Break Bulk Shipping Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436912 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Break Bulk Shipping Market Size

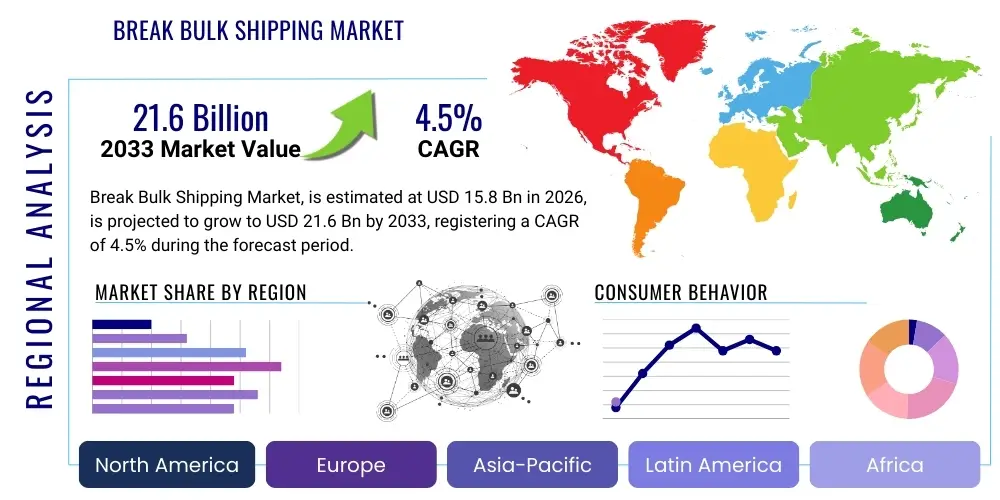

The Break Bulk Shipping Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 15.8 billion in 2026 and is projected to reach USD 21.6 billion by the end of the forecast period in 2033.

Break Bulk Shipping Market introduction

The Break Bulk Shipping Market involves the transportation of goods that cannot be placed in standard shipping containers, requiring individual loading onto and off a vessel. This method is crucial for handling specialized, oversized, or heavy-lift cargo, often termed project cargo, which includes large machinery, steel coils, oil and gas equipment, wind turbine components, and infrastructure materials. Unlike containerized cargo, break bulk demands specialized handling equipment, rigorous planning, and often customized vessel modifications, making it an essential, albeit niche, segment of the global maritime logistics industry.

The primary applications of break bulk shipping span critical industrial sectors, particularly large-scale infrastructure and energy projects. This shipping methodology provides unparalleled flexibility for transporting components that are too large or awkwardly shaped for conventional means. Key benefits include the ability to serve ports lacking sophisticated container infrastructure, better flexibility in stowage planning for heterogeneous cargo mixes, and reduced exposure to the potential supply chain choke points that frequently plague standardized container trade. Furthermore, the specialized nature of the service mitigates risks associated with handling high-value, unique items that require gentle and tailored logistics solutions.

Driving factors for sustained market expansion are intrinsically linked to global capital investment cycles. Rapid industrialization and urbanization in developing economies necessitate extensive infrastructure development, including power plants, bridges, rail networks, and large manufacturing facilities, all requiring break bulk components. Concurrently, the accelerating global energy transition, which involves massive investments in offshore and onshore wind farms, solar farms, and related renewable infrastructure, is creating substantial demand for heavy-lift and specialized project cargo movements, underpinning the projected growth trajectory of the break bulk sector.

Break Bulk Shipping Market Executive Summary

The Break Bulk Shipping Market is currently navigating a period defined by fluctuating geopolitical risks and sustained high demand from the renewable energy sector. Business trends indicate a pivot towards increased operational efficiency achieved through digital tools, particularly in complex stowage and route optimization, counteracting the inherent cost pressures of manual handling. Specialized heavy-lift operators are experiencing strong utilization rates driven by mega-projects in the construction and mining sectors, forcing carriers to invest heavily in modern, versatile vessels equipped with enhanced lifting capabilities to secure long-term contracts and maintain competitiveness in this capital-intensive domain.

Regional trends demonstrate that Asia Pacific remains the dominant growth engine, fueled by vast governmental infrastructure spending programs in countries like India and Southeast Asia, alongside China’s continued investment in global connectivity initiatives. North America and Europe show robust demand tied predominantly to the energy transition, including major offshore wind developments requiring ultra-heavy components and precision logistics. However, port infrastructure limitations and regulatory complexities, especially in emerging markets, pose consistent challenges that specialized carriers must strategically address through localized partnerships and optimized transshipment solutions.

Segmentation trends highlight the increasing dominance of Project Cargo, specifically the logistics required for wind turbine blades, nacelles, and tower sections, which are continuously growing in size and weight. The steel and metals segment, a traditional backbone of break bulk, remains stable but less dynamic compared to specialized machinery. Carrier strategies are shifting toward offering end-to-end logistics solutions, integrating freight forwarding, customs brokerage, and specialized land transport, thereby creating higher barriers to entry for new competitors and reinforcing the market position of established, integrated logistics providers focused on high-margin specialized cargo movements.

AI Impact Analysis on Break Bulk Shipping Market

Common user questions regarding AI's impact on Break Bulk Shipping focus heavily on optimizing the complex, non-standardized processes inherent to this cargo type. Users are primarily concerned with how AI can address inefficient stowage planning, which currently relies heavily on manual expertise, and how predictive maintenance can reduce unexpected downtime for specialized heavy-lift cranes and vessel components, critical given the high cost of delays in project cargo. There is also significant interest in AI's role in improving safety protocols during non-standard loading and discharge operations, coupled with the desire for automated documentation and regulatory compliance checks across diverse international jurisdictions for complex project shipments.

AI adoption is poised to revolutionize several operational facets of break bulk shipping, moving beyond simple data analytics to prescriptive decision-making. Specifically, AI-powered algorithms can process variables like cargo dimensions, weight distribution, vessel stability parameters, port limitations, and weather forecasts simultaneously to generate optimal stowage plans in real-time. This capability not only maximizes vessel utilization and ensures safety but also drastically reduces the planning time associated with multi-piece, heterogeneous break bulk shipments. Furthermore, natural language processing (NLP) is streamlining the processing of vast amounts of project documentation, purchase orders, and customs declarations, minimizing human error and accelerating the flow of crucial information throughout the complex supply chain.

The integration of machine learning models into vessel and port operations is already enhancing efficiency and predictive capability. For carriers, AI analyzes sensor data from specialized lifting gear and propulsion systems to forecast potential equipment failure, enabling proactive maintenance scheduling and extending asset lifespan, thereby reducing operational expenditure and improving reliability for strict project deadlines. For port operators, AI optimizes yard management and berth allocation specifically for break bulk operations, often characterized by irregular berth occupancy times, ensuring fluid movement and reducing overall port stay for high-value cargoes, translating directly into significant cost savings for clients.

- Automated Stowage Optimization: AI algorithms design highly efficient and stable loading patterns for irregular cargo dimensions.

- Predictive Maintenance: Machine learning identifies potential failures in vessel cranes, specialized gear, and propulsion systems, minimizing costly delays.

- Dynamic Route and Schedule Planning: Optimization of vessel routes considering specific port handling capabilities and real-time weather risks.

- Enhanced Safety Monitoring: AI-powered computer vision systems monitor cargo handling operations for compliance with safety protocols, reducing human error risk.

- Digital Documentation and Compliance: NLP automates the processing and verification of complex project documentation across multiple regulatory frameworks.

- Demand Forecasting: Advanced models predict future break bulk capacity needs based on macroeconomic indicators and project pipeline analysis.

DRO & Impact Forces Of Break Bulk Shipping Market

The Break Bulk Shipping Market is driven primarily by global infrastructure needs, restrained by inherent high operational costs and complexity, and presented with opportunities through technological specialization and integration. Impact forces dictate that macroeconomic stability, especially relating to capital expenditure on large industrial projects, remains the dominant external factor influencing market growth. While the shift toward renewable energy provides a robust and consistent driver, the fragmented nature of the break bulk supply chain, relying heavily on specialized manual labor and dedicated equipment, acts as a perpetual restraint, often leading to higher lead times and operational expense compared to containerized options.

Key drivers include substantial global commitments to decarbonization, fueling the construction of large-scale renewable energy infrastructure, such as wind farms and hydrogen production facilities, which require significant volumes of specialized, oversized components. Furthermore, the strategic diversification of manufacturing and supply chains, driven by geopolitical concerns, encourages investment in new production facilities in diverse regions, necessitating the movement of heavy machinery via break bulk. Conversely, the market faces strong restraints from volatile bunker fuel prices, stringent environmental regulations (particularly regarding vessel emissions), and persistent labor shortages in skilled heavy-lift operation and rigging, complicating consistent service delivery.

Opportunities for market players lie in vertical integration and digital transformation, specifically offering comprehensive door-to-door project logistics services that encompass marine transport, customs, and inland movement, thereby providing a single point of accountability for complex projects. Investment in multimodal transport solutions tailored for remote project sites further unlocks market potential. The impact forces underscore that consolidation among smaller specialized carriers is likely, driven by the need for greater financial resilience and the ability to fund the next generation of specialized, environmentally compliant heavy-lift vessels capable of handling the ever-increasing size of components like offshore wind turbines.

Segmentation Analysis

The Break Bulk Shipping Market is primarily segmented based on the type of cargo handled and the end-user industry generating the demand. Understanding these segments is crucial as the required vessel type, handling gear, stowage planning complexity, and pricing structure differ dramatically between generic break bulk cargo (like steel products) and highly specialized project cargo (like oil and gas modules or nuclear reactor components). The increasing size and weight of components across all major end-use sectors, particularly energy and manufacturing, dictate continuous evolution in vessel design and cargo handling capabilities, influencing strategic investment decisions across the market.

The most lucrative segment remains Project Cargo, encompassing high-value, bespoke items that require dedicated, complex logistical planning and execution. This segment is driven by long-term capital projects and is less susceptible to short-term economic fluctuations than general cargo. Conversely, the traditional General Cargo segment, primarily involving packaged goods, bags, and certain semi-finished products, faces persistent competition from containerization, although it retains relevance in trades to ports with limited infrastructure. Analyzing end-user demand reveals that global energy infrastructure, fueled by both fossil fuels and rapidly expanding renewables, dominates the required capacity, followed closely by large-scale infrastructure and manufacturing expansion projects.

The segmentation structure not only helps in pricing and risk assessment but also guides technological investment. For instance, the specialized needs of the Renewable Energy Components segment necessitate vessels with exceptional deck strength and stability for ultra-long items (e.g., turbine blades), whereas the Oil & Gas Equipment segment demands highly precise lifting capabilities and often strict environmental compliance for movement of modules into remote areas. Strategic carriers are increasingly specializing their fleets to capture high-margin project cargo contracts, recognizing that differentiation based on technical capability offers a significant competitive advantage over sheer capacity volume.

- By Type:

- General Cargo

- Project Cargo

- Heavy Lift Cargo

- Steel & Metals

- Oil & Gas Equipment

- Renewable Energy Components (Wind, Solar, Tidal)

- Forest Products

- By Application:

- Manufacturing and Industrial

- Construction and Infrastructure

- Energy (Oil, Gas, Power Generation)

- Mining and Extractive Industries

- Automotive and Aerospace

- Others

- By Destination Type:

- Developed Ports

- Developing Ports (Limited Infrastructure)

Value Chain Analysis For Break Bulk Shipping Market

The value chain for break bulk shipping is intricate and characterized by a high degree of collaboration among specialized participants, differentiating it significantly from the standardized container chain. The upstream segment involves manufacturers of specialized vessels and heavy-lift equipment, including cranes, rigging gear, and bespoke lashing materials, where technological innovation focuses heavily on safety, capacity, and environmental compliance. Shipowners and operators, who control the specialized fleet capacity, sit centrally in the chain, managing complex asset utilization and risk assessment for unique cargo movements. Securing financing for these specialized, high-cost assets is a critical upstream activity that shapes the overall market supply structure.

The core of the value chain involves operational execution, where specialized freight forwarders, often acting as the single point of contact for the shipper (project owner), play a critical role in orchestrating multimodal transport, securing vessel space, and managing regulatory compliance. Downstream, terminal operators and stevedoring companies provide the essential services of physically handling the non-standard cargo, a segment requiring highly skilled labor, specialized heavy-duty harbor cranes, and extensive marshalling areas. The distribution channel is predominantly direct or highly curated, meaning the relationship between the carrier and the project owner or their nominated freight forwarder is paramount, minimizing the influence of large, generalized intermediaries.

Direct engagement with large project owners (e.g., EPC contractors or utilities) provides carriers and specialized forwarders with long-term, predictable revenue streams, often managed through dedicated contracts of affreightment. Indirect channels primarily involve general cargo movements handled through ship brokers or general agents who facilitate ad hoc bookings, although these constitute a smaller, less profitable portion of the market compared to dedicated project logistics. The complexity inherent in the break bulk chain demands transparency and robust communication protocols between all parties to manage the high risks associated with non-standard loading, transit, and discharge operations, ultimately determining the final delivered value to the end customer.

Break Bulk Shipping Market Potential Customers

Potential customers in the Break Bulk Shipping Market are overwhelmingly concentrated in sectors involved in large-scale capital expenditure projects requiring the movement of oversized, overweight, or high-value components that cannot be containerized. These end-users are typically characterized by long investment cycles, strict project deadlines, and a high sensitivity to risk and damage during transit, demanding specialized, reliable, and often tailor-made logistics solutions. The customer base primarily consists of multinational engineering, procurement, and construction (EPC) firms, major energy companies (both renewable and conventional), and heavy machinery manufacturers.

In the energy sector, key buyers include utilities developing massive power generation facilities, such as offshore wind farm developers requiring specialized transport for colossal turbine blades and foundations, or oil and gas majors moving modular processing units to remote refinery or extraction sites. The infrastructure and construction segment relies on break bulk for transporting structural steel, heavy bridge sections, large industrial boilers, and tunneling equipment necessary for governmental and private sector mega-projects like ports, dams, and major factory expansions globally. These customers prioritize carriers that demonstrate not only capacity but also proven safety records and technical expertise in handling highly complex lifts and regulatory requirements.

Furthermore, major global manufacturers of industrial equipment, mining machinery (e.g., huge dump trucks, excavators), and specialized steel products represent a continuous demand stream. These shippers often seek reliable break bulk solutions for global supply chains where components are fabricated in one region and assembled in another. The purchasing decision for these sophisticated buyers is heavily weighted toward carrier reputation, technical specifications of the fleet (crane capacity, deck space), adherence to environmental and safety standards, and the ability to provide integrated logistics planning from the point of origin to the final installation site.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 billion |

| Market Forecast in 2033 | USD 21.6 billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Maersk, CMA CGM, COSCO Shipping, Mediterranean Shipping Company (MSC), Hapag-Lloyd, DSV Panalpina, NYK Line, OOCL, ZIM Integrated Shipping Services, BBC Chartering, Spliethoff Group, BigLift Shipping, AAL Shipping, Chipolbrok, Rickmers-Linie, Swire Shipping, United Heavy Lift, Intermarine, Global Shipping Services, Fesco Transportation Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Break Bulk Shipping Market Key Technology Landscape

The technological landscape in the Break Bulk Shipping Market is defined by continuous evolution in vessel design and cargo handling equipment, aimed at accommodating increasingly large and heavy items while improving operational efficiency and safety. Key technological advancements include the development of specialized multi-purpose vessels (MPVs) and heavy-lift vessels (HLVs) equipped with powerful, combined lifting capacities often exceeding 1,000 metric tons, essential for handling massive project cargo modules like offshore foundations or large reactor components. Furthermore, hull forms and propulsion systems are being optimized for fuel efficiency and lower emissions, adhering to tightening international maritime organization (IMO) regulations, pushing adoption of alternative fuels or hybrid propulsion systems.

On the operational front, digitalization is rapidly transforming traditional manual processes. Advanced software solutions are being deployed for meticulous stowage planning, utilizing 3D modeling and stress analysis to ensure cargo safety and vessel stability, which is highly complex given the irregular nature of break bulk items. The integration of the Internet of Things (IoT) sensors on vessels and specialized handling equipment allows for real-time monitoring of cargo location, environmental conditions (e.g., shock, temperature), and equipment performance. This data integration improves transparency for shippers and enables predictive maintenance for high-value assets, minimizing unanticipated delays.

Furthermore, technology is enhancing port and terminal operations specific to break bulk, which traditionally suffers from lower throughput compared to containerization. Automated lashing and securing systems, alongside specialized self-propelled modular transporters (SPMTs) used for on-dock movement of ultra-heavy items, are becoming standard practice in leading terminals. Training simulators incorporating augmented reality (AR) are also being used to train highly specialized rigging and crane operators, improving proficiency and safety in highly demanding and non-standard lift operations. This blend of hardware innovation (vessels) and software intelligence (planning and monitoring) is crucial for meeting the stringent demands of complex project logistics.

Regional Highlights

The global distribution of break bulk activity is highly dependent on regional capital investment cycles, particularly in infrastructure and energy development. Asia Pacific (APAC) currently holds the largest market share and exhibits the highest growth potential, driven by massive public and private infrastructure spending, including major port expansions, industrial corridors, and the rapid deployment of renewable energy projects across Southeast Asia, India, and China. The consistent demand for steel, heavy machinery, and project cargo associated with these mega-projects ensures the region remains the epicenter of market activity, though it also faces challenges related to port congestion and regulatory fragmentation.

Europe and North America represent highly mature markets characterized by stringent quality and safety standards, focusing predominantly on high-value, complex project cargo related to advanced manufacturing and the green energy transition. The European market, in particular, is witnessing substantial break bulk demand driven by the development of offshore wind farms in the North Sea and Baltic Sea, requiring specialized vessels for installation and transport of exceptionally large components. North America's demand is spurred by major investments in oil and gas infrastructure expansion (pipelines, LNG facilities) and reshoring manufacturing initiatives, requiring the shipment of large factory modules.

The Middle East and Africa (MEA) and Latin America regions are critical emerging markets, highly dependent on commodity export cycles and resource extraction projects. MEA demand is consistently high due to ongoing oil and gas upstream investments and large civil construction projects in the Gulf Cooperation Council (GCC) states. Latin America's break bulk requirements are dominated by mining projects (e.g., copper, iron ore) and associated infrastructure development, often requiring highly reliable and adaptable logistics solutions to navigate challenging geographical terrains and limited port access in some areas. These regions prioritize carriers capable of managing high-risk and high-complexity logistics into remote locations.

- Asia Pacific (APAC): Dominant market share due to unparalleled infrastructure development (ports, roads, industrial parks) and high demand for specialized components for renewable energy deployment, particularly in China and India.

- Europe: Strong demand driven by the massive expansion of the offshore wind energy sector and sophisticated manufacturing exports, emphasizing high-tech, high-value project cargo movements.

- North America: Stable demand rooted in traditional heavy industries, oil and gas expansion, and government-backed infrastructure revitalization programs requiring large material and machinery imports.

- Middle East and Africa (MEA): Significant demand linked to large-scale oil and gas investments, petrochemical plant construction, and rapid urbanization projects in key GCC nations.

- Latin America: Demand largely influenced by mining sector investment and energy infrastructure projects, often requiring customized logistical solutions for remote access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Break Bulk Shipping Market.- Maersk

- CMA CGM

- COSCO Shipping

- Mediterranean Shipping Company (MSC)

- Hapag-Lloyd

- DSV Panalpina

- NYK Line

- OOCL

- ZIM Integrated Shipping Services

- BBC Chartering

- Spliethoff Group

- BigLift Shipping

- AAL Shipping

- Chipolbrok

- Rickmers-Linie

- Swire Shipping

- United Heavy Lift

- Intermarine

- Global Shipping Services

- Fesco Transportation Group

Frequently Asked Questions

Analyze common user questions about the Break Bulk Shipping market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between break bulk shipping and container shipping?

Break bulk shipping involves loading non-standardized, individual units of cargo (often oversized or heavy) directly into the vessel hold, requiring specialized handling and stowage. Container shipping uses standardized metal boxes for efficient, mechanized handling, suitable for uniform cargo.

Which industrial sectors are the primary users of break bulk services?

The primary users are the Energy sector (oil, gas, and renewable infrastructure, such as wind turbine components), heavy Construction and Infrastructure projects (steel, large modules, machinery), and the Mining and Extractive industries for moving specialized equipment.

What are the main challenges facing the Break Bulk Shipping Market?

Key challenges include high operational costs due to manual handling, severe restrictions on specialized heavy-lift vessel capacity, managing complex customs and regulatory requirements for project cargo, and ensuring safety during the handling of oversized, irregularly shaped items.

How is technology impacting operational efficiency in break bulk logistics?

Technology is enhancing efficiency through AI-powered stowage planning software, predictive maintenance using IoT sensors on specialized cranes and vessels, and advanced 3D modeling for route planning and risk assessment, reducing human error and optimizing utilization.

What is driving the long-term growth forecast for break bulk carriers?

The sustained long-term growth is driven overwhelmingly by global government spending on critical infrastructure development and the exponential expansion of the renewable energy sector, particularly offshore wind, which requires constant movement of increasingly large and specialized project components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager