Bromine Chlorine Hydantoin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431410 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Bromine Chlorine Hydantoin Market Size

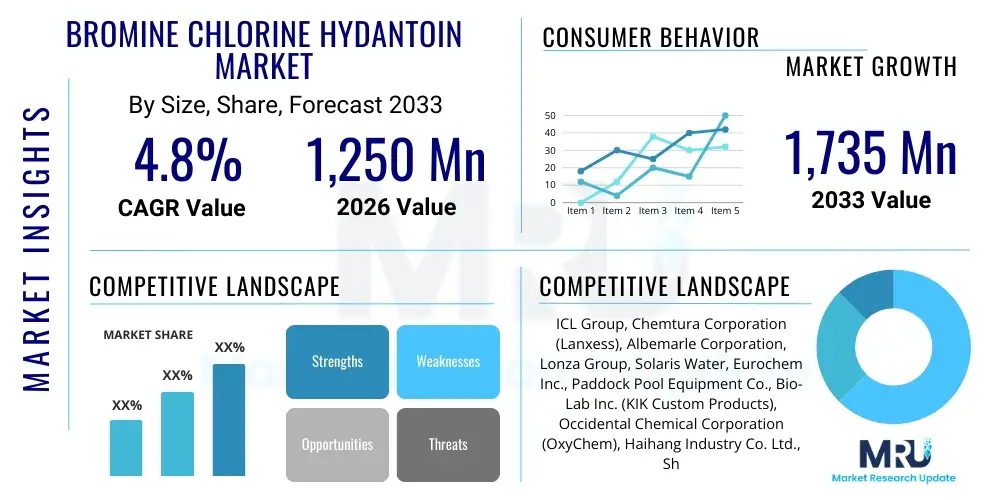

The Bromine Chlorine Hydantoin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1,250 million in 2026 and is projected to reach $1,735 million by the end of the forecast period in 2033.

Bromine Chlorine Hydantoin Market introduction

Bromine Chlorine Hydantoin (BCH), commonly utilized as a powerful halogen-based sanitizer and biocide, is a cornerstone chemical compound in water treatment and industrial disinfection processes globally. This tri-halogenated compound offers superior disinfection efficiency compared to traditional chlorination agents, providing stability and sustained release of both bromine and chlorine. The primary appeal of BCH lies in its effectiveness across varying pH levels, maintaining biocidal activity even in alkaline conditions where chlorine activity significantly diminishes. This chemical versatility allows for its deployment in complex industrial circulating water systems where pH fluctuations are common. Furthermore, its ability to rapidly destroy a broad spectrum of microorganisms, including hardier pathogens such as Legionella pneumophila, bacteria, viruses, algae, and fungi, makes it indispensable for maintaining public health and operational integrity. Its application spectrum is vast, extending from circulating water systems and cooling towers to recreational water bodies and specific sanitation protocols in food and beverage processing, underscoring its pivotal role in preventive maintenance and epidemiological control.

The product is typically manufactured through the reaction of hydantoin with halogens, primarily bromine and chlorine, resulting in a stable powder or granular form that is easily handled and dosed. BCH delivers enhanced performance characteristics, such as reduced volatility compared to liquid chlorine or hypochlorites, making it significantly safer for storage, transport, and application in commercial and residential settings. This enhanced stability translates directly into logistical and safety advantages for end-users, reducing the risk of accidental exposure and simplifying compliance with hazardous material regulations. The primary market drivers include stringent global regulations concerning public health and water quality, notably EPA and WHO guidelines that mandate minimal microbial contamination levels in both drinking and recreational water. Moreover, the increasing demand for high-performance, cost-effective industrial biocides in critical sectors such as HVAC systems, refineries, and the pulp and paper production bolsters market expansion. BCH acts as a vital intermediate chemical, ensuring the longevity and operational efficiency of industrial infrastructure by effectively preventing biofouling and associated material corrosion, which can lead to catastrophic system failures and extensive downtime.

Major applications of Bromine Chlorine Hydantoin center predominantly on municipal and residential swimming pool sanitation, where it serves as a robust alternative to unstable chlorine products due to its enhanced residual effect and resistance to UV degradation. This photochemical stability is a key selling point in outdoor aquatic environments. Beyond recreational applications, the cooling water treatment sector represents a significant, high-volume consumer, utilizing BCH to prevent microbial growth and biofilm formation that can impede critical heat exchange efficiency and cause accelerated material corrosion. The compound's versatility and efficacy in combating biofilm formation, which is notoriously resistant to many other biocides, make it indispensable across multiple industrial sectors requiring high standards of microbial control. The inherent benefits, such as low odor and reduced eye/skin irritation compared to traditional chlorine compounds, further contribute to its sustained adoption, especially in customer-facing environments such as hospitality and leisure complexes, bolstering its competitive edge in the global sanitizer market.

Bromine Chlorine Hydantoin Market Executive Summary

The Bromine Chlorine Hydantoin (BCH) market exhibits robust growth driven primarily by escalating demand in industrial water treatment and public health sanitation protocols worldwide. Business trends indicate a strong, accelerated shift towards sustainable and high-efficacy biocide solutions, favoring BCH over traditional alternatives, particularly in high-growth regions like Asia Pacific due to rapid industrialization, burgeoning population densities, and concomitant infrastructural development in water management. Key strategic movements among leading manufacturers include proactive vertical integration efforts designed to secure a reliable supply chain for critical raw materials (such as DMH and halogens) and expanding production capacities through brownfield and greenfield investments to meet the sustained surge in demand from critical infrastructure operators, including large power generation facilities and major municipal water providers. Innovation in the market is heavily focused on developing stabilized, slow-release tablet and granular formulations of BCH to enhance product longevity, improve dosing control, and maximize efficacy in large-scale applications, simultaneously ensuring compliance with increasingly stringent environmental discharge standards globally.

Regionally, Asia Pacific is strategically positioned to dominate both in terms of market share volume and growth rate, propelled by rapid urbanization, significant state-led investments in clean water infrastructure, and the massive expansion of the chemicals, textiles, and manufacturing sectors in economically powerful nations like China, India, and Indonesia. North America and Europe, while representing mature markets, maintain stable and high-value consumption, largely focusing on the systematic replacement of older, less environmentally efficient disinfection methods with advanced, regulated BCH solutions. This transition is principally driven by directives from governmental bodies such as the US Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA). Segmentally, the critical water treatment application segment continues to command the largest market share, directly correlated with global population growth, climate change-induced water stress, and the finite nature of clean water resources, necessitating highly reliable and persistent disinfection agents. Furthermore, the specialized industrial biocide segment is experiencing accelerated, high-margin growth, reflecting the increased operational demands of process industries to minimize system downtime and protect capital assets from irreversible damage caused by microbial contamination and biofouling.

Future market trends are heavily influenced by the imperative for environmental sustainability and optimized operational expenditures. This includes the strategic consolidation of smaller, localized regional players by global chemical giants aiming to achieve significant economies of scale, standardize product quality, and optimize complex international distribution networks. Furthermore, there is an increasing regulatory scrutiny on the environmental impact of persistent halogenated compounds, which compels sustained Research and Development (R&D) investments towards minimizing Disinfection Byproduct (DBP) formation and optimizing chemical usage rates through advanced delivery mechanisms. The integration of advanced computational monitoring and IoT-enabled precision dosing systems in industrial water facilities allows for highly accurate, real-time control over BCH application, thereby significantly reducing chemical waste, lowering operational costs, and guaranteeing superior biocide performance. This synergistic convergence of regulatory requirements, technological sophistication, and unwavering global public health concern will fundamentally define the competitive landscape and sustain the positive growth trajectory of the Bromine Chlorine Hydantoin market throughout the specified forecast period.

AI Impact Analysis on Bromine Chlorine Hydantoin Market

Common user questions regarding AI's influence on the Bromine Chlorine Hydantoin market revolve primarily around supply chain optimization, predictive maintenance of water systems, and developing advanced process controls for BCH synthesis and dosing. Users are keen to understand how AI-driven analytics can optimize the highly regulated production processes of hydantoin derivatives, improve inventory management for fluctuating demand from municipal clients, and refine the chemical dosage requirements in complex industrial water systems to maximize efficacy while minimizing cost and environmental footprint. The key themes include efficiency improvement, predictive quality control, and the potential for smart water management systems to automate BCH application, thereby reducing human error and chemical overuse. This user curiosity underscores the expectation that AI will transition BCH usage from reactive treatment to proactive, data-driven microbial control. The integration of neural networks with sensor data is expected to revolutionize how biocides are managed, moving from scheduled application to demand-responsive treatment, ensuring compliance with strict discharge limits.

- AI-driven predictive modeling optimizes chemical feedstock procurement, minimizing raw material cost volatility, especially for bromine and chlorine, critical inputs for BCH production.

- Machine learning algorithms enhance quality control processes by analyzing spectroscopic data in real-time, predicting inconsistencies in purity levels of intermediate hydantoin compounds and minimizing waste.

- Integration of AI in smart water grids enables real-time monitoring of microbial loads and automated, precise dosing of BCH, optimizing biocide efficacy and reducing chemical consumption by up to 15%.

- Predictive maintenance schedules for industrial water systems utilize AI to continuously analyze operational data (e.g., flow rate, pressure drop) to accurately forecast biofouling risk, triggering preemptive BCH treatment before efficiency loss occurs.

- Generative AI supports materials R&D efforts by simulating new, more stable and environmentally friendly BCH formulations and reaction pathways, significantly accelerating product innovation cycles and reducing time-to-market.

- Automation of complex regulatory compliance checks using natural language processing (NLP) ensures BCH manufacturers adhere strictly to constantly updated global chemical handling, transportation, and discharge standards.

- Optimized logistics and global distribution networks managed by AI minimize transit times, reduce carbon footprint, and lower storage costs for BCH products across international borders.

DRO & Impact Forces Of Bromine Chlorine Hydantoin Market

The dynamics of the Bromine Chlorine Hydantoin market are shaped by compelling growth drivers, significant regulatory restraints, and emerging opportunities that collectively exert measurable and influential impact forces on market expansion and profitability. Driving forces are predominantly centered around the globally increasing scarcity of safe, potable water and the resultant imperative for highly efficient recycling, cooling, and sanitation protocols across industrial and municipal sectors. The chemical superiority of BCH, including its inherent stability, low volatility, and highly effective microbial efficacy across a wider range of pH conditions compared to traditional alternatives such as sodium hypochlorite, makes it the unequivocally preferred biocide choice in challenging environments like high-temperature industrial cooling towers and closed-loop systems. This demonstrated high performance advantage ensures sustained, inelastic demand, especially in heavy manufacturing, petrochemical refining, and power generation industries where system integrity, continuous operation, and avoidance of heat transfer efficiency loss are absolute operational priorities. This reliance on BCH for asset protection reinforces its strategic position in the industrial chemical supply chain and supports consistent volume growth year-over-year.

However, market growth is significantly restrained by stringent global and regional environmental regulations governing the formation and ultimate discharge of halogenated organic byproducts (specifically Trihalomethanes (THMs) and Haloacetic Acids (HAAs)) that inevitably result from the reaction of chlorine-based biocides with organic matter in water. This regulatory pressure compels BCH manufacturers to allocate substantial capital and operational expenditure towards R&D for developing cleaner synthesis routes, investing in advanced water treatment mitigation technologies, or rapidly pursuing alternative chemical formulations that promise reduced DBP profiles. Additionally, the market faces logistical and cost volatility challenges stemming from the concentrated supply chain of key raw materials, particularly elemental bromine, which is often sourced from brine reserves in politically sensitive or geographically concentrated areas. Fluctuations in the cost of energy required for halogen synthesis and transportation further introduce significant operational uncertainties that can constrain ambitious production scaling plans and pressure end-user pricing, particularly impacting highly price-sensitive residential segments and small commercial operations.

Opportunities for market stakeholders center strategically on geographical penetration and sustained commercial expansion into rapidly developing economies across Southeast Asia, South America, and specific regions of Africa, which are currently undergoing massive, government-led infrastructural investment in modern water and wastewater management systems that mandate sophisticated disinfection solutions. There is also a substantial commercial opportunity in developing highly specialized, customized BCH formulations tailored for niche, high-value applications, such as advanced oil and gas drilling operations, horizontal fracking, and deep-sea exploration, where biocidal efficacy under extreme conditions of high pressure, variable salinity, and elevated temperature is mission-critical. Furthermore, innovation strictly adhering to 'green chemistry' principles, focusing on reducing the environmental toxicity and minimizing the formation of persistent disinfection byproducts, offers a viable pathway to establishing premium market positioning and proactively circumscribing future regulatory hurdles. The commercial adoption of proprietary, stabilized blending technologies to create hybrid sanitizers that combine the robust properties of BCH with synergistic non-halogenated agents (e.g., UV or ozone) could unlock entirely new high-margin revenue streams and address specific industry preferences for multi-barrier water treatment solutions.

Segmentation Analysis

The Bromine Chlorine Hydantoin (BCH) market is meticulously segmented based on product type, application, and geographical region, reflecting the diverse end-user requirements and the varied chemical specifications needed across different sectors. The segmentation by type primarily distinguishes products based on purity levels (e.g., 96% vs. 98% active ingredient) and physical formulation (e.g., granular, tablets, or briquettes), recognizing that large industrial applications often demand high concentrations for cost-efficiency while residential markets prioritize stability, slow dissolution, and ease of handling and dosing. The physical form determines the method of application and the required dissolution rate, significantly influencing efficacy in different water environments. Manufacturers strategically align their product portfolio purity and formulation types to maximize penetration across these distinct user profiles, addressing specific logistical and regulatory constraints inherent to each segment.

The application segmentation clearly delineates the massive consumption volume dominated by the general water treatment sector (which includes municipal swimming pools, private spas, and hotel recreational facilities) versus the highly technical, smaller volume requirements of industrial biocides. Industrial uses span complex systems such as cooling water towers (necessary for thermal management in manufacturing and power plants), pulp and paper manufacturing (for slime and odor control), and specialized applications in oil and gas exploration (for microbial corrosion prevention in pipelines and well injection systems). Understanding the distinct performance requirements of these segments is vital for manufacturers to tailor product specifications, packaging, regulatory documentation, marketing messaging, and distribution strategies effectively, ensuring optimal product alignment with the specific operational demands of the target customer base. The predominance of the water treatment segment reflects global priorities in sanitation and public health, while industrial segments showcase BCH's technical utility in preserving expensive capital assets and ensuring continuous operation.

- By Type:

- 96% Purity Bromine Chlorine Hydantoin (Standard Industrial Grade)

- 98% Purity Bromine Chlorine Hydantoin (High-Performance/Pharmaceutical Grade)

- Custom Formulation Blends (Stabilized slow-release tablets and briquettes)

- Granular and Powder Formulations (Quick dissolution products)

- By Application:

- Water Treatment (Municipal Pools, Commercial Spas, Residential Use, Water Parks)

- Industrial Biocides (Cooling Towers, Evaporative Condensers, Air Washers)

- Pulp and Paper Manufacturing (Slime control and odor prevention)

- Oil and Gas Exploration and Production (Fracking fluid preservation, reservoir souring control)

- Sanitation and Disinfectants (Institutional cleaning and commercial facility disinfection)

- Aquaculture and Agricultural Water Management (Hatchery disinfection, irrigation systems)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Southeast Asia)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Bromine Chlorine Hydantoin Market

The value chain for the Bromine Chlorine Hydantoin market begins with the critical upstream segment involving the procurement and complex synthesis of key foundational raw materials. These materials primarily include hydantoin derivatives (such as DMH, or dimethylhydantoin), elemental chlorine gas, and various bromine compounds. This initial stage is heavily capital intensive and technologically demanding, as the purity, stability, and eventual biocidal effectiveness of the final BCH product are intrinsically linked to the quality and consistency of these precursor chemicals. Upstream challenges frequently involve managing the extreme logistical difficulty, potential hazards, and volatile market pricing associated with securing and handling large volumes of bromine and chlorine, which are highly regulated substances. Major global chemical producers typically engage in strategic backward integration, acquiring or developing internal production capabilities for hydantoin and halogen sourcing to secure stable, high-volume supplies, thereby achieving greater cost control and mitigating significant supply chain vulnerability and geopolitical risks associated with key commodity inputs. The core manufacturing process involves highly precise chemical engineering steps, including carefully controlled reaction kinetics and advanced crystallization techniques to yield BCH in the desired purity level and specific physical form (e.g., fine granules or highly compressed tablets).

Moving downstream, the value chain strategically incorporates secondary processing, sophisticated formulation development, specialized packaging, and complex distribution logistics tailored to diverse international end-user markets. Formulators often specialize in customizing the BCH product, adding proprietary stabilizing agents, inert binders, or specialized polymeric coatings that enable controlled, slow-release characteristics critical for industrial longevity and residential convenience. This formulation step adds significant value, transforming the raw chemical into a differentiated, application-specific product. The distribution channel is logically segmented into two main pathways: direct sales and technical service agreements negotiated with large-volume industrial customers (e.g., major power utilities, integrated chemical complexes, and large municipal water authorities) and indirect sales facilitated through a robust network of specialized chemical distributors, regional wholesalers, and mass-market retail chains catering primarily to the decentralized residential and small commercial pool sectors. Distributors are vital partners, providing essential functions such as localized inventory management, navigating highly complex regional chemical transport regulations, and offering critical technical support and emergency response services to dispersed customers.

The overall efficiency and optimization of the distribution network, particularly the logistical challenges posed by the "last mile" delivery to often remote specialized industrial sites or decentralized networks of pool and spa supply stores, significantly impacts the total delivered cost and market accessibility of BCH. While direct distribution strategies minimize intermediary costs and allow for greater control over customer relationships, they demand substantial internal investment in specialized logistics, regulatory compliance expertise, and warehousing capability from the manufacturer. Conversely, leveraging established, accredited chemical distribution partners allows BCH manufacturers to rapidly and efficiently penetrate diverse international geographical markets, particularly those with restrictive regulatory barriers or complex import requirements. Profitability analysis along the chain suggests that the highest margins are often captured in the initial manufacturing stage due to economies of scale and proprietary synthesis technology, but specialized formulation and reliable, compliant distribution services also generate healthy, sustained margins due to the highly technical nature of the service and the essential compliance expertise required by end-users.

Bromine Chlorine Hydantoin Market Potential Customers

The potential customer base for the Bromine Chlorine Hydantoin market is intrinsically heterogeneous, spanning major governmental, industrial, and consumer sectors across the globe where effective water quality management and rigorous microbial control are absolute operational and public health imperatives. Primary, high-volume customers include professional operators of municipal and large commercial swimming pools, health club facilities, high-end resorts, and residential spas who require a highly stable, effective, and relatively user-friendly sanitizer to consistently maintain public health standards, ensure compliance with local regulations, and protect patron safety. Industrially, the most significant consumers are large enterprises managing vast volumes of circulating water. This includes major power generation facilities (thermal and nuclear), integrated chemical processing plants, food and beverage processing facilities, and large institutional HVAC system operators that rely heavily on open- and closed-loop cooling towers. These heavy industrial buyers procure substantial, consistent quantities of BCH primarily to prevent pervasive biofouling, which drastically impairs critical heat exchange efficiency, inflates energy consumption, and causes rapid material degradation and corrosion, thereby safeguarding immensely expensive capital equipment and ensuring uninterrupted operations.

Secondary, yet rapidly expanding, potential customers include manufacturers within the resource sector, notably the oil and gas industry, representing a dynamic growth area. This sector utilizes BCH for stringent microbial control in drilling muds, hydraulic fracturing water, produced water injection, and pipeline protection strategies to actively prevent microbial-induced corrosion (MIC) and the undesirable generation of toxic hydrogen sulfide (reservoir souring). Furthermore, manufacturers in the pulp and paper industry are consistent consumers, utilizing BCH as a highly effective agent for slime and biofilm control within process water systems, which directly enhances product uniformity and quality while eliminating foul odors. Institutional entities such as military bases, large university campuses, public hospitals, and specialized commercial laundries also represent consistent, volume buyers for general premise sanitation and large-scale disinfection requirements. Geographically, potential customer growth opportunities are overwhelmingly concentrated in emerging markets where new, modern infrastructure projects are being commissioned and mandated to adhere to international water quality guidelines for the first time, necessitating the reliable performance offered by BCH.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,250 million |

| Market Forecast in 2033 | $1,735 million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ICL Group, Chemtura Corporation (Lanxess), Albemarle Corporation, Lonza Group, Solaris Water, Eurochem Inc., Paddock Pool Equipment Co., Bio-Lab Inc. (KIK Custom Products), Occidental Chemical Corporation (OxyChem), Haihang Industry Co. Ltd., Shandong Xuelian Chemical Co., Ltd., Limin Chemical Co., Ltd., Great Lakes Solutions (Chemtura), Westlake Chemical Corporation, Nanjing Chemical Co., Ltd., Jiangsu Liyuan Chemical Co., Ltd., Changzhou Tronly New Electronic Materials Co., Ltd., Shouguang Hongfa Chemical Co., Ltd., Hebei Xingfei Chemical Co., Ltd., China National Chemical Corporation (ChemChina), Hebei Jianxin Chemical Co., Ltd., Kao Corporation, Makhteshim Agan Industries (ADAMA), Zhejiang NHU Co., Ltd., Shandong Minji Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bromine Chlorine Hydantoin Market Key Technology Landscape

The technology landscape within the Bromine Chlorine Hydantoin market is highly dynamic, driven by imperatives to optimize synthesis efficiency, significantly enhance product stability, and fundamentally minimize the environmental impact associated with chemical usage throughout the product lifecycle. A crucial technological focus involves the refinement and large-scale implementation of continuous flow reaction processes for the precise halogenation of hydantoin compounds. This represents a strategic departure from older, often less consistent, batch processes, allowing manufacturers to achieve substantially higher yields, superior purity consistency, and marked reductions in operational overhead costs. This modernization includes the adoption of state-of-the-art reactor designs, such as advanced continuous stirred-tank reactors (CSTRs) and specialized plug flow reactors, which facilitate precise control over temperature gradients and mixing parameters during the highly exothermic halogenation steps. Such precision ensures significantly safer operations, minimizes undesirable side reactions, and guarantees a highly uniform final product specification, which is crucial for compliance in highly regulated applications like public water systems and pharmaceuticals.

A second significant technological pillar involves proprietary formulation and material science advancements, specifically directed at developing robust, controlled, and slow-release mechanisms for the active biocide. While standard BCH dissolves relatively quickly, requiring frequent manual or automated dosing, contemporary technologies utilize advanced polymeric binders, specialized compression techniques, or microencapsulation/coating technologies to meticulously control the dissolution rate of the tablets or granules. This technological breakthrough significantly extends the effective biocidal residual period in the treated water, which is extremely advantageous in massive volume systems like large industrial cooling water circuits or community swimming pools, leading to substantial improvements in system longevity, reduced maintenance labor costs, and maximized chemical efficiency. These sophisticated, proprietary formulations often act as a key competitive differentiator among leading international manufacturers, enabling them to justify and command premium pricing based on superior, verifiable performance stability and resistance to degradation across varied environmental stresses, including high pH levels and intense solar UV exposure.

Finally, the technological evolution extends critically into the application side, embodied by the proliferation of sophisticated smart dosing and intelligent monitoring systems. The mandatory integration of highly sensitive chemical sensors, Oxidation-Reduction Potential (ORP) probes, and sophisticated Internet of Things (IoT) devices now allows water treatment facilities and large pool operators to monitor critical water quality parameters (e.g., pH, flow rate, microbial concentration) in real-time, 24/7. This high-fidelity data is fed directly into advanced Programmable Logic Controllers (PLCs) and cloud-based AI systems, which automatically calculate and initiate precise, minimal dosing of BCH in a closed-loop system. This prevents critical issues such as under-dosing (which results in microbial proliferation and system failure) and catastrophic over-dosing (leading to excessive chemical waste, high operational cost, and dangerous levels of DBP formation). These precise, data-driven control systems are essential not only for guaranteeing absolute regulatory compliance but also for maximizing the intrinsic efficacy of BCH, representing the definitive shift towards truly data-driven, optimized chemical management in both municipal and industrial water treatment sectors globally.

Regional Highlights

The geographical distribution and growth trajectory of the Bromine Chlorine Hydantoin market are highly reflective of global industrialization trends, prevailing water scarcity issues, and the maturity and stringency of regulatory frameworks governing water treatment and chemical usage across different continents.

- Asia Pacific (APAC): Positioned as the fastest-growing and currently the largest regional market by volume, driven intensely by massive governmental and private investments in public and industrial water infrastructure, rapid, large-scale industrial expansion (especially petrochemicals, textiles, and power generation), and an increasing governmental focus on establishing and enforcing stringent public sanitation standards in high-population nations like China, India, and Indonesia. This region offers the highest growth potential for both bulk and formulated BCH products.

- North America: Characterized by a highly mature market with consistently high demand derived from established recreational water management sectors (pools and spas) and highly regulated industrial cooling tower systems. Growth in this region is primarily stable, driven by the systematic replacement cycles of older, less efficient disinfection technologies and increasingly strict environmental regulations favoring highly efficient, reliable, and DBP-minimized biocides like advanced BCH formulations.

- Europe: Exhibits steady, regulated growth, heavily influenced by the rigorous requirements of the EU Biocidal Products Regulation (BPR), which mandates exhaustive testing, authorization, and demonstration of safety for all biocides sold. This regulatory stringency favors established manufacturers providing high-quality, fully compliant BCH products, specifically targeting sensitive municipal water applications, food processing disinfection, and pharmaceutical auxiliary processes.

- Latin America (LATAM): Represents a crucial emerging market with accelerating demand directly linked to rapid urbanization, development of new commercial and industrial infrastructure (including hospitality and manufacturing parks), and growing pressure on regional governments to implement modern, centralized water and wastewater treatment policies. Market penetration for BCH is accelerating as it replaces less stable, older technologies.

- Middle East and Africa (MEA): Growth is significantly concentrated in the Gulf Cooperation Council (GCC) countries, propelled by intense industrial activity (oil and gas production, mega-desalination plants, and large-scale cooling requirements) and the absolute necessity for robust cooling water treatment solutions in extremely arid, high-temperature climates where traditional chlorine products suffer rapid thermal degradation, making BCH the superior choice for stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bromine Chlorine Hydantoin Market.- ICL Group

- Chemtura Corporation (Lanxess)

- Albemarle Corporation

- Lonza Group

- Solaris Water

- Eurochem Inc.

- Paddock Pool Equipment Co.

- Bio-Lab Inc. (KIK Custom Products)

- Occidental Chemical Corporation (OxyChem)

- Haihang Industry Co. Ltd.

- Shandong Xuelian Chemical Co., Ltd.

- Limin Chemical Co., Ltd.

- Great Lakes Solutions (Chemtura)

- Westlake Chemical Corporation

- Nanjing Chemical Co., Ltd.

- Jiangsu Liyuan Chemical Co., Ltd.

- Changzhou Tronly New Electronic Materials Co., Ltd.

- Shouguang Hongfa Chemical Co., Ltd.

- Hebei Xingfei Chemical Co., Ltd.

- China National Chemical Corporation (ChemChina)

- Hebei Jianxin Chemical Co., Ltd.

- Kao Corporation

- Makhteshim Agan Industries (ADAMA)

- Zhejiang NHU Co., Ltd.

- Shandong Minji Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Bromine Chlorine Hydantoin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Bromine Chlorine Hydantoin (BCH) and its primary function in the market?

BCH is a powerful, stable halogenated compound utilized predominantly as a broad-spectrum sanitizer and biocide. Its main function is the effective disinfection and stringent control of microbial growth (including resistant bacteria, algae, and viruses) in critical water systems, notably commercial swimming pools, industrial cooling towers, and essential commercial sanitation applications, offering proven superior chemical stability and efficacy across a wide pH range compared to traditional liquid chlorine products.

Which application segment holds the largest share in the BCH market and why?

The Water Treatment segment, which incorporates disinfection for swimming pools, spas, and other recreational water bodies, currently holds the definitive largest market share. This dominance is directly attributable to increasingly stringent governmental public health mandates worldwide, high public usage volumes, and the compound's efficiency, low odor, and operational ease of use in decentralized recreational water management systems.

What are the main market drivers accelerating the growth of the BCH market through 2033?

Key market drivers include increasingly strict global regulations on mandatory water quality and public sanitation; growing, inelastic industrial demand for highly effective anti-biofouling agents crucial for preserving efficiency in cooling systems (power plants, refineries); and the strategic necessity for stable, long-lasting sanitizers in rapidly urbanizing and infrastructurally expanding emerging economies.

How do regulatory restraints impact BCH manufacturers, particularly in developed regions?

Manufacturers face significant regulatory pressure from agencies like the EPA and ECHA concerning the environmental formation and ultimate discharge of Disinfection Byproducts (DBPs) such as trihalomethanes (THMs). This mandates continuous, high-investment R&D into developing cleaner synthesis routes and DBP-mitigating formulations to ensure long-term market access and continuous compliance with stringent environmental protection laws.

Which region is expected to demonstrate the fastest growth rate for Bromine Chlorine Hydantoin and what is the reason?

The Asia Pacific (APAC) region is strongly projected to exhibit the fastest Compound Annual Growth Rate (CAGR) due to rapid industrialization, massive state-led investment in new wastewater treatment and industrial water facilities, and the large-scale expansion of industrial sectors (e.g., manufacturing, power) that demand high-volume, reliable biocide applications, particularly in China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager