Bridal Jewelry Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437061 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Bridal Jewelry Market Size

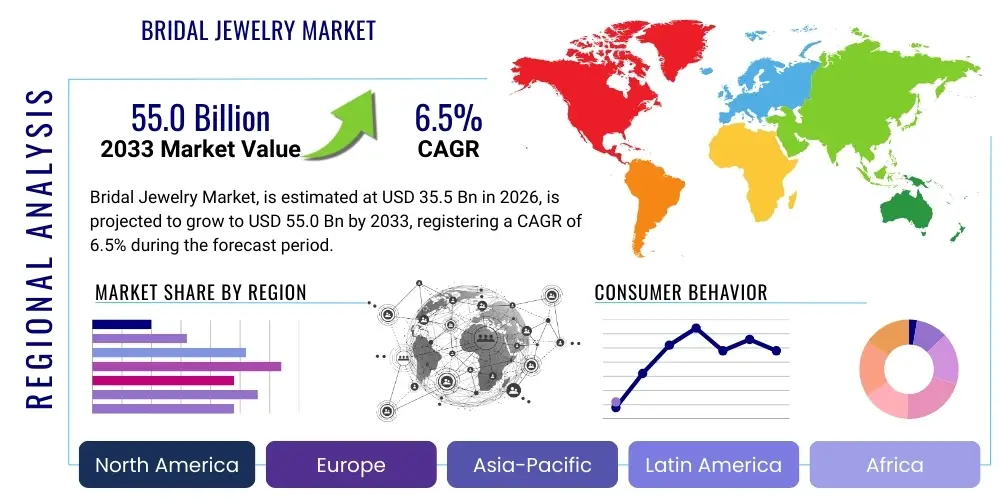

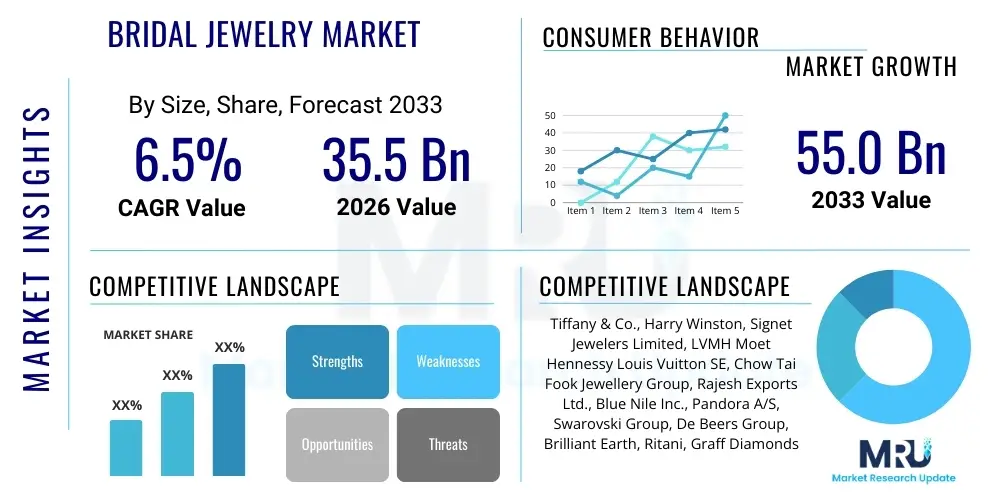

The Bridal Jewelry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 55.0 Billion by the end of the forecast period in 2033.

Bridal Jewelry Market introduction

The Bridal Jewelry Market encompasses all ornamentation purchased and worn specifically for engagement, wedding, and associated ceremonial events. This category includes, but is not limited to, engagement rings, wedding bands, bridal necklaces, earrings, bracelets, and customized sets. The market is fundamentally driven by global marriage rates, disposable income growth, evolving consumer preferences toward personalized and sustainable luxury, and the sustained cultural significance placed upon bridal accessories as symbols of commitment and status. Products range across various materials, including natural diamonds, lab-grown diamonds, gold (yellow, white, and rose), platinum, and various precious gemstones like sapphires and emeralds, catering to a wide spectrum of consumer budgets and aesthetic demands. The industry is characterized by a mix of established global luxury brands and specialized niche designers focusing on craftsmanship and unique design narratives.

Major applications of bridal jewelry extend beyond the primary wedding ceremony, often serving as heirloom pieces passed down through generations. The enduring sentimental value attached to these items significantly influences purchasing behavior, often prioritizing quality and durability over short-term trends. Key benefits derived from this market include the emotional fulfillment of celebrating major life milestones, the investment potential inherent in precious metals and stones, and the fashion statement provided by high-end design. The market landscape is increasingly digitized, with e-commerce platforms playing a crucial role in product discovery, customization, and transaction, allowing specialized designers to reach a global clientele while simultaneously putting pressure on traditional brick-and-mortar retailers to enhance the in-store experience with personalization tools.

Driving factors propelling market expansion include the rising affluence in emerging economies, particularly in Asia Pacific, where wedding spending is surging, and the growing acceptance and marketing of lab-grown diamonds as a sustainable and cost-effective alternative to mined stones. Furthermore, targeted marketing campaigns leveraging social media platforms, coupled with celebrity endorsements, continually shape contemporary bridal trends, pushing consumers towards specific styles such as halo settings, vintage-inspired designs, or unique colored stones. The increasing focus on bespoke and ethically sourced jewelry also acts as a critical driver, compelling manufacturers and retailers to maintain transparency regarding their supply chains and sourcing practices to meet the stringent demands of modern, socially conscious consumers.

Bridal Jewelry Market Executive Summary

The global Bridal Jewelry Market demonstrates resilient growth, underpinned by sustained cultural investment in weddings and rapid adoption of digital retail channels. Current business trends indicate a significant shift towards omni-channel strategies, where physical showrooms integrate seamlessly with sophisticated online platforms offering virtual try-ons and custom design interfaces. The competitive landscape is evolving due to the rising prominence of Direct-to-Consumer (D2C) brands specializing in ethically sourced materials, particularly lab-grown diamonds, which are successfully capturing younger, environmentally conscious demographic segments. Furthermore, customization and personalization are no longer luxury options but expected standards, driving innovation in computer-aided design (CAD) and 3D printing technologies within the manufacturing segment to facilitate unique product creation at scale. Retailers are focusing heavily on creating memorable purchasing experiences, recognizing that bridal jewelry acquisition is highly emotional and high-value.

Regionally, Asia Pacific (APAC) is projected to remain the dominant growth engine, fueled by large populations, increasing household wealth, and culturally significant large-scale wedding ceremonies in countries like India and China, where jewelry acquisition forms a central part of the cultural ritual and financial investment. North America and Europe, while mature markets, maintain high average transaction values and continue to lead trends in design innovation and sustainability adoption, particularly concerning certification standards like the Kimberley Process and blockchain traceability. The Middle East and Africa (MEA) segment exhibits robust demand for high-carat gold and intricately designed traditional pieces, reflecting strong local cultural preferences and significant luxury spending power within certain nations. Market localization efforts, including tailoring designs to specific regional tastes and ensuring compliance with local import/export regulations, are crucial for maintaining market share across these diverse geographies.

Segment-wise, the Rings category, dominated by engagement and wedding bands, maintains the largest market share, driven by their universal necessity in marriage rituals. However, the Earrings and Necklaces segment is anticipated to register the fastest growth, largely due to increased demand for coordinated bridal sets and the influence of global fashion trends integrating high-end jewelry into daily wear post-ceremony. By Material, Gold continues its reign due to traditional value and investment perception, but the Diamond segment, particularly encompassing lab-grown diamonds, is showing exponential acceleration, challenging the historical dominance of mined stones. The online distribution channel is outpacing traditional retail growth, offering greater price transparency, diverse inventory, and the convenience of home consultation, thereby redefining consumer purchase pathways and demanding substantial investment in digital infrastructure by all key industry players.

AI Impact Analysis on Bridal Jewelry Market

Common user inquiries regarding the impact of AI on the Bridal Jewelry Market center primarily around personalization capabilities, supply chain ethics, and retail efficiency. Users frequently ask: "How can AI design my perfect engagement ring?", "Will AI ensure my diamonds are ethically sourced?", and "Are virtual try-ons using AI accurate?" Based on these common questions, the key themes summarize the expectation that AI should transform the highly personal process of jewelry selection through advanced recommendation engines and enhanced visualization tools. Concerns revolve around the balance between algorithmic efficiency and the need for human emotion and craftsmanship in luxury goods. Users expect AI to enforce transparency and traceability in the complex diamond supply chain and revolutionize the purchase experience by providing seamless, hyper-personalized interactions both online and in physical stores.

AI's primary influence is establishing predictive analytics for demand forecasting and trend identification, enabling retailers to optimize inventory levels for specific cuts, materials, and settings before they peak in popularity, minimizing waste and capital lock-up. Furthermore, AI-powered recommendation systems analyze extensive customer data, including browsing history, aesthetic preferences, social media engagement, and cultural background, to generate highly customized design suggestions, significantly reducing the decision paralysis often associated with high-value purchases like bridal jewelry. This predictive customization extends into material sourcing, where algorithms can verify the provenance of stones, cross-referencing global databases to enhance trust and adherence to ethical sourcing standards, thus addressing a major consumer concern regarding sustainability and provenance integrity.

In the retail environment, AI is critical for improving customer engagement through sophisticated chatbots that handle initial inquiries, scheduling, and basic product customization, freeing human sales associates to focus on complex, high-touch interactions. Crucially, AI underpins augmented reality (AR) and virtual reality (VR) applications, allowing customers to virtually try on different rings and jewelry pieces accurately scaled to their hand or body dimensions, bridging the gap between digital discovery and physical purchasing confidence. This technological integration is vital for D2C brands to compete effectively against traditional retail, offering a novel and highly engaging shopping experience that leverages data intelligence to streamline the entire customer journey from initial inspiration to final delivery.

- AI-driven personalized design recommendations based on buyer profiles and current market trends.

- Enhanced supply chain transparency and traceability using AI to monitor ethical sourcing and conflict-free guarantees (Blockchain integration).

- Optimized inventory management and demand forecasting for specific cuts and precious metals.

- Implementation of sophisticated Virtual Try-On (VTO) experiences using AR/VR technology guided by AI spatial mapping.

- Automated customer service (chatbots) for initial inquiry handling and 24/7 engagement.

- Quality control assessment in manufacturing through machine vision systems identifying material flaws.

DRO & Impact Forces Of Bridal Jewelry Market

The dynamics of the Bridal Jewelry Market are influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the primary Impact Forces shaping its trajectory. Key drivers include increasing disposable incomes globally, particularly among millennials and Generation Z who are now reaching prime marriage age, coupled with the effective marketing campaigns that continually reinforce the cultural necessity and emotional significance of high-value bridal pieces. The widespread acceptance and cost-effectiveness of lab-grown diamonds present a significant commercial driver, expanding the accessibility of diamond jewelry to broader economic segments. Conversely, the market faces restraints such as the volatility of gold and precious metal prices, imposing fluctuating input costs on manufacturers and potentially dissuading price-sensitive consumers. Furthermore, shifting social trends, including delayed marriages and a growing preference for smaller, more intimate ceremonies, might moderate the overall market size growth in mature Western economies.

Opportunities within the market largely stem from technological advancement and geographical expansion. The continued development of sophisticated e-commerce platforms, offering highly immersive digital shopping experiences through augmented reality and advanced customization tools, presents a strong avenue for growth, particularly in underserved rural or geographically disparate regions. Moreover, the increasing consumer focus on ethical sourcing and sustainability creates substantial opportunities for brands that invest heavily in transparent, blockchain-verified supply chains, allowing them to differentiate their offerings and command premium pricing. Targeting the burgeoning luxury markets in emerging economies, specifically Southeast Asia and parts of Latin America, where wealth accumulation is rapid and cultural investment in matrimonial jewelry is high, offers substantial returns for focused global brands capable of localizing their product lines effectively.

The collective impact forces suggest a market moving towards premiumization based on provenance and personalization, rather than solely carat weight or traditional branding. The primary driving force is the sociological pressure and inherent emotional value placed on bridal products, which remains impervious to short-term economic fluctuations. However, the restraining force of ethical scrutiny requires mandatory compliance and verifiable transparency from all players. The most powerful impact force is the technological transformation catalyzed by D2C models and AI integration, which forces traditional retailers to rapidly innovate their operational and customer engagement strategies, ultimately benefiting the consumer through greater choice, transparency, and tailored products.

Segmentation Analysis

The Bridal Jewelry Market is highly fragmented and segmented based on multiple criteria including Product Type, Material, Distribution Channel, and End-Use. A thorough segmentation analysis is crucial for understanding specific consumer behaviors and targeting strategies within this high-value category. The segmentation highlights the divergence between traditional luxury segments, which favor classic materials like platinum and natural diamonds, and emerging mass-market segments increasingly opting for modern alternatives such as lab-grown diamonds and titanium. The overall market complexity demands that manufacturers maintain diverse production lines capable of fulfilling orders across the entire value spectrum, from bespoke high-end designs to accessible, mass-produced wedding bands.

The primary segment, Product Type, reveals that engagement rings and wedding bands command the largest market share due to their universal requirement in wedding rituals. However, complementary segments like necklaces, earrings, and bracelet sets are rapidly growing, driven by fashion trends encouraging coordinated bridal looks and the subsequent use of these pieces for formal events post-marriage. Distribution Channel segmentation indicates a significant power shift towards the online segment, accelerated by the COVID-19 pandemic and sustained by continuous improvements in digital trust and visualization tools. Yet, the traditional brick-and-mortar stores remain essential for high-value transactions, where consumers prefer the tactile experience of inspecting materials and receiving personalized, expert consultations before making major investment decisions.

Material segmentation clearly reflects the ongoing transition in consumer values. While traditional metals like gold and platinum retain their fundamental positions, the fastest growth is observed in the segment dedicated to lab-grown diamonds, appealing particularly to Millennial and Gen Z buyers motivated by price advantage and ethical considerations. This segmentation informs competitive strategy, necessitating dual inventory management—one for natural, certified stones and another for synthetic alternatives—to effectively cater to the dichotomous preferences shaping modern purchasing patterns. Furthermore, the segmentation by end-use (Men vs. Women) shows the steady growth of the men's bridal jewelry market, moving beyond simple bands to include more stylized and material-diverse wedding rings, reflecting broader acceptance of male ornamentation.

- By Product Type:

- Rings (Engagement Rings, Wedding Bands, Promise Rings)

- Necklaces and Pendants

- Earrings

- Bracelets

- Others (Tiaras, Hair Accessories)

- By Material:

- Gold (Yellow, White, Rose)

- Platinum

- Silver

- Diamond (Natural and Lab-Grown)

- Other Precious Stones (Sapphire, Ruby, Emerald)

- Other Metals (Titanium, Palladium)

- By Distribution Channel:

- Offline Retail (Exclusive Brand Stores, Jewelry Stores, Departmental Stores)

- Online Retail (E-commerce Platforms, Brand Websites)

- By End-User:

- Women

- Men

Value Chain Analysis For Bridal Jewelry Market

The value chain for the Bridal Jewelry Market is complex, beginning with the highly capital-intensive upstream segment involving the sourcing and processing of raw materials—precious metals and gemstones. The upstream activities include mining and refining gold, silver, and platinum, and the exploration, extraction, and cutting/polishing of diamonds (both natural and lab-grown). Efficiency and ethical compliance at this stage are paramount, as controversies surrounding conflict minerals or unsustainable mining practices can severely damage downstream brand reputation. Key players at this stage often include large multinational mining corporations and specialized diamond processing facilities, particularly concentrated in regions such as Africa, Russia, and India, with highly specialized cutting centers focusing on precision and yield optimization.

The midstream process involves design, manufacturing, and wholesale distribution. Manufacturers take the refined metals and cut stones to create finished jewelry pieces, often leveraging advanced technologies like Computer-Aided Design (CAD), 3D printing for prototypes and molds, and precision casting. This stage includes meticulous craftsmanship, setting of stones, and quality assurance, transitioning raw materials into high-value consumer goods. The distribution channel then moves the finished product downstream. Traditional distribution relied on wholesale agreements with independent or chain jewelry stores. However, the modern market increasingly utilizes Direct-to-Consumer (D2C) channels via brand-owned e-commerce sites and exclusive flagship stores, allowing brands greater control over pricing, brand narrative, and customer experience, minimizing reliance on third-party retailers.

The downstream segment focuses on retail and consumer engagement, which is critical for bridal jewelry due to the emotional and investment nature of the purchase. Direct channels, such as branded boutiques and online stores, facilitate a high-touch sales process, often including private consultations and customization services. Indirect channels, like multi-brand luxury e-tailers and department stores, offer broader market reach but involve margin sharing. The success of the downstream operation hinges on effective visual merchandising, highly trained sales personnel capable of conveying authenticity and craftsmanship, and robust after-sales service, including resizing, cleaning, and long-term warranties. Transparency regarding sourcing and certification throughout the entire value chain is now a consumer expectation, making traceability systems essential for maintaining brand credibility at the point of sale.

Bridal Jewelry Market Potential Customers

The core potential customers for the Bridal Jewelry Market are individuals planning to marry or those celebrating major marital milestones, predominantly falling within the millennial (25-40 years old) and late Generation Z demographics (20-25 years old). These consumers are often making their first significant luxury purchase and are highly information-driven, relying extensively on peer reviews, social media trends, and detailed product specifications. They exhibit diverse preferences, with some seeking traditional, large-carat diamond rings as aspirational purchases, while a growing segment prioritizes bespoke designs, ethical sourcing, and value-driven alternatives such as moissanite or high-quality lab-grown diamonds, reflecting a higher degree of social and environmental consciousness in their consumption habits.

Secondary customer segments include family members (parents, grandparents) who frequently contribute to or fund the purchase of bridal jewelry, especially in cultures where jewelry serves as a form of financial security or mandatory gift-giving during weddings. Furthermore, customers involved in vow renewals or anniversary celebrations constitute a steady, albeit smaller, market segment. These buyers typically seek upgrade pieces or complementary jewelry sets and possess higher disposable incomes, often opting for limited-edition or extremely high-end custom designs. Retail strategies must differentiate communications for these segments, focusing on emotional longevity and heirloom value for the older cohort, and emphasizing personalization and ethical provenance for the younger, primary buying group.

Geographically, potential customers are concentrated in urban and rapidly urbanizing areas worldwide due to higher marriage rates and greater purchasing power. The APAC region represents the largest reservoir of new potential customers due to its high population density and increasing middle-class income levels. The key characteristic across all segments is the emotional nature of the purchase, dictating that successful engagement strategies must involve storytelling, personalized consultation, and building enduring relationships based on trust and product quality assurance. The end-user/buyers are highly sensitive to brand reputation and third-party validation (e.g., GIA certification), making transparency a non-negotiable requirement for successful market penetration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 55.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tiffany & Co., Harry Winston, Signet Jewelers Limited, LVMH Moet Hennessy Louis Vuitton SE, Chow Tai Fook Jewellery Group, Rajesh Exports Ltd., Blue Nile Inc., Pandora A/S, Swarovski Group, De Beers Group, Brilliant Earth, Ritani, Graff Diamonds, Zales, Kay Jewelers, Van Cleef & Arpels, Cartier, Rosy Blue, Chopard, Buccellati |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bridal Jewelry Market Key Technology Landscape

The technological landscape of the Bridal Jewelry Market is rapidly modernizing, driven by the need for enhanced personalization, faster production cycles, and superior supply chain transparency. Computer-Aided Design (CAD) software remains fundamental, enabling jewelers to digitally conceptualize complex designs and visualize potential outcomes before material commitment. Coupled with CAD, additive manufacturing (3D printing), particularly using wax and resin-based systems, allows for the rapid prototyping and creation of precise molds for casting. This integration of digital design and rapid prototyping significantly reduces the time-to-market for new collections and is crucial for fulfilling the high demand for bespoke and customized engagement rings, offering unparalleled precision in intricate settings and unique geometric forms that were previously difficult or cost-prohibitive to achieve using traditional methods.

In the material science domain, the advancement of Chemical Vapor Deposition (CVD) and High-Pressure High-Temperature (HPHT) technologies has revolutionized the lab-grown diamond sector. These technologies now reliably produce high-quality, large-carat stones chemically and physically identical to mined diamonds, at a fraction of the environmental and financial cost. The maturity of lab-grown diamond technology is forcing the wider industry to invest heavily in robust testing equipment to differentiate between natural and synthetic stones, ensuring grading integrity and consumer trust. Furthermore, technology is addressing the core industry challenge of supply chain ethics. Blockchain technology is emerging as a critical tool, providing immutable, digital ledgers that track diamonds from their origin (mine or lab) through cutting, polishing, and setting, offering end-to-end transparency that aligns with contemporary consumer demands for ethical provenance.

Customer engagement technologies are equally transformative. Augmented Reality (AR) and Virtual Reality (VR) platforms are essential components of the modern online jewelry shopping experience. AR applications, often integrated into brand mobile apps or websites, allow users to virtually try on rings or necklaces using their smartphone cameras, providing a realistic visualization of the product on their person. This technology significantly lowers barriers to online purchasing for high-value items by enhancing visual confidence and reducing return rates. Moreover, the implementation of sophisticated data analytics and Artificial Intelligence (AI) powers personalized shopping journeys, from recommending compatible wedding band pairings to dynamically adjusting online inventory based on real-time geographical trend data, thereby optimizing both the consumer experience and operational efficiency for retailers.

Regional Highlights

The Bridal Jewelry Market exhibits distinct consumption patterns and growth dynamics across its primary geographical segments: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA). North America, driven predominantly by the United States, is characterized by its high average transaction value and rapid adoption of lab-grown diamonds and D2C brands. This region dictates many global trends, favoring large settings, customized designs, and a strong preference for certified, high-quality stones. Market maturity necessitates a focus on innovation in retail technology and differentiated product offerings, such as sustainable and recycled gold options, to capture the sophisticated consumer base.

Europe represents a blend of traditional and modern tastes, with significant demand coming from the UK, Germany, and France. While traditional luxury brands maintain strong loyalty, particularly for heirloom quality, the market is showing increasing elasticity towards contemporary, minimalist designs and ethically sourced materials. European consumers place a strong emphasis on craftsmanship and design history, valuing unique boutique experiences over mass-market branding. Growth in this region is steady, supported by stable marriage rates and high disposable income, but is subject to stringent regulations regarding material sourcing and quality stamping, driving brands toward greater verifiable transparency.

Asia Pacific (APAC) is undoubtedly the engine of future market growth, accounting for the highest volume of transactions and the most substantial projected increase in market size. Countries such as India and China view gold and diamond jewelry not only as celebratory adornment but also as critical financial investments, especially during marriage. The demand in APAC is characterized by a strong preference for high-carat gold (22k in India) and elaborate, traditional designs. The market is evolving quickly, however, with rising Western influence among younger urban populations driving demand for modern diamond engagement rings. Marketing strategies in this region must successfully navigate diverse cultural tastes and complex regulatory environments.

- North America: High transaction value; leading adoption of lab-grown diamonds; mature e-commerce infrastructure; focus on personalization and D2C models.

- Europe: Strong preference for heirloom quality and historical craftsmanship; steady growth; increasing acceptance of minimalist and ethical designs; strict quality regulation compliance.

- Asia Pacific (APAC): Fastest growth potential due to rising affluence; high volume sales; cultural preference for gold as investment; major markets include China and India.

- Latin America: Emerging market with fluctuating but increasing demand; tendency towards bright colored stones and high-carat gold; growth fueled by economic stabilization in key countries (Brazil, Mexico).

- Middle East & Africa (MEA): Robust demand for high-end luxury goods and customized, elaborate designs; strong cultural emphasis on gold and statement pieces; significant spending power in the Gulf Cooperation Council (GCC) states.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bridal Jewelry Market.- Tiffany & Co.

- Harry Winston

- Signet Jewelers Limited

- LVMH Moet Hennessy Louis Vuitton SE

- Chow Tai Fook Jewellery Group

- Rajesh Exports Ltd.

- Blue Nile Inc.

- Pandora A/S

- Swarovski Group

- De Beers Group

- Brilliant Earth

- Ritani

- Graff Diamonds

- Zales

- Kay Jewelers

- Van Cleef & Arpels

- Cartier

- Rosy Blue

- Chopard

- Buccellati

Frequently Asked Questions

Analyze common user questions about the Bridal Jewelry market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current trend regarding lab-grown versus natural diamonds in bridal jewelry?

The current market trend shows significant consumer acceptance and growth in the lab-grown diamond segment, driven by ethical sourcing concerns and cost-effectiveness. While natural diamonds maintain their premium status, lab-grown alternatives are rapidly capturing market share, especially among younger buyers seeking identical quality and composition at a lower price point and verified ethical provenance. Retailers increasingly offer both options.

How is ethical sourcing and sustainability impacting purchasing decisions in the bridal jewelry market?

Ethical sourcing is a major impact force; modern buyers prioritize transparency and sustainability. Consumers actively seek jewelry certified conflict-free (Kimberley Process) or traceable via blockchain technology. Brands emphasizing recycled metals, verifiable supply chains, and low environmental impact (like Brilliant Earth or specific D2C platforms) are gaining a competitive advantage and commanding greater consumer trust.

Which distribution channel is expected to dominate the Bridal Jewelry Market by 2033?

While traditional brick-and-mortar retail remains vital for high-value transactions requiring tactile assessment, the online retail channel, encompassing brand websites and e-commerce platforms, is projected to exhibit the fastest growth and potentially dominate transactions by 2033. This growth is sustained by advancements in Virtual Try-On (VTO) technology, personalized consultations, and greater price transparency offered online.

What is the most popular type of metal used for engagement rings globally?

Gold, in its various colors (yellow, white, and rose), remains the most popular metal globally due to its historical value, durability, and versatility. Platinum holds the highest premium segment due to its hypoallergenic nature and extreme durability, particularly in mature markets like North America and Europe, while high-carat yellow gold continues to dominate Asian markets for its traditional investment appeal.

How does technological customization influence the price points in bridal jewelry?

Technological customization, enabled by CAD and 3D printing, allows consumers to design unique pieces. While bespoke design traditionally commanded a very high premium, technology now streamlines the process, making mid-range personalization more accessible. This democratization of customization allows brands to offer unique, semi-bespoke pieces efficiently, justifying slight price increases based on personalized design input rather than strictly material cost.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager