Brazilian Coffee Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433274 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Brazilian Coffee Powder Market Size

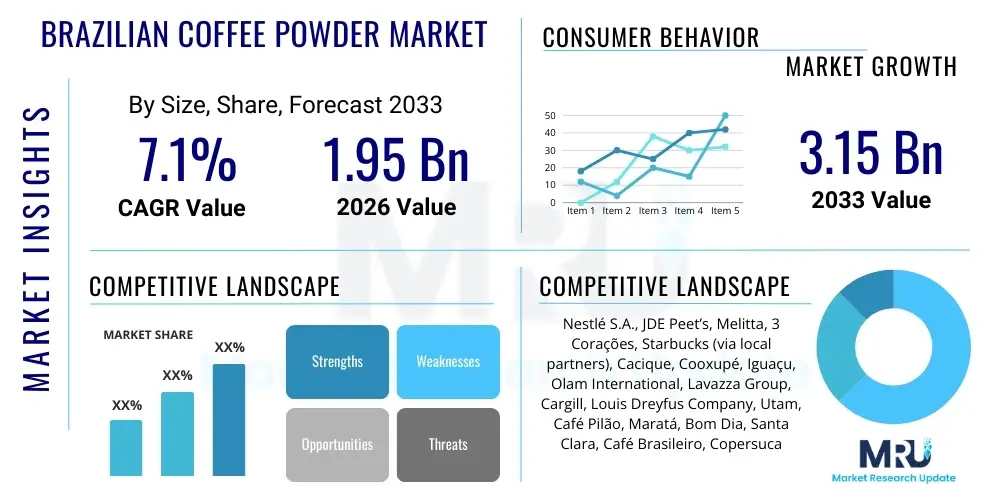

The Brazilian Coffee Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 3.15 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by Brazil's deep-rooted coffee culture, coupled with increasing consumer preference for convenient, high-quality instant and ground coffee formats, reflecting both traditional consumption patterns and modern lifestyle demands.

Brazil holds a dominant position as the world's largest producer and exporter of green coffee beans, establishing a massive domestic processing capacity for coffee powder. The market size reflects significant internal consumption, influenced by urbanization, rising disposable incomes, and widespread retail distribution. Furthermore, continuous innovation in packaging technologies, such as vacuum-sealed and single-serve options, contribute substantially to market value appreciation, ensuring product freshness and convenience for the modern Brazilian consumer base.

Brazilian Coffee Powder Market introduction

The Brazilian Coffee Powder Market encompasses the production, processing, distribution, and consumption of coffee derivatives, ranging from traditional fine ground coffee to soluble instant formats, catering to diverse consumer segments across household and commercial applications. The product description spans various roast profiles (light, medium, dark) and origins, capitalizing on the country's extensive regional coffee diversity, predominantly Arabica and Robusta varieties. Major applications include immediate domestic consumption (breakfast staple), professional catering (HORECA sector), and ingredient use in confectionery and flavorings. Key benefits driving market penetration are accessibility, preparation speed, and consistency in flavor profile, especially for instant coffee, while ground coffee maintains cultural importance. Driving factors are intrinsically linked to Brazil's cultural identity as a coffee-consuming nation, supported by sustained economic recovery, effective marketing by major domestic and multinational producers, and rising domestic demand for premium, certified, and sustainably sourced products.

Brazilian Coffee Powder Market Executive Summary

The Brazilian Coffee Powder Market demonstrates resilient business trends characterized by strong vertical integration, where major cooperatives and multinational corporations control significant portions of the supply chain, from bean farming to final retail distribution. A key trend is the accelerating pace of premiumization, focusing on single-origin, specialty roasts, and certified organic coffee powders, appealing to affluent, quality-conscious consumers willing to pay a premium for enhanced sensory experience and ethical sourcing guarantees. Regionally, the market is highly concentrated in the Southeast (São Paulo, Rio de Janeiro, Minas Gerais), which serves as both the primary consumption hub and the center for large-scale processing and distribution, though Northeastern states show high growth potential due to expanding middle-class populations. Segment-wise, the Instant Coffee Powder segment is experiencing faster volume growth due to convenience, while the Medium Roast segment remains the dominant value driver, reflecting the preferred taste profile of the traditional Brazilian consumer, positioning the market for both volume and value expansion throughout the forecast period.

AI Impact Analysis on Brazilian Coffee Powder Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Brazilian Coffee Powder Market predominantly center on efficiency gains in large-scale farming, optimizing supply chain logistics to combat fluctuating commodity prices, and leveraging predictive analytics for consumer demand forecasting. Users frequently question how AI can ensure crop sustainability amidst climate change (e.g., precision agriculture), reduce post-harvest loss, and personalize product offerings to match regional consumer preferences across Brazil's vast territory. There is significant interest in how AI-driven quality control systems can standardize the flavor profile of mass-produced coffee powder, addressing current concerns about batch variability. The summarized expectation is that AI will transform the industry from a volume-based commodity market towards a highly efficient, quality-driven, and sustainable sector, primarily through data-driven decision-making in agricultural operations and processing plants, thereby stabilizing costs and enhancing product differentiation.

- AI-Powered Precision Agriculture: Utilization of drones and sensor data for optimizing irrigation, fertilization, and pest control in coffee plantations, reducing resource waste and enhancing yield predictability, particularly crucial for large Brazilian farms.

- Supply Chain Optimization: Deployment of machine learning algorithms to forecast demand fluctuations, manage inventory levels across complex distribution networks, and optimize transport routes, significantly lowering logistical costs across the extensive geographic regions.

- Automated Quality Control: Implementation of computer vision and spectral analysis in processing plants to grade green beans and roasted coffee powder instantly, ensuring consistency in color, grind size, and defect detection before packaging.

- Predictive Maintenance: Use of AI tools in manufacturing facilities to monitor machinery health (roasters, grinders, packaging equipment), minimizing unplanned downtime and maximizing operational efficiency during peak production seasons.

- Personalized Marketing and Retail Strategy: Analyzing vast datasets of consumer purchasing behavior, social media trends, and regional demographic information to tailor marketing campaigns and introduce localized flavor blends or packaging formats.

- Climate Change Adaptation: Utilizing predictive modeling to assess the risk of weather events (droughts, excess rain) on specific growing regions and advising farmers on resilient crop management strategies, securing long-term supply stability.

- Sustainable Sourcing Verification: Leveraging blockchain integrated with AI to track coffee from farm to cup, ensuring transparency and verifiable compliance with sustainable and fair trade certifications sought after by premium consumers.

- Flavor Profile Generation: Exploring generative AI models to simulate and predict how changes in roasting parameters or blend compositions will affect the final taste profile, assisting R&D in new product development cycles.

DRO & Impact Forces Of Brazilian Coffee Powder Market

The Brazilian Coffee Powder Market is dynamically influenced by a complex interplay of internal market strength and global commodity pressures. Key drivers include the ingrained cultural habit of coffee consumption, often exceeding two cups per person daily, supported by rising consumer affluence enabling shifts toward premium products, and rapid urbanization demanding convenience formats like instant coffee. Restraints predominantly revolve around the inherent volatility of global green coffee prices, impacting procurement costs for processors, and intense domestic competition leading to narrow profit margins in the standard segment. Opportunities are significant in expanding specialty coffee consumption, penetrating untapped digital retail channels across less developed interior regions, and focusing on product diversification suchibilities as ready-to-drink (RTD) coffee preparation systems. Impact forces manifest through government agricultural policies, exchange rate fluctuations affecting export competitiveness and input costs, and consumer health trends favoring natural, minimally processed food products, compelling manufacturers to adapt quickly to environmental and economic changes.

The market faces structural challenges related to infrastructure bottlenecks, particularly in transporting beans from remote producing regions to major processing hubs, which elevates logistical costs. Despite these hurdles, Brazil’s established international reputation provides a stable foundation for growth. Furthermore, the increasing focus on ESG (Environmental, Social, and Governance) criteria by multinational buyers and domestic financial institutions acts as a powerful force, pushing the industry toward sustainable practices, traceable supply chains, and better labor standards, which in turn enhances the perceived value of Brazilian coffee powder globally and domestically.

Technological advancement is a critical impact force, enabling smaller players to implement cost-effective, high-quality roasting and grinding processes, democratizing access to modern production capabilities. However, regulatory complexity related to food safety standards and labeling requirements, specific to the Brazilian health authority (ANVISA), acts as a constant restraint, requiring substantial compliance investment from all market participants. Balancing the need for high-volume production to meet domestic demand with the drive for specialty, low-volume, high-value products defines the strategic landscape for major corporations operating within this vibrant market ecosystem.

Segmentation Analysis

The Brazilian Coffee Powder Market is strategically segmented across several dimensions including the chemical profile of the product (Type), the physical state offered to the consumer (Form), the channels utilized for transaction (Distribution Channel), and the ultimate context of consumption (Application). This comprehensive segmentation allows market participants to tailor their processing, branding, and pricing strategies to specific consumer cohorts, maximizing market penetration and profitability. Traditional segmentation based on roast level (Medium, Dark) remains fundamental due to entrenched consumer preferences, while newer distinctions, such as premium vs. mainstream categories within the Form segment (Instant vs. Ground), reflect evolving purchasing power and time constraints of the Brazilian populace.

- Type:

- Traditional Roast

- Medium Roast

- Dark Roast

- Flavored and Specialty Roast

- Form:

- Instant Coffee Powder (Soluble)

- Ground Coffee Powder (Standard, Fine, Espresso Grind)

- Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores and Local Markets

- Online Retail (E-commerce Platforms)

- Foodservice (HORECA - Hotels, Restaurants, Cafes)

- Specialty Coffee Shops

- Application:

- Household Consumption

- Commercial Consumption (Institutional, Office, Foodservice)

Value Chain Analysis For Brazilian Coffee Powder Market

The Brazilian Coffee Powder value chain initiates with the upstream analysis focusing on green bean cultivation and harvesting, largely dominated by millions of small farmers and large cooperatives like Cooxupé. This stage is critical for quality determination, heavily relying on climate, soil conditions, and efficient post-harvest processing (wet or dry milling). The midstream phase involves the industrial transformation—roasting, grinding, and often spray-drying or freeze-drying (for instant coffee)—processes that require significant capital investment and technological expertise, typically handled by large national and multinational players. The downstream analysis focuses on the final delivery to the consumer, utilizing a complex matrix of distribution channels.

Distribution is bifurcated into direct and indirect channels. Direct channels involve manufacturers selling directly to large institutional clients or through proprietary retail outlets, which allows for better margin control and brand interaction. However, indirect channels, particularly modern Supermarkets/Hypermarkets and traditional local wholesalers, account for the vast majority of volume sales. These indirect channels necessitate sophisticated logistics management due to Brazil's challenging infrastructure. E-commerce, while smaller in volume, is a rapidly expanding direct-to-consumer route, especially for premium and specialty coffee powder brands seeking nationwide reach without relying solely on physical retail shelf space.

The efficiency of the value chain is consistently tested by logistical demands; moving raw materials from inland farms to coastal processing or major metropolitan consumer centers is often costly. Successful market players invest heavily in optimizing transportation and warehousing, leveraging centralized distribution centers located strategically near consumer hubs (like São Paulo and Minas Gerais). Furthermore, sustainability and traceability audits are increasingly integrated into every stage of the value chain, adding complexity but boosting compliance and brand reputation, particularly in export markets, which often reflect back on domestic consumer expectations for ethical production.

Brazilian Coffee Powder Market Potential Customers

Potential customers for the Brazilian Coffee Powder Market span across broad demographic and commercial segments, segmented primarily by volume and price sensitivity. The largest segment remains the traditional Brazilian household consumer, characterized by high daily consumption frequency, often prioritizing value and consistency, driving demand for standard roast ground coffee purchased predominantly through supermarkets. A rapidly growing potential customer base includes younger, urbanized professionals and high-income households who are increasingly seeking specialty, single-origin, or flavored coffee powders, reflecting a global trend towards coffee connoisseurship and willingness to pay a premium for enhanced experience, often purchasing through online platforms or specialty stores.

Commercially, the HORECA (Hotels, Restaurants, and Cafes) sector represents a critical B2B buyer segment, demanding consistent supply, reliable delivery, and specific roast profiles suitable for high-volume service, including both ground coffee for espresso preparation and quality instant coffee for breakfast services. Institutional buyers, such as large corporate offices, hospitals, and educational facilities, constitute another significant bulk purchasing segment, primarily focused on instant coffee or economical ground varieties that offer ease of preparation and scalability. The diversification of consumer tastes means that manufacturers must cater simultaneously to the high-volume, cost-conscious traditional buyer and the low-volume, quality-driven specialty enthusiast, necessitating a dual strategy for product portfolio and market outreach.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 3.15 Billion |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., JDE Peet’s, Melitta, 3 Corações, Starbucks (via local partners), Cacique, Cooxupé, Iguaçu, Olam International, Lavazza Group, Cargill, Louis Dreyfus Company, Utam, Café Pilão, Maratá, Bom Dia, Santa Clara, Café Brasileiro, Copersucar, Aliança |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Brazilian Coffee Powder Market Key Technology Landscape

The Brazilian Coffee Powder Market relies heavily on sophisticated processing technologies to ensure quality, consistency, and scale necessary for mass domestic and international supply. Key technological advancements center on controlled roasting processes, utilizing computerized profile systems to maintain precise temperature curves, minimizing bean defects and maximizing desired aromatic compounds, crucial for the highly competitive ground coffee segment. For Instant Coffee Powder, the dominant technologies are Spray Drying and Freeze Drying. While Spray Drying remains the most cost-effective and highest-volume technique, Freeze Drying is increasingly employed for premium instant lines, as it better preserves the volatile flavor profile, appealing to consumers demanding near-fresh taste convenience. Modern grinding equipment further ensures uniform particle size distribution, essential for optimized extraction, particularly for fine-grind espresso applications.

Packaging technology is another vital area of innovation, with manufacturers widely adopting high-barrier materials, vacuum sealing, and nitrogen flushing to extend shelf life and preserve freshness against Brazil's humid climate. Single-serve packaging systems (e.g., rigid capsules or flexible sachets for instant coffee) represent a rapidly growing technological niche, driving convenience and portability. Furthermore, traceability technology, often utilizing QR codes and emerging blockchain platforms, is becoming standard practice, enabling consumers to verify the origin and sustainability certifications of the coffee powder, adding transparency and addressing modern ethical consumption demands.

In the upstream sector, sensor technology and IoT devices deployed in large plantations facilitate precision farming, optimizing resource use and improving yield consistency, which directly impacts the quality and cost of the green coffee input for powder production. The integration of these digital technologies, from farm management software to automated packaging lines, dictates the competitive edge in the Brazilian market, allowing leading players to achieve economies of scale while simultaneously delivering the quality associated with specialty products, thus navigating the dual market structure effectively.

Regional Highlights

The analysis of the Brazilian Coffee Powder Market's regional dynamics reveals a landscape driven by both population density and production capacity, with the Southeast region acting as the dominant gravitational center for consumption and industrial activity, while key producing states provide the necessary raw material base.

- Southeast Region (São Paulo, Minas Gerais, Rio de Janeiro): This region is the undisputed powerhouse of the Brazilian market, contributing the largest share of market revenue. Minas Gerais is the single largest coffee producing state globally, ensuring raw material proximity and lower logistical costs for major processors. São Paulo serves as the primary consumption, distribution, and financial hub, characterized by high disposable income and sophisticated consumer demand, driving trends towards specialty coffee powders and innovative retail formats.

- South Region (Paraná, Rio Grande do Sul, Santa Catarina): Known for higher disposable incomes relative to the national average, the South exhibits robust demand for premium and internationally branded coffee powders. This region shows significant adoption of instant coffee due to its busy, urbanized consumer base, and its proximity to major ports also facilitates efficient distribution and occasional export operations.

- Northeast Region (Bahia, Pernambuco, Ceará): Representing a massive, untapped consumer base, the Northeast is characterized by volume growth potential. As incomes rise, consumers are transitioning from lower-grade soluble coffee to standard ground coffee. Bahia is an emerging coffee production state, diversifying the national supply. Infrastructure development and expanding modern retail chains are critical factors influencing market penetration here.

- Midwest Region (Goiás, Mato Grosso do Sul, Distrito Federal): While less dense in terms of consumption, this region features strong commercial demand driven by the institutional sector and government offices (Brasília). Logistical challenges related to long-distance distribution are a primary factor influencing pricing and product freshness in this central area.

- North Region (Amazonas, Pará): This region, while sparsely populated, holds cultural significance for traditional consumption. The market here is sensitive to price, often favoring high-volume, economical coffee powder options. Market growth is closely tied to infrastructure improvements and increasing access to modern retail chains over traditional local markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Brazilian Coffee Powder Market.- Nestlé S.A.

- JDE Peet’s

- Melitta

- 3 Corações

- Starbucks (via local partners)

- Cacique

- Cooxupé

- Iguaçu

- Olam International

- Lavazza Group

- Cargill

- Louis Dreyfus Company

- Utam

- Café Pilão

- Maratá

- Bom Dia

- Santa Clara

- Café Brasileiro

- Copersucar

- Aliança

Frequently Asked Questions

What is the primary factor driving the premiumization trend in the Brazilian Coffee Powder Market?

The primary factor driving the premiumization trend is the sustained increase in the disposable income of the urban middle and upper classes, coupled with significant exposure to global coffee culture via travel and digital media. Brazilian consumers are increasingly prioritizing quality, specialized flavor profiles, and ethical sourcing, moving away from generic commercial coffee powder. This shift is supported by enhanced in-country marketing of single-origin beans, certified organic options, and specialized roasting techniques, leading to higher average selling prices and greater market segmentation among premium brands. This evolution reflects a transition from coffee as a mere commodity staple to an appreciated experience product.

How does the volatile global price of green coffee beans specifically restrain the growth of the Brazilian powder market?

The volatile global price of green coffee beans restrains the Brazilian powder market by creating significant cost unpredictability for domestic processors. Since Brazil is a key global exporter, domestic pricing often correlates with international commodity benchmarks, meaning raw material procurement costs fluctuate widely. This instability compresses profit margins, especially for mass-market coffee powder brands operating in highly competitive, price-sensitive segments where passing raw material cost increases directly to the consumer is challenging. Furthermore, price volatility complicates long-term investment planning for processing infrastructure and hedging strategies required by large manufacturers.

What role does e-commerce and online retail play in the distribution of Brazilian Coffee Powder?

E-commerce and online retail are rapidly transforming the distribution landscape, primarily by expanding reach for niche and specialty coffee powder brands that struggle to secure shelf space in massive physical supermarket chains. While major supermarkets remain the volume driver, online platforms offer consumers unparalleled convenience and access to detailed product information, crucial for specialty products (e.g., precise roast dates, origin stories, certification details). This channel bypasses some traditional logistical hurdles, facilitating direct-to-consumer sales, which is particularly effective in reaching affluent urban consumers and buyers in geographically remote areas previously underserved by specialty retail.

Which technology is most critical for maintaining product quality consistency in large-scale Brazilian instant coffee powder production?

For large-scale Brazilian instant coffee powder production, the most critical technology for quality consistency is the application of advanced freeze-drying and spray-drying optimization systems, often managed through computerized process controls. Specifically, optimizing the spray-drying parameters (temperature, pressure, and flow rate) is essential to minimize thermal degradation and ensure consistent bulk density and solubility of the final powder. For premium lines, modern freeze-drying technology is critical as it preserves significantly more volatile aromatic compounds, ensuring the instant product closely mirrors the flavor complexity of fresh ground coffee, thereby maintaining consumer perception of high quality across large batches.

What are the expected long-term impacts of sustainability regulations on the Brazilian Coffee Powder industry?

The long-term impacts of sustainability regulations, driven by both domestic policy and international buyer requirements (e.g., EU Deforestation Regulation), are expected to fundamentally restructure the Brazilian Coffee Powder industry. This transition will mandate increased investment in farm-level traceability technology, certified sustainable farming practices (e.g., reducing water use and chemical inputs), and improved labor practices. While these requirements initially increase operational costs, the long-term benefits include enhanced access to high-value export markets, strengthened brand reputation, reduced climate risk exposure for farmers, and a competitive advantage in the domestic specialty segment where ethical consumption is gaining momentum. Ultimately, sustainability acts as a catalyst for modernization and efficiency throughout the supply chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager