Bulletproof Tires Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434741 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Bulletproof Tires Market Size

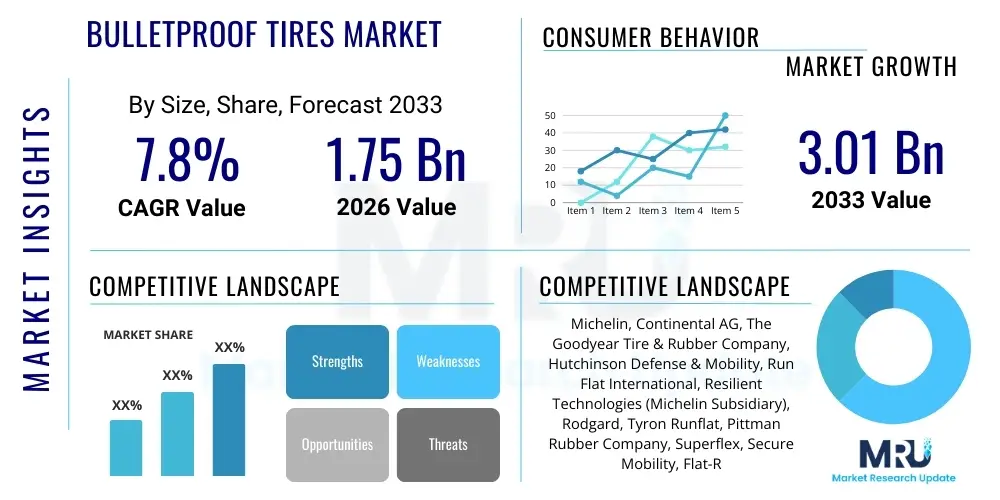

The Bulletproof Tires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.75 Billion in 2026 and is projected to reach USD 3.01 Billion by the end of the forecast period in 2033.

Bulletproof Tires Market introduction

The Bulletproof Tires Market encompasses highly specialized tire systems engineered to maintain functionality and structural integrity even after sustaining significant damage, such as punctures from ballistic attacks or sharp objects. These tires are critical safety components primarily utilized in sectors requiring enhanced security and operational continuity, including defense, executive protection, and secure transport services. The core technologies involved typically include run-flat inserts, auxiliary support systems, and advanced non-pneumatic structures, which allow the vehicle to travel safely for specified distances at reduced speeds following tire deflation, dramatically improving occupant safety and mission completion rates.

Products within this market are designed for extreme durability and resilience, often incorporating specialized materials like Kevlar, reinforced polymers, and high-density rubber compounds. Major applications span military armored personnel carriers (APCs), high-security government vehicles, presidential motorcades, cash-in-transit (CIT) vehicles, and armored SUVs used by high-net-worth individuals and corporate security teams. The inherent benefit of these tires is the significant reduction in mobility kill risk, offering a vital security layer that standard pneumatic tires cannot provide. The primary driving force behind the market expansion is the escalating global demand for specialized security solutions due to rising geopolitical instability, terrorism threats, and organized crime activities targeting high-value assets or critical personnel.

Bulletproof Tires Market Executive Summary

The Bulletproof Tires Market is currently characterized by robust expansion driven primarily by increasing global defense expenditures and the proliferating adoption of armored civilian vehicles. Business trends indicate a strong move toward lightweight composite materials and non-pneumatic tire (NPT) solutions to address the historic drawback of increased tire weight associated with traditional run-flat systems. The focus of leading manufacturers is shifting toward integrating smart sensor technology into tires, enabling real-time monitoring of pressure, temperature, and structural integrity, thereby enhancing predictive maintenance capabilities and overall operational effectiveness for high-stakes missions.

Regional trends highlight North America and Europe as dominant markets, primarily due to the high concentration of defense contractors, stringent safety regulations, and a mature executive protection industry. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid militarization, increasing internal security concerns in developing economies, and significant infrastructure investments that require secure transport for high-value goods. Segmentation trends show the Military & Defense segment retaining the largest market share, though the Commercial Security segment, encompassing CIT and private security firms, is experiencing accelerated adoption due to the increased frequency of high-risk transactions and transportation needs.

The competitive landscape remains fragmented, dominated by a few specialized technology providers and major conventional tire manufacturers who have established dedicated security divisions. Key players are aggressively pursuing long-term contracts with governmental and military entities, focusing on optimizing their supply chains to deliver customized solutions rapidly. Furthermore, strategic collaborations between tire manufacturers and armored vehicle OEMs are becoming essential to ensure seamless integration and optimized performance of these complex wheel assemblies, which often require bespoke design specifications tailored to specific vehicle weight classes and operational environments.

AI Impact Analysis on Bulletproof Tires Market

User queries regarding the impact of Artificial Intelligence (AI) on the Bulletproof Tires Market frequently center on how AI can enhance the material composition, optimize the manufacturing process for niche products, and improve in-field performance monitoring. Key themes that emerge include the desire to use AI for simulating complex ballistic impacts to accelerate R&D cycles, the application of machine learning (ML) in predicting maintenance needs based on accumulated operational stress data, and the use of AI-driven robotics for precise and intricate production of composite run-flat inserts. Users are concerned with achieving higher reliability and lower lifecycle costs through intelligent systems, moving beyond traditional physical testing limitations.

AI’s most transformative influence is projected to be in the realm of advanced material science and generative design. Machine learning algorithms can analyze vast datasets concerning polymer characteristics, composite behavior under extreme temperatures, and stress propagation patterns, allowing researchers to predict optimal material blends for superior puncture resistance and heat dissipation—critical factors in high-speed run-flat performance. Furthermore, AI-powered predictive maintenance models, leveraging data from integrated sensors (IoT), can assess the remaining useful life of a bulletproof tire system with high accuracy, minimizing unexpected failures during critical operations and significantly reducing vehicle downtime for military and security fleets.

Beyond material innovation, AI is streamlining the highly customized manufacturing process inherent to this niche market. AI-driven simulation tools allow for the rapid prototyping and virtual testing of new non-pneumatic tire geometries, reducing the time and expense associated with traditional physical tests, especially when dealing with bespoke vehicle specifications. This shift towards smart manufacturing, guided by AI, not only improves the quality control of complex composite structures but also enhances supply chain responsiveness, ensuring that high-priority defense and security clients receive specialized components efficiently and reliably.

- AI-Driven Generative Design: Optimizes complex internal tire structures (run-flat inserts, NPT patterns) for maximum strength and minimum weight.

- Predictive Maintenance (PMM): Utilizes integrated IoT sensors and ML algorithms to forecast tire system failure based on operational stress, temperature, and residual structural integrity.

- Advanced Material Discovery: Accelerates the development of new, stronger composite materials (e.g., self-healing polymers) through rapid analysis of chemical compositions and physical properties.

- Optimized Manufacturing Robotics: AI controls precise, multi-axis robotic systems for the flawless layering and curing of specialized high-security rubber and composite compounds.

- Supply Chain Optimization: ML algorithms forecast demand spikes for specific tire types (e.g., military vs. civilian armored vehicle specifications), improving inventory management and logistics for critical components.

DRO & Impact Forces Of Bulletproof Tires Market

The dynamics of the Bulletproof Tires Market are shaped by a complex interplay of internal and external forces. Key drivers include the pervasive global increase in asymmetrical warfare and internal security threats, which necessitate reliable mobility for defense personnel and high-value assets. This demand is further amplified by robust and consistent defense spending globally, particularly in North America and Asia, where military modernization programs prioritize vehicle survivability. Conversely, major restraints involve the inherently high initial cost of these specialized tire systems compared to standard options, their increased weight which negatively affects fuel efficiency and maneuverability, and the complex maintenance protocols requiring specialized equipment and training, limiting adoption among smaller security firms.

Opportunities for growth are significant, particularly in the expanding application of bulletproof systems within the commercial sector, specifically for high-risk logistics, heavy-duty industrial vehicles operating in unstable regions, and the booming market for civilian armored vehicles utilized by corporate executives and VIPs in emerging economies. Technological advances, such as the maturation of Non-Pneumatic Tire (NPT) technology and the integration of lightweight, high-strength polymers, present a crucial opportunity to overcome current limitations related to weight and maintenance complexity. These innovations are poised to expand the addressable market by offering more versatile and cost-effective solutions tailored for broader commercial application.

The impact forces within the market, analyzed using Porter’s Five Forces model, reveal a high barrier to entry due to the intense R&D requirements, specialized manufacturing infrastructure, and the necessity for rigorous military and government certifications. Supplier power is moderate, as raw material suppliers for specialized composites (Kevlar, high-grade polymers) are niche but essential. However, buyer power is high, especially for major defense ministries and large OEMs, who demand tailored solutions, bulk discounts, and long-term service agreements, pressuring profitability. The threat of substitutes is low, as traditional run-flat inserts or self-sealing gels do not offer the same level of ballistic protection, thus maintaining the value proposition of dedicated bulletproof systems.

Segmentation Analysis

The Bulletproof Tires Market is systematically segmented based on the core components of the product, the type of vehicle utilizing the tire, and the specific application or end-use sector. This granular segmentation allows manufacturers and strategists to precisely target offerings based on performance requirements, which vary significantly between highly demanding military environments and commercial security operations. The main segmentation frameworks include categorization by tire construction (e.g., run-flat inserts vs. solid tires), which defines the operational capability post-puncture, and by end-use application, distinguishing between the stringent specifications demanded by defense versus the cost-effectiveness sought by the commercial sector.

Detailed analysis across these segments reveals distinct growth patterns. The segmentation by type is dominated by the Run-Flat Insert segment, owing to its versatility and ease of integration into existing pneumatic tire infrastructure, while the emerging Non-Pneumatic Tire (NPT) segment is gaining traction due to superior durability and zero risk of air loss, though adoption remains constrained by cost and standardization issues. Application-wise, the Military & Defense segment commands the largest revenue share due to high volume procurement and consistent modernization cycles, whereas the VIP & Executive Protection segment is demonstrating the most accelerated CAGR, reflecting the increasing global demand for discreet, high-level personal security solutions in unstable urban environments.

Geographically, while North America and Europe provide mature, high-value markets, the fastest growth is emanating from Asia Pacific, particularly countries investing heavily in internal security and border patrol capabilities. Vehicle type segmentation indicates that Armored SUVs and Light Armored Vehicles (LAVs) are the primary consumers of bulletproof tire technology, driven by the popularity of these platforms for both military scouting missions and private security transport. This structured approach to market segmentation is crucial for tailoring product development, marketing strategies, and distribution channels to meet the diverse operational requirements across the global security landscape.

- By Type:

- Run-Flat Inserts (Auxiliary Supported Systems)

- Non-Pneumatic Tires (Solid/Airless)

- Self-Sealing Tires (Gel-based/Lining-based)

- By Vehicle Type:

- Armored SUVs and Sedans

- Light Armored Vehicles (LAVs)

- Heavy Armored Vehicles (Tanks, APCs)

- Commercial Security Vehicles (Cash-in-Transit, High-Risk Logistics)

- By Application/End-User:

- Military & Defense

- VIP & Executive Protection (Private Security)

- Government & Law Enforcement

- Commercial Security (Cash-in-Transit, High-Value Transport)

- By Material:

- Composite Materials (Kevlar, Polyurethane)

- Specialized Rubber Compounds

- Polymer Inserts

Value Chain Analysis For Bulletproof Tires Market

The value chain for the Bulletproof Tires Market begins with the sourcing of highly specialized raw materials, particularly high-strength synthetic polymers, specialized rubber blends capable of high heat dissipation, and advanced composite materials such as aramid fibers (e.g., Kevlar) used in the reinforcing structure. Upstream analysis highlights that the quality and availability of these materials are critical, often relying on a small number of specialized chemical and composite suppliers, which can introduce supply bottlenecks and moderate supplier power. Manufacturers must engage in rigorous quality control during this initial stage, as material integrity directly dictates the tire's ballistic and run-flat performance.

The manufacturing process forms the core of the value chain, involving proprietary techniques for molding, curing, and integrating the complex run-flat system or non-pneumatic structure into the tire casing and rim assembly. This stage is highly capital-intensive and requires specialized machinery and highly trained technical staff. Manufacturers frequently invest heavily in R&D to optimize the balance between protection level (ballistic rating) and the tire’s overall weight and heat management capabilities. The focus here is on achieving certified standards (like NATO STANAG or specific regional defense certifications) which act as major entry barriers for new players.

Downstream analysis reveals a critical distribution channel structure. Direct distribution is predominant for the largest buyers, namely military organizations, major defense contractors, and specialized armored vehicle original equipment manufacturers (OEMs). These relationships are often cemented through long-term contracts and require dedicated technical support and field training. Indirect distribution occurs via highly specialized aftermarket security dealers and certified installers who cater to the VIP/Executive protection segment and smaller commercial security firms. Marketing in this niche market relies heavily on proven track records, performance certifications, and trusted relationships within the defense and security communities, rather than broad consumer advertising. Service and maintenance—including repair and lifecycle management—form a crucial post-sale component, ensuring product longevity and consistent performance for mission-critical applications.

Bulletproof Tires Market Potential Customers

Potential customers for bulletproof tires are organizations and individuals whose operational continuity and physical safety are paramount, particularly in environments characterized by high security risks, insurgency, or geopolitical instability. The primary end-users are institutional bodies, led by government defense ministries and military forces, which require tires for their tactical and logistical fleets, including heavy-duty transport, light armored patrol vehicles, and specialized reconnaissance units. These buyers prioritize survivability, compliance with strict military specifications, and long-term supply agreements for standardization across large fleets, making them the largest and most consistent purchasers in the market.

A rapidly expanding customer base includes global government agencies, such as federal law enforcement, homeland security departments, and diplomatic corps, who utilize armored vehicles for high-profile transport and mission deployment in volatile areas. Furthermore, the commercial security sector represents a significant opportunity, comprising cash-in-transit (CIT) companies, mining and energy corporations operating in remote or high-risk extraction zones, and private security contractors. These commercial buyers value reduced downtime and enhanced protection against organized theft or ambush, viewing the investment in specialized tires as essential risk mitigation against financial and human losses.

The third major segment consists of high-net-worth individuals (HNWIs), corporate executives, and non-governmental organizations (NGOs) operating in conflict zones. For this clientele, discretion and reliability are key. They seek tires that integrate seamlessly into standard vehicle appearances while providing maximum protection. Purchases are typically managed through specialized armored vehicle converters or bespoke security consultants who select products based on specific threat profiles and vehicle types (typically armored SUVs and high-end sedans). The purchasing criteria here are often driven by perceived quality, brand reputation within the security community, and the capability of the tire to sustain mobility under severe attack conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.75 Billion |

| Market Forecast in 2033 | USD 3.01 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Continental AG, The Goodyear Tire & Rubber Company, Hutchinson Defense & Mobility, Run Flat International, Resilient Technologies (Michelin Subsidiary), Rodgard, Tyron Runflat, Pittman Rubber Company, Superflex, Secure Mobility, Flat-Run, Amerityre Corporation, Briscoe Run-Flat, TerraTire Systems, Bridgestone Corporation, Sumitomo Rubber Industries, Trelleborg AB, Denso Corporation, Yokohama Rubber Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bulletproof Tires Market Key Technology Landscape

The technology landscape of the Bulletproof Tires Market is highly specialized, focusing primarily on achieving zero-pressure mobility and maximizing resistance to ballistic and road hazard damage while managing heat buildup—a critical performance inhibitor. The dominant technology is the Auxiliary Supported System, commonly known as the run-flat insert. These systems utilize tough, rigid composite rings or segments (often made of engineered polymers or reinforced rubber) fitted around the rim inside a standard pneumatic tire. Upon deflation, this internal ring supports the weight of the vehicle, allowing it to continue operating, typically for 50 to 150 kilometers at speeds up to 80 km/h, which is sufficient for escaping immediate threat zones. Continuous innovation in this area focuses on reducing the weight of these inserts and improving their heat tolerance.

A significant disruptive technology gaining traction is the Non-Pneumatic Tire (NPT) or airless tire. NPTs eliminate the threat of pressure loss entirely, relying instead on a web-like, structured core (often honeycomb or spoke designs) to carry the load. Materials used in NPTs, such as specialized polymers and advanced composites, are designed for extreme load cycling and impact absorption. While offering ultimate resistance to punctures, NPT adoption is currently hampered by higher manufacturing complexity and challenges in matching the speed and smooth ride characteristics of pneumatic systems, though military applications often overlook these drawbacks for superior survivability and maintenance reduction.

Furthermore, sensor integration and smart materials are becoming cornerstones of the technology landscape. The integration of Tire Pressure Monitoring Systems (TPMS) and sophisticated internal sensors that track temperature, internal stress, and structural degradation in real-time is crucial for high-end military and security applications. These IoT-enabled tires communicate vital data to the vehicle’s central system, allowing for predictive maintenance and immediate situational awareness during an attack. Research into self-sealing technology, utilizing advanced high-viscosity gels or polymer linings that automatically repair minor punctures, continues, providing a supplementary layer of protection for less extreme threats and enhancing overall tire durability.

Regional Highlights

Regional dynamics heavily influence the demand and adoption patterns within the Bulletproof Tires Market, reflecting varied defense spending, geopolitical climates, and economic development levels. North America currently dominates the market in terms of revenue share, primarily driven by the colossal defense budget of the United States, continuous modernization of military vehicle fleets, and the high concentration of both armored vehicle manufacturers and security service providers. The region benefits from stringent government procurement standards and substantial investment in R&D, positioning it as a key innovation hub for advanced run-flat and NPT technologies.

Europe represents a mature market characterized by robust demand from NATO member countries and a strong presence of premium armored vehicle OEMs (Original Equipment Manufacturers) catering to diplomatic, executive, and cash-in-transit security needs. While growth rates are steady, the market is highly competitive and regulated, focusing on lightweight solutions that adhere to strict European Union safety and environmental standards. Countries like the United Kingdom, Germany, and France are significant end-users, reflecting their active participation in global security missions and the need for internal security upgrades.

The Asia Pacific (APAC) region is projected to register the fastest growth over the forecast period. This acceleration is fueled by increasing inter-state tensions, border disputes, and internal security challenges (such as organized crime and insurgency) across countries like India, China, and South Korea. Governments in APAC are significantly boosting their defense spending and modernizing their police and paramilitary forces, leading to high-volume procurement of armored vehicles and, consequently, bulletproof tire systems. The expansion of commercial activities in remote and high-risk resource extraction areas also drives demand in this region.

Latin America and the Middle East & Africa (MEA) constitute important, albeit smaller, segments of the market. In Latin America, high levels of transnational crime and organized gangs drive the demand for armored civilian vehicles among HNWIs and corporate executives, relying heavily on imported technology. The MEA region is characterized by high, localized demand spurred by ongoing conflicts, large-scale energy sector logistics requiring secure transport, and substantial defense spending by wealthy Gulf Cooperation Council (GCC) nations. Demand in MEA is often project-based and highly sensitive to geopolitical shifts and oil price fluctuations, focusing on heavy-duty, extreme-environment performance.

- North America: Market leader; driven by high US defense expenditure, advanced military vehicle programs, and a mature executive protection industry. Focus on advanced R&D in NPT and lightweight composite run-flat systems.

- Europe: Steady growth; strong demand from NATO forces and prominent armored vehicle OEMs. Emphasis on meeting stringent safety standards and developing solutions for high-speed executive transport.

- Asia Pacific (APAC): Fastest-growing region; boosted by significant military modernization, escalating border tensions, and substantial internal security investment in populous nations. High demand for light armored vehicle tires.

- Middle East & Africa (MEA): Critical niche market; demand concentrated in defense and security applications for wealthy GCC states and specialized logistics in conflict zones (e.g., oil and gas security).

- Latin America: Focused growth in the civilian armored vehicle segment; driven by high levels of urban violence and security concerns for HNWIs and corporate assets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bulletproof Tires Market.- Michelin

- Continental AG

- The Goodyear Tire & Rubber Company

- Hutchinson Defense & Mobility

- Run Flat International

- Resilient Technologies (Michelin Subsidiary)

- Rodgard

- Tyron Runflat

- Pittman Rubber Company

- Superflex

- Secure Mobility

- Flat-Run

- Amerityre Corporation

- Briscoe Run-Flat

- TerraTire Systems

- Bridgestone Corporation

- Sumitomo Rubber Industries

- Trelleborg AB

- Denso Corporation

- Yokohama Rubber Co. Ltd.

- KraussMaffei Technologies GmbH (Specialized Manufacturing Equipment)

Frequently Asked Questions

Analyze common user questions about the Bulletproof Tires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard run-flat tires and military-grade bulletproof tires?

Standard run-flat tires are designed primarily to manage punctures caused by typical road debris, allowing limited distance travel at low speeds. Military-grade bulletproof or tactical tires, however, are engineered to withstand severe, high-impact ballistic threats (e.g., rifle fire, explosive shrapnel). They incorporate highly resilient internal inserts, often made of advanced composites like aramid fibers, or utilize entirely non-pneumatic structures, guaranteeing mobility even after massive structural compromise. The primary distinction lies in the level of engineered protection and the adherence to rigorous ballistic standards (such as NATO STANAG levels).

How does Non-Pneumatic Tire (NPT) technology impact the future maintenance and lifecycle cost of armored vehicles?

Non-Pneumatic Tire (NPT) technology significantly reduces the lifecycle cost and maintenance burden of armored vehicles by eliminating the risk of pressure loss and the associated complex field repairs. Since NPTs do not rely on air pressure, they eliminate blowouts, frequent pressure checks, and vulnerability to traditional punctures. This dramatically lowers the need for specialized repair kits and spare tire logistics in combat or high-risk zones, leading to greater operational readiness and reduced long-term fleet expenditures, despite the potentially higher initial unit cost of the airless system.

Which end-user segment is driving the fastest adoption of bulletproof tire technology globally?

While the Military & Defense sector remains the largest revenue contributor due to massive volume contracts, the fastest growing segment in terms of compound annual growth rate (CAGR) is the VIP & Executive Protection segment, closely followed by the Commercial Security sector (particularly cash-in-transit and high-value logistics). This growth is attributed to the increasing wealth disparity in developing nations and the subsequent rise in security threats targeting corporate and high-net-worth individuals, necessitating discreet yet robust personal armored transport solutions globally.

What are the primary technical challenges facing the widespread adoption of bulletproof tires?

The main technical challenges revolve around balancing ballistic resilience with core performance metrics. Bulletproof systems, especially run-flat inserts, often add significant weight, negatively impacting fuel efficiency, vehicle maneuverability, and handling, particularly at high speeds. Furthermore, the immense friction and kinetic energy generated during zero-pressure operation lead to severe heat build-up within the tire/insert assembly. Overcoming this heat dissipation challenge while maintaining structural integrity and reducing overall system weight remains the primary focus of ongoing material science and engineering R&D efforts in the industry.

What role does Artificial Intelligence play in the manufacturing and development of new high-security tires?

Artificial Intelligence (AI) is instrumental in two key areas. First, in development, AI and Machine Learning (ML) are utilized for advanced material science research, analyzing thousands of material compositions to predict optimal polymer blends and composite structures for superior impact resistance and thermal stability. Second, in manufacturing, AI-driven simulation tools allow for Generative Design, optimizing the geometric structure of run-flat inserts and NPT spokes for peak performance under load, minimizing the need for lengthy and costly physical prototyping and testing cycles, thereby accelerating the time-to-market for highly customized security solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager