Bromelain and Papain Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438757 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Bromelain and Papain Market Size

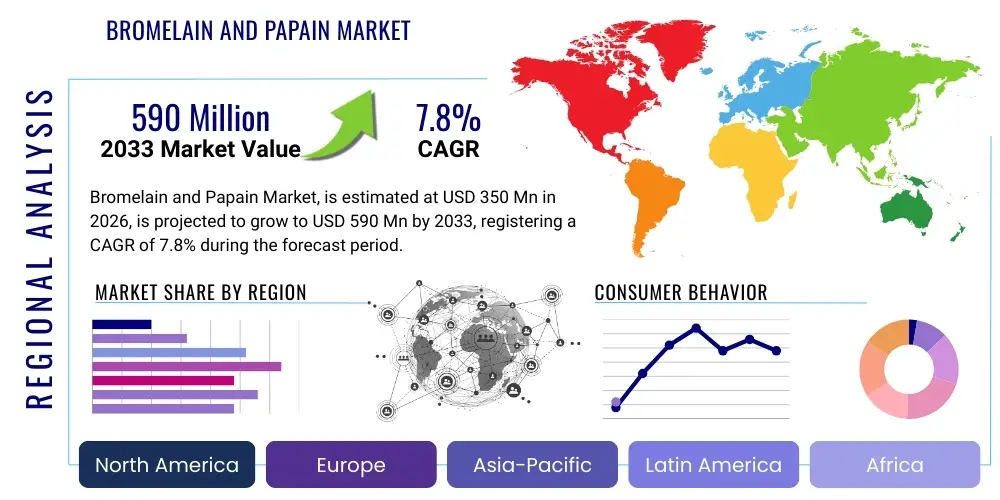

The Bromelain and Papain Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 590 Million by the end of the forecast period in 2033.

Bromelain and Papain Market introduction

The Bromelain and Papain Market encompasses the global trade and utilization of two pivotal plant-derived proteolytic enzymes, bromelain (sourced primarily from pineapple stems and fruits) and papain (derived from the latex of unripe papaya fruit). These natural enzymes possess significant capabilities in breaking down proteins, making them indispensable across various industrial applications. Their functional efficacy is rooted in their cysteine protease activity, which is harnessed commercially for diverse purposes ranging from enhancing digestive health supplements to optimizing industrial processes such as meat tenderization and textile processing.

Major applications of these enzymes span the pharmaceutical, nutraceutical, food and beverage, and cosmetic industries. In pharmaceuticals, they are valued for their anti-inflammatory, analgesic, and wound-healing properties, driving their inclusion in therapeutic formulations. The nutraceutical sector heavily utilizes them as digestive aids and systemic enzyme therapy components, capitalizing on the rising consumer preference for natural health solutions. The market benefits significantly from robust scientific validation supporting the therapeutic efficacy of these enzymes, coupled with ongoing technological advancements that improve extraction yield and purity.

Driving factors for sustained market growth include the escalating global health consciousness leading to increased demand for dietary supplements, the expanding use of enzymes as cleaner alternatives to chemical processing agents in the food industry, and the increasing geriatric population seeking natural remedies for chronic conditions. Furthermore, the functional superiority of these plant proteases in applications like brewing (chill haze prevention) and leather processing (dehairing) secures their position as essential industrial biocatalysts, ensuring strong demand growth throughout the forecast period.

Bromelain and Papain Market Executive Summary

The global Bromelain and Papain Market is experiencing significant upward momentum, largely fueled by dynamic business trends in the functional food and nutraceutical sectors. High investment in enzyme stabilization and formulation technologies is enabling producers to deliver high-purity, stable products required by stringent regulatory bodies in North America and Europe. Key market participants are focusing on vertical integration, controlling raw material sourcing (pineapple and papaya cultivation) to mitigate supply chain volatility and ensure consistent quality, a crucial factor given the seasonal nature of enzyme extraction.

Regionally, Asia Pacific (APAC) stands out as a dominant force, not only due to its established position as a primary source of raw materials but also because of the burgeoning domestic demand in countries like China and India for processed foods and affordable health supplements. North America and Europe maintain high market value due to advanced pharmaceutical research and premium pricing for high-grade, encapsulated enzyme products. The regional trend is characterized by a shift of manufacturing capacities towards low-cost economies in Southeast Asia while research and development activities remain concentrated in Western markets, focusing on clinical trials and novel applications.

Segmentation trends indicate that the pharmaceutical and nutraceutical segment holds the largest market share, driven by the strong clinical evidence for inflammation management and digestive support. The papain segment, specifically, is seeing increased adoption in cosmetic formulations for exfoliation and skin renewal, contributing significantly to its growth trajectory. Furthermore, the market is observing a trend toward customized enzyme blends, combining bromelain and papain with other proteases or digestive aids to enhance synergistic therapeutic effects, reflecting a broader movement toward personalized wellness solutions.

AI Impact Analysis on Bromelain and Papain Market

Analysis of common user questions regarding AI's influence on the Bromelain and Papain market reveals several key themes centered around process optimization, novel product discovery, and enhanced quality control. Users are primarily concerned with how AI can mitigate the inherent variability in enzyme activity, which stems from fluctuations in raw material quality due to environmental factors and cultivation practices. Furthermore, there is significant interest in utilizing predictive algorithms to forecast demand based on global health trends and consumer preferences, thereby optimizing inventory and reducing waste in the production lifecycle. Expectations are high regarding AI's capability to accelerate the identification of novel therapeutic targets where bromelain or papain might exhibit maximal efficacy, moving beyond traditional applications.

The implementation of AI and machine learning (ML) models is set to revolutionize the upstream segment of the market by enhancing the efficiency and sustainability of enzyme production. AI algorithms can analyze vast datasets concerning climate conditions, soil quality, and harvesting techniques to predict optimal times for harvesting pineapple and papaya, maximizing the concentration and purity of the target enzymes (bromelain and papain). This precision agriculture approach minimizes resource wastage and stabilizes the supply chain, which historically suffers from unpredictable yields. Downstream, ML is being applied to optimize complex purification chromatography processes, reducing operational costs and improving the overall specific activity of the final product, which is critical for pharmaceutical-grade applications.

Moreover, AI is playing an expanding role in research and development, particularly in designing personalized enzyme formulations. By analyzing individual genetic data and health profiles, AI can recommend optimal dosages or specific enzyme combinations (e.g., specific ratio of bromelain to papain) tailored to individual digestive or inflammatory conditions. This transition towards precision health care not only expands the therapeutic potential of these enzymes but also positions the manufacturers who adopt these technologies as innovators capable of delivering highly differentiated, high-value products. These technological advancements ensure that the market remains competitive and highly responsive to evolving consumer health demands.

- AI optimizes raw material sourcing by predicting optimal harvest times based on climate data, maximizing enzyme yield.

- Machine Learning models enhance extraction and purification efficiency, resulting in higher purity and reduced processing costs.

- AI facilitates the discovery of novel therapeutic uses and molecular targets for bromelain and papain through high-throughput data analysis.

- Predictive analytics improve supply chain resilience and inventory management by forecasting fluctuating global demand for enzyme supplements.

- AI assists in developing personalized medicine formulations, tailoring enzyme blends and dosages based on individual patient data.

- Automation driven by AI in quality control systems ensures compliance with strict regulatory standards for enzyme activity and stability.

DRO & Impact Forces Of Bromelain and Papain Market

The market dynamics for bromelain and papain are driven by a compelling combination of increasing consumer interest in natural health products, significant therapeutic efficacy demonstrated through clinical trials, and growing industrial applications seeking enzymatic solutions over chemical alternatives. However, these driving forces are counterbalanced by crucial restraining factors, primarily concerning the volatility of raw material supply, which is highly dependent on agricultural output, and the high capital investment required for pharmaceutical-grade purification processes. The overall impact forces suggest a market characterized by high growth potential, moderated by operational challenges related to sourcing and standardization.

Drivers: A primary driver is the widespread recognition of the health benefits associated with these enzymes, particularly their potent anti-inflammatory and digestive properties. The shift away from synthetic drugs toward natural supplements, especially in developed economies, strongly favors the adoption of bromelain and papain. Furthermore, the food processing industry utilizes these enzymes extensively for protein modification, including meat tenderization and flavor enhancement, driven by consumer demand for high-quality, naturally processed food products. Economic growth in developing regions also increases the accessibility and affordability of these supplements, further expanding the consumer base.

Restraints: The market faces significant restraints related to the seasonality and geographical concentration of pineapple and papaya cultivation. Fluctuations in crop yields due to unpredictable weather patterns or disease outbreaks can lead to sharp price increases and supply shortages for enzyme manufacturers. Moreover, maintaining the stability and activity of the enzymes during processing, storage, and transport poses a technical challenge, often requiring complex stabilization techniques that increase final product cost. Regulatory hurdles concerning classification (food additive vs. drug) across different regions also create market friction, demanding costly compliance efforts.

Opportunities: Significant growth opportunities exist in the cosmeceutical sector, where papain is increasingly used in exfoliating agents and anti-aging formulations due to its gentle protein-digesting action. Furthermore, advancements in biotechnology, specifically submerged and solid-state fermentation techniques, present opportunities to develop cost-effective, sustainable, and high-yield methods for enzyme production, reducing reliance on traditional agricultural sources. The exploration of novel applications in veterinary medicine and the continued push for systemic enzyme therapy in cancer adjunct treatment also open up lucrative avenues for market expansion.

Segmentation Analysis

The Bromelain and Papain Market is strategically segmented based on factors such as type, application, and form, providing detailed insights into demand patterns across various end-use industries. Understanding these segments is critical for manufacturers to align their production capabilities and marketing strategies with specific high-growth areas. The dominance of the application segment, specifically pharmaceuticals and nutraceuticals, reflects the strong consumer prioritization of health and wellness, which translates directly into high demand for highly purified enzyme products used in dietary supplements and prescribed treatments for inflammation and digestive disorders. The high value associated with therapeutic uses necessitates stringent quality control and high-purity standards.

The segmentation by enzyme type, bromelain versus papain, reveals distinct market trajectories driven by their chemical differences and specific functional uses. Bromelain often commands a higher price point in clinical applications due to its comprehensive anti-inflammatory profile, while papain maintains a robust position in industrial sectors like meat processing and brewing, capitalizing on its strong proteolytic activity for bulk processing. Geographically, the market complexity requires distinct strategies, with Western markets demanding premium, stabilized products and Asian markets focusing on volume and cost-efficiency for industrial uses and basic nutraceuticals. This dual structure emphasizes the need for flexible manufacturing and distribution networks capable of catering to diverse regional requirements.

The market dynamics are further refined by the Form segment (Powder vs. Liquid), where the powdered form holds a commanding position due to superior stability, easier integration into capsules and tablets, and lower transportation costs, making it the preferred choice for supplement manufacturers. However, the liquid form maintains relevance in certain topical pharmaceutical formulations and specific food processing applications requiring immediate enzymatic action. Successful market penetration depends on mastering the production of stable, high-activity enzyme powders while simultaneously innovating liquid formulations that address stability challenges through advanced encapsulation and buffering technologies.

- By Type: Bromelain, Papain

- By Application: Pharmaceuticals and Nutraceuticals, Food and Beverage, Cosmetics, Animal Feed, Other Industrial Applications

- By Form: Powder, Liquid

- By Source: Pineapple (Bromelain), Papaya (Papain)

- By Purity Grade: Technical Grade, Pharmaceutical Grade, Food Grade

Value Chain Analysis For Bromelain and Papain Market

The value chain for bromelain and papain is characterized by several complex stages, starting from the volatile agricultural supply chain (upstream) and culminating in highly regulated end-use product manufacturing (downstream). Upstream analysis focuses on the cultivation and harvesting of pineapples and papayas, primarily concentrated in tropical regions like Southeast Asia and South America. Efficiency at this stage is critical, as the quantity and quality of raw latex or stem material directly dictate the final enzyme yield and cost. Key challenges include maintaining consistent agricultural practices and ensuring rapid initial extraction to preserve enzyme activity before shipment to processing facilities.

The core processing phase involves extraction, purification, and formulation. Extraction utilizes aqueous solutions followed by complex precipitation and filtration methods. Advanced purification, often involving chromatography, is necessary to achieve pharmaceutical-grade purity, which significantly increases the production cost but also the final product value. Distribution channels are highly specialized. Direct distribution is common for large industrial buyers (meat processors, brewers) who require technical-grade enzymes in bulk. Indirect distribution, leveraging specialized chemical and ingredient distributors, serves the vast network of smaller nutraceutical and cosmetic manufacturers globally.

Downstream analysis centers on the integration of these enzymes into final consumer products. This involves high-tech capsule filling, tablet pressing, or integration into specialized topical creams and beverages. The end-users, such as pharmaceutical companies and major supplement brands, demand rigorous quality documentation and certifications. The dominance of the powder form necessitates specialized handling during formulation to prevent moisture degradation. The entire chain is subject to stringent regulatory oversight, particularly concerning safety, dosage, and claims substantiation, driving collaboration between manufacturers, distributors, and regulatory consultants to ensure market access.

Bromelain and Papain Market Potential Customers

Potential customers for bromelain and papain are highly diversified, reflecting the broad applicability of these potent proteolytic enzymes across different sectors. The largest customer base resides within the pharmaceutical and nutraceutical industries, which utilize these enzymes extensively for producing digestive aids, anti-inflammatory supplements, and systemic enzyme therapies. These customers prioritize high-purity, standardized products with validated enzyme activity, seeking suppliers capable of providing comprehensive documentation and meeting Good Manufacturing Practice (GMP) standards necessary for therapeutic applications.

The food and beverage industry represents another substantial customer segment, primarily utilizing technical-grade enzymes. Meat processors are key buyers, using papain and bromelain for meat tenderization to improve texture and palatability. Brewers rely on these enzymes for chill-haze stabilization, ensuring clarity in beer. These industrial end-users prioritize cost-efficiency, consistent bulk supply, and enzymes that function optimally under specific processing temperatures and pH levels. Demand in this sector is highly sensitive to ingredient pricing and global commodity market fluctuations.

A rapidly growing customer segment includes cosmetic and personal care product manufacturers. These companies incorporate papain into skin care products (especially exfoliants and peels) and hair removal formulations. Additionally, veterinary product manufacturers constitute a niche but important customer group, using these enzymes in animal feed to improve nutrient absorption and in topical treatments for wound care. These diverse customer needs require enzyme manufacturers to maintain a wide portfolio of products differing in purity, concentration, and formulation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 590 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | S. A. Pharmachem Pvt. Ltd., Enzyme Development Corporation, National Enzyme Company, Advanced Enzyme Technologies, E. I. du Pont de Nemours and Company (DuPont Nutrition & Biosciences), Specialty Enzymes & Probiotics, Amano Enzyme Inc., Bio-Cat Inc., Enzybel International S. A., Nature's Enzymes, X-Pure Enzymes, Mitushi Biopharma, Sigma-Aldrich (Merck KGaA), Guangxi Greatforest Enzyme Industry Co. Ltd., Nanjing Suning Bio-products Co., Ltd., Shenzhen Qianxi Bio-Tech Co., Ltd., GNC Holdings Inc., NOW Health Group Inc., Source Naturals, Inc., Solgar Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bromelain and Papain Market Key Technology Landscape

The technology landscape governing the Bromelain and Papain Market is focused primarily on enhancing extraction efficiency, ensuring enzyme stabilization, and achieving high levels of purity necessary for pharmaceutical integration. Traditional extraction methods, involving precipitation using solvents, are being refined through modern membrane filtration techniques such as ultrafiltration and microfiltration. These methods significantly improve throughput and reduce chemical residues, resulting in cleaner, higher-activity enzyme concentrates. Furthermore, the development of immobilized enzyme technology is crucial, as it allows for the reuse of the enzyme in continuous industrial processes, leading to considerable cost savings and enhanced process control, particularly in brewing and protein hydrolysis applications.

A significant technological focus is placed on enzyme stabilization during drying and formulation. Since bromelain and papain are highly susceptible to denaturation by heat, moisture, and pH variations, advanced drying techniques like lyophilization (freeze-drying) and vacuum drying are essential for producing stable enzyme powders with extended shelf life. Research into novel encapsulation technologies, including microencapsulation using biodegradable polymers, aims to protect the active enzyme core, particularly for products intended for oral administration. This ensures that the enzymes survive the acidic environment of the stomach and are released effectively in the small intestine, maximizing their therapeutic benefits.

Furthermore, genetic engineering and fermentation technology are beginning to influence the sourcing and production methods. While the majority of market supply still relies on plant extraction, advancements in recombinant DNA technology allow for the expression of bromelain or papain genes in microbial hosts (like yeast or bacteria). Although currently more costly, this recombinant approach offers the long-term potential for consistent, high-yield, and customized enzyme production that is independent of agricultural variability, thereby offering a strategic technological hedge against supply chain risks and quality fluctuation inherent in traditional plant sourcing.

Regional Highlights

- North America: North America, comprising the United States and Canada, holds a substantial share of the global Bromelain and Papain market value. This dominance is attributable to the region's highly advanced healthcare infrastructure, significant consumer expenditure on dietary supplements and functional foods, and the presence of major pharmaceutical and nutraceutical companies. The US market, in particular, exhibits high demand for premium, high-purity enzyme products, driven by proactive health management trends and an aging population seeking natural anti-inflammatory and digestive support. Regulatory clarity, although stringent, provides a stable environment for product commercialization, favoring manufacturers who invest in rigorous clinical testing and quality certification. The focus here is less on bulk industrial use and more on specialized, high-value therapeutic applications, leading to higher average selling prices.

- Europe: Europe represents a mature and highly regulated market for bromelain and papain. Demand is robust across Germany, the UK, and France, largely driven by the adoption of plant-based ingredients in medical food supplements and cosmetics. European regulations, particularly those established by the European Food Safety Authority (EFSA), dictate strict standards for purity, sourcing, and health claims, compelling manufacturers to invest heavily in traceability and quality assurance. The application of papain in the meat industry for tenderization is also significant, though the strongest growth segment remains nutraceuticals. The regional strategy for market penetration often involves partnering with local distributors who possess expertise in navigating the complex national regulatory frameworks governing herbal and enzymatic products.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth rate and dominates the market in terms of volume. This region is critical for both supply and demand. Countries like Thailand, the Philippines, India, and China are primary producers of pineapple and papaya, giving them a geographical advantage in raw material sourcing and low-cost enzyme extraction. Simultaneously, the burgeoning middle class in countries like China and India is fueling massive domestic demand for affordable food processing enzymes and dietary supplements. Furthermore, traditional Ayurvedic and Chinese medicine systems have long incorporated plant enzymes, providing cultural acceptance that accelerates market adoption. The challenge in APAC lies in standardization, as local markets often accept technical-grade enzymes for industrial applications where purity standards are less rigorous than in Western therapeutic markets. Investment in modern processing infrastructure is key to capturing high-value export opportunities.

- Latin America (LATAM): Latin America is a crucial region primarily due to its role as a key raw material supplier. Brazil, Mexico, and other Central American countries are significant producers of pineapple and papaya. While the local processing industry is developing, a large portion of the crude enzyme extract is exported for advanced purification elsewhere. Local consumption is primarily focused on industrial applications, particularly in the domestic food processing sectors. The market growth is closely tied to economic stability and foreign investment in local processing facilities aimed at reducing export reliance on crude extracts and capturing higher value through local manufacturing of purified products.

- Middle East and Africa (MEA): The MEA region currently holds the smallest market share but presents emerging opportunities. The growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by increasing disposable incomes and a growing interest in Western-style health supplements. The enzyme usage in this region is primarily import-driven, targeting the nutraceutical sector. Challenges include high logistics costs, limited local sourcing, and cultural or regulatory barriers related to supplement approval. The animal feed industry shows nascent potential for using these enzymes to improve feed efficiency in large-scale livestock operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bromelain and Papain Market.- S. A. Pharmachem Pvt. Ltd.

- Enzyme Development Corporation

- National Enzyme Company

- Advanced Enzyme Technologies

- E. I. du Pont de Nemours and Company (DuPont Nutrition & Biosciences)

- Specialty Enzymes & Probiotics

- Amano Enzyme Inc.

- Bio-Cat Inc.

- Enzybel International S. A.

- Nature's Enzymes

- X-Pure Enzymes

- Mitushi Biopharma

- Sigma-Aldrich (Merck KGaA)

- Guangxi Greatforest Enzyme Industry Co. Ltd.

- Nanjing Suning Bio-products Co., Ltd.

- Shenzhen Qianxi Bio-Tech Co., Ltd.

- GNC Holdings Inc.

- NOW Health Group Inc.

- Source Naturals, Inc.

- Solgar Inc.

Frequently Asked Questions

Analyze common user questions about the Bromelain and Papain market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary therapeutic benefits driving the demand for bromelain and papain?

The primary therapeutic benefits driving demand include their potent anti-inflammatory effects, particularly bromelain, and their efficacy as digestive aids (proteolytic activity), which assists in breaking down proteins and improving nutrient absorption in the gastrointestinal tract.

How does the sourcing of raw materials affect the pricing and stability of the enzyme market?

Raw material sourcing, primarily from agricultural crops (pineapple and papaya), introduces volatility. Fluctuations in crop yields due to climate or disease directly impact the cost of crude extract, leading to price instability and supply chain risks for enzyme manufacturers.

Which application segment accounts for the highest value share in the bromelain and papain market?

The Pharmaceuticals and Nutraceuticals application segment accounts for the highest value share due to the demand for high-purity, clinical-grade enzymes used in high-margin dietary supplements and prescription medications for inflammation and systemic enzyme therapy.

What are the key technological challenges in processing bromelain and papain?

Key technological challenges include maintaining the optimal stability and activity of the enzymes during extraction, drying, and storage, which often necessitates costly advanced techniques like lyophilization and protective microencapsulation to prevent denaturation.

Which region is the largest producer and consumer of technical-grade enzymes?

The Asia Pacific (APAC) region is the largest producer and consumer of technical-grade bromelain and papain, benefiting from abundant raw material supply and extensive usage in the regional food and beverage and industrial sectors, prioritizing volume and cost-effectiveness.

What role does papain specifically play in the cosmetics industry?

In the cosmetics industry, papain is highly valued for its gentle enzymatic exfoliating properties. It breaks down dead skin cells and proteins on the skin's surface, making it a popular active ingredient in facial peels, cleansers, and topical formulations aimed at skin renewal and anti-aging.

How do purification methods impact the final quality grade of the enzymes?

Purification methods, particularly chromatography and advanced filtration, are crucial determinants of the final quality grade. Pharmaceutical-grade enzymes require rigorous, multi-step purification to achieve high specific activity and minimal impurities, significantly differentiating them from lower-cost technical grades.

Is the market trending towards liquid or powdered forms of these enzymes?

The market predominantly favors the powdered form. Powdered enzymes offer superior long-term stability, easier handling, and lower transportation costs, making them the preferred format for incorporation into capsules, tablets, and dry industrial blends over less stable liquid formulations.

What impact does globalization have on the Bromelain and Papain supply chain?

Globalization leads to complex supply chains where raw material extraction often occurs in APAC or LATAM, while high-level purification and final product formulation are typically carried out in North America and Europe, requiring sophisticated international logistics and quality control standardization.

How is the animal feed segment utilizing bromelain and papain?

In the animal feed segment, these enzymes are used as feed additives to enhance the digestibility of protein-rich ingredients, improving nutrient absorption, reducing feed conversion ratios, and potentially mitigating gastrointestinal health issues in livestock and poultry.

Are there synthetic or recombinant alternatives challenging the market?

While most commercial supply is still plant-derived, recombinant DNA technology allows for the potential production of bioengineered enzymes in microbial systems. These synthetic alternatives offer consistent quality independent of agricultural harvests, presenting a long-term technological challenge to traditional sourcing methods.

What regulatory hurdles affect the market growth in Europe?

Regulatory hurdles in Europe include stringent requirements from EFSA regarding substantiated health claims for nutraceutical products and strict limits on pesticide residues and heavy metals, necessitating high levels of quality control throughout the production process to gain market approval.

How are AI and ML contributing to enzyme production efficiency?

AI and Machine Learning (ML) contribute by optimizing process parameters in extraction and purification, predicting optimal harvest times for raw materials based on environmental data, and reducing variability, thus enhancing overall yield and operational efficiency.

Why is bromelain often preferred over papain for systemic anti-inflammatory treatments?

Bromelain is often preferred for systemic anti-inflammatory treatments due to its complex mixture of proteases and non-proteolytic components that exhibit strong immunomodulatory and fibrinolytic activities, providing a broader therapeutic profile compared to the more straightforward proteolytic action of papain.

What are the market opportunities related to sustainable sourcing?

Opportunities related to sustainable sourcing involve optimizing agricultural practices to maximize yield with less resource input, utilizing waste materials (like pineapple stem residuals) more efficiently, and exploring sustainable fermentation methods to reduce reliance on conventional agriculture.

How does the use of bromelain and papain contribute to the clean-label trend in the food industry?

Bromelain and papain contribute to the clean-label trend by serving as natural processing aids. For example, they are used to tenderize meat or clarify beverages without the need for synthetic chemical additives, appealing directly to consumers seeking products with recognizable, natural ingredients lists.

What is the significance of the Technical Grade purity segment?

The Technical Grade purity segment is significant for high-volume industrial applications such as leather processing, brewing, and bulk meat tenderization, where the primary requirement is strong proteolytic activity at a competitive cost, rather than the extreme purity needed for medical use.

Which demographic trend most strongly influences the growth of the nutraceutical segment?

The increasing global geriatric population most strongly influences the nutraceutical segment growth, as older individuals frequently seek natural solutions for age-related inflammatory conditions and require assistance with digestive efficiency, driving demand for enzyme supplements.

How do manufacturers ensure the consistent activity units (GDU/FCCPU) across batches?

Manufacturers ensure consistent activity units by implementing strict standardization protocols, performing rigorous quality control assays at multiple stages, and using sophisticated blending techniques post-purification to normalize the enzyme concentration before final packaging and distribution.

Why are Latin American countries key players in the upstream market?

Latin American countries are key players in the upstream market because their favorable climate and large-scale agricultural production of pineapples and papayas make them primary sources of the raw plant material (stems and latex) necessary for initial crude enzyme extraction before global export.

What is the potential of systemic enzyme therapy involving these proteases?

Systemic enzyme therapy, involving high-dose oral administration of bromelain and papain, holds potential for managing systemic inflammation, reducing pain, accelerating wound healing, and potentially acting as an adjunct therapy to improve outcomes in specific chronic diseases, driving long-term pharmaceutical research.

How does competitive pricing pressure affect product differentiation?

Competitive pricing pressure forces product differentiation through innovation in formulation (e.g., enteric coating for stability) and marketing based on verifiable purity standards (pharmaceutical vs. food grade). Companies compete less on price in high-value segments and more on quality assurance and clinical data.

What is the expected long-term impact of climate change on raw material availability?

Climate change poses a long-term risk by increasing the unpredictability of tropical weather patterns, potentially leading to more frequent crop failures, reduced yields of pineapples and papayas, and subsequently driving up the cost and volatility of raw enzyme material sourcing.

How is the pharmaceutical industry utilizing the thrombolytic properties of bromelain?

The pharmaceutical industry is investigating and utilizing bromelain’s thrombolytic properties to aid in preventing excessive blood clotting and potentially reducing cardiovascular risk, positioning it as a natural adjunct or alternative to synthetic anticoagulants in specific therapeutic areas.

What is the distinction between technical grade and pharmaceutical grade papain?

The distinction lies in purity and application; pharmaceutical grade papain undergoes extensive purification (chromatography) to remove contaminants, ensuring high specific activity and safety for human ingestion, whereas technical grade is less pure and used for bulk industrial processes like leather tanning and textile desizing.

Which type of enzyme, bromelain or papain, typically commands a higher price in the market?

Bromelain generally commands a higher price, especially in therapeutic formulations, due to its broader spectrum of clinically recognized systemic benefits, including significant anti-inflammatory and edema-reducing capabilities, often requiring specialized, high-purity extraction methods.

How do manufacturers overcome the pH sensitivity of these enzymes during production?

Manufacturers overcome pH sensitivity by utilizing buffering agents and maintaining tightly controlled pH levels during the extraction and purification phases. In final product formulation, advanced technologies like enteric coatings are used to protect the enzymes from stomach acid.

What growth trend is observed in the use of these enzymes in the brewing industry?

The brewing industry sees a stable demand for these enzymes, particularly papain, which is used for chill-haze stabilization. This prevents the formation of protein-polyphenol complexes that cloud the beer when cooled, ensuring product clarity and shelf appeal.

What market role do large distributors play in the supply chain?

Large distributors act as crucial intermediaries, managing inventory risks, providing specialized handling (cold chain logistics), and offering market access to smaller end-users in specialized sectors like personal care and localized food manufacturing, bridging the gap between global producers and local buyers.

How do clinical studies influence market adoption for bromelain?

Positive and rigorous clinical studies validating the efficacy of bromelain in reducing post-operative swelling, joint pain, and inflammation are critical for securing trust among healthcare professionals, directly leading to increased recommendations and driving high-value market adoption in the pharmaceutical sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager