Broadcast Monitor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437012 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Broadcast Monitor Market Size

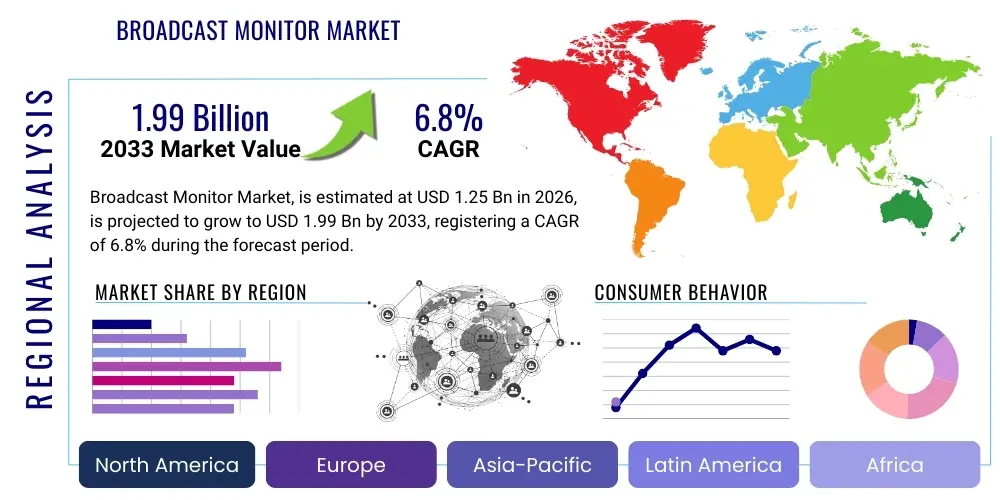

The Broadcast Monitor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.99 Billion by the end of the forecast period in 2033.

Broadcast Monitor Market introduction

The Broadcast Monitor Market encompasses specialized display devices engineered for critical visual assessment in professional broadcasting, post-production, and media creation environments. Unlike consumer displays, broadcast monitors offer precise color fidelity, accurate luminance calibration, and adherence to industry standards such as Rec. 709, DCI-P3, and Rec. 2020. These monitors are indispensable tools for quality control, ensuring compliance with technical specifications, and making critical creative decisions regarding color grading, contrast, and framing before content distribution. The core function of these devices is to provide an objective visual reference, which is paramount in a multi-platform content delivery landscape where visual consistency is non-negotiable.

The primary driving factors propelling the growth of this market include the global transition towards higher resolution formats, particularly 4K (Ultra High Definition) and 8K, which necessitate specialized monitoring capabilities to handle the increased data bandwidth and pixel density. Furthermore, the proliferation of High Dynamic Range (HDR) content across major streaming platforms and linear broadcast channels has created an urgent demand for monitors capable of accurately displaying extended luminosity ranges and wider color gamuts. These technological shifts require broadcasters and production houses to continually upgrade their monitoring infrastructure, stimulating robust market demand for advanced OLED and high-brightness LCD solutions.

Major applications of broadcast monitors span across live event production, news gathering, master control rooms, video editing suites, and digital intermediate facilities. The key benefits derived from utilizing high-end broadcast monitors include reduced production errors, adherence to international broadcast standards, and improved overall viewing experience for the end consumer. As content consumption patterns diversify, driven by Over-The-Top (OTT) services and a constant demand for visually superior content, the specialized technology offered by broadcast monitors remains central to the integrity of the professional media supply chain.

Broadcast Monitor Market Executive Summary

The Broadcast Monitor Market is experiencing dynamic shifts driven primarily by the acceleration of IP-based production workflows and the universal adoption of high-fidelity formats like 4K and HDR. Business trends indicate a strong focus on merging traditional hardware capabilities with software-defined monitoring tools, allowing for remote operation and flexible resource allocation in decentralized production environments. Key market players are heavily investing in research and development to enhance panel technology, specifically aiming for monitors that deliver perfect black levels (OLED) while simultaneously achieving the peak luminance required for HDR mastering (high-end professional LCD). Strategic mergers and partnerships focused on integrating monitoring solutions with broader broadcast infrastructure systems, such as multiviewers and production switchers, are defining the competitive landscape.

Regional trends demonstrate North America and Europe retaining leadership due to high early adoption rates of 4K/HDR technology, the presence of major broadcasting networks, and significant investment in professional post-production houses. However, the Asia Pacific (APAC) region, particularly China, Japan, and South Korea, is emerging as the fastest-growing market segment. This accelerated growth in APAC is fueled by expanding local content production, massive investment in regional sports broadcasting infrastructure, and governmental initiatives supporting the establishment of large-scale digital media hubs. Latin America and MEA are also showing moderate growth, often driven by the necessity to upgrade legacy Standard Definition (SD) and High Definition (HD) systems to modern digital standards.

Segment trends highlight the Professional Segment (often 17 inches and above, used for critical grading) showing stable growth due to the necessity for specialized HDR calibration tools. Conversely, the smaller sizes (5 to 10 inches), typically utilized in on-camera applications and field monitoring, are seeing rapid innovation in terms of portability, battery life, and high-brightness daylight viewability. Technologically, the OLED segment, despite higher initial costs, is gaining market share in color-critical applications, while advanced LCD technology continues to dominate environments where maximum brightness and larger screen sizes are prioritized. The market structure suggests continued premium pricing for reference-grade monitors, balanced by competitive pricing in the production and quality control segments.

AI Impact Analysis on Broadcast Monitor Market

User queries regarding AI’s influence on the Broadcast Monitor Market predominantly revolve around three critical themes: automation of quality control (QC), enhancement of visual fidelity, and the potential displacement of human monitoring tasks. Users are actively seeking information on how AI algorithms can automatically detect broadcast compliance errors, such as macroblocking, audio sync issues, or incorrect color space metadata, thus reducing reliance on constant manual observation. A key concern is whether AI-driven color management systems could eventually automate parts of the color grading and calibration process, impacting the demand for ultra-high-end human reference monitors. The overarching expectation is that AI will transform monitoring from a purely visual task to an intelligent, proactive system that flags deviations and suggests corrections, integrating seamlessly into existing monitoring hardware.

While AI is unlikely to replace the need for high-quality display hardware, it significantly enhances the intelligence layer operating behind the glass. AI is rapidly being deployed for tasks such as automated content recognition, real-time metadata analysis, and predictive failure detection within the signal chain. This integration allows monitors, particularly those used in master control and playout, to function as intelligent endpoints, prioritizing alerts based on severity and context derived from machine learning models trained on vast amounts of broadcast data. This shift moves the focus from passively displaying signals to actively interpreting and analyzing the quality and compliance of the displayed signal in real time.

The increasing use of AI in compression efficiency and resolution scaling (upscaling from HD to 4K or 8K) indirectly influences the monitor market. High-quality broadcast monitors are required to accurately display and assess the subtle artifacts or improvements introduced by these AI-driven processing pipelines. Furthermore, the development of software-defined monitoring solutions utilizing AI for resource optimization in cloud-based production environments is expanding the functionality of monitoring solutions beyond traditional hardware constraints, demanding greater network connectivity and processing power embedded within the monitors themselves.

- AI enables automated detection of compliance issues (e.g., loudness, gamut violations).

- Predictive failure analysis minimizes downtime in master control rooms.

- AI-enhanced metadata monitoring simplifies complex signal path management.

- Integration of AI algorithms for real-time visual assessment and artifact suppression viewing.

- Development of intelligent color management systems utilizing machine learning.

DRO & Impact Forces Of Broadcast Monitor Market

The Broadcast Monitor Market is shaped by powerful forces emanating from both technological evolution and economic necessity. Key drivers include the pervasive industry shift towards High Dynamic Range (HDR) and Ultra High Definition (UHD - 4K/8K) content creation, which mandates specialized, high-fidelity display hardware. The continuous expansion of global media consumption, particularly through high-quality streaming services (OTT), compels content creators to adhere to stricter visual standards, thereby increasing the demand for reference-grade monitors capable of accurate Rec. 2020 color space representation. Furthermore, the ongoing transition from traditional Serial Digital Interface (SDI) infrastructure to IP-based video delivery (SMPTE ST 2110) requires new monitoring solutions that are native IP-compliant, driving replacement cycles.

However, significant restraints temper the market growth. The most prominent constraint is the high initial capital expenditure associated with purchasing professional reference monitors, especially those incorporating advanced OLED or dual-cell LCD technology required for true HDR mastering. This cost factor often delays upgrades, particularly for smaller post-production facilities or broadcasters operating on tighter budgets. Another restraint is the rapid obsolescence cycle inherent in digital display technology; as new standards (like 8K or even higher frame rates) emerge, current generation equipment quickly becomes outdated, forcing users into difficult investment decisions. The complexities involved in accurate HDR calibration and the scarcity of skilled technicians who can properly manage these advanced systems also act as a bottleneck for broader market adoption.

Opportunities for growth are abundant, primarily through the expansion of cloud-based production and remote collaboration workflows. Monitoring solutions that can securely and accurately display critical video signals remotely offer significant potential. Emerging markets, especially in APAC, present untapped demand for establishing new broadcast infrastructure. Moreover, the opportunity lies in developing more cost-effective, high-performance monitoring solutions that bridge the gap between expensive reference monitors and consumer-grade displays, making advanced visual quality tools accessible to a broader base of independent content creators and educational institutions. The overall impact forces suggest a strong push toward technological advancement (high impact) balanced by moderate resistance due to high costs and technical complexities (medium impact).

Segmentation Analysis

The Broadcast Monitor Market is strategically segmented based on crucial factors including display technology, screen size, application, and resolution. Understanding these divisions is vital for analyzing specific demand pockets and technological preferences across various end-user environments. The technology segmentation distinguishes between traditional liquid crystal display (LCD) monitors, which offer versatility and high brightness, and Organic Light-Emitting Diode (OLED) monitors, which are highly valued for their perfect black levels and superior contrast, critical for reference viewing. These segments cater to fundamentally different needs within the production chain, from field work to critical mastering.

Screen size segmentation dictates the primary usage scenario; small monitors (below 10 inches) are essential for portable and on-camera applications, mid-sized monitors (10 to 25 inches) serve quality control and editing workstations, and large reference monitors (above 25 inches) are dedicated to color grading and master verification. The resolution segment is rapidly moving from HD to 4K, with 8K slowly gaining traction in high-end post-production. Furthermore, the application split between studio/fixed monitoring and mobile/field monitoring reflects the industry’s need for both stable, calibrated environments and rugged, portable solutions.

The evolution of the market is heavily influenced by the rise of HDR capability as a mandatory feature, leading to sub-segmentation within the technology categories (e.g., standard dynamic range vs. high dynamic range monitors). This detailed segmentation helps market participants tailor their offerings, addressing the specialized requirements of different end-users, such as broadcasters (focused on compliance and reliability), post-production houses (focused on fidelity and color depth), and live production teams (focused on ruggedness and low latency).

- By Technology:

- LCD (Liquid Crystal Display)

- OLED (Organic Light-Emitting Diode)

- MicroLED (Emerging)

- By Screen Size:

- Below 10 Inches (On-Camera/Field)

- 10 to 25 Inches (QC/Editing)

- Above 25 Inches (Reference/Grading)

- By Resolution:

- HD (High Definition)

- 4K (Ultra High Definition)

- 8K (Emerging)

- By Application:

- Studio Monitoring (Master Control Room, News Room)

- Post-Production and Color Grading

- Field and Live Production (OB Vans)

Value Chain Analysis For Broadcast Monitor Market

The value chain for the Broadcast Monitor Market begins with highly specialized upstream suppliers focusing on critical component manufacturing. This includes the development and fabrication of high-fidelity display panels (OLED and advanced LCD matrices), sophisticated color processing chipsets (ASICs), and precise LED backlighting systems necessary for HDR compliance. Key upstream actors are often large global display manufacturers (like Samsung, LG, and specific Japanese component suppliers) who invest heavily in achieving extreme uniformity, perfect black performance, and wide color gamut adherence. The quality and cost of these core components directly influence the final product’s performance and pricing strategy.

Midstream activities involve the Original Equipment Manufacturers (OEMs) who design, assemble, and integrate these components into a finished broadcast monitor product. This phase includes crucial steps such as engineering robust chassis suitable for studio environments, developing sophisticated calibration software, integrating necessary input interfaces (SDI, HDMI, and increasingly IP-native inputs like SMTPE 2110), and rigorous quality control testing. Integration is complex, as the OEM must ensure the monitor meets stringent international broadcast standards and interoperates seamlessly with other professional equipment like waveform monitors and vector scopes. Brand reputation, known for accuracy and longevity, plays a critical role in the midstream value proposition.

The downstream segment involves distribution and end-user adoption. Products are typically sold through highly specialized distribution channels, including professional audio-visual integrators, broadcast equipment resellers, and direct sales teams catering to major networks and production groups. Due to the technical nature of the product, post-sale support, precise calibration services, and training are integral parts of the downstream value delivery. Potential customers, including major broadcasting companies (like NBC, BBC), film studios, and high-end post-production houses, demand localized support and expert consultation before making substantial purchasing decisions, emphasizing the importance of specialized indirect distribution channels over mass-market retail.

Broadcast Monitor Market Potential Customers

Potential customers for broadcast monitors primarily comprise organizations and facilities involved in the professional production, transmission, and quality control of video content. The largest segment of end-users are major national and international broadcasting networks. These entities require a comprehensive range of monitors, from high-end reference models for master control rooms and color grading suites to mid-range production monitors deployed in news gathering, studio floors, and mobile outside broadcast (OB) vans. Their purchasing decisions are driven by reliability, adherence to regulatory standards, and integration capability with large-scale existing infrastructure, including migration to IP workflows.

The second critical customer base consists of post-production facilities and specialized visual effects (VFX) houses, which place the highest premium on color accuracy and contrast fidelity. These users are typically the main purchasers of top-tier OLED reference monitors necessary for precise cinematic color grading (HDR/Dolby Vision/HLG mastering). For these facilities, the monitor is a crucial creative tool, and investment is justified by the need to meet the strict technical delivery requirements imposed by major content distributors like Netflix, Amazon Prime Video, and major Hollywood studios. Accuracy and low calibration drift are non-negotiable specifications for this demanding segment.

Furthermore, other significant buyers include corporate media departments, educational institutions offering advanced film and media studies, government and military organizations requiring specialized video analysis, and independent production companies. While independent producers often utilize smaller, more portable field monitors, they are increasingly adopting affordable professional-grade solutions as high-resolution content creation becomes democratized. The demand from the esports and gaming industry for ultra-low latency, high-refresh-rate professional monitoring solutions is also beginning to emerge as a niche, high-growth potential customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.99 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sony Corporation, Panasonic Corporation, Canon Inc., EIZO Corporation, Flanders Scientific Inc. (FSI), Marshall Electronics, TVLogic, Atomos Limited, Blackmagic Design, Leader Electronics, BOE Technology Group, AJA Video Systems, JVCKENWOOD Corporation, Sharp Corporation, Dell Technologies, DataVideo Corporation, SmallHD (The Vitec Group), Astro Design, HP Development Company, Ltd., Konvision |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Broadcast Monitor Market Key Technology Landscape

The technology landscape of the Broadcast Monitor Market is rapidly evolving, driven primarily by the need to handle higher data rates and deliver superior image fidelity demanded by 4K, 8K, and HDR standards. One of the most significant technological advancements is the maturation of OLED panel technology in the broadcast sector. While traditionally favored for consumer devices, professional OLED monitors now offer true self-emissive pixels, resulting in perfect black levels and infinite contrast ratios, making them the gold standard for color-critical reference monitoring, especially in low-light cinematic grading environments. However, their lower peak brightness compared to LCDs remains a limiting factor in some HDR applications and bright studio settings.

To counter OLED’s advantages in contrast, manufacturers are heavily investing in advanced LCD technologies, such as dual-cell LCD and highly localized dimming backlights (Mini-LED). Dual-cell technology utilizes two LCD layers to achieve vastly improved contrast ratios, approaching OLED performance while maintaining the high luminance needed for HDR peak white specifications (1000 nits and above). Furthermore, the shift from legacy SDI connectivity to native IP interfaces, leveraging standards like SMPTE ST 2110 and ST 2022, is transforming monitor architecture. Modern broadcast monitors must now include integrated IP decoding capabilities and sophisticated synchronization tools to manage timing in distributed IP networks, moving away from purely physical connectivity.

Another crucial technological development is the implementation of advanced calibration and look-up table (LUT) management systems directly within the monitor hardware. This ensures that the monitor accurately tracks specific color spaces (like DCI-P3 or Rec. 2020) and adheres to precise gamma and EOTF curves (e.g., PQ for HDR). Features such as built-in waveform monitors, vector scopes, and advanced pixel analysis tools are now standard, reducing the need for external measurement equipment. Looking forward, MicroLED is poised to be the next revolutionary technology, promising the perfect blacks of OLED combined with the high brightness and longevity of traditional LED, though its commercial deployment in production monitors is still in nascent stages.

Regional Highlights

The Broadcast Monitor Market displays distinct regional demand patterns influenced by media maturity, technological infrastructure, and investment cycles. North America commands a significant market share, characterized by high production volume across major studios and networks, leading to a constant demand for cutting-edge 4K and HDR reference monitors. The rapid adoption of cloud-based production and distributed workflows in the US and Canada further accelerates the uptake of IP-native monitoring solutions, often serving as the benchmark for global industry standards and technological deployment.

Europe holds the second-largest share, driven by a strong public broadcasting sector (like the BBC, ARD/ZDF) and a robust independent film and television production industry. Regulatory requirements and the historical prominence of European standards (e.g., EBU standards) necessitate strict adherence to color and compliance monitoring, sustaining consistent demand for high-quality professional displays. Key growth areas are Western European countries investing heavily in replacing aging SDI infrastructure with ST 2110 IP networks, which mandates comprehensive monitor upgrades.

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is primarily attributable to significant governmental and private investment in establishing high-definition and UHD broadcasting capabilities in populous countries like India, China, and Southeast Asian nations. The surging demand for localized content, particularly from OTT platforms based in the region, fuels the need for expanded post-production facilities and subsequent demand for new monitoring equipment capable of handling modern color spaces and resolutions. Economic development and urbanization are direct contributors to increased media consumption and infrastructure spending.

- North America: Dominates high-end reference monitor sales; rapid shift to IP workflows (SMPTE ST 2110); high demand driven by major studios and streaming giants.

- Europe: Strong demand from public broadcasters; emphasis on regulatory compliance and high-fidelity standards; early adoption of advanced HDR monitoring techniques.

- Asia Pacific (APAC): Highest expected growth rate; driven by massive infrastructure expansion in China and India; increasing local content creation and OTT platform growth.

- Latin America (LATAM): Moderate growth driven by digitalization efforts and system upgrades from SD/HD to basic 4K capabilities in major regional broadcasting hubs.

- Middle East and Africa (MEA): Emerging market demand focused on establishing new broadcast facilities, particularly for sports and news production infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Broadcast Monitor Market.- Sony Corporation

- Panasonic Corporation

- Canon Inc.

- EIZO Corporation

- Flanders Scientific Inc. (FSI)

- Marshall Electronics

- TVLogic

- Atomos Limited

- Blackmagic Design

- Leader Electronics

- JVCKENWOOD Corporation

- SmallHD (The Vitec Group)

- AJA Video Systems

- Dell Technologies

- Konvision

- Sharp Corporation

- Astro Design

- DataVideo Corporation

- BOE Technology Group

- HP Development Company, Ltd.

Frequently Asked Questions

Analyze common user questions about the Broadcast Monitor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a broadcast monitor and a standard consumer display?

Broadcast monitors are engineered for critical image assessment, featuring superior color fidelity, accurate factory calibration, higher contrast ratios, support for industry color spaces (Rec. 709, Rec. 2020), and professional connectivity (SDI, ST 2110), making them essential for compliance and color grading. Consumer displays lack this level of precision and adherence to professional standards.

How is High Dynamic Range (HDR) impacting the demand for new broadcast monitors?

HDR mandates monitors capable of displaying a significantly wider luminance range and color gamut (Rec. 2020). This requires new panel technologies like high-end OLED or advanced Mini-LED LCDs, forcing broadcasters and post-production houses to upgrade their existing Standard Dynamic Range (SDR) equipment to ensure accurate mastering and quality control of HDR content.

Which display technology, OLED or LCD, is currently dominating the reference monitoring segment?

OLED technology is increasingly dominating the highly critical color grading and reference monitoring segment due to its perfect black levels and infinite contrast ratio, crucial for accurate cinematic HDR assessment. However, advanced professional LCD (with Mini-LED or dual-cell tech) still leads in applications requiring very high peak brightness for specific outdoor or studio HDR workflows.

How does the transition to IP video networks affect broadcast monitor compatibility?

The industry shift to IP protocols (like SMPTE ST 2110) requires modern broadcast monitors to incorporate native IP decoding, timing, and synchronization capabilities. Monitors must now act as IP endpoints, capable of receiving and processing compressed or uncompressed video streams over standard network infrastructure without external converters, driving an entirely new product cycle.

What is the projected growth rate (CAGR) for the Broadcast Monitor Market?

The Broadcast Monitor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven primarily by continuous technological mandates for 4K/8K resolution and the global proliferation of HDR content creation across all professional media sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager