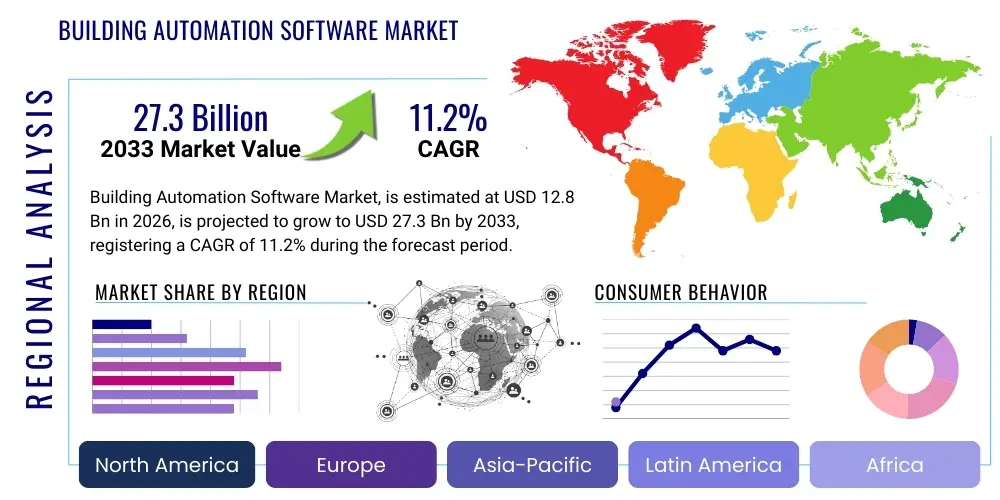

Building Automation Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437042 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Building Automation Software Market Size

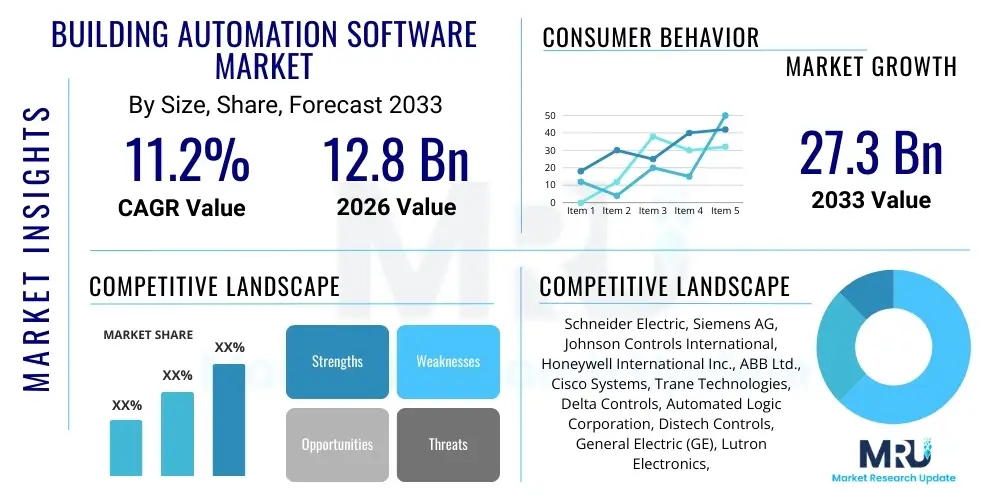

The Building Automation Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.2% between 2026 and 2033. The market is estimated at USD 12.8 Billion in 2026 and is projected to reach USD 27.3 Billion by the end of the forecast period in 2033.

Building Automation Software Market introduction

The Building Automation Software Market encompasses a wide range of platforms and applications designed to monitor, manage, and control essential building systems such as Heating, Ventilation, and Air Conditioning (HVAC), lighting, security, and access control. This software serves as the central nervous system for modern smart buildings, enabling centralized data aggregation and optimized operational efficiency. Major applications include energy management systems, facility management, and predictive maintenance scheduling, crucial for reducing operational expenditure and enhancing occupant comfort. The primary benefits derived from these solutions include significant reductions in energy consumption, improved building security posture, and extension of equipment lifespan through proactive monitoring. Key driving factors accelerating market expansion include stringent government mandates related to energy efficiency, the rapid proliferation of the Internet of Things (IoT) devices within commercial and residential structures, and the increasing demand for sustainable and green building certifications globally, compelling facility managers to adopt sophisticated digital management tools.

Building Automation Software Market Executive Summary

The global Building Automation Software (BAS) market is experiencing robust momentum driven by transformative technological shifts, particularly in digitalization and IoT integration across commercial and industrial sectors. Business trends emphasize a shift towards cloud-based and Software-as-a-Service (SaaS) models, offering scalability and lower total cost of ownership compared to traditional on-premise deployments, thereby democratizing access to advanced automation capabilities for Small and Medium Enterprises (SMEs). Regionally, North America and Europe remain mature markets, characterized by high adoption rates spurred by strict environmental regulations and established infrastructure, while the Asia Pacific (APAC) region is emerging as the fastest-growing hub, fueled by rapid urbanization, massive infrastructure development projects, and government investments in smart city initiatives, specifically in China and India. Segmentation trends highlight the dominance of energy management applications within the software component category, reflecting the universal corporate priority of reducing carbon footprint and achieving operational sustainability targets, coupled with increasing demand for integrated security and fire safety management platforms that leverage convergence for holistic risk mitigation.

AI Impact Analysis on Building Automation Software Market

User inquiries regarding the impact of Artificial Intelligence (AI) frequently center on how AI will transition BAS from reactive systems to truly predictive and autonomous operational models. Common questions revolve around the efficacy of AI in dynamic energy optimization, the potential for autonomous fault detection and diagnostics (AFDD), and the cybersecurity implications of integrating machine learning (ML) models into critical infrastructure. Users are keen to understand how AI-driven BAS can move beyond simple rule-based automation to anticipate failures, adjust parameters based on occupant behavior patterns, and dynamically optimize climate control and lighting based on real-time data from disparate sources like weather APIs and internal sensors.

The primary concern is often related to data management—specifically, the volume, velocity, and veracity of data required to effectively train and deploy robust AI models within diverse building environments, alongside vendor lock-in concerns regarding proprietary algorithms. Expectations are exceptionally high for operational expenditure (OpEx) reduction, with AI promising 15% to 30% further savings beyond conventional automation. This transformative influence is forcing existing BAS providers to rapidly integrate AI/ML capabilities, focusing on delivering prescriptive insights rather than just descriptive reports, fundamentally altering the competitive landscape towards platforms offering superior data processing and cognitive automation features.

Consequently, AI is acting as a major market disruptor, shifting the value proposition from hardware installation and basic scheduling towards advanced software intelligence and predictive service delivery. This integration not only enhances performance but also unlocks new service revenue streams for vendors, such as predictive maintenance contracts and continuous optimization services, making buildings significantly smarter, more resilient, and highly personalized to occupant needs, thereby justifying the higher initial software investment costs.

- AI enables predictive maintenance by analyzing sensor data patterns to anticipate equipment failure, drastically reducing unplanned downtime.

- Machine Learning (ML) algorithms optimize HVAC scheduling and setpoints based on real-time occupancy and external weather forecasts, achieving dynamic energy efficiency.

- AI-driven anomaly detection enhances building cybersecurity by identifying unusual network behavior and potential breaches across the integrated IoT ecosystem.

- Cognitive automation facilitates personalized environmental control, learning individual occupant preferences regarding temperature and lighting levels.

- Natural Language Processing (NLP) integration is improving human-machine interaction, allowing facility managers to query system performance using voice commands.

DRO & Impact Forces Of Building Automation Software Market

The Building Automation Software market's trajectory is primarily driven by mounting global pressure for energy conservation and sustainability, stringent regulatory frameworks like the European Union’s Energy Performance of Buildings Directive (EPBD), and the exponential rise in IoT connectivity, which provides the necessary data foundation for advanced control systems. Conversely, market growth is often restricted by the substantial initial capital expenditure required for BAS implementation, especially in older buildings that necessitate comprehensive retrofitting, alongside prevailing concerns regarding data privacy, system integration complexity across heterogeneous platforms, and the persistent shortage of skilled technicians capable of managing these sophisticated digital ecosystems. Significant market opportunities lie in the vast potential for retrofitting existing commercial infrastructure, integrating advanced AI and edge computing capabilities for localized processing, and expanding service offerings to smaller commercial facilities (SMEs) via affordable, scalable cloud-based solutions. These forces combine to create an environment where the demand for optimization solutions is high, yet adoption rates are tempered by cost and complexity barriers, necessitating innovative financing models and simplified user interfaces from vendors.

Segmentation Analysis

The Building Automation Software market is meticulously segmented across multiple dimensions, including component type, application focus, deployment model, and end-user vertical, reflecting the diversity of needs within the commercial real estate and industrial sectors. The component segmentation notably divides the market into core software platforms—which include modules for facility management, energy analytics, and security management—and associated professional services, which cover crucial elements like system integration, consulting, and maintenance support. This structural breakdown helps vendors tailor solutions precisely, from foundational monitoring tools to advanced, AI-enabled optimization suites that require deep integration expertise.

The application segment reveals that Heating, Ventilation, and Air Conditioning (HVAC) control software consistently captures the largest market share, directly linked to HVAC systems' role as the single largest consumer of energy within a typical commercial building, thereby offering the fastest and most substantial return on investment (ROI) through optimization. However, the fastest growth is currently observed in the integrated security and surveillance applications segment, driven by the convergence of physical access control, video analytics, and cybersecurity solutions onto unified platforms, addressing the holistic security needs of modern enterprises.

Further analysis of the deployment models shows a decisive industry shift toward the cloud (SaaS) model, favored for its flexibility, reduced maintenance burden, and capability for rapid updates and scalability across diverse portfolios, which is particularly attractive to large multi-site organizations seeking centralized management. Nevertheless, highly sensitive facilities such as data centers, critical government infrastructure, and certain manufacturing plants often continue to prefer on-premise solutions due to stringent data security mandates and lower latency requirements, ensuring that both deployment types maintain significant market relevance, albeit with different growth trajectories.

- By Component: Software (Energy Management Software, Facility Management Software, Security Management Software), Services (Installation, Maintenance, Consulting, System Integration)

- By Application: HVAC Control, Lighting Control, Security and Surveillance, Fire and Life Safety, Energy Management

- By Deployment Model: On-premise, Cloud-based (SaaS)

- By End-User: Commercial (Offices, Retail, Healthcare, Hospitality), Residential (Luxury Apartments, Smart Homes), Industrial (Manufacturing Plants, Data Centers), Government and Institutional

Value Chain Analysis For Building Automation Software Market

The Building Automation Software value chain begins intensely in the upstream segment with the providers of essential hardware and foundational technology, primarily IoT sensor manufacturers, control panel developers, communication protocol creators (e.g., BACnet, Modbus), and data infrastructure providers. This phase focuses on developing resilient, secure, and interoperable hardware components and operating systems that form the data collection layer, where innovation centers heavily on miniaturization, enhanced sensor accuracy, and the standardization of connectivity protocols to ensure seamless integration into diverse environments.

The core value addition occurs in the middle segment, involving the BAS developers themselves. These players specialize in writing complex application software, developing proprietary algorithms for optimization (AI/ML), creating user-friendly Human-Machine Interfaces (HMIs), and managing vast data lakes. Their role is to translate raw data streams from the upstream hardware into actionable intelligence and automated control commands, demanding deep expertise in building science, data analytics, and cybersecurity engineering to produce effective, scalable solutions.

The distribution channel is multifaceted, relying heavily on professional system integrators and specialized installers who act as the crucial link between the software vendor and the end-user. Direct sales channels are often employed for large, strategic projects or key corporate accounts, while indirect channels leverage partnerships with Value-Added Resellers (VARs), mechanical contractors, and engineering consulting firms who specify, install, configure, and maintain the complex BAS ecosystems. Finally, the downstream analysis focuses on the end-user operations, where the software delivers measurable utility through enhanced energy performance, predictive maintenance outputs, and optimized occupant experiences, forming the feedback loop for continuous product improvement and service refinement.

Building Automation Software Market Potential Customers

Potential customers, or end-users, of Building Automation Software span the entire spectrum of built environments, ranging from single residential luxury homes to vast corporate real estate portfolios and critical industrial facilities. The primary buyer segment consists of commercial building owners, facility managers, and chief sustainability officers (CSOs) who prioritize operational cost reduction, regulatory compliance, and enhancing the value of their assets through smart infrastructure investments. For large portfolio owners, the key decision drivers revolve around centralized management capabilities, system standardization across different geographies, and robust data analytics tools that support enterprise-level strategic planning and capital expenditure decisions.

A rapidly expanding segment includes operators of specialized facilities, such as hyperscale data centers, hospitals, and pharmaceutical manufacturing plants, where the integration of BAS is critical not just for energy efficiency but for maintaining strict environmental conditions (temperature, humidity, air quality) essential for sensitive operations. These buyers seek highly reliable, redundant, and secure BAS platforms capable of meeting stringent regulatory and uptime requirements, often preferring on-premise or hybrid deployment models combined with extensive service level agreements (SLAs).

Furthermore, government and institutional buyers, including universities, military bases, and municipal buildings, represent substantial potential customers driven by mandates for public sector energy reduction and carbon neutrality goals. These organizations often execute large, phased procurement contracts, placing a high value on open protocol standards, long-term vendor stability, and demonstrable security compliance, positioning the market toward scalable, open-source-friendly BAS solutions capable of integrating legacy systems alongside new technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.8 Billion |

| Market Forecast in 2033 | USD 27.3 Billion |

| Growth Rate | 11.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schneider Electric, Siemens AG, Johnson Controls International, Honeywell International Inc., ABB Ltd., Cisco Systems, Trane Technologies, Delta Controls, Automated Logic Corporation, Distech Controls, General Electric (GE), Lutron Electronics, Crestron Electronics, KMC Controls, Phoenix Contact, Bosch Security Systems, Lennox International, Veris Residential, Microsoft Corporation, IBM Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Building Automation Software Market Key Technology Landscape

The technological evolution within the Building Automation Software market is fundamentally shaped by the convergence of the Internet of Things (IoT), sophisticated data analytics, and the increasing reliance on cloud computing infrastructure. IoT forms the essential backbone, utilizing a vast array of interconnected sensors, smart meters, and actuators that feed real-time operational data into the BAS platform. This proliferation of connected devices necessitates robust edge computing capabilities, allowing for critical, low-latency control decisions to be made locally, thereby reducing reliance on continuous cloud communication and enhancing system reliability, especially for time-sensitive applications like fire detection and critical machinery control.

A paramount technological trend involves the transition from monolithic, proprietary systems toward open, API-driven architectures. Protocols like BACnet and Modbus, while foundational, are increasingly complemented by modern, web-based communication standards (e.g., REST APIs, MQTT) that facilitate seamless integration with third-party applications, such as Enterprise Resource Planning (ERP) systems and dedicated maintenance platforms. This shift towards openness fosters greater innovation, reduces vendor lock-in risk for end-users, and accelerates the development of integrated smart building ecosystems that transcend basic operational control.

Furthermore, advancements in Artificial Intelligence (AI) and Machine Learning (ML) are becoming standard features, moving BAS from scheduled control to predictive and prescriptive optimization. These technologies utilize historical and real-time data to create highly accurate digital twins of buildings, simulating performance under various conditions to optimize energy consumption and predict maintenance needs far more effectively than traditional statistical models. The adoption of robust cybersecurity technologies, including zero-trust architectures and encryption for data transmission, is also a critical component of the technological landscape, addressing the inherent vulnerabilities introduced by widely networked systems.

Regional Highlights

Regional dynamics significantly influence the adoption and maturity of the Building Automation Software market, reflecting varying levels of infrastructural development, regulatory pressures, and energy costs across different continents. North America, spearheaded by the United States and Canada, remains the largest market, characterized by high technological maturity, substantial investment in commercial real estate modernization, and early adoption of advanced solutions like AI-driven fault detection and sophisticated cybersecurity measures. The robust competitive landscape and the presence of major industry players further solidify the region's dominance, focusing heavily on reducing energy consumption in large office buildings and data center complexes.

Europe demonstrates a strong market driven primarily by strict governmental mandates focused on achieving ambitious carbon neutrality targets and enhancing the energy performance of buildings, particularly through the renovation of existing building stock. Countries like Germany, the UK, and the Netherlands lead in implementing sophisticated smart grid integration capabilities and pioneering sustainable building design concepts. European demand is often characterized by a preference for open systems that ensure interoperability and long-term sustainability, favoring standardized technologies like KNX and comprehensive building energy management systems (BEMS).

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate during the forecast period, fueled by rapid urbanization and large-scale smart city projects, particularly in developing economies such as China, India, and Southeast Asian nations. This growth is driven by the construction of new commercial and residential high-rises, where BAS is integrated from the design phase. While initial adoption was price-sensitive, increasing awareness of long-term operational savings and government support for green technology adoption are accelerating the deployment of advanced automation software across critical infrastructure and manufacturing sectors throughout the region.

- North America: Market leader due to high concentration of technology firms, early adoption of IoT, and strong regulatory pressure for LEED certification and energy performance optimization, especially in Texas and California.

- Europe: Growth propelled by stringent environmental regulations (e.g., EPBD, nearly zero-energy buildings mandate) and focus on BEMS for sustainable urban development and high operational efficiency across diverse building types.

- Asia Pacific (APAC): Fastest-growing market driven by urbanization, immense infrastructure development, governmental investments in smart cities, and growing awareness of energy efficiency benefits in new commercial construction projects.

- Latin America: Emerging market characterized by increasing foreign investment in commercial infrastructure, driving initial adoption, particularly in Brazil and Mexico, though adoption is often slowed by economic volatility and reliance on basic automation systems.

- Middle East and Africa (MEA): Growth centered on massive construction projects in GCC countries (UAE, Saudi Arabia) requiring sophisticated BAS for managing extreme climate conditions, focused heavily on HVAC optimization and high-security integrations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Building Automation Software Market.- Schneider Electric

- Siemens AG

- Johnson Controls International

- Honeywell International Inc.

- ABB Ltd.

- Cisco Systems

- Trane Technologies

- Delta Controls

- Automated Logic Corporation

- Distech Controls

- General Electric (GE)

- Lutron Electronics

- Crestron Electronics

- KMC Controls

- Phoenix Contact

- Bosch Security Systems

- Lennox International

- Veris Residential

- Microsoft Corporation

- IBM Corporation

Frequently Asked Questions

Analyze common user questions about the Building Automation Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Building Automation Software market?

The market is primarily driven by global mandates for energy efficiency and sustainability, the exponential proliferation of Internet of Things (IoT) devices providing granular data, and the rising demand for intelligent systems that minimize operational costs and enhance building performance through predictive analytics and centralized control capabilities across HVAC and lighting systems.

How does AI contribute to modern Building Automation Software functionality?

AI significantly enhances BAS by moving beyond reactive control to predictive and autonomous operations. AI/ML algorithms analyze historical and real-time data to optimize energy usage dynamically, predict equipment failures (predictive maintenance), and fine-tune environmental controls based on precise occupancy patterns, maximizing both efficiency and occupant comfort levels seamlessly.

Which deployment model is currently dominating the BAS market, and why?

The Cloud-based (SaaS) deployment model is gaining significant traction and market share due to its inherent advantages in scalability, flexibility, and reduced initial capital expenditure. Cloud solutions enable centralized management across geographically dispersed portfolios, offer automated software updates, and facilitate easy integration with advanced analytics and AI tools, making them preferred by multi-site commercial enterprises.

What is the main challenge limiting the widespread adoption of BAS, particularly in older buildings?

The most significant challenge is the high initial cost associated with implementing comprehensive Building Automation Software, particularly when retrofitting older, legacy infrastructure. This process requires substantial capital investment in new sensors, controllers, and wiring, coupled with the complexity of integrating heterogeneous proprietary systems and addressing potential cybersecurity vulnerabilities in networked operational technology.

Which application segment holds the largest share in the Building Automation Software Market?

The HVAC (Heating, Ventilation, and Air Conditioning) Control application segment consistently holds the largest market share. This dominance stems from HVAC systems being the largest energy consumers in commercial buildings, making their optimization through BAS crucial for achieving substantial energy savings and regulatory compliance, thereby offering the quickest and highest return on investment for building owners.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager