Bulgaria Food and Drink Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431698 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Bulgaria Food and Drink Market Size

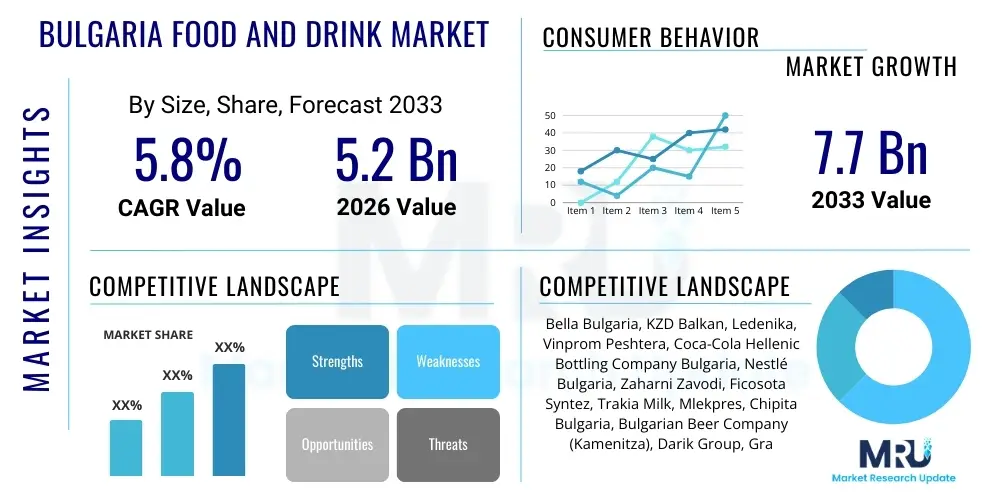

The Bulgaria Food and Drink Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $7.7 Billion by the end of the forecast period in 2033.

Bulgaria Food and Drink Market introduction

The Bulgarian Food and Drink Market is characterized by a dynamic blend of traditional, locally sourced products and a growing infiltration of international, premium, and functional foods, driven largely by increasing disposable incomes and convergence with European Union (EU) consumption standards. This sector is a cornerstone of the Bulgarian economy, encompassing everything from staple commodities like grains and dairy to highly processed goods, beverages, and specialized organic items. Key drivers include robust domestic consumption, favorable agricultural endowments, and a steady increase in exports, particularly targeting neighboring Balkan states and Western European countries that value high-quality, regionally distinct produce. The domestic demand is shifting notably towards healthier options, non-alcoholic specialty beverages, and convenient ready-to-eat formats, reflecting modern urban lifestyles.

Product categories span across essential foods (meat, bread, milk, vegetables), packaged foods (confectionery, snacks), and the substantial beverage segment (wine, beer, mineral water). Major applications involve retail sales through hypermarkets and convenience stores, the growing e-commerce channel, and the expanding HoReCa (Hotel, Restaurant, and Catering) sector, which benefits from Bulgaria's increasing tourism influx. The primary benefits derived from this market growth include enhanced food security, increased foreign direct investment (FDI) in processing infrastructure, and sustained employment across the value chain, from farm to fork. Furthermore, the market's technological adoption, particularly in logistics and quality control, ensures better product consistency and traceability, meeting stringent EU regulatory requirements.

Driving factors propelling market expansion include favorable macroeconomic conditions supporting consumer spending, proactive government policies supporting agricultural modernization through EU funds (like the Common Agricultural Policy), and shifting consumer preferences demanding higher transparency, ethical sourcing, and specialized dietary products (e.g., plant-based alternatives, gluten-free items). Moreover, Bulgaria serves as a crucial transit and processing hub within Southeast Europe, leveraging its strategic geographic position to facilitate cross-border trade in key commodities and finished food products, contributing significantly to regional supply chain robustness and diversification.

Bulgaria Food and Drink Market Executive Summary

The Bulgarian Food and Drink market trajectory is defined by structural shifts toward premiumization, digitalization of the supply chain, and increasing alignment with global sustainability standards. Business trends emphasize consolidation among domestic producers seeking scale to compete with multinational entrants, coupled with significant investment in advanced food preservation and packaging technologies to extend shelf life and reduce waste. Retail dominance continues to be held by large international supermarket chains, although specialized and ethnic food stores are gaining traction in major urban centers like Sofia and Plovdiv. A critical business imperative is the optimization of logistics to handle the growing demand for chilled and frozen goods, necessitated by evolving consumer lifestyles and modern retail formats.

Regional trends are bifurcated: urban centers exhibit higher demand for convenience, imported gourmet products, and high-margin functional foods, whereas rural areas maintain strong preference for traditional, locally produced, and lower-cost staple goods. Geographically, Southern Bulgaria, particularly regions with strong agricultural bases like the Thracian Valley, remains the primary hub for production and primary processing (especially wine and produce), while the Northeastern regions contribute significantly to grain and meat production. The capital region, Sofia, acts as the primary distribution nexus and the main driver for innovation adoption and specialized food retailing. Infrastructure improvements, particularly road networks, are crucial for integrating production areas with consumption centers and export ports, supporting efficient distribution.

Segmentation trends highlight vigorous growth in the healthy snacks and non-alcoholic beverages segments, reflecting a nationwide focus on wellness and preventative health measures. The dairy sector, traditionally robust, is seeing innovation through high-protein and fermented products (like the indigenous Bulgarian yogurt, recognized globally for its quality). The processed meat sector is undergoing rigorous quality scrutiny due to regulatory changes, leading to a shift towards higher-quality, traceable sources. Technology integration is paramount, with manufacturers adopting automation to handle increased volumes and ensure compliance with complex hygiene standards, thereby improving overall efficiency and product safety across all major segments.

AI Impact Analysis on Bulgaria Food and Drink Market

Common user inquiries regarding AI in the Bulgarian Food and Drink Market frequently revolve around optimizing complex supply chain logistics, improving food safety and quality control (QC), and personalizing consumer engagement strategies. Users are keen to understand how AI-driven predictive maintenance can reduce costly downtime in aging processing plants and how machine learning (ML) algorithms can accurately forecast demand fluctuations, particularly for highly perishable goods like fresh produce and dairy. A key concern focuses on the accessibility and affordability of these advanced technologies for small and medium-sized enterprises (SMEs) that constitute a large portion of the local market structure. Furthermore, there is significant interest in using AI to enhance product development cycles, leveraging consumer data to rapidly prototype flavors and formulations that align with emerging health and wellness trends specific to the Balkan consumer base.

The deployment of Artificial Intelligence is anticipated to fundamentally redefine operational efficiencies, particularly in large-scale logistics and manufacturing. In processing facilities, computer vision systems, powered by AI, are replacing manual inspection processes, leading to faster detection of contaminants, inconsistencies, and packaging defects, thereby drastically improving final product quality and reducing recall risks. For the agricultural segment, AI-driven precision farming techniques, including drone-based imagery analysis and predictive soil health models, enable Bulgarian farmers to optimize input usage (fertilizer, water), leading to higher yields and reduced environmental impact, which aligns with EU green initiatives. This level of granular control offers a substantial competitive advantage in a region where optimizing resource use is critical for profitability.

Beyond the operational sphere, AI is revolutionizing market strategy and customer interaction. Predictive analytics tools are being adopted by major retailers to manage inventory levels dynamically, minimizing spoilage losses—a significant issue for fresh food supply chains. On the consumer front, AI-powered chatbots and recommendation engines are personalizing the online grocery shopping experience, suggesting relevant Bulgarian and international products based on purchase history, dietary restrictions, and stated health goals. This shift towards personalized marketing strengthens brand loyalty and enables quicker monetization of specialized product niches, driving overall market value growth. The successful integration of these tools hinges on robust data infrastructure and specialized training for the local workforce.

- AI-driven Predictive Demand Forecasting minimizing inventory spoilage, crucial for fresh food logistics.

- Implementation of Computer Vision systems for automated quality control and foreign object detection during processing.

- Optimization of supply chain routing and cold chain monitoring using machine learning algorithms.

- Precision agriculture deployment to optimize fertilizer application and yield forecasting in grain and produce farming.

- Personalized marketing and product recommendation engines enhancing consumer engagement in e-commerce channels.

- Automated compliance monitoring, using NLP to track and interpret evolving EU and national food safety regulations.

DRO & Impact Forces Of Bulgaria Food and Drink Market

The dynamics of the Bulgarian Food and Drink market are shaped by a complex interplay of internal and external forces categorized as Drivers, Restraints, and Opportunities (DRO), which collectively exert significant impact forces on market expansion and structure. A major driving force is the consistent increase in private consumption expenditure, bolstered by rising wages and a lower unemployment rate, which translates directly into higher demand for both essential and discretionary food items, particularly those associated with convenience and perceived luxury. Furthermore, the robust investment in the agricultural sector, often subsidized by EU structural funds, enables modernization and increases capacity, providing a steady stream of high-quality raw materials. However, regulatory harmonization with stringent EU standards acts as both a driver for quality improvement and a significant constraint due to the high compliance costs associated with traceability, hygiene, and environmental protocols, especially for smaller, traditionally run processing units.

Restraints primarily stem from high energy and raw material volatility, which significantly impacts production costs, particularly in energy-intensive sectors like dairy and meat processing, frequently eroding profit margins. Another critical restraint is the persistent shortage of skilled labor, particularly in technical processing roles and high-level supply chain management, challenging the scaling and modernization efforts of food manufacturers. Operational inefficiencies, often observed in fragmented distribution networks outside major metropolitan areas, also limit the rapid penetration of innovative products. The impact forces are further complicated by external geopolitical instabilities affecting commodity prices, which are swiftly passed down to Bulgarian consumers, creating inflationary pressure and sometimes shifting consumer purchasing behavior towards lower-cost alternatives, especially in price-sensitive segments.

Opportunities for sustained growth are substantial, particularly in developing the export potential of indigenous Bulgarian products such as yogurt, specialized cheeses, and high-quality wines, capitalizing on the "Made in Bulgaria" premium positioning in certain international markets. The rapidly growing segment of functional foods (e.g., probiotics, fortified beverages) and plant-based alternatives presents a fertile ground for domestic innovation and foreign investment, driven by the younger, health-conscious consumer base. The increasing sophistication of the domestic tourism sector also generates substantial opportunities for suppliers catering to the HoReCa segment, demanding premium ingredients and ready-to-use food solutions. Strategic investments in digitalization of the farm-to-table pathway, leveraging blockchain for enhanced traceability, offer a crucial differentiator in competitive European markets, further solidifying Bulgaria's position as a regional food supplier.

Segmentation Analysis

The segmentation of the Bulgarian Food and Drink Market is critical for understanding consumer behavior and operational strengths, categorized primarily by Product Type, Distribution Channel, and End-User. By Product Type, the market is structurally dominated by processed foods, staples, and the significant dairy segment, given Bulgaria's cultural affinity for dairy products. However, the fastest growth is observed within niche segments like organic foods, functional ingredients (e.g., proteins and vitamins), and ready-to-eat meals, reflecting modernization and increasing time constraints on consumers. Analysis shows manufacturers are strategically optimizing product portfolios to balance high-volume staple production with high-margin, specialized item manufacturing, thereby maximizing overall profitability within a competitive environment.

Distribution is segmented into traditional retail (small independent shops), modern retail (supermarkets, hypermarkets), and institutional sales (HoReCa, government contracts). Modern retail channels currently account for the largest share due to convenience and competitive pricing strategies. The e-commerce channel, although starting from a smaller base, demonstrates exceptional growth rates, particularly in urban areas, driven by improved cold chain delivery infrastructure and consumer reliance on digital platforms post-pandemic. Understanding channel preference is essential, as the choice dictates packaging requirements, logistical complexity, and marketing strategy, with a clear trend toward multichannel presence for key brands.

Further segment analysis considers the level of processing—primary, secondary, and tertiary—which defines the technological complexity and value addition within the market. Primary processing (e.g., grain milling, milk pasteurization) forms the foundational layer, while tertiary processing (e.g., complex ready meals, highly refined beverages) commands the highest margins but requires the most significant capital expenditure in advanced machinery and R&D. These segment insights are crucial for both domestic producers seeking expansion and international investors evaluating entry strategies, ensuring investment aligns with specific high-growth subsectors that exhibit favorable regulatory conditions and strong consumer uptake.

- By Product Type:

- Dairy Products (Yogurt, Cheese, Milk)

- Meat and Meat Alternatives (Processed Meats, Poultry, Plant-Based)

- Bakery and Confectionery (Bread, Pastries, Chocolate)

- Beverages (Alcoholic - Wine, Beer; Non-Alcoholic - Water, Juices, Soft Drinks)

- Grains and Cereals

- Fresh Produce (Fruits and Vegetables)

- Oils and Fats

- By Distribution Channel:

- Hypermarkets and Supermarkets (Modern Trade)

- Convenience Stores and Traditional Grocery Stores (Traditional Trade)

- Online Retail (E-commerce)

- Food Service (HoReCa)

- By Level of Processing:

- Unprocessed/Minimally Processed

- Processed (Canned, Frozen, Packaged)

- Highly Processed (Ready-to-Eat, Functional Foods)

Value Chain Analysis For Bulgaria Food and Drink Market

The Value Chain for the Bulgarian Food and Drink Market begins with the Upstream analysis, primarily centered on agriculture, farming, and raw material supply. This stage is highly fragmented, consisting of many small, private landholders alongside a few large, commercial farming cooperatives, particularly in grain and oilseed production. Key upstream activities include seed provision, fertilizer and agrochemical supply, primary harvesting, and initial storage. EU subsidies play a critical role here, financing equipment modernization and promoting sustainable farming practices (organic certification). The efficiency of this upstream segment is foundational, as it dictates the quality, consistency, and cost structure of raw inputs delivered to processors. Challenges often arise from seasonal volatility and the need for improved cold storage infrastructure immediately post-harvest to minimize losses.

The Midstream component involves the complex network of processing and manufacturing facilities, where raw materials are transformed into finished goods. This includes large-scale meat packers, dairy processors, beverage bottlers, and packaged food manufacturers. Investment in this segment is driven by the need for compliance with strict EU health and safety standards (HACCP implementation) and optimization through automation technology. Direct distribution channels involve large manufacturers supplying directly to major retail chains or institutional buyers (hotels/restaurants), allowing for better margin control and product tracking. Indirect distribution involves various intermediaries, including wholesalers, regional distributors, and logistics providers who manage the complex task of reaching traditional retail outlets and rural markets, where direct delivery is cost-prohibitive for producers.

The Downstream analysis focuses on the final stages of market penetration: retail and consumption. Modern retail—hypermarkets and large supermarket chains—dominate the downstream, offering centralized purchasing power and efficient stock management. The growing importance of e-commerce necessitates investment in specialized last-mile delivery and dedicated cold chain logistics, which constitutes a major expenditure. Final consumers, the end-users, are increasingly influenced by factors such as convenience, sustainability claims, and nutritional labeling. The efficiency of the entire chain, from farm gate to consumer plate, is crucial; robust cold chain management and high-speed data integration (e.g., using ERP systems) are essential to maintain quality and minimize waste, ultimately influencing consumer trust and brand perception within the highly competitive downstream market.

Bulgaria Food and Drink Market Potential Customers

The primary customer base for the Bulgarian Food and Drink Market is highly segmented, driven by socioeconomic status, geographic location, and lifestyle choices. The largest volume segment comprises individual consumers and households, with consumption patterns heavily skewed towards essential staples, dairy products, and domestically produced meats. Within this segment, there is a clear demarcation between urban, affluent consumers who prioritize premiumization, imported specialties, and health-centric products (organic, functional foods), and rural, price-sensitive consumers who focus on affordability and traditional food sources. Targeted marketing strategies must acknowledge this dual nature, utilizing digital platforms for the urban population and focusing on traditional media and in-store promotions for rural demographics to optimize reach and conversion rates.

The second major group consists of the rapidly expanding Hotel, Restaurant, and Catering (HoReCa) sector, fueled by Bulgaria’s strong and increasing tourism flow, especially along the Black Sea coast and ski resorts. These institutional buyers demand consistency, bulk supply, specific quality specifications, and increasingly rely on specialized food service distributors capable of handling complex logistics and just-in-time delivery schedules. Suppliers targeting HoReCa must maintain stringent quality control certifications and offer a diverse portfolio, including processed ingredients, specialty cheeses, high-quality wines, and convenient ready-to-use preparations that minimize kitchen labor, thereby offering significant added value to busy establishments.

Finally, international importers and foreign wholesalers represent a critical potential customer base for Bulgarian products, particularly high-value items like wines, traditional fermented dairy products (Bulgarian yogurt), and high-quality essential oils derived from local agriculture. These customers prioritize adherence to international quality standards, robust traceability documentation, and competitive pricing relative to other EU suppliers. Export potential is particularly strong in the EU, where Bulgarian products benefit from zero-tariff trade, making strategic engagement with export promotion agencies and compliance with destination-specific labeling requirements vital for unlocking significant cross-border revenue streams and diversifying the domestic producer's market risk.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $7.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bella Bulgaria, KZD Balkan, Ledenika, Vinprom Peshtera, Coca-Cola Hellenic Bottling Company Bulgaria, Nestlé Bulgaria, Zaharni Zavodi, Ficosota Syntez, Trakia Milk, Mlekpres, Chipita Bulgaria, Bulgarian Beer Company (Kamenitza), Darik Group, Gradus, Karat-S. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bulgaria Food and Drink Market Key Technology Landscape

The Bulgarian Food and Drink market is witnessing a fundamental shift in its technological landscape, moving beyond basic mechanization towards advanced automation, digitization, and intelligent processing systems, largely driven by the imperative to meet rigorous EU standards and improve resource efficiency. A core technological focus involves the adoption of sophisticated Food Safety and Quality (FSQ) systems, including advanced sensors, real-time monitoring devices, and standardized traceability platforms utilizing blockchain technology. These systems are crucial for maintaining end-to-end transparency, reducing the risk of contamination, and streamlining audit processes, providing a vital competitive edge, particularly for export-oriented firms dealing in high-risk categories such as dairy and meat. Furthermore, investments are concentrated in energy-efficient technologies, such as waste heat recovery systems and optimized refrigeration units, aiming to mitigate the high operational costs associated with electricity and natural gas volatility.

Packaging technology represents another pivotal area of innovation, with a noticeable trend towards sustainable and smart packaging solutions. This includes the utilization of biodegradable materials, recyclable plastics, and active/intelligent packaging systems that incorporate indicators for freshness or temperature deviations, thus improving food quality assurance across extended supply chains. Automated packaging lines, utilizing robotics and high-speed sorting mechanisms, are replacing manual labor to enhance throughput and consistency, which is particularly vital for mass-market staple goods like bread, milk, and bottled beverages. The adoption of Flexible Manufacturing Systems (FMS) is also increasing, allowing manufacturers to quickly pivot production lines to accommodate smaller batch sizes for diverse product variants, a requirement driven by rapid consumer preference shifts towards niche market products.

On the operational front, Enterprise Resource Planning (ERP) systems, integrated with Supply Chain Management (SCM) software, form the technological backbone for modern Bulgarian food and drink enterprises. These platforms facilitate optimized inventory control, enhanced production scheduling, and synchronized communication across procurement, manufacturing, and distribution functions. The move towards cloud-based ERP solutions provides scalability and real-time data access, enabling faster, data-driven decision-making regarding sourcing and pricing strategies in highly dynamic market conditions. This holistic integration of Information Technology (IT) with Operational Technology (OT) is transforming traditional processing plants into smart factories, enhancing overall efficiency and enabling adherence to international benchmarks for operational excellence, thereby future-proofing the industry against increasing global competition.

Regional Highlights

While the Bulgaria Food and Drink Market is analyzed at a national level, internal regional dynamics significantly influence production specialization, consumption patterns, and logistical requirements. The South-Central planning region, encompassing areas like Plovdiv and the Thracian Valley, stands out as the agricultural heartland, characterized by high output in wine, essential oils (rose production), and fruit/vegetable processing. This region leverages its fertile lands and established processing infrastructure, benefiting from direct rail and road connections that facilitate both domestic distribution and exports via major ports. Investment here is highly concentrated in specialized, high-value-added products that capitalize on geographical indications (GIs).

The Southwestern region, centered around Sofia, holds paramount importance not as a primary production area but as the main consumption, distribution, and administrative hub. Sofia drives the demand for premium, imported, and ready-to-eat products, reflecting higher average incomes and urbanized lifestyles. This region is the primary entry point for international food service chains and the headquarters for most multinational food corporations operating in Bulgaria. Logistical efficiency and cold chain robustness are most critical in this high-density urban environment to ensure quick delivery and minimize spoilage.

The Northern and Northeastern regions are significant for commodity crops, particularly grain production (wheat, corn, sunflower seeds) and meat processing. These regions often rely on older, larger processing facilities and face higher infrastructural challenges compared to the South. Their strategic relevance lies in their proximity to the Romanian market and access to the Danube River, which is critical for bulk commodity transportation. Future growth here is contingent upon modernization of storage facilities and adoption of efficient large-scale farming technologies to compete effectively in the global commodity markets.

- Sofia Capital Region: Primary consumption center, key distribution hub, highest demand for premium/imported goods and e-commerce services.

- South-Central (Plovdiv, Thracian Valley): Major production area for high-value crops (wine, rose oil, fruits) and primary processing, strong reliance on EU funds.

- Northeastern Region (Varna, Ruse): Focus on large-scale commodity production (grains, meat), important for regional trade and Danube transport logistics.

- Black Sea Coast Region: Significant seasonal demand driven by tourism, requiring high flexibility and capacity in the HoReCa supply chain during summer months.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bulgaria Food and Drink Market.- Bella Bulgaria

- KZD Balkan (Karnobat Dairy Farm)

- Ledenika (Meat Processing)

- Vinprom Peshtera (Beverages, Spirits)

- Coca-Cola Hellenic Bottling Company Bulgaria

- Nestlé Bulgaria

- Zaharni Zavodi (Sugar and Confectionery)

- Ficosota Syntez (F&B Division)

- Trakia Milk

- Mlekpres

- Chipita Bulgaria (Snacks and Bakery)

- Bulgarian Beer Company (Kamenitza)

- Darik Group (Mineral Water)

- Gradus (Poultry and Eggs)

- Karat-S (Meat Processing)

- Danone Bulgaria

- Mondelez International (Bulgarian Operations)

- Agropolychim AD (Input Supplier/Related)

- Devin JSC (Water Bottling)

- Biser Olive (Oils and Fats)

Frequently Asked Questions

Analyze common user questions about the Bulgaria Food and Drink market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the premium food segment in Bulgaria?

The growth in the premium food segment is primarily driven by rising real disposable incomes, urbanization in major cities like Sofia and Plovdiv, and a strong consumer focus on health, wellness, and traceable, high-quality international and local organic products. Increased tourism also boosts demand for high-end dining experiences and specialized regional products.

How significant is the role of EU membership in shaping the Bulgarian Food and Drink market?

EU membership is foundational, providing significant financial support through agricultural subsidies (CAP), enforcing stringent food safety and quality standards (HACCP), and offering tariff-free access to the vast European common market, driving modernization and export competitiveness across all segments, especially dairy and processed goods.

What are the primary logistical challenges facing the distribution of perishable goods in Bulgaria?

Primary logistical challenges include fragmented distribution networks outside of major urban corridors, necessitating complex third-party logistics (3PL) solutions, and the critical need for continuous investment in reliable cold chain infrastructure (refrigerated warehousing and transport) to minimize waste and ensure product integrity across long distances.

Which product category is expected to exhibit the highest Compound Annual Growth Rate (CAGR) by 2033?

The Non-Alcoholic Beverages segment, particularly functional waters, ready-to-drink coffee/teas, and specialized health drinks, along with the Plant-Based Alternatives sector, is projected to show the highest CAGR, fueled by evolving health trends and demand for convenient, low-sugar alternatives to traditional soft drinks.

How is technology being utilized to improve sustainability within the Bulgarian F&D supply chain?

Technology is enhancing sustainability through precision agriculture (optimizing input use in farming), implementing smart packaging to extend shelf life and reduce waste, and utilizing AI-driven demand forecasting to minimize inventory losses at the retail and manufacturing level, aligning with broader European Green Deal objectives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager