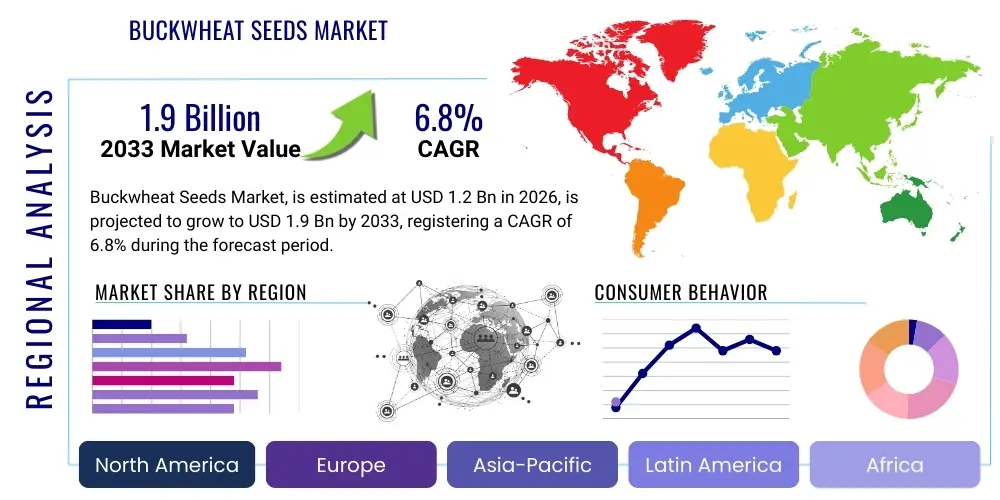

Buckwheat Seeds Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436230 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Buckwheat Seeds Market Size

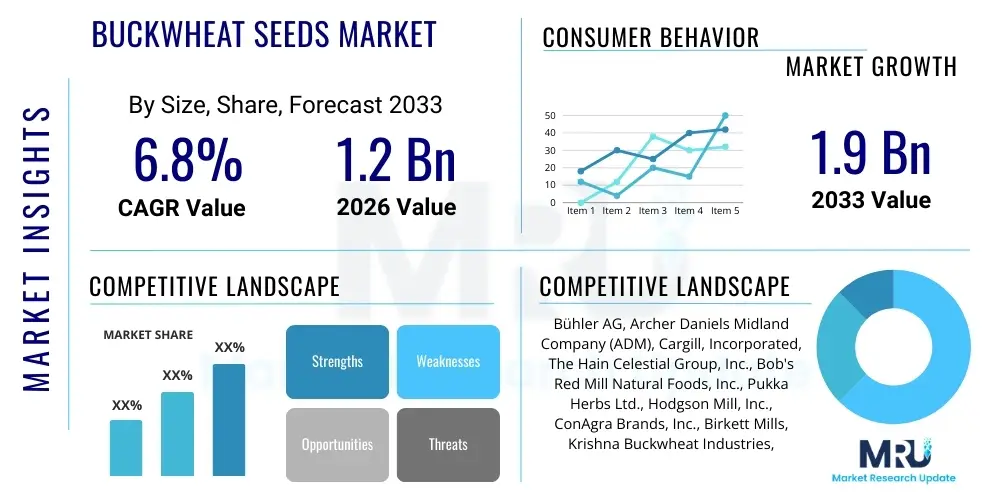

The Buckwheat Seeds Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033.

Buckwheat Seeds Market introduction

The Buckwheat Seeds Market encompasses the cultivation, processing, distribution, and consumption of various species of buckwheat (primarily Fagopyrum esculentum). Buckwheat, despite its name, is not a type of wheat but is categorized as a pseudo-cereal, highly valued for its exceptional nutritional profile, including high levels of essential amino acids, fiber, and potent antioxidants like rutin. Its inherent gluten-free nature positions it as a critical ingredient in specialized dietary markets, catering specifically to individuals suffering from celiac disease or gluten sensitivity, thereby underpinning significant growth in Western consumer segments. The versatility of buckwheat seeds allows for their application across multiple sectors, transforming into products such as flour, groats, noodles (soba), teas, and extracts used in nutraceuticals and cosmetics.

Market expansion is fundamentally driven by a global shift towards healthier, plant-based diets and the increasing awareness surrounding the digestive and cardiovascular benefits associated with consuming ancient grains and pseudo-cereals. Developing economies in Asia Pacific remain the primary producers and traditional consumers, utilizing buckwheat in staple foods and traditional medicine. Conversely, consumption growth is skyrocketing in North America and Europe, where consumers are actively seeking 'clean label' and functional food ingredients. Furthermore, the sustainable agricultural practices often associated with buckwheat cultivation, such as its ability to thrive in poor soils and its function as a natural cover crop, enhance its appeal to environmentally conscious producers and consumers, further accelerating market penetration across diverse application segments.

Major applications of buckwheat seeds span the food and beverage industry, where they are used extensively in baking, breakfast cereals, and specialty snacks; the animal feed sector, particularly for poultry and livestock due to their high protein content; and the burgeoning pharmaceutical and nutraceutical sectors, leveraging the anti-inflammatory and antioxidant properties of buckwheat extracts. The driving factors include favorable government initiatives promoting crop diversification, advancements in processing technologies to enhance flavor and shelf life, and aggressive marketing campaigns highlighting its superfood status. These combined forces are expected to maintain robust demand throughout the forecast period, transitioning buckwheat from a niche commodity to a mainstream dietary component.

Buckwheat Seeds Market Executive Summary

The Buckwheat Seeds Market is characterized by robust business trends centered on sustainability, functional food development, and expansion in gluten-free applications. Key business dynamics involve substantial investment in sustainable farming practices, including organic certification, to meet the premium demands of developed markets. Furthermore, major food processing companies are actively integrating buckwheat derivatives into mainstream products, diversifying away from traditional wheat and rice bases. This trend is amplified by the proliferation of innovative product forms, such as ready-to-eat buckwheat snacks and specialized protein powders derived from the pseudo-cereal, optimizing consumer convenience and catering to the busy lifestyle demographic. Supply chain resilience is a critical focus area, with companies seeking dual sourcing strategies to mitigate risks associated with regional climatic variability and geopolitical tensions that could affect key producing nations.

Regional trends indicate a clear duality: Asia Pacific (specifically China, Russia, and Kazakhstan) continues to dominate global production volumes, ensuring steady supply, but growth in consumption value is significantly higher in North America and Europe. North American markets exhibit strong demand driven by consumer health consciousness and established gluten-intolerance diagnostics, translating into premium pricing for certified gluten-free buckwheat products. European markets are witnessing accelerated adoption, fueled by stringent regulatory standards favoring non-GMO and organic ingredients, particularly in Germany and France. Meanwhile, emerging markets in Latin America and the Middle East are beginning to show promise, driven by urbanization and rising disposable incomes leading to greater adoption of health-focused imported foods, offering new frontiers for market expansion and distribution network establishment.

Segmentation trends highlight the dominance of the Food and Beverages application segment, particularly within the flour and groats subsegments, reflecting its utility in both mainstream and specialty baking. Tartary buckwheat is gaining prominence over common buckwheat due to its superior rutin content, positioning it strongly within the nutraceutical and functional food space, leading to higher average selling prices for this variety. The distribution channel analysis shows a significant and accelerated transition towards online retail platforms, which offer consumers greater variety, transparency regarding sourcing, and targeted marketing of health benefits. This shift is reshaping traditional supply chain roles, putting pressure on conventional brick-and-mortar retailers to enhance their specialty and organic offerings to remain competitive against agile e-commerce competitors focusing on niche, health-conscious consumers.

AI Impact Analysis on Buckwheat Seeds Market

Analysis of common user questions regarding the influence of Artificial Intelligence (AI) in the buckwheat seeds domain reveals major themes revolving around optimizing agricultural yield, enhancing quality control, and improving supply chain transparency. Users frequently inquire about how AI-driven predictive analytics can mitigate the risks associated with buckwheat's high susceptibility to climate variations, particularly frost. There is also significant interest in using machine learning models to identify optimal harvesting times and processing parameters (like dehulling efficiency) to maximize yield and maintain nutritional integrity. Consumers and businesses alike are concerned with ensuring the purity and traceability of gluten-free products, prompting questions about AI’s role in real-time supply chain monitoring and fraud detection. Key expectations include leveraging AI for advanced market forecasting to stabilize pricing and reduce waste throughout the value chain.

The implementation of AI algorithms, particularly in precision agriculture, is revolutionizing buckwheat cultivation. AI-powered drone imagery and IoT sensors are utilized to monitor soil health, water requirements, and pest outbreaks with unprecedented accuracy. This allows farmers to apply resources only where needed, significantly reducing operational costs and minimizing environmental impact, which aligns perfectly with buckwheat's sustainable image. Furthermore, machine learning models analyze historical climate data and current weather patterns to provide dynamic planting and harvesting recommendations, directly addressing the crop’s sensitivity to environmental fluctuations. This technology adoption is crucial for large-scale commercial farming operations seeking consistency and efficiency, potentially stabilizing the global supply of premium buckwheat varieties.

Beyond the farm, AI plays a pivotal role in the processing and commercialization stages. In the milling process, AI vision systems can rapidly inspect buckwheat groats for defects, foreign materials, and consistency, ensuring that the final product meets stringent food safety and quality standards, which is vital for maintaining high-value product lines such as organic flour and nutraceutical extracts. Additionally, AI-driven market intelligence tools are essential for SEO/AEO optimization of digital content, helping processors and retailers understand niche consumer demand, predict optimal inventory levels across different regional markets, and execute highly targeted marketing campaigns based on detailed demographic and health-trend data. This integration of AI optimizes both the efficiency of production and the effectiveness of market outreach.

- AI optimizes irrigation and nutrient management using predictive climate models, enhancing yield stability.

- Machine learning algorithms improve genetic selection for frost resistance and higher rutin content in new buckwheat strains.

- Real-time monitoring via AI-integrated IoT sensors ensures optimal storage conditions, minimizing post-harvest losses and maintaining seed quality.

- AI-driven supply chain platforms enhance traceability, crucial for maintaining organic and gluten-free certification integrity and combating counterfeiting.

- Predictive pricing models utilizing AI help processors and distributors hedge against market volatility caused by unpredictable harvests.

DRO & Impact Forces Of Buckwheat Seeds Market

The dynamics of the Buckwheat Seeds Market are heavily influenced by a balanced interplay of drivers (D), restraints (R), opportunities (O), and potent impact forces, collectively shaping its trajectory. The primary driver is the exponentially increasing global prevalence of gluten intolerance and celiac disease, positioning buckwheat as a naturally superior, nutrient-dense alternative to traditional gluten-containing grains. Concurrently, heightened consumer education regarding the substantial health benefits, including improved cardiovascular health due to high rutin content and better blood sugar control, further catalyzes demand, especially in developed Western economies where functional food consumption is paramount. This confluence of nutritional advantages and specialized dietary requirements provides a foundational impetus for sustained market expansion, pushing processors to innovate new product formats.

However, the market faces significant restraints that necessitate strategic management. Buckwheat cultivation is highly sensitive to climatic variability, particularly sudden temperature changes and late frosts, leading to unpredictable harvest yields and consequential supply chain instability. Furthermore, compared to major commodity crops like wheat and corn, the global infrastructure for buckwheat processing, particularly advanced dehulling and specialized milling, remains relatively underdeveloped, often resulting in higher production costs and lower scalability. Another constraint involves consumer acceptance outside traditional consuming regions; flavor profiles and cooking requirements sometimes present a hurdle for mainstream adoption, requiring substantial investment in product formulation and consumer education to overcome entrenched dietary habits.

Opportunities for growth are abundant, chiefly derived from the burgeoning nutraceutical and cosmetic industries. Tartary buckwheat extracts, highly concentrated in bio-active compounds, present lucrative avenues for developing high-value health supplements targeting anti-aging and cardiovascular wellness. Additionally, the increasing demand for sustainable and rotational crops presents an opportunity for buckwheat to integrate into conventional farming systems, benefiting both soil health and farm diversification. The market can also capitalize on product innovation, expanding beyond traditional flour and groats into niche segments such as specialized protein isolates, fermented products, and unique beverage applications, broadening the consumer base and increasing the average product value significantly across key geographical regions.

Segmentation Analysis

The Buckwheat Seeds Market segmentation analysis provides a granular view of market dynamics based on Product Type, Application, Form, and Distribution Channel. This detailed categorization is crucial for stakeholders to identify high-growth niches, allocate resources effectively, and tailor product development strategies to specific consumer needs. The market’s complexity, driven by diverse consumption patterns globally—from traditional soba noodle consumption in Asia to advanced health supplement utilization in North America—mandates a clear understanding of which segments are providing the most significant returns and future potential. Analyzing the interplay between form factors, such as whole versus hulled seeds, and their corresponding applications, like animal feed versus human consumption, reveals disparities in price points and demand elasticity, guiding strategic planning for major suppliers.

The primary axes of segmentation reflect not only the physical characteristics of the seed but also the value addition throughout the processing chain. For instance, segmentation by Product Type (Common vs. Tartary) highlights a distinct value differential, where Tartary buckwheat, known for its heightened nutritional benefits, commands a premium price and is increasingly directed toward the pharmaceutical and functional food sectors, rather than bulk commodities. Similarly, application segmentation clarifies end-user priorities; the food industry focuses on volume and quality standardization, while the cosmetic industry emphasizes purity and specific extract efficacy. Understanding these segment-specific requirements is vital for input suppliers, processors, and retailers striving for optimal market positioning and sustained competitive advantage within this increasingly diversified market landscape.

- By Product Type:

- Common Buckwheat (Fagopyrum esculentum)

- Tartary Buckwheat (Fagopyrum tataricum)

- Silverhull Buckwheat

- By Application:

- Food & Beverages (Baking, Noodles, Breakfast Cereals, Snacks)

- Animal Feed (Poultry, Livestock)

- Pharmaceutical/Nutraceuticals (Supplements, Functional Ingredients)

- Cosmetics & Personal Care

- By Form:

- Whole Seed

- Hulled Seed (Groats)

- Flour/Grits

- Extracts and Derivatives

- By Distribution Channel:

- Direct Sales (Business-to-Business, Bulk Orders)

- Retail Sales (Supermarkets/Hypermarkets, Convenience Stores)

- Online Retail & E-commerce

- Specialty Stores (Health Food Stores)

Value Chain Analysis For Buckwheat Seeds Market

The Buckwheat Seeds market value chain commences with the upstream activities of cultivation and harvesting, which are primarily concentrated in specific agricultural regions globally, such as the major producing countries in Eastern Europe and Asia. Upstream analysis involves assessing the sourcing of high-quality seeds, optimization of farming techniques (increasingly utilizing organic and precision agriculture methodologies), and the critical post-harvest activities like initial drying and storage. Key challenges at this stage include fragmentation among small-scale farmers and the significant vulnerability to climatic events, necessitating effective risk management and contractual arrangements to ensure a steady, quality-controlled supply of raw material to processors. This initial stage dictates the base cost and quality parameters for all subsequent value-added products derived from the seeds.

The middle segment of the value chain involves critical processing activities, including primary cleaning, specialized dehulling (a process crucial for separating the hull from the groat while minimizing breakage), and subsequent milling into flour, grits, or extraction of high-value compounds like rutin. This stage requires significant technological investment in specialized machinery to handle the pseudo-cereal's specific characteristics and to meet stringent international food safety standards, particularly concerning gluten-free certification. Distribution channels link processors to end-users, operating via direct and indirect routes. Direct sales are common for bulk quantities sold to large industrial users (e.g., major food manufacturers or animal feed producers), characterized by long-term contracts and tailored specifications. Indirect channels involve wholesalers, specialized distributors, and retailers, crucial for reaching smaller businesses and the general consumer market.

The downstream analysis focuses on the final product market and consumer consumption patterns, where value capture is maximized through branding, packaging, and product innovation, especially in the high-margin nutraceutical and health food sectors. End-users, including commercial bakeries, supplement manufacturers, and specialized pet food companies, demand consistently high quality and reliable supply chains. Direct distribution gains importance in the rapidly growing e-commerce space, allowing specialty producers to bypass traditional intermediaries and establish direct relationships with health-conscious consumers. The ultimate value accrues through product differentiation—for instance, certified organic, non-GMO, or Tartary buckwheat products command significant premiums over generic common buckwheat commodities, reflecting the consumer's willingness to pay for validated purity and enhanced health attributes.

Buckwheat Seeds Market Potential Customers

The primary potential customers and end-users of buckwheat seeds and their derivatives span a diverse range of industries, driven largely by the seed's unique nutritional composition and its gluten-free status. Food and beverage manufacturers constitute the largest customer segment, utilizing buckwheat flour extensively in the production of specialized bakery items, pasta, gluten-free cereals, and functional snacks designed for the health-conscious market. These buyers prioritize consistent supply, high-quality milling specifications, and robust supplier certifications, particularly those guaranteeing freedom from cross-contamination with gluten-containing grains. Their procurement decisions are often influenced by prevailing consumer dietary trends, necessitating suppliers to offer innovative ingredients like pre-gelatinized flours or specialized buckwheat-based protein blends to meet formulation needs.

A rapidly expanding customer base includes nutraceutical and pharmaceutical companies, which are intensely focused on sourcing Tartary buckwheat extracts for their high concentration of bioactive compounds, most notably rutin. These customers use these extracts in the formulation of dietary supplements targeting cardiovascular health, inflammation reduction, and overall wellness. Their purchasing criteria are exceptionally strict, demanding high purity levels, standardized extract concentrations, and rigorous documentation proving efficacy and safety. This segment represents a high-value, albeit volume-sensitive, customer group where long-term partnership and research collaboration with suppliers are often preferred over purely transactional relationships, ensuring a sustainable supply of premium raw materials.

Other significant customer segments include the animal feed industry, utilizing whole or cracked buckwheat seeds as a nutritious protein source for poultry and livestock, particularly in organic feed formulations where non-GMO ingredients are mandated. Furthermore, cosmetic and personal care manufacturers are emerging customers, incorporating buckwheat extracts into skin care products (e.g., creams, serums) due to their antioxidant and protective properties against environmental stressors. Retail channels, encompassing both large-scale supermarkets and specialized health food stores, act as direct buyers of packaged buckwheat groats, flour, and ready-to-eat products, serving the final consumer. These retailers rely heavily on effective branding and shelf presence, making marketing support and attractive packaging essential criteria for supplier selection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bühler AG, Archer Daniels Midland Company (ADM), Cargill, Incorporated, The Hain Celestial Group, Inc., Bob's Red Mill Natural Foods, Inc., Pukka Herbs Ltd., Hodgson Mill, Inc., ConAgra Brands, Inc., Birkett Mills, Krishna Buckwheat Industries, VWR International, LLC, Starwest Botanicals, Inc., Nu-World Foods, Ningxia Hongxing Pharmaceutical Co., Ltd., China National Cereals, Oils and Foodstuffs Corporation (COFCO), Qingdao Jinhaoli Foods Co., Ltd., Qingdao Hanming Foodstuff Co., Ltd., Miniso Group Holding Limited, Taos Mountain Trading Co., Inc., King Arthur Baking Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Buckwheat Seeds Market Key Technology Landscape

The technological landscape for the Buckwheat Seeds Market is primarily focused on optimizing efficiency across cultivation, processing, and quality assurance to enhance yield, purity, and nutritional value. In the cultivation phase, the adoption of precision agriculture technologies, including satellite imagery, advanced weather modeling, and specialized planting equipment, is crucial for mitigating the crop's sensitivity to climatic fluctuations. Sophisticated seed breeding techniques, increasingly reliant on non-GMO methodologies like marker-assisted selection (MAS), are being employed to develop new buckwheat varieties that exhibit enhanced resistance to common diseases, improved frost tolerance, and, critically, higher concentrations of desirable functional compounds such as rutin and fiber, thereby maximizing the return on investment for farmers.

In the processing segment, technological advancements are centered around improving dehulling efficiency and minimizing product breakage, which directly impacts the quality and market value of the resulting groats and flour. Modern pneumatic dehulling equipment and specialized optical sorters are utilized to separate the hull while maintaining the integrity of the fragile seed, often achieving purity levels required for certified gluten-free products. Furthermore, advancements in specialized milling technologies are allowing processors to produce ultra-fine buckwheat flour with superior textural properties suitable for high-end baking and gluten-free formulation, overcoming previous limitations related to the gritty texture often associated with traditional milling methods. These technologies ensure that buckwheat products can effectively compete with conventional grain derivatives in terms of culinary performance.

Quality control and supply chain management represent another critical area of technological focus. The adoption of advanced spectroscopic techniques (e.g., Near-Infrared Spectroscopy, or NIR) allows for rapid, non-destructive analysis of nutritional composition and quality markers, ensuring batch consistency. Crucially, the integration of blockchain technology is gaining traction to provide immutable traceability for premium and organic buckwheat products, addressing consumer demands for transparency regarding origin and processing standards, especially important for the nutraceutical and specialty food segments. Additionally, controlled atmosphere storage and smart warehousing utilizing IoT sensors help maintain optimal moisture levels and temperature, significantly extending the shelf life of raw and processed buckwheat products and reducing inventory loss throughout the global supply chain, bolstering market confidence.

Regional Highlights

Regional dynamics heavily influence the Buckwheat Seeds Market, exhibiting significant differences in production volume, consumption patterns, and product innovation. Asia Pacific (APAC) stands as the undisputed leader in both production and traditional consumption, with China, Russia, and Kazakhstan being major global producers. In APAC, buckwheat is deeply integrated into traditional diets, notably in the form of noodles (soba) and staple porridge, driving consistent, large-scale demand. However, the region is also rapidly evolving, adopting modern processing techniques and focusing on exporting premium organic and specialized Tartary buckwheat varieties to meet the escalating health trends in Western markets. Investment in agricultural technology and export infrastructure is paramount across this region to solidify its position as the global supply hub.

North America (particularly the US and Canada) represents the fastest-growing market in terms of value addition, primarily fueled by the strong demand for gluten-free and functional foods. Consumer acceptance of buckwheat as a superfood and a suitable alternative for individuals with celiac disease has dramatically increased its penetration in specialty retail and food service industries. The regional focus here is on product diversification—introducing buckwheat into mainstream products like pancake mixes, breakfast cereals, and snack bars—and ensuring rigorous third-party certification (e.g., Celiac Association accreditation) to build consumer trust. High disposable incomes support the consumption of premium imported and domestically grown organic buckwheat products, commanding substantially higher price points than the global average.

Europe is another critical consumption region, characterized by mature consumer awareness regarding healthy eating and strong regulatory support for organic and sustainable farming practices. Countries like Germany, France, and the Netherlands show substantial demand for organic buckwheat flour and groats, driven by the clean label movement. Furthermore, the European nutraceutical sector actively utilizes buckwheat extracts. While domestic production exists, the region relies significantly on imports from Eastern Europe and Asia. The Middle East and Africa (MEA) and Latin America (LATAM) markets are nascent but show potential, driven by urbanization, globalization of food trends, and increasing health consciousness among the affluent urban population, presenting long-term opportunities for strategic market entry by major international suppliers focusing on bulk imports and initial product education.

- Asia Pacific (APAC): Dominates global production volumes; significant traditional consumption base (e.g., soba noodles); increasing focus on high-quality organic exports, primarily from China and Russia.

- North America: Highest growth market by value, driven by robust demand for gluten-free foods and nutraceutical supplements; market highly influenced by consumer health trends and specialized retail channels.

- Europe: Strong demand for organic and non-GMO certified products; significant importer catering to the healthy bakery and functional food sectors; strict regulatory environment supporting clean label standards.

- Latin America (LATAM): Emerging market showing steady growth due to rising disposable income and increasing Western dietary influence; opportunities in both food manufacturing and specialized retail segments.

- Middle East and Africa (MEA): Small but promising segment focusing on high-value imported specialty grains for expatriate communities and affluent local consumers; growth linked to food diversification policies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Buckwheat Seeds Market.- Bühler AG

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- The Hain Celestial Group, Inc.

- Bob's Red Mill Natural Foods, Inc.

- Pukka Herbs Ltd.

- Hodgson Mill, Inc.

- ConAgra Brands, Inc.

- Birkett Mills

- Krishna Buckwheat Industries

- VWR International, LLC

- Starwest Botanicals, Inc.

- Nu-World Foods

- Ningxia Hongxing Pharmaceutical Co., Ltd.

- China National Cereals, Oils and Foodstuffs Corporation (COFCO)

- Qingdao Jinhaoli Foods Co., Ltd.

- Qingdao Hanming Foodstuff Co., Ltd.

- Miniso Group Holding Limited

- Taos Mountain Trading Co., Inc.

- King Arthur Baking Company

Frequently Asked Questions

Analyze common user questions about the Buckwheat Seeds market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Buckwheat Seeds Market?

The primary driver is the escalating global demand for gluten-free and functional foods, positioning buckwheat as a naturally gluten-free pseudo-cereal rich in beneficial compounds like rutin, highly sought after by consumers with celiac disease or focusing on cardiovascular health.

How does Tartary Buckwheat differ in market value from Common Buckwheat?

Tartary Buckwheat (Fagopyrum tataricum) generally commands a higher market value than Common Buckwheat due to its significantly higher concentration of beneficial antioxidants, particularly rutin, making it the preferred raw material for high-value nutraceutical and pharmaceutical applications.

Which geographical region dominates the production side of the Buckwheat Seeds Market?

The Asia Pacific region, specifically countries such as China, Russia, and Kazakhstan, dominates global buckwheat production volumes, serving as the main global source for raw materials, although North America leads in terms of market value growth.

What are the main technological challenges facing buckwheat processors?

The main technological challenges include optimizing dehulling processes to maximize yield and minimize seed breakage, and implementing advanced sorting technologies to ensure the purity necessary for meeting strict certified gluten-free standards and high-quality export requirements.

In what key industrial application is buckwheat most prominently used?

Buckwheat is most prominently used in the Food and Beverages sector, particularly for producing gluten-free flour, groats, and specialized baked goods, catering directly to the rapidly growing consumer segment seeking healthy, clean-label ancient grains alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager