Bulk Baijiu Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433843 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Bulk Baijiu Market Size

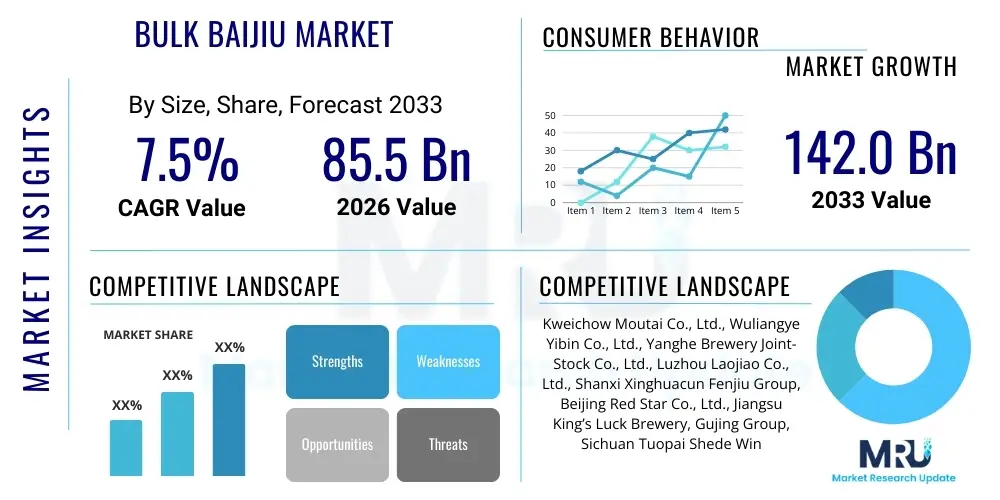

The Bulk Baijiu Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 85.5 Billion in 2026 and is projected to reach USD 142.0 Billion by the end of the forecast period in 2033.

Bulk Baijiu Market introduction

The Bulk Baijiu Market encompasses the production, distribution, and utilization of high-volume, typically non-premium grade Chinese distilled spirits (baijiu) destined primarily for secondary processing, commercial blending, or mass local consumption. Baijiu itself is characterized by its complex fermentation process involving Qu (starter culture) and diverse raw materials, predominantly sorghum, rice, or wheat. Bulk products serve a critical function within the industry supply chain, acting as foundational spirits that are either bottled directly for value-conscious consumers or utilized by major distillers for blending to achieve consistency across large batches of branded products, thereby significantly reducing production costs and lead times for high-demand varieties.

Major applications for Bulk Baijiu include large-scale blending operations, where lower-cost bulk spirit is combined with aged or high-grade baijiu to meet specific aroma and flavor profiles mandated by commercial brands. Furthermore, substantial quantities are channeled into industrial applications such as the production of traditional Chinese medicines (TCMs) that require alcohol as a solvent or preservative, as well as being sold directly to restaurants and specialized retail outlets for local, unbranded consumption. The inherent cost-efficiency of bulk production, coupled with the consistently high domestic demand for alcoholic beverages in China, establishes this segment as a vital, high-volume component supporting the broader spirits market ecosystem.

Driving factors for the sustained growth of this market segment include urbanization in second and third-tier Chinese cities, leading to increased disposable income and social consumption; the continued dominance of baijiu as the preferred celebratory and traditional spirit; and the operational necessity for major distilleries to maintain stable inventory levels of base spirits for their blending requirements. The market’s robustness is highly correlated with raw material pricing and the overall health of China’s hospitality and traditional retail sectors, positioning Bulk Baijiu as a fundamentally important, albeit less visible, economic driver within the global spirits industry.

Bulk Baijiu Market Executive Summary

The Bulk Baijiu Market is characterized by resilient domestic demand, structural cost advantages, and increasing technological integration aimed at enhancing supply chain efficiency. Business trends indicate a move toward more standardized bulk production methods, particularly leveraging automation in fermentation and distillation processes to ensure batch consistency, a requirement increasingly emphasized by downstream blenders. While premium and super-premium segments capture high value, the bulk segment offers volume stability, serving as the economic foundation of the entire baijiu industry by supplying base materials and catering to the vast value-for-money consumer base, especially in rural and emerging urban areas.

Regional trends are overwhelmingly dominated by the Asia Pacific (APAC) region, specifically mainland China, which accounts for virtually all production and consumption. Key production hubs, such as Sichuan, Guizhou, and Jiangsu, specializing in Strong Aroma, Sauce Aroma, and Light Aroma types respectively, dictate global market dynamics. However, emerging interest is observed in export markets, where bulk baijiu is being utilized by international spirits companies exploring fusion beverages or attempting small-scale local bottling operations, driven by Chinese diaspora communities and the growing global recognition of Asian spirits.

Segment trends highlight the perpetual dominance of Strong Aroma (Nong Xiang) and Light Aroma (Qing Xiang) varieties in bulk production due to their broad appeal and versatility in blending. There is a notable rising trend in the production of Sauce Aroma (Jiang Xiang) bulk baijiu, driven by the increasing popularity and higher pricing of flagship sauce aroma brands, prompting distillers to increase their reserves of bulk foundation spirits. Application-wise, the blending segment maintains the largest market share, essential for the mass-market products of major manufacturers, while the direct local consumption segment remains strong due to its cost-effectiveness and localized distribution networks.

AI Impact Analysis on Bulk Baijiu Market

User inquiries regarding AI's influence in the Bulk Baijiu market frequently center on how technology can solve endemic challenges related to consistency, quality assurance, and high raw material costs. Common questions focus on whether AI can monitor and control the complex traditional fermentation process (e.g., controlling temperature and humidity in pits or tanks), predict supply chain bottlenecks related to seasonal sorghum or rice harvests, and optimize blending ratios to minimize wastage while maintaining specified aroma profiles. There is also significant curiosity about using machine learning to detect and mitigate counterfeit bulk spirits before they enter the formal supply chain and leveraging predictive analytics to forecast localized bulk demand shifts across various provincial markets, crucial for optimizing logistics and inventory management in this high-volume commodity sector.

AI's primary impact involves transforming traditional, highly experience-dependent production stages into data-driven processes. By deploying machine vision systems and sensor networks within fermentation pits and distillation columns, distillers can capture real-time data on microbial activity, chemical composition, and temperature gradients. Machine learning algorithms then analyze these vast datasets to predict optimal harvest times for the fermented grains, adjust processing parameters instantly, and significantly reduce the variance between batches, which is paramount in the bulk segment where consistency is often difficult to achieve across massive production volumes. This shift from manual assessment to algorithmic control guarantees higher quality base spirits while simultaneously reducing the reliance on highly skilled, aging master blenders, providing a pathway for sustainable scaling.

Furthermore, AI is crucial in inventory and logistics optimization. Bulk baijiu storage and distribution across China often involves complex logistics due to the sheer volume and regional regulatory differences. AI-powered demand forecasting tools integrate historical sales data, seasonal consumption patterns (e.g., Chinese New Year, weddings), and macroeconomic indicators to generate highly accurate forecasts for regional warehouses. This predictive capability minimizes overstocking, reduces capital tied up in inventory, and lowers transportation costs by optimizing routes and shipment timings for high-volume liquid freight, ensuring timely supply to downstream blenders and bottlers throughout the vast Chinese market.

- AI optimizes complex fermentation processes using sensor data and predictive modeling.

- Machine learning ensures batch consistency and reduces quality variance in bulk spirits.

- Predictive analytics enhance supply chain efficiency and localized demand forecasting.

- AI-driven robotics automate packaging and bulk handling, improving throughput.

- Computer vision systems are deployed for rapid quality control and counterfeit detection.

DRO & Impact Forces Of Bulk Baijiu Market

The Bulk Baijiu Market is fundamentally driven by overwhelming domestic consumption volumes and the foundational role bulk spirit plays in the branded product supply chain, contrasted sharply by persistent regulatory scrutiny regarding food safety and a societal shift toward lower-volume, higher-quality consumption. Drivers include the cost-effectiveness of bulk production, enabling affordability for mass markets, and the continuous need for base spirits by large, established distillers for standardizing their final products. Restraints encompass stringent government regulations on distillation and environmental protection, particularly concerning water usage and waste disposal (spent grain), which affect high-volume operations, coupled with increasing consumer preference for premium, smaller-batch, or imported spirits.

Opportunities arise from technological advancements, specifically implementing automation and sensor technology to enhance quality control, thereby closing the perceived quality gap between bulk and premium spirits. Additionally, the development of specialized, region-specific bulk aroma types (e.g., Rice Aroma from the South) offers niche market expansion potential. The main impact forces shaping the market include strict government intervention (regulatory force), which mandates production standards and inventory holding periods; competitive dynamics within the core Chinese market; and evolving social trends prioritizing health and moderation, which subtly pressures the high-volume, lower-margin bulk segment.

The net impact of these forces suggests a period of consolidation and standardization within the bulk market. Smaller, less compliant distilleries face significant pressure from tightening environmental regulations, pushing production toward larger, more technologically equipped players. While demand remains robust, future growth will be increasingly contingent on the ability of producers to demonstrate transparency, sustainability, and consistent quality, moving away from the purely commoditized perception of bulk spirits toward a value-added base ingredient crucial for the entire industry's stability and growth.

Segmentation Analysis

The Bulk Baijiu market is segmented based on critical technical and application parameters that define both production methodology and end-use behavior. Key segmentations focus on Aroma Type, which directly dictates the production region and flavor profile (the most crucial distinction in baijiu), Raw Material composition, reflecting ingredient sourcing and traditional methods, and Application, which differentiates between commercial use (blending/industrial) and direct consumer consumption. Understanding these segments is vital as bulk pricing and market dynamics vary significantly depending on the aroma complexity and intended downstream use, with Sauce Aroma often commanding higher bulk prices than Light Aroma due to its prolonged maturation requirements.

The Aroma Type segmentation is the bedrock of the market, defining regional specialization and consumer expectation. Strong Aroma dominates the volume due to its widespread production base (Sichuan, Anhui) and versatile blending properties, followed by Light Aroma, known for its clean profile and cost-efficient production. The third major segment, Sauce Aroma, while lower in volume, represents spirits requiring complex, lengthy, and expensive production cycles (e.g., Da Qu fermentation in Guizhou), making its bulk production strategically important for future premiumization efforts. Raw material segmentation typically includes Sorghum (the primary component for most major baijiu types), Rice (common in the South, yielding Rice Aroma), and Mixed Grains (used for specific regional and complex flavor profiles).

Application segmentation illustrates the functional role of bulk spirits. The largest segment remains commercial Blending and Bottling, where bulk spirits are the foundational components for mass-market and mid-range branded products, ensuring flavor standardization and volume stability. Industrial use, particularly in Traditional Chinese Medicine and food flavorings, forms a stable secondary segment. The Direct Consumption segment, which includes unbranded or locally bottled spirits sold directly to consumers in volume, reflects the value-conscious segment of the market and maintains strong regional presence in rural areas and local marketplaces, driven purely by price and immediate local availability.

- By Aroma Type:

- Strong Aroma (Nong Xiang)

- Sauce Aroma (Jiang Xiang)

- Light Aroma (Qing Xiang)

- Rice Aroma (Mi Xiang)

- Other Aroma Types (e.g., Phoenix, Compound)

- By Raw Material:

- Sorghum-Based

- Rice-Based

- Wheat-Based

- Mixed Grain

- By Application:

- Commercial Blending and Bottling

- Direct Consumer Consumption (Unbranded/Local)

- Industrial Use (TCM, Food Flavoring)

Value Chain Analysis For Bulk Baijiu Market

The Bulk Baijiu value chain is characterized by a high degree of integration between raw material sourcing, specialized fermentation, bulk storage, and downstream processing, focusing heavily on volume efficiency. The upstream segment is dominated by agriculture, primarily focusing on high-yield sorghum and wheat cultivation, where sourcing efficiency and price stability are paramount. Since bulk production is highly cost-sensitive, large distillers often secure long-term contracts or invest in agricultural infrastructure to ensure a steady, affordable supply of specific grain varieties optimized for distillation yields and desired aroma production. Specialized suppliers of Qu (starter culture), which is proprietary and essential for the fermentation process, also form a critical, yet less commoditized, part of the upstream chain, dictating quality outcomes.

The midstream process involves the complex and energy-intensive stages of fermentation (often in underground pits or specialized tanks), distillation (frequently continuous or semi-continuous for bulk volume), and maturation (which can range from minimal aging to several years, depending on the required quality grade). Distribution channels for bulk spirit are typically short and direct. Large-volume movements occur between the bulk production facility and the corporate blending/bottling plant of the buying company. Direct distribution also occurs via specialized alcohol wholesalers and distributors who cater specifically to the unbranded local market or industrial purchasers.

Downstream analysis shows two primary endpoints: the Brand Bottlers (indirect channel) and local/industrial consumers (direct channel). Brand Bottlers utilize bulk baijiu to create their branded product lines, relying heavily on consistent bulk supply to maintain market presence. The direct channel bypasses major branding and flows quickly to restaurants, small regional retailers, and TCM factories. The efficiency of the indirect channel is critical for major spirits companies, who negotiate large, stable contracts, while the direct channel is often more price-volatile and segmented, driven by local pricing pressures and immediate regional demand shifts. This structure underscores the bulk market's foundational role in supporting the immense scale of the mainstream baijiu industry.

Bulk Baijiu Market Potential Customers

The primary customers for Bulk Baijiu are large-scale, established baijiu distilleries and multinational beverage corporations that require vast quantities of foundational base spirit for their blending operations. These institutional buyers prioritize consistency, volume capacity, and stable pricing, using bulk spirit to maintain the flavor profile and alcohol content of their mass-market and mid-range bottled products. This strategy allows them to meet high consumer demand without the excessive costs associated with producing 100% aged or premium-grade base spirit internally, making them the most significant volume off-takers in the market.

A secondary, yet robust, customer base includes local wholesalers, regional retailers, and specialized commercial operations. Local wholesalers distribute unbranded or semi-branded bulk baijiu directly to restaurants, banquet halls, and rural consumers seeking cost-effective alternatives to premium brands for social and ceremonial consumption. Additionally, industries such as Traditional Chinese Medicine (TCM) manufacturing and food processing (flavor extracts, preservatives) rely on bulk baijiu for its high proof and neutral properties as a solvent or preservative. These buyers are typically sensitive to ethanol purity and regulatory compliance, ensuring the bulk spirit meets specific industrial standards rather than purely flavor criteria.

Emerging potential customers are international beverage groups and specialty exporters looking to introduce baijiu-based cocktails or fusion spirits into Western markets. While currently small in volume compared to domestic demand, these customers seek specific, high-quality bulk spirits that offer unique regional characteristics (e.g., Sauce Aroma profile) to create differentiated products. This segment focuses on sourcing high-quality bulk components that minimize logistical complexity while maximizing flavor authenticity, suggesting a future opportunity for premiumized bulk offerings tailored for export.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.5 Billion |

| Market Forecast in 2033 | USD 142.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kweichow Moutai Co., Ltd., Wuliangye Yibin Co., Ltd., Yanghe Brewery Joint-Stock Co., Ltd., Luzhou Laojiao Co., Ltd., Shanxi Xinghuacun Fenjiu Group, Beijing Red Star Co., Ltd., Jiangsu King’s Luck Brewery, Gujing Group, Sichuan Tuopai Shede Wine, Hubei Jingpai Co., Ltd., Shandong Jinxin Liquor, Henan Songhe Liquor, Hunan Jiugui Liquor, Yibin Red Star Co., Ltd., Sichuan Langjiu Group, Jilin Dehui Liquor, Confucius Family Wine, Yingjia Gongjiu, Hulan Distillery, Erguotou Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bulk Baijiu Market Key Technology Landscape

The technological evolution within the Bulk Baijiu market is driven primarily by the need for increased production consistency, enhanced efficiency, and compliance with increasingly strict environmental mandates. Traditionally, baijiu production relies on highly manual, time-intensive processes, but modern bulk producers are rapidly adopting automation in areas susceptible to human error. Key technology deployment includes sophisticated monitoring systems, such as advanced spectroscopic sensors and chromatographs, used to analyze the chemical profile of the base spirit during distillation and aging. These tools provide real-time data, allowing for precise cut-points during distillation, minimizing off-flavors, and ensuring the bulk product meets exact specifications required by downstream blenders, significantly improving quality consistency across massive volumes.

Furthermore, bulk production facilities are heavily investing in industrial internet of things (IIoT) sensors integrated throughout the fermentation and storage infrastructure. In the high-volume environment of bulk baijiu, managing the fermentation environment (temperature, humidity, microbial balance) is critical. IIoT systems, often coupled with AI algorithms, monitor thousands of data points from fermentation pits or tanks, predicting potential fermentation failures or deviations from the optimal state. This proactive control minimizes batch loss and optimizes the yield from raw materials, which is crucial for profitability in a high-volume, cost-sensitive segment. Automated handling and packaging systems are also deployed to manage the logistics of moving vast amounts of liquid, reducing labor costs and improving safety.

Environmental technology is another major focus, specifically concerning waste management and energy efficiency. Bulk baijiu production generates significant solid waste (spent grain, or jiuzao) and requires substantial water resources. Modern distilleries implement advanced wastewater treatment systems and utilize spent grain biomass for biofuel generation or high-value animal feed supplements, turning waste streams into revenue sources. Energy recovery systems, which capture waste heat from the distillation columns, are deployed to pre-heat incoming water or power other parts of the facility, drastically reducing the overall carbon footprint and operational utility costs, ensuring the long-term sustainability and regulatory compliance of high-volume bulk production facilities.

Regional Highlights

The global Bulk Baijiu Market is fundamentally anchored in Asia Pacific (APAC), particularly Mainland China, which serves as the epicenter for both production and consumption. The sheer volume and cultural significance of baijiu within China mean that regional dynamics within the country dictate global trends, pricing, and technological adoption rates. Production centers like Sichuan, known for its Strong Aroma baijiu, and Guizhou, famous for its Sauce Aroma production, represent specialized ecosystems where bulk production methods are highly refined to support the largest branded players. The APAC market stability is driven by consistent population growth, urbanization, and deep cultural integration of baijiu into social and economic life, ensuring robust demand for base spirits across all aroma types. Regulatory shifts in China, especially concerning quality standards and environmental compliance, have immediate and profound impacts on bulk producers, often forcing consolidation toward larger, compliant facilities.

While minimal in comparison to APAC, the North American and European markets present opportunities for specialized bulk export. Demand here is predominantly fueled by Chinese diaspora communities and the growing global exploration of Asian spirits by craft distillers and mixologists. Bulk baijiu exported to these regions often serves two purposes: direct retail through ethnic grocery stores or use as a base ingredient for unique fusion spirits, often marketed as exotic white spirits. Producers targeting these markets must navigate complex international labeling and alcohol content regulations (e.g., TTB in the US), making bulk export a niche, high-compliance activity focused on specific, higher-quality bulk grades rather than mass commodity volumes.

Latin America, the Middle East, and Africa (LAMEA) currently exhibit negligible production but represent potential long-term consumer markets, specifically within urban centers with growing Chinese investment and expatriate populations. Any potential future growth in these regions would initially rely entirely on imports of packaged bulk or finished products from China. The barriers to entry—cultural unfamiliarity, high tariffs, and preference for established Western spirits—keep the bulk segment penetration low, positioning these regions primarily as emerging areas for market development rather than current consumption drivers. Success in LAMEA hinges on strategic distribution partnerships that can effectively introduce baijiu to new consumer demographics.

- Asia Pacific (APAC): Dominates the market entirely. China is the sole significant producer and consumer, characterized by high-volume internal trade and strict regulatory oversight governing quality and environment. Key production hubs are Sichuan, Guizhou, and Jiangsu.

- North America: Niche market driven by diaspora consumption and craft distilling interest. Focus on high-quality, specialized bulk spirits for fusion products. Growth constrained by low general consumer awareness.

- Europe: Similar to North America, driven by small import volumes for specialty shops and premium cocktail culture experimentation. Compliance with complex EU alcohol regulations is a key barrier to bulk entry.

- LAMEA (Latin America, Middle East, Africa): Very limited market presence; future opportunity tied to Chinese expatriate communities and potential long-term development of local consumer taste for non-traditional spirits.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bulk Baijiu Market.- Kweichow Moutai Co., Ltd. (Major consumer and producer of high-grade base spirit)

- Wuliangye Yibin Co., Ltd. (High-volume producer across multiple aroma types)

- Yanghe Brewery Joint-Stock Co., Ltd. (Leading producer of blended and base spirits)

- Luzhou Laojiao Co., Ltd. (Historic producer, key in Strong Aroma bulk)

- Shanxi Xinghuacun Fenjiu Group (Dominant player in Light Aroma bulk production)

- Beijing Red Star Co., Ltd. (Leading Erguotou, high-volume, cost-effective producer)

- Jiangsu King’s Luck Brewery (Focus on regional bulk and mid-range spirits)

- Gujing Group (Strong regional presence and bulk production capacity)

- Sichuan Tuopai Shede Wine (Significant bulk capacity for Strong Aroma varieties)

- Hubei Jingpai Co., Ltd. (Known for health-oriented baijiu, requires specialized bulk bases)

- Shandong Jinxin Liquor (Regional volume leader)

- Henan Songhe Liquor (High-volume producer in Central China)

- Hunan Jiugui Liquor (Focus on specialized aroma production and bulk bases)

- Yibin Red Star Co., Ltd. (Key regional bulk supplier)

- Sichuan Langjiu Group (Major producer and consumer of Sauce Aroma bulk spirit)

- Jilin Dehui Liquor (Northeast China bulk specialist)

- Confucius Family Wine (Focus on traditional production methods and bulk reserves)

- Yingjia Gongjiu (Anhui province major distiller)

- Hulan Distillery (Regional volume producer)

- Erguotou Group (Specializing in highly cost-effective bulk spirits for mass market)

Frequently Asked Questions

Analyze common user questions about the Bulk Baijiu market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines Bulk Baijiu compared to Premium Baijiu?

Bulk Baijiu refers to high-volume, foundational distilled spirit, often unaged or minimally aged, used primarily as a base for blending mass-market brands or for cost-effective direct consumption. Premium Baijiu, conversely, involves extended aging, specialized distillation techniques, and high-value branding, commanding significantly higher prices.

Which Aroma Type dominates the Bulk Baijiu production volume?

The Strong Aroma (Nong Xiang) variety dominates bulk production volume globally. This is due to its widespread consumer acceptance, versatile blending properties, and the large, industrialized production capacity established in provinces like Sichuan, making it the most cost-efficient base spirit for mass-market products.

How do regulatory changes in China impact the Bulk Baijiu Market?

Recent regulatory changes, particularly concerning environmental protection (waste water and spent grain disposal) and quality control standardization, heavily impact bulk producers. These mandates often lead to consolidation, as smaller distilleries lacking compliance technology are forced out, driving production toward larger, more technologically advanced operations capable of sustainable high-volume output.

What role does technology play in ensuring Bulk Baijiu quality consistency?

Technology, including IIoT sensors, advanced chromatography, and AI-driven monitoring systems, is crucial for improving consistency. These tools analyze fermentation chemistry and distillation parameters in real-time, allowing producers to minimize batch variation and ensure the high-volume base spirit meets the exact, stable specifications required by downstream commercial blenders.

What are the primary distribution channels for high-volume Bulk Baijiu?

The primary distribution channel is direct B2B transfer from the bulk distillery to the corporate blending and bottling facilities of major branded spirits companies. A secondary channel involves specialized regional wholesalers who supply unbranded bulk spirit to local restaurants, banquets, and industrial users, operating within localized, price-sensitive networks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager