Branch Circuit Monitoring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435053 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Branch Circuit Monitoring Market Size

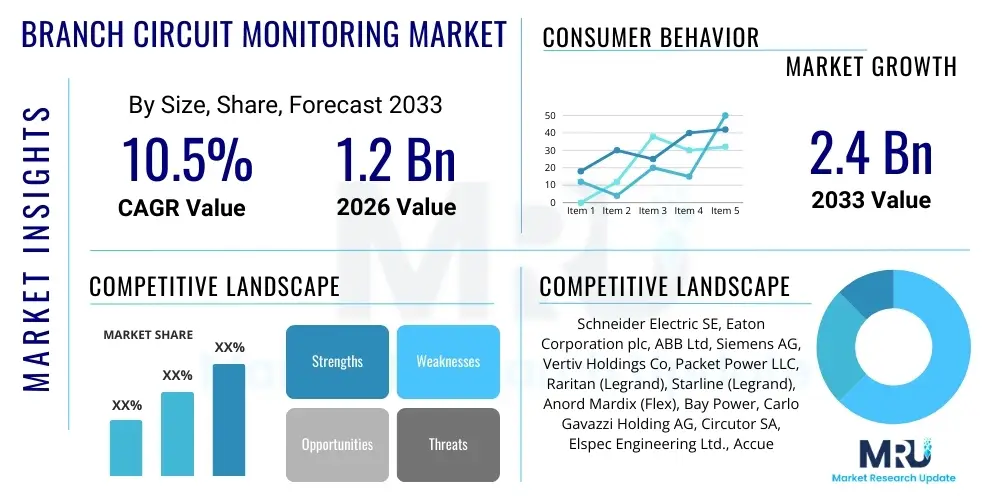

The Branch Circuit Monitoring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.4 Billion by the end of the forecast period in 2033.

Branch Circuit Monitoring Market introduction

Branch Circuit Monitoring (BCM) involves the deployment of specialized hardware and software solutions designed to measure, analyze, and report electrical parameters such as current, voltage, power, and energy consumption at the individual circuit breaker level. This granular level of monitoring is crucial for maintaining operational efficiency, ensuring regulatory compliance, and proactively identifying potential electrical issues before they escalate into failures or downtime. BCM systems are predominantly utilized in critical power environments, including hyperscale data centers, telecommunication facilities, industrial manufacturing plants, and large commercial buildings where uninterrupted power supply and optimized energy usage are paramount business objectives. The fundamental purpose of BCM is to provide real-time insights into power utilization, allowing facility managers and electrical engineers to perform effective load balancing, capacity planning, and energy efficiency initiatives, thereby significantly reducing operating expenditures and enhancing infrastructure reliability. The rising global emphasis on sustainable energy practices and stringent regulatory standards governing energy reporting further solidifies the essential role of BCM technologies across diverse commercial and industrial sectors.

The product description encompasses sophisticated sensor technologies, typically current transformers (CTs) or Rogowski coils, integrated with intelligent metering devices and networked communication modules, often leveraging protocols like Modbus, SNMP, or BACnet for data transmission. These systems are inherently scalable, allowing for the concurrent monitoring of hundreds or even thousands of circuits within a single facility, providing a centralized dashboard for comprehensive power management visibility. Major applications include monitoring power distribution units (PDUs) in data centers, tracking energy consumption in multi-tenant commercial facilities for accurate billing (sub-metering), and ensuring the thermal stability and load integrity of critical industrial equipment. The complexity of modern power infrastructure, coupled with the increasing power density demands, necessitates the deployment of BCM solutions capable of handling dynamic load changes and ensuring that circuits operate within their designed capacity limits, preventing overloads that could lead to thermal runaway or circuit tripping.

Key benefits derived from implementing Branch Circuit Monitoring solutions include enhanced power reliability, precise identification of energy wastage, optimization of infrastructure capacity, and improved safety through early detection of arc faults or abnormal consumption patterns. Driving factors propelling market growth include the explosive proliferation of data centers globally, necessitated by cloud computing, AI, and IoT adoption, which demands meticulous power management. Furthermore, the increasing cost of electricity and corporate mandates for reducing carbon footprints incentivize organizations to invest in technologies that offer immediate and verifiable energy savings. Government regulations promoting energy efficiency in building codes and the mandatory implementation of smart grid technologies also contribute significantly to the accelerating adoption rate of BCM systems across established and emerging economies. The ongoing transition towards high-density computing environments requires proactive monitoring, making BCM an indispensable tool for modern infrastructure management.

- Market Intro: Specialized hardware and software providing granular electrical monitoring at the circuit breaker level.

- Product Description: Integration of current sensors (CTs/Rogowski coils), intelligent meters, and networked communication protocols (Modbus, SNMP).

- Major Applications: Data Center Power Distribution Units (PDUs), commercial building sub-metering, industrial equipment load tracking, and critical facility reliability assurance.

- Benefits: Improved power reliability, enhanced energy efficiency, accurate capacity planning, regulatory compliance, and proactive fault detection.

- Driving Factors: Global data center expansion, rising energy costs, stringent energy efficiency regulations, and increasing complexity of power infrastructure.

Branch Circuit Monitoring Market Executive Summary

The Executive Summary highlights robust business trends driven primarily by the global shift toward digitalization and sustainability mandates. The market is experiencing significant integration of BCM solutions into holistic Data Center Infrastructure Management (DCIM) platforms, transforming power monitoring from a standalone function into an integrated element of overall facility optimization. Key business trends involve strategic partnerships between hardware manufacturers and software analytics providers to offer cloud-based BCM services, providing enhanced data accessibility and predictive maintenance capabilities. Furthermore, there is a distinct competitive emphasis on developing non-invasive BCM technologies, which simplifies installation in retrofitted environments and minimizes downtime. Adoption is accelerating across all major verticals, with data centers remaining the cornerstone demand segment, followed by utility providers seeking better grid resilience and industrial facilities aiming for enhanced operational technology (OT) monitoring. Investment in R&D is heavily focused on miniaturization of sensor technology and improving data sampling rates for high-frequency anomaly detection.

Regionally, North America maintains the leading market share, primarily due to the high concentration of hyperscale data centers, stringent energy efficiency standards (particularly in California and the Northeast), and early technology adoption in smart building infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth in APAC is fueled by massive infrastructure investments in emerging economies like China and India, the exponential construction of new Tier III and Tier IV data centers, and governmental push towards smart city initiatives that require real-time utility monitoring. Europe is characterized by strict energy performance directives (like the Energy Efficiency Directive), driving substantial retrofitting and modernization efforts in existing commercial and industrial building stock. Regional strategies often involve localizing software interfaces and ensuring compliance with specific national electrical codes and reporting requirements, such as those related to environmental, social, and governance (ESG) reporting.

Segmentation trends indicate that hardware components, particularly intelligent sensors and meters, constitute the largest segment by revenue, driven by the necessary initial investment in physical infrastructure. However, the software and services segment, which includes monitoring platforms, data analytics, and maintenance contracts, is poised for the fastest growth. This acceleration is attributed to the increasing reliance on advanced algorithms for predictive analytics, capacity planning simulations, and load forecasting, transforming raw monitoring data into actionable business intelligence. Application-wise, the data center segment is dominant, but growth is accelerating in the industrial sector, spurred by Industry 4.0 initiatives that demand precise energy usage visibility for optimizing machine utilization and reducing manufacturing overhead. The market is also witnessing a shift from traditional shunt-based metering to more advanced, compact current transformer solutions that offer higher accuracy and easier integration into dense power panels.

- Business Trends: Integration with DCIM platforms, shift to cloud-based BCM services, focus on non-invasive monitoring hardware, strategic partnerships for enhanced data analytics.

- Regional Trends: North America dominance due to hyperscale data center presence; APAC exhibiting fastest growth driven by urbanization and infrastructure investment; Europe focusing on retrofitting for energy efficiency compliance.

- Segments Trends: Hardware components retain largest revenue share; Software and Services segment showing highest CAGR due to demand for predictive analytics; Data Centers remain the largest application area, followed by rapid growth in the Industrial sector.

AI Impact Analysis on Branch Circuit Monitoring Market

User inquiries regarding AI's influence on Branch Circuit Monitoring primarily center on how artificial intelligence can transform reactive monitoring into proactive power management. Common questions explore the capability of AI algorithms to detect subtle anomalies indicative of impending equipment failure, optimize power allocation in real-time based on fluctuating IT loads, and enhance energy efficiency beyond simple load balancing. Users are deeply interested in the shift from manual data review to automated insights, focusing on AI's role in predictive maintenance, improving power usage effectiveness (PUE) scores, and ensuring operational resilience in increasingly complex data center environments. There is also significant curiosity about the integration of machine learning (ML) models with BCM data streams to identify non-obvious correlations between environmental factors (like temperature) and electrical performance, aiming for holistic infrastructure optimization and maximizing the lifespan of power components.

The incorporation of Artificial Intelligence and Machine Learning (AI/ML) is fundamentally changing the landscape of Branch Circuit Monitoring, moving the value proposition far beyond basic measurement and alarming. AI models ingest vast quantities of BCM data—spanning current harmonics, voltage fluctuations, power factor changes, and historical usage patterns—to establish highly accurate baseline operational profiles. Once baselines are established, AI can identify minute deviations that human operators or simple threshold alarms might miss, such as a gradual increase in current draw signaling bearing degradation in a cooling unit or an intermittent anomaly suggesting a loose connection or potential arc fault risk. This capability allows facility managers to schedule maintenance based on predicted failure timelines rather than fixed intervals, dramatically reducing operational risks and minimizing unnecessary downtime for preventive maintenance tasks.

Furthermore, AI algorithms are critical for advanced capacity management and load forecasting, especially in hyper-converged and virtualized environments where IT load distribution is highly dynamic. ML models can predict future power demand based on computational workload schedules, virtualization migration patterns, and historical trends, enabling BCM systems to suggest optimal load placement and dynamic adjustments to power distribution units (PDUs). This automated forecasting prevents underutilization of expensive power infrastructure, maximizes the effective capacity of the data center, and ensures that redundant power resources are available precisely when needed. The integration of AI tools also significantly enhances energy efficiency reporting by providing deep insights into transient power inefficiencies, optimizing energy consumption down to the individual server or rack level, thus directly impacting PUE metrics and aligning with corporate sustainability goals.

- Enhanced Anomaly Detection: AI algorithms establish dynamic baselines and detect subtle changes indicative of loose connections or impending component failure (predictive maintenance).

- Real-time Load Optimization: Machine learning predicts IT workload demands, enabling dynamic load balancing and efficient allocation of power resources across PDUs and racks.

- Improved Capacity Planning: AI uses historical BCM data for highly accurate forecasting of future power needs, maximizing infrastructure utilization and deferring capital expenditure.

- Automated Energy Efficiency: ML identifies transient power inefficiencies and optimizes energy usage at granular levels, directly improving Power Usage Effectiveness (PUE).

- Holistic Infrastructure Monitoring: AI correlates BCM data with environmental metrics (temperature, humidity) to provide comprehensive insights into overall system health and thermal management efficiency.

DRO & Impact Forces Of Branch Circuit Monitoring Market

The Branch Circuit Monitoring market growth is primarily driven by the escalating demand for reliable power infrastructure within data centers and critical facilities, coupled with global regulatory pressures favoring energy efficiency. However, market adoption is constrained by the significant initial capital expenditure required for installing BCM systems, especially in legacy facilities where retrofitting complexity can be substantial. Opportunities lie in the continued evolution of wireless and non-invasive monitoring technologies, which lower installation costs and time, making BCM more accessible to a broader range of commercial and industrial applications. These factors, combined with intense competition and rapid technological obsolescence, shape the overall impact forces on market trajectory, dictating investment priorities and influencing end-user adoption cycles across key geographical regions. The balance between infrastructure reliability requirements (a strong driver) and budget limitations (a restraint) defines the current market tension.

Key drivers include the massive global build-out of data centers fueled by cloud services, 5G deployment, and IoT device proliferation, all of which require meticulous power management to prevent costly downtime. The average cost of data center downtime, which often exceeds hundreds of thousands of dollars per hour, makes proactive BCM solutions an essential insurance policy for business continuity. Furthermore, governmental and organizational commitments to reducing carbon emissions and achieving net-zero targets necessitate high visibility into energy consumption, making BCM integral to ESG reporting and compliance. The increasing density of power loads within racks, often exceeding 20 kW, mandates precise circuit-level monitoring to ensure safety, thermal management, and adherence to electrical panel design limits, thereby accelerating mandatory deployment.

Restraints impeding market penetration include the complexity associated with integrating BCM systems into older electrical distribution infrastructure, requiring specialized expertise and potential interruption of critical operations. Moreover, the initial investment for high-accuracy, multi-channel BCM systems can be prohibitive for small to medium-sized enterprises (SMEs). Another significant restraint is the growing concern over data security and privacy, as BCM systems collect highly sensitive operational data; end-users require assurance that these networked monitoring solutions are resilient against cyber threats. Conversely, opportunities abound in developing markets where new infrastructure is being constructed, allowing for seamless, integrated BCM deployment from the ground up. The potential for BCM data to be monetized through value-added services, such as enhanced insurance products or predictive service contracts offered by third-party vendors, also represents a significant avenue for market expansion and revenue generation beyond the hardware sale.

- Drivers: Exponential growth of data centers and cloud computing; high cost of downtime in critical facilities; stringent governmental regulations concerning energy efficiency (e.g., ISO 50001); increasing power density and complexity of modern electrical infrastructure.

- Restraints: High initial capital expenditure and cost barriers for retrofitting existing facilities; perceived complexity of integration with legacy Building Management Systems (BMS); ongoing concerns regarding the cybersecurity risks associated with networked metering devices.

- Opportunities: Development of non-invasive, wireless BCM sensor technologies; expanding application scope into edge computing environments and smart industrial settings (Industry 4.0); integration of BCM data with AI for enhanced predictive maintenance and automated capacity management.

- Impact Forces: The necessity for operational resilience (high impact) outweighs integration difficulty in Tier 1 applications, pushing adoption forward, while price sensitivity remains a limiting factor in standard commercial applications.

Segmentation Analysis

The Branch Circuit Monitoring market is broadly segmented based on Component, Application, End-Use Industry, and Measurement Type. The component segmentation differentiates between the physical hardware (sensors, meters, communication modules) and the crucial software and services required for data acquisition, analysis, visualization, and maintenance. Application segmentation highlights the core operational areas where BCM is deployed, with Data Centers traditionally leading the market due to their power intensity and critical nature. End-Use Industry analysis categorizes consumption across sectors such as IT & Telecom, Industrial, Commercial, and Utilities, reflecting diverse operational requirements and regulatory environments. Measurement type distinguishes between current (AC/DC) monitoring technologies and those focused on voltage and specialized parameters like harmonics and power factor correction.

Understanding these segments is essential for strategic market positioning. The fastest-growing segment is anticipated to be the software and services category, capitalizing on the shift towards subscription-based models and the increasing sophistication of analytical tools. Cloud-based BCM software, offering remote monitoring and distributed fleet management, provides scalability and reduced infrastructure investment for end-users. Within the application landscape, while large data centers dominate market revenue, the industrial sector, driven by the need for equipment optimization and predictive maintenance in highly automated factories, is poised for significant incremental growth, particularly in precision manufacturing and heavy industries aiming for improved uptime.

- By Component: Hardware (Meters, Sensors, Communication Modules), Software (Monitoring Platforms, Analytics Tools), and Services (Installation, Maintenance, Consulting).

- By Application: Power Distribution Units (PDUs), Remote Power Panels (RPPs), Distribution Boards, Industrial Control Panels.

- By End-Use Industry: Data Centers & IT, Telecom, Industrial Manufacturing, Commercial Buildings, Utilities & Energy.

- By Measurement Type: AC Circuit Monitoring, DC Circuit Monitoring, Specialized Parameter Monitoring (Harmonics, Power Quality).

Value Chain Analysis For Branch Circuit Monitoring Market

The Branch Circuit Monitoring value chain commences with upstream suppliers, primarily providing high-precision electronic components, microprocessors, current sensing technologies (CT cores, Rogowski coils, shunt resistors), and communication modules essential for the BCM devices. Component manufacturing is characterized by specialized expertise in sensor calibration and robust hardware design necessary to withstand harsh electrical environments and maintain high measurement accuracy over time. Key upstream players focus on miniaturization and enhancing the reliability and data acquisition speed of the core metering technology. Strategic relationships at this stage are crucial, as the quality and cost of sensors directly impact the final product’s performance and profitability. Furthermore, semiconductor suppliers play a vital role in providing the low-power, high-performance processing capabilities required for edge-based data processing within the BCM unit itself, before data is transmitted over the network.

The midstream stage involves the design, assembly, and manufacturing of the integrated BCM systems, where specialized companies integrate the components into functional meters, enclosures, and communication gateways. This stage includes critical activities such as firmware development, system testing, and compliance certification (e.g., UL, CE, FCC). Distribution channels are bifurcated into direct sales, common for large hyperscale data center projects where customized solutions and direct technical consultation are required, and indirect sales, which leverage system integrators, electrical wholesalers, and specialized distributors. System integrators are particularly important as they bridge the gap between BCM technology and existing Building Management Systems (BMS) or Data Center Infrastructure Management (DCIM) platforms, providing necessary integration services and tailored deployment strategies for the end-user.

The downstream segment focuses on the end-users (Data Centers, Industrial Facilities, Commercial Buildings) and the critical post-sale services. Downstream activities include installation, commissioning, software integration, data analytics, and ongoing maintenance. The increasing importance of software analytics means that service providers offering specialized data interpretation, load forecasting, and predictive maintenance support capture significant value at this stage. Direct engagement between BCM manufacturers and large enterprise customers ensures deep understanding of operational requirements, driving tailored product improvements and fostering long-term contractual relationships for software updates and technical support. The entire chain is optimized to ensure high accuracy, reliability, ease of integration, and actionable data delivery to the operational personnel responsible for facility management and energy consumption optimization.

Branch Circuit Monitoring Market Potential Customers

Potential customers for Branch Circuit Monitoring solutions are defined by entities that operate mission-critical power infrastructure, manage high-density IT loads, or have significant financial and regulatory pressure to optimize energy consumption and ensure operational uptime. The primary end-users are Data Center Operators, ranging from large cloud service providers (hyperscalers) and colocation facilities to enterprise data centers. These customers rely on BCM to manage power capacity at the rack level, optimize PUE, and prevent costly electrical failures. The massive power demands and the high cost of downtime in this sector make BCM a mandatory investment, rather than an optional enhancement, ensuring they constitute the core demand segment for advanced BCM features, including high-speed communication and integration with DCIM software.

A secondary, but rapidly expanding customer base includes Industrial Manufacturing facilities, particularly those involved in precision, high-volume, or continuous process manufacturing (e.g., automotive, pharmaceuticals, chemicals, and semiconductors). For these industrial clients, BCM is used for monitoring the energy consumption and operational status of high-value production equipment, ensuring balanced loads, preventing localized power quality issues from damaging machinery, and facilitating accurate cost allocation to specific production lines. The integration of BCM with industrial control systems (ICS) and SCADA platforms is increasingly common in the context of Industry 4.0, transforming power data into critical operational intelligence for manufacturing optimization and preventative maintenance scheduling.

Other significant buyer groups encompass large commercial entities and multi-tenant complexes, where BCM is essential for tenant sub-metering, accurate utility billing, and compliance with increasingly stringent green building standards and energy consumption mandates. Telecom companies, particularly those maintaining extensive networks of remote cell sites and switching centers, are also crucial customers, using BCM to monitor remote power loads, detect theft, and optimize energy usage across geographically dispersed infrastructure. Utilities and energy providers represent another segment, utilizing BCM solutions for managing localized power quality, detecting unauthorized consumption, and improving overall grid resilience and distribution efficiency within complex urban environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.4 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schneider Electric SE, Eaton Corporation plc, ABB Ltd, Siemens AG, Vertiv Holdings Co, Packet Power LLC, Raritan (Legrand), Starline (Legrand), Anord Mardix (Flex), Bay Power, Carlo Gavazzi Holding AG, Circutor SA, Elspec Engineering Ltd., Accuenergy Ltd., Socomec Group, Enlogic (CIS Global), PDI (Legrand), GE Digital, Power Assure Inc., Supermicro. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Branch Circuit Monitoring Market Key Technology Landscape

The technological landscape of the Branch Circuit Monitoring market is dominated by advancements in current sensing mechanisms, integrated data processing capabilities (edge computing), and communication protocols optimized for industrial and data center environments. Current Transformer (CT) technology, including solid core, split core, and flexible Rogowski coils, remains foundational, with the trend favoring highly accurate, small-footprint sensors suitable for high-density environments. Rogowski coils, in particular, are gaining traction due to their high linearity, wide dynamic range, and ease of installation in existing infrastructure without needing to disconnect power. Significant innovation is focused on enhancing measurement accuracy to comply with regulatory standards (e.g., Class 0.5 or better) and ensuring reliable measurement of complex loads, including those generated by modern variable frequency drives (VFDs) and switched-mode power supplies (SMPS).

A crucial technological development is the shift towards embedded intelligence and edge processing within the BCM device itself. Modern BCM meters are no longer simple transducers; they incorporate sophisticated microcontrollers capable of real-time calculations, filtering, data aggregation, and anomaly detection at the source. This edge computing capability reduces the volume of raw data transmitted over the network, decreases latency, and enables rapid response capabilities, such as local alarming or automated shutdown sequences. Furthermore, the integration with robust networking standards like Modbus TCP/IP, SNMP, and increasingly secure IoT-specific protocols ensures seamless communication with centralized DCIM platforms or cloud-based analytics engines, forming a fully integrated data ecosystem for power management and optimization.

Connectivity advancements, particularly the introduction of wireless BCM solutions, are reshaping deployment strategies. Utilizing technologies such as Wi-Fi, Zigbee, or proprietary low-power wide-area networks (LPWAN) addresses the challenge of retrofitting existing facilities by eliminating the need for extensive wiring runs, significantly reducing installation time and costs. Power Quality Monitoring (PQM) is also becoming a standard feature, extending BCM functionality beyond simple load monitoring to include detailed analysis of harmonics, voltage sags, swells, and transient events. This comprehensive PQM capability is critical for protecting sensitive IT equipment from damage and ensuring compliance with strict power quality standards, making the BCM unit a multifaceted tool for electrical system health and integrity checks, driving the market towards more holistic power management solutions.

Regional Highlights

- North America: This region holds the largest market share, driven by the colossal presence of hyperscale and large enterprise data centers requiring advanced BCM for high-density rack management and power utilization optimization. Strong regulatory frameworks related to energy efficiency (e.g., mandates for PUE reporting) and the rapid adoption of cloud computing technologies further cement its dominance. The focus here is on sophisticated analytics, cybersecurity integration, and compatibility with leading DCIM platforms.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive digital transformation initiatives, rapid urbanization, and extensive construction of new data center capacity in countries like China, India, Japan, and Southeast Asia. Government support for smart cities and infrastructure development, coupled with growing energy conservation awareness, is accelerating BCM adoption, particularly in commercial real estate and manufacturing sectors.

- Europe: Europe is characterized by strict energy performance directives and robust sustainability goals, necessitating BCM for compliance and energy auditing, particularly in existing commercial and governmental buildings undergoing retrofitting. The market demands solutions offering high accuracy and certified compliance with European electrical standards. Germany, the UK, and the Nordic countries, with their strong focus on sustainable and green data centers, are key growth contributors.

- Latin America (LATAM): This region is an emerging market, driven by increasing investment in IT infrastructure modernization and the gradual migration of enterprise workloads to local cloud environments. Brazil and Mexico are leading the charge, emphasizing BCM solutions for improving grid reliability and managing unstable power supplies in industrial applications.

- Middle East and Africa (MEA): Growth in MEA is spurred by substantial government investments in data center parks and smart city projects (e.g., UAE, Saudi Arabia). The need to manage extremely high cooling loads and energy consumption in hot climates makes BCM essential for operational efficiency and managing escalating energy costs, though procurement processes can be complex due to regulatory differences.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Branch Circuit Monitoring Market.- Schneider Electric SE

- Eaton Corporation plc

- ABB Ltd

- Siemens AG

- Vertiv Holdings Co

- Packet Power LLC

- Raritan (Legrand)

- Starline (Legrand)

- Anord Mardix (Flex)

- Bay Power

- Carlo Gavazzi Holding AG

- Circutor SA

- Elspec Engineering Ltd.

- Accuenergy Ltd.

- Socomec Group

- Enlogic (CIS Global)

- PDI (Legrand)

- GE Digital

- Power Assure Inc.

- Supermicro

Frequently Asked Questions

What is the primary function of Branch Circuit Monitoring (BCM) in a data center environment?

The primary function of BCM in a data center is to provide granular, real-time measurement of electrical parameters (current, voltage, power) at the individual circuit breaker level. This data is critical for ensuring load balancing, preventing circuit overloads, optimizing Power Usage Effectiveness (PUE), and maximizing infrastructure capacity without risking power failure or downtime.

How do BCM systems contribute to energy efficiency and PUE improvement?

BCM systems provide the necessary data granularity to identify and quantify energy losses due to imbalances, underutilized power strips, or inefficient equipment. By pinpointing exact consumption patterns, facility managers can optimize capacity planning and implement load consolidation strategies, directly contributing to a lower, more favorable PUE score and verifiable energy savings.

What is the technological advantage of using Rogowski coils in BCM over traditional current transformers (CTs)?

Rogowski coils offer key advantages including easier, non-invasive installation in existing panels, high accuracy across a wide current range, and immunity to core saturation. Their flexibility and small profile make them ideal for retrofitting high-density power distribution units (PDUs) without requiring major electrical shutdowns.

Which segment is projected to show the fastest growth rate in the BCM market?

The Software and Services segment is projected to exhibit the fastest growth rate. This acceleration is driven by the increasing integration of BCM data with AI and machine learning for predictive maintenance, advanced load forecasting, and the shift towards cloud-based monitoring platforms offering subscription analytics services.

What role does Branch Circuit Monitoring play in Industry 4.0 initiatives?

In Industry 4.0, BCM is crucial for connecting physical power usage to operational technology (OT) insights. It provides the necessary energy consumption data for individual machines, enabling manufacturers to perform precise cost allocation, optimize equipment utilization schedules, predict maintenance needs based on power anomalies, and improve overall operational transparency and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager