Breast Surgery Retractors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436130 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Breast Surgery Retractors Market Size

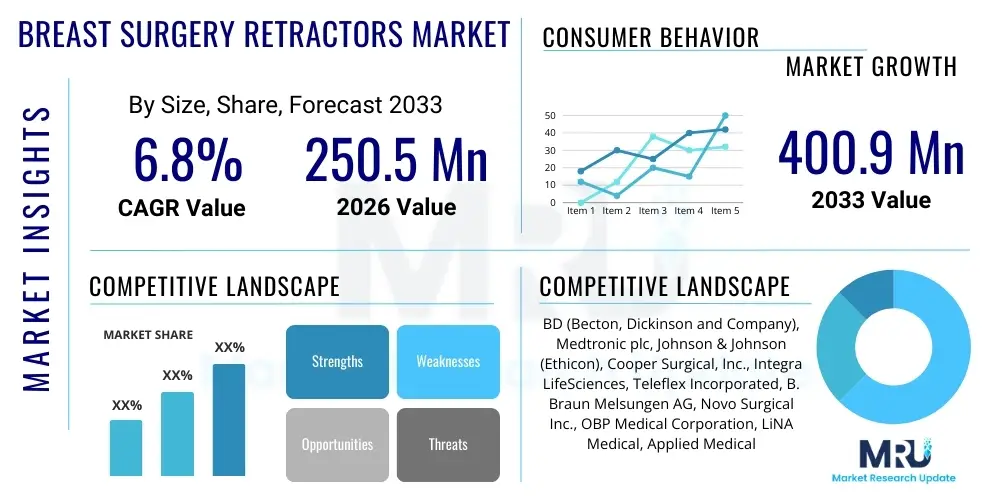

The Breast Surgery Retractors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $250.5 Million in 2026 and is projected to reach $400.9 Million by the end of the forecast period in 2033.

Breast Surgery Retractors Market introduction

The Breast Surgery Retractors Market encompasses specialized surgical instruments designed to safely and effectively hold back tissue, providing optimal visualization and access to the surgical site during various breast procedures, including mastectomies, lumpectomies, breast reconstruction, and cosmetic augmentation. These devices are crucial for minimizing tissue trauma, ensuring precise dissection, and facilitating better outcomes in complex oncological and aesthetic surgeries. The evolution of breast surgery techniques, moving towards minimally invasive and oncoplastic approaches, necessitates advanced retraction systems that offer adjustability, illumination, and stability without compromising patient safety or cosmetic results. Modern retractors often incorporate features such as fiber optic illumination, interchangeable blades, and ergonomic handles to enhance surgical efficiency.

The product portfolio within this market includes a range of devices, primarily segmented into wire retractors, fixed retractors, and self-retaining retractors, each optimized for specific surgical requirements. Self-retaining systems, such as the widely adopted lighted retractors, are gaining significant traction due to their ability to free up surgical assistants, improve deep-cavity visualization, and maintain a consistent field of view throughout lengthy procedures. Major applications span hospital operating rooms, specialized breast centers, and ambulatory surgical centers, driven largely by the increasing global incidence of breast cancer and the rising demand for reconstructive and aesthetic breast procedures. The utility of these specialized tools is paramount in achieving the dual goals of complete tumor excision and optimal cosmesis.

The market growth is substantially driven by technological advancements focusing on integrated illumination systems, which reduce shadows and improve the surgeon's dexterity, particularly in smaller incision procedures. Furthermore, the global emphasis on improving surgical safety standards, coupled with favorable reimbursement policies for oncological procedures, fuels the adoption of high-quality, specialized retraction instruments. The expanding aging population, which is more susceptible to breast cancer, alongside continuous innovation in materials science leading to lighter and more durable retractors, collectively serves as the primary impetus for market expansion across developed and emerging economies.

Breast Surgery Retractors Market Executive Summary

The Breast Surgery Retractors Market is characterized by robust expansion, fueled primarily by the rising global prevalence of breast cancer diagnoses and the subsequent increase in surgical interventions, including radical and conservative approaches. Business trends indicate a strong shift towards advanced, specialty-specific devices, particularly those incorporating integrated light sources (fiber optic or LED) to improve surgical precision and reduce procedure times. Key market players are concentrating on strategic mergers, acquisitions, and collaborations with large hospital networks to ensure high penetration of their proprietary self-retaining retractor systems. Furthermore, the emphasis on single-use (disposable) retractors is growing, driven by stringent infection control protocols and the rising cost and complexity associated with sterilizing reusable instruments, creating a parallel revenue stream for disposable product manufacturers.

Regionally, North America maintains market dominance due to high healthcare expenditure, sophisticated surgical infrastructure, and early adoption of technologically superior products, alongside the established presence of major medical device manufacturers. However, the Asia Pacific (APAC) region is poised for the fastest growth, primarily attributed to the expanding healthcare access in countries like China and India, increasing awareness of early breast cancer detection, and the rapid establishment of modern surgical facilities. European markets continue to demonstrate steady, predictable growth, supported by universal healthcare coverage and continuous efforts to standardize breast cancer treatment protocols utilizing high-quality instruments. Market participants are increasingly customizing product offerings to comply with diverse regional regulatory requirements, particularly focusing on FDA and CE mark certifications.

In terms of segment trends, the Product Type segmentation highlights the accelerating adoption of Self-Retaining Retractors over traditional hand-held variants, primarily due to efficiency gains in the operating room. The Application segment shows oncological surgery (mastectomy and lumpectomy) dominating the revenue share, given the high volume of necessary procedures. Nonetheless, the aesthetics and reconstruction segment is exhibiting faster growth driven by the rising disposable incomes and acceptance of cosmetic procedures globally. The End-User segmentation reinforces that Hospitals remain the largest revenue generators, though Ambulatory Surgical Centers (ASCs) are emerging as critical high-growth environments due to their focus on elective and less complex breast procedures, demanding specialized, cost-effective retraction kits.

AI Impact Analysis on Breast Surgery Retractors Market

User queries regarding the impact of Artificial Intelligence (AI) on the Breast Surgery Retractors market primarily revolve around three core themes: the potential for AI integration in guiding or optimizing retractor placement, the role of machine learning in pre-operative planning to select the optimal retraction technique, and the automation of procedural documentation related to retractor usage. Users are concerned about whether AI-driven surgical robotics might eventually eliminate the need for traditional manual retraction systems, or conversely, if AI systems will be developed to enhance the precision of existing instruments, particularly those used in deep-cavity or reconstructive surgeries. There is a clear expectation that AI could significantly contribute to personalized surgery, dictating instrument size and positioning based on real-time anatomical data and minimizing the risk of nerve or tissue damage caused by excessive retraction pressure.

The most immediate influence of AI is observed in pre-operative imaging analysis and surgical simulation, where algorithms process MRI and mammography data to create highly accurate 3D models of the breast anatomy, including tumor location and surrounding tissue structure. This analysis allows surgeons to pre-select the most appropriate retractor design and anticipate potential challenges related to visualization, thereby streamlining the procedure. While AI does not directly manufacture or manipulate the retractors currently, its application in planning leads directly to more informed choices regarding instrument type (e.g., specific depth of fiber optic retractor required) and placement angle, thus optimizing surgical workflow and device utilization efficiency.

In the long term, the integration of AI with robotic surgical platforms is anticipated to change the deployment model of retraction. Retractor systems might evolve into intelligent, pressure-sensing units that automatically adjust their tension based on robotic feedback, ensuring tissue viability is maintained while visibility remains optimal. This evolution necessitates the development of 'smart retractors' that can communicate data points (like force applied or tissue impedance) back to the AI-driven surgical console. This convergence of hardware and smart software promises enhanced safety, improved outcomes, and reduced variability in surgical performance, validating the market's continuous need for specialized, though technologically advanced, retraction tools.

- AI-enhanced Pre-operative Planning: Algorithms determine optimal incision lines and retractor placement angles based on patient-specific anatomy and tumor characteristics.

- Robotic-Assisted Retraction: Future retractors may integrate sensors communicating with AI-driven robots to dynamically adjust tension, minimizing tissue trauma.

- Predictive Modeling: Machine learning predicts potential visualization difficulties during complex reconstruction, prompting the use of specific lighted retractor designs.

- Inventory and Supply Chain Optimization: AI analyzes surgical schedules and historical usage data to ensure specialized retractor sets are available and sterilized efficiently.

- Training and Simulation: AI-powered virtual reality (VR) training uses simulated retractor models to improve trainee proficiency and hand-eye coordination in breast procedures.

- Real-time Tissue Viability Monitoring: Integration of AI with imaging tools (e.g., intraoperative ultrasound) to assess tissue strain under retraction, mitigating risks of ischemia or necrosis.

DRO & Impact Forces Of Breast Surgery Retractors Market

The Breast Surgery Retractors Market is powerfully influenced by dynamic forces encapsulated by Drivers, Restraints, and Opportunities. The primary Drivers revolve around the escalating global incidence of breast cancer, which necessitates a growing volume of surgical interventions including therapeutic and prophylactic mastectomies and breast-conserving surgeries (lumpectomies). This clinical demand is synergistically supported by technological advancements, specifically the development of illuminated and specialized oncoplastic retractors that significantly enhance visualization and surgical accuracy. Furthermore, rising patient preference for aesthetic outcomes, even in oncological cases, pushes surgeons toward minimally invasive and tissue-sparing techniques requiring highly refined retraction tools, thereby boosting market growth.

Conversely, the market faces significant Restraints, predominantly the high initial acquisition and maintenance costs associated with premium self-retaining and illuminated retractor systems, which can limit adoption in budget-constrained healthcare settings, particularly in emerging economies. The inherent risk of nerve or tissue damage associated with improper or excessive retraction, though low with modern devices, also mandates strict surgical training and protocol adherence, posing a continuous operational challenge. Furthermore, the market is subject to rigorous regulatory landscapes and lengthy approval processes for novel devices, which can slow down product introduction and commercialization, impacting the pace of innovation adoption.

Opportunities for market expansion are substantial, driven by the rapidly growing medical tourism sector for aesthetic breast augmentation and reconstruction procedures, particularly in Asia and Latin America, creating new avenues for specialized device sales. The shift towards Ambulatory Surgical Centers (ASCs) for elective procedures provides an opportunity for manufacturers to introduce cost-effective, disposable, and ergonomic retractor kits tailored for outpatient settings. Finally, focusing research and development efforts on integrating smart technologies, such as sensor-equipped retractors for real-time pressure monitoring, presents a significant avenue for competitive differentiation and value creation in a market increasingly focused on patient safety and optimized surgical precision. These internal and external factors, combined with the inherent impact forces of technological obsolescence risk and competitive pricing pressures, define the strategic landscape of the market.

Segmentation Analysis

The Breast Surgery Retractors Market is extensively segmented based on several key operational and technical factors, including product type, application, and end-user, enabling manufacturers and stakeholders to precisely target specific market niches. Understanding these segments is crucial for strategic planning, as distinct needs drive adoption within each category. For instance, the demand for self-retaining systems is strongly correlated with complex, time-intensive oncological procedures where stability is paramount, whereas simpler, hand-held retractors might suffice for basic aesthetic augmentations. The segmentation analysis provides granular insights into which product innovations are driving revenue growth and which end-user segments represent the highest potential for future market penetration, particularly highlighting the fastest-growing sectors like Ambulatory Surgical Centers.

Product type categorization offers clarity on material preferences and mechanism of action, differentiating between manual, self-retaining, and specialized lighted systems. This distinction is vital as healthcare providers often prioritize illumination and reduced surgical assistance needs, leaning towards advanced self-retaining retractors, which subsequently command higher price points and offer better profit margins for market leaders. Application segmentation clearly delineates the massive market size driven by oncology versus the high-growth trajectory observed in cosmetic and reconstructive surgeries, allowing companies to allocate R&D funding appropriately. The prevalence of breast cancer dictates a consistent baseline demand in the oncology segment.

Finally, the End-User segmentation provides insight into procurement patterns and volume potential. Hospitals, with their large operating theaters and high patient throughput, remain the largest consumers, demanding bulk quantities of various retractor types. However, the rapidly expanding network of specialized Breast Clinics and ASCs represents a dynamic shift, characterized by a preference for customized, often disposable, sterile packs designed for streamlined outpatient workflow. This shift influences distribution channel strategies, favoring direct sales and specialized medical supply partnerships capable of catering to diverse facility needs efficiently.

- By Product Type:

- Hand-Held Retractors (e.g., Richardson Retractors, Deaver Retractors)

- Self-Retaining Retractors (e.g., Lone Star Retractor System, OncoPlast Retractor System)

- Wire Retractors

- Specialty Retractors (e.g., Fiber Optic/Lighted Retractors, Flexible Retractors)

- By Application:

- Oncological Surgery (Mastectomy, Lumpectomy)

- Breast Reconstruction

- Aesthetic Surgery (Augmentation, Reduction, Lift)

- Nipple-Sparing Procedures

- By End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Specialized Cancer Centers

Value Chain Analysis For Breast Surgery Retractors Market

The value chain for the Breast Surgery Retractors Market begins with the Upstream Analysis, which focuses primarily on the procurement of high-grade raw materials. These materials typically include medical-grade stainless steel (for reusable devices), advanced polymers and plastics (for disposable components and handles), and complex fiber optic cables and LED components (for lighted systems). Suppliers of these specialized components must adhere to rigorous quality and biocompatibility standards, often requiring ISO certifications and validation of material traceability. Key activities in this stage include material engineering, specialized molding, and precision machining, ensuring the instruments possess the necessary strength, corrosion resistance, and ergonomic design essential for surgical performance.

The core Manufacturing and Operations segment involves design optimization, assembly, sterilization, and rigorous quality control. Manufacturers are heavily invested in cleanroom facilities and specialized assembly lines for fiber optic integration. Given the highly regulated nature of surgical tools, significant resources are allocated to validating sterilization processes (e.g., autoclaving compatibility for reusable, or ethylene oxide for disposable) and ensuring dimensional accuracy, particularly for self-retaining and customizable systems. Intellectual property protection through patents related to unique locking mechanisms, blade designs, or illumination techniques is a crucial value-added activity at this stage, establishing competitive barriers.

Downstream Analysis and Distribution Channel effectiveness define the final stages of the value chain. The distribution model is predominantly mixed: Direct sales channels are often employed for large hospital systems and teaching institutions, allowing manufacturers to maintain tight control over product education and after-sales service for expensive, specialized retractor systems. Conversely, Indirect channels, utilizing national and regional medical distributors and wholesalers, are vital for reaching smaller clinics, ASCs, and international markets. The shift towards disposable product lines favors efficient logistical networks capable of managing high-volume, low-margin shipments. Effective marketing, clinician training, and strategic key opinion leader (KOL) engagement are final, crucial components that drive product adoption and maintain brand loyalty among surgical professionals.

Breast Surgery Retractors Market Potential Customers

The primary End-Users and potential buyers of breast surgery retractors are institutions and medical professionals actively involved in performing breast-related surgical procedures, encompassing oncological treatment, reconstructive surgery, and cosmetic enhancements. Hospitals, particularly those affiliated with large academic medical centers and specialized oncology departments, represent the largest and most consistent demand segment. These institutions handle the highest volume of complex breast cancer cases, requiring a comprehensive inventory of both specialized, illuminated retractors for deep-cavity work and standard stainless-steel models for routine procedures. Procurement decisions in this segment are often centralized and driven by clinical trials, brand reputation, and long-term cost-of-ownership, favoring durable, high-quality, reusable systems.

Ambulatory Surgical Centers (ASCs) and specialized outpatient Breast Clinics form the second high-growth customer segment. These facilities primarily focus on elective procedures such as cosmetic augmentation, minor tumor excisions (e.g., benign biopsies), and reconstruction follow-ups. ASCs prioritize efficiency and cost-effectiveness, making them highly receptive to disposable, sterile, and easy-to-use retractor kits that minimize turnover time and eliminate the need for costly in-house sterilization processes. The buying cycle here tends to be faster, influenced by product ease-of-use and manufacturer support for bundled procedural kits tailored to outpatient settings.

Finally, independent plastic surgeons and private surgical practices constitute an important, though smaller, customer base. These practitioners require specialized retractors optimized for aesthetic results, demanding features such as minimal footprint and highly focused lighting for delicate tissue manipulation. Educational institutions and training hospitals are also critical customers, purchasing retractors for surgical simulation and residency training programs. Successful market penetration hinges on manufacturers demonstrating superior clinical utility, ergonomic advantage, and cost-benefit ratio across these diverse professional environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250.5 Million |

| Market Forecast in 2033 | $400.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BD (Becton, Dickinson and Company), Medtronic plc, Johnson & Johnson (Ethicon), Cooper Surgical, Inc., Integra LifeSciences, Teleflex Incorporated, B. Braun Melsungen AG, Novo Surgical Inc., OBP Medical Corporation, LiNA Medical, Applied Medical Resources Corporation, K.S. Surgical, Innomed, Inc., Tydings & Company, C. R. Bard (Acquired by BD), SurgiWire Inc., Millennium Surgical Corp., Marina Medical, Accurate Surgical & Scientific Instruments, Wexler Surgical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Breast Surgery Retractors Market Key Technology Landscape

The technology landscape of the Breast Surgery Retractors Market is dominated by advancements aimed at improving intraoperative illumination, ergonomics, and minimizing tissue disruption. The transition from basic stainless steel hand-held devices to sophisticated Self-Retaining Retractor Systems featuring integrated Fiber Optic or high-intensity LED lighting represents the most critical technological evolution. Fiber optic retractors channel powerful, focused light directly into the deep surgical cavity, overcoming the shadowing issues typical of conventional operating room lighting. This integration significantly enhances visualization, which is particularly vital in complex oncoplastic procedures or deep chest wall dissections during mastectomy, leading to improved outcomes and reduced operative time. Manufacturers are continually refining light sources to be brighter, cooler (to prevent tissue desiccation), and more efficiently integrated into the slim profiles of the retractor blades.

Another major technological focus is on modularity and specialization. Modern retractor systems are increasingly modular, allowing surgeons to interchange various lengths, depths, and shapes of blades to match specific patient anatomy and procedural needs (e.g., blades optimized for implant placement versus tissue flap harvesting). Self-retaining mechanisms are becoming more stable and easier to manipulate, often incorporating fine-adjustment gears or magnetic locking systems that maintain consistent retraction force without slippage. The drive towards disposable retraction systems, primarily constructed from high-strength medical polymers, is also a significant trend, addressing infection control concerns while offering instruments with guaranteed sharpness and sterility, thus simplifying hospital inventory management and reducing sterilization costs.

Looking ahead, the market is moving towards "Smart" Retractors. While still nascent, this technology involves embedding miniature sensors within the retractor blades or frame. These sensors are designed to monitor parameters such as the pressure exerted on adjacent tissues, temperature, or even localized impedance, providing real-time feedback to the surgical team. This data integration, potentially linked to AI-driven surgical navigation systems, aims to prevent retraction-related complications like nerve injury or vascular compromise, pushing the boundaries of surgical safety and precision. Furthermore, the development of lighter-weight, biocompatible materials for retractors used in robotic breast surgery ensures compatibility with high-precision automated platforms, cementing technology as the primary differentiator in market competition.

Regional Highlights

- North America: Dominates the global market share, largely due to high public awareness regarding breast health, robust infrastructure for advanced surgical procedures, and high per capita healthcare spending. The U.S. acts as the primary driver, characterized by rapid adoption of premium, self-retaining, and lighted retractor systems, strong presence of key market players, and favorable reimbursement policies for both oncological and reconstructive surgeries. Canada also contributes significantly through universal access to cancer treatment and continuous investment in surgical technology upgrades.

- Europe: Holds the second-largest market share, driven by standardized breast cancer screening programs and treatment protocols across the European Union (EU). Countries like Germany, France, and the UK are major consumers, emphasizing quality and clinical efficacy. The market here shows a balanced uptake of both reusable high-quality stainless steel systems and disposable specialized retractor kits, highly influenced by rigorous MedTech regulations and local procurement guidelines focusing on cost-efficiency and environmental sustainability.

- Asia Pacific (APAC): Projected to be the fastest-growing region during the forecast period. This accelerated growth is attributed to the rapidly increasing aging population, improvements in healthcare infrastructure in emerging economies (China, India, South Korea), increasing disposable income leading to higher demand for aesthetic breast surgeries, and growing awareness and early diagnosis of breast cancer. Market penetration is often focused on value-based, scalable solutions, though affluent private hospitals readily adopt high-end US/EU-manufactured illuminated systems.

- Latin America (LATAM): Exhibits moderate growth, primarily driven by Mexico and Brazil, which are major hubs for cosmetic surgery tourism and have a significant incidence of breast cancer. The market is often price-sensitive, leading to a strong demand for competitively priced, often locally manufactured or imported non-premium retractors, though high-end private clinics frequently purchase advanced systems to maintain international standards in aesthetic procedures.

- Middle East and Africa (MEA): Represents the smallest, but expanding, market share. Growth is concentrated in Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE) due to high healthcare investments, medical city developments, and a focus on high-quality specialized surgical services, particularly in private healthcare sectors. Challenges remain in broader Africa due to resource constraints and underdeveloped surgical infrastructure, although philanthropic efforts and public health initiatives are slowly increasing access to basic surgical equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Breast Surgery Retractors Market.- BD (Becton, Dickinson and Company)

- Medtronic plc

- Johnson & Johnson (Ethicon)

- Cooper Surgical, Inc.

- Integra LifeSciences

- Teleflex Incorporated

- B. Braun Melsungen AG

- Novo Surgical Inc.

- OBP Medical Corporation

- LiNA Medical

- Applied Medical Resources Corporation

- K.S. Surgical

- Innomed, Inc.

- Tydings & Company

- C. R. Bard (Acquired by BD)

- SurgiWire Inc.

- Millennium Surgical Corp.

- Marina Medical

- Accurate Surgical & Scientific Instruments

- Wexler Surgical

- Sklar Instruments

- Aesculap (B. Braun subsidiary)

- Arthrex Inc.

- Retraction Hardware LLC

Frequently Asked Questions

Analyze common user questions about the Breast Surgery Retractors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What types of breast surgery retractors are most commonly used in oncological procedures?

Self-retaining retractors, particularly those with integrated illumination such as fiber optic systems, are most commonly used in oncological procedures like lumpectomies and mastectomies. These systems provide consistent, hands-free visualization of deep cavities and tumor margins, which is critical for achieving clear excision margins and maintaining surgical efficiency.

How are advancements in technology influencing the design of breast surgery retractors?

Technology is driving the shift towards lighted (fiber optic/LED) and modular retractor systems. These advancements enhance surgical field visibility, improve ergonomics, and allow for customization of blade shape and length based on specific patient anatomy and procedural requirements, thereby optimizing surgical outcomes and minimizing tissue damage.

What is the primary factor restraining growth in the breast surgery retractors market?

The primary factor restraining market growth is the high capital cost associated with acquiring and maintaining advanced, reusable self-retaining and illuminated retractor systems. These significant initial investments, coupled with necessary associated sterilization costs, can be prohibitive for smaller hospitals or facilities in developing regions, hindering widespread adoption.

Do Ambulatory Surgical Centers (ASCs) prefer disposable or reusable breast surgery retractors?

ASCs increasingly prefer disposable, single-use breast surgery retractors. This preference is driven by the need for quick turnover times, strict infection control protocols, and the desire to bypass the operational costs and logistics complexity associated with sterilizing and tracking reusable specialized surgical instrumentation.

Which geographical region holds the largest revenue share in the Breast Surgery Retractors Market?

North America holds the largest revenue share in the Breast Surgery Retractors Market. This dominance is due to high healthcare expenditure, established advanced surgical infrastructure, high rates of breast cancer diagnosis, and the swift adoption of innovative, premium retraction devices across major hospitals and specialized surgical centers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager