Building Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432761 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Building Products Market Size

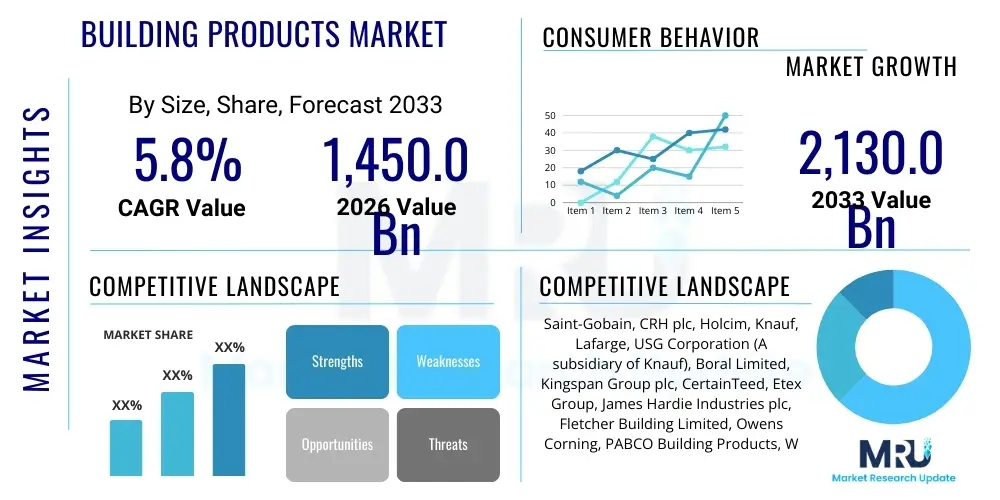

The Building Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1,450.0 Billion in 2026 and is projected to reach USD 2,130.0 Billion by the end of the forecast period in 2033.

Building Products Market introduction

The Building Products Market encompasses a vast, multi-trillion-dollar ecosystem comprising essential materials, integrated components, and advanced systems indispensable for the construction, comprehensive renovation, and routine maintenance of every type of built environment, ranging from residential complexes to critical industrial infrastructure. Products span the spectrum from fundamental commodities such as cement, aggregates, and structural steel, which form the skeletal framework of structures, to highly sophisticated, value-added components like advanced kinetic facades, energy-generating photovoltaic roofing tiles, and modular precast concrete elements. The market's health is intricately tied to global economic cycles, public spending patterns on infrastructure modernization, and critical demographic shifts, particularly the relentless global trend of urbanization which mandates continuous development of residential and commercial spaces. This continuous demand underscores the market’s inherent stability and strategic importance to global GDP. The market is intensely competitive, with major global players leveraging geographic diversification and product specialization to maintain dominance, while regional manufacturers focus on localized supply chain resilience and niche material expertise.

Major applications for building products are broadly categorized into the housing sector, which includes single-family homes, high-density multi-family housing, and affordable residential projects; the commercial sector, covering high-specification office towers, expansive retail centers, technologically advanced data centers, and specialized healthcare facilities; and the heavy civil infrastructure domain, which involves large-scale governmental projects such as highways, mass transit systems, ports, and water treatment plants. The utilization of high-performance building products yields multiple critical benefits: these include profoundly enhanced structural resilience against natural hazards, such as earthquakes and extreme weather events, significant improvements in the operational efficiency of the building through superior thermal insulation and daylighting control, leading directly to reduced energy consumption and lower utility bills, and crucial compliance with increasingly stringent national and international building safety and environmental standards. Architects and engineers increasingly rely on integrated digital tools like BIM to specify materials that optimize for both initial construction cost and long-term operational expense.

Key driving factors ensuring sustained market momentum include substantial, often mandated, government spending on climate change adaptation and infrastructure renewal projects, especially visible in emerging economies requiring modernization of transport and utility networks. Furthermore, in mature markets, the imperative for energy transition has led to massive demand for retrofitting existing building stock with advanced materials to comply with stringent net-zero emission targets. The complexity of modern architectural requirements, emphasizing aesthetics combined with hyper-efficiency, pushes manufacturers toward intensive R&D, fostering innovation in composite materials and sustainable alternatives, such as bio-based polymers and high-strength engineered wood. Despite these drivers, the market navigates significant challenges, predominantly stemming from chronic volatility in global raw material supply chains—a constraint that places a premium on localized production, resilient procurement strategies, and the critical development of local substitutes to maintain market stability and profitability margins across the entire construction ecosystem.

Building Products Market Executive Summary

The Building Products Market is currently positioned for strong expansion, propelled by converging forces including rebounding global construction activity, particularly in the post-recessionary phase, and a profound industry-wide shift toward sustainability and digitalization that is restructuring traditional business models. Strategic business trends emphasize vertical integration among leading market players, securing control over essential raw materials—a critical move to mitigate persistent price fluctuation risks associated with commodities like steel, cement clinker, and oil-derived insulation foams. Furthermore, manufacturers are aggressively pursuing digital transformation across the value chain, investing heavily in technologies such as 3D printing for specialized components and deploying advanced data analytics powered by AI to enhance operational efficiencies across the factory floor and the distribution network. The increasing market acceptance of modular and prefabricated construction techniques is fundamentally reshaping material consumption patterns, favoring standardized, factory-finished products over traditional site-built components, thereby guaranteeing improved quality, reduced waste, and significantly faster project completion cycles, which is becoming a decisive competitive advantage.

Regional dynamics clearly illustrate a dual market reality. The Asia Pacific region is the powerhouse of volume growth, benefiting from high population density, rapid urban migration, and massive state-backed infrastructure projects, creating unparalleled demand for basic structural materials. Conversely, North America and Western Europe are characterized by robust, but steadier, growth concentrated in high-value, specialized segments. These mature markets prioritize innovation in green building materials, smart home integration, and energy-saving façade systems, driven primarily by strict regulatory enforcement aimed at achieving ambitious climate goals and improving the energy performance of the existing building inventory. The ongoing geopolitical complexities influence material flow and pricing; hence, diversification of supply lines, near-shoring, and regional production localization have become critical strategic imperatives for multinational corporations aiming to maintain supply continuity, manage trade tariffs, and ensure price competitiveness globally against regional incumbents.

Analysis of market segments reveals sustained outperformance in niche, technology-intensive areas. The insulation market, covering everything from thermal barriers to advanced acoustic dampeners, is witnessing explosive demand directly resulting from global energy efficiency mandates and increasing consumer awareness regarding indoor air quality and comfort. Similarly, the fenestration and roofing segments are seeing strong uptake of specialized products like integrated solar panels and smart, switchable glass that dynamically responds to external light conditions. The shift toward sustainable materials is no longer marginal; it is becoming mainstream, with an increasing percentage of tender specifications globally requiring validated environmental product declarations and certification from recognized bodies like the Green Building Council. These trends underscore a permanent transition in the market toward higher specification, performance-driven products, necessitating continuous innovation in material science and agile production techniques to satisfy evolving regulatory demands and sophisticated consumer preferences for environmentally responsible and functionally superior construction outcomes.

AI Impact Analysis on Building Products Market

Analyzing common user inquiries regarding the influence of Artificial Intelligence (AI) on the Building Products Market highlights critical areas of interest: optimization of resource utilization, assurance of manufactured quality, and accelerating the material R&D pipeline. Users consistently ask how AI algorithms can effectively manage the extremely complex logistics of delivering high-volume, low-margin products like cement or drywall to diverse and geographically dispersed construction sites, particularly in predicting and mitigating bottlenecks caused by labor shortages or extreme weather. A core theme is the expectation that AI will be the foundational technology enabling personalized material specification and automated design optimization, leading to significant waste reduction and enhanced cost predictability in large-scale projects. Furthermore, concerns frequently arise regarding data privacy when deploying advanced monitoring systems and the scalability of AI solutions across globally distributed manufacturing facilities.

The overarching consensus and expectation within the industry is that AI will function as a profound force multiplier, enhancing human capabilities across the entire manufacturing-to-installation workflow. In manufacturing, AI algorithms analyze real-time sensor data from production lines to adjust variables dynamically, maintaining optimal curing temperatures for concrete or ensuring precise thickness for insulation panels, thereby dramatically reducing variances and improving overall yield. This deployment of machine learning in production environments moves quality control from reactive inspection to proactive, predictive assurance. Moreover, AI is proving invaluable in the laboratory, simulating the molecular behavior of new composite materials and predicting their long-term structural performance, drastically cutting the lengthy and costly traditional experimental phase necessary for developing next-generation building envelopes.

Looking downstream, AI applications are fundamentally altering how project management and procurement are executed. By integrating with Building Information Modeling (BIM) data, AI systems can automatically generate optimized material schedules, forecasting the required quantity and timing for thousands of diverse components across a project's timeline, minimizing both on-site storage needs and the risk of costly delays due to material unavailability. For product distribution, AI optimizes warehousing layouts and delivery routes, accounting for complex variables like traffic patterns, vehicle capacity, and delivery window restrictions. This precision in logistical execution is vital for a market dependent on timely delivery to maintain tight construction schedules, ultimately improving customer satisfaction and strengthening the reliability of the entire supply chain ecosystem.

- Optimized supply chain logistics through predictive inventory management and real-time route optimization across complex distribution networks.

- Enhanced quality control using machine vision systems integrated into production lines to instantly detect microscopic defects in manufactured components, such as stress fractures or improper mixing ratios.

- Accelerated material science R&D, utilizing generative AI models and molecular simulation to design and test new, high-performance, and low-carbon material compositions, drastically shortening innovation cycles.

- Deployment of predictive maintenance schedules for critical manufacturing equipment (e.g., kilns, mixers), minimizing costly unplanned downtime and maximizing plant utilization efficiency.

- AI-driven optimization of resource usage, including energy consumption and raw material sourcing, contributing significantly to sustainability targets and waste reduction in factory operations.

- Automated pricing and dynamic demand forecasting algorithms based on the real-time aggregation of economic indicators, construction permits issued, and project commencement data.

- Integration of AI-powered design tools within BIM platforms to automatically select and specify the most optimal material types based on performance, cost, and environmental criteria for complex building designs.

DRO & Impact Forces Of Building Products Market

The Building Products Market's trajectory is determined by a powerful confluence of internal drivers, external constraints, and strategic opportunities, all mediated by transformative impact forces. Primary market drivers include the unstoppable global megatrend of demographic shift toward urban centers, which necessitates extensive new construction, and the escalating governmental and corporate commitment to decarbonization. The latter driver translates directly into regulatory requirements for passive house standards, mandatory thermal efficiency upgrades, and the widespread adoption of products engineered for zero or low embodied carbon content, providing a non-negotiable impetus for high-specification materials like advanced insulation, sustainable lumber alternatives, and low-carbon cementitious materials. The continuous need to replace or upgrade aging infrastructure globally further supports stable long-term demand regardless of short-term residential market cycles.

However, the market confronts serious, structural restraints. The foremost restraint is the acute volatility and inflationary pressure affecting major commodity inputs—notably steel, petrochemicals used in polymers and adhesives, and high-quality timber—which severely compress manufacturer profit margins and complicate long-term fixed-price contracts for construction firms. Furthermore, the persistent global shortage of skilled construction labor creates bottlenecks in project completion, subsequently dampening the consistent demand for materials and increasing project timelines. Regulatory fragmentation across national and regional jurisdictions, particularly regarding safety certifications and material usage codes, presents a non-tariff barrier that complicates the scaling of standardized, innovative products globally, requiring costly adaptation and certification processes for different markets, inhibiting rapid expansion.

Significant opportunities abound in the rapid commercialization of circular economy principles applied to construction materials, including advanced recycling programs for demolition waste and the integration of substantial recycled content into new products, such as concrete and drywall, which offers cost and environmental advantages. The burgeoning demand for high-speed, scalable construction methodologies further opens the door for manufacturers specializing in pre-engineered systems, modular kitchens, and factory-built volumetric units, providing superior quality control and faster project delivery compared to traditional methods. Critical impact forces shaping the market include aggressive global climate policy (e.g., carbon taxes and green procurement mandates), technological disruptions such as advanced robotics in manufacturing, and macroeconomic cycles related to interest rate fluctuations, which dramatically affect the cost of construction financing and, consequently, project commencement rates and material demand elasticity across the globe.

Segmentation Analysis

The segmentation of the Building Products Market is multidimensional, allowing for a detailed examination of supply and demand dynamics across material types, functional applications, and end-use sectors. By Material Type, the market is broadly divided between heavy structural elements (like concrete and steel) and lighter, finishing, and performance-enhancing materials (such as coatings, insulation, and fenestration systems). This distinction is vital as the heavy materials segment is highly commoditized and volume-driven, sensitive to infrastructure spending, whereas the performance-enhancing segment is value-driven, marked by higher R&D intensity, and demonstrates greater resilience to economic downturns due to mandatory retrofit demands for energy efficiency.

Analyzing the market by Application—Residential, Commercial, Industrial, and Infrastructure—provides clarity on the primary source of expenditure. The Commercial segment often commands higher material specifications due to stricter fire safety requirements, necessity for longer structural spans, and advanced HVAC integration requirements, leading to demand for premium, customized product usage. Infrastructure, although often cyclical based on government budgeting, demands extreme material durability and long service life, driving steady demand for specialized polymer additives, protective coatings, and high-performance concrete. Crucially, the End-Use Sector analysis, dividing demand into New Construction versus Repair, Maintenance, and Renovation (RMR), highlights that RMR activity typically stabilizes market revenue during periods of reduced new project starts, acting as a crucial buffer against overall market volatility, especially in established economies where the existing building stock is aging and requires mandatory energy modernization to meet regulatory standards.

Within the Material Type breakdown, the fastest transformation is occurring within the Insulation and Composites sub-segments, particularly due to the convergence of sustainability and performance needs. Manufacturers are innovating rapidly, moving toward non-petroleum-based foams, vacuum insulated panels (VIPs), and bio-based insulation materials (like hemp or cellulose) to meet stringent environmental standards while offering superior thermal resistance. The shift is away from generic components toward integrated systems, where manufacturers provide entire façade solutions or complete roofing systems that combine structure, insulation, weather protection, and aesthetic finish. This comprehensive approach offers contractors simplified installation, enhanced system compatibility, and single-source warranty guarantees, which is highly valued in increasingly complex, large-scale construction projects seeking risk reduction and efficiency gains.

- By Material Type:

- Heavy Building Materials (Cement, Ready-Mix Concrete, Aggregates, Precast Structural Elements, Masonry)

- Wood Products (Dimensional Lumber, Engineered Wood, OSB, Plywood, Cross-Laminated Timber (CLT), Glulam)

- Metals (Structural Steel, Rebar, Aluminum Framing, Sheet Metal for Roofing, Fasteners)

- Plastics and Composites (PVC Piping and Windows, Fiberglass, Advanced Composites for Structural Applications, Polymer Sealants)

- Chemicals and Adhesives (Sealants, Waterproofing Membranes, High-Performance Coatings, Concrete Admixtures)

- Insulation Materials (Mineral Wool, Extruded Polystyrene (XPS), Polyurethane Foams, Vacuum Insulated Panels, Bio-based Insulation)

- Finishing Materials (Drywall, Interior Paneling, Flooring, Paint, Wall Coverings, Ceiling Systems)

- By Application:

- Residential Construction (Single-family Housing, Multi-family Apartments, Affordable Housing Schemes, Custom Homes)

- Commercial Construction (Office Buildings, Retail Centers, Hospitality, Data Centers, Educational Facilities, Healthcare)

- Industrial Construction (Manufacturing Plants, Logistics and Distribution Warehouses, Power Generation Facilities, Processing Plants)

- Infrastructure (Roads, Highways, Bridges, Tunnels, Rail Systems, Ports, Airports, Water and Utility Infrastructure)

- By End-Use Sector:

- New Construction (Greenfield and Brownfield Development Projects, Complete Structural Builds)

- Repair, Maintenance, and Renovation (RMR) (Building Upgrades, Energy Retrofits, Structural Repairs, Aesthetic Modernization)

Value Chain Analysis For Building Products Market

The Building Products Value Chain commences in the upstream segment, dominated by high-volume, resource-intensive activities such as the quarrying of aggregates and limestone, the extraction of bauxite or iron ore, and sustainable forestry management. This segment requires massive capital expenditure for specialized processing machinery and land access rights, and operations are profoundly influenced by global commodity pricing cycles, energy costs, and stringent environmental permitting processes. Successful upstream players focus intensely on resource efficiency, investing in advanced geological surveying and processing technologies to minimize material waste and ensure the consistent quality of feedstocks, which is non-negotiable for downstream processes like cement production or precision steel fabrication. Maintaining robust, long-term supply agreements and optimizing logistics for bulk material transportation are crucial components of mitigating geopolitical risk in material sourcing and ensuring market price stability.

The manufacturing stage represents the core value-added segment where manufacturers transform basic raw materials into highly specified, marketable products using proprietary production and finishing processes. This stage demands continuous technological investment in automation, highly energy-efficient production (e.g., transitioning to hydrogen or alternative fuels to decarbonize cement kilns), and adherence to strict international quality and safety certifications (e.g., ISO and ASTM standards). Product differentiation is often achieved through superior performance metrics—such as higher fire rating, enhanced structural span capabilities, or unique aesthetic finishes—which allows manufacturers to command premium pricing over commoditized offerings. Innovation here is paramount; companies often collaborate closely with architectural firms and engineering consultants early in the design phase to optimize product utility and integration into complex building systems, driving specification and ensuring product acceptance.

Distribution is the critical bridge connecting finished production to end consumption. The channel structure is typically bifurcated: direct distribution handles high-value, bespoke products (e.g., custom curtain wall systems or complex mechanical systems) delivered straight to large project sites, ensuring minimal logistical risk and tailored installation support. Indirect distribution utilizes an expansive network of large national distributors, specialized regional wholesalers, and consumer-facing retail chains (DIY stores). These intermediaries perform essential logistical and financial functions, including inventory holding, localized delivery management, provision of trade credit to contractors, and catering to the fragmented demand of the RMR sector. The increasing digitalization of distributor inventory and logistics management systems, utilizing cloud technology, is enhancing overall supply chain visibility and efficiency, minimizing material stockouts at critical construction junctures and improving inventory turns for the manufacturer.

Building Products Market Potential Customers

The Building Products Market serves a highly stratified clientele, each segment possessing distinct procurement drivers, volume requirements, and purchasing behaviors. The largest and most demanding customer group comprises institutional Construction Entities, including international general contractors, highly specialized trade subcontractors (e.g., specialized HVAC or glazing firms), and major private and public real estate developers. These customers are driven by scale and risk reduction, requiring vast, consistent volumes of materials, competitive bulk pricing structures, absolute adherence to predictable delivery schedules, and comprehensive product performance warranties. Their procurement is highly formalized, typically involving rigorous competitive tendering processes and demanding full compliance with highly detailed technical specifications documented in integrated digital models. Long-term, established supplier relationships, founded on demonstrable reliability and robust technical support, are essential for securing high-value business within this critical segment.

Secondly, Public Sector and Government Agencies constitute a vital, albeit heavily regulated, customer base, particularly for foundational infrastructure materials and public facility construction. Agencies responsible for transport networks, water utilities, and public facilities (schools, defense complexes) prioritize material longevity, verifiable resistance to environmental degradation, and strict compliance with public safety standards and local procurement regulations. There is an accelerating regulatory imperative for these entities to specify sustainable, low-carbon, and often locally sourced products, driven by governmental policies aimed at supporting domestic manufacturing and meeting national climate goals. Materials for heavy civil engineering projects, such as specialized high-performance concrete for bridges or durable road paving mixtures designed for specific traffic loads, represent a substantial and non-discretionary portion of this segment’s demand, requiring materials with proven life-cycle cost advantages.

The third customer group is the expansive segment of Homeowners, property managers, and small-to-medium-sized renovation contractors. These customers primarily access the market through retail channels, lumber yards, and regional specialty stores. While their individual purchase volume is smaller compared to institutional buyers, their collective activity in the highly resilient RMR sector constitutes a massive and indispensable market component. These buyers place a high value on ease of access, immediate product availability, competitive transactional pricing, and strong brand recognition backed by user-friendly installation instructions and aesthetic variety. Marketing strategies targeted at this segment often focus on translating complex performance attributes into tangible consumer benefits, such as significant energy savings (for insulation and windows) or increased home value (for premium siding and finishes), typically utilizing broad, accessible retail distribution and engaging digital content to drive impulsive or planned purchasing decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,450.0 Billion |

| Market Forecast in 2033 | USD 2,130.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saint-Gobain, CRH plc, Holcim, Knauf, Lafarge, USG Corporation (A subsidiary of Knauf), Boral Limited, Kingspan Group plc, CertainTeed, Etex Group, James Hardie Industries plc, Fletcher Building Limited, Owens Corning, PABCO Building Products, Weyerhaeuser Company, CEMEX S.A.B. de C.V., Tarkett S.A., Fastenal Company, Assa Abloy AB, Masco Corporation, Nippon Paint Holdings Co., Ltd., BASF SE, Huntsman Corporation, Dow Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Building Products Market Key Technology Landscape

The technological evolution within the Building Products Market is characterized by the confluence of advanced material science and digital manufacturing methodologies. Key technologies focus intensely on improving product performance attributes, enhancing manufacturing sustainability footprints, and crucially streamlining construction integration processes. The proliferation of digital platforms, particularly Building Information Modeling (BIM), has moved beyond a niche design tool to become a mandatory requirement for large, complex projects globally. Manufacturers must now provide detailed, performance-rich digital twins of their products, integrating seamlessly with contractor workflows, enabling accurate clash detection, precise cost estimation, and comprehensive lifecycle management, thereby effectively dictating specification success and reducing construction risk.

In manufacturing, the industrial adoption of robotics and highly automated, flexible production cells is significantly enhancing precision and throughput, particularly for complex components like pre-hung window assemblies or customized pre-engineered trusses, minimizing reliance on manual labor and maximizing consistency. Concurrently, the rise of industrial Internet of Things (IIoT) sensors allows for real-time, comprehensive monitoring of machine performance and material quality throughout the production cycle, enabling immediate corrective adjustments. This high degree of factory automation is essential for competing in a global environment where labor costs fluctuate and quality deviation is increasingly penalized. Furthermore, the systematic development of closed-loop recycling and sophisticated waste valorization technologies is optimizing resource input, turning production by-products (e.g., industrial fly ash, furnace slag) into valuable components for next-generation building products, aligning with circular economy mandates.

The leading edge of technological innovation involves revolutionary material development focused on long-term resilience and functional integration. This includes the commercial maturation of self-healing materials, particularly in concrete and polymer coatings, which automatically repair micro-cracks upon moisture exposure, drastically extending the product lifespan and reducing ongoing maintenance costs. The widespread integration of Phase Change Materials (PCMs) directly into drywall and insulation offers superior passive thermal regulation, critical for reducing reliance on active HVAC systems and improving energy ratings. Additionally, the development and regulatory acceptance of engineered mass timber products, such as CLT (Cross-Laminated Timber) and Glulam, are successfully challenging the traditional dominance of steel and concrete in mid-rise and high-rise construction, driven by their superior seismic performance, reduced carbon footprint, and markedly faster assembly times on site. These technological advancements collectively underpin the industry’s transition towards resilient, smart, digitally integrated, and ultimately sustainable built environments globally.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed center of gravity for the Building Products Market, responsible for the highest consumption volumes driven by relentless, state-sponsored urbanization programs and rapid industrialization. Countries like China, despite signs of economic maturity, maintain significant infrastructure investments in high-speed rail and utility grids, while emerging giants such as India and Indonesia are undergoing explosive residential and commercial development cycles driven by rapid population expansion. The demand profile in APAC is dual: exceptionally high volume for basic structural materials (cement, aggregates, rebar) for mass market needs, coupled with rapidly escalating demand for high-specification, imported, and locally manufactured premium products (advanced insulation, smart glass, specialized façade systems) driven by foreign direct investment and increasingly sophisticated local building codes in major metropolitan centers that require world-class performance.

North America (NA) and Europe represent highly mature, value-driven markets where growth is stable but concentrated in the non-discretionary RMR sector and specialized, performance-based new construction. In NA, the market is highly influenced by extreme climate zones (both hot and cold), driving substantial demand for resilient roofing, high-efficiency fenestration, and robust insulation systems capable of handling significant temperature fluctuations and reducing energy dependency. Procurement is heavily digitized, with strong contractor loyalty to established brands offering proven warranties and robust distribution networks. European growth is inextricably linked to strict regulatory frameworks such as the ‘Fit for 55’ package and national energy performance mandates, making compliance and sustainability credentials the central market drivers. This dense regulatory environment creates a highly favorable landscape for manufacturers of bio-based materials, advanced heat recovery systems, and integrated façade solutions that facilitate the mandatory deep energy retrofitting of aging structures across the continent.

Latin America (LATAM) presents a complex market characterized by high localized demand volatility, with growth heavily tied to specific national economic health and government stability. Key markets like Brazil, Mexico, and Chile exhibit significant underlying potential in affordable housing and essential transport infrastructure projects. The primary focus for building products here is durability, cost-effectiveness, and resilience against common localized challenges, such as seismic activity, high humidity, or intense rainfall. The Middle East and Africa (MEA) market is dominated by large-scale, often debt-financed, sovereign projects designed to diversify economies away from hydrocarbons (e.g., NEOM in Saudi Arabia). Demand is concentrated in specialized, high-performance materials for iconic architectural projects, demanding high-end curtain wall systems, extreme temperature-resistant materials, and imported luxury finishes. Africa’s long-term potential lies in exponential growth driven by rapid population growth and nascent infrastructure development, though current market entry requires navigating complex logistics and highly fragmented, informal distribution channels.

- Asia Pacific (APAC): Dominates market volume due to rapid urbanization, extensive infrastructure development (e.g., high-speed rail, utility upgrades), and strong government support for affordable housing programs, particularly in key economies like China, India, and Vietnam.

- North America: Characterized by high RMR (Repair, Maintenance, and Renovation) activity and the mandatory adoption of strict energy codes (e.g., ICC and ASHRAE standards), driving intense demand for high-efficiency insulation, durable roofing materials, and sophisticated smart building components for residential applications.

- Europe: Growth primarily driven by mandatory decarbonization targets (EU Green Deal and national net-zero commitments), fostering intense innovation in sustainable, bio-composite materials, advanced off-site construction systems, and intelligent façade technology optimized for thermal envelopes.

- Middle East and Africa (MEA): High growth potential driven by planned mega-projects (e.g., Giga Projects in KSA) and economic diversification efforts, leading to high-specification demand for premium, imported, heat-resistant construction materials, advanced air quality systems, and customized luxury finishes.

- Latin America (LATAM): Market expansion linked to increasing investments in foundational infrastructure and addressing the severe housing deficit, with a focus on cost-effective, durable, locally sourced, and standardized building solutions designed to withstand regional climate variations and specific seismic requirements efficiently.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Building Products Market.- Saint-Gobain (France) - Global leader in construction materials, including glass, plasterboard, and high-performance insulation.

- CRH plc (Ireland) - Major provider of diversified building materials, focusing on heavy materials, aggregates, and asphalt products.

- Holcim (Switzerland) - Global leader in cement, concrete, and aggregates, heavily investing in low-carbon cement technologies and circular economy solutions.

- Knauf Group (Germany) - Dominant player in drywall, plaster systems, insulation solutions, and specialized building boards globally.

- LafargeHolcim (now Holcim Group)

- USG Corporation (USA/Germany) - Leading provider of wallboard, mineral fiber ceilings, and specialized building systems, now part of Knauf.

- Boral Limited (Australia) - Strong presence in construction materials, particularly concrete, quarrying, asphalt, and roofing across ANZ and USA.

- Kingspan Group plc (Ireland) - Specialized in high-performance insulation and advanced building envelopes, a key driver of regulatory-compliant energy efficiency.

- CertainTeed (USA/France) - North American brand of Saint-Gobain, specializing in roofing, insulation, and vinyl and fiber cement siding products.

- Etex Group (Belgium) - Focuses on lightweight construction materials, including fiber cement, insulation, and roof coverings.

- James Hardie Industries plc (Ireland/USA) - Global leader in high-performance fiber cement building products, particularly siding and backerboard.

- Fletcher Building Limited (New Zealand) - Diversified manufacturer and distributor across construction and materials in the Australia and New Zealand (ANZ) region.

- Owens Corning (USA) - Leading provider of insulation, roofing, and fiberglass composites for residential and commercial applications.

- PABCO Building Products (USA) - Manufacturer of roofing and gypsum products primarily for the Western US market, focused on regional resilience.

- Weyerhaeuser Company (USA) - Focuses heavily on sustainable timber and engineered wood products, managing vast forest resources.

- CEMEX S.A.B. de C.V. (Mexico) - Multinational building materials company specializing in cement, ready-mix concrete, and aggregates across key markets.

- Tarkett S.A. (France) - Global leader in flooring and sports surfaces, emphasizing sustainability and circular design principles.

- Fastenal Company (USA) - Distributor of industrial, construction, and safety supplies, an essential component in the indirect supply chain for site management.

- Assa Abloy AB (Sweden) - Global leader in access solutions, including mechanical and electromechanical locks, doors, and entrance automation systems.

- Masco Corporation (USA) - Manufacturer of branded consumer products for home improvement and building industries (e.g., plumbing, architectural coatings, cabinets).

- Nippon Paint Holdings Co., Ltd. (Japan) - Major player in decorative, industrial, and specialized architectural coatings and paints.

- BASF SE (Germany) - Supplies specialized chemicals, polymers, concrete admixtures, and high-performance construction chemical systems.

- Huntsman Corporation (USA) - Provider of polyurethanes and advanced materials crucial for rigid insulation and composite production.

- Dow Inc. (USA) - Major chemical manufacturer providing sealants, adhesives, and essential materials for complex weatherization and building envelope systems.

Frequently Asked Questions

What is the projected growth rate for the Building Products Market?

The Building Products Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This consistent growth is primarily fueled by extensive global infrastructure spending, continued global urbanization, and increasing regulatory focus on energy efficiency and mandatory decarbonization in construction practices worldwide, driving demand for premium materials.

Which material segment is expected to show the highest growth?

The Insulation Materials and Advanced Composites segments are anticipated to demonstrate the highest growth rates. This trajectory is driven by increasingly stringent global mandates requiring residential and commercial buildings to achieve near-zero or net-zero energy consumption, significantly increasing the necessity for high-performance thermal barriers and lightweight structural elements like Cross-Laminated Timber (CLT) that enhance building performance.

How is Artificial Intelligence (AI) transforming the building products manufacturing process?

AI is fundamentally transforming manufacturing by optimizing highly complex supply chains through advanced predictive analytics, dramatically enhancing material quality control via integrated machine vision systems, and enabling proactive predictive maintenance in capital-intensive production facilities. This integration leads to measurable reductions in operational costs, improved yield rates, and enhanced product consistency and reliability across the entire production line.

Which geographical region dominates the Building Products Market in terms of volume?

The Asia Pacific (APAC) region currently holds the largest market share in terms of volume and is projected to maintain the fastest growth rate throughout the forecast period. This dominance is largely attributable to rapid, state-backed urbanization, massive government investment in public infrastructure modernization, and escalating new residential and commercial construction activity across key emerging economies like India and China.

What major regulatory factors influence demand for green building materials?

Key regulatory drivers include the adoption of mandatory global green building certifications (e.g., LEED, BREEAM), national energy performance directives (such as the EU’s EPBD), and the escalating requirement for comprehensive Environmental Product Declarations (EPDs), which force manufacturers to track and disclose the embodied carbon content of their products, favoring certified sustainable and bio-based alternatives with lower environmental impact.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager