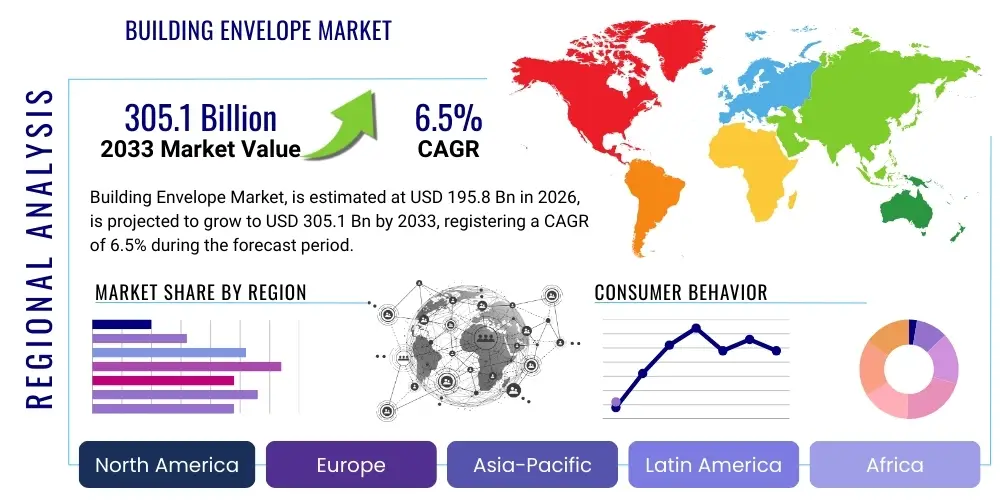

Building Envelope Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437439 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Building Envelope Market Size

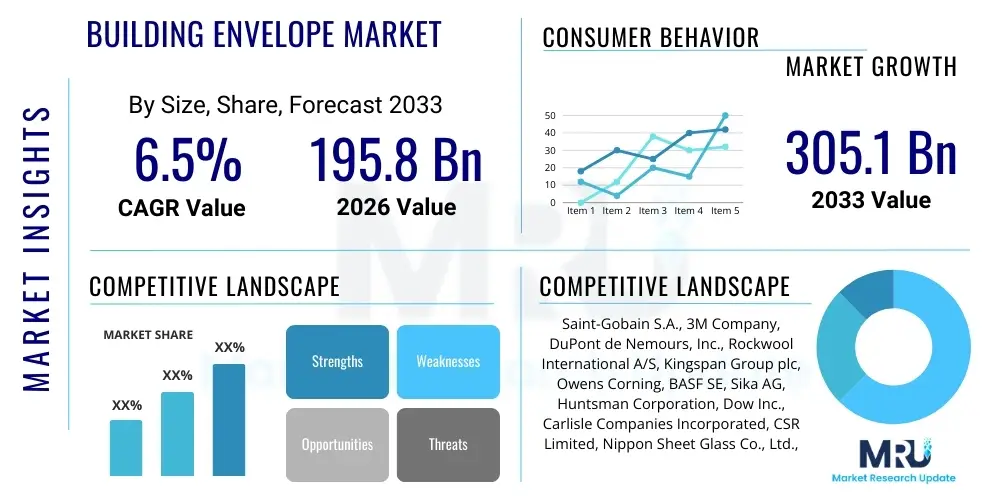

The Building Envelope Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $195.8 Billion in 2026 and is projected to reach $305.1 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by stringent global energy conservation policies, increasing awareness regarding the long-term operational costs associated with inefficient buildings, and the accelerating demand for high-performance sustainable infrastructure. Market growth is particularly pronounced in segments focusing on thermal insulation and advanced glazing systems, which are critical components for minimizing heat transfer and achieving net-zero energy goals across residential, commercial, and industrial sectors.

Building Envelope Market introduction

The Building Envelope Market encompasses all elements of the outer shell of a structure—including the walls, roof, windows, doors, and foundation—that separate the interior conditioned environment from the exterior elements. The primary function of the building envelope is multifaceted, serving as a comprehensive control layer against thermal transfer, moisture infiltration, air leakage, and solar radiation, thereby defining the building's overall energy performance and occupant comfort. Products range from high-R value insulation materials and advanced weather-resistive barriers to sophisticated curtain wall systems and dynamic glazing solutions. The market is propelled by the necessity to comply with continuously evolving national and international energy codes, such as Passive House standards and mandatory updates to the International Energy Conservation Code (IECC), making efficient building design a non-negotiable requirement for new constructions and major retrofitting projects globally.

Major applications for building envelope technologies span the entire spectrum of the construction industry, including high-density commercial skyscrapers requiring custom facade engineering, institutional buildings demanding robust durability and safety features, and residential complexes prioritizing cost-effective thermal performance. The inherent benefits derived from investing in superior envelope solutions include significantly reduced Heating, Ventilation, and Air Conditioning (HVAC) loads, lower carbon footprints over the building’s lifecycle, improved indoor air quality by mitigating moisture intrusion risks, and enhanced acoustic isolation. These factors contribute directly to higher property values and lower operational expenditures, making them attractive investments for developers and property owners committed to long-term sustainability and efficiency.

Key driving factors currently shaping the market include aggressive governmental targets for greenhouse gas reduction, leading to subsidy programs for energy-efficient retrofits, and technological advancements such as the integration of Building Integrated Photovoltaics (BIPV) and smart thermal management systems. Furthermore, global trends such as rapid urbanization in developing economies and the need to upgrade aging infrastructure in mature markets provide constant underlying demand. The focus is shifting from basic barrier components to integrated, high-performance systems that can interact intelligently with external climate conditions, emphasizing systems engineering approaches rather than isolated component selection, thereby fostering innovation across the material science and construction technology supply chain.

Building Envelope Market Executive Summary

The Building Envelope Market is characterized by a strong shift toward digitalization, system integration, and regulatory compliance, positioning it as a pivotal segment within the global construction industry. Current business trends highlight significant consolidation among material manufacturers seeking vertical integration to offer complete, warrantied facade systems, moving away from component-only sales. Furthermore, there is a pronounced investment in manufacturing capabilities for prefabricated and modular envelope components, which addresses persistent challenges related to on-site construction quality, skilled labor shortages, and project timelines. Sustainability mandates, especially in Western Europe and North America, are accelerating the adoption of materials with low embodied carbon, such as bio-based insulation and recycled content cladding, pushing innovators to develop substitutes for traditionally carbon-intensive materials like concrete and conventional foam plastics.

Regionally, the market dynamics vary significantly. The European Union demonstrates leadership due to the ambitious goals set by the European Green Deal and the Energy Performance of Buildings Directive (EPBD), focusing heavily on deep retrofitting of the massive existing building stock. North America, driven by state-level mandates and private sector ESG commitments, shows strong growth in high-performance commercial construction and sophisticated glazing technologies, particularly in climate zones with extreme temperature variations. Conversely, the Asia Pacific (APAC) region is experiencing explosive volume growth, fueled by rapid urbanization and infrastructure development, although the primary focus often remains on cost-efficiency alongside emerging adoption of minimum energy code compliance, leading to high demand for standardized, scalable envelope solutions.

Segment trends reveal that the Insulation Materials segment maintains the largest market share due to its foundational role in thermal performance, with mineral wool and rigid foam insulation leading in demand, particularly in the retrofit space. However, the Glazing Systems segment is projected to exhibit the highest CAGR, propelled by the widespread adoption of smart glass, low-emissivity (Low-E) coatings, and triple-pane windows that significantly reduce solar heat gain and improve insulation value. Within applications, the Commercial Sector, particularly office spaces and retail, remains the most demanding category, requiring advanced aesthetic and performance specifications, while the Residential Segment benefits from mass-market acceptance of energy-efficient housing standards and the increasing availability of integrated wall systems designed for fast deployment.

AI Impact Analysis on Building Envelope Market

Common user questions regarding AI’s impact on the Building Envelope Market typically revolve around optimizing complex facade geometry, predicting long-term material degradation and moisture intrusion risks, and streamlining the specification process. Users are particularly keen on understanding how AI can facilitate performance-based design, replacing traditional prescriptive methods. Key concerns center on whether AI tools can accurately model complex thermal bridges in non-standard assemblies, how effectively large-scale material databases can be leveraged for sustainable sourcing decisions, and the readiness of the construction labor force to utilize AI-driven diagnostic and robotic installation tools. There is high expectation that AI will standardize quality assurance protocols for weather-sealing and air tightness testing, moving quality control from manual inspection to continuous, data-driven monitoring throughout the construction and operational phases.

The influence of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly transitioning the building envelope domain from traditional static design toward adaptive, performance-driven engineering. AI algorithms are crucial for simulating thousands of environmental scenarios (sun path, wind load, temperature cycles) against different material combinations and envelope assemblies to determine the most energy-efficient and cost-effective design long before physical construction commences. This computational power allows architects and engineers to rapidly iterate designs, optimizing orientation, glazing ratios, shading device placement, and insulation thicknesses to minimize lifecycle energy consumption and ensure resilience against extreme weather events. Furthermore, predictive maintenance powered by ML analyzes data from embedded sensors (monitoring temperature, humidity, and pressure differentials) to identify early signs of failure, such as compromised air barriers or water leaks, dramatically reducing repair costs and prolonging the functional life of the envelope system.

In manufacturing and supply chain management, AI is enhancing operational efficiency. ML models are employed to forecast demand for specific high-performance materials (like high-R polyurethane panels or electrochromic glass) based on regional regulatory timelines and construction pipeline forecasts, optimizing inventory levels and reducing waste. On the job site, computer vision combined with robotics and drones is used to monitor the installation quality of critical envelope layers, ensuring precise application of membranes and sealants, a vital step often prone to human error. This comprehensive application of AI—from initial design optimization and material sourcing to in-service performance monitoring—is fundamentally changing how building envelopes are conceived, verified, and maintained, ensuring higher realized energy savings and improved building durability across the market.

- Optimization of facade geometry and material selection for minimum U-values and maximum daylighting.

- Predictive maintenance analytics identifying early envelope failure points (moisture, air leaks, thermal bridging).

- AI-driven simulation tools for rapid performance testing against local climate data and regulatory standards.

- Automated quality control (AQC) using computer vision during installation of weather barriers and insulation.

- Streamlining supply chain logistics and reducing material waste through demand forecasting and sourcing optimization.

DRO & Impact Forces Of Building Envelope Market

The Building Envelope Market is shaped by powerful Drivers promoting energy efficiency, significant Restraints challenging high-performance adoption, and compelling Opportunities arising from technological convergence, all contributing to dynamic Impact Forces influencing investment and material choices. Primary drivers include increasingly strict global energy codes and mandatory sustainability certifications (e.g., LEED, BREEAM, WELL), which necessitate high-performance envelopes to meet regulatory baselines. However, restraints such as the high initial capital investment required for advanced materials (like dynamic glass or vacuum insulated panels) and the shortage of specialized construction labor capable of correctly installing complex envelope systems slow down adoption rates, particularly in less-regulated markets. The key opportunity lies in the convergence of building automation systems with the envelope, enabling adaptive facades and personalized climate control, along with the vast, underserved market for retrofitting structurally sound but energy-inefficient buildings. These forces collectively push the market toward materials and systems that offer guaranteed, verifiable performance over the entire building lifecycle.

The foremost driver remains the operational cost reduction potential offered by superior envelopes. As energy prices continue to be volatile and carbon taxes increase in many developed economies, the return on investment (ROI) from insulating the structure effectively becomes highly appealing to long-term asset owners. This economic incentive is further amplified by government tax credits and rebates targeting envelope upgrades. Conversely, a major constraint is the lifecycle environmental impact of some high-performance materials; for example, certain conventional foam insulations have high Global Warming Potential (GWP) blowing agents, leading to market pressure and regulatory constraints demanding the swift transition to lower GWP alternatives. Moreover, the inherent complexity in correctly coordinating multiple trades (glazing, cladding, roofing, insulation) during construction often results in performance gaps that undermine the intended energy savings, presenting a continuous challenge to quality control and assurance in project delivery.

The transformative opportunity that holds the greatest long-term market influence is the integration of the building envelope into the Internet of Things (IoT) and smart city infrastructures. Future envelopes will not merely be passive barriers but active components, harvesting solar energy (BIPV), adjusting light transmission (dynamic glazing), and monitoring structural health. This transition to 'smart skins' provides significant differentiation for manufacturers and opens up new service markets based on performance monitoring and optimization, moving the industry beyond just material sales. The cumulative impact force ensures that future investment will be directed towards systemic solutions rather than standalone products, rewarding companies capable of providing verified, integrated, and data-rich building performance ecosystems that satisfy evolving global expectations for sustainability and energy resilience.

- Drivers:

- Strict global energy efficiency regulations and mandatory building performance standards (e.g., Net-Zero ready targets).

- Rising energy costs and the necessity for reduced operational expenditures (OPEX) over the building lifecycle.

- Increasing public and corporate emphasis on ESG (Environmental, Social, and Governance) compliance and green building certifications.

- Restraints:

- High initial capital costs associated with advanced, high-performance envelope materials and systems.

- Shortage of skilled labor proficient in the complex installation techniques required for integrated facade systems.

- Volatility in raw material costs (e.g., petrochemical derivatives for insulation and aluminum for framing).

- Opportunities:

- Massive growth potential in the existing building stock retrofitting market, driven by renovation mandates.

- Development and commercialization of advanced materials, including Phase Change Materials (PCMs) and transparent insulation.

- Integration of smart technologies, such as dynamic glazing and Building Integrated Photovoltaics (BIPV), creating active envelopes.

- Impact Forces:

- Regulatory Pressure (High): Mandates shape minimum performance requirements and material phase-out timelines.

- Technological Innovation (High): Drives differentiation and performance optimization, particularly in facade systems.

- Cost Sensitivity (Medium to High): Initial cost remains a key barrier, requiring strong focus on lifecycle ROI justification.

Segmentation Analysis

The Building Envelope Market is segmented primarily based on Material Type, Application, and Construction Type, reflecting the diverse requirements and complexity of various building projects globally. Segmentation by Material Type is crucial as it dictates the primary function and performance characteristics, ranging from insulation products that manage heat flow to cladding materials that provide aesthetic appeal and weather resistance, and sealing solutions ensuring air and moisture tightness. The segmentation analysis helps stakeholders understand where technological innovation and regulatory pressures are most concentrated, allowing for targeted product development and market entry strategies within specific material categories such as insulation (fiberglass, mineral wool, rigid foam), glazing (single, double, triple Low-E coated), and roofing (membrane, metal, green roofs).

Further segmentation by Application—into Residential, Commercial, and Industrial—reveals differential demand patterns. Commercial buildings, including offices and retail centers, typically require highly engineered curtain walls and complex moisture management systems due to size and aesthetic requirements, often prioritizing longevity and integrated energy generation (BIPV). Residential construction, while high in volume, generally focuses on standardized, cost-effective solutions for wall insulation and window performance. Industrial applications prioritize durability, fire resistance, and specific thermal regulation necessary for manufacturing or storage processes, driving demand for specific metal panels and high-density roof membranes designed for extreme environments.

The final layer of segmentation, by Construction Type (New Construction versus Retrofit/Renovation), defines the deployment challenges and product specifications. New construction projects allow for full integration of advanced, customized envelope systems and are often designed to meet the highest energy efficiency standards immediately. Conversely, the Retrofit market requires flexible, minimally invasive, and externally applicable solutions designed to improve existing, often structurally challenging, envelopes without disrupting occupants. The retrofit segment is expected to grow substantially, particularly in developed regions where the existing building stock constitutes the largest source of potential energy savings and requires solutions such as external insulation finishing systems (EIFS) and replacement window systems.

- By Material:

- Insulation (Mineral Wool, Fiberglass, Rigid Foam, Cellulose)

- Glazing (Double, Triple Pane, Low-E, Dynamic Glass)

- Cladding (Metal Panels, Composite Materials, Brick, Stone)

- Roofing Systems (Membranes, Metal Roofing, Vegetative Roofs)

- Air and Moisture Barriers (WRBs, Vapor Retarders, Sealants)

- By Application:

- Residential

- Commercial (Office, Retail, Hospitality, Healthcare)

- Industrial

- By Construction Type:

- New Construction

- Retrofit and Renovation

Value Chain Analysis For Building Envelope Market

The Building Envelope Value Chain begins with raw material extraction and chemical processing, encompassing the sourcing of basic components like aggregates, petrochemicals, minerals (sand, limestone), and metal ores essential for insulation, sealants, glazing, and framing. Upstream activities involve specialized manufacturing where these raw materials are transformed into high-performance, standardized components, such as extruded aluminum profiles for window frames, high-density foam panels, or advanced coatings. This manufacturing stage is critical, requiring significant R&D investment to comply with thermal, fire safety, and structural requirements. Key players at this stage often include large chemical companies and specialized material manufacturers who hold proprietary technologies for enhanced thermal resistance (e.g., vacuum insulation panels or next-generation polymer foams).

The middle segment of the value chain involves fabrication, distribution, and specification. Fabrication includes custom assembly of standardized components into project-specific units, such as pre-glazed curtain wall modules or unitized facade panels, often performed by specialized fabricators near the project location. Distribution channels are varied, including direct sales for large, complex projects (especially in commercial sectors) and indirect sales through large construction material distributors and specialized trade suppliers for residential and standard projects. Crucially, the architect, engineer, and consultant community plays a vital role as the specifier, dictating material performance and vendor selection based on design criteria, energy models, and budgetary constraints, effectively driving demand for certified and proven systems rather than generic components.

Downstream activities center on installation, integration, and post-construction performance monitoring. Installation requires highly specialized subcontractors focusing solely on facade assembly, roofing, or weatherproofing, as poor installation is the leading cause of envelope failure and energy performance gaps. The final stage involves the integration of the envelope with internal systems (e.g., HVAC connections near windows) and the long-term operational phase, where digital twins and sensor networks are increasingly used to monitor the envelope’s real-world performance against design specifications. This downstream focus on verified performance is creating opportunities for third-party quality assurance firms and software providers specializing in building diagnostics, closing the loop between design, construction, and operation, and shifting accountability towards the performance of the integrated system.

Building Envelope Market Potential Customers

Potential customers for building envelope products are primarily segmented into three key categories: large-scale commercial real estate developers and institutional investors, public sector entities and government agencies, and custom home builders and residential homeowners. Commercial developers represent the most high-value segment, as they require large volumes of highly customized, technically advanced systems for major projects like high-rise offices, data centers, and specialized manufacturing facilities. These buyers prioritize life-cycle cost analysis, desiring envelopes that guarantee maximum energy efficiency and minimize maintenance burdens, directly correlating the envelope quality to long-term asset valuation and tenant appeal, especially concerning factors like indoor environmental quality (IEQ) and daylighting.

The public sector, including municipalities, state, and federal agencies, constitutes another major customer base, particularly for infrastructure projects such as schools, hospitals, military bases, and government offices. Procurement in this segment is strongly influenced by public policy mandates regarding sustainability, resilience, and budget constraints. Government buyers often require verifiable certifications for fire safety, disaster resistance, and compliance with stringent public procurement standards, leading to consistent demand for high-quality, long-lasting materials and reliable suppliers. Furthermore, public sector renovation programs targeting energy poverty or aging public housing provide steady opportunities for insulation and weatherization products.

The residential market, consisting of tract builders, custom home constructors, and individual homeowners conducting renovations, forms the largest volume segment. Custom builders prioritize high-end performance materials (e.g., triple-pane windows and high-R walls) to differentiate their offerings based on energy efficiency and luxury standards. For mainstream residential tract builders, the purchasing decision is heavily skewed towards compliance with minimum building codes and maximizing cost-efficiency in materials like fiberglass insulation and standard double-pane windows. Individual homeowners undertaking retrofits are primarily driven by incentives (tax credits, rebates) and immediate comfort improvements, focusing on accessible, easy-to-install solutions like exterior insulation or high-efficiency door and window replacements. The purchasing trend across all segments is increasingly centralized around energy consultants and architects who act as crucial intermediaries in the decision-making process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $195.8 Billion |

| Market Forecast in 2033 | $305.1 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saint-Gobain S.A., 3M Company, DuPont de Nemours, Inc., Rockwool International A/S, Kingspan Group plc, Owens Corning, BASF SE, Sika AG, Huntsman Corporation, Dow Inc., Carlisle Companies Incorporated, CSR Limited, Nippon Sheet Glass Co., Ltd., Tremco Incorporated, GAF Materials Corporation, Firestone Building Products, CertainTeed, Henry Company, Holcim Group, Wienerberger AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Building Envelope Market Key Technology Landscape

The technological landscape of the Building Envelope Market is shifting rapidly towards active and integrated systems, moving beyond passive protection towards energy generation and dynamic climate responsiveness. A crucial area of innovation is the commercialization of Building Integrated Photovoltaics (BIPV), where solar cells are seamlessly incorporated into roofing shingles, facade panels, and glazing, transforming the envelope from an energy consumer to a generator. Furthermore, advanced thermal materials, such as Phase Change Materials (PCMs) embedded within wall assemblies, are gaining traction. PCMs absorb and release heat during phase transitions, increasing the thermal mass of lightweight structures, thereby reducing peak cooling and heating loads and enabling smaller, more efficient HVAC systems, crucial for meeting stringent thermal comfort standards.

Another dominant technology trend is the deployment of dynamic and smart glazing systems, primarily electrochromic and thermochromic glass. These technologies allow the solar heat gain coefficient (SHGC) and visible light transmittance (VLT) of windows to be electrically or passively controlled, respectively, optimizing daylight harvesting and minimizing unwanted solar heat gain in real-time. This eliminates the need for external shading devices and drastically improves occupant comfort while saving significant energy. Concurrently, the proliferation of digital sensing technologies is pivotal; wireless sensors embedded within insulation layers and air barriers monitor temperature, moisture, and pressure differentials, providing continuous data for real-time diagnostics and ensuring the envelope maintains its designed performance throughout its operational lifespan, feeding into digital twin models for enhanced asset management.

Finally, material science advancements focus on enhancing durability and sustainability. This includes the development of self-healing concrete and polymers that automatically seal micro-cracks, significantly extending the maintenance intervals for facades and foundations. Furthermore, there is a strong emphasis on developing high-performance, low-embodied carbon materials, such as bio-based insulation derived from agricultural waste and advanced vacuum insulated panels (VIPs) that offer extremely high R-values at minimal thickness. These technological shifts not only improve energy performance but also align the industry with circular economy principles, making the envelope system a high-tech, integrated component of smart, sustainable infrastructure.

Regional Highlights

- North America: This region is characterized by high demand for energy-efficient commercial construction, particularly in the US and Canada, driven by utility incentives, mandatory energy performance benchmarking (e.g., California’s Title 24), and ambitious net-zero commitments from large corporations. The market excels in advanced glazing technologies, pre-fabricated modular wall systems, and resilient roofing solutions necessary to withstand increasingly severe weather events, fostering strong technological adoption.

- Europe: Leading the global market in terms of regulatory strictness, Europe's growth is predominantly fueled by the renovation wave mandated by the European Green Deal. The primary focus is on deep energy retrofitting of existing buildings, requiring high-R value insulation (like mineral wool and EPS/XPS with low GWP) and external insulation finishing systems (EIFS). Germany, France, and the Nordics are pioneers in adopting Passive House standards, emphasizing extremely low air permeability and minimal thermal bridging in all new construction.

- Asia Pacific (APAC): APAC represents the highest volume growth potential, driven by rapid urbanization, massive infrastructure spending, and industrial expansion in China, India, and Southeast Asia. While cost sensitivity remains a factor, regulatory compliance is strengthening in metropolitan areas, driving demand for basic insulation, standard double-glazed windows, and durable cladding materials. Japan and South Korea lead the region in advanced material adoption, particularly BIPV and specialized seismic-resistant envelope solutions.

- Latin America (LATAM): Growth in this region is localized and primarily centered around major economic hubs in Brazil and Mexico. The market is increasingly adopting imported high-performance materials due to heightened construction standards in specific commercial and luxury residential sectors. The main market drivers are focused on solar shading and cooling load reduction due to prevalent warm climates, fostering demand for high-performance coatings and specialized solar control films.

- Middle East and Africa (MEA): This region is characterized by extreme climatic conditions, driving specialized demand for superior solar reflectance, thermal performance, and dust mitigation. Significant investments in megaprojects (e.g., NEOM in Saudi Arabia) are pushing demand for cutting-edge, customized, high-tech facade engineering, often incorporating smart shading and integrated water harvesting systems to manage desert environments effectively.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Building Envelope Market.- Saint-Gobain S.A.

- 3M Company

- DuPont de Nemours, Inc.

- Rockwool International A/S

- Kingspan Group plc

- Owens Corning

- BASF SE

- Sika AG

- Huntsman Corporation

- Dow Inc.

- Carlisle Companies Incorporated

- CSR Limited

- Nippon Sheet Glass Co., Ltd.

- Tremco Incorporated

- GAF Materials Corporation

- Firestone Building Products

- CertainTeed

- Henry Company

- Holcim Group

- Wienerberger AG

Frequently Asked Questions

Analyze common user questions about the Building Envelope market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of the building envelope in sustainable construction?

The primary role of the building envelope is to act as the interface between the controlled interior environment and the external climate, critically managing heat, air, moisture, and vapor transfer. In sustainable construction, a high-performance envelope is essential for minimizing reliance on mechanical systems (HVAC), drastically lowering energy consumption, and achieving certifications like Net-Zero or Passive House standards.

How do air barriers differ from vapor barriers in building envelope systems?

Air barriers control the movement of bulk air into and out of the building structure, which is vital for preventing convective heat loss and managing moisture transport. Vapor barriers, or vapor retarders, specifically restrict the diffusion of water vapor through the building assembly, preventing condensation within wall or roof cavities that could lead to material degradation and mold growth.

What are the key technological advancements driving demand in the glazing segment?

Key advancements include the increasing adoption of Low-E (low-emissivity) coatings and inert gas fills (argon/krypton) in multi-pane windows to improve R-value. More dynamically, demand is driven by electrochromic (smart) glass, which electrically adjusts tinting to control solar heat gain and daylighting automatically, optimizing energy use and occupant comfort in real-time.

Which market segment offers the highest growth potential: new construction or retrofit?

While new construction offers high-value contracts, the retrofit and renovation segment is projected to show the highest long-term growth potential, particularly in developed regions like Europe and North America. This is due to regulatory mandates requiring existing buildings to undergo deep energy efficiency upgrades to meet ambitious national carbon reduction targets.

What role does digitalization play in optimizing building envelope performance?

Digitalization leverages technologies like AI, IoT sensors, and Building Information Modeling (BIM) to optimize the envelope. BIM facilitates precise design and material coordination, while IoT sensors embedded in the envelope provide continuous data on temperature and humidity, enabling predictive maintenance, minimizing performance gaps, and ensuring long-term functional integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager