Bug vacuum Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434102 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Bug vacuum Market Size

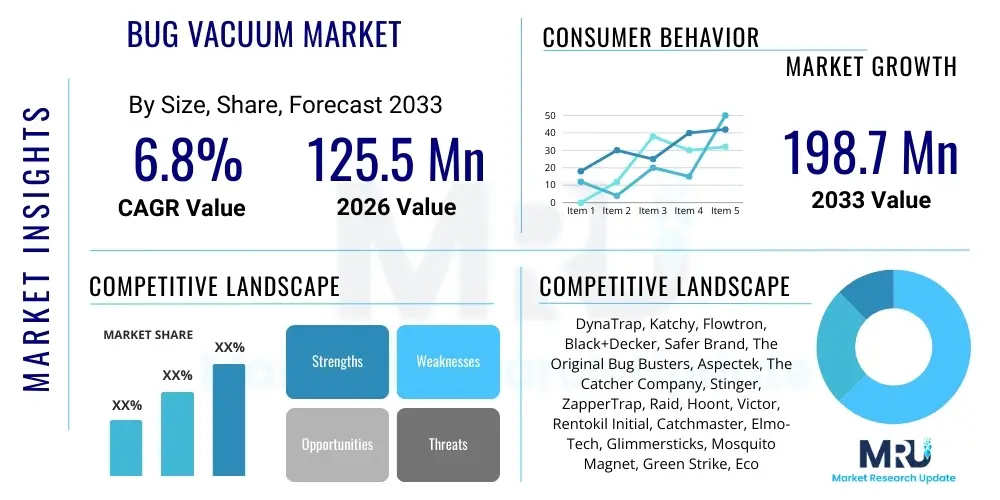

The Bug vacuum Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 125.5 million in 2026 and is projected to reach USD 198.7 million by the end of the forecast period in 2033.

Bug vacuum Market introduction

The Bug vacuum Market encompasses specialized consumer electronics designed for the non-lethal, hygienic, and efficient removal of insects and small arachnids from indoor and outdoor environments. These devices utilize low-power suction mechanisms, often paired with ergonomic handheld designs and specialized containment features, offering an alternative to chemical sprays and physical smashing. Key products range from portable, battery-operated units optimized for single-insect removal (catch-and-release) to larger, corded industrial models used for managing significant insect infestations in controlled environments. The fundamental principle is to provide a clean, environmentally conscious solution for integrated pest management (IPM) in residential, commercial, and agricultural settings.

Major applications of Bug vacuums span household pest control, greenhouse management, and entomological research. In the residential sector, they are crucial for individuals seeking immediate, safe removal of common household pests like spiders, wasps, and mosquitoes, particularly benefiting households with children or pets where chemical exposure is a concern. Commercially, they are deployed in food service areas, hospitals, and controlled environments where maintaining stringent hygiene standards without volatile organic compounds (VOCs) is mandatory. The core benefits driving adoption include ease of use, chemical-free operation, enhanced safety, and the ability to capture insects intact for subsequent release or examination, catering directly to the growing demand for sustainable pest management solutions across diverse consumer demographics.

The market is significantly driven by escalating consumer awareness regarding the health risks associated with conventional chemical insecticides, coupled with regulatory shifts favoring eco-friendly pest control methods. Furthermore, technological advancements in battery life (specifically lithium-ion integration), motor efficiency, and nozzle design have dramatically improved the performance and portability of modern bug vacuums, expanding their applicability. The increasing prevalence of outdoor living spaces and the seasonal demands of mosquito and fly control also contribute substantially to sustained market growth, particularly in North America and Europe, where disposable income allows for investment in specialized convenience devices.

Bug vacuum Market Executive Summary

The Bug vacuum Market is poised for robust expansion, primarily fueled by the accelerating global adoption of non-toxic pest control methodologies and continuous improvements in cordless technology, enhancing product portability and performance. Key business trends indicate a strong move toward ergonomic, multi-functional designs that integrate features such as LED lighting for nighttime use and specialized filters for allergen containment. Manufacturers are intensely focused on optimizing battery endurance and reducing charging times to address primary consumer pain points. Strategic partnerships between hardware producers and integrated pest management service providers are emerging as a crucial strategy to capture the commercial segment, particularly in high-specification environments like healthcare and specialized manufacturing.

Regionally, North America maintains market dominance due to high consumer spending on specialized home maintenance tools and a strong regulatory framework encouraging chemical alternatives. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven by rapid urbanization, increasing disposable incomes, and the rising menace of endemic insect-borne diseases, leading to increased adoption of immediate, localized pest control measures. European growth remains stable, supported by stringent environmental standards and robust consumer preference for ecological solutions. Segment-wise, the Cordless Bug Vacuum segment is significantly outpacing its corded counterpart, reflecting the premium placed on mobility and convenience, while the Residential application sector remains the foundational revenue driver.

Overall, the market environment is characterized by moderate fragmentation, with strong competition centered on innovation in motor technology, lightweight materials, and user interface design. The long-term profitability of the market will depend heavily on mitigating supply chain volatility related to electronic components and effectively communicating the superior health and environmental benefits of these devices compared to traditional pest control methods. Successfully leveraging digital marketing platforms to educate consumers about specialized use cases (e.g., safe bee removal, exotic pet feeding) will be vital for sustained competitive advantage and market penetration.

AI Impact Analysis on Bug vacuum Market

Common user questions regarding AI's influence on the Bug vacuum market typically revolve around the feasibility of autonomous pest detection, smart device integration for predictive infestation management, and the use of machine learning to optimize suction power based on insect type. Users inquire whether AI could automate bug identification (e.g., distinguishing pests from beneficial insects), enhancing the efficacy of catch-and-release models. The core themes center on leveraging AI for improved operational efficiency, transforming simple suction devices into integral components of a smart home ecosystem, and generating data insights on pest patterns for targeted removal, ultimately moving the product category from a reactive tool to a proactive, intelligent defense system.

- AI-Powered Object Recognition: Integration of small, low-power machine vision systems to classify insect types, optimizing vacuum intensity and improving user awareness of specific pests.

- Predictive Maintenance and Infestation Modeling: Using AI algorithms to analyze collected data (time, location, type of catch) to predict localized infestation risks in real-time, feeding into broader smart home security systems.

- Autonomous Path Planning: Future commercial/industrial models utilizing AI for automated navigation and patrolling in greenhouses or large warehouses, targeting areas identified as high-risk by sensor data.

- Energy Optimization: Machine learning adjusting motor speed and suction dynamically based on resistance or detected insect size, maximizing battery life and ensuring efficient capture.

- Data Analytics and Reporting: Generating detailed reports for commercial users on pest activity trends, crucial for compliance and professional integrated pest management strategies.

DRO & Impact Forces Of Bug vacuum Market

The Bug vacuum Market is shaped by dynamic interactions between environmental consciousness, technological evolution, and shifting consumer preferences, creating a complex interplay of Drivers, Restraints, and Opportunities. A primary driver is the global regulatory push towards safer, non-chemical alternatives in pest control, particularly in sensitive sectors like food processing and healthcare, which mandates the use of devices that do not introduce harmful residues. This driver is amplified by increasing public health concerns regarding pesticide toxicity and allergic reactions. Concurrently, rapid innovation in motor and battery technology, specifically the advent of lightweight, long-lasting lithium-ion batteries, fundamentally addresses the historical drawback of poor portability and limited operating time, significantly boosting consumer satisfaction and product utility across diverse applications.

However, market growth faces notable restraints. The relatively high initial purchase price compared to inexpensive chemical sprays often deters price-sensitive consumers, particularly in developing economies, leading to slower adoption. Moreover, limitations in suction power for handling extremely small or heavily armored insects, coupled with the need for frequent charging or reliance on cumbersome cords, restrict the devices' overall efficacy for severe infestations, positioning them primarily as supplementary tools rather than primary defenses. Consumer skepticism regarding the overall effectiveness and durability of these specialized appliances compared to traditional methods also acts as a psychological barrier to entry, necessitating substantial investment in consumer education and robust performance guarantees by manufacturers.

Opportunities for expansion are predominantly centered on technological convergence and market penetration strategies. The integration of Bug vacuums into smart home ecosystems, leveraging IoT connectivity for remote monitoring and scheduling, represents a significant avenue for value creation and premium pricing. Furthermore, the development of highly specialized nozzles and attachment kits tailored for specific environments (e.g., aquaculture nets, specialized hydroponics setups) or specific pests (e.g., bed bug removal) can unlock lucrative niche markets. Geographically, aggressive market expansion into untapped segments of Latin America and Southeast Asia, coupled with targeted marketing focusing on environmental stewardship and child safety, provides a fertile ground for sustained high-growth potential throughout the forecast period.

Segmentation Analysis

The Bug vacuum market is meticulously segmented based on product characteristics, application environments, and distribution methodologies, allowing manufacturers to target specific consumer needs with specialized designs. Key segmentation variables include the power source (Corded vs. Cordless), determining mobility and sustained performance; application (Residential, Commercial, Industrial), dictating required durability and capacity; and distribution channel (Online vs. Offline Retail), influencing pricing and market reach. This structural breakdown helps in identifying high-growth segments, such as cordless models driven by convenience, and understanding the distinct purchasing behaviors of residential users versus commercial entities which prioritize robustness and compliance with sanitation regulations.

- By Product Type:

- Cordless Bug Vacuums (Dominate residential market due to portability and ease of use)

- Corded Bug Vacuums (Preferred in industrial or stationary settings requiring sustained, high power)

- By Application:

- Residential (Focus on ergonomic design, aesthetic appeal, and safe catch-and-release features)

- Commercial (Used in restaurants, hotels, and retail; emphasis on hygiene and efficiency)

- Industrial & Agricultural (Deployed in warehouses, greenhouses, and specialized food processing units; emphasis on high volume capacity and durable construction)

- By Power/Motor Technology:

- Brushed Motor (Lower cost, less efficient)

- Brushless Motor (Higher efficiency, longer lifespan, preferred in premium cordless models)

- By Distribution Channel:

- Online Retail (E-commerce platforms; driving accessibility and comparative shopping)

- Offline Retail (Department stores, home improvement centers, specialized pest control suppliers)

Value Chain Analysis For Bug vacuum Market

The value chain for the Bug vacuum Market is structured, beginning with crucial upstream activities involving raw material procurement and specialized component manufacturing. Upstream analysis focuses intensely on securing high-quality, lightweight plastics (ABS, polycarbonate) for casings, reliable small-scale motors (often BLDC for efficiency), and advanced lithium-ion battery cells, which are typically sourced from Asian suppliers. Innovation at this stage includes materials science research aimed at developing more durable, chemical-resistant polymers and miniaturizing high-efficiency suction technology. Effective supply chain management at the upstream level is critical for maintaining cost competitiveness and mitigating risks associated with global semiconductor shortages and mineral extraction volatility affecting battery components.

Midstream activities involve core manufacturing, assembly, and quality assurance. This stage focuses on efficient injection molding, integrating electronic circuitry (PCBs), and ensuring the ergonomic design translates into a functional, user-friendly device. Companies often invest heavily in robotic assembly to maintain precision and scalability. Brand differentiation frequently occurs here through proprietary nozzle designs, patented filtering systems, and the integration of specialized features like UV lights or laser pointers for targeting. High manufacturing standards, especially concerning motor calibration and battery safety compliance, are essential for penetrating regulated markets in North America and Europe, requiring rigorous adherence to international certifications (e.g., CE, UL).

Downstream analysis covers distribution channels and post-sales services. The distribution landscape is bifurcated into direct sales (primarily through e-commerce and branded websites) and indirect sales via established retail chains and specialized distributors. Direct channels allow for greater control over pricing and customer engagement, facilitating direct feedback loops crucial for product refinement. Indirect distribution, particularly through large home improvement centers, provides mass market visibility. Post-sales services, including warranty claims, spare parts supply (e.g., replacement filters, batteries), and customer support, are vital for brand reputation and sustaining customer loyalty, impacting the overall lifetime value of the product in this highly competitive consumer electronics segment.

Bug vacuum Market Potential Customers

The Bug vacuum Market serves a diverse array of end-users, broadly categorized into residential, commercial, and industrial segments, each possessing unique needs and purchasing criteria. Residential buyers represent the largest volume segment, primarily driven by concerns about health, chemical exposure (especially for pets and children), and the need for immediate, localized pest relief. These customers prioritize portability, ease of storage, aesthetic design, and quiet operation, often seeking models that emphasize humane 'catch-and-release' capabilities. Key residential buyer personas include suburban homeowners, apartment dwellers sensitive to shared space pest issues, and hobbyists maintaining indoor plants or reptile enclosures that require non-chemical insect management.

Commercial customers constitute a high-value segment, encompassing sectors such as hospitality (hotels, resorts), healthcare (clinics, nursing homes), and food service (restaurants, catering facilities). For this segment, the primary purchasing drivers are hygiene compliance, speed of intervention, and professional appearance. They require durable units with higher capacity and sustained power for managing ongoing or large-scale, yet non-toxic, pest maintenance. Commercial entities often purchase through specialized procurement channels or facility management suppliers, prioritizing service agreements, bulk discounts, and devices compliant with stringent public health standards that prohibit the use of aerosol sprays in food preparation or patient care areas.

The Industrial and Agricultural sectors represent a specialized clientele, focusing on high-volume, continuous operation under rugged conditions. This includes greenhouse operators needing to manage plant pests without harming crops or beneficial insects, entomological researchers requiring intact insect specimens for study, and managers of large storage facilities or archives needing sterile pest control. These buyers require features like heavy-duty filtration, sustained corded power or industrial-grade batteries, and specialized attachments for accessing difficult areas or handling high volumes of debris. Their purchasing decisions are heavily influenced by return on investment, regulatory compliance specific to their industry (e.g., USDA regulations), and the device's compatibility with existing integrated pest management protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125.5 Million |

| Market Forecast in 2033 | USD 198.7 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DynaTrap, Katchy, Flowtron, Black+Decker, Safer Brand, The Original Bug Busters, Aspectek, The Catcher Company, Stinger, ZapperTrap, Raid, Hoont, Victor, Rentokil Initial, Catchmaster, Elmo-Tech, Glimmersticks, Mosquito Magnet, Green Strike, Eco-Pest Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bug vacuum Market Key Technology Landscape

The core technology landscape of the Bug vacuum market is defined by continuous evolution in three critical areas: suction generation, power management, and containment mechanisms. Suction generation is increasingly moving away from traditional brushed motors toward high-efficiency Brushless Direct Current (BLDC) motors, particularly in high-end cordless models. BLDC technology offers superior torque, reduced friction, quieter operation, and significantly extended product lifespan, directly addressing consumer demand for powerful yet compact devices. Furthermore, advances in aerodynamic nozzle design are crucial, utilizing Bernoulli's principle to maximize airflow and capture radius while minimizing the energy required, thus enhancing the practical efficacy of the devices against fast-moving or fragile insects.

Power management systems are experiencing the most rapid transformative change. The widespread adoption of advanced lithium-ion battery technology, including higher energy density cells and smarter battery management systems (BMS), is standardizing features like rapid charging, consistent power output throughout the charge cycle, and robust safety protections against overcharging or overheating. Furthermore, integration with USB-C charging standards enhances user convenience and portability. Manufacturers are also experimenting with energy harvesting technologies and ultra-low-power standby modes to maximize the utility of the cordless format, making these devices comparable in readiness to smart handheld electronics rather than traditional bulky cleaning appliances.

Containment and filtration technology represent a third important technological focus, driven by hygiene and sustainability requirements. Modern Bug vacuums often employ multi-stage filtration systems, not only to prevent collected debris from damaging the motor impeller but also to contain fine dust, insect fragments, and potential allergens, crucial for clinical and residential applications. The design of the catch chamber itself is evolving, with self-sealing mechanisms and clear, durable plastic construction that facilitates easy, hygienic disposal or release without direct contact with the captured insect. Beyond basic filtration, some premium models integrate UV sterilization features within the containment area to eliminate bacteria and viruses associated with certain pests, elevating the device's value proposition beyond simple removal to comprehensive sanitation.

Regional Highlights

- North America: This region holds the largest market share, driven by high consumer awareness regarding product innovation and strong adoption of home automation and specialized cleaning gadgets. The U.S. market is mature, characterized by high disposable income and a strong preference for cordless, high-specification models featuring long battery life and ergonomic design. The regulatory environment strongly supports non-toxic pest control, bolstering demand in both residential and professional integrated pest management sectors. Innovation here often focuses on smart features and enhanced durability to withstand seasonal pest cycles.

- Europe: Europe is characterized by stable, sustained growth, strongly influenced by rigorous environmental and chemical safety regulations (e.g., REACH), which accelerates the shift away from traditional chemical insecticides. Consumers, particularly in Western and Northern Europe, exhibit a high willingness to pay a premium for eco-friendly and sustainably manufactured products. The market tends to favor efficient, quiet, and aesthetically pleasing designs suitable for dense urban living spaces. Germany, the UK, and France are key contributors, with growth often spurred by seasonal pest issues exacerbated by climate change.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This rapid expansion is fueled by accelerating urbanization, rising living standards, and the critical need for effective control of disease-vector insects like mosquitoes and flies, particularly in populous countries such as China, India, and Southeast Asian nations. Price sensitivity remains a factor, driving demand for locally manufactured, cost-effective models; however, premium segments are expanding rapidly within metropolitan areas that mirror Western consumption patterns. Market penetration is significantly aided by booming e-commerce platforms and robust local manufacturing capabilities.

- Latin America (LATAM): The LATAM market is emerging, demonstrating potential driven by climatic conditions conducive to high insect activity and increasing public health initiatives aimed at mitigating vector-borne diseases. Challenges include economic volatility and less developed distribution networks in rural areas. However, countries like Brazil and Mexico are experiencing growth in commercial applications, particularly in agricultural processing and hospitality sectors, where maintaining hygiene standards is paramount, necessitating durable, mid-range priced Bug vacuum solutions.

- Middle East and Africa (MEA): Growth in MEA is highly localized. The Middle Eastern segment shows high demand in commercial and hospitality sectors due to strict appearance and hygiene standards in luxury environments. African markets face challenges related to infrastructure and affordability, yet they offer significant long-term potential in public health and agricultural applications, where chemical-free methods are increasingly sought after for sensitive crops and controlled environments. Market expansion often relies on governmental or NGO initiatives promoting public health tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bug vacuum Market.- DynaTrap

- Katchy

- Flowtron

- Black+Decker

- Safer Brand

- The Original Bug Busters

- Aspectek

- The Catcher Company

- Stinger

- ZapperTrap

- Raid (SC Johnson)

- Hoont

- Victor (Woodstream Corporation)

- Rentokil Initial

- Catchmaster (AP&G Co.)

- Elmo-Tech

- Glimmersticks

- Mosquito Magnet

- Green Strike

- Eco-Pest Solutions

Frequently Asked Questions

Analyze common user questions about the Bug vacuum market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Bug vacuum Market?

The Bug vacuum Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven primarily by demand for non-toxic pest control solutions and advancements in cordless technology.

What are the primary factors driving the adoption of Bug vacuums?

Key drivers include the global shift towards environmentally friendly and chemical-free pest management methods, increasing public health awareness regarding insecticide risks, and technological improvements in battery life and motor efficiency which enhance product portability and power.

Which segmentation dominates the current Bug vacuum market?

The Cordless Bug Vacuum segment is currently dominating the market due to high consumer preference for mobility and convenience in residential applications, while the Residential segment remains the largest end-user category globally.

How is AI expected to influence the future of Bug vacuum technology?

AI is anticipated to enhance Bug vacuums by enabling smart features such as automatic insect recognition, dynamic suction optimization based on pest type, and integration into smart home systems for predictive infestation monitoring and targeted pest control strategies.

Which geographical region represents the fastest growth potential?

The Asia Pacific (APAC) region is forecasted to demonstrate the fastest growth rate, fueled by rapid urbanization, rising disposable incomes, and the critical necessity for effective control of disease-vector insects across major emerging economies in the area.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager