Brass Wires Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431399 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Brass Wires Market Size

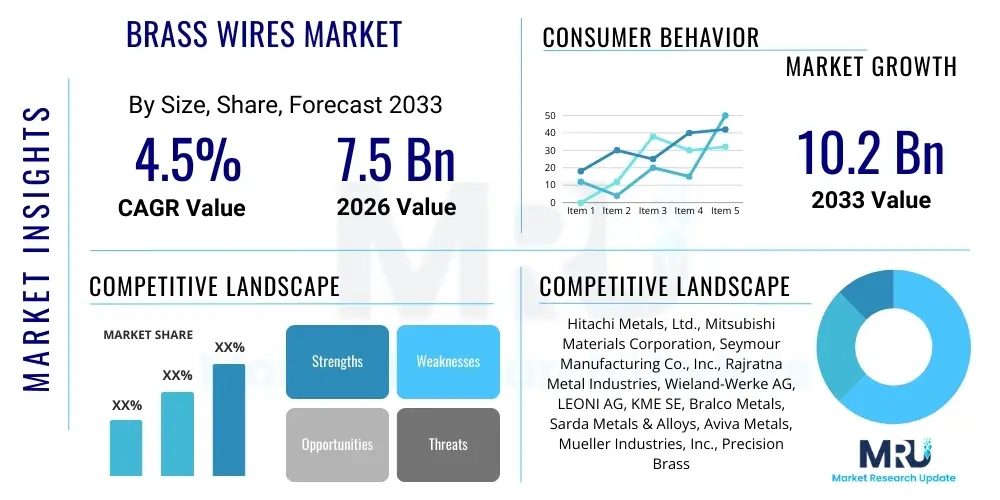

The Brass Wires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $10.2 Billion by the end of the forecast period in 2033.

Brass Wires Market introduction

The Brass Wires Market encompasses the production, distribution, and consumption of wires manufactured primarily from brass, an alloy composed mainly of copper and zinc. These wires are highly valued across numerous industrial sectors due to their excellent malleability, superior corrosion resistance, high electrical and thermal conductivity, and attractive aesthetic properties. The specific composition of the brass alloy, particularly the zinc content, dictates the wire’s final characteristics, such as hardness and ductility, making it suitable for applications ranging from delicate electronic components to robust industrial fasteners. The versatility of brass wires ensures their sustained demand in manufacturing environments globally.

Major applications of brass wires include the Electrical Discharge Machining (EDM) sector, where high precision and consistent quality are paramount for cutting complex metal shapes, often in the aerospace and mold-making industries. Furthermore, brass wires are extensively utilized in electrical wiring components, connectors, terminals, and switches, owing to their reliable conductivity and anti-tarnishing characteristics. The construction industry employs brass wire for architectural detailing, decorative meshes, and plumbing fixtures that require durability and a visually appealing finish, thereby capitalizing on its inherent resistance to environmental degradation.

The primary driving factors propelling market growth include rapid industrialization, particularly in emerging economies, the burgeoning demand for precision components from the automotive and electronics sectors, and the inherent cost-effectiveness compared to pure copper in certain non-critical electrical applications. The benefits derived from using brass wire—such as improved fatigue resistance, ease of soldering, and compliance with various international standards for materials used in consumer goods and infrastructure—further solidify its position as a critical intermediate product in the global supply chain, contributing significantly to modern manufacturing processes.

Brass Wires Market Executive Summary

The Brass Wires Market is characterized by robust growth, driven primarily by favorable business trends surrounding increased global investment in infrastructure and the sustained expansion of the Electrical Discharge Machining (EDM) sector, which relies heavily on high-quality brass EDM wire for precision cutting. Key business trends indicate a shift toward specialized, high-performance alloys designed for demanding applications in automotive manufacturing, particularly electric vehicle (EV) component production, where lightweight and corrosion-resistant materials are highly sought after. Furthermore, manufacturers are focusing on integrating sustainable production practices and improving process efficiency to mitigate volatile raw material costs, fostering a competitive environment focused on quality certification and supply chain resilience.

Regionally, the Asia Pacific (APAC) continues to dominate the market, largely due to the massive manufacturing bases in China, India, and Southeast Asia, which are major consumers of brass wires for electronics assembly, construction, and automotive production. This dominance is further cemented by ongoing rapid urbanization and governmental infrastructure projects requiring large volumes of wiring and fastening materials. North America and Europe, while growing at a steadier pace, are focusing more on high-value, niche applications, such as medical device components and specialized aerospace fasteners, where stringent regulatory standards drive demand for premium, certified brass alloys.

Segment trends highlight the growing importance of the ‘High-Speed EDM Wire’ and ‘Low Zinc Content Wire’ segments. The application segment is heavily influenced by the increasing complexity of molds and dies, necessitating finer and more accurate EDM cutting wires. In terms of end-use, the automotive segment exhibits substantial growth due propelled by advancements in vehicle electrification and the associated need for specialized connectors and battery management systems components. Conversely, the market faces constraints related to the volatility of global copper and zinc prices, which necessitates sophisticated hedging strategies and optimized inventory management among major producers to maintain pricing stability for downstream customers.

AI Impact Analysis on Brass Wires Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Brass Wires Market typically center on how machine learning can optimize the brass casting and drawing process, predict raw material price fluctuations (copper/zinc), and enhance quality control to minimize defects in high-precision wires, such as those used in EDM. Users are concerned about implementing complex sensor systems and data analysis platforms but anticipate that AI integration will lead to significant improvements in yield rates, energy consumption optimization during annealing and drawing stages, and faster identification of microstructural flaws. The overall expectation is that AI will transform the manufacturing floor into a predictive and highly efficient environment, lowering operational expenditure and increasing competitiveness, particularly for specialty wire grades.

AI's role is shifting from basic automation to cognitive manufacturing, where deep learning algorithms analyze historical production data alongside real-time sensor feedback to fine-tune machine parameters autonomously. This capability is crucial in the brass wire industry where slight deviations in temperature, tension, or alloy composition can drastically affect the wire's physical properties (tensile strength, elongation). By providing predictive maintenance alerts, AI minimizes costly downtime, ensuring continuous operation of high-speed drawing machines, which are critical for meeting the high volume demands of sectors like automotive and consumer electronics.

Furthermore, AI-driven supply chain platforms are becoming essential tools for mitigating geopolitical and economic risks associated with metal procurement. These systems analyze global commodity exchanges, logistics bottlenecks, and supplier performance data to provide prescriptive recommendations on purchasing timing and volume, thereby buffering manufacturers against the notorious volatility of copper and zinc markets. This optimization ultimately translates into more stable pricing for end-users of brass wires, making the market more predictable and resilient.

- AI-Powered Quality Control: Utilizing computer vision and machine learning for real-time defect detection during wire drawing and spooling, minimizing scrap rates and ensuring dimensional accuracy, especially for fine EDM wires.

- Predictive Maintenance: AI algorithms analyze vibration and thermal data from wire drawing and annealing equipment to forecast potential failures, maximizing operational uptime and reducing repair costs.

- Raw Material Price Forecasting: Implementation of AI models to analyze complex macroeconomic and commodity trading data, offering predictive insights into copper and zinc price movements for optimized procurement strategies.

- Process Optimization: Using reinforcement learning to dynamically adjust drawing speeds, lubrication levels, and annealing temperatures to achieve desired metallurgical properties with minimum energy consumption.

- Automated Inventory Management: Deploying intelligent systems that forecast demand fluctuations and manage inventory levels of specialized brass wire grades (e.g., high-zinc or low-zinc alloys) to prevent stockouts or overstocking.

DRO & Impact Forces Of Brass Wires Market

The market is primarily propelled by significant drivers, including the rapid technological advancements in Electrical Discharge Machining (EDM), which necessitates consistently high-quality, specialized brass wires for intricate component manufacturing in aerospace and medical sectors. The global increase in construction activities, demanding reliable brass fasteners, plumbing fixtures, and decorative elements, alongside the exponential growth of the electronics industry, particularly in Asia, further solidifies demand. These drivers collectively create a strong positive impact force, pushing manufacturers towards capacity expansion and product innovation to meet diverse application requirements while maintaining competitive pricing despite raw material volatility.

However, the market faces notable restraints, chiefly the extreme volatility and upward trend in the prices of key raw materials, specifically copper and zinc, which directly impacts production costs and profit margins. Furthermore, the substitution threat posed by alternative materials such as high-strength steel alloys, specialized aluminum, and advanced plastics in certain non-critical applications presents a persistent challenge. Regulatory pressures concerning lead content in brass alloys, especially in potable water applications (requiring lead-free brass wires), necessitate costly reformulation and certification processes, acting as a moderate dampener on market expansion in highly regulated regions like North America and Europe.

Opportunities for market expansion are abundant, particularly through strategic focus on developing specialized high-performance brass alloys tailored for new applications, such as lead-free variants for plumbing and green energy solutions (e.g., solar and wind turbine components). The adoption of Industry 4.0 manufacturing techniques, including advanced automation and AI-driven quality control, offers significant scope for improving operational efficiency and reducing waste. Impact forces, therefore, lean towards moderate to high positive due to unyielding industrial demand, provided manufacturers can effectively manage supply chain risks and capitalize on emerging technology trends favoring precision manufacturing and sustainable material use.

Segmentation Analysis

The Brass Wires Market is broadly segmented based on Type, Application, and End-Use Industry, allowing for a detailed analysis of specific market dynamics and consumption patterns. Segmentation by Type often involves categorizing wires based on their zinc content, yielding distinct properties suitable for different manufacturing processes and end-user requirements. The Application segment highlights the varied operational uses, with EDM wire consumption being a critical indicator of high-precision manufacturing activity globally. Analyzing the End-Use Industry provides insight into major consumption sectors, such as electrical, automotive, construction, and consumer goods, defining market volume and regional demand variability. This granular approach enables stakeholders to identify high-growth areas and tailor product offerings accordingly.

- By Type:

- High-Zinc Brass Wire (e.g., C27200, C27000)

- Medium-Zinc Brass Wire (e.g., C26000)

- Low-Zinc Brass Wire (e.g., C22000, C23000)

- Lead-Free Brass Wire

- By Application:

- Electrical Discharge Machining (EDM) Wire

- Fasteners and Rivets

- Hardware and Components

- Electronic Connectors

- Decorative and Architectural Meshes

- Welding and Brazing

- By End-Use Industry:

- Automotive (Connectors, Radiator Components)

- Electrical and Electronics (Terminals, Switches)

- Construction and Infrastructure (Plumbing, Architectural)

- Aerospace and Defense

- Industrial Machinery and Equipment

- Consumer Goods

- By Manufacturing Process:

- Drawn Wire

- Extruded Wire

- Cast Wire

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LAMEA)

- Middle East and Africa (South Africa, GCC Countries, Rest of MEA)

Value Chain Analysis For Brass Wires Market

The value chain for the Brass Wires Market begins with intensive upstream activities focused on the mining and refining of primary raw materials: copper and zinc. The volatility and global sourcing requirements for these metals significantly influence the initial cost structure of the final brass wire product. Key upstream players include major copper and zinc miners and smelters. Efficiency in this stage is crucial, as any fluctuation in commodity prices immediately cascades down the chain, necessitating strong long-term procurement contracts and potential integration of metal hedging strategies by large wire manufacturers to stabilize input costs.

The midstream focuses on the brass wire manufacturing process, which involves alloying, continuous casting, hot rolling, cold drawing, and specialized surface treatments (e.g., coating for EDM wires). Manufacturers invest heavily in sophisticated machinery, such as multi-wire drawing lines and specialized annealing furnaces, to achieve the stringent dimensional tolerances and specific metallurgical properties required by high-precision customers. Efficiency gains through advanced automation (Industry 4.0) are vital here for minimizing energy consumption and maximizing yield, transforming the bulk alloy into finished, spooled wires ready for distribution.

Downstream activities involve complex distribution channels. Direct sales are common for high-volume, highly customized orders, especially those supplied to large automotive OEMs or major industrial machinery builders. However, indirect channels—involving specialized industrial distributors, metal service centers, and regional agents—handle the majority of the market volume, providing logistical support, inventory management, and cutting services for smaller end-users. Distributors play a critical role in reaching diverse market segments, including small and medium-sized enterprises (SMEs) in construction and general fabrication, linking wire producers efficiently to the final end-user.

Brass Wires Market Potential Customers

Potential customers for brass wires are highly diversified, encompassing industrial manufacturers that require materials offering a unique balance of conductivity, corrosion resistance, and workability. The largest segment of buyers consists of Electrical and Electronic Component Manufacturers who purchase brass wire for creating terminals, connectors, circuit board components, and switches, prioritizing high quality and reliable electrical performance. These customers are highly sensitive to material specifications, requiring adherence to industry standards like RoHS and REACH, and often enter into long-term supply agreements with specialized wire producers to ensure consistency and volume.

Another major buying segment includes Precision Engineering Firms and Mold Manufacturers that utilize specialized brass EDM wires for intricate die cutting, particularly in tool and mold making for plastic injection, metal stamping, and prototyping. These customers are willing to pay a premium for ultra-fine wires with specific coatings that enhance cutting speed and surface finish accuracy. Their purchasing decisions are driven by technical performance metrics such as cutting speed, wire tension reliability, and erosion rates, making product innovation a key competitive factor for suppliers targeting this niche.

The third critical group of buyers includes Automotive OEMs and Tier 1 Suppliers, particularly those focused on the transition to electric vehicles (EVs). Brass wire is integral for manufacturing specialized fasteners, complex internal connectors, and components within battery cooling systems where corrosion resistance is paramount. Furthermore, Construction and Plumbing fixture manufacturers represent a steady demand base, requiring standard brass wires for durable hardware, architectural meshes, and lead-free plumbing components, with procurement heavily influenced by both price competitiveness and compliance with regional health and safety regulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $10.2 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Metals, Ltd., Mitsubishi Materials Corporation, Seymour Manufacturing Co., Inc., Rajratna Metal Industries, Wieland-Werke AG, LEONI AG, KME SE, Bralco Metals, Sarda Metals & Alloys, Aviva Metals, Mueller Industries, Inc., Precision Brass Wire Industries, Shree Extrusions Limited, MKM Mansfelder Kupfer und Messing GmbH, Luvata, A.J. Oster Co., P.C. Cox Brass Wires, Sumitomo Electric Industries, Ltd., Metrod Holding Berhad, Teshima Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Brass Wires Market Key Technology Landscape

The core technology landscape in the Brass Wires Market revolves around optimizing the continuous casting and cold drawing processes to achieve superior mechanical properties and stringent dimensional tolerances, especially for fine gauge wires. Continuous casting systems allow manufacturers to produce high-quality brass billets with reduced porosity and improved microstructure uniformity compared to traditional batch casting methods. Advanced multi-wire drawing machines utilize sophisticated tension control and lubrication systems to draw the brass down to micrometer thicknesses at high speeds, minimizing wire breakage and surface imperfections, which are critical requirements for demanding applications like high-speed EDM and micro-electronics.

A significant technological focus is placed on specialized alloying and surface treatment techniques. Manufacturers are investing in metallurgy research to develop novel lead-free brass compositions that maintain excellent machinability and corrosion resistance while meeting stricter environmental regulations, particularly in the plumbing and food contact industries. For EDM wires, advanced coating technologies, often involving zinc or zinc-rich layers applied post-drawing, are essential to enhance the electrical performance and stability of the wire during the cutting process, allowing for faster cutting speeds and improved surface finishes in complex machining operations. These coatings, applied through electrolytic or chemical processes, must be uniform and highly durable.

Furthermore, the integration of Industry 4.0 elements, including advanced sensor technology, real-time monitoring, and data analytics, is transforming the production floor. Sophisticated quality assurance systems employ non-contact measurement devices and AI-driven vision systems to inspect the wire surface and diameter continuously, guaranteeing product integrity before spooling. This technological evolution not only improves production efficiency and reduces material waste but also enables manufacturers to offer highly specialized, traceable, and consistent products that meet the rigorous specifications of aerospace and high-end electronics clients.

Regional Highlights

-

Asia Pacific (APAC): Dominance in Manufacturing and Consumption

The APAC region holds the largest market share and is expected to exhibit the highest growth rate during the forecast period. This dominance is attributable to the region's position as the global hub for manufacturing across electronics, automotive, and general industrial sectors. Countries like China, India, South Korea, and Japan drive massive demand for brass wires, fueled by extensive production of consumer electronics (requiring thin-gauge connector wires) and the rapid expansion of the electric vehicle (EV) market. Infrastructure development and urbanization projects further bolster the consumption of standard brass wires for construction and electrical applications.

The competitive advantage in APAC often stems from lower operational costs and the presence of integrated supply chains, although manufacturers in this region are increasingly focusing on improving product quality and adopting global environmental standards, moving beyond mere cost competition to specialized high-performance offerings. Investment in high-precision EDM wire production facilities is particularly intense in East Asia, driven by the local mold and die making industry.

-

North America: Focus on High-Value and Regulatory Compliance

North America represents a mature, high-value market characterized by stringent quality standards and a strong emphasis on lead-free compliance, particularly within plumbing and medical applications. The demand is heavily concentrated in the automotive, aerospace, and high-tech industrial machinery sectors, which require premium, high-specification brass alloys. Market growth here is slower but stable, driven by the replacement of outdated infrastructure and consistent investment in precision manufacturing technologies, including advanced EDM machinery.

Manufacturers in the U.S. and Canada prioritize traceability and certification. The market is witnessing a steady shift toward sustainable and recycled brass inputs, aligning with corporate sustainability goals. The procurement patterns favor long-term contracts with suppliers who demonstrate advanced technological capabilities and the ability to rapidly develop custom alloys for niche, demanding applications.

-

Europe: Strict Environmental Standards and Specialized Industrial Use

The European market for brass wires is highly regulated, particularly concerning the Restriction of Hazardous Substances (RoHS) and REACH regulations, compelling manufacturers to invest heavily in lead-free brass formulations. Germany, Italy, and France are key consumers, driven by their robust automotive and industrial machinery sectors. Europe exhibits high consumption of EDM wire due to its advanced tooling and mold-making industries, emphasizing quality and performance consistency.

Growth in Europe is supported by the region's commitment to renewable energy infrastructure, where brass wires and components are used in durable, corrosion-resistant electrical systems. The region’s focus on sustainable manufacturing also drives demand for brass products with high recycled content, influencing both sourcing and production technologies deployed by key market players.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Brass Wires Market.- Hitachi Metals, Ltd.

- Mitsubishi Materials Corporation

- Seymour Manufacturing Co., Inc.

- Rajratna Metal Industries

- Wieland-Werke AG

- LEONI AG

- KME SE

- Bralco Metals

- Sarda Metals & Alloys

- Aviva Metals

- Mueller Industries, Inc.

- Precision Brass Wire Industries

- Shree Extrusions Limited

- MKM Mansfelder Kupfer und Messing GmbH

- Luvata

- A.J. Oster Co.

- P.C. Cox Brass Wires

- Sumitomo Electric Industries, Ltd.

- Metrod Holding Berhad

- Teshima Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Brass Wires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Electrical Discharge Machining (EDM) segment within the Brass Wires Market?

The EDM segment growth is primarily driven by the increasing demand for precision components in aerospace, medical devices, and mold-making industries. Brass EDM wires offer the required balance of electrical conductivity and flushability for accurate, high-speed cutting of complex, hard materials, making them essential for modern manufacturing complexity.

How does the volatility of copper and zinc prices affect the Brass Wires Market?

Raw material price volatility significantly impacts the production cost and pricing structure of brass wires, as copper and zinc constitute the majority of the input cost. Manufacturers mitigate this risk through advanced commodity hedging, optimized inventory management, and often by passing on fluctuations to downstream buyers via flexible pricing agreements.

Which geographical region dominates the consumption and production of brass wires globally?

The Asia Pacific (APAC) region dominates the global Brass Wires Market, driven by its expansive manufacturing bases in China and India, high volume consumption in electronics and automotive sectors, and rapid industrialization and infrastructure development projects across East and Southeast Asia.

What are the key technical challenges associated with producing lead-free brass wires?

The main challenge in producing lead-free brass wires is maintaining the optimal mechanical properties, particularly machinability and ductility, which lead traditionally enhanced. Manufacturers utilize specialized alloying elements like bismuth or silicon and require advanced casting and drawing processes to achieve required performance while ensuring environmental compliance.

What is the role of specialized coating technology in enhancing brass EDM wire performance?

Specialized coatings, typically zinc-rich layers, are applied to brass EDM wires to optimize the melting point and discharge characteristics. This enhancement allows for faster cutting speeds, improved flushing of debris, reduced wire breakage, and ultimately, a better surface finish on the machined part, which is critical for precision engineering applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager