Bubble Wrap Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433143 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Bubble Wrap Packaging Market Size

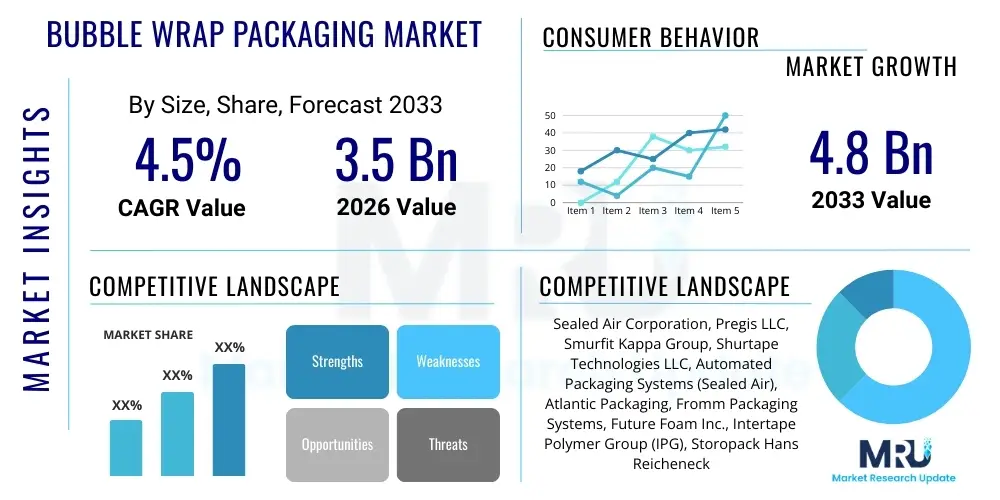

The Bubble Wrap Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.8 Billion by the end of the forecast period in 2033.

Bubble Wrap Packaging Market introduction

The Bubble Wrap Packaging Market is defined by the manufacturing, distribution, and utilization of flexible plastic sheeting characterized by encapsulated air pockets, serving as a critical protective medium during the transportation and storage of goods. Historically, the product was invented as textured wallpaper, but its superior shock-absorption capabilities quickly established its indispensable role in logistics. The base material, predominantly Low-Density Polyethylene (LDPE), provides elasticity and durability, making it an economically viable solution for protecting products against vibrational damage, impact shocks, and surface abrasion. Furthermore, the trapped air offers minor thermal insulation, beneficial for goods sensitive to rapid temperature fluctuations, extending its utility beyond purely mechanical protection.

The primary function of bubble wrap packaging is damage mitigation within the complex global supply chain. Its application spans wrapping individual items, serving as interleaving cushioning, or acting as void fill within shipping cartons. Over the last decade, product innovation has led to specialized variants, including films co-extruded with nylon barriers to significantly slow air loss, enhancing long-term cushioning integrity. The versatility of bubble wrap, available in numerous bubble diameters (e.g., 3/16 inch, 1/2 inch) and material gauges, allows users to select optimal cushioning levels tailored to product fragility and transit risk. This customization capability solidifies its position as a preferred protective solution over rigid alternatives.

Driving factors for sustained market expansion are intrinsically linked to the macroeconomic phenomenon of global digital commerce penetration and the corresponding increase in parcel shipping volumes. As consumers increasingly rely on direct-to-consumer models for everything from electronics to fresh produce, the demand for efficient, high-volume protective packaging solutions escalates. Additional impetus stems from growth in high-value manufacturing sectors, such as precision machinery and medical devices, where the high cost of product damage outweighs packaging expenditure, mandating the use of reliable protective wraps. Key benefits such as lightweighting (reducing overall shipping weight), ease of use (especially in automated systems), and relatively low cost per cubic foot of cushioning continue to cement bubble wrap’s market relevance, despite competitive challenges from alternative void fill materials. Regulatory shifts favoring circular economy principles are simultaneously fostering innovation in material composition, focusing on enhancing the recyclability and sustainable sourcing of the polymer films used.

The evolution of the product also includes the transition from traditional large rolls to on-demand inflation systems, where compact rolls of uninflated film are utilized at the point of packing. This not only minimizes storage space in fulfillment centers but also reduces inbound freight costs for the material itself. The market introduction of bubble mailers—laminated envelopes combining paper or plastic exteriors with internal bubble cushioning—has captured a significant share of the lightweight shipping market. Major applications include safeguarding consumer electronics (smartphones, tablets), protecting glassware and ceramics, securing pharmaceutical vials, and cushioning delicate automotive components. The reliance on this protective barrier is global, making the bubble wrap market a vital component of the packaging industry infrastructure, highly sensitive to overall global trade volumes and consumer spending patterns.

Bubble Wrap Packaging Market Executive Summary

The Bubble Wrap Packaging Market is exhibiting resilient growth, underpinned by fundamental shifts in retail and logistics infrastructure globally. Business trends are defined by intense competitive pressure leading to continuous product differentiation, particularly in barrier technology to extend cushion life, and significant emphasis on operational efficiency improvements in the manufacturing process. Large market players are leveraging strategic acquisitions to consolidate regional market shares and achieve vertical integration into resin production or specialized conversion capabilities. The core competitive strategies currently revolve around offering complete protective packaging portfolios that integrate bubble wrap with other solutions like foam and air pillows, providing customers with comprehensive, streamlined sourcing options. Sustainability reporting and compliance have also become mandatory strategic imperatives, dictating investment into material science research focused on PCR content incorporation.

Regional dynamics clearly illustrate a rapid power shift toward the Asia Pacific (APAC) region, which is currently registering the highest growth velocity due to favorable demographics, explosive domestic e-commerce growth, and expanding industrial manufacturing bases, notably in export-oriented economies. Conversely, North America and Europe, while representing high-value, mature markets, are experiencing growth primarily through premium, specialized products like anti-static films and advanced barrier wraps, rather than simple volume expansion. These regions are also setting global benchmarks for regulatory compliance and circular economy practices, forcing market participants to adapt quickly by offering highly certified recyclable products. The infrastructural development in emerging economies, particularly the build-out of modern logistics hubs and cold chain capabilities, further accelerates the localized demand for protective films in regions previously reliant on less effective traditional packaging methods.

Segmentation analysis confirms the overwhelming dominance of Polyethylene (PE) material, valued for its cost-to-performance ratio, while the specialized Anti-static Bubble Wrap segment demonstrates the highest revenue CAGR due to the unrelenting global demand from the sensitive electronics and data center equipment markets. In terms of end-use, the symbiotic relationship between e-commerce and third-party logistics (3PL) providers fuels the largest demand pool, necessitating massive volumes of perforated rolls and standardized bubble mailers tailored for automated insertion and handling. The market is also witnessing a trend where traditional standard bubble wrap is being increasingly supplemented or replaced by on-demand air pillows for generic void fill, pushing traditional bubble films towards more technical, product-wrapping applications where superior, consistent cushioning is required. Market profitability is tightly linked to effective management of polymer raw material procurement and optimized conversion line utilization.

Furthermore, the competitive environment is increasingly characterized by patent disputes over barrier technologies and sustainable material compositions. Manufacturers are required to navigate complex global trade policies and tariff structures that affect the cost of importing base resins and exporting finished goods. The focus on lightweighting films, achieved through improved tensile strength and advanced film structure, represents a key factor in reducing logistical costs for both manufacturers and end-users. The overall market trajectory indicates continued resilience, but profitability will increasingly depend on the successful integration of sustainability goals with operational cost efficiency, particularly in highly saturated markets where price competition is intense.

AI Impact Analysis on Bubble Wrap Packaging Market

User engagement concerning AI and the protective packaging sector frequently highlights crucial questions regarding how intelligent automation alters material choice, whether AI-driven design tools can eliminate packaging waste, and the potential for smart, connected packaging films. The underlying concern for many stakeholders is the dual effect of AI: on one hand, potentially displacing some manual packaging tasks and reducing generic void fill consumption; on the other, enhancing the use of bubble wrap by ensuring it is precisely deployed where protection is optimally required. Key user expectations focus on AI's ability to seamlessly integrate packaging decisions into complex, high-throughput logistical frameworks, optimizing protection without incurring excessive material costs or environmental impact. The debate centers on efficiency versus volume reduction.

Artificial Intelligence is profoundly influencing the demand dynamics of the bubble wrap market through applications in sophisticated inventory and demand forecasting. Machine learning algorithms analyze historical sales data, seasonal variations, and external market factors to predict packaging material needs with much higher accuracy than traditional statistical methods. This predictive capability directly translates to improved inventory management for packaging distributors and end-users, minimizing obsolete stock and ensuring a stable supply of specific bubble wrap types, such as specialized anti-static variants, precisely when production peaks occur. Beyond forecasting, AI is instrumental in enhancing manufacturing quality control. High-speed cameras and AI vision systems scrutinize the film during production, detecting minute inconsistencies in bubble size, seal integrity, and material gauge, ensuring that only high-quality, defect-free rolls enter the supply chain, thereby boosting the reliability of the protective offering.

The most immediate and transformative impact of AI is visible within fulfillment and warehousing operations. AI-powered dimensional weighing (dim weight) and scanning systems, often integrated with robotic packaging cells, instantaneously analyze product geometry and fragility characteristics. Based on predefined parameters and learned behavior from millions of prior shipments, these systems determine the ideal box size, the optimal quantity of void fill, and the precise required dimensions of protective wrap. This shift from manual, often over-packaged, cushioning to AI-optimized fit-to-size protection directly mitigates packaging waste. While this optimization might reduce the aggregate volume of generic, oversized bubble wrap used, it concurrently drives up demand for specialized, technically precise bubble films that meet stringent performance standards dictated by the automated system, reinforcing the value proposition of high-quality barrier products.

In the near future, AI and machine learning are expected to further revolutionize packaging design itself. By feeding impact and vibration data collected during transit (via IoT sensors) back into design models, AI can dynamically suggest optimal bubble geometries, material thickness, and composition to withstand specific logistical hazards encountered on particular shipping routes. This advanced, data-driven material specification moves the market away from 'one-size-fits-all' protective solutions towards bespoke, performance-verified bubble wrap designs. This iterative improvement cycle, fueled by real-world data and machine learning, ensures that bubble wrap remains a technologically relevant and highly optimized solution in the face of competitive alternatives, transforming it from a commodity product into a data-optimized protection system.

- AI-driven optimization of void fill material usage, reducing overall bubble wrap consumption per package volume by up to 15-20% in large automated logistics centers.

- Implementation of machine vision systems for precise, automated bubble wrap application and accurate product damage risk assessment in fulfillment centers.

- Predictive analytics enhancing supply chain resilience and optimizing raw material procurement for polymer resin and bubble film manufacturers, minimizing inventory holding costs.

- AI algorithms informing dynamic sizing and density specifications for specialized bubble film production, optimizing bubble structure for specific impact absorption requirements.

- Improved quality control and defect detection during the bubble film manufacturing process via deep learning models analyzing film thickness and seal integrity at high speeds.

- Integration of AI data analysis (from IoT sensors in smart packaging trials) to recommend optimal protective packaging based on product fragility, transit route risks, and environmental conditions.

- Facilitation of personalized packaging solutions tailored by AI for high-volume e-commerce clients, balancing cost, protection, and sustainability metrics.

- Development of automated packaging machinery guided by AI to select between bubble wrap, air pillows, or paper fillers based on instantaneous cost and material availability data.

- AI modeling assisting in the design of new sustainable bubble wrap materials, optimizing the polymer blend for maximum recyclability without compromising cushioning performance.

DRO & Impact Forces Of Bubble Wrap Packaging Market

The strategic dynamics of the Bubble Wrap Packaging Market are dictated by compelling Drivers, restrictive Restraints, emerging Opportunities, and powerful external Impact Forces. The primary and most influential driver is the consistent, double-digit growth of the global E-commerce sector, which necessitates billions of individual protective packages annually. This continuous high-volume demand provides a stable foundation for the market. Secondary drivers include the global expansion of logistics infrastructure, which demands standardized, resilient packaging materials, and the increased manufacturing of fragile, high-value electronics and medical equipment globally. These factors collectively push the market towards higher production volumes and continuous product performance improvement.

However, market growth is significantly challenged by stringent Restraints. Chief among these is the escalating regulatory environment targeting single-use plastics, particularly in mature markets like the EU and certain US states, which incentivizes a shift towards non-plastic, paper-based alternatives for void fill. Public perception and corporate sustainability mandates add further pressure, with large retailers actively seeking to minimize or eliminate non-recyclable plastic packaging components, forcing bubble wrap manufacturers to invest heavily in expensive, complex recycled content technologies. Additionally, intense competition from alternative cushioning solutions—such as air pillows, paper void fill systems, and foam-in-place applications—constantly pressures pricing and market share, particularly for generic bubble wrap products.

Opportunities for high-margin growth lie predominantly in the development and commercialization of next-generation sustainable materials, including bio-based polymers (e.g., starch-derived plastics) and bubble films incorporating extremely high percentages of certified Post-Consumer Recycled (PCR) content while maintaining performance integrity. A significant technological opportunity exists in specialized product segments, notably advanced Anti-static (ESD) films and proprietary barrier technology offering long-term air retention, catering to high-value, sensitive industries like semiconductors, aerospace components, and pharmaceuticals. Furthermore, market expansion into untapped emerging regional markets, supported by local manufacturing setup, presents substantial growth potential by reducing reliance on costly imports.

Impact forces currently shaping the competitive landscape are multifaceted and intense. The volatility of petrochemical feedstock prices (polyethylene resin) is a critical factor, directly influencing the manufacturing cost structure and pricing power of bubble wrap producers, often leading to rapid margin compression during periods of price spikes. Market consolidation, evidenced by strategic mergers and acquisitions among major packaging conglomerates, is another strong force that standardizes product offerings, affects distribution networks, and concentrates research and development investments. Finally, the transformative power of automation and robotics in fulfillment centers dictates the functional requirements of packaging materials; materials must be easily handled, consistently sized, and compatible with high-speed automated application equipment, penalizing non-standard or inconsistent products.

Segmentation Analysis

The granular analysis of the Bubble Wrap Packaging Market through its segmentation framework allows for precise identification of market demand pockets and future investment priorities. Segmentation by Material underscores the enduring reliance on Polyethylene (PE), specifically LDPE, which offers the ideal balance of elasticity, manufacturing ease, and cost-effectiveness. While PE dominates volume, strategic growth is anticipated in specialized materials, including specific co-polymers utilized for enhanced barrier properties and, crucially, the expanding use of materials incorporating certified high levels of recycled plastics, driven by regulatory demands and circular economy goals imposed by major end-users globally.

Product Type segmentation highlights a sophisticated market moving beyond basic cushioning. Standard Bubble Wrap remains foundational, utilized extensively across general packaging needs, but the fastest growth segment is Anti-static Bubble Wrap. This specialization is non-negotiable for industries handling sensitive electronics where electrostatic discharge must be rigorously prevented. Moreover, Bubble Mailers have evolved into a major segment, serving the growing need for efficient, standardized, and lightweight protective packaging for small items shipped via e-commerce and postal services. Differentiation is achieved through barrier technology, creating 'heavy-duty' versions that offer superior resistance to impact and puncture, justifying their higher unit cost in critical logistics applications.

Segmentation by End-Use Industry demonstrates the dependency of the bubble wrap market on the logistics ecosystem. The E-commerce and 3PL sector represents the overwhelming volume driver, demanding massive, scalable solutions optimized for rapid, automated application. The electronics and semiconductor industries constitute a highly valuable segment, characterized by lower volume but extremely high specification requirements (ESD and cleanliness standards). The steady demand from the Automotive and Pharmaceutical sectors for protecting high-value, essential components and medical supplies ensures stability and drives innovation in specialized barrier films, including sterile and customized wrapping solutions designed to withstand specific environmental challenges during transport, confirming the market's reliance on sector-specific protective integrity.

Detailed analysis of bubble size within the Standard Bubble Wrap category reveals specific performance expectations: small bubbles (3/16 inch or 1/4 inch) are preferred for surface protection and wrapping finished goods to prevent scratches, whereas medium (5/16 inch) and large bubbles (1/2 inch) are primarily used for heavy cushioning, blocking, bracing, and void fill applications. This functional separation within the product segment means manufacturers must manage diversified production lines and inventory to effectively service the entire market demand spectrum, from delicate surface protection to robust void management in heavy-duty applications, ensuring that the protective packaging solution precisely matches the required performance profile of the item being shipped.

- By Material:

- Polyethylene (PE): Dominant material, favored for cost and flexibility.

- Polypropylene (PP): Used in specific heavy-duty or chemical-resistant applications.

- Others (e.g., Bio-based Polymers, Recycled Content): Emerging high-growth segment driven by sustainability mandates and circular economy pressures.

- By Product Type:

- Standard Bubble Wrap (Small, Medium, Large Bubbles): General-purpose cushioning and surface protection.

- Anti-static Bubble Wrap (ESD Protection): Essential for electronics, semiconductors, and sensitive components, preventing electrostatic discharge damage.

- Heavy-duty Bubble Wrap: Enhanced puncture and impact resistance for industrial machinery and large components.

- Bubble Mailers (Padded Envelopes): High-volume, integrated solution for small, lightweight e-commerce goods.

- Barrier Bubble Film (Long-term air retention): Specialized product minimizing air loss, vital for extended storage or long transit times.

- By End-Use Industry:

- E-commerce and Retail: Highest volume consumer, driving demand for automated and mailer solutions.

- Logistics and Shipping (3PLs): Major purchasers of bulk rolls for large-scale void fill and protective wrapping operations across numerous clients.

- Electronics and Semiconductor: Strict requirements for anti-static and clean room packaging solutions.

- Automotive and Aerospace: Demand for securing expensive, heavy, and complex spare parts and assemblies.

- Pharmaceutical and Healthcare: Focus on sterile, high-barrier, and potentially thermal-insulating bubble packaging for sensitive supplies.

- Food and Beverages: Used primarily for protecting glass bottles and fragile containers during transportation and distribution.

- Consumer Goods: Broad applications across household products, toys, and small appliances requiring basic transit protection.

Value Chain Analysis For Bubble Wrap Packaging Market

The upstream segment of the bubble wrap value chain is critically dependent on the global petrochemical industry, specifically the production of polymer resins, predominantly LDPE. Key players in this segment are major chemical companies whose operational outputs are influenced by crude oil prices, geopolitical stability, and refining capacity. Securing stable, cost-effective feedstock supply is the foundation of profitability for bubble wrap manufacturers. Furthermore, the sourcing of specialized additives, colorants, and anti-static compounds necessary for specialized film products also constitutes a vital upstream activity, determining the final product's technical specifications and cost structure. Strategic sourcing contracts and vertical integration (where manufacturers produce their own resin or specialized compounds) provide significant competitive advantages in mitigating raw material price volatility and ensuring quality consistency.

The midstream segment involves the transformation of resin pellets into finished bubble wrap products. This includes the high-tech process of film extrusion, where molten polymer is processed into thin sheets, followed by the lamination or co-extrusion steps that create the characteristic air pockets and apply necessary barrier layers. Conversion operations, such as slitting, perforating, and converting films into rolls, sheets, or integrated products like bubble mailers, are crucial midstream activities where efficiency and automation maximize throughput. Distribution channels span a complex network: direct sales cater to high-volume industrial clients (e.g., multinational electronics firms), offering customized sizes and supply chain management services. Indirect distribution involves packaging distributors and resellers, who aggregate products from multiple manufacturers to serve fragmented small and medium-sized enterprise (SME) markets, providing essential inventory management and logistical support.

Downstream activities center on the end-user application and the emerging challenges of post-use management. E-commerce and 3PL warehouses implement the packaging, increasingly relying on on-demand inflation systems to manage volume and space efficiently. The efficacy of the value chain is ultimately measured by damage rates and customer satisfaction experienced by end-users. A major downstream constraint and focus area is the lack of standardized, effective municipal recycling infrastructure for mixed plastic films, leading to high post-consumer waste. This drives innovation toward creating mono-material bubble films that are universally accepted in standard PE film recycling streams (curbside recyclable), completing the circular economy loop. Successful value chain management requires close collaboration between film manufacturers and end-users to optimize packaging application and minimize material waste.

Bubble Wrap Packaging Market Potential Customers

The universe of potential customers for the Bubble Wrap Packaging Market is extraordinarily broad, defined primarily by any logistical requirement involving the movement or storage of fragile, high-value, or easily damaged goods. The most critical and high-volume customer segment remains the E-commerce and Mail Order Retail sector, which purchases vast quantities of bubble wrap and integrated bubble mailers. These companies operate on extremely tight fulfillment schedules and prioritize reliable supply, high compatibility with automated packaging machinery, and increasingly, verifiable environmental certifications for their protective solutions.

Secondly, major customers include manufacturers within the Technology and Electronics industries, encompassing original equipment manufacturers (OEMs), component suppliers, and repair services. For this segment, the primary driver is the need for specialized Anti-static (ESD) protection and the assurance of clean, dust-free packaging materials, often demanding certifications that go beyond standard protective requirements. These customers view packaging quality not merely as a cost but as a direct component of product quality and integrity, leading to a willingness to pay premiums for advanced, high-specification bubble films.

Furthermore, established industrial customers such as those in the Automotive Aftermarket, Precision Machinery, and Glass/Ceramics manufacturing sectors represent a stable, significant demand pool. These segments require heavy-duty, puncture-resistant bubble wraps suitable for securing large, heavy, or irregularly shaped parts, often bought in customized large rolls or sheets. The pharmaceutical and medical device manufacturing industries are also rapidly growing customer segments, requiring ultra-clean, and sometimes sterilized, protective packaging, driving demand for specialized barrier films designed for sensitive healthcare supply chains where product integrity is paramount for patient safety and regulatory compliance.

Lastly, Small and Medium-sized Enterprises (SMEs) and third-party moving and storage companies constitute a highly fragmented but critical customer base. SMEs often rely on packaging distributors for just-in-time supplies, purchasing medium-sized rolls and sheets. Moving companies utilize heavy-gauge bubble wrap for cushioning furniture and household goods. These diverse customer profiles necessitate that bubble wrap suppliers offer a wide range of product formats, volume discounts, and robust logistical support to meet varying scales of protective packaging needs, reinforcing the need for highly adaptable manufacturing and distribution strategies across the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sealed Air Corporation, Pregis LLC, Smurfit Kappa Group, Shurtape Technologies LLC, Automated Packaging Systems (Sealed Air), Atlantic Packaging, Fromm Packaging Systems, Future Foam Inc., Intertape Polymer Group (IPG), Storopack Hans Reichenecker GmbH, Veritiv Corporation, Jiffy Packaging Co., Protective Packaging Ltd., NEFAB GROUP, 3M Company, R.R. Donnelley & Sons Company, WestRock Company, DS Smith Plc, Sparsh Industries, FP International, EcoEnclose, Ranpak Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bubble Wrap Packaging Market Key Technology Landscape

The contemporary technology landscape of the Bubble Wrap Packaging Market is fundamentally characterized by innovations aimed at optimizing protective performance while simultaneously addressing critical sustainability mandates. The development of advanced barrier technology is paramount; this involves multi-layer co-extrusion processes that incorporate specialized polymer resins or nylon barriers to create a film structure with significantly reduced permeability. This technological advancement drastically slows the rate of air diffusion out of the bubbles, ensuring that the cushioning remains effective over extended transit times or long-term storage, a necessity for international shipping and warehousing, ultimately allowing for the successful reduction of overall material thickness (gauge reduction) without compromising protection.

A second crucial area of focus is sustainable material science. Manufacturers are leveraging sophisticated compounding and blending technologies to seamlessly integrate high percentages of Post-Consumer Recycled (PCR) polyethylene into the film while maintaining the clarity, tensile strength, and sealing properties required for high-speed manufacturing. Furthermore, research and investment are accelerating in the development of genuinely bio-based and compostable polymer alternatives that can mimic the protective properties of traditional PE bubble wrap, aiming to alleviate regulatory pressures concerning plastic waste. This requires extensive R&D to overcome current hurdles related to the shelf life and protective integrity of these sustainable formulations, ensuring they perform reliably in demanding logistics environments.

In the application domain, the proliferation of automated packaging machinery dictates technological development. This includes the widespread adoption of on-demand inflation systems that utilize compact rolls of flat film (which may or may not be traditional bubble wrap, but often uses similar polymer film processing technologies) to generate air cushions or bubble films instantly at the packing station. These systems feature high-speed sealing mechanisms and precise cutting capabilities, optimized for integration with AI-powered fulfillment lines. Additionally, specialized coating technologies are continuously evolving, specifically for anti-static films, ensuring consistent surface resistivity and reliable Electrostatic Discharge (ESD) protection required for handling sensitive electronics, where material failure can result in catastrophic product loss.

Moreover, the integration of Industry 4.0 principles, including IoT and sensor technology, is beginning to penetrate the protective packaging sector. Smart packaging initiatives involve embedding low-cost sensors within bubble wrap or packaging layers to monitor critical parameters like shock, vibration, humidity, and temperature during transit. The data collected provides real-time feedback to shippers and manufacturers, allowing for immediate intervention and, crucially, serving as data input for AI systems to dynamically refine packaging protocols. This technological convergence is transforming bubble wrap from a simple protective layer into a component of a data-driven, optimized supply chain protection system, requiring specialized material compatibility and manufacturing precision.

Regional Highlights

Asia Pacific (APAC): The Nexus of Growth and Manufacturing Dominance

The APAC region commands the highest growth trajectory globally for the Bubble Wrap Packaging Market, fundamentally driven by its dual status as the world’s manufacturing hub and the fastest-growing consumer market for e-commerce. Countries such as China, India, Japan, and South Korea exhibit soaring demand due to massive expansion in electronics production, automotive assembly, and pharmaceutical manufacturing. Domestic e-commerce platforms like Alibaba and Flipkart necessitate an unparalleled volume of protective packaging solutions, fueling local manufacturing capacity expansion. The logistical challenge presented by vast geographical areas and varying infrastructure quality within APAC further reinforces the demand for robust, reliable cushioning, with standard and heavy-duty bubble wrap solutions seeing massive procurement volumes.

North America: Automation, Specialization, and Sustainability Leadership

North America holds a substantial market share, characterized by high technological maturity in packaging automation. The US, in particular, leads in the adoption of automated fulfillment centers and advanced supply chain optimization technologies, which demand highly consistent, specification-driven packaging materials. Growth in this region is less about volume expansion and more focused on value addition, driven by stringent corporate sustainability goals. Leading corporations require suppliers to deliver packaging solutions that feature verifiable recycled content (PCR) and are compliant with established circular economy protocols. Specialized segments like anti-static bubble wrap and high-barrier films for pharmaceutical shipments command premium pricing and drive technological innovation within the regional market.

Europe: Regulatory Pressure and High-Value Industrial Demand

The European market, encompassing the EU and the UK, is defined by strict regulatory frameworks concerning plastic waste and environmental protection. This regulatory environment acts as a persistent push factor, compelling manufacturers to pivot rapidly toward fully recyclable and bio-degradable packaging alternatives. While this restrains traditional PE bubble wrap growth, it simultaneously creates opportunities for highly innovative, specialized packaging solutions compliant with EU directives. Consistent demand comes from the high-value sectors such as premium automotive parts manufacturing, precision engineering, and a robust pharmaceutical supply chain, which requires specialized, quality-certified protective films, particularly those with sophisticated tracking and tamper-evident features.

Latin America (LATAM) and Middle East & Africa (MEA): Emerging Market Penetration

LATAM and MEA represent emerging markets with high latent potential. Growth in these regions is correlated with increasing foreign investment in localized manufacturing and the initial stages of large-scale e-commerce penetration. Infrastructure development, including the modernization of port facilities and the establishment of sophisticated logistics centers, fuels demand for imported and locally manufactured protective packaging. Challenges include fragmented distribution channels and economic volatility, but the transition away from rudimentary packaging methods toward standardized, protective bubble wrap solutions, especially in rapidly urbanizing economies like Brazil, Mexico, and the GCC states, provides a clear avenue for future market expansion and investment.

- Asia Pacific (APAC): Highest growth trajectory fueled by e-commerce expansion in China and India; strong demand from electronics and manufacturing sectors; focus on high-volume production efficiency and localized supply chain development.

- North America: Mature market characterized by high automation adoption; strong emphasis on sustainable and recycled content bubble films; dominance of 3PL and large-scale retail distribution centers prioritizing high-performance, specialized barrier products.

- Europe: Growth influenced by stringent regulatory push for recyclability and plastic reduction; consistent demand from high-value industries like automotive and pharma; technological focus on compliant, mono-material bubble solutions and sustainable sourcing.

- Latin America (LATAM): Emerging market with increasing penetration of modern retail and logistics infrastructure; accelerated growth tied to economic stabilization and regional manufacturing expansion; opportunity for both standard and anti-static product introduction.

- Middle East & Africa (MEA): Growth stimulated by diversification of economies away from traditional sectors, leading to increased investment in logistics hubs and local manufacturing; market characterized by high import reliance for advanced materials but growing local conversion capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bubble Wrap Packaging Market.- Sealed Air Corporation

- Pregis LLC

- Smurfit Kappa Group

- Shurtape Technologies LLC

- Automated Packaging Systems (Sealed Air)

- Atlantic Packaging

- Fromm Packaging Systems

- Future Foam Inc.

- Intertape Polymer Group (IPG)

- Storopack Hans Reichenecker GmbH

- Veritiv Corporation

- Jiffy Packaging Co.

- Protective Packaging Ltd.

- NEFAB GROUP

- 3M Company

- R.R. Donnelley & Sons Company

- WestRock Company

- DS Smith Plc

- Sparsh Industries

- FP International

- EcoEnclose

- Ranpak Corp.

- Taral Plastics

- Transpaco Limited

Frequently Asked Questions

Analyze common user questions about the Bubble Wrap Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Bubble Wrap Packaging Market?

The market is projected to grow at a steady CAGR of 4.5% between 2026 and 2033, driven largely by sustained global e-commerce activity and increasing requirements for high-performance protective solutions across industrial logistics networks worldwide.

How does the shift towards sustainable packaging impact the bubble wrap industry?

The sustainability shift is a critical market driver, compelling manufacturers to invest heavily in R&D for high Post-Consumer Recycled (PCR) content integration, bio-based polymers, and the development of certified curbside-recyclable, mono-material bubble films to meet stringent corporate and regulatory environmental targets.

Which end-use industry is the primary consumer of bubble wrap packaging?

The E-commerce and Retail industry segment, closely supported by Third-Party Logistics (3PL) providers, consumes the highest volume of bubble wrap, driven by the massive scale of individual parcel shipments and the operational necessity for cost-effective, high-speed cushioning solutions.

What are the key technological advancements transforming bubble wrap packaging?

Key technological advancements include advanced barrier technologies (multi-layer films) for enhanced air retention and subsequent material lightweighting, along much with the sophisticated integration of automated on-demand inflation systems compatible with high-speed, data-driven fulfillment processes globally.

How is AI influencing the future consumption of protective bubble film?

AI systems primarily optimize the application process. While AI-driven dimensioning and robotics reduce excess, generic void fill, they simultaneously increase demand for specialized, high-performance bubble wrap (like anti-static or barrier films) where precision protection is determined to be mandatory for high-value items.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager