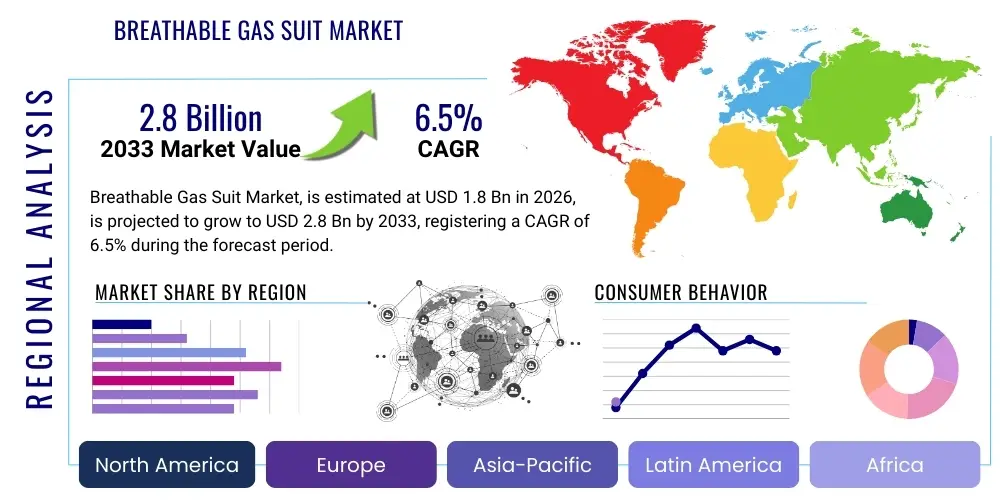

Breathable Gas Suit Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435993 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Breathable Gas Suit Market Size

The Breathable Gas Suit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Breathable Gas Suit Market introduction

The Breathable Gas Suit Market encompasses specialized personal protective equipment (PPE) designed to shield workers from environments containing hazardous gases, vapors, particulate matter, and chemical splashes, often categorized under Chemical, Biological, Radiological, and Nuclear (CBRN) protection levels. These suits are critical safety components in environments where atmospheric contamination poses an immediate danger to life or health (IDLH). The suits function by providing a sealed barrier and, crucially, integrating a positive pressure or forced-air supply system, ensuring that the wearer breathes purified external air or air from a dedicated supply cylinder, thereby maintaining an internal pressure higher than the external contaminated atmosphere to prevent ingress.

Major applications of breathable gas suits span highly regulated and hazardous industries, including oil and gas exploration and refining, chemical manufacturing, pharmaceutical research, emergency response (HAZMAT teams), and military defense operations. The core benefit derived from utilizing these suits is the mitigation of catastrophic exposure risks, ensuring compliance with rigorous international safety standards set by bodies like OSHA (Occupational Safety and Health Administration) and ISO. The sophisticated design incorporates features such as viewing ports, communication systems, and chemically resistant seam technology to maximize protection while allowing operational effectiveness in critical situations.

Driving factors for sustained market growth are fundamentally rooted in escalating industrial safety regulations globally, particularly in emerging economies undergoing rapid industrialization. Furthermore, the increasing frequency and complexity of hazardous material transportation and storage necessitate enhanced preparedness, pushing end-users to invest in high-quality, certified protective gear. Technological advancements in material science, focusing on lighter, more flexible materials with superior chemical permeation resistance and improved thermal management capabilities, are continually expanding the suit’s usability and acceptance in demanding work environments, thereby fueling market expansion across diverse sectors.

Breathable Gas Suit Market Executive Summary

The Breathable Gas Suit Market is characterized by robust regulatory influence and continuous technological innovation, maintaining steady growth driven primarily by mandates emphasizing worker safety in highly hazardous environments such as petrochemical processing and advanced chemical synthesis. Business trends indicate a strategic focus among manufacturers on developing reusable suits constructed from high-performance elastomers and polymer blends that offer extended service life and enhanced resistance to a broader spectrum of toxic agents, moving away from purely disposable options in certain long-term operational contexts. Furthermore, market competition is intensifying around the integration of smart technologies, including suit integrity monitoring sensors and closed-loop communication systems, transforming the suit from a passive barrier into an active, connected safety system.

Regionally, North America and Europe currently dominate the market share, attributed to stringent existing safety legislation, mature industrial infrastructure, and substantial investment capacity in high-end protective gear by established chemical and defense sectors. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is propelled by escalating industrial activity, particularly in China and India, coupled with the increasing adoption and strict enforcement of international occupational safety standards, necessitating immediate investment in specialized gas suits for growing manufacturing and refining complexes. The Middle East and Africa (MEA) are also emerging as significant markets due to large-scale oil and gas infrastructure projects and corresponding safety regulations.

Segment trends reveal that the reusable suit segment, while possessing a higher initial cost, is gaining traction due to lower lifetime cost of ownership and reduced environmental footprint, particularly favored by military and specialized industrial maintenance crews. In terms of protection level, Level A suits, offering the highest barrier against gas and vapor penetration, command a premium price and remain essential for handling unknown or highly volatile substances. The material segment is seeing a notable shift toward composite fabrics that blend traditional barrier polymers with advanced materials like PTFE (Polytetrafluoroethylene) films, optimizing the balance between chemical resistance, tear strength, and wearer comfort, which is a significant factor affecting operational endurance.

AI Impact Analysis on Breathable Gas Suit Market

User queries regarding the impact of Artificial Intelligence (AI) on the Breathable Gas Suit Market predominantly center on how AI can enhance predictive maintenance, optimize logistical deployment of specialized PPE inventories, and improve training simulations for emergency responders wearing complex suits. Key concerns frequently revolve around ensuring AI algorithms accurately assess suit integrity—looking for micro-tears or material degradation invisible to the human eye—and whether AI-driven climate control systems within suits can effectively manage wearer heat stress in real-time. Expectations include AI standardizing training by simulating diverse hazardous scenarios and providing immediate, personalized feedback on donning and doffing procedures, thereby minimizing accidental exposure risk which is often associated with human error in preparation.

The application of AI is primarily anticipated in pre-deployment planning and post-exposure analysis. For instance, AI can analyze historical data regarding specific chemical exposures, environmental conditions, and suit material performance to recommend the optimal suit type and expected operational lifespan for a given mission, minimizing the risk of material failure. Furthermore, during manufacturing, AI-powered vision systems can conduct micro-level quality assurance checks on seams and valves far faster and more consistently than manual inspection, significantly raising the baseline quality and reliability of the life-saving equipment before it reaches the end-user.

Beyond material science and quality control, AI systems are becoming instrumental in asset management. Large organizations, such as major chemical companies or national defense forces, manage vast inventories of specialized suits with varying expiration dates and certification cycles. AI algorithms can optimize the rotation, inspection scheduling, and refurbishment process for reusable suits, reducing operational downtime and ensuring regulatory compliance across multiple global sites, transforming inventory management from a static logistical task into a dynamic, condition-based predictive process that guarantees readiness when a hazardous event occurs.

- AI-driven predictive maintenance modeling for suit material degradation and valve performance.

- Optimization of supply chain and inventory management for time-sensitive suit replenishment and rotation.

- Real-time monitoring and analysis of physiological data (heart rate, temperature) within smart suits to prevent heat stress or fatigue.

- AI-enhanced visual inspection during manufacturing to detect micro-defects in seams and materials.

- Development of advanced virtual reality (VR) training simulations with AI feedback for standardized donning, doffing, and operational procedures.

- Creation of specialized algorithms to recommend the optimal suit configuration based on atmospheric hazard concentration and duration of exposure.

DRO & Impact Forces Of Breathable Gas Suit Market

The dynamics of the Breathable Gas Suit Market are powerfully shaped by an interplay of regulatory drivers and high inherent costs, creating a complex operating environment for manufacturers and end-users alike. The primary drivers stem from the global increase in stringent occupational safety standards, particularly the establishment of minimum protective equipment requirements by regional bodies, compelling industries dealing with highly toxic or volatile substances to invest in certified, high-grade gas suits. Concurrently, the proliferation of large-scale industrial projects in chemical processing, oil refining, and nuclear energy sectors globally dictates a constant, high-volume demand for reliable protection against catastrophic failure risks.

However, significant restraints temper the market's growth trajectory. The most pronounced restraint is the inherently high cost associated with manufacturing and purchasing certified gas suits, especially Level A encapsulating models, which require expensive, high-performance barrier materials and rigorous quality control testing. Furthermore, these suits often present considerable physiological limitations, primarily related to weight, restricted maneuverability, and the rapid onset of heat stress, which limits the effective operational duration for the wearer and necessitates specialized cooling systems, further increasing complexity and expense. The required rigorous, regular maintenance and expensive re-certification processes for reusable suits also act as a substantial barrier to entry for smaller organizations.

Opportunities for market stakeholders primarily lie in pioneering next-generation suit technology that addresses the current comfort and operational limitations. This includes developing lighter, more breathable composite materials that maintain superior chemical resistance, along with integrating active cooling technology (such as phase change materials or micro-ventilation systems) that allows workers to perform tasks for longer periods without risk of heat exhaustion. The increasing global focus on preparing for environmental disasters and complex pandemic responses also presents a significant opportunity for manufacturers capable of producing suits optimized for biohazard and multi-threat scenarios, driving specialized product development and expanding governmental procurement contracts worldwide.

Segmentation Analysis

Segmentation analysis of the Breathable Gas Suit Market reveals a highly specialized landscape influenced by material science, protection requirements, and application environment. The market is primarily segmented by Suit Type (Disposable vs. Reusable), Material Composition (Polymer vs. Elastomer vs. Composite), Level of Protection (Level A, B, C, D), and End-Use Application (Chemical, Oil & Gas, Emergency Response, etc.). Understanding these segments is crucial as procurement decisions are rarely based solely on price, but rather on balancing regulatory compliance, chemical threat specificity, and the economic viability of the suit's service life, particularly differentiating between single-use applications and long-term industrial maintenance requirements.

The disposable segment, often utilizing lighter materials like Tyvek combined with specialized films, dominates volume share due to its requirement in situations demanding rapid contamination control and easy disposal, such as minor spills or certain healthcare environments. Conversely, the reusable segment, utilizing heavy-duty materials like Butyl rubber or high-performance composites, captures a higher value share. This segment caters to highly corrosive or high-risk industrial environments where robust protection and the economic benefit of re-use after decontamination outweigh the initial investment cost, particularly favored by specialized cleanup contractors and military CBRN units.

Material segmentation reflects ongoing advancements, moving toward composite fabrics that layer multiple barrier technologies (e.g., PTFE films laminated onto high-strength polymer carriers) to achieve resistance to a wider array of chemicals, including gases, acids, and solvents, while minimizing weight. Application analysis shows that the Chemical and Petrochemical sectors remain the largest revenue generators, given the constant risk of large-scale toxic releases, whereas the Emergency Response and Defense segments, while smaller in volume, drive innovation toward multi-threat protection capabilities and integrated communication features necessary for critical, fast-moving scenarios.

- By Suit Type:

- Disposable Suits

- Reusable Suits

- By Material:

- Butyl Rubber

- PVC (Polyvinyl Chloride)

- Viton/FKM (Fluoroelastomer)

- Tyvek/Composite Fabrics (Laminates)

- Polyethylene (PE)

- By Level of Protection (OSHA/ANSI/NFPA):

- Level A (Gas/Vapor Tight, SCBA required)

- Level B (Liquid Splash Protection, SCBA required)

- Level C (Liquid Splash Protection, APR/PAPR required)

- Level D (Minimal Protection, Work Uniform)

- By Application/End-Use:

- Chemical Manufacturing and Processing

- Oil and Gas (Upstream and Downstream)

- Pharmaceutical and Biotechnology

- Hazardous Material (HAZMAT) Response

- Mining and Metallurgy

- Defense and Military Operations (CBRN)

- Nuclear Energy and Cleanup

Value Chain Analysis For Breathable Gas Suit Market

The value chain for the Breathable Gas Suit Market is characterized by high barriers to entry due to stringent material specifications, complex manufacturing processes, and demanding regulatory certification requirements. The upstream analysis begins with the specialized sourcing of high-performance chemical barrier materials, including synthetic elastomers like butyl and Viton, and advanced composite films such as PTFE and specialized polyethylene laminates. These raw material suppliers must ensure lot-to-lot consistency and provide comprehensive permeation data, as even minor variations can compromise the integrity of the final protective layer, making material quality control the most critical initial step in the value chain.

Midstream activities involve sophisticated manufacturing processes, focusing on proprietary seam sealing techniques—such as heat sealing, ultrasonic welding, or taped seams—which are vital to guaranteeing the vapor and gas tightness required for Level A and B suits. Manufacturing facilities must maintain ISO certification and adhere to specialized quality management systems (QMS) specific to PPE production. Investment in specialized machinery for bonding dissimilar materials and rigorous in-house testing facilities (e.g., pressure testing for gas leakage) significantly adds to the cost of goods sold, defining this stage as high-value added and technologically intensive, often limiting effective production to a few key global players.

Downstream analysis highlights the vital role of specialized distribution channels, given that the end-users require expert guidance on selection, fitting, and maintenance. Direct distribution is common for large defense or petrochemical clients that require customized solutions and long-term service contracts. Indirect channels utilize specialized safety equipment distributors who offer localized inventory, training, and support, especially to smaller HAZMAT teams or industrial maintenance contractors. The sales process is heavily consultant-driven, necessitating certified training for sales staff to ensure the correct suit is matched to the specific chemical hazard, driving demand for value-added services alongside the product sale.

Breathable Gas Suit Market Potential Customers

Potential customers for breathable gas suits are defined by their operational exposure to environments that are immediately dangerous to life or health (IDLH), necessitating the highest level of respiratory and skin protection. The primary end-users fall into highly regulated industries where the cost of non-compliance or accidental exposure far exceeds the investment in advanced PPE. Tier 1 chemical manufacturers, particularly those handling highly toxic solvents, volatile organic compounds, or potent acids, represent a core customer segment. These entities utilize gas suits for routine maintenance in contaminated areas, emergency response protocols, and during the clean-up of process leaks, making recurring procurement a necessity driven by usage rates and suit integrity maintenance schedules.

A second major customer category includes government and quasi-governmental agencies, specifically national HAZMAT (Hazardous Materials) teams, fire and rescue services, military CBRN defense units, and environmental protection agencies involved in large-scale cleanup operations. These organizations prioritize Level A and high-end reusable suits, often requiring customization for integration with specialized communication and breathing apparatus (SCBA). Procurement for these segments is typically project-based or through multi-year governmental tenders, emphasizing reliability, proven field performance, and logistical support from the supplier for training and certification compliance.

Furthermore, sectors involved in remediation and nuclear facility management constitute a specialized but crucial customer base. Companies involved in decommissioning nuclear power plants, cleaning up contaminated sites, or managing chemical weapons stockpiles require suits capable of resisting multiple hazards simultaneously—including chemical, radiological, and particulate threats. These end-users demand highly specialized materials and rigorously tested seam integrity to guarantee complete encapsulation against invisible hazards, pushing the envelope for material innovation in terms of longevity and resistance to degradation from prolonged exposure to harsh environmental factors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont de Nemours, MSA Safety, Honeywell International Inc., Lakeland Industries, Drägerwerk AG & Co. KGaA, Kappler Inc., 3M Company, Respirex International Ltd., Shigematsu Works Co., Ltd., AlphaProTech, Sioen Industries, Ansell Limited, Kimberly-Clark Professional, Bulwark Protective Apparel, International Safety Equipment Association (ISEA) Members, Trelleborg Protective Products, Saint-Gobain, Rembe Safety + Control, Fumiya Trading Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Breathable Gas Suit Market Key Technology Landscape

The technology landscape for the Breathable Gas Suit Market is primarily driven by three critical areas: advanced material science, integrated life-support systems, and enhanced structural integrity mechanisms. In material science, the focus is on creating multi-layered laminate barriers that offer broad chemical resistance without compromising flexibility or increasing bulk. Key innovations include the development of proprietary barrier films (often based on high-density polymers or specialized fluoropolymers) that minimize permeation rates for the most aggressive industrial chemicals and warfare agents, alongside antistatic treatments to reduce the risk of ignition in volatile atmospheres, maintaining the operational safety margin required for complex industrial tasks.

A second major technological advancement centers around integrated life support and thermal management. Given that the encapsulated nature of Level A suits rapidly leads to heat stress, necessitating short operational windows, manufacturers are integrating sophisticated cooling solutions. These range from passive systems utilizing phase change materials (PCMs) embedded in inner garments to active micro-ventilation systems that circulate conditioned air within the suit envelope. Furthermore, integrated communication systems—often utilizing bone conduction technology or voice amplifiers—are becoming standard, ensuring continuous, reliable communication between the wearer and the command center, a vital element in high-stakes emergency scenarios where visual or verbal cues are obstructed.

Structural integrity and ease of use represent the third pillar of technological innovation. This includes developing advanced, patented seam-sealing techniques (e.g., vulcanized seams or dual-taped and stitched designs) that provide vapor-tight security while allowing for ergonomic movement. Moreover, rapid-donning closures, optimized entry zippers, and specialized glove/boot attachment systems (bayonet locking or integrated seals) minimize the potential points of failure during the preparation and execution of a mission. Technology is also being applied post-use, with sensors and AI analysis tools being developed to automate and verify the effectiveness of decontamination and pressure testing processes, ensuring the suitability of reusable suits for subsequent missions, maximizing safety, and reducing the total cost of ownership over the suit's operational life.

Regional Highlights

- North America (NA): Dominates the current market revenue share, primarily driven by the extremely mature and strict regulatory framework mandated by OSHA, EPA, and NFPA, requiring mandatory use of certified protective gear in petrochemical, chemical, and nuclear industries. High R&D investment, particularly in the US defense sector (CBRN preparedness), fosters continuous innovation in suit technology, demanding high-value, specialized Level A suits with integrated air supply systems. Canada’s extensive oil and gas industry also contributes significantly to sustained regional demand for high-performance protection.

- Europe: Represents a high-value market characterized by robust environmental and worker safety standards enforced by the European Union (EU) directives, particularly REACH regulations affecting chemical handling. Western European countries, notably Germany (chemical manufacturing base) and the UK, are key consumers. The European market emphasizes reusable, high-performance suits and stringent conformity assessment procedures (CE marking), focusing heavily on sustainable manufacturing practices and recycling/disposal procedures for single-use PPE.

- Asia Pacific (APAC): Expected to be the fastest-growing region in terms of volume and value. Rapid industrialization, massive infrastructure development, and growing chemical and pharmaceutical manufacturing hubs in countries like China, India, and South Korea necessitate enhanced safety provisions. While historical adoption was slower, tightening government oversight and multinational company investment in local facilities demand compliance with global safety standards, driving massive procurement growth, often initially favoring cost-effective, high-quality disposable and Level B suits.

- Latin America (LATAM): Market growth is steady, concentrated in resource-rich nations such as Brazil and Mexico, driven by oil extraction, mining operations, and burgeoning chemical refining capacity. Market penetration is often focused on international safety standards adoption, but price sensitivity remains a constraint, leading to a balance between certified imported suits and locally manufactured alternatives, particularly for non-Level A requirements.

- Middle East and Africa (MEA): Growth is primarily fueled by extensive capital expenditure in the oil and gas sector (especially Saudi Arabia, UAE, and Qatar). The region demands specialized suits that can withstand high ambient temperatures while providing chemical protection. Government entities and large energy corporations are the primary procurers, often focusing on long-term contracts for reusable, high-durability suits essential for refinery maintenance and critical infrastructure protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Breathable Gas Suit Market.- DuPont de Nemours, Inc.

- MSA Safety Incorporated

- Honeywell International Inc.

- Lakeland Industries, Inc.

- Drägerwerk AG & Co. KGaA

- Kappler Inc.

- 3M Company

- Respirex International Ltd.

- Shigematsu Works Co., Ltd.

- AlphaProTech

- Sioen Industries NV

- Ansell Limited

- Kimberly-Clark Professional

- Bulwark Protective Apparel (a brand of VF Corporation)

- Trelleborg Protective Products

- International Safety Equipment Association (ISEA)

- Microgard Ltd. (part of Ansell)

- Saint-Gobain S.A.

- Sartorius AG

- Gore & Associates (W. L. Gore)

Frequently Asked Questions

Analyze common user questions about the Breathable Gas Suit market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between a Level A and Level B gas suit?

Level A gas suits provide the highest level of protection, offering a totally encapsulated, vapor-tight barrier against gaseous and vapor hazards, requiring a self-contained breathing apparatus (SCBA) worn inside the suit. Level B suits provide liquid splash protection and are not vapor-tight; they are used when gas hazards are ruled out, but SCBA is still required because the atmosphere may be oxygen deficient or contain hazardous particulates/liquids.

What materials offer the best chemical resistance for gas suits?

The best chemical resistance is typically achieved using high-performance, non-permeable materials such as Butyl rubber or proprietary composite laminates (often involving PTFE or Viton layers). These materials are tested against specific chemicals to verify permeation breakthrough times, ensuring maximum barrier integrity against corrosive acids, toxic solvents, and nerve agents.

How often must a reusable breathable gas suit be inspected and certified?

Reusable gas suits require inspection before and after every use, including a mandatory pressure test (or inflation test) for integrity verification. Full certification and hydrostatic testing, per manufacturer and regulatory guidelines (e.g., NFPA 1991 standard in the US), are typically required annually to confirm the suit’s ability to remain gas-tight under operational stress.

What are the primary factors driving the growth of the Breathable Gas Suit Market in the APAC region?

Growth in the Asia Pacific region is primarily driven by massive expansion in chemical manufacturing, oil refining, and pharmaceutical industries, coupled with the increasing adoption and rigorous enforcement of international occupational safety and health standards by local governments and multinational companies operating within the region.

How does the integration of smart technology impact operational safety in gas suits?

Smart technology, including embedded sensors and AI analytics, improves operational safety by continuously monitoring the wearer's physiological status (heart rate, core temperature) to mitigate heat stress, and by using predictive modeling to assess the structural integrity of the suit material in real-time, alerting users to potential failures before exposure occurs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager