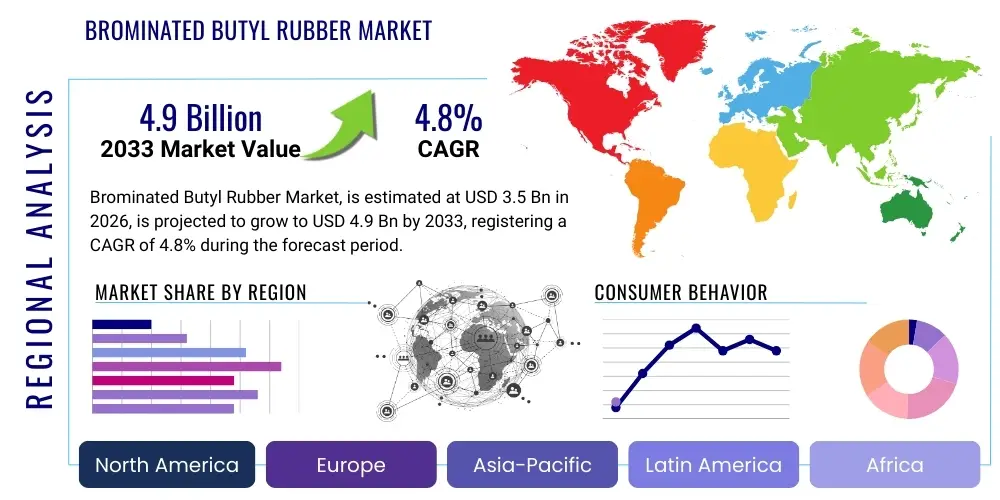

Brominated Butyl Rubber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435036 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Brominated Butyl Rubber Market Size

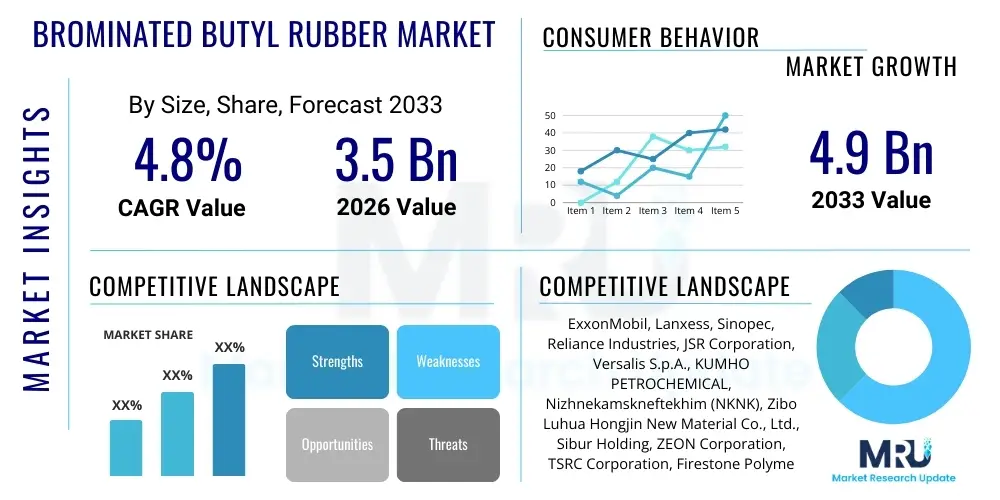

The Brominated Butyl Rubber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

Brominated Butyl Rubber Market introduction

Brominated Butyl Rubber (BIIR), a halogenated derivative of Butyl Rubber (IIR), is an elastomer synthesized through the controlled bromination of copolymerized isobutylene and isoprene. This process introduces reactive bromine atoms into the polymer backbone, significantly enhancing the rubber's properties, particularly its vulcanization rate and compatibility with unsaturated rubber matrices like Natural Rubber (NR) and Styrene-Butadiene Rubber (SBR). Historically, Butyl Rubber was known for its excellent impermeability to gases, but its low reactivity posed challenges in co-vulcanization; BIIR resolves this by providing superior cross-linking efficiency, making it the material of choice for demanding applications where heat resistance, dynamic fatigue resistance, and low air permeability are critical.

The product is highly valued across major industrial sectors, primarily driven by its application in tire manufacturing, where it is extensively used for inner liners due to its unparalleled ability to maintain tire inflation pressure over long periods, thereby improving fuel efficiency and safety. Beyond automotive, BIIR’s unique attributes—including excellent resistance to weathering, ozone, and chemicals—make it indispensable in pharmaceutical packaging, high-performance sealants, protective membranes, and specialized construction materials. The structural stability and chemical inertness offered by the brominated structure allow it to function effectively in environments characterized by extreme temperatures and aggressive media, further solidifying its market position as a specialty elastomer.

Driving factors for the Brominated Butyl Rubber Market include stringent global regulations concerning vehicular emissions and fuel efficiency, which necessitate the use of high-performance inner liners to reduce rolling resistance and maintain consistent tire pressure. Furthermore, the robust growth in the healthcare and pharmaceutical sectors, particularly the demand for high-quality elastomeric stoppers and closures that ensure product sterility and integrity, substantially contributes to market expansion. Investment in advanced compounding techniques and the pursuit of low-molecular-weight grades for specific sealant applications are also key factors shaping the technological landscape and commercial trajectory of this specialized polymer segment.

Brominated Butyl Rubber Market Executive Summary

The Brominated Butyl Rubber (BIIR) market is experiencing steady growth, underpinned by non-negotiable demand from the automotive sector, which utilizes BIIR for critical components such as tire inner liners. Business trends indicate a strong focus on sustainable manufacturing practices and the development of bio-based or partially renewable feedstock for butyl rubber production, driven by increasing consumer and regulatory pressure for eco-friendlier materials. Major multinational players are investing heavily in capacity expansion, particularly in the Asia Pacific region, to cater to the burgeoning automotive and construction markets there. Furthermore, strategic partnerships and supply chain integration—from monomer production to final polymer compounding—are defining the competitive landscape, aiming to mitigate volatility in feedstock prices, especially isobutylene.

Regionally, the Asia Pacific (APAC) dominates the consumption landscape, primarily due to the massive volume of tire production centered in countries like China, India, and Southeast Asian nations. This regional dominance is projected to accelerate as manufacturing shifts continue towards cost-effective jurisdictions. North America and Europe, while mature markets, maintain high demand for BIIR in premium applications, particularly within the pharmaceutical and specialty automotive segments (e.g., electric vehicle battery sealing and vibration damping), where adherence to strict quality and regulatory standards (like FDA and REACH) is paramount. Market segments show that the Tire Production application segment commands the largest market share, driven by universal adoption of BIIR inner liners, whereas the Pharmaceutical Closures segment exhibits the highest growth rate, reflecting global healthcare expansion.

Segment trends reveal a preference for High Molecular Weight Grade BIIR in demanding applications requiring exceptional tensile strength and durability, such as high-pressure hoses and heavy-duty truck tire components. Conversely, Low Molecular Weight Grades are gaining traction in the adhesives, sealants, and vibration damping markets, benefiting from their improved flow characteristics and ease of processing. The future growth trajectory is tied closely to advancements in compounding technology, including the adoption of nano-fillers and specialized accelerators, which further enhance BIIR’s already superior performance characteristics, pushing its adoption into new niche markets requiring specialized gas barrier properties.

AI Impact Analysis on Brominated Butyl Rubber Market

User queries regarding the impact of Artificial Intelligence (AI) on the Brominated Butyl Rubber (BIIR) market commonly revolve around optimizing polymerization processes, predicting raw material volatility (isobutylene/isoprene pricing), and accelerating the discovery of new additive formulations. Key themes include the use of AI in computational chemistry to model the complex bromination kinetics, thereby improving yield and consistency, and leveraging machine learning for predictive maintenance in large-scale polymerization reactors. Users expect AI to minimize off-spec product runs, enhance energy efficiency in highly exothermic reactions, and streamline quality control by analyzing massive data sets generated during synthesis and compounding. The primary concern remains the initial high investment cost and the necessity for specialized data science expertise to implement these AI solutions effectively within established chemical manufacturing facilities, ensuring that integration leads to tangible reductions in operational expenditure (OpEx) and improved product homogeneity.

- AI-driven optimization of polymerization reactor conditions, enhancing yield and purity consistency.

- Predictive maintenance analytics for BIIR production machinery, minimizing unexpected downtime and maximizing asset utilization.

- Machine Learning models for forecasting feedstock price fluctuations (isobutylene and isoprene), enabling proactive procurement strategies.

- Computational chemistry simulations accelerated by AI to design novel cross-linking agents and non-halogenated BIIR alternatives.

- Automated quality control systems using computer vision and sensor data fusion to detect microscopic defects in finished rubber sheets or components.

- Supply chain visibility and optimization via AI algorithms, ensuring timely delivery of BIIR products to global tire manufacturers.

DRO & Impact Forces Of Brominated Butyl Rubber Market

The dynamics of the Brominated Butyl Rubber market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market movement. A primary driver is the pervasive and non-substitutable demand from the tire industry, mandated by increasing global standards for road safety and fuel economy, which necessitate the exceptional air retention properties of BIIR for tire inner liners. Restraints often center on the inherent volatility and increasing cost of key hydrocarbon feedstocks, notably isobutylene, which pressures manufacturing margins. Opportunities arise from the rapidly expanding Electric Vehicle (EV) market, as BIIR is increasingly used in battery module sealing and noise, vibration, and harshness (NVH) mitigation components, demanding high-performance elastomers resistant to heat and chemicals, a specialty of BIIR.

Impact forces currently favoring market growth include the robust expansion of the middle class in emerging economies, leading to increased vehicular ownership and replacement tire demand. Furthermore, the stringent regulatory environment in developed nations regarding volatile organic compounds (VOCs) and material safety standards pushes manufacturers towards high-purity, halogenated elastomers for applications like medical stoppers and food contact materials. Counteracting forces include environmental concerns surrounding halogenated compounds, which, although BIIR is relatively stable, drive research into completely halogen-free alternatives, posing a long-term substitution threat if performance parity is achieved. The cyclical nature of the automotive manufacturing industry also exerts a significant short-term impact force on demand fluctuations, requiring flexible production capacities.

The market faces internal pressure from the need for continuous technological innovation to improve process efficiency, especially concerning energy consumption during polymerization and bromination. Manufacturers must consistently invest in optimizing their proprietary catalyst systems and solvent recovery processes to maintain competitiveness while meeting stricter environmental discharge limits. The balance between capitalizing on BIIR's superior performance attributes (drivers) and mitigating cost pressures associated with raw materials and environmental compliance (restraints) will ultimately determine the market's sustained growth trajectory and profitability across the forecast period.

Segmentation Analysis

The Brominated Butyl Rubber market is meticulously segmented based on key structural differences and end-user applications to provide a granular view of demand dynamics and growth pockets. Segmentation by application clearly defines the market structure, with the massive tire manufacturing sector acting as the primary consumption engine, while diverse segments like pharmaceuticals, industrial goods, and specialized construction offer high-value growth potential. Grade segmentation reflects variations in molecular weight and bromine content, directly impacting processability and end-product performance, allowing users to select optimized grades for specific mechanical or chemical requirements, such as higher tensile strength or improved cross-linking density.

Further analysis of the market segments involves assessing the relative growth rates. While tire production remains dominant in volume, high-end applications, particularly in the healthcare sector (stoppers, plungers) and specialized sealing components for emerging technologies (fuel cells, electric vehicle battery gaskets), demonstrate faster-than-average CAGR due to increasing quality standards and technological adoption. Geographic segmentation remains crucial, highlighting the dichotomy between high-volume, cost-competitive manufacturing regions (APAC) and high-specification, premium markets (North America and Europe), guiding strategic resource allocation and targeted marketing efforts by key industry players to maximize penetration across disparate market characteristics.

- By Application:

- Tire Production (Inner Liners, Sidewalls, Curing Bladders)

- Pharmaceutical Closures and Medical Plungers

- Adhesives and Sealants (Construction, Automotive)

- Protective Liners and Membranes (Chemical, Industrial)

- Dampers and Mounts (Noise, Vibration, and Harshness Reduction)

- By Grade:

- Regular Grade (Standard Bromine Content)

- Low Molecular Weight Grade (Enhanced Flow and Processability)

- High Molecular Weight Grade (Superior Strength and Durability)

- By Manufacturing Process:

- Slurry Process

- Solution Process

Value Chain Analysis For Brominated Butyl Rubber Market

The Brominated Butyl Rubber value chain commences with the upstream extraction and refining of petrochemical feedstocks, primarily isobutylene and isoprene, which are derived from crude oil or natural gas processing. This highly capital-intensive stage involves global chemical giants managing complex polymerization processes to create Butyl Rubber (IIR). The subsequent critical step is halogenation, where IIR is reacted with bromine to yield BIIR. Upstream dynamics are heavily influenced by global oil and gas prices, refining capacity, and the proprietary technology held by major petrochemical companies, which ensures a tight control over the initial raw material supply and price structure, creating a significant barrier to entry for new competitors in the manufacturing sector.

Midstream activities involve the conversion of BIIR into usable forms, often through compounding with specialized fillers (carbon black, silica), plasticizers, and vulcanization agents tailored for specific applications. The distribution channel is bifurcated: direct sales channels dominate the supply to Tier 1 tire manufacturers and large pharmaceutical companies due to the need for large, consistent volumes and highly technical support. Indirect channels, involving specialized chemical distributors, cater to smaller manufacturers, custom compounders, and regional businesses, providing inventory management and smaller batch deliveries. The efficiency of the distribution network, particularly logistics for heavy, sensitive elastomeric materials, plays a crucial role in maintaining quality and reducing time-to-market.

Downstream analysis focuses on the end-use applications, where BIIR is fabricated into final products. This stage is dominated by major global tire makers (e.g., Michelin, Bridgestone), specialized pharmaceutical packaging companies, and large industrial seal and gasket manufacturers. These end-users, acting as the ultimate buyers, possess significant bargaining power, driving demand for optimized, cost-effective grades and influencing material specifications. The integration of the value chain is critical; companies that control both the polymerization and the final compounding stages often achieve superior cost advantages and quality control, leveraging proprietary compounding recipes to meet stringent application requirements in highly competitive sectors like automotive and medical devices.

Brominated Butyl Rubber Market Potential Customers

Potential customers for Brominated Butyl Rubber are concentrated in sectors where exceptional gas impermeability, chemical resistance, and high-temperature performance are non-negotiable requirements, making the material a specialty purchase rather than a commodity. The largest segment of buyers comprises major international tire manufacturers who rely on BIIR for inner liners, sidewall components, and curing bladders, viewing the elastomer as essential for meeting modern fuel efficiency and safety standards; these buyers prioritize volume consistency, price stability, and regulatory compliance (e.g., adherence to environmental impact standards). The decision-makers in this sector are procurement specialists and materials engineers focused on minimizing rolling resistance and maximizing product lifespan.

Another significant customer segment includes pharmaceutical and medical device manufacturers, specifically those producing injectable drug packaging such as vial stoppers, syringe plungers, and bottle liners. These buyers require ultra-high purity, compliance with Pharmacopoeial standards (USP Class VI), and demonstrable chemical inertness to prevent drug contamination or leaching. For these high-value applications, quality assurance, validated material consistency, and supplier reliability significantly outweigh marginal cost differences, meaning buyers demand sophisticated technical documentation and audit support from BIIR suppliers to maintain regulatory approvals.

Additionally, specialized industrial engineering firms and automotive component suppliers constitute potential buyers, utilizing BIIR in high-performance sealants, adhesives, automotive hoses, vibration mounts, and protective equipment. These customers value the material's resistance to ozone, heat, and aggressive industrial fluids (e.g., brake fluid). The procurement process in this diverse segment often involves purchasing agents seeking highly specialized grades (e.g., low molecular weight for easy spray application, or high molecular weight for enhanced durability), emphasizing supplier flexibility and the ability to customize formulations for unique engineering challenges.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Lanxess, Sinopec, Reliance Industries, JSR Corporation, Versalis S.p.A., KUMHO PETROCHEMICAL, Nizhnekamskneftekhim (NKNK), Zibo Luhua Hongjin New Material Co., Ltd., Sibur Holding, ZEON Corporation, TSRC Corporation, Firestone Polymers, PetroChina, Formosa Plastics Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Brominated Butyl Rubber Market Key Technology Landscape

The core technology in the Brominated Butyl Rubber market centers around the specialized process of halogenating Butyl Rubber (IIR) to introduce reactive sites without substantially degrading the polymer chain, predominantly executed via the Solution Process or the Slurry Process. The Solution Process, involving the dissolution of IIR in a hydrocarbon solvent before bromination, is favored by many major players for its control over reaction kinetics and resulting polymer homogeneity, leading to high-purity, uniform BIIR suitable for stringent applications like pharmaceutical stoppers. However, this process is energy-intensive and requires sophisticated solvent recovery systems, driving innovation towards maximizing solvent efficiency and minimizing residual VOCs to comply with environmental regulations.

Recent technological advancements are focused heavily on improving the sustainability and efficiency of BIIR production. This includes the development of more effective, proprietary catalyst systems that enable lower operating temperatures and reduced reaction times during the polymerization of isobutylene and isoprene. Furthermore, manufacturers are exploring advanced mixing and compounding techniques, particularly leveraging Banbury mixers and twin-screw extruders, to ensure uniform dispersion of specialized nanofillers, such as carbon nanotubes or nanoclays. These high-performance fillers are crucial for enhancing BIIR's mechanical properties, including tensile strength and abrasion resistance, especially in demanding tire tread compounds or high-flex industrial applications, pushing the material’s performance beyond standard specifications.

Another emerging technological focus involves the production of Low Molecular Weight (LMW) BIIR grades, which are designed specifically for use as additives in coatings, specialized adhesives, and sealants. The synthesis of LMW BIIR requires meticulous control over the polymerization termination step and subsequent bromination to ensure the desired molecular weight distribution, which dictates flow characteristics and wetting properties. Furthermore, there is ongoing research into non-halogenated butyl derivatives or "green" BIIR alternatives. Although these alternatives currently struggle to match the performance and cure versatility of traditional BIIR, the technological drive is motivated by long-term environmental concerns regarding halogenated polymers, necessitating investment in advanced computational chemistry and materials science to bridge the performance gap through innovative polymer backbone design.

Regional Highlights

The regional dynamics of the Brominated Butyl Rubber market are characterized by divergent patterns of consumption and production capacity across the globe. Asia Pacific (APAC) stands out as the predominant region, driven by unparalleled growth in automotive production and infrastructural development, particularly in China, India, and Southeast Asia. The concentration of global tire manufacturing hubs in this region dictates high volume consumption of BIIR for tire inner liners, making APAC both the largest producer and consumer. Economic expansion, coupled with favorable manufacturing costs, continues to attract significant capacity investments from global BIIR suppliers, solidifying its market leadership and ensuring that any supply chain shifts or price movements in APAC have a profound global impact.

North America and Europe represent mature, high-value markets focused on premium applications and strict regulatory compliance. While overall volume growth may be slower compared to APAC, the demand for specialized, high-purity BIIR grades in the pharmaceutical, aerospace, and high-specification automotive sectors (e.g., gaskets for battery electric vehicles) remains robust. Regulatory frameworks such as REACH in Europe impose stringent material safety requirements, pushing manufacturers to innovate in terms of purity and process controls. These regions prioritize performance, material traceability, and sustainability, often willing to pay a premium for specialized grades that meet stringent environmental and health standards, thus sustaining market profitability despite intense competition.

Latin America, the Middle East, and Africa (MEA) are emerging regions exhibiting considerable potential, albeit from a smaller base. Growth in these areas is largely propelled by infrastructure projects, expanding domestic automotive assembly, and rising healthcare access. Countries in the Middle East, capitalizing on access to basic petrochemical feedstocks, are exploring opportunities to establish localized production capabilities to enhance supply security and regional self-sufficiency. However, market penetration in these regions often faces challenges related to economic volatility and reliance on imported finished products or intermediate BIIR materials, which results in fluctuating demand heavily dependent on regional economic stability and investment cycles.

- Asia Pacific (APAC): Dominates the market share due to extensive tire manufacturing capacity and rapidly expanding automotive industries in China and India.

- North America: Strong demand driven by the high-value pharmaceutical sector (stoppers and seals) and specialized automotive applications (EV components).

- Europe: Focus on premium, high-specification grades driven by stringent EU regulations (REACH) and high-performance requirements in industrial and medical sectors.

- Latin America (LATAM): Emerging market with growth tied to domestic automotive production and infrastructure development, particularly in Brazil and Mexico.

- Middle East & Africa (MEA): Growth potential linked to expanding infrastructure projects and upstream integration opportunities in feedstock-rich nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Brominated Butyl Rubber Market.- ExxonMobil

- Lanxess

- Sinopec

- Reliance Industries

- JSR Corporation

- Versalis S.p.A.

- KUMHO PETROCHEMICAL

- Nizhnekamskneftekhim (NKNK)

- Zibo Luhua Hongjin New Material Co., Ltd.

- Sibur Holding

- ZEON Corporation

- TSRC Corporation

- Firestone Polymers

- PetroChina

- Formosa Plastics Corporation

- Goodyear Chemical

- Dalian Jinzhou Chemical Co., Ltd.

- Japan Synthetic Rubber Co., Ltd. (JSR)

- Showa Denko K.K.

- Shanghai Petrochemical Company Limited

Frequently Asked Questions

Analyze common user questions about the Brominated Butyl Rubber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Brominated Butyl Rubber (BIIR) and its primary use?

Brominated Butyl Rubber (BIIR) is a halogenated synthetic elastomer derived from isobutylene and isoprene. Its primary application is in tire inner liners due to its exceptional impermeability to gases, significantly improving tire inflation retention and fuel efficiency.

How is the Electric Vehicle (EV) industry impacting the demand for BIIR?

The EV industry is positively impacting BIIR demand, as the material is increasingly used in specialized sealing applications for battery packs, charging ports, and anti-vibration mounts (NVH components) requiring high thermal stability and chemical resistance.

Which geographical region holds the largest market share for Brominated Butyl Rubber?

The Asia Pacific (APAC) region holds the largest market share for BIIR, driven by the concentration of global automotive and tire manufacturing industries, particularly in countries like China and India.

What are the key substitutes or competing materials for Brominated Butyl Rubber?

Key substitutes include standard Butyl Rubber (IIR) for less demanding applications and certain non-halogenated elastomers. However, achieving BIIR's combination of gas barrier properties and cure compatibility remains challenging for most competing materials in core applications like tire inner liners.

What is the main driver of cost fluctuations in the BIIR market?

The main driver of cost fluctuations is the price volatility of the primary raw material feedstock, isobutylene, which is derived from the refining of crude oil and natural gas, directly linking BIIR manufacturing costs to global petrochemical market movements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager