Bulk Salt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434302 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Bulk Salt Market Size

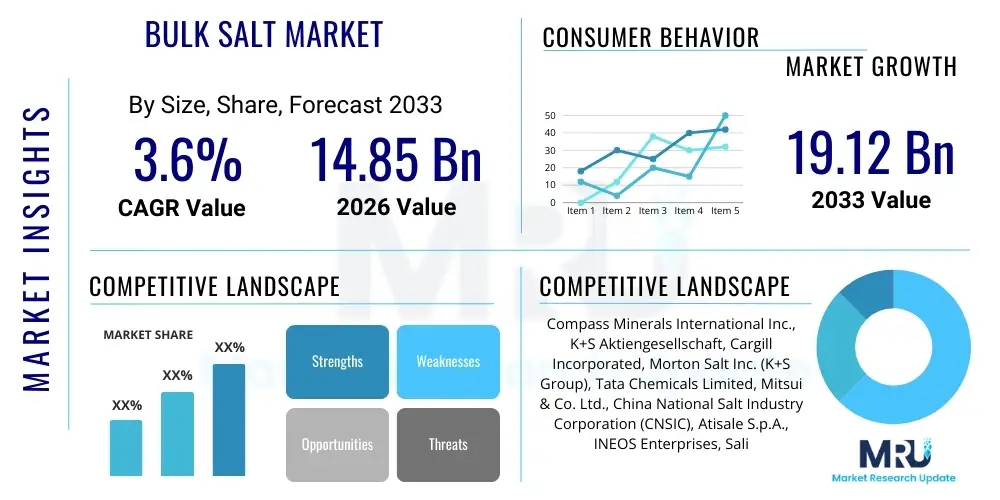

The Bulk Salt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.65% between 2026 and 2033. The market is estimated at USD 14.85 Billion in 2026 and is projected to reach USD 19.12 Billion by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by sustained demand from critical infrastructural sectors, particularly road de-icing operations in temperate zones and robust industrial applications such as chlor-alkali production. While the market exhibits maturity in developed economies, dynamic urbanization and industrialization across emerging regions, coupled with necessary investments in water treatment infrastructure, ensure a stable and calculable growth trajectory over the mid-term forecast.

Market valuation reflects the sheer volume of salt required for essential civic and industrial processes. Bulk salt, differentiated from packaged or highly refined specialty salts, forms the backbone of several major global industries. Price volatility, often influenced by seasonal weather patterns, energy costs for extraction, and geopolitical trade dynamics, provides a complex environment for market forecasting. Nevertheless, the inelastic demand for applications like highway safety (de-icing) and fundamental chemical manufacturing buffers the market against significant long-term contraction, cementing its foundational role in the global commodities landscape. Strategic stock management by key market players, influenced by predictive weather analytics, is becoming crucial for maintaining supply stability and optimizing profitability margins across the forecast period.

Bulk Salt Market introduction

The Bulk Salt Market encompasses large-volume, minimally processed sodium chloride (NaCl) primarily sourced from rock salt mines, solar evaporation ponds, and vacuum evaporation facilities. This commodity is indispensable across numerous sectors, functioning as a critical feedstock or operational necessity rather than a consumer-facing product. Major applications include road de-icing and winter maintenance, where salt lowers the freezing point of water on paved surfaces, ensuring transportation safety. Furthermore, bulk salt is vital for the chemical industry, serving as the raw material for the production of chlorine and caustic soda (chlor-alkali products), which are foundational ingredients for plastics, solvents, and aluminum production. Its versatility and low cost relative to substitute materials make it a persistent choice for these large-scale industrial requirements.

The principal benefits derived from bulk salt usage center on efficiency, effectiveness, and economic viability. For de-icing, it remains one of the most cost-effective and readily available solutions for managing snow and ice on public infrastructure. In industrial settings, the established processes utilizing salt for chemical synthesis are highly optimized and difficult to replace without significant capital expenditure. Driving factors for market expansion include escalating infrastructural development globally, particularly the growth of road networks that require winter maintenance; increasing demand for polyvinyl chloride (PVC) and other derivatives from the chlor-alkali sector; and regulatory compliance for municipal water and wastewater treatment, where salt is used for brine regeneration and disinfection processes. The market dynamics are intrinsically linked to macroeconomic health and climatic variability, creating a cyclical yet perpetually essential demand profile.

Bulk Salt Market Executive Summary

The Bulk Salt Market trajectory is characterized by steady, moderate growth, propelled predominantly by cyclical winter maintenance necessities in North America and Europe, alongside relentless industrial demand from the Asia Pacific chemical sector. Current business trends indicate a critical focus on optimizing logistics and supply chain resilience, given the high bulk weight and sensitivity to freight costs. Companies are increasingly investing in proprietary storage facilities near key distribution points (e.g., ports, major rail lines) to mitigate transportation bottlenecks and ensure rapid deployment during peak seasonal demand. Furthermore, consolidation among key mining and processing players is stabilizing pricing structures, although local competition, especially among smaller solar salt producers, remains intense. Technological innovation, though slow in core extraction, is accelerating in refining processes and purity enhancements, particularly for specialty industrial applications.

Regional trends highlight divergence in demand drivers. North America leads the market consumption by volume, with the overwhelming majority dedicated to road de-icing, making its market performance highly susceptible to annual variations in winter severity. Conversely, the Asia Pacific region, led by China and India, registers the fastest growth due; the demand here is primarily industrial, driven by massive investments in chemical manufacturing, glass production, and textile processing. Europe presents a balanced scenario, featuring strong industrial input requirements alongside sophisticated de-icing infrastructure, though environmental regulations concerning brine runoff pose increasing constraints. Segmentation trends indicate that the Rock Salt segment, due to its low cost and high availability, continues to dominate the market share, while the Vacuum Salt segment is projected to show higher growth rates, attributed to its superior purity demanded by pharmaceutical and high-end food processing applications.

AI Impact Analysis on Bulk Salt Market

Analysis of common user questions regarding the influence of Artificial Intelligence (AI) on the Bulk Salt Market reveals key thematic concerns centered around supply chain efficiency, predictive demand modeling, and environmental sustainability. Users frequently ask how AI can stabilize volatile salt pricing, which is often dictated by unpredictable weather events. There is significant interest in AI's capacity to optimize the logistical network—specifically, how machine learning algorithms can minimize storage costs and optimize complex multi-modal transportation routes (rail, ship, truck) for a high-volume, low-margin commodity. Furthermore, users explore the role of AI in improving safety and efficiency within resource-intensive salt mining operations, alongside developing better predictive maintenance schedules for expensive extraction and processing machinery. The consensus expectation is that AI will not fundamentally alter the product itself but will revolutionize the operational efficiency and strategic deployment of bulk salt resources, creating a leaner and more responsive market structure.

- AI-driven Predictive Maintenance: Utilizing sensor data from mining equipment (e.g., excavators, crushers) to forecast mechanical failures, reducing unplanned downtime and optimizing overall production yield in rock salt mines.

- Advanced Demand Forecasting: Applying deep learning models to integrate historical usage data with real-time climatic variables (temperature, precipitation forecasts, snow accumulation) to accurately predict seasonal de-icing needs for municipalities.

- Logistics and Route Optimization: Employing AI algorithms to dynamically adjust shipping schedules and transportation routes based on real-time freight capacity, fuel costs, and distribution center inventory levels, lowering the overall cost-to-serve.

- Inventory Management Automation: Implementing AI systems to monitor warehouse and dome storage levels, automating replenishment orders, and minimizing costly stockouts or overstock situations, especially crucial for time-sensitive de-icing operations.

- Process Optimization in Vacuum Evaporation: Using machine learning to fine-tune energy inputs and processing parameters in highly energy-intensive vacuum salt production, leading to reductions in utility costs and improved product consistency.

- Supply Chain Risk Modeling: Assessing geopolitical or climatic disruptions on salt sourcing and distribution networks, allowing companies to build resilient contingency plans using generative AI simulation.

- Environmental Monitoring Enhancement: Deploying AI to analyze runoff data and soil saturation near salt application sites, aiding in the development of more sustainable spreading techniques and minimizing ecological impact.

DRO & Impact Forces Of Bulk Salt Market

The Bulk Salt Market is powerfully influenced by a unique combination of infrastructural requirements, environmental constraints, and high logistics intensity. The primary market driver is the mandatory requirement for road safety and winter maintenance across regions experiencing snowfall, translating directly into high, non-negotiable demand during winter months. Concurrently, the unceasing global industrial requirement for chlorine and caustic soda provides a stable, long-term foundation for industrial salt consumption, largely independent of seasonal factors. Opportunities exist in the development of purified salt derivatives for higher-margin applications, such as pharmaceutical excipients and advanced food grade products, and in expanding utilization within nascent water desalination and treatment infrastructure across arid regions, particularly the Middle East and Africa.

However, market growth is significantly restrained by increasing environmental concerns regarding the detrimental effect of chloride runoff on infrastructure (corrosion of bridges and roads), freshwater ecosystems, and vegetation. This is pushing municipalities to explore costlier, less effective alternatives or blend salt with abrasives, thereby limiting pure bulk salt volume growth in developed markets. Furthermore, the sheer weight and volume of bulk salt mean transportation and fuel costs represent a substantial percentage of the final price, acting as a major impact force. Price stability is constantly threatened by highly volatile energy costs and the necessity of managing massive inventories through long, hot summers in anticipation of short, severe winters.

The cumulative impact forces dictate that while demand remains resilient due to essential utility, profitability depends heavily on operational excellence. Companies that successfully implement sophisticated, multi-regional supply chains capable of adapting rapidly to climatic changes and managing high energy inputs will hold a competitive advantage. The interplay between regulatory pressure (environmental restraints) and infrastructural necessity (drivers) compels the industry to seek continuous, marginal efficiency gains in sourcing and distribution, reinforcing the foundational commodity status of bulk salt while simultaneously pushing for higher-purity, value-added derived products to improve profitability.

Segmentation Analysis

The Bulk Salt Market is broadly segmented based on its source of extraction (rock, solar, vacuum), the form in which it is sold (coarse, fine), and critically, its application. Application segmentation is crucial as it dictates the required purity level and, consequently, the production method and cost structure. De-icing operations typically utilize lower-purity rock salt due to its cost-effectiveness and volume requirements. In contrast, the food processing, pharmaceutical, and certain high-end chemical sectors necessitate higher-purity salt, driving demand for solar or vacuum-evaporated products. The granular structure of this segmentation allows market players to specialize their production capabilities and target specific high-value end-user markets, while maintaining volume output for the dominant de-icing segment.

Geographic segmentation is equally important, reflecting disparate consumption patterns. North America and Europe are dominated by the de-icing segment, whereas Asia Pacific is characterized by industrial consumption. Segmentation based on source also reflects regional geological availability; for instance, rock salt is widely mined in the US and Europe, while solar salt production is concentrated in arid coastal regions like Australia, India, and parts of Latin America. Analyzing these segment intersections provides a holistic view of the market dynamics, revealing opportunities for producers to diversify their sourcing methods or expand into regions with unmet specific application demands, such as establishing vacuum salt facilities closer to major chemical manufacturing hubs in Southeast Asia to reduce import dependency and logistics expenditure.

- By Source:

- Rock Salt

- Solar Salt

- Vacuum Salt

- By Application:

- De-icing (Roads, Runways, Municipal Infrastructure)

- Chemical Manufacturing (Chlor-Alkali Industry)

- Food Processing (Preservation, Flavoring)

- Water Treatment (Resin Regeneration, Desalination)

- Agriculture (Animal Nutrition, Soil Treatment)

- Oil and Gas (Drilling Fluids)

- By Form:

- Coarse Grains

- Fine Grains

Value Chain Analysis For Bulk Salt Market

The bulk salt value chain is fundamentally structured around resource extraction, processing, logistics, and end-user distribution, emphasizing high throughput and low margins at the initial stages. The upstream segment involves the energy-intensive activities of mining (for rock salt), harvesting (for solar salt), or boiling (for vacuum salt), requiring significant capital investment in machinery, land rights, and energy supply. Vertical integration, where major companies control the entire process from mining to distribution, is common, providing critical cost control and supply security. The quality of the salt harvested or mined dictates the subsequent processing requirements; rock salt often undergoes minimal crushing and screening, while solar and vacuum salt require washing, drying, and anti-caking treatments to meet higher purity specifications demanded by midstream chemical and food processors.

The midstream phase is dominated by sophisticated logistics, which constitute a disproportionately high component of the final price. Due to the high weight and low value of the commodity, transportation modes—including bulk shipping via ocean carriers, long-haul rail, and heavy trucking—must be meticulously optimized. Strategic location of processing plants near captive mines or efficient ports is a key competitive differentiator. Distribution channels bifurcate into direct and indirect routes. Large volume end-users, such as major chemical conglomerates or large metropolitan transportation departments, often procure salt directly from producers via long-term contracts. This direct channel ensures supply continuity and price stability for both parties.

The downstream segment focuses on getting the bulk product to smaller industrial users and municipalities. Indirect distribution involves leveraging specialized distributors, commodity traders, and local wholesalers who manage smaller inventories and provide localized delivery services. These intermediaries add value through localized storage (critical for rapid de-icing response) and customized blending or packaging services. The effectiveness of the overall value chain hinges on minimizing bottlenecks between extraction/processing and deployment, particularly during high-demand periods, reinforcing the reliance on sophisticated inventory and logistics management software platforms.

Bulk Salt Market Potential Customers

Potential customers for bulk salt span multiple foundational sectors of the global economy, making the market highly diversified yet volume-intensive. The largest customer group by volume consumption consists of governmental agencies, including state and municipal departments of transportation and public works, which procure massive quantities for road and highway de-icing during winter months. These entities require guaranteed supply, competitive tender pricing, and strategic delivery to maintain public safety and economic continuity throughout cold seasons. The volatility inherent in this segment necessitates flexible contract terms and robust inventory holdings from suppliers.

The second major group is the industrial sector, dominated by chlor-alkali manufacturers. Companies producing chlorine, caustic soda, and soda ash rely on high-purity bulk salt as their essential chemical precursor. These customers typically demand long-term, stable supply agreements, consistent quality specifications, and just-in-time delivery to feed continuous operational processes. Furthermore, the water treatment industry constitutes a rapidly growing customer base, utilizing salt for regenerating ion-exchange resins in water softening systems, wastewater treatment, and large-scale water purification plants, often demanding specialized grades of high-purity salt that minimize system fouling and optimize efficiency.

Other key buyers include large-scale food processors, particularly those engaged in meat curing, vegetable brining, and commercial baking, though this group often demands a higher, food-grade quality often associated with vacuum or highly refined solar salt. The agriculture sector also utilizes bulk salt for livestock feed supplements and soil treatment. Understanding these varied customer requirements—ranging from ultra-high volume/low-purity (de-icing) to lower volume/high-purity (industrial/food)—is paramount for bulk salt providers to tailor their product offerings and distribution strategies effectively across the diverse market landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.85 Billion |

| Market Forecast in 2033 | USD 19.12 Billion |

| Growth Rate | 3.65% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Compass Minerals International Inc., K+S Aktiengesellschaft, Cargill Incorporated, Morton Salt Inc. (K+S Group), Tata Chemicals Limited, Mitsui & Co. Ltd., China National Salt Industry Corporation (CNSIC), Atisale S.p.A., INEOS Enterprises, Salins Group, Cheetham Salt Limited, Rio Tinto Group, Exportadora de Sal S.A. (ESSA), Aso Group, Zoutman, AkzoNobel Salt Specialties, Dominion Salt, Dampier Salt (Rio Tinto), Redmond Inc., US Salt LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bulk Salt Market Key Technology Landscape

The technological landscape in the Bulk Salt Market is characterized less by disruptive new chemistry and more by continuous improvement in efficiency, sustainability, and quality control throughout the extraction and refinement processes. For rock salt mining, advancements focus on improving underground safety, optimizing blasting patterns using geotechnical modeling to maximize yield, and deploying heavy-duty, low-emission machinery. Automated guided vehicles (AGVs) and remote monitoring systems are being slowly integrated to reduce human risk exposure and optimize continuous extraction cycles. The adoption of AI and IoT sensors aids in monitoring the structural integrity of mines and predicting equipment failure, thus stabilizing production outputs and lowering maintenance expenditures in traditionally high-risk environments.

In the processing segment, particularly for solar and vacuum salt, key technologies revolve around energy minimization and purity enhancement. Vacuum evaporation technology, which produces the highest purity salt suitable for high-grade industrial applications, is constantly refined through advanced heat recovery systems (HRS) and membrane filtration techniques. These improvements aim to significantly reduce the staggering energy inputs required to boil large volumes of brine. Furthermore, technology plays a critical role in developing anti-caking additives and corrosion inhibitors, essential for enhancing the performance of de-icing salt and reducing its negative environmental impact on surrounding infrastructure and waterways. New anti-caking agents ensure that bulk salt remains flowable, simplifying storage and application processes for municipalities.

Logistics technology represents perhaps the most rapidly evolving area. The industry relies heavily on sophisticated Enterprise Resource Planning (ERP) and Supply Chain Management (SCM) software customized for bulk commodities. These systems manage complex multi-modal shipments, integrating data from rail carriers, port operations, and truck fleets. Satellite tracking, real-time inventory management, and generative modeling of weather patterns enable companies to pre-position massive salt reserves optimally across distribution networks. The utilization of drones for inspecting large salt stockpiles and verifying inventory volumes is also becoming standard practice, ensuring compliance with contractual obligations and minimizing measurement discrepancies across the vast scale of bulk salt operations.

Regional Highlights

- North America: Market Volume Leader Driven by De-icing: North America, particularly the United States and Canada, dominates the global bulk salt consumption landscape primarily due to extensive road networks and mandatory winter maintenance protocols. The market here is highly cyclical, dependent on the severity and duration of winter seasons. The primary segment is rock salt for de-icing, but there is also robust industrial demand, supported by significant domestic mining operations and sophisticated logistics networks ensuring timely deployment of salt reserves across major snow belts. Concerns over chloride contamination are driving modest shifts toward engineered de-icing alternatives, but bulk salt remains the foundational solution.

- Asia Pacific (APAC): Fastest Growing Region Focused on Industrialization: APAC is forecast to register the highest growth rate, fueled not by de-icing, but by exponential industrial expansion, particularly in China, India, and Southeast Asia. The demand is anchored by the burgeoning chlor-alkali industry supplying essential chemicals for the rapidly expanding plastics, textiles, and construction sectors. High-purity salt demand is also increasing sharply due to growing food processing and pharmaceutical manufacturing capabilities. Expansion of solar salt production facilities along coastal regions and increased reliance on international bulk shipping characterize the regional supply dynamics.

- Europe: Mature Market with Strict Environmental Regulations: European demand is mature, characterized by stable requirements for both de-icing and industrial use. The region benefits from significant rock salt reserves (e.g., in Germany and the UK) and strong vacuum salt production capabilities. However, Europe faces some of the strictest environmental regulations globally concerning salt runoff. This regulatory environment pushes for the adoption of highly efficient spreading techniques, pre-wetting technologies, and higher-purity salts to minimize ecological impact, often increasing operational costs for municipalities but driving technological refinement among producers.

- Latin America (LATAM): Industrial and Water Treatment Focus: The Latin American bulk salt market is driven mainly by industrial requirements, primarily chemical manufacturing, and resource extraction (mining/oil and gas). Brazil and Mexico are key markets. Furthermore, the increasing need for municipal water treatment and the expansion of desalination projects, especially in arid coastal regions, contribute to stable, non-seasonal demand growth. The region often relies on efficient solar evaporation methods due to favorable climatic conditions.

- Middle East and Africa (MEA): Emerging Water Security Demand: The MEA region, while currently a smaller market share holder, represents a significant long-term opportunity, particularly due to investments in water security. Bulk salt is crucial for large-scale desalination plants and brine management. Industrial demand, linked to petrochemical expansion and infrastructural projects in Gulf Cooperation Council (GCC) countries, is growing steadily. The region is actively exploring indigenous solar salt production capabilities to reduce dependency on costly imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bulk Salt Market.- Compass Minerals International Inc.

- K+S Aktiengesellschaft

- Cargill Incorporated

- Morton Salt Inc. (Subsidiary of K+S Group)

- Tata Chemicals Limited

- Mitsui & Co. Ltd.

- China National Salt Industry Corporation (CNSIC)

- Atisale S.p.A.

- INEOS Enterprises

- Salins Group

- Cheetham Salt Limited

- Rio Tinto Group (Dampier Salt)

- Exportadora de Sal S.A. (ESSA)

- Aso Group

- Zoutman

- AkzoNobel Salt Specialties

- Dominion Salt

- Redmond Inc.

- US Salt LLC

- Standard Industries Ltd.

Frequently Asked Questions

Analyze common user questions about the Bulk Salt market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Bulk Salt Market?

Market growth is primarily driven by three essential non-discretionary demands: the mandatory need for road safety and winter maintenance (de-icing) in developed economies, the continuous, high-volume requirement for bulk salt as a foundational raw material in the global chlor-alkali chemical industry, and increasing infrastructural investments in water treatment and desalination globally.

How does the source of bulk salt (Rock, Solar, Vacuum) influence its application and price?

The source dictates purity and processing costs. Rock salt is the cheapest, lowest purity, and used mainly for de-icing. Solar salt has medium purity, is ideal for industrial use and general food applications, and relies on low-cost natural evaporation. Vacuum salt offers the highest purity suitable for specialized food, pharmaceutical, and high-end chemical needs, but requires significant energy input, resulting in the highest market price.

What is the main restraint impacting the long-term expansion of the Bulk Salt Market?

The most significant restraint is the environmental impact, specifically chloride runoff resulting from de-icing operations. Growing regulatory pressure in North America and Europe concerning freshwater contamination and infrastructure corrosion forces municipalities to seek reduced-salt alternatives or invest in costly mitigation strategies, potentially slowing volume growth in the largest application segment.

Which geographical region dominates the consumption of bulk salt, and what drives its specific demand?

North America is the dominant consumer by volume. This dominance is overwhelmingly driven by the essential requirement for road and highway de-icing across the major snow belts of the United States and Canada, leading to massive, seasonally fluctuating demand for rock salt every winter.

What role does technology play in improving efficiency within the bulk salt supply chain?

Technology, particularly Artificial Intelligence (AI) and advanced Supply Chain Management (SCM) software, plays a crucial role in optimizing the bulk salt market. It enables precise, predictive demand forecasting based on weather data, dynamic route optimization for high-volume transport, and the use of IoT sensors for predictive maintenance in mining, ensuring critical operational efficiency and minimizing high logistics costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager