Brake Wear Indicator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433777 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Brake Wear Indicator Market Size

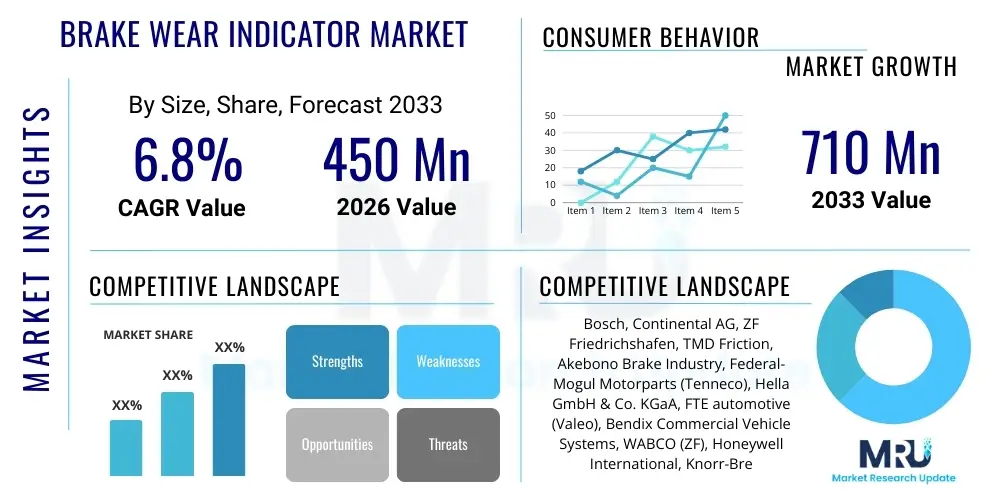

The Brake Wear Indicator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033.

Brake Wear Indicator Market introduction

The Brake Wear Indicator Market encompasses the manufacturing and distribution of devices designed to alert vehicle operators when brake pads or shoes have worn down to a critical limit, necessitating replacement. These indicators are vital safety components, ensuring optimal braking performance and preventing potential catastrophic failures resulting from metal-to-metal contact. The market primarily includes mechanical/audible indicators (which create a high-pitched squeal when the pad is low) and electrical indicators (which utilize sensors embedded in the pad material to activate a dashboard warning light). The demand for these systems is intrinsically linked to global automotive production volumes, stringent vehicle safety regulations, and the increasing complexity of modern braking systems, particularly in premium and high-performance vehicles where sensor-based monitoring is standard.

The core product, the brake wear indicator, serves as an essential preventative maintenance tool. Its primary applications span across Passenger Vehicles (PVs), Commercial Vehicles (CVs) including heavy-duty trucks and buses, and increasingly in specialized vehicles such as electric vehicles (EVs) and autonomous platforms. The integration of advanced driver-assistance systems (ADAS) and electronic stability control (ESC) mandates high reliability in all braking components, thereby amplifying the importance of accurate wear monitoring. Benefits derived from these indicators include enhanced road safety, reduction in costly damage to brake rotors and calipers, and providing convenience to vehicle owners by eliminating the need for manual inspection during routine checks.

Key driving factors accelerating market expansion include rapid motorization in emerging economies, consistent growth in the global vehicle parc, and rising consumer awareness regarding vehicle maintenance and safety standards. Furthermore, regulatory mandates, particularly in North America and Europe, requiring minimum safety standards for new vehicles, continue to underpin sustained demand. The shift towards connected vehicles also plays a role, as newer, more sophisticated wear indicators are integrated into diagnostic systems, offering real-time data on brake health and remaining lifespan, which is crucial for proactive fleet management and predictive maintenance strategies.

Brake Wear Indicator Market Executive Summary

The Brake Wear Indicator Market exhibits robust growth driven by mandatory safety protocols and technological advancements focusing on sensor integration and connectivity. Business trends indicate a strong move toward developing integrated electronic wear indicators, favored particularly by Original Equipment Manufacturers (OEMs) for integration into advanced vehicle diagnostic platforms. There is increasing consolidation among sensor manufacturers to offer comprehensive braking system monitoring solutions. Aftermarket demand remains stable, supported by the large volume of older vehicles requiring replacement components. Cost optimization and material innovation are central themes for market stakeholders aiming to balance high reliability with competitive pricing in both OEM and replacement sectors. Supply chain resilience, especially concerning semiconductor components utilized in electronic indicators, has become a key strategic priority for leading manufacturers.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by the vast automotive manufacturing bases in China, India, and Japan, coupled with rapidly expanding vehicle ownership. North America and Europe maintain high market maturity, characterized by stringent regulations that drive the adoption of high-quality, electronic wear indicators across all vehicle classes. European markets, in particular, show higher penetration of sophisticated sensor-based systems due to early adoption of advanced safety features like ABS and ESC. Meanwhile, Latin America and MEA present significant growth opportunities as regulatory environments mature and the demand for new, safer vehicles increases, transitioning the market from reliance on simpler mechanical indicators to more reliable electrical systems.

Segment trends highlight the dominance of Electrical Brake Wear Indicators over Mechanical/Acoustic types, especially in new vehicle production, due to their superior accuracy and seamless integration with vehicle electronics. The Passenger Vehicle segment continues to account for the largest market share, dictated by sheer volume, although the Commercial Vehicle segment is exhibiting a faster growth trajectory, propelled by the need for minimizing downtime and maximizing efficiency through predictive maintenance solutions in fleet operations. In terms of sales channel, the OEM segment holds a slight edge due to mass installation during manufacturing, but the Aftermarket segment remains critical for sustaining profitability through consistent replacement cycles.

AI Impact Analysis on Brake Wear Indicator Market

Common user questions regarding AI's impact on brake wear indicators often center on predictive maintenance capabilities, the reliability of projected remaining life, and how AI integration changes traditional replacement timing. Users frequently inquire if AI-driven diagnostics will entirely replace physical sensors or how machine learning algorithms can improve fault detection accuracy. The key themes revolve around transitioning from reactive component alerts (a simple light turning on) to sophisticated, predictive models that analyze driving patterns, environmental factors, and historical wear data to precisely forecast the point of failure or required service. This shift addresses concerns about premature replacements or, conversely, running brakes down to dangerous limits, ultimately optimizing vehicle uptime and safety.

The immediate impact of Artificial Intelligence (AI) and Machine Learning (ML) is not on the physical indicator component itself, but rather on the data processing and decision-making layers surrounding it. AI algorithms can analyze continuous data streams from electronic brake wear sensors (measuring resistance or distance) alongside telematics data, speed profiles, load factors, and climate conditions. This holistic analysis allows vehicle management systems to provide highly accurate, personalized maintenance schedules, far beyond the generic thresholds set by traditional indicators. For fleet operators, AI transforms the maintenance paradigm from mileage-based schedules to condition-based servicing, resulting in substantial operational cost savings and improved safety compliance across their asset base.

Furthermore, AI-powered diagnostic tools are enhancing the manufacturing and quality control processes for these sensors. By analyzing production line data, ML models can quickly identify defects or inconsistencies in sensor calibration, improving overall product quality and reliability. In the context of autonomous vehicles (AVs), AI integration is crucial; AVs require constant, real-time assessment of all safety-critical components, including brakes. Predictive algorithms ensure that the AV's operational design domain (ODD) is never compromised due to unexpected brake wear, facilitating automated maintenance scheduling without human intervention, thereby solidifying the role of advanced indicator systems as critical data inputs for Level 4 and Level 5 automation.

- AI enables Predictive Maintenance (PdM) by analyzing sensor input and driving behavior, estimating the precise remaining life of brake pads.

- Machine Learning algorithms enhance the accuracy of fault detection, reducing false positives associated with electronic wear indicators.

- Integration with telematics platforms allows AI to provide centralized, optimized fleet service planning based on aggregated wear data.

- AI models assist in refining manufacturing tolerances and quality control processes for embedded sensor technology.

- Advanced AI diagnostics are essential for autonomous vehicles to ensure critical braking components are consistently monitored and serviced proactively.

DRO & Impact Forces Of Brake Wear Indicator Market

The Brake Wear Indicator Market is characterized by strong regulatory tailwinds (Drivers) ensuring consistent demand for reliable safety components, counterbalanced by technological hurdles and cost pressures (Restraints). Opportunities emerge from the rapid electrification of the automotive industry and the increasing penetration of smart, connected vehicle platforms. These internal dynamics are significantly shaped by external Impact Forces such as global commodity pricing affecting sensor material costs, consumer safety expectations, and the ongoing shift towards advanced electronic vehicle architectures which prioritize data-rich components. The synergy between regulatory push and technological pull is the primary determinant of market trajectory, favoring sophisticated solutions over simple mechanical warnings.

Key drivers include global automotive safety mandates and consumer preference for vehicles equipped with comprehensive diagnostic features. The necessity of maintaining optimal braking performance, coupled with the rising cost of replacing damaged rotors caused by neglected pad wear, incentivizes the use of indicators. Conversely, restraints involve the relatively short replacement cycle of brake pads themselves, which often dictates the replacement of the attached low-cost indicator, limiting the profit margins for highly specialized sensor systems. Furthermore, market fragmentation, particularly in the aftermarket, poses challenges regarding standardization and quality consistency, which can lead to consumer mistrust in cheaper replacement indicators.

Significant opportunities lie in the development of non-contact or wireless brake wear monitoring systems that eliminate the need for physical connection or embedding within the pad material, potentially offering higher durability and ease of installation. The electric vehicle (EV) segment presents a unique opportunity; although EVs use regenerative braking, which reduces friction wear, when friction brakes are engaged, reliable monitoring is still crucial, and the sophisticated electronics in EVs are perfectly suited for integrating advanced sensor technology. The cumulative impact of these forces—drivers pushing for safety and technology, restraints related to cost and quality, and opportunities presented by EV and connectivity—results in a market environment focused on maximizing product lifespan and data utility.

- Drivers: Stringent government safety regulations; increase in global vehicle production; rising consumer safety awareness; demand for predictive maintenance solutions in commercial fleets.

- Restraints: Intense price competition, especially in the aftermarket; low-cost mechanical indicators limiting adoption of advanced electronic versions; challenges associated with sensor durability in harsh operating environments.

- Opportunities: Rapid expansion of the Electric Vehicle (EV) market; integration with vehicle telematics and V2X communication systems; development of non-contact sensing technologies; growth in the use of advanced driver-assistance systems (ADAS) requiring precise component health monitoring.

- Impact Forces: Global raw material price fluctuations (copper, plastics, semiconductors); evolving intellectual property landscape in sensor technology; consumer expectations regarding vehicle diagnostic transparency.

Segmentation Analysis

The Brake Wear Indicator Market is primarily segmented based on the Indicator Type, Application (Vehicle Type), and Sales Channel, reflecting the diverse requirements of the automotive ecosystem. Indicator Type segmentation distinguishes between Electrical (sensor-based) and Mechanical (acoustic/metal tab) systems, with electrical indicators capturing increasing market share due to their superior accuracy and ability to integrate with vehicle electronics. The application segment delineates the distinct needs of Passenger Vehicles versus Commercial Vehicles, where CVs prioritize durability and predictive analytics functionality due to their high mileage usage and operational demands. Understanding these segments is crucial for manufacturers to tailor product specifications, pricing strategies, and distribution networks effectively across the global automotive supply chain.

The segmentation by Sales Channel, comprising Original Equipment Manufacturers (OEMs) and Aftermarket, reveals contrasting market dynamics. The OEM channel is volume-driven, demanding high standardization, strict quality control, and long-term supply contracts. The Aftermarket channel, conversely, is characterized by high replacement volume, often requiring indicators compatible with a wide array of vehicle models and braking system designs. Regional regulations and prevailing vehicle parc characteristics significantly influence the dominance of specific segments; for instance, European markets show high penetration of electronic indicators across all new PVs, whereas developing markets still heavily rely on cost-effective mechanical indicators for older vehicle models and simpler platforms.

Further granularity exists within the electronic indicator sub-segment, distinguishing between active and passive sensors, though standard integration is becoming the norm. The Commercial Vehicle segment often includes heavy-duty specialized wear sensors designed to withstand extreme temperatures and contaminants typical in trucking and logistics operations. Overall, the market analysis suggests a secular trend favoring segments that allow for data generation and connectivity, supporting the broader industry movement towards smart components and predictive maintenance regimes, thus ensuring continued investment in the electrical indicator category.

- By Indicator Type:

- Electrical Brake Wear Indicators (Sensor-based)

- Mechanical/Acoustic Brake Wear Indicators (Metal tab or spring)

- By Vehicle Type (Application):

- Passenger Vehicles (PVs)

- Commercial Vehicles (CVs)

- Electric Vehicles (EVs/HEVs)

- By Sales Channel:

- Original Equipment Manufacturers (OEM)

- Aftermarket (Replacement/Independent)

Value Chain Analysis For Brake Wear Indicator Market

The Value Chain for the Brake Wear Indicator Market begins with upstream activities focused on the sourcing and processing of raw materials, primarily plastics, copper, specialized metal alloys for mechanical tabs, and sensitive semiconductor components for electrical sensors. This stage is crucial as the performance and reliability of the final product are heavily dependent on the quality and consistency of these inputs, particularly the resistance wire or conductive material used in electronic indicators. Raw material suppliers feed into component manufacturers who specialize in producing the physical sensor bodies, connectors, and wiring harnesses, often operating under strict quality assurance standards mandated by Tier 1 automotive suppliers. Price volatility in base metals and microchip shortages have significantly impacted the profitability and stability of this upstream segment recently.

Midstream activities involve the design, assembly, and testing of the final brake wear indicator product. Tier 1 suppliers often integrate these indicators directly into the complete brake pad assembly. This integration step is complex, requiring precise calibration and robust sealing to ensure the indicator functions correctly under harsh driving conditions. Distribution channels bifurcate into direct and indirect paths. Direct distribution involves supplying indicators to OEMs for assembly into new vehicles; this requires large volume capabilities and long-term contract adherence. Indirect distribution focuses on the Aftermarket, involving a network of wholesalers, distributors, retail automotive parts stores, and independent service garages, which requires flexible packaging and broad product compatibility to serve the diverse global vehicle parc.

The downstream segment is defined by installation, servicing, and end-user feedback. Installation occurs both at OEM assembly lines and through independent service garages during brake replacement. For electronic indicators, downstream activities also include software integration with the vehicle's onboard diagnostics (OBD) system. End-users are the ultimate consumers whose safety and maintenance decisions are directly informed by the indicator's performance. Feedback loops from service centers regarding failure rates and product lifespan are essential for continuous improvement in the upstream manufacturing processes. The high complexity of electronic indicators necessitates specialized diagnostic tools and technician training, adding a critical layer to the downstream support structure.

Brake Wear Indicator Market Potential Customers

The primary customers for Brake Wear Indicators are the global automotive manufacturing sector (OEMs) and the vast network of vehicle owners and maintenance providers (Aftermarket). OEMs, including major players like Volkswagen Group, Toyota, General Motors, and their Tier 1 suppliers (e.g., Brembo, Bosch, Continental), represent the largest volume buyers, purchasing indicators for mass installation on new production vehicles. These customers prioritize components that meet stringent safety standards, offer high durability, and seamlessly integrate into complex vehicle electronic architectures. The shift toward EV production requires OEMs to adapt to specialized indicators compatible with different braking characteristics.

The second major customer group is the Aftermarket, comprising independent automotive repair shops, dealership service centers, dedicated brake service specialists, fleet maintenance organizations, and retail consumers purchasing parts for DIY installation. Fleet operators of commercial vehicles (logistics, public transport) are particularly crucial aftermarket buyers, seeking robust and data-enabled electrical indicators to minimize vehicle downtime and maximize asset utilization through predictive maintenance. These end-users typically prioritize accessibility, reliability, and cost-effectiveness of replacement parts, ensuring that a broad range of compatible indicators remains available across various distribution channels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Continental AG, ZF Friedrichshafen, TMD Friction, Akebono Brake Industry, Federal-Mogul Motorparts (Tenneco), Hella GmbH & Co. KGaA, FTE automotive (Valeo), Bendix Commercial Vehicle Systems, WABCO (ZF), Honeywell International, Knorr-Bremse, AISIN Corporation, Delphi Technologies, Standard Motor Products, MTE-THOMSON, ACDelco, TRW Automotive. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Brake Wear Indicator Market Key Technology Landscape

The technology landscape of the Brake Wear Indicator Market is transitioning rapidly from simple mechanical tabs to highly integrated electronic sensor systems. Mechanical indicators rely on basic metallurgy and physical design, utilizing a metal spring or tab that scrapes against the rotor when the pad reaches a minimum thickness, generating an audible squeal. While cost-effective and extremely reliable in terms of function simplicity, they offer no data feedback and provide the alert only when wear is critical. This mature technology segment is gradually losing share in new vehicle production but remains dominant in the low-cost aftermarket sector, particularly for older vehicles lacking complex electronic systems.

The cutting-edge technology centers on Electrical Brake Wear Indicators, which use sensors embedded in the brake pad material. These sensors operate typically by completing an electrical circuit with a low-resistance wire or conductive path. Once the pad wears down sufficiently, the material is exposed and breaks the circuit, triggering a dashboard warning light via the vehicle's Engine Control Unit (ECU). Advanced electronic systems incorporate multiple stages of warning or utilize varying resistance measurements to provide a more nuanced reading of the pad's remaining thickness. This level of precision is essential for modern vehicles equipped with advanced safety features like Adaptive Cruise Control (ACC) and Collision Mitigation Braking (CMB), which depend on immediate and reliable braking responsiveness.

Emerging technologies include non-contact measurement systems, such as ultrasonic or radar-based sensors, which monitor the gap between the caliper and the rotor. These advanced solutions are designed to address the durability limitations of embedded sensors, which are constantly subjected to heat, moisture, and brake dust contamination. Non-contact methods promise longer lifespan, improved accuracy, and the capability to provide continuous, quantifiable data on wear progression, which is paramount for integrating indicators into advanced diagnostic and AI-driven maintenance platforms. The development path focuses heavily on miniaturization, enhanced electromagnetic shielding, and robust communication protocols (like CAN bus integration) to manage the voluminous data generated by these smart components.

Regional Highlights

- Asia Pacific (APAC): This region dominates the global market in terms of volume due to the massive automotive production bases in China, India, and Japan. Rapid urbanization, increasing disposable income, and subsequent growth in vehicle sales drive high OEM demand. While the aftermarket in developing nations still heavily utilizes cost-effective mechanical indicators, stringent new safety standards in economies like South Korea and Australia are propelling the adoption of electronic wear sensors in new vehicles. APAC is also a critical manufacturing hub for the sensors themselves, benefiting from favorable manufacturing costs and established electronic supply chains.

- Europe: Characterized by high market maturity and strict safety regulations (e.g., adherence to UNECE standards). Europe exhibits the highest penetration rate of electronic brake wear indicators across both passenger and commercial vehicles. Key markets like Germany, France, and the UK prioritize vehicle safety and advanced diagnostics, favoring sensors that integrate seamlessly with sophisticated vehicle control systems. The rapid transition to electric vehicles (EVs) in Europe further fuels demand for reliable, data-rich electronic indicators, despite the reduced mechanical wear associated with regenerative braking.

- North America (NA): A highly profitable market driven by strong demand for large commercial vehicles (trucks and buses) and a significant consumer focus on vehicle reliability and safety features. Regulatory bodies and insurance requirements incentivize the use of high-quality indicators. While the OEM segment is robust, the aftermarket is substantial, fueled by the long average lifespan of vehicles in the US and Canada, necessitating frequent replacement of worn pads and sensors. NA is a leader in integrating wear data into telematics systems for large fleet management.

- Latin America: This region is characterized by steady growth, primarily focused on basic passenger vehicle models. The market here is sensitive to economic volatility, often leading to a preference for lower-cost mechanical indicators. However, as foreign investments increase and regional production standards align more closely with global norms, the adoption of electronic systems is gradually accelerating, particularly in major automotive economies like Brazil and Mexico, driven by imported vehicle models and local safety reforms.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in GCC countries due to oil wealth driving luxury and new vehicle imports, which invariably feature advanced electronic indicators. South Africa also maintains a significant and mature aftermarket. Challenges include diverse climatic conditions (extreme heat and dust) which necessitate high sensor durability, and varying regulatory enforcement across different nations, leading to a fragmented demand pattern between sophisticated OEM installations and highly cost-conscious replacement parts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Brake Wear Indicator Market.- Bosch

- Continental AG

- ZF Friedrichshafen

- TMD Friction

- Akebono Brake Industry

- Federal-Mogul Motorparts (Tenneco)

- Hella GmbH & Co. KGaA

- FTE automotive (Valeo)

- Bendix Commercial Vehicle Systems

- WABCO (ZF)

- Honeywell International

- Knorr-Bremse

- AISIN Corporation

- Delphi Technologies

- Standard Motor Products

- MTE-THOMSON

- ACDelco

- TRW Automotive

- Hitachi Astemo

- Marelli

Frequently Asked Questions

Analyze common user questions about the Brake Wear Indicator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between mechanical and electrical brake wear indicators?

Mechanical indicators use a physical metal tab to create an audible screech when the pad is critically worn, offering a simple, late-stage warning. Electrical indicators use embedded sensors connected to the vehicle's electronic system, illuminating a dashboard warning light, which provides a more precise and timely alert before immediate damage occurs.

Are brake wear indicators mandatory on all new vehicles globally?

While not universally mandatory by specific regulation in every country, stringent vehicle safety standards in major automotive regions (like the EU, US, and Japan) effectively necessitate the inclusion of reliable wear indicators, usually electronic types, especially on vehicles equipped with ABS and ESC systems.

How does the growth of Electric Vehicles (EVs) impact the demand for brake wear sensors?

EVs primarily use regenerative braking, reducing wear on friction brakes. However, reliable electronic indicators remain critical for monitoring the backup friction brakes. EVs require highly accurate sensors compatible with their complex electronic architecture, often leading to increased demand for advanced, integrated sensor systems.

What role does Artificial Intelligence play in modern brake wear monitoring?

AI utilizes data from electronic indicators and telematics to enable predictive maintenance (PdM). Instead of merely signaling critical wear, AI algorithms analyze driving conditions and historical data to forecast the precise remaining life of the pads, optimizing replacement timing for fleet efficiency and safety.

Which market segment currently holds the largest share and why?

The Passenger Vehicle (PV) segment holds the largest market share due to the sheer volume of PV production and sales globally. Within this, the Electrical Brake Wear Indicator sub-segment is rapidly gaining dominance, driven by OEM requirements for higher safety standards and better integration with advanced vehicle diagnostics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager