Bridal Wear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434856 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Bridal Wear Market Size

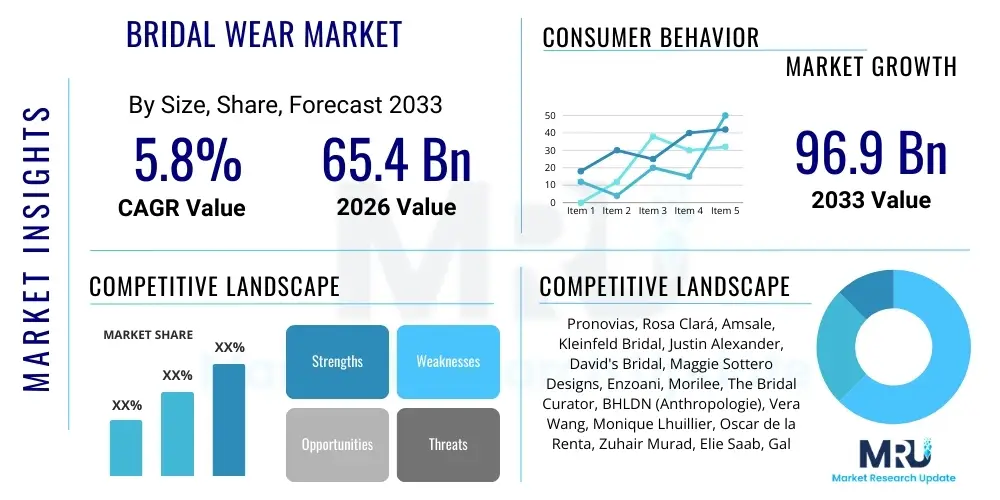

The Bridal Wear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 65.4 Billion in 2026 and is projected to reach USD 96.9 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the resurgence of large-scale wedding ceremonies post-pandemic, coupled with increasing consumer expenditure on luxury and customized apparel. The premiumization trend, particularly in established markets such as North America and Europe, alongside rapid urbanization and rising disposable incomes in emerging economies, provides a robust foundation for consistent market valuation growth over the next decade.

Bridal Wear Market introduction

The Bridal Wear Market encompasses the production, distribution, and sale of apparel and related accessories specifically designed for wedding ceremonies and adjacent events. Products typically include traditional wedding gowns, contemporary bridal dresses, veils, headpieces, footwear, and specialized innerwear. The market is highly segmented, ranging from bespoke, high-end designer creations targeting the luxury consumer segment, to mass-produced, affordable options catering to budget-conscious buyers. Major applications revolve around the primary wedding ceremony, rehearsal dinners, and destination weddings, reflecting a comprehensive wardrobe approach by modern consumers.

Key benefits associated with the products include emotional fulfillment, aesthetic significance, and cultural relevance, as bridal wear often serves as a central element of the matrimonial tradition globally. The market is characterized by high levels of emotional attachment and low price elasticity for luxury segments. Driving factors for market expansion are multifaceted, including the powerful influence of social media platforms (Instagram, Pinterest) in showcasing current styles and inspiring higher consumer spending, the global standardization of Western wedding formats, and the continuous innovation in fabric technology and design aesthetics, offering lighter, more comfortable, and sustainable options.

Furthermore, globalization has facilitated cross-border cultural exchanges, leading to hybrid styles that blend traditional garments with modern silhouettes, broadening the product scope significantly. The increasing prevalence of destination weddings also necessitates specialized travel-friendly bridal attire. As consumer focus shifts towards ethical consumption, sustainability in fabric sourcing and production processes is becoming a critical differentiator, prompting brands to invest in eco-friendly lines and transparent supply chains, thereby stimulating a niche but rapidly growing segment within the overall market structure.

Bridal Wear Market Executive Summary

The global Bridal Wear Market is poised for significant expansion, underpinned by evolving consumer preferences for personalized experiences and the sustained cultural importance of weddings. Major business trends emphasize omnichannel distribution, blending the experiential nature of physical boutiques with the convenience and broader inventory access offered by e-commerce platforms. Customization services, enabled by digital tools and advanced manufacturing, are rapidly becoming standard, moving beyond mere alterations to offering fully personalized design experiences, driving premiumization across segments. Furthermore, the market is navigating challenges related to inventory management and demand volatility, especially considering the highly seasonal nature of purchasing behavior, pushing companies toward optimized, just-in-time manufacturing models.

Regionally, North America and Europe maintain dominance, driven by high average wedding budgets and the strong presence of established luxury design houses. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by large population bases, rising affluence, and the increasing adoption of Western bridal styles alongside traditional ceremonies, particularly in countries like China and India. Latin America and the Middle East and Africa (MEA) present burgeoning opportunities, characterized by culturally rich, high-spending wedding events, though logistical complexities remain a hurdle for widespread distribution. Regional trends also reflect localized aesthetic preferences, requiring global players to adopt highly flexible and decentralized design strategies.

Segment trends indicate strong growth in the Accessories segment, complementing the main attire and offering high-margin opportunities. The Online Stores distribution channel is outpacing traditional brick-and-mortar growth, driven by Millennials and Gen Z who prioritize digital research and comparison shopping, though the final purchase for the main gown often remains offline due to fit requirements. In terms of product type, the demand for convertible or multi-functional wedding dresses is increasing, reflecting a consumer desire for practicality and value. Sustainability and ethical sourcing are transforming segment preferences, notably influencing the Luxury and Mid-Range price points as consumers become willing to pay a premium for traceability and environmentally conscious materials.

AI Impact Analysis on Bridal Wear Market

User queries regarding AI's impact on the Bridal Wear Market primarily center around personalized shopping experiences, efficiency in supply chain and inventory management, and the potential for hyper-realistic virtual try-on technologies. Users frequently ask: "How can AI suggest the perfect dress based on my body type and style preferences?" and "Will AI reduce the high cost of custom bridal wear?" Key concerns revolve around the depersonalization of the high-touch bridal boutique experience and data privacy related to sensitive personal measurements and style data. The analysis suggests that users anticipate AI primarily as an augmentation tool for design and logistics, rather than a replacement for human consultation, expecting it to streamline the process from initial design visualization to final fitting. The summary indicates a strong user expectation for AI to solve historical pain points related to fitting errors, inventory mismatch, and prolonged customization timelines, while simultaneously maintaining the emotional connection inherent in the bridal journey.

AI's role is rapidly transitioning from theoretical application to practical implementation within the bridal sector. Algorithms are being deployed to analyze vast datasets of past sales, current fashion trends, and social media engagement to predict color palettes, silhouette popularity, and fabric demand up to 18 months in advance. This predictive analytics capability significantly enhances the efficiency of design houses, allowing them to optimize material purchasing and reduce waste associated with overstocking unpopular styles. Furthermore, machine learning models are crucial in analyzing body scan data provided by clients, ensuring initial patterns generated for custom fittings are far more accurate than traditional manual measurements, minimizing subsequent alteration cycles and improving overall customer satisfaction.

In the consumer-facing domain, AI powers sophisticated recommendation engines that move beyond basic filters. These engines interpret implicit style signals from user browsing behavior, saved images, and even textual descriptions, correlating them with specific design elements (e.g., lace pattern density, sleeve volume, train length) to present highly curated collections. The introduction of generative AI tools is also enabling designers to rapidly iterate on sketch concepts, visualizing hundreds of variations of a single design input, thereby drastically shortening the ideation phase. This technological integration is crucial for maintaining market competitiveness, especially as fast fashion and rapidly changing micro-trends influence even the traditionally slow-moving luxury bridal sector.

- AI-driven predictive analytics optimizes inventory and forecasting demand for seasonal collections.

- Machine learning algorithms enhance personalized recommendations based on consumer style history and body metrics.

- Generative AI tools accelerate the initial design and visualization process for custom gowns.

- Computer vision assists in quality control checks during the manufacturing and embellishment stages.

- AI enables sophisticated virtual try-on experiences, reducing the need for physical samples and reducing return rates.

- Automated customer service bots handle preliminary queries regarding appointments, pricing, and alteration policies.

- Supply chain optimization using AI tracks fabric origins and ethical sourcing compliance in real-time.

DRO & Impact Forces Of Bridal Wear Market

The dynamics of the Bridal Wear Market are shaped by a complex interplay of internal growth drivers (D), external constraints (R), future opportunities (O), and structural impact forces. The primary engine for growth remains the robust societal and cultural significance placed on the wedding event globally, often translating into non-negotiable, high-value expenditures by consumers. This cultural impetus, combined with rising global disposable incomes, particularly among the middle and affluent classes in developing nations, allows for consistent market expansion. However, the market faces structural restraints, primarily the inherently high cost structure associated with specialized labor, luxury materials (silks, intricate lace, hand embroidery), and stringent quality control, which limits accessibility for mass markets. The trend towards sustainable and ethically sourced materials, while positive, also increases the initial procurement costs, presenting a challenge to margin maintenance.

Opportunities are largely rooted in technological integration and geographical expansion. The ability to offer highly customized products via digital platforms, leveraging 3D body scanning and augmented reality (AR) fitting sessions, provides a competitive edge and addresses the consumer desire for unique, personalized attire. Furthermore, underserved markets in Southeast Asia, Africa, and specific regions of Latin America offer fertile ground for targeted expansion strategies, provided companies can successfully navigate local regulatory and cultural nuances regarding apparel. The secondary market, including high-end rental services and certified pre-owned bridal wear, presents a sustainable revenue stream and addresses the restraint posed by high one-time expenditure, offering opportunities for brand participation in the circular economy.

The impact forces driving market transformation include powerful demographic shifts, specifically the delay of marriage age in developed economies, leading to couples with higher cumulative income capable of affording more expensive bridal options. Social influence, propagated through celebrity weddings and high-profile events, rapidly dictates fashion trends, forcing manufacturers to shorten their design-to-market cycle, an operational challenge for highly artisanal production. Regulatory impact forces, particularly concerning material safety, import/export duties on textiles, and ethical labor standards, necessitate rigorous compliance frameworks. Competition intensity remains high, driven by the fragmentation of the mid-range segment and the constant threat of counterfeiting impacting luxury brands, requiring continuous investment in intellectual property protection and brand integrity measures.

Segmentation Analysis

The Bridal Wear Market is extensively segmented based on product type, distribution channel, and price point, allowing for targeted strategic planning and marketing efforts. Analyzing these segments is crucial for understanding specific consumer behaviors and regional preferences. The core segmentation by product highlights the dominance of the wedding dress/gown category, which acts as the primary revenue driver, while accessories and footwear contribute significantly to overall profit margins due to lower manufacturing complexity and higher frequency of purchase relative to the main dress. Market saturation and growth rates vary substantially across these segments; for instance, the demand for non-traditional, colored, or short bridal dresses is accelerating within the urbanized, younger demographic, diversifying the traditional 'Gown' segment.

Segmentation by distribution channel reveals a dynamic shift, where traditional specialty boutiques, valued for their personalized consultation and fitting services, coexist alongside rapidly expanding online retail platforms. E-commerce platforms are increasingly adopted for accessory purchases and mid-range gowns, utilizing sophisticated logistics to manage returns and sizing issues. The price point segmentation is perhaps the most defining characteristic, clearly delineating consumer purchasing power and brand positioning. The Luxury segment, characterized by bespoke design and exclusive materials, maintains strong resilience against economic downturns due to its aspirational value, while the Mass Market segment is highly sensitive to price competition and supply chain efficiency, often relying on high-volume production models.

Effective segmentation strategies require companies to align their product offerings with the unique needs of each buyer group. For example, a firm targeting the Mid-Range segment must balance quality materials with cost-efficient manufacturing, potentially leveraging hybrid overseas production. Conversely, a luxury brand focuses heavily on maintaining exclusivity, the client experience, and artisanal craftsmanship, justifying their premium pricing. This granular understanding enables precise inventory management, optimized promotional activities, and localized marketing campaigns, ultimately enhancing market penetration and stabilizing revenue streams across diverse economic environments.

- By Type:

- Wedding Gown/Dress (Traditional, Contemporary, Convertible)

- Accessories (Veils, Headpieces, Jewelry, Gloves)

- Footwear (Heels, Flats, Specialized Bridal Sneakers)

- Others (Bridal Lingerie, Robes, Attire for related ceremonies)

- By Distribution Channel:

- Online Stores (Brand Websites, E-tailers, Multi-brand Platforms)

- Offline Stores (Specialty Boutiques, Department Stores, Bridal Chain Stores)

- By Price Point:

- Luxury (Above $10,000)

- Mid-Range ($2,500 - $10,000)

- Mass Market (Below $2,500)

Value Chain Analysis For Bridal Wear Market

The value chain for the Bridal Wear Market is characterized by highly specialized stages, beginning with upstream raw material sourcing and culminating in the highly personalized retail experience. Upstream analysis involves the procurement of highly specific textiles, including fine silks, delicate lace, specialized tulle, and high-quality embellishments such as Swarovski crystals or pearls. Unlike standard apparel, the requirements for bridal materials emphasize purity of color (various shades of white/ivory), drape, and durability, necessitating long-term relationships with certified and often geographically dispersed suppliers. Challenges upstream involve traceability, ensuring ethical sourcing, and managing the volatility of raw material prices, particularly for natural fibers. Innovation at this stage focuses on developing sustainable fabrics and materials that offer comparable luxury aesthetics with a lower environmental footprint, such as organic cotton lace or recycled polyester satins.

Midstream activities encompass design, cutting, garment construction, and intricate hand-finishing or embellishment. This phase is labor-intensive and requires highly skilled artisans, especially for luxury and haute couture pieces. Distribution channels are bifurcated into direct and indirect models. Direct distribution involves flagship stores or owned e-commerce platforms, offering maximum control over branding and customer experience, particularly important for luxury houses seeking to maintain exclusivity. Indirect distribution relies on multi-brand boutiques, specialty bridal retail chains, and department store concessions. These intermediaries provide wider geographical reach and manage local logistics, but require robust training protocols to ensure consistent brand representation and service quality.

Downstream analysis focuses on the consumer experience, which is arguably the most critical stage due to the emotional nature of the purchase. This includes fitting consultations, alteration services, and post-sale care. Specialty boutiques often excel here by providing dedicated consultants and private fitting rooms, creating a premium service environment. The integration of technology, such as AR fitting rooms and centralized digital platforms for tracking alteration progress, is modernizing this downstream service delivery. The efficacy of the value chain is directly proportional to its ability to maintain quality and emotional connection from the raw thread to the final gown presentation, distinguishing successful market players through superior product quality and unparalleled customer experience management.

Bridal Wear Market Potential Customers

The primary end-users and buyers of bridal wear products span a broad demographic spectrum but can be strategically categorized based on lifestyle, budget, and purchasing motivations. The core target demographic includes engaged individuals, predominantly women aged 25 to 35, who are planning their first or subsequent marriages. This group is highly digitally engaged, using platforms like Pinterest and Instagram extensively for inspiration, and tends to prioritize uniqueness and personalized elements in their attire. Secondary buyers include the bridal party (bridesmaids, mothers of the bride/groom) who purchase related apparel, often guided by the primary bride's aesthetic choices. A critical, often overlooked, segment is the non-traditional buyer, including LGBTQ+ couples seeking specialized or gender-neutral options, and second-time brides who often seek less elaborate but equally high-quality garments.

The segmentation of potential customers also heavily relies on income level, defining their engagement with the Luxury, Mid-Range, or Mass Market price points. Luxury customers seek bespoke services, designer pedigree, exclusive fabrics, and an exceptional in-store experience, viewing the purchase as a significant investment and status symbol. Mid-Range customers prioritize a balance of quality and cost, often seeking recognizable brand names that offer semi-customization options (e.g., mixing standard components or choosing fabric types). Mass Market consumers are highly price-sensitive and prioritize affordability, convenience, and functional aesthetics, frequently utilizing online retailers or large chain stores for efficient purchasing.

Understanding the purchasing journey of these end-users is paramount. The journey typically starts 9 to 18 months before the wedding date, beginning with extensive research, followed by several in-person consultations, and multiple fittings, concluding shortly before the event. Given the high emotional stakes, brand trust, peer recommendations, and the quality of customer service during fittings play a decisive role in the final decision. Therefore, marketing efforts must focus heavily on visual storytelling, demonstrating quality craftsmanship, and building robust, trustworthy relationships through personalized consultation services, addressing the complex emotional and logistical needs of these high-value transactions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.4 Billion |

| Market Forecast in 2033 | USD 96.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pronovias, Rosa Clará, Amsale, Kleinfeld Bridal, Justin Alexander, David's Bridal, Maggie Sottero Designs, Enzoani, Morilee, The Bridal Curator, BHLDN (Anthropologie), Vera Wang, Monique Lhuillier, Oscar de la Renta, Zuhair Murad, Elie Saab, Galia Lahav, Reem Acra, Temperley London, Carolina Herrera |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bridal Wear Market Key Technology Landscape

The Bridal Wear Market is undergoing a rapid technological transformation, moving away from purely manual, artisanal processes toward digital integration to enhance efficiency and customer experience. A core technology is 3D body scanning, which utilizes high-resolution sensors and software to capture precise body measurements in seconds. This technology significantly reduces the reliance on manual tape measures, thereby minimizing measurement errors—a critical factor given the high stakes and complexity of custom bridal fittings. By creating a digital avatar or "body map," designers can generate initial patterns that require fewer alterations, streamlining the production process and improving profitability by reducing labor costs associated with repeated adjustments. Furthermore, 3D scanning facilitates remote fittings, crucial for destination weddings or geographically distant clients, bridging the gap between bespoke service and global accessibility.

Augmented Reality (AR) and Virtual Reality (VR) technologies are profoundly changing the consumer shopping journey. AR applications, often accessed via smartphones or in-store mirrors, allow customers to virtually try on different gown silhouettes, necklines, and even fabric textures without physically changing clothes. This digital sampling process dramatically narrows down the customer's selection, making in-person appointments more efficient and focused. VR, utilized in high-end boutiques, can immerse the customer in a realistic virtual showroom experience, enabling them to visualize how different dresses look in various lighting conditions or simulated wedding venues. These visualization tools not only enhance customer engagement but also reduce the physical inventory burden on retailers, as fewer sample gowns are needed on the showroom floor.

On the manufacturing side, Computer-Aided Design (CAD) and advanced laser cutting systems are paramount for precision and speed. CAD software integrates seamlessly with 3D body scans to create highly optimized patterns, minimizing fabric waste, which aligns with sustainability objectives. For intricate embellishments and lace application, robotic automation is increasingly utilized in specific segments, ensuring uniformity and speed that human hands cannot consistently match. Blockchain technology is also emerging as a tool for supply chain transparency, allowing customers to verify the authenticity of high-value materials (e.g., designer lace, ethically sourced diamonds or pearls) and the ethical labor practices involved in the gown's construction, building essential trust and supporting premium pricing strategies.

Regional Highlights

- North America: This region maintains a strong market share, primarily driven by high average wedding expenditure and cultural trends that emphasize large, opulent ceremonies. The US and Canada are characterized by a strong presence of both major chain retailers (e.g., David's Bridal, BHLDN) and world-renowned luxury designers (Vera Wang, Monique Lhuillier). Key drivers include robust marketing campaigns, high consumer acceptance of credit, and rapid adoption of digital technologies like virtual try-ons. The regional market shows significant preference for modern silhouettes, often incorporating customizable elements and a strong demand for ethical fashion.

- Europe: The European market, particularly Western Europe (UK, France, Italy, Spain), is defined by its deep tradition of haute couture and specialized craftsmanship. Spain, home to giants like Pronovias and Rosa Clará, acts as a major global export hub. The region exhibits strong segmentation, with highly sophisticated, artisanal demand in countries like Italy and France, contrasting with more price-conscious, volume-driven markets in Eastern Europe. Sustainability regulations and consumer preferences for locally sourced materials are significant regional characteristics, compelling designers to prioritize European manufacturing and transparent supply chains.

- Asia Pacific (APAC): APAC represents the fastest-growing region, fueled by rising disposable incomes, urbanization, and the increasing preference for hybrid wedding ceremonies that integrate both traditional Asian garments and Western white gowns. Countries like China and India present massive untapped potential due to their demographic scale. The market is highly diverse, ranging from the ultra-luxury demand in major urban centers (Shanghai, Tokyo) to rapidly evolving mid-range consumption across Southeast Asia. Challenges include navigating diverse cultural requirements, complex distribution logistics, and managing competition from local, high-volume manufacturers.

- Latin America (LATAM): The LATAM region shows steady growth, driven by strong cultural emphasis on elaborate weddings, particularly in countries like Brazil and Mexico. The market is characterized by a preference for vibrant designs, rich fabrics, and often larger, more dramatic silhouettes. Economic volatility and currency fluctuations can, however, pose significant restraints on import-dependent luxury segments. Local designers often thrive by catering directly to specific regional tastes and utilizing domestic labor and materials, emphasizing cultural authenticity and tailored fit.

- Middle East and Africa (MEA): The MEA region is a crucial market for ultra-luxury and bespoke bridal wear, especially the Gulf Cooperation Council (GCC) countries where wedding expenditures per event are among the highest globally. Demand is concentrated in highly opulent, modest designs that often feature heavy embroidery, high-quality fabrics, and custom embellishments. The African market, while varied, is seeing increasing demand for accessible, stylish bridal wear as middle-class populations grow. Logistical challenges and political instability in certain sub-regions necessitate careful market entry strategies focusing on secure, high-end retail environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bridal Wear Market.- Pronovias

- Rosa Clará

- Amsale

- Kleinfeld Bridal

- Justin Alexander

- David's Bridal

- Maggie Sottero Designs

- Enzoani

- Morilee

- The Bridal Curator

- BHLDN (Anthropologie)

- Vera Wang

- Monique Lhuillier

- Oscar de la Renta

- Zuhair Murad

- Elie Saab

- Galia Lahav

- Reem Acra

- Temperley London

- Carolina Herrera

Frequently Asked Questions

Analyze common user questions about the Bridal Wear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current high growth rate in the luxury bridal segment?

The luxury segment's growth is primarily driven by delayed marriage ages resulting in higher cumulative income among couples, increased spending per event, and the powerful influence of social media showcasing bespoke, high-end designer gowns, making unique customization a key purchasing factor.

How is technology reshaping the traditional bridal wear shopping experience?

Technology is enhancing personalization and efficiency through 3D body scanning for accurate measurements, Augmented Reality (AR) and Virtual Reality (VR) for digital try-ons, and AI-driven recommendation engines, streamlining the selection process while maintaining the bespoke fitting quality.

What role does sustainability play in the purchasing decisions of bridal wear consumers?

Sustainability is increasingly important, particularly in North America and Europe. Consumers are seeking gowns made from ethically sourced, recycled, or organic fabrics, and they prioritize brands with transparent supply chains and ethical labor practices, often willing to pay a premium for verified traceability.

Which distribution channel is experiencing the fastest expansion in the bridal market?

The Online Stores distribution channel is experiencing the fastest expansion. While high-value gown purchases often conclude offline, the initial research, accessory purchases, and sales of mid-range and pre-owned dresses are rapidly migrating to e-commerce platforms due to convenience and wide inventory access.

What are the primary challenges faced by new entrants in the Bridal Wear Market?

New entrants face high barriers related to establishing brand trust, managing complex, specialized supply chains for luxury materials, navigating intense competition from established designer houses, and overcoming the high operational costs associated with personalized fitting and alteration services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager