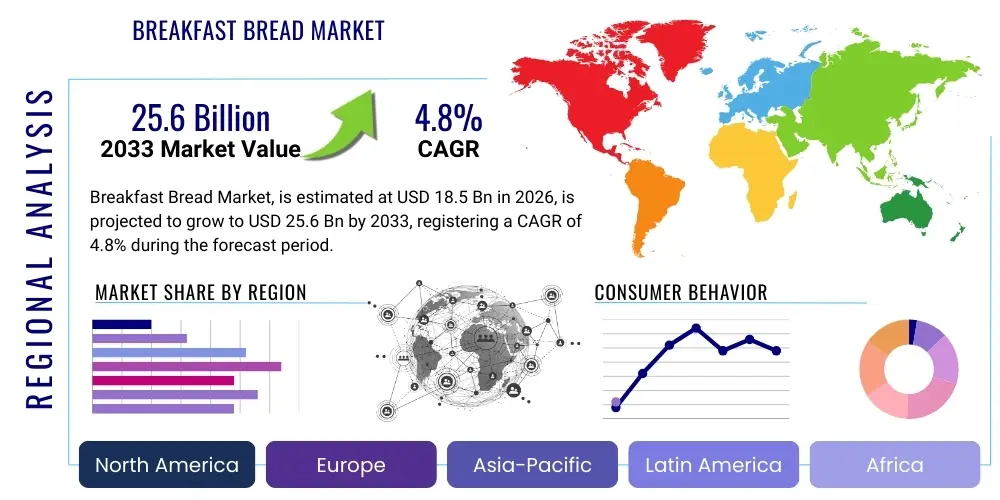

Breakfast Bread Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437072 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Breakfast Bread Market Size

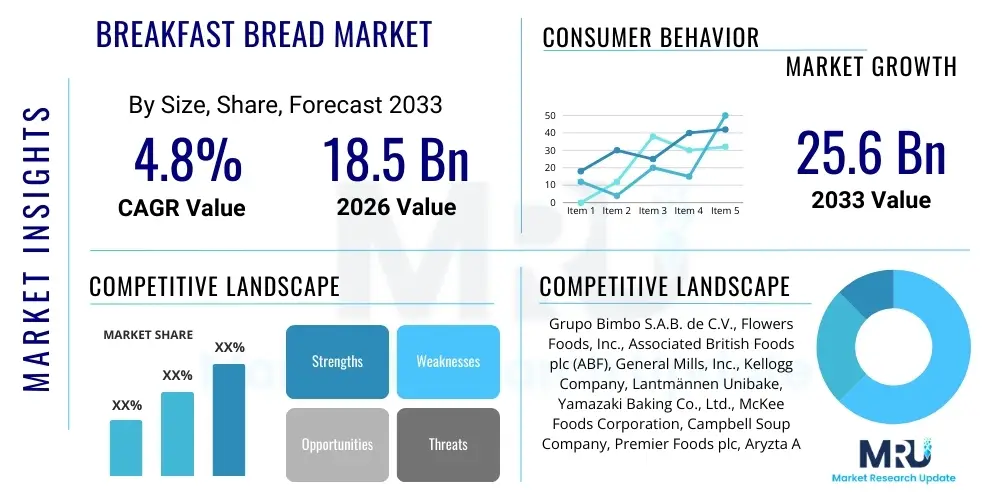

The Breakfast Bread Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 25.6 Billion by the end of the forecast period in 2033.

Breakfast Bread Market introduction

The Breakfast Bread Market encompasses a highly dynamic spectrum of baked products, ranging from universally consumed packaged sliced loaves to specialized artisanal pastries, all tailored for consumption during the morning routine. This segment is intrinsically linked to modern global socio-economic shifts, particularly the acceleration of consumer life cycles and the resulting premium placed on convenient, ready-to-eat (RTE) food solutions. Product diversification is critical, extending across traditional white, whole grain, and specialty formats such as bagels, English muffins, toaster pastries, and artisanal rolls. The primary function of these products is to provide a swift, accessible, and often nutritionally fortified start to the day. The industry is characterized by a strong interplay between global commodity pricing for inputs like wheat and sugar, and localized consumer preferences regarding texture, flavor, and preparation method, demanding a highly adaptive manufacturing base.

Major applications of breakfast bread products span both the retail consumer segment and the vast institutional food service sector. Retail applications include standard home consumption, driven by the convenience factor inherent in pre-sliced, packaged formats which minimize preparation time. Crucially, the market’s expansion is being driven by continuous technological innovation focused on improving the nutritional profile of historically viewed indulgent products. For example, advancements in fermentation science and the incorporation of alternative flours (such as almond, chickpea, or ancient grains like spelt and quinoa) are allowing manufacturers to successfully market high-fiber, high-protein, and gluten-free alternatives. This pivot towards functional ingredients is a direct response to global public health campaigns advocating for reduced consumption of refined carbohydrates and sugars, positioning breakfast bread as a staple capable of delivering targeted health benefits, thereby significantly enhancing its perceived value.

Key market benefits include unparalleled convenience, extended shelf stability provided by advanced packaging techniques, and versatility, allowing pairing with numerous spreads, toppings, and protein sources. Driving factors further contributing to market robustness include favorable demographic trends, such as rising disposable incomes in emerging markets which facilitate the shift from homemade breads to branded, packaged options. Moreover, intense competition among leading manufacturers compels continuous investment in product differentiation, often involving flavor innovation, improved texture engineering (maintaining softness over time), and clear labeling regarding ingredient transparency. The continuous integration of the supply chain, from sourcing specialty grains to highly efficient automated baking processes, underpins the industry's ability to maintain competitive pricing while simultaneously addressing consumer demand for premium, healthier product formulations globally. This commitment to both efficiency and specialized offerings sustains the robust growth trajectory projected for the forecast period.

Breakfast Bread Market Executive Summary

The Breakfast Bread Market is undergoing profound transformations, marked by intense business trends favoring consolidation among major players seeking to achieve global scale, alongside the emergence of niche, digitally native artisanal brands leveraging e-commerce. A defining trend is the prioritization of ‘clean label’ and transparent ingredient sourcing, moving away from artificial colors, flavors, and excessive preservatives, thereby driving up production costs but securing consumer trust and premium pricing. Financially, major corporations are allocating substantial capital expenditure towards supply chain resiliency, specifically implementing advanced hedging strategies to mitigate the impact of volatile agricultural commodity pricing, which poses a persistent threat to stable profitability margins. Furthermore, strategic partnerships with food technology startups focusing on sustainable ingredient alternatives, like insect proteins or lab-grown yeasts, represent future-proofing investments.

From a regional perspective, the market divergence between mature and emerging economies is stark. North America and Western Europe are dominated by the demand for value-added products—organic, non-GMO, and specialized therapeutic diets (e.g., low FODMAP, specific allergen-free bread lines). These regions exhibit slower volume growth but higher value per unit. Conversely, the Asia Pacific (APAC) region is the engine of volume growth, where the rapid expansion of modern retail infrastructure (supermarkets and convenience stores) combined with shifting consumer habits towards Western-style breakfasts creates massive untapped potential. Regional manufacturers must navigate complex and often localized regulatory environments concerning food safety and labeling standards, which necessitates tailored product portfolios and localized supply chain solutions to ensure compliance and market acceptance. This geographical disparity requires customized market entry and growth strategies focused on either premiumization (West) or volume expansion and affordability (East).

Segmentation analysis clearly indicates that whole grain and high-fiber bread categories are experiencing significantly higher growth rates compared to traditional refined white bread, reflecting global health priorities. The frozen and par-baked segment is also gaining substantial traction, particularly in food service and among households seeking maximum flexibility and reduced waste. This growth is facilitated by technological improvements in freezing processes that preserve the sensory qualities of bread upon baking. An essential trend within the segment landscape is the rise of alternative flour-based products, such as those derived from pulse crops (beans, lentils), which naturally increase protein and fiber content, appealing to the plant-based diet demographic. This strategic focus on functional ingredients and convenience, backed by scalable automation, is essential for maintaining a competitive edge and capturing the sustained demand for healthier, time-saving breakfast options across global consumer bases.

AI Impact Analysis on Breakfast Bread Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Breakfast Bread Market primarily revolve around supply chain optimization, personalized nutrition, and predictive maintenance in baking facilities. Key themes include how AI can manage commodity price volatility (e.g., wheat, yeast) through real-time forecasting, whether AI can design personalized bread recipes based on genetic markers or dietary tracking data, and the role of machine learning in ensuring consistent quality and preventing contamination across mass production lines. Concerns often focus on data privacy related to personalized dietary recommendations and the potential displacement of skilled labor in highly automated baking environments. Users anticipate that AI will fundamentally transform how ingredients are sourced, recipes are developed, and how products are marketed directly to individual consumers seeking specific functional benefits.

The application of AI in the Breakfast Bread sector is revolutionizing inventory management and minimizing waste, which is a major cost factor in fresh baked goods. By deploying sophisticated machine learning models, manufacturers can analyze vast datasets concerning sales patterns, seasonality, local weather conditions, and promotion effectiveness to forecast precise demand levels for perishable items, dramatically reducing spoilage across the distribution network. This predictive capability ensures optimal stock levels at the retail level, enhancing consumer satisfaction while improving operational efficiency for producers and retailers alike. Furthermore, AI-driven robotics and quality control systems are employed on the production floor to monitor dough consistency, baking temperature profiles, and visual quality attributes in real-time, far surpassing human capabilities in speed and consistency.

Beyond logistics, AI is proving critical in new product development (NPD). Generative AI algorithms are being utilized to rapidly iterate on ingredient combinations and flavor profiles, allowing R&D teams to quickly test the viability of novel functional ingredients—such as alternative protein sources or advanced prebiotic fibers—within complex dough matrices. This significantly shortens the time-to-market for specialized health-focused bread variants. Moreover, in personalized marketing, AI algorithms process consumer purchase history and demographic data to recommend specific bread products tailored to individual health goals, creating highly effective and targeted advertising campaigns that maximize conversion rates and foster brand loyalty in a crowded marketplace. Blockchain technology, often integrated with AI for data verification, provides transparent, traceable records of raw material origin and processing stages, enhancing brand trust regarding 'clean label' claims.

- AI optimizes ingredient sourcing by predicting commodity price fluctuations and identifying cost-effective suppliers using global financial and climate models.

- Machine learning enhances localized demand forecasting accuracy by integrating social media trends, public event schedules, and real-time weather data, dramatically reducing perishable food waste.

- Generative AI accelerates new product development, particularly for functional and customized nutritional bread formulations (e.g., predicting the optimal blend of non-wheat flours for specific crumb textures).

- AI-powered visual inspection systems utilize high-resolution thermal and optical imaging to ensure real-time quality control of dough proofing, crust coloration, and internal structure consistency.

- Predictive maintenance algorithms analyze sensor data from high-throughput machinery (mixers, dividers, ovens) to anticipate failures, minimizing unexpected downtime and maximizing plant utilization rates.

- Personalized marketing uses AI to recommend specific bread types (e.g., keto, high-fiber, gluten-free) directly to targeted consumer segments based on historical consumption patterns and declared health goals.

- Blockchain technology, often integrated with AI for data verification, provides transparent, traceable records of raw material origin and processing stages, enhancing brand trust regarding 'clean label' claims.

DRO & Impact Forces Of Breakfast Bread Market

The market dynamics are defined by a crucial interplay between robust drivers and persistent restraints, creating a necessity for strategic innovation to capture identified opportunities. The primary driver is the pervasive trend of global urbanization and the resultant fast-paced lifestyle, which inherently increases reliance on convenient, pre-packaged food items like breakfast breads. This is strongly supported by continuous advancements in nutritional science allowing for the development of healthier, value-added products (high protein, low glycemic index) that counteract common health concerns associated with traditional refined grains. Furthermore, the extensive penetration of retail channels, ranging from hypermarkets to convenience stores, ensures widespread availability, significantly boosting consumption volume. However, the market faces significant restraint from the volatile costs of core raw materials, particularly global wheat prices, which are susceptible to climatic variations and geopolitical instability, directly impacting profitability and requiring careful hedging strategies from large manufacturers.

A second major driver includes extensive penetration of retail channels, ranging from hypermarkets and supermarkets to smaller convenience stores and specialized bakery outlets, ensuring widespread availability of products across diverse demographics. Effective cold chain logistics and improved shelf-life technologies further enable distribution efficiency, supporting market growth in geographically challenging areas. Conversely, a significant restraint is the sustained negative perception and consumer distrust surrounding processed foods, leading to a strong preference for fresh, artisanal, or homemade alternatives, particularly among health-conscious consumers in developed economies. This forces substantial investment into 'clean label' and natural ingredient messaging to mitigate skepticism, increasing production complexity and costs, and demanding costly certification processes to validate organic or non-GMO claims.

Opportunities for expansion are predominantly focused on emerging markets where per capita consumption of packaged breakfast items is accelerating, driven by demographic shifts and rising middle-class incomes, providing high volume potential. Furthermore, strategic diversification into functional and specialized diets, such as Paleo, Keto, and specialized digestive health bread lines (incorporating prebiotics/probiotics), offers premium pricing potential and insulation from the highly commoditized standard loaf segment. The impact forces are currently skewed towards technological advancement in production automation and sustainable packaging solutions. Industry leaders are leveraging these forces not only to improve efficiency but also to meet consumer demands for environmentally responsible practices, ensuring long-term brand equity and market resilience against shifting regulatory landscapes and consumer preferences, especially concerning waste reduction and ingredient sourcing ethics.

Segmentation Analysis

Market segmentation in the Breakfast Bread sector serves as a crucial framework for understanding diverse consumer motivations and allocating resources effectively, reflecting the vast heterogeneity of global dietary habits. The fundamental segmentation by product type captures the spectrum from basic necessities (e.g., large-volume sliced bread for sandwiches) to specialized indulgences (e.g., filled croissants and gourmet muffins). Within the sliced bread category itself, further distinction based on grain type (white, whole wheat, ancient grain) is necessary, as purchasing behavior is strongly influenced by perceived health benefits and price point. Manufacturers must maintain high flexibility in their production lines to switch rapidly between these formats, catering to seasonal demands and promotional requirements across various segments simultaneously.

Ingredient composition segmentation highlights the industry's response to specific health and lifestyle movements. The growth of the gluten-free segment requires entirely separate, dedicated production facilities and rigorous certification protocols to prevent cross-contamination, representing a substantial investment but yielding high-margin returns. Similarly, the demand for organic and non-GMO certified products necessitates specialized sourcing agreements and traceability systems upstream. The segmentation based on nutritional claims—such as 'low sugar,' 'high protein,' or 'source of Omega-3'—allows brands to target clinical and performance-focused demographics, utilizing specific functional ingredients (e.g., added flaxseed, whey protein isolates) to substantiate these claims, moving the product beyond basic carbohydrate source into the functional food category.

Distribution channel segmentation reflects the modernization of food retail. While supermarkets and hypermarkets remain the dominant channel for packaged bread due to high volume and visibility, the rapid expansion of online retail, supported by improvements in chilled logistics, is providing a crucial growth avenue for premium and perishable items, particularly in urban areas. The food service segment (Horeca) requires segmentation based on format, such as pre-portioned, par-baked, or frozen dough products, optimized for commercial kitchens seeking labor savings and inventory control. Successful market penetration necessitates a bespoke channel strategy for each segment, balancing the economies of scale achieved through mass retail with the high-value customization required by institutional and specialized online buyers.

- Product Type:

- Sliced Bread (Standard White, Whole Wheat, Multigrain, Seeded)

- Rolls & Buns (Kaiser Rolls, Hotdog, Hamburger, Specialty Brioche Buns)

- Bagels (Plain, Sesame, Whole Wheat, Everything, Frozen Pre-sliced)

- Muffins & Cupcakes (Sweet, Savory, Low-Fat/Sugar Reduced Options)

- Doughnuts & Pastries (Croissants, Danishes, Strudel, Toaster Pastries)

- Others (Pita Bread, Naan, Ciabatta, Specialty Sourdough Loaves, English Muffins)

- Ingredient Composition:

- Wheat-Based (Conventional and Organic Wheat Flour)

- Rye-Based (Light Rye, Dark Pumpernickel)

- Gluten-Free Grains (Rice, Corn, Tapioca, Potato Starch Blends)

- Alternative Flours (Almond, Coconut, Chickpea, Ancient Grains - Spelt, Quinoa)

- Distribution Channel:

- Supermarkets & Hypermarkets (Traditional Mass Retail)

- Convenience Stores (Quick Grab-and-Go Formats)

- Online Retail (E-commerce Platforms and D2C Subscriptions)

- Artisan & Specialty Bakeries (High-End Fresh Products)

- Food Service (Hotels, Restaurants, Cafeterias, Institutional Catering)

- Nutritional Claim:

- Organic (USDA/EU Certified)

- Low Sugar / Sugar-Free

- High Fiber / Source of Whole Grain

- Gluten-Free Certified

- Non-GMO Verified

- High Protein / Keto-Friendly

Value Chain Analysis For Breakfast Bread Market

The Breakfast Bread value chain initiates with sophisticated upstream procurement, dominated by the sourcing of agricultural commodities such as milling wheat, specific flours, sugar, yeast, and specialized functional ingredients. Upstream analysis highlights the necessity for global sourcing strategies to mitigate localized crop failures or political instability impacting core grain supplies. Large manufacturers often engage in vertical integration or long-term hedging contracts to secure stable pricing and consistent quality, recognizing that ingredient quality directly impacts the final product’s texture and shelf life. The specialized nature of modern breakfast bread, particularly high-fiber or gluten-free variants, necessitates partnerships with ingredient technology providers for customized enzymes, hydrocolloids, and stabilizers that ensure technical performance during high-speed manufacturing, adding layers of complexity to the initial procurement phase.

The manufacturing stage (midstream) is characterized by high capital intensity and advanced automation. This includes sophisticated blending and kneading equipment capable of handling diverse dough types, high-capacity proofing chambers, and computer-controlled baking ovens optimized for energy efficiency. Downstream logistics are exceptionally critical due to the perishable nature of the product, necessitating a highly efficient cold chain or temperature-controlled warehousing and transportation network. Packaging is not merely a protective layer but a core technology component; investments in Modified Atmosphere Packaging (MAP) and advanced sealing systems are essential for extending shelf life and reducing returns from retail, which significantly impacts the bottom line. Efficient routing software and real-time shipment tracking are deployed to ensure just-in-time delivery to retail points, crucial for maximizing on-shelf freshness.

Distribution spans both direct and indirect channels, influencing both market reach and cost structure. Large, established players often utilize robust Direct Store Delivery (DSD) systems, especially in North America and parts of Europe, offering superior control over shelf presentation, stock levels, and promotional displays. This high-control method, while costly, ensures products are presented optimally to the consumer. Conversely, indirect distribution through regional wholesalers and general food distributors is often leveraged to penetrate fragmented markets or reach the diverse institutional food service sector, where customized logistical solutions are often required. E-commerce represents the fastest growing distribution avenue, demanding specialized e-tail packaging designed to withstand parcel shipping while maintaining product integrity, fundamentally shifting the traditional logistics model toward consumer-centric fulfillment.

Breakfast Bread Market Potential Customers

The customer base for the Breakfast Bread Market is broadly segmented into the high-volume Household Consumer segment and the specialized Institutional Buyer segment, each demanding distinct product attributes and supply chain commitments. Household consumers are primarily segmented by lifestyle and health consciousness. The core segment comprises middle-to-lower income families and price-sensitive individuals prioritizing basic, affordable, and fortified sliced bread, emphasizing value for money and extended shelf stability. The critical high-growth segment, however, consists of affluent, health-aware individuals who demand premium attributes such as organic certification, low glycemic index, and unique artisanal qualities like long-fermented sourdough. This premium segment values ingredient transparency, clean labels, and is willing to pay a significant premium, driving profitability and innovation across the industry.

Beyond basic demographics, consumer purchasing behavior is heavily influenced by meal preparation habits and dietary adherence. Potential buyers of specialized products include individuals adhering to exclusionary diets (Keto, Paleo, Vegan) or those medically required to avoid certain allergens (e.g., celiac patients requiring certified gluten-free products). These consumers are highly educated about ingredients and often rely on specialized third-party certifications and transparent brand communication. Manufacturers target this demographic through highly specific product launches and targeted digital marketing that highlights functional benefits, moving away from generalized marketing towards precision nutrition messaging.

Institutional customers represent a massive, stable volume segment, including large-scale operators such as multinational hotel chains (Horeca), national QSR franchises, airlines, and healthcare facilities. These buyers require stringent adherence to standardized specifications regarding size, weight, texture consistency, and, crucially, competitive wholesale pricing under long-term supply contracts. For example, a global hamburger chain requires billions of identical buns annually, necessitating dedicated, high-capacity production lines focused solely on consistency and food safety compliance. Securing these institutional contracts provides a stable revenue stream and requires manufacturers to demonstrate robust operational capacity, impeccable hygiene standards, and sophisticated supply chain management capable of national or international scale distribution.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 25.6 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grupo Bimbo S.A.B. de C.V., Flowers Foods, Inc., Associated British Foods plc (ABF), General Mills, Inc., Kellogg Company, Lantmännen Unibake, Yamazaki Baking Co., Ltd., McKee Foods Corporation, Campbell Soup Company, Premier Foods plc, Aryzta AG, Barilla G. e R. F.lli S.p.A., Harry-Brot GmbH, Goodman Fielder, Hostess Brands, Lewis Bakeries, Panera Bread (Panera at Home), Fazer Group, Rich Products Corporation, Warburton's Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Breakfast Bread Market Key Technology Landscape

The technological evolution within the Breakfast Bread Market is centered on three core areas: achieving high volume production consistency, extending natural shelf life, and innovating within specialized nutritional formulations. Central to high-volume output are Computer-Integrated Manufacturing (CIM) systems which manage the entire production process, from automated ingredient scaling and mixing (ensuring precise hydration and temperature control for optimal dough development) to robotic handling and palletizing. Modern industrial ovens utilize highly efficient, controlled heat transfer mechanisms (e.g., thermal oil heating or direct-fired radiant heat) that ensure uniform baking across extremely large batches, which is vital for maintaining consistent product attributes such as crust thickness, internal moisture, and volume, crucial parameters for packaged goods stability.

Shelf-life technology advancements are critical to mitigating the high waste rate inherent in fresh baking. Beyond Modified Atmosphere Packaging (MAP), manufacturers are increasingly utilizing advanced enzyme technology, specifically baking enzymes (amylases, proteases, lipases), which naturally retard the staling process by interacting with starch molecules, thereby maintaining softness and fresh texture for longer periods without requiring chemical preservatives. Furthermore, the adoption of aseptic packaging processes and specialized barriers in packaging films significantly minimizes the risk of microbial contamination post-baking. For products aimed at the food service sector, advancements in cryogenic freezing techniques allow par-baked or fully baked products to be stabilized quickly, preserving quality for subsequent reconstitution, which is essential for global distribution efficiency.

In the realm of product innovation, sophisticated laboratory analysis techniques, including Rheology and Texture Profile Analysis (TPA), are used to scientifically engineer the mouthfeel and structural integrity of new bread formulations, particularly in the complex gluten-free sector. These technologies enable R&D teams to systematically replace the functional properties of gluten using blends of alternative starches and hydrocolloids. Furthermore, the integration of blockchain technology is becoming prevalent, providing an immutable record of the origin and quality testing of every batch of specialty ingredients (e.g., organic seeds, certified non-GMO flour). This level of technological transparency directly supports 'clean label' marketing and builds consumer trust, serving as a powerful competitive differentiator in a market increasingly scrutinized for ingredient safety and provenance.

Regional Highlights

North America dominates the market in terms of value, driven by high consumer spending power and a highly developed infrastructure for packaged food distribution. The market is characterized by intense brand competition and substantial investment in health-oriented product lines. Specifically, the US market sees immense popularity in bagels, English muffins, and toaster pastries, often leveraging high-protein or functional claims. The market's maturity necessitates continual, aggressive innovation in product form factors (e.g., snackable bread bites, thin-sliced bagels) and ingredient profiles (e.g., flaxseed inclusion for Omega-3) to capture marginal market share. Furthermore, the widespread adoption of private label brands by major US retailers adds a significant layer of price competition, forcing national brand manufacturers to heavily focus on proprietary formulations and high-impact marketing campaigns to justify their premium pricing structure over generic alternatives.

Europe, while culturally diverse in its preferences, presents a complex yet robust market where the demand for local, fresh, artisan breads coexists with highly efficient packaged goods distribution. Western Europe, notably Germany, France, and the UK, maintains robust consumption of specialty rolls and loaves, but the UK and Nordic countries are significant consumers of convenient packaged sliced bread. European consumer preferences are strongly influenced by sustainability metrics and organic certification standards, often surpassing regulatory minimums. This pressure drives significant technological investment in environmentally friendly packaging and ethically sourced ingredients. The legislative environment, particularly the EU's Farm to Fork strategy, mandates stringent traceability and transparency, positioning European manufacturers at the forefront of sustainable supply chain management, creating high barriers to entry for non-compliant international competitors.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, fueled by rapid urbanization, Western influence on dietary habits, and the expansion of the organized food retail sector in populous nations like China, India, and Southeast Asia. While traditional regional breads remain staples, the younger, urban population increasingly adopts sliced bread, buns, and packaged pastries for quick breakfasts. Manufacturers are focused on adapting flavor profiles to local tastes (e.g., sweeter, milk-based breads preferred in some Asian markets) while maintaining the convenience of Western packaged formats. Investment in cold chain infrastructure is crucial for realizing the full potential of this region, given the climatic challenges and vast geographical distances involved in efficient distribution, particularly for highly perishable goods in emerging Asian cities.

Latin America (LATAM) holds a strong market position based on high volume consumption, primarily driven by staple packaged bread in countries like Brazil, Mexico, and Argentina. The market here is sensitive to economic fluctuations and heavily relies on affordability and accessibility. Manufacturers often focus on fortifying products with essential vitamins and minerals as a public health initiative, which also serves as a key marketing differentiator. The Middle East and Africa (MEA) market is showing potential, driven by population growth and expatriate communities demanding international food options. However, market penetration is slower due to fragmented distribution networks and varying local regulatory environments, with growth concentrated in the Gulf Cooperation Council (GCC) countries due to higher disposable incomes and established retail infrastructure.

- North America: Market maturity, focus on premiumization, high demand for gluten-free and functional breads (keto/low-carb). Strong e-commerce penetration and intense competition from sophisticated private label programs.

- Europe: High regulation standards, strong artisan bakery presence coexisting with packaged goods. Emphasis on organic, non-GMO, and sustainable production practices driven by strict EU directives.

- Asia Pacific (APAC): Fastest growth due to urbanization and Western dietary adoption. Expansion of organized retail and focus on localized flavor profiles and extended shelf stability suitable for climate.

- Latin America (LATAM): High volume consumption, driven by affordability and fortification efforts. Regional concentration of major industry players and economic sensitivity influencing pricing strategies.

- Middle East & Africa (MEA): Emerging market, growth concentrated in GCC nations, driven by demographic shifts and rising disposable incomes. Challenges in cold chain and distribution, reliance on imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Breakfast Bread Market.- Grupo Bimbo S.A.B. de C.V.

- Flowers Foods, Inc.

- Associated British Foods plc (ABF)

- General Mills, Inc.

- Kellogg Company

- Lantmännen Unibake

- Yamazaki Baking Co., Ltd.

- McKee Foods Corporation

- Campbell Soup Company (Artisan Bread Division)

- Premier Foods plc

- Aryzta AG

- Barilla G. e R. F.lli S.p.A.

- Harry-Brot GmbH

- Goodman Fielder

- Hostess Brands, Inc.

- Lewis Bakeries

- Panera Bread (Panera at Home)

- Fazer Group

- Rich Products Corporation

- Warburton's Inc.

Frequently Asked Questions

Analyze common user questions about the Breakfast Bread market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the gluten-free breakfast bread segment?

The gluten-free segment growth is propelled by increased diagnosis rates of celiac disease and wheat intolerance, coupled with a mainstream consumer trend viewing gluten avoidance as part of a healthier lifestyle. Technological advances in alternative flour mixtures now provide texture and flavor comparable to traditional wheat bread, boosting consumer adoption and market value.

How is sustainability impacting breakfast bread packaging?

Sustainability is shifting packaging towards recyclable, biodegradable, and compostable materials, driven by consumer demand and regulatory pressures (e.g., plastic taxes). Manufacturers are actively reducing reliance on single-use plastics and investing in paper-based solutions, often balancing environmental requirements with the necessary shelf-life extension features achieved through advanced film barriers.

Which geographical region offers the highest growth potential for new breakfast bread entrants?

The Asia Pacific (APAC) region, particularly emerging economies like India and China, offers the highest volume and value growth potential due to rapid urbanization, increased Western culinary influence, and significant expansion of organized retail infrastructure, creating vast, accessible market segments for packaged and convenient breakfast solutions.

What are the primary restraints affecting market profitability?

The major restraints are the extreme volatility in global agricultural commodity prices, specifically for wheat and sugar, which directly impacts production costs. Additionally, intense price competition within the standardized packaged bread category and increasing energy costs associated with industrial baking continually exert pressure on profit margins across the industry.

How are breakfast bread manufacturers leveraging automation and AI technology?

Manufacturers utilize automation (robotics and CIM systems) to ensure high-speed consistency and reduce labor costs. AI technology is specifically leveraged for highly accurate demand forecasting, real-time quality control via computer vision systems, and accelerating R&D for complex, functional ingredient formulations to maintain market competitiveness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager