Bridal Gowns Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431827 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Bridal Gowns Market Size

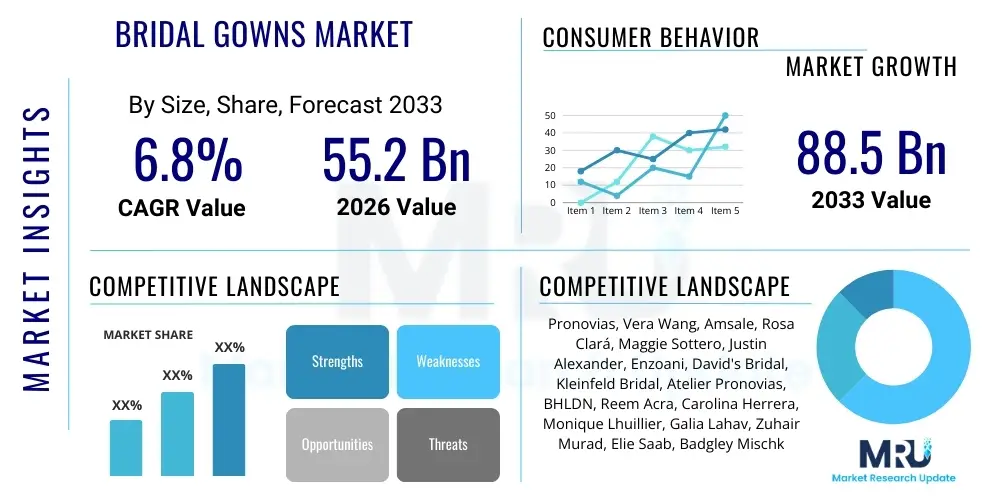

The Bridal Gowns Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $55.2 Billion in 2026 and is projected to reach $88.5 Billion by the end of the forecast period in 2033.

Bridal Gowns Market introduction

The Bridal Gowns Market encompasses the design, manufacturing, and distribution of specialized attire worn by brides during wedding ceremonies. This highly specialized segment of the apparel industry is intrinsically linked to global cultural traditions, fashion cycles, and economic stability. Bridal gowns are differentiated by material (silk, satin, organza, lace), silhouette (A-line, ballgown, sheath, mermaid), and customization levels (haute couture, designer, or ready-to-wear). The market's stability is underpinned by the consistent global marriage rate, which drives continuous demand for new products and evolving styles. Key applications include traditional ceremonies, destination weddings, and commitment ceremonies, each requiring distinct gown features and durability characteristics.

The primary driving factors propelling market expansion include rising disposable income in developing economies, increased consumer expenditure on luxury goods, and the powerful influence of social media platforms, which amplify global fashion trends and increase visibility for high-end designer wear. Modern brides often prioritize personalization and unique aesthetic appeal, pushing manufacturers toward bespoke services and higher material quality. Furthermore, the commercialization of weddings, combined with a growing emphasis on elaborate celebrations, ensures that the bridal gown remains a central and high-value component of wedding budgets globally. Innovations in textile technology and sustainable material sourcing are also acting as key market facilitators.

Benefits derived from this market include maintaining employment across specialized artisanal trades (e.g., lacework and embroidery), supporting the textile supply chain, and fulfilling a deep-seated cultural need for commemorative attire. The market has demonstrated resilience, adapting to shifts toward smaller, more intimate ceremonies by offering versatile and less structured dress options. The enduring emotional and symbolic value attached to the bridal gown ensures that, despite economic fluctuations or the rise of rental options, a significant portion of consumers will continue to opt for a purchase, particularly within the mid-to-high luxury segments, thereby driving consistent revenue streams for manufacturers and retailers.

Bridal Gowns Market Executive Summary

The Bridal Gowns Market is experiencing significant transformation, driven primarily by evolving consumer preferences favoring personalization, sustainability, and technological integration across the retail experience. Current business trends indicate a strong divergence between the accessible, fast-fashion approach, largely supported by e-commerce platforms offering customization tools, and the ultra-luxury segment, which emphasizes craftsmanship, exclusivity, and personalized in-store service. Sustainability has emerged as a critical trend, with brands increasingly adopting recycled fabrics, ethical sourcing practices, and transparency in their supply chains. The necessity for advanced inventory management and streamlined logistics, often leveraging predictive analytics, is defining competitive advantage among leading manufacturers and minimizing overstocking risks associated with seasonal fashion changes.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by demographic factors such as a large young population, rising disposable incomes in countries like China and India, and the burgeoning adoption of Western-style wedding ceremonies alongside traditional attire. While North America and Europe remain mature markets characterized by high average transaction values and the presence of established designer houses, growth here is concentrated in specialized niches, such as sustainable luxury and custom digital design services. The focus in developed regions is shifting from volume to value, prioritizing experiential retail and seamless omnichannel integration to cater to sophisticated, digitally-native consumers who demand high levels of transparency and convenience.

In terms of segmentation, the material segment shows rapid growth in demand for natural and eco-friendly fabrics, pushing up the average cost of raw materials. The distribution segment is highly dynamic, with specialized bridal boutiques continuing to dominate the high-end market due to the need for fittings and alterations, while online channels are rapidly gaining traction in the ready-to-wear and lower-to-mid price segments. Key trends across product segments include the increasing popularity of non-traditional wedding outfits, such as separates and colored gowns, reflecting a broader cultural shift towards individualism and expressive personal style, thereby diversifying the product portfolio beyond conventional silhouettes and white or ivory hues.

AI Impact Analysis on Bridal Gowns Market

User queries regarding the impact of Artificial Intelligence on the Bridal Gowns Market predominantly revolve around three core themes: personalized design and fitting accuracy, operational efficiency in the supply chain, and the preservation of artisanal craft versus automation. Consumers are keen to know if AI can generate truly unique designs based on mood boards or personal preferences (Generative Design), and how Machine Learning can improve sizing predictions to reduce the significant costs and time associated with physical alterations and returns. There is also considerable interest in how AI tools, such as predictive analytics, can help retailers forecast subtle fashion shifts faster than human experts, enabling optimized inventory levels that align precisely with seasonal demands. A key underlying concern frequently raised is whether the integration of AI tools will ultimately dilute the artistry and emotional connection inherent in traditional bridal wear creation or if it will simply serve as an enabling tool for designers, allowing them to focus on high-touch creative elements rather than mundane tasks.

The application of AI is already proving transformative in minimizing the traditionally high inefficiency rates of bridal retail. By employing Computer Vision and sophisticated algorithmic models, companies can offer virtual try-on experiences, significantly reducing the need for customers to visit multiple physical locations while simultaneously capturing valuable biometric and preference data. This data feedback loop informs future design cycles, allowing brands to prototype and launch gowns that have a higher statistical probability of market success. Furthermore, AI-powered chatbots and customer service interfaces are streamlining the initial consultation phase, helping brides navigate complex style options and scheduling fittings, thereby enhancing the overall customer journey from initial inquiry to final purchase.

Operationally, AI is revolutionizing supply chain management within this niche market. Given the long lead times for bespoke bridal gowns—often six to twelve months—accurate forecasting is essential. Predictive modeling utilizes historical sales data, social media trends, and economic indicators to anticipate material requirements and manufacturing capacity needs, thereby reducing the risk of delays or material shortages. This proactive approach ensures that manufacturers can source specialized materials like specific lace patterns or hand-beading components well in advance, maintaining profitability and meeting critical delivery deadlines, which are paramount in the wedding industry where dates are immovable.

- AI-driven Generative Design assists designers in creating novel silhouettes and pattern variations based on trend data.

- Machine Learning algorithms enhance size prediction and virtual fitting accuracy, minimizing alteration costs and product returns.

- Predictive analytics optimize inventory management and material sourcing, shortening supply chain lead times.

- Computer Vision and AR/VR technologies enable immersive virtual try-on experiences for remote customers.

- Automated customer service (chatbots) manages initial style consultations and appointment scheduling efficiently.

- AI enhances fraud detection and ensures secure transactions, particularly within high-value online sales channels.

- Ethical AI usage focuses on maintaining data privacy while customizing recommendations for individual users.

DRO & Impact Forces Of Bridal Gowns Market

The Bridal Gowns Market is fundamentally shaped by a complex interplay of driving forces (D), restraints (R), and opportunities (O), which collectively define the impact forces influencing long-term profitability and market structure. Key drivers include increasing global marriage rates, particularly in emerging economies, combined with a cultural shift towards elaborate, high-budget weddings influenced by global media and social platforms. The continued demand for highly personalized and customized gowns ensures high average selling prices in the luxury segment. Conversely, market growth is significantly restrained by the rise of the bridal rental and resale market, which offers cost-effective alternatives to buying. Additionally, volatile raw material prices, particularly for luxury textiles like silk and specialized lace, and the high labor costs associated with traditional garment manufacturing pose substantial constraints on margins for mid-market brands. Furthermore, economic uncertainty can prompt couples to reduce overall wedding expenditure, disproportionately impacting the discretionary budget allocated for the gown.

Opportunities within the market center primarily around digital transformation and sustainability. The expansion of high-quality e-commerce platforms, offering advanced customization tools and virtual fitting technologies, allows brands to reach wider global audiences and reduce reliance on expensive physical retail footprints. The growing consumer demand for sustainable and ethically produced bridal wear creates a substantial opportunity for innovative brands to command premium pricing for eco-friendly fabrics (e.g., organic cotton, recycled polyester, or innovative plant-based fibers) and transparent supply chains. Developing market penetration in regions where traditional attire is being supplemented or replaced by Western-style gowns—such as certain parts of Southeast Asia and Africa—also presents a lucrative growth avenue for mass-market and mid-tier manufacturers capable of scaling production efficiently.

These DRO factors generate powerful impact forces that restructure the competitive landscape. The pressure from restraints (rental/resale) forces incumbent brands to innovate in product longevity and emotional value retention, potentially through collectible or multi-use designs. The combined impact of customization drivers and technological opportunities necessitates significant capital investment in 3D body scanning, AI design, and sophisticated CRM systems to handle bespoke orders effectively. Successful market participants must strategically balance maintaining high-touch service and traditional craftsmanship—a driver for luxury segments—with the operational efficiency and scalability demanded by global e-commerce, ensuring they cater effectively to the divergent needs of the distinct high-end and mass-market consumer bases.

Segmentation Analysis

The Bridal Gowns Market is critically segmented across several dimensions, including Material Type, Price Range, Distribution Channel, and Design Silhouette, reflecting the diverse preferences and budgets of the global consumer base. Material segmentation, covering silks, satins, lace, and synthetic blends, is crucial as it directly impacts both the product's final cost and its sustainability profile, guiding sourcing strategies for manufacturers. The distribution channel breakdown—encompassing specialized bridal boutiques, designer stores, multi-brand outlets, and burgeoning online retail platforms—defines market accessibility and the level of personalized service provided to the customer. Understanding these segments is vital for crafting targeted marketing strategies and optimizing supply chain logistics specific to each channel’s demands, such as longer lead times for custom boutique orders versus rapid fulfillment for online ready-to-wear segments.

Price Range segmentation—categorizing gowns into luxury (above $10,000), mid-range ($2,000 to $10,000), and mass-market/affordable (below $2,000)—is the most defining characteristic, influencing brand positioning and competitive tactics. Luxury segments prioritize exclusivity, hand-finished detailing, and personalized styling consultations, maintaining high margins. Conversely, the mass-market segment relies on high-volume sales, efficient supply chains, and leveraging synthetic materials or simplified construction techniques to achieve competitive pricing. The Design Silhouette segment, featuring traditional styles like the Ballgown and A-line alongside contemporary trends such as Sheath, Mermaid, and separates, directly reflects consumer fashion trends and dictates manufacturing complexity, with highly structured styles requiring specialized internal construction and more intricate fitting processes.

The dynamic interplay between these segments demonstrates the market's maturity. For instance, the rise of online distribution heavily impacts the affordable and mid-range segments, demanding robust e-commerce capabilities and simplified sizing protocols. Meanwhile, the luxury segment is leveraging technology (e.g., virtual consultations) primarily to enhance, not replace, the personalized physical boutique experience. Future growth will likely be concentrated in segments that successfully bridge the gap between high-quality, personalized design and efficient, transparent production—a strategy often achieved through advanced digital customization tools integrated into omnichannel retail models that maintain the emotional connection crucial to the bridal purchase journey.

- By Material:

- Silk and Organza

- Satin and Taffeta

- Lace and Tulle

- Synthetic Blends and Polyester

- By Price Range:

- Luxury (Above $10,000)

- Mid-Range ($2,000 - $10,000)

- Affordable (Below $2,000)

- By Silhouette:

- Ballgown

- A-Line

- Mermaid and Trumpet

- Sheath and Column

- Separates and Jumpsuits

- By Distribution Channel:

- Specialized Bridal Boutiques (Direct and Indirect)

- Multi-Brand Retail Stores

- Online Retail (E-commerce Platforms)

- Designer Flagship Stores

Value Chain Analysis For Bridal Gowns Market

The value chain for the Bridal Gowns Market is characterized by high complexity, long lead times, and a significant reliance on specialized artisanal skills, distinguishing it from general ready-to-wear apparel manufacturing. Upstream analysis begins with the meticulous sourcing of raw materials, dominated by luxury textiles such as high-grade silk, imported French lace, and fine tulle. This phase is critical, as material quality dictates the final aesthetic and cost. Raw material suppliers must adhere to stringent quality standards and increasingly, ethical sourcing guidelines, adding layers of verification and cost. Manufacturing processes are labor-intensive, often involving significant hand-stitching, elaborate embroidery, and structured internal construction, which necessitates highly skilled pattern makers and seamstresses. This high dependence on manual labor limits rapid scalability and introduces geopolitical risks related to manufacturing locations, driving some high-end brands to maintain production closer to key markets for quality control.

Mid-stream activities focus on design, customization, and quality assurance. Unlike mass-market fashion, bridal manufacturing incorporates extensive fitting cycles and alteration services, representing a critical value-add that justifies the high price point, particularly in the designer segment. The distribution phase is segmented into direct and indirect channels. Direct channels involve designer flagship stores or branded e-commerce sites, allowing for greater margin control and direct customer relationship management. Indirect channels, which include specialized multi-brand bridal boutiques (the dominant route for personalized service), require strong relationships and managed inventory consignment models. These boutiques provide the crucial physical consultation, try-on, and alteration services that are indispensable to the bridal purchase process, acting as trusted intermediaries between the brand and the end consumer.

Downstream analysis focuses on marketing, sales, and after-sales service. Marketing heavily utilizes visual platforms like Instagram and Pinterest, leveraging influencer collaborations and elaborate runway shows to build brand equity and emotional resonance. After-sales service, including professional cleaning, preservation, and minor post-wedding repairs, enhances customer lifetime value, although this revenue stream is often handled by third-party specialists recommended by the retailer. The efficiency of the entire chain is increasingly being optimized through technology integration; for instance, digital pattern drafting (CAD) speeds up initial production, while RFID tracking improves inventory visibility across the complex network of manufacturers, distribution centers, and independent boutiques, ensuring accurate delivery timing, which is paramount in this sector.

Bridal Gowns Market Potential Customers

The potential customer base for the Bridal Gowns Market is fundamentally segmented by purchasing power, aesthetic preferences, and lifestyle factors, extending far beyond the traditional Western bride. Primary end-users are engaged women across all demographic segments globally, but the purchasing decision is often significantly influenced by family budget allocations, cultural expectations, and the specific venue or theme of the wedding ceremony. High-value customers typically fall into the luxury segment, characterized by high disposable incomes, prioritizing haute couture craftsmanship, exclusive designer labels, and complex customization, often seeking unique, one-of-a-kind gowns that reflect significant status and personal artistry. These customers are less price-sensitive and highly responsive to emotional branding and personalized shopping experiences, often traveling internationally for fittings.

The largest volume of buyers resides in the mid-range segment, comprising middle-class individuals who seek a balance between quality, modern design, and affordability. These consumers are highly sophisticated, actively using online research to compare materials, reviews, and pricing across specialized boutiques and reputable online retailers. Their needs are often met by established mid-tier designers offering semi-customizable options (e.g., changes in neckline or sleeve length) that maintain high aesthetic appeal while managing cost through standardized manufacturing processes. This segment is highly responsive to value propositions that include complimentary fittings or complete accessory packages, demonstrating a pragmatic approach to their wedding expenditure.

A rapidly growing segment includes budget-conscious and sustainable consumers. This group often seeks affordable options through mass-market bridal lines, off-the-rack retailers, or rental services, prioritizing environmental impact and ethical production. They represent the core demand for the expanding online bridal market, utilizing e-commerce for convenience and accessing a broader array of styles that might not be available locally. Furthermore, this segment is increasingly composed of individuals seeking second-time wedding dresses or those opting for non-traditional, often colored, gowns or separates, driven by a desire for practicality and expressing a minimalist aesthetic. Brands targeting this segment must excel in digital marketing, transparent sourcing, and efficient fulfillment to succeed.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $55.2 Billion |

| Market Forecast in 2033 | $88.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pronovias, Vera Wang, Amsale, Rosa Clará, Maggie Sottero, Justin Alexander, Enzoani, David's Bridal, Kleinfeld Bridal, Atelier Pronovias, BHLDN, Reem Acra, Carolina Herrera, Monique Lhuillier, Galia Lahav, Zuhair Murad, Elie Saab, Badgley Mischka, Sareh Nouri, Savin London |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bridal Gowns Market Key Technology Landscape

The contemporary Bridal Gowns Market is rapidly integrating advanced technologies to enhance design precision, streamline manufacturing, and revolutionize the customer experience. A cornerstone of this technological transformation is the adoption of advanced 3D body scanning and computer-aided design (CAD) software. 3D scanning accurately captures detailed body measurements, minimizing human error associated with manual measurements, which is critical for bespoke and made-to-measure gowns where precise fit is non-negotiable. CAD systems enable designers to visualize patterns, simulate how different fabrics drape, and rapidly generate and modify prototypes digitally, drastically reducing the time and material waste involved in physical sampling. This integration of precise digital tooling with traditional pattern-making skills is enhancing efficiency while preserving the high standards of fit expected in luxury bridal wear.

Another significant technological driver is the utilization of smart textiles and innovative manufacturing processes, specifically 3D printing. While 3D printing is not yet standard for entire gown fabrication, it is increasingly employed for creating intricate, lightweight, and customizable embellishments, structured components (like corsetry supports), and highly detailed lace-like patterns that are impossible or prohibitively expensive to produce using traditional embroidery methods. Furthermore, the development of sustainable, high-performance fabrics, often engineered with micro-encapsulation or specialized weaving techniques, offers gowns that are lighter, wrinkle-resistant, and more comfortable, appealing directly to the modern bride prioritizing experience and practicality alongside aesthetics, particularly for destination weddings.

The retail environment is being fundamentally reshaped by Augmented Reality (AR) and Virtual Reality (VR) applications, particularly Virtual Try-On (VTO) solutions. VTO allows potential customers to digitally overlay gowns onto their body avatars, visualizing various styles and customizations without needing multiple physical fittings. This technology is crucial for expanding the reach of online distribution channels, reducing logistical barriers for international customers, and lowering operational costs associated with maintaining extensive physical sample inventories in boutiques. Coupled with robust Enterprise Resource Planning (ERP) systems integrated with predictive analytics, technology ensures real-time visibility across the production lifecycle, from initial material order to final customer delivery, guaranteeing the timely fulfillment of highly customized, high-value orders.

Regional Highlights

- North America (United States, Canada, Mexico)

North America constitutes one of the most established and largest markets for bridal gowns, characterized by high average wedding expenditure and strong brand awareness. The United States drives the majority of the regional revenue, emphasizing diverse fashion preferences ranging from traditional designer labels to bohemian and minimalist styles. Key regional trends include the sustained demand for highly customized, luxury gowns and the rapid adoption of digital retail models, fueled by a high penetration of e-commerce and advanced virtual try-on technologies. Consumers here are highly influenced by celebrity weddings and social media trends, placing continuous pressure on retailers to frequently refresh collections and ensure swift inventory turnover. The market also exhibits a strong preference for high-quality fabrics and transparent, ethical sourcing, particularly among younger, affluent demographics.

The regional market is highly competitive, featuring both large national chains like David's Bridal and exclusive independent luxury boutiques. There is a noticeable shift towards shorter engagement periods and a higher incidence of destination weddings, which drives demand for lighter, versatile, and easily transportable gown styles. Canadian and Mexican markets, while smaller, are steadily growing, mirroring US trends but often incorporating stronger localized cultural elements, particularly in Mexico where traditional craftsmanship is highly valued. Maintaining operational efficiency in logistics and offering comprehensive alteration services remain critical differentiators in this mature, service-focused market.

- Europe (Germany, UK, France, Italy, Spain)

Europe holds a significant share of the global bridal market, heavily influenced by historical craftsmanship, established fashion houses, and a strong preference for high-quality, artisanal fabrics, particularly lace and silk sourced within the continent. Countries like Italy, Spain, and France are not only major consumers but also global centers for high-end design and manufacturing, home to influential brands like Pronovias and Rosa Clará. The market exhibits slow, steady growth, focusing primarily on high-value transactions and exclusive, non-mass-produced designs. Sustainability and circular economy practices are critically important here, with stringent consumer demand for transparency regarding the origin of materials and ethical production processes.

The UK market shows robust growth in the mid-range segment, with a strong emphasis on personalized boutique experiences, reflecting a consumer desire for emotional connection with the purchase process. Germany and Scandinavia often favor more minimalist, clean-lined, and functional designs, aligning with Northern European aesthetic traditions. The high regulatory standards for textile imports and labor practices across the European Union reinforce the value chain's focus on quality and ethical compliance. Furthermore, European designers are leaders in integrating modern technology, such as 3D printing for structural elements and decorative features, while meticulously preserving the tradition of intricate hand-finishing.

- Asia Pacific (APAC) (China, Japan, India, South Korea)

APAC is the fastest-growing region globally, driven by demographic expansion, rapidly increasing disposable incomes, and the widespread adoption of Western-style wedding ceremonies alongside traditional garments. China and India are the primary growth engines; China’s vast consumer base and high expenditure on luxury goods fuel the demand for international designer brands, while India sees a significant market opportunity in both highly customized Western wear and hybrid fusion gowns. South Korea and Japan, mature markets within APAC, prioritize contemporary, minimalist design and advanced technological retail experiences, including sophisticated virtual fitting rooms.

The market in this region is characterized by high diversity and sensitivity to regional holidays and cultural specifics, requiring brands to localize their marketing and product offerings significantly. High bridal gown costs are often justified by the cultural importance placed on status and appearance during the ceremony. The growth of organized retail and specialized wedding service providers in urban centers across APAC is improving accessibility for international brands. E-commerce penetration is rising rapidly, particularly for accessing international designers, though the cultural preference for tactile fitting and personalized service means physical boutiques remain vital for high-end purchases.

- Latin America (Brazil, Argentina, Colombia)

The Latin American bridal gowns market is characterized by a strong emphasis on large, lavish weddings, reflecting regional cultural values, driving steady demand for high-volume, often elaborate designs, typically featuring full skirts, intricate detailing, and rich fabrics. Brazil represents the largest market, supported by a large population and a resilient luxury segment in major cities. While economic instability can impact consumer confidence, the commitment to high-quality wedding expenditure generally remains robust, prioritizing visibility and ceremonial grandeur.

Local designers hold significant market share, often better attuned to regional preferences for fit and silhouette, but international brands are gaining traction, primarily through specialized boutiques in metropolitan areas. The market displays a price sensitivity in the mid-to-low segments, leading to strong competition among domestic manufacturers who specialize in optimizing material costs without sacrificing aesthetic appeal. The use of social media for trend dissemination is exceptionally high, influencing local tastes toward global fashion styles, creating opportunities for international ready-to-wear brands to penetrate the market via efficient digital channels.

- Middle East and Africa (MEA) (Saudi Arabia, UAE, South Africa)

The MEA region presents a unique market landscape defined by extremely high average expenditure on luxury bridal wear, particularly in the Gulf Cooperation Council (GCC) countries such as the UAE and Saudi Arabia. Consumers here often prioritize haute couture, unique customization, and gowns heavily featuring luxury embellishments, demanding materials like exclusive silks, high-grade crystal detailing, and complex hand-stitched embroidery. This region attracts major international luxury fashion houses and is a crucial market for global high-end bridal designers.

In Africa, the market is highly diverse. South Africa is the most mature market, blending Western trends with local aesthetic influences. Across the broader African continent, rising urbanization and increasing disposable incomes are slowly fueling demand for modern bridal wear, often alongside traditional attire. Distribution channels are highly polarized: exclusive designer showrooms dominate the GCC luxury segment, while the rest of the region relies more on independent retailers and cross-border e-commerce. Cultural and religious sensitivities significantly influence gown design, requiring modesty and customization options that cater to specific regional traditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bridal Gowns Market.- Pronovias

- Vera Wang

- Amsale

- Rosa Clará

- Maggie Sottero

- Justin Alexander

- Enzoani

- David's Bridal

- Kleinfeld Bridal

- Atelier Pronovias

- BHLDN (Anthropologie Group)

- Reem Acra

- Carolina Herrera

- Monique Lhuillier

- Galia Lahav

- Zuhair Murad

- Elie Saab

- Badgley Mischka

- Sareh Nouri

- Savin London

- Halfpenny London

- Ines Di Santo

- Lazaro Bridal

- Jenny Packham

- Grace Loves Lace

- Martina Liana

- Morilee

- Wtoo by Watters

- Daalarna Couture

- Lillian West

Frequently Asked Questions

Analyze common user questions about the Bridal Gowns market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the sustainable bridal gown segment?

The sustainable bridal gown segment is expanding rapidly, primarily driven by increasing consumer environmental consciousness (especially among millennials and Gen Z), demand for ethically sourced materials (like organic silks or recycled polyesters), and greater supply chain transparency. Brands implementing eco-friendly practices can command premium pricing and attract a dedicated niche consumer base seeking responsible luxury.

How is e-commerce impacting the traditional bridal boutique distribution model?

E-commerce is highly disruptive in the mid-to-affordable segments by offering greater convenience, price comparison tools, and direct-to-consumer models. While physical boutiques remain essential for fittings and high-end services, online channels leverage virtual try-on technology and simplified sizing to capture volume sales, forcing traditional retailers to enhance the in-store experience with personalization and exclusive services.

What are the key technological advancements redefining the bridal gown fitting process?

Key technological advancements include 3D body scanning for precise measurement capture and virtual reality (VR) or augmented reality (AR) virtual try-on (VTO) applications. These tools dramatically reduce the necessity for multiple physical fittings, improve sizing accuracy, and allow remote customization, streamlining the customer journey and reducing alteration costs for both the consumer and the retailer.

Which geographical region exhibits the strongest growth potential in the forecast period?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, shows the strongest growth potential. This growth is underpinned by rising middle-class disposable incomes, increased acceptance of Western-style weddings, and substantial demographic factors that guarantee a continuous and expanding pool of potential consumers over the forecast period.

Are bridal gown rental services significantly restraining market revenue growth?

Yes, rental services pose a material restraint, particularly in North America and Europe, by offering a cost-effective alternative to purchasing, catering to budget-conscious and minimalist consumers. While luxury segments remain relatively immune, the growth of high-quality rental and resale platforms impacts the mid-range and affordable segments, forcing manufacturers to emphasize the emotional and long-term value of ownership.

What is the current trend regarding non-traditional bridal silhouettes?

The current market trend demonstrates a strong pivot towards non-traditional silhouettes, including stylish separates (bodysuits and skirts), jumpsuits, and short cocktail-length dresses. This reflects a broader consumer movement towards individualism, practicality, and versatile attire suitable for smaller or non-conventional ceremonies, driving product diversification beyond the classic Ballgown and A-line styles.

How does the volatile price of raw materials affect the profitability of bridal gown manufacturers?

The volatile price of luxury raw materials, such as imported silks and high-quality lace, directly compresses the profit margins of manufacturers, especially those in the mid-range segment who cannot fully pass costs on to consumers. This volatility necessitates sophisticated hedging strategies, long-term supplier contracts, and an emphasis on value engineering to maintain competitive pricing while ensuring product quality.

What role does social media play in shaping contemporary bridal fashion trends?

Social media platforms like Instagram, TikTok, and Pinterest are critical drivers of trend formation and diffusion, acting as powerful marketing channels. They expose consumers instantly to global runway styles, influencer endorsements, and celebrity weddings, accelerating the adoption rate of new designs and compelling brands to maintain a strong, visually compelling digital presence to capture consumer interest early in the wedding planning cycle.

What defines the 'Luxury' segment of the Bridal Gowns Market?

The Luxury segment is defined by price points typically exceeding $10,000, exclusivity, use of high-grade natural materials (e.g., custom French lace, pure silk), extensive hand-finished detailing (beading, embroidery), and personalized high-touch service, often provided directly by the designer or through exclusive flagship stores. This segment prioritizes artisanal craftsmanship and bespoke uniqueness over volume.

How are geopolitical factors influencing the bridal gown supply chain?

Geopolitical factors, including trade tariffs, labor regulations, and regional instability in key manufacturing hubs (e.g., parts of Asia), introduce supply chain risk and cost uncertainty. This encourages some luxury brands to 'nearshore' production back to high-wage countries (like Italy or Portugal) to ensure quality control, ethical compliance, and maintain shorter, more reliable lead times for exclusive, high-value orders.

What are the primary challenges facing mid-market bridal retailers?

Mid-market retailers face dual challenges: competition from high-volume, low-cost online retailers and the pressure to compete with the experiential retail offered by luxury boutiques. They must balance offering moderate customization and high-quality service while managing tight margins affected by rising material and labor costs, often relying on efficient inventory management and streamlined omnichannel sales to survive.

What is the significance of the alteration process in the bridal retail value chain?

The alteration process is a mandatory and critical value-add in the bridal retail value chain, often representing a significant revenue stream and a core component of customer satisfaction. Because bridal gowns are structured garments requiring precise fit, quality alterations ensure the final product meets expectations, justifying the premium associated with specialized boutiques and highly skilled in-house seamstresses.

Why is customization crucial for success in the modern bridal market?

Customization is crucial because modern brides prioritize individuality and personal expression over mass trends. Offering personalized options—ranging from minor changes in fabric or embellishment to fully bespoke designs—allows brands to justify higher prices, build stronger customer loyalty, and differentiate themselves in a saturated market where unique product offerings are highly valued and promoted via social media.

How do destination weddings impact the demand for specific gown styles?

Destination weddings drive demand for specific gown characteristics, primarily lightweight construction, wrinkle-resistant fabrics, ease of packing, and versatile, less structured silhouettes. Brides planning international ceremonies often avoid heavy ballgowns, preferring sheath, A-line, or separates that are practical, durable, and comfortable in warmer climates or remote locations.

What is the role of natural fibers versus synthetic fibers in contemporary bridal gown production?

Natural fibers (silk, cotton, linen) dominate the luxury and sustainable segments due to their superior drape, breathability, and feel, commanding higher prices. Synthetic fibers (polyester, nylon blends) are essential for the mass-market and affordable segments, offering durability, structure retention, and significantly lower cost, often used in blends to reduce overall retail price and enhance wrinkle resistance.

How are bridal manufacturers addressing the need for ethical labor practices?

Manufacturers are addressing ethical labor needs by implementing strict supplier codes of conduct, investing in third-party auditing and certifications, and increasingly consolidating manufacturing operations to facilities where oversight is easier. Transparency regarding factory conditions and fair wages is becoming a major marketing and compliance requirement, especially for brands targeting environmentally and socially aware Western consumers.

What influence do cultural differences have on bridal gown design globally?

Cultural differences profoundly influence design, affecting color choice (white vs. red/gold), required modesty levels (sleeves, necklines), and integration of traditional elements (specific embroidery, fabric patterns). Global brands must offer diversified collections or localized customization options to cater effectively to regional markets, particularly in APAC and the MEA where cultural traditions dictate specific attire requirements.

What are the typical lead times associated with high-end bridal gown purchases?

High-end or bespoke bridal gowns typically require lead times ranging from 6 to 12 months. This extended timeline is necessary to accommodate complex processes including material sourcing (often international imports), pattern creation, multiple fittings, and intricate hand-finished construction. Efficient supply chain management is crucial to guarantee adherence to these strict delivery schedules, which cannot be adjusted due to fixed wedding dates.

How does the increasing trend of smaller, intimate weddings affect the market?

The trend toward smaller, more intimate ceremonies, often fueled by post-pandemic shifts or economic considerations, drives demand for less formal, simpler gowns or high-quality ready-to-wear options. While volume might be slightly affected, the market compensates by maintaining high average selling prices for sophisticated, versatile designs suitable for various settings, focusing on quality over maximalist design.

What role does influencer marketing play in the bridal gown market?

Influencer marketing is highly effective, utilizing key figures (wedding planners, celebrity stylists, fashion bloggers) to showcase gowns and establish aspirational brand imagery. This strategy builds trust, validates high-value purchases, and significantly accelerates trend adoption, particularly for emerging or non-traditional brands seeking rapid market penetration among digitally native consumers.

What are the challenges of managing inventory in the bridal gown sector?

Inventory management is challenging due to the high unit cost, long lead times, and inherent seasonality of bridal wear, combined with rapid trend cycles. Overstocking is expensive, while understocking risks losing time-sensitive sales. Manufacturers increasingly rely on AI-driven predictive analytics to forecast demand precisely, minimizing holding costs and maximizing successful order fulfillment rates.

How is the market adapting to demand for colored or non-white bridal gowns?

The market is adapting by integrating diverse palettes, including soft pinks, blues, golds, and champagne hues, into mainline collections, moving away from strict reliance on white or ivory. This adaptation caters to consumers seeking unique personal expression or second-time brides, broadening the product appeal and providing new avenues for brand differentiation in contemporary bridal fashion.

What are the financial implications of high return rates in online bridal retail?

High return rates in online bridal retail impose significant financial burdens, including reverse logistics costs, necessary cleaning/restocking fees, and the risk of damage to high-value garments. Retailers mitigate this through improved size guides, detailed product descriptions, virtual try-on technology, and potentially stricter return policies for highly customized or deeply discounted items.

How important are trunk shows to the sales strategy of designer bridal brands?

Trunk shows are highly important marketing and sales events. They allow designers to present their full, often exclusive, collections directly to consumers via a retail partner (boutique) for a limited time. This strategy generates immediate, high-value sales, creates urgency, and allows designers to gather direct feedback on new or experimental styles before full-scale production launch.

What differentiates the Asian Pacific market from North America in terms of consumer behavior?

The APAC market differs by often having higher involvement of family in the purchasing decision, a strong cultural emphasis on status-symbol luxury purchases, and the prevalence of wearing multiple outfits (including traditional attire) during the wedding event. In contrast, North American consumers prioritize personalization, rapid fulfillment, and often make decisions more independently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager