Breathing Filters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436956 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Breathing Filters Market Size

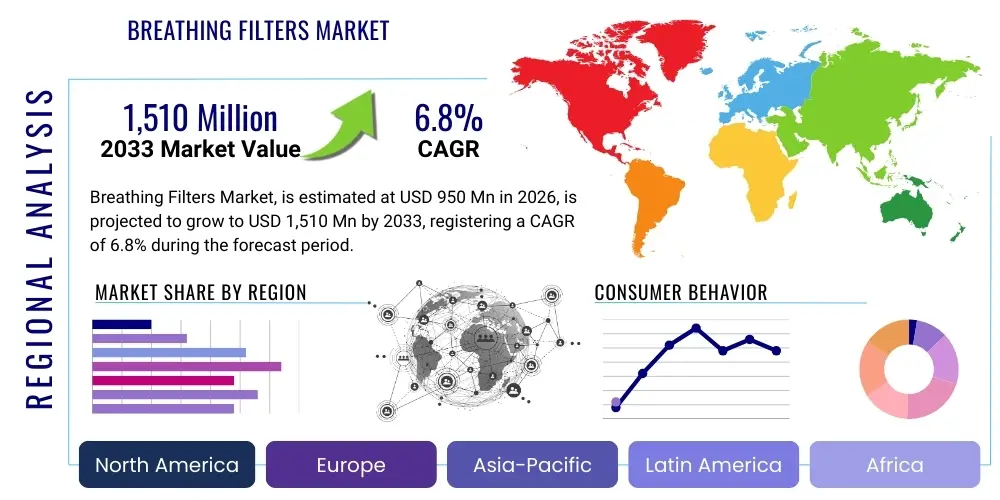

The Breathing Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 950 million in 2026 and is projected to reach USD 1,510 million by the end of the forecast period in 2033.

Breathing Filters Market introduction

The Breathing Filters Market encompasses specialized disposable devices crucial for protecting patients, healthcare professionals, and respiratory equipment from microbial contamination, particularly during mechanical ventilation and anesthesia procedures. These filters, primarily categorized as Heat and Moisture Exchangers (HMEs), bacterial/viral filters, or combined HMEF filters, serve the dual purpose of humidifying inspired gases and preventing the transfer of airborne pathogens such as bacteria and viruses. The fundamental function is to maintain optimal heat and moisture levels in the respiratory tract while ensuring high filtration efficiency, thereby minimizing complications like tracheal tube occlusion and ventilator-associated pneumonia (VAP).

Major applications of breathing filters span across diverse clinical settings, including critical care units, operating rooms, and home respiratory care. In critical care, the filters are indispensable for prolonged ventilation, offering protection against contaminants within the hospital environment. For anesthesia applications, they ensure the safety of both the patient and the anesthetic circuit by preventing cross-contamination between patients and safeguarding sensitive monitoring equipment. The market growth is substantially driven by the increasing global prevalence of chronic respiratory diseases, the growing number of surgical procedures requiring mechanical support, and heightened awareness regarding infection control protocols following global health crises.

The primary benefits of utilizing high-efficiency breathing filters include enhanced patient safety through reduced risk of respiratory tract infections, improved functioning of respiratory devices by preventing internal circuit contamination, and compliance with stringent international healthcare standards. Key driving factors include technological advancements leading to filters with lower dead space and higher efficiency, coupled with favorable reimbursement policies in developed economies. Furthermore, the persistent demand for single-use, sterile medical consumables reinforces the market's upward trajectory, making these components essential in modern respiratory management.

Breathing Filters Market Executive Summary

The global Breathing Filters Market exhibits robust growth, primarily fueled by significant business trends such as the integration of advanced filter media technologies and a strategic shift toward preventive healthcare measures globally. Leading manufacturers are focusing heavily on developing filters that offer ultra-high filtration efficiency (e.g., HEPA equivalents) alongside low flow resistance, optimizing patient comfort and respiratory mechanics. Mergers, acquisitions, and strategic alliances among major players are common strategies aimed at expanding product portfolios, enhancing distribution networks, and securing dominance in specialized clinical segments like neonatal and pediatric care. The shift towards portable and user-friendly respiratory support systems also necessitates the development of compact, high-performance filters tailored for home care and ambulatory settings, driving innovation in product design and materials science.

Regional trends indicate that North America and Europe currently hold the largest market shares due to well-established healthcare infrastructure, high expenditure on critical care facilities, and the rapid adoption of advanced respiratory technologies. However, the Asia Pacific region is poised to demonstrate the fastest growth rate, driven by escalating healthcare investments, a rapidly aging population, increasing incidence of chronic obstructive pulmonary disease (COPD) and asthma, and improvements in accessing modern medical facilities, particularly in China and India. Latin America and the Middle East and Africa are emerging markets, characterized by improving economic conditions and a heightened focus on upgrading hospital infection control standards, presenting substantial long-term growth opportunities for international market participants.

Segment trends highlight the dominance of the HMEF (Heat and Moisture Exchanger Filter) product type, preferred for its combined humidification and pathogen blocking capabilities, essential in long-term ventilation. The critical care application segment remains the largest consumer, reflecting the high usage rates in intensive care units (ICUs) and emergency settings. There is a noticeable trend towards specialized filters, such as those optimized for specific gas flows or tidal volumes, catering to complex patient needs, including those undergoing specialized cardiac or neurosurgical procedures. Furthermore, the end-user segment of Hospitals and Clinics continues to lead due to the high volume of surgical procedures performed and the centralization of complex respiratory management cases within these institutions.

AI Impact Analysis on Breathing Filters Market

Common user inquiries regarding the intersection of Artificial Intelligence and the Breathing Filters Market revolve primarily around predictive maintenance, optimized inventory management, and the potential for smart filtration systems. Users frequently ask how AI can forecast surges in demand for specific filter types during endemic or pandemic scenarios, and whether AI can be integrated into ventilators to monitor filter efficacy in real-time. Key concerns often center on the development cost associated with ‘smart’ filters—those potentially embedded with sensors—and the data privacy implications of transmitting patient respiration and environmental data. Users also express expectations that AI-driven supply chain optimization tools will lead to reduced costs and fewer stock-outs of crucial consumables in high-demand environments like ICUs.

The influence of AI is currently indirect but foundational, primarily affecting the upstream and downstream supply chain efficiencies rather than the filters themselves. AI-powered predictive analytics tools are being deployed to analyze historical consumption patterns, seasonal respiratory illness trends, and real-time hospital occupancy data to accurately predict the demand for various types of breathing filters. This strategic forecasting helps manufacturers optimize production schedules, manage raw material procurement, and minimize warehousing costs, leading to more resilient supply chains capable of responding swiftly to unforeseen demand spikes, such as those caused by influenza seasons or new viral outbreaks.

Looking ahead, AI is expected to play a role in developing the next generation of smart respiratory systems. While the filter itself remains a mechanical device, embedded sensors in the ventilator circuit, analyzed by machine learning algorithms, could monitor parameters such as filter differential pressure, moisture retention, and potential microbial breakthrough indicators. This data could trigger alerts for timely filter replacement, preventing failures and reducing the risk of Ventilator-Associated Pneumonia (VAP). This integration promises to elevate patient care standards by moving from fixed replacement schedules to condition-based monitoring, optimizing both clinical outcomes and resource utilization.

- AI optimizes supply chain logistics and demand forecasting for filter production.

- Machine learning algorithms analyze environmental and clinical data to predict filter consumption peaks.

- Future integration of AI with ventilator systems will enable real-time monitoring of filter performance (e.g., pressure drop, moisture levels).

- Predictive maintenance driven by AI can shift filter replacement from scheduled timing to condition-based requirements.

- AI aids in optimizing inventory levels within hospitals, ensuring availability during critical demand periods.

DRO & Impact Forces Of Breathing Filters Market

The market dynamics for breathing filters are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The primary driver is the alarming global rise in the incidence of respiratory conditions, including Chronic Obstructive Pulmonary Disease (COPD), asthma, and various infectious diseases requiring mechanical ventilation support. This is compounded by the global increase in the geriatric population, which is inherently more susceptible to respiratory illnesses and often requires surgical interventions. Simultaneously, the imposition of increasingly strict infection control guidelines by global health bodies, mandating the use of high-efficiency filters in all breathing circuits, strongly propels market adoption. These regulatory pressures necessitate continuous investment in high-quality, certified filter products by healthcare facilities worldwide.

Conversely, the market faces significant restraints that temper its growth potential. One major restraint is the relatively high cost associated with advanced HMEF and bacterial/viral filters, particularly for healthcare systems in developing nations with constrained budgets. Furthermore, the market operates under intense regulatory scrutiny, requiring lengthy and costly approval processes for new filter materials or designs, which can slow down innovation cycles. Another challenge is the lack of standardized disposal and recycling methods for these high-volume, single-use plastic medical consumables, contributing to environmental concerns that may necessitate future regulatory restrictions or the development of more sustainable, biodegradable filter options, which currently remain complex and expensive to produce.

Opportunities for market expansion are abundant, particularly in emerging economies where healthcare infrastructure is rapidly developing and adoption rates of advanced critical care technologies are accelerating. There is a substantial opportunity for manufacturers to develop specialized, high-performance filters for niche applications, such as ultra-low tidal volume ventilation used in neonatology, or filters resistant to chemical agents used in some specific anesthetic applications. Moreover, the trend toward non-invasive ventilation (NIV) and home healthcare provides avenues for developing compact, portable, and energy-efficient filters suitable for long-term patient use outside the traditional hospital environment. Innovations focused on enhancing moisture output while maintaining minimal dead space are expected to capture significant market share.

Segmentation Analysis

The Breathing Filters Market is comprehensively segmented based on product type, application, and end-user, reflecting the diverse clinical needs and varied technological specifications required across different healthcare settings. Analyzing these segments provides crucial insights into market utilization patterns and identifies the most lucrative growth areas. The product type segmentation distinguishes between the various mechanical and electrostatic mechanisms employed for filtration and heat/moisture exchange, which directly influences product performance characteristics such as filtration efficiency, dead space, and flow resistance, thereby determining their suitability for specific patient populations like adults, pediatrics, or neonates.

Segmentation by application highlights where these devices are most critically used, with Critical Care and Anesthesia dominating market share due to the high volume of invasive procedures and prolonged ventilation requirements. The functional differences between filters used in operating theatres (often involving anesthetic gases) and those used in ICUs (focused on infection control during long-term ventilation) drive product specialization. Furthermore, the growing segment of Home Care applications is significant, reflecting the global trend towards treating chronic respiratory conditions outside acute care settings, requiring specialized, durable, and cost-effective filters for personal ventilation devices.

The end-user breakdown clearly illustrates that Hospitals and Clinics constitute the primary consumer base, owing to their capacity for high-volume surgeries, complex respiratory treatments, and critical care management. However, the rapidly expanding network of Ambulatory Surgery Centers (ASCs) and specialized Diagnostic Laboratories are increasingly contributing to market demand. This shift reflects efficiency improvements in the healthcare delivery system, where less complex procedures are moved out of general hospitals, requiring filters for short-stay ventilation and recovery processes, thus driving demand for medium-duration, high-efficiency filters.

- Type: HME Filters, HMEF Filters, Bacterial/Viral Filters, Electrostatic Filters, Mechanical/Hydrophobic Filters.

- Application: Anesthesia, Critical Care, Home Care, Respiratory Care, Ambulatory Surgery Centers.

- End-User: Hospitals and Clinics, Diagnostic Laboratories, Ambulatory Care Settings, Research and Academic Institutes.

Value Chain Analysis For Breathing Filters Market

The value chain for the Breathing Filters Market begins with the Upstream Analysis, which focuses on the sourcing of critical raw materials, primarily specialized polymer fibers (hydrophobic and electrostatic), filter media (such as pleated paper or synthetic materials), and plastic components for the housing (like polypropylene or polycarbonate). Key upstream activities include securing stable supplies of medical-grade plastics and developing specialized coating technologies that enhance moisture retention or filtration efficacy. Efficiency in this stage relies heavily on long-term contracts with material suppliers and adherence to strict quality control standards to ensure the final product meets ISO and clinical performance requirements.

Moving into the core manufacturing stage, companies are responsible for advanced processes such as material cutting, pleating, assembly, and sterilization (often using EtO or gamma radiation). This stage is capital-intensive and requires highly controlled manufacturing environments (cleanrooms). The distribution channel encompasses both Direct and Indirect strategies. Major multinational players often utilize direct sales forces for large hospital networks and government contracts, ensuring brand presence and offering technical support. Conversely, the majority of sales rely on indirect channels, involving specialized medical distributors and supply chain intermediaries who manage warehousing, logistics, and delivery to a vast network of smaller clinics, pharmacies, and home care providers globally.

The Downstream Analysis involves the procurement and consumption of filters by end-users, primarily hospitals and critical care centers. Factors influencing downstream decisions include product shelf-life, cost-per-use, clinical performance data (filtration efficiency and moisture output), and compliance with institutional infection control policies. Furthermore, logistics and inventory management play a crucial role downstream, as hospitals require just-in-time delivery to prevent stock-outs, especially for essential, single-use consumables. The entire value chain is characterized by a high need for regulatory compliance, traceability, and continuous quality validation from raw material sourcing through to patient use.

Breathing Filters Market Potential Customers

The primary and largest segment of potential customers for breathing filters consists of institutional healthcare providers, specifically large multi-specialty Hospitals and critical care facilities globally. These institutions are the biggest end-users because they perform the highest volume of surgical procedures requiring general anesthesia and manage the largest number of patients in Intensive Care Units (ICUs) and Coronary Care Units (CCUs) who rely on mechanical ventilation for extended periods. The need for strict infection control in these high-risk environments makes the regular, high-volume purchase of certified bacterial and viral filters a mandatory operational requirement. Procurement decisions here are often driven by centralized purchasing organizations focusing on reliability, clinical data, and long-term cost-effectiveness.

A rapidly expanding customer base includes Ambulatory Surgery Centers (ASCs) and specialized outpatient Clinics. As healthcare systems increasingly shift procedures that do not require overnight stays to ASCs to reduce costs and improve efficiency, the demand for filters used during short-duration anesthesia and recovery is rising significantly. While their volume per site is lower than large hospitals, the aggregate growth in the number of ASCs globally presents a lucrative, decentralized market opportunity. These buyers often prioritize ease of use, standardization across different equipment platforms, and competitive pricing for bulk orders.

Beyond traditional acute care, an important growing customer segment comprises Home Care Providers and individual patients utilizing long-term respiratory support equipment, such as BiPAP/CPAP machines or home ventilators. The rising incidence of chronic respiratory diseases coupled with technological advancements enabling portable ventilation systems drives this segment. These customers require durable, compact, and affordable filters that can be easily replaced by caregivers or patients themselves, emphasizing convenience and simplified procurement processes, often facilitated through specialized durable medical equipment (DME) suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 million |

| Market Forecast in 2033 | USD 1,510 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Teleflex, BD (Becton, Dickinson and Company), GE Healthcare, Drägerwerk AG & Co. KGaA, Armstrong Medical, Vyaire Medical, Philips Healthcare, ResMed, Fisher & Paykel Healthcare, Smiths Medical, GVS, Pall Corporation, Intersurgical Ltd., ForaCare Inc., Hamilton Medical, SunMed LLC, Drive DeVilbiss Healthcare, Allied Healthcare Products, AirLife (Vyaire Medical subsidiary) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Breathing Filters Market Key Technology Landscape

The core technology driving the Breathing Filters Market revolves around specialized filtration media designed to achieve high efficiency while minimizing flow resistance and maintaining optimal heat and moisture exchange. The primary technological advancement has been in the development of sophisticated filter materials, including both pleated hydrophobic membrane materials (Mechanical/Hydrophobic Filters) and electrostatically charged media (Electrostatic Filters). Hydrophobic filters physically block liquid droplets, providing excellent microbial barrier protection, while electrostatic filters use charged fibers to attract and trap airborne pathogens, often offering a lower breathing resistance. Manufacturers continually innovate to combine the best attributes of both types, leading to highly efficient HMEF (Heat and Moisture Exchanger Filter) hybrids that are standard in critical care.

A significant technological focus is placed on enhancing the Heat and Moisture Exchange capabilities. HME technology incorporates hygroscopic materials, such as treated cellulose or ceramic fibers, which capture heat and moisture from the patient's exhaled breath and return it during inhalation, effectively conditioning the inspired gas. Recent innovations aim to reduce the "dead space" volume within the filter unit—the volume of air that does not participate in gas exchange—which is crucial, especially for pediatric and neonatal applications where minimizing dead space is paramount to prevent rebreathing of carbon dioxide. New designs are achieving smaller, lighter filters without compromising efficiency or moisture output, expanding their applicability to a wider range of patient sizes and clinical scenarios.

Further technological trends include the integration of novel coatings and materials that possess antimicrobial properties, aiming to neutralize pathogens upon contact and extend the safety window of the filter, although these are still undergoing rigorous clinical evaluation. Standardization and miniaturization are also key technical drivers, ensuring filters are compatible with various international ventilator and anesthesia circuits while maintaining standardized connection sizes (e.g., 15mm and 22mm ISO connectors). The market is also witnessing the preliminary development of smart filters, incorporating micro-sensors or indicators that change color or transmit data wirelessly when the filter integrity is compromised or when the pressure differential indicates blockage, providing real-time safety alerts to clinicians, leveraging advancements in microelectromechanical systems (MEMS) technology.

Regional Highlights

- North America: Dominates the global market share, driven by high healthcare spending, the presence of major key players, and stringent regulatory standards promoting the mandatory use of high-efficiency filters in critical care. The US market, in particular, benefits from robust critical care infrastructure and high awareness regarding hospital-acquired infections (HAIs).

- Europe: Represents a mature and stable market, characterized by standardized healthcare systems and early adoption of HMEF technologies. Western European countries, including Germany, the UK, and France, maintain high consumption rates due to a large elderly population and advanced anesthesia practices. Focus on green manufacturing practices is an emerging trend impacting product development.

- Asia Pacific (APAC): Projected to be the fastest-growing region, fueled by expanding healthcare access, rapidly improving hospital infrastructure, and increasing foreign direct investment in countries like China and India. The rising prevalence of respiratory diseases coupled with high-volume surgical tourism contributes significantly to market acceleration.

- Latin America: Characterized by increasing government investment in public health systems and a slow but steady adoption of international infection control standards. Brazil and Mexico are the primary revenue contributors, driven by modernization of critical care facilities and rising private healthcare penetration.

- Middle East and Africa (MEA): A growing market segment, particularly in the Gulf Cooperation Council (GCC) countries, supported by large-scale government initiatives to build world-class healthcare cities and implement advanced critical care technologies. Demand is highly reliant on imports of certified products from European and North American manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Breathing Filters Market.- Medtronic

- Teleflex

- BD (Becton, Dickinson and Company)

- GE Healthcare

- Drägerwerk AG & Co. KGaA

- Armstrong Medical

- Vyaire Medical

- Philips Healthcare

- ResMed

- Fisher & Paykel Healthcare

- Smiths Medical

- GVS

- Pall Corporation

- Intersurgical Ltd.

- ForaCare Inc.

- Hamilton Medical

- SunMed LLC

- Drive DeVilbiss Healthcare

- Allied Healthcare Products

- AirLife (Vyaire Medical subsidiary)

Frequently Asked Questions

Analyze common user questions about the Breathing Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between HME filters and HMEF filters in clinical use?

HME (Heat and Moisture Exchanger) filters primarily function to humidify and heat inspired gases, essential for long-term ventilation. HMEF (Heat and Moisture Exchanger Filter) units combine this humidification capability with a highly efficient microbial filter (bacterial/viral filter), offering both airway conditioning and protection against cross-contamination in one device.

How frequently must breathing filters be replaced in critical care settings?

The replacement frequency for breathing filters is highly dependent on the manufacturer's recommendations, the specific type of filter (HME vs. HMEF), and the clinical context, but standard institutional protocols typically mandate replacement every 24 hours to 48 hours to minimize the risk of bacterial colonization and reduce flow resistance due to moisture accumulation.

What factors are driving the strongest growth in the Asia Pacific Breathing Filters Market?

Growth in the APAC market is primarily driven by substantial improvements in healthcare infrastructure, increasing health expenditure, rapid demographic changes leading to a larger geriatric population susceptible to respiratory diseases, and increased awareness and enforcement of international infection control standards in hospitals across major economies like China and India.

Are there significant environmental concerns associated with the use of disposable breathing filters?

Yes, significant environmental concerns exist because breathing filters are predominantly single-use, non-recyclable medical plastic consumables, contributing large volumes of waste. Market innovation is focused on developing materials and disposal methods that are more sustainable, while adhering to essential sterility requirements for patient safety.

What is the role of electrostatic technology in current breathing filter design?

Electrostatic technology utilizes charged fibers within the filter media to capture airborne particles and pathogens via electrostatic attraction. This design often allows for lower breathing resistance compared to purely mechanical filters, making them highly suitable for patients with compromised respiratory mechanics while maintaining high filtration efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager