherently simpler to integrate since there is no physical cable or mechanical linkage to the throttle; the accelerator command is purely electronic. This allows for fine-tuning the torque reduction instantaneously via the inverter control unit, offering superior responsiveness. For autonomous vehicles, the BOS must function as a critical fail-safe layer in the event of software faults in the self-driving stack. This necessitates a robust, segregated computing environment for the BOS logic, often involving dedicated microprocessors and secure software architectures to ensure that pedal input interpretation remains flawless and non-corruptible, even when the primary autonomous system encounters a critical failure state.

Regional Highlights

North America: North America represents a mature yet continually growing market for Brake Override Systems, characterized by stringent federal safety regulations, particularly those enforced by NHTSA. The US and Canada were early adopters of mandates encouraging or requiring features designed to prevent unintended acceleration, driving high penetration rates across passenger vehicle segments. The regional demand is heavily influenced by technological sophistication, with consumers prioritizing features integrated with advanced ADAS suites. OEMs operating here focus intensely on system redundancy and functional safety certification to mitigate the region's heightened legal liability exposure. Future growth will be steady, driven by the shift towards high-end electronic BOS in the burgeoning EV sector and the replacement cycle of older vehicles.

The regional market benefits significantly from the strong presence of major Tier 1 suppliers and advanced R&D centers dedicated to automotive electronics safety. The US market, in particular, showcases a high adoption rate for vehicles featuring premium, software-defined BOS solutions that offer enhanced diagnostic capabilities and Over-the-Air (OTA) update potential. Furthermore, the strong emphasis on fleet safety among large commercial transportation companies drives significant adoption in the heavy-duty truck segment, often requiring customized, robust BOS solutions capable of handling extreme operational conditions. Regulatory updates focused on autonomous vehicle safety will further solidify BOS requirements as a mandatory fallback mechanism.

Europe: Europe is a key innovation hub and a significant market for BOS, driven primarily by the high standards set by the European Union (EU) General Safety Regulation (GSR) and the rigorous testing protocols of Euro NCAP. European regulations often lead global trends in mandating active safety features, ensuring high market saturation for BOS. The region emphasizes functional safety standards (ISO 26262) and requires sophisticated software validation. Market growth is sustained by the widespread adoption of advanced electronic stability control systems, with which BOS is intrinsically linked, and the aggressive shift towards electric vehicles, particularly in countries like Germany, Norway, and the UK. The European market demands highly calibrated systems that cater to diverse driving conditions, including high-speed Autobahns and dense urban centers, requiring advanced algorithms to minimize false activations.

The preference for compact and luxury vehicles in Europe necessitates miniaturized, highly integrated BOS components that do not compromise interior design or space. German OEMs, in particular, play a crucial role in dictating technology trends, often pushing suppliers for systems that offer superior diagnostic feedback and seamless integration into complex vehicle architectures. The strong environmental focus also contributes indirectly, as the efficient integration of BOS into the electronic architecture of electric vehicles helps maximize energy recovery and optimize vehicle performance. Competitive pressures are high, focusing on cost-efficiency alongside performance for mass-market vehicles while providing premium, customized solutions for luxury brands.

Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally, fueled by exponential growth in vehicle production, rapidly increasing disposable income, and the gradual adoption of global safety standards in major markets like China, India, Japan, and South Korea. China stands out due to its immense production volume and increasing regulatory focus on vehicle safety, making it the single largest consumption hub for BOS components. India is another critical growth engine, where newly mandated safety regulations are forcing local manufacturers to incorporate previously optional features like BOS into mass-market vehicles.

While Japan and South Korea already possess highly advanced safety regulations and feature high BOS penetration rates similar to Western markets, the core market dynamism lies in emerging economies transitioning towards international safety norms. The challenge in APAC remains cost optimization; manufacturers need high-volume, reliable systems that minimize overall production costs while adhering to certification requirements. The market environment is characterized by intense price competition among local and international suppliers. Furthermore, the diversification of vehicle types, from small budget cars to large commercial trucks, requires suppliers to offer a flexible range of BOS solutions adapted for varying complexity and performance needs, emphasizing localization and supply chain efficiency.

Latin America (LATAM): The LATAM market is experiencing moderate but accelerating growth, primarily driven by economic recovery and harmonization of safety standards within trade blocs like MERCOSUR. Countries such as Brazil and Mexico, which are major automotive manufacturing hubs, are increasingly aligning their vehicle safety requirements with European or US standards, thereby creating mandatory demand for features like BOS. However, market penetration rates are still lower compared to developed regions, and cost sensitivity remains a primary factor influencing purchasing decisions. The market tends to prioritize proven, reliable technology over the absolute cutting-edge innovations.

Adoption in LATAM is closely linked to governmental policies and consumer education campaigns promoting road safety. The expansion of localized production facilities by global OEMs also facilitates technology transfer and standardizes safety feature inclusion. While the aftermarket for replacement parts is significant due to the prevalence of older vehicles, the OEM segment holds the majority share of value, focusing on providing reliable entry-level electronic BOS solutions that meet minimum local regulatory benchmarks. Infrastructure challenges in some areas also necessitate robust component design capable of enduring varied road conditions.

Middle East and Africa (MEA): The MEA market for Brake Override Systems is nascent but shows potential, especially within the Gulf Cooperation Council (GCC) countries where high-end vehicle sales and stringent import regulations drive demand for premium safety features. The GCC nations, characterized by hot climate conditions, require robust and temperature-resistant electronic components. Vehicle fleet safety standards are also rising in line with urbanization and infrastructure development, particularly for oil and gas industry fleets and public transport. Africa, while highly fragmented, is beginning to see increased regulatory push in South Africa and North African countries, although adoption is predominantly confined to imported or locally assembled higher-segment vehicles.

Challenges include fluctuating economic stability and varying regulatory landscapes across different African nations. However, the high sales volume of commercial vehicles used in resource extraction and logistics provides a growing niche for heavy-duty BOS installations focused on reliability and durability. The market tends to favor established global brands due to trust in quality and certified reliability. Future expansion depends heavily on consistent regulatory enforcement and economic investment in local automotive manufacturing capabilities to drive down the cost of integrating advanced safety features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Brake Override System Market.- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Denso Corporation

- Autoliv Inc.

- Hyundai Mobis

- Delphi Technologies (BorgWarner)

- Visteon Corporation

- Magna International

- HELLA GmbH & Co. KGaA

- Hitachi Automotive Systems

- Aisin Seiki

- Valeo SA

- Knorr-Bremse AG

- Mando Corporation

- Aptiv PLC

- Infineon Technologies

- NXP Semiconductors

- Sensata Technologies

- Lear Corporation

Frequently Asked Questions

Analyze common user questions about the Brake Override System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental mechanism of a Brake Override System (BOS)?

The Brake Override System is a critical safety feature that instantly cuts engine power or reduces throttle input to idle when both the accelerator pedal and the brake pedal are depressed simultaneously. Its mechanism relies on electronic control units (ECUs) and multiple redundant sensors to prioritize the braking command, ensuring the vehicle stops regardless of unintended acceleration input.

Why is BOS implementation mandatory in certain regions and how does it affect vehicle safety ratings?

BOS implementation is driven by governmental mandates in regions like North America and Europe to prevent accidents resulting from pedal misapplication, a common form of driver error. Inclusion of a certified BOS is now a prerequisite or significantly boosts a vehicle's score in consumer safety assessments conducted by agencies like Euro NCAP and NHTSA, directly influencing consumer perception and purchasing decisions.

How does the shift to electric vehicles (EVs) impact the design and performance of Brake Override Systems?

The transition to EVs simplifies BOS implementation as throttle control is entirely electronic (drive-by-wire). In EVs, BOS directly manages the motor's torque output via the inverter, providing instantaneous power reduction without mechanical lag. This allows for superior performance, reliability, and tighter integration into the vehicle’s centralized electronic architecture compared to systems in traditional Internal Combustion Engine (ICE) vehicles.

What role does functional safety certification (ASIL) play in the BOS Market?

Functional Safety (ISO 26262), typically required at ASIL D (the highest integrity level) for safety-critical components like BOS, is paramount. This certification ensures the system is developed and validated to minimize systematic and random failures, confirming that the BOS will perform its safety function reliably when needed. High ASIL requirements drive up R&D costs but establish stringent quality barriers for suppliers.

Which segments are showing the highest growth potential in the Brake Override System market?

The Commercial Vehicle segment (trucks and buses) and the Electric Vehicle segment are demonstrating the highest growth potential. Commercial fleets increasingly require BOS for compliance and liability reduction, while EVs facilitate seamless, optimized electronic integration of the BOS function, driving rapid adoption within the growing electric mobility sector, particularly in the Asia Pacific region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager