Bus Manufacturing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435009 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Bus Manufacturing Market Size

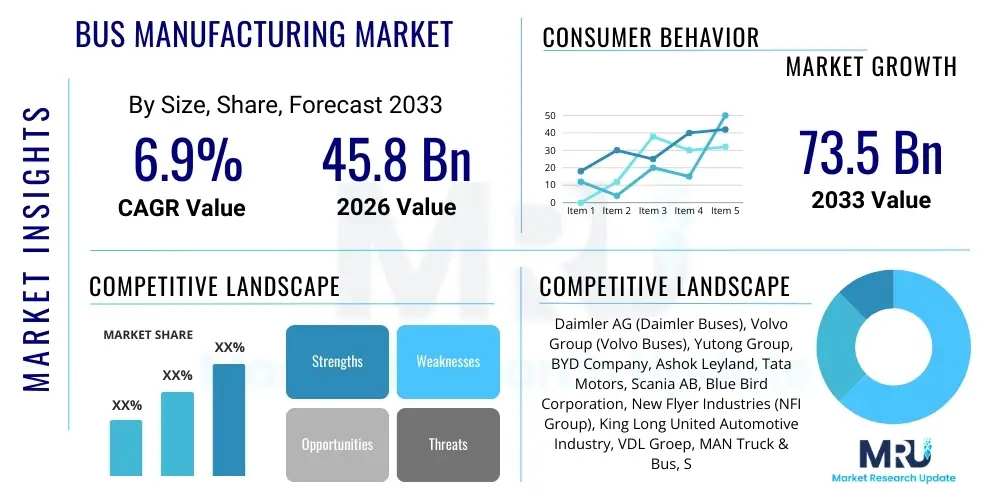

The Bus Manufacturing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 73.5 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by increasing global urbanization rates, substantial government investments in public transport infrastructure, and the accelerating global transition towards sustainable mobility solutions, particularly electric buses (e-buses).

Market expansion is also supported by stringent environmental regulations imposed across developed and emerging economies, compelling transit authorities to phase out high-emission diesel vehicles in favor of zero-emission alternatives. Furthermore, the rising demand for efficient and safe student transportation, especially in North America and Asia Pacific, is boosting the school bus segment. Technological advancements, including the integration of telematics, advanced driver-assistance systems (ADAS), and IoT connectivity, are enhancing bus operational efficiency, safety, and passenger experience, thereby further stimulating market demand.

However, the market faces headwinds such as the high initial acquisition cost of electric buses compared to traditional internal combustion engine (ICE) counterparts, and complexities related to charging infrastructure deployment and battery life management. Despite these challenges, continuous research and development focused on improving battery energy density, reducing charging times, and implementing standardization across components are expected to mitigate cost barriers and solidify the market's positive outlook through the forecast period.

Bus Manufacturing Market introduction

The Bus Manufacturing Market encompasses the design, production, assembly, and sales of various types of motorized passenger vehicles designed for mass transportation. These vehicles range from small microbuses used for specialized transit to large articulated or double-decker buses essential for high-capacity urban routes and intercity travel. Key products include city/transit buses, school buses, and coaches, with modern production increasingly focused on incorporating zero-emission technologies such as battery electric, fuel cell electric, and advanced hybrid powertrains, moving away from conventional diesel and gasoline engines.

Major applications of manufactured buses span public transit systems operated by municipal authorities, private contract operations for corporate or institutional transport, and long-distance intercity travel provided by commercial operators. The primary benefit of buses lies in their ability to offer cost-effective, high-capacity, and relatively energy-efficient solutions for passenger mobility, significantly reducing individual car usage and associated urban congestion and emissions. The shift towards electrification provides added benefits related to noise reduction and localized air quality improvement within densely populated areas.

Driving factors for this market include rapid global population growth necessitating better public infrastructure, government subsidies and tax incentives favoring electric vehicle adoption, and mandatory fleet renewal policies established in many developed countries to meet climate goals. Furthermore, the push for enhanced passenger safety and comfort, driven by consumer expectations and regulatory mandates regarding features like ADAS, accessibility standards, and onboard connectivity (Wi-Fi), continually drives manufacturers toward innovation and higher production volumes of advanced models.

Bus Manufacturing Market Executive Summary

The Bus Manufacturing Market is undergoing a rapid transformation, characterized by a fundamental shift in business trends away from traditional fossil fuels towards sustainable, electric mobility solutions. This transition is redefining supply chains, demanding new core competencies in battery management systems and charging infrastructure integration, and fostering strategic partnerships between legacy manufacturers and battery technology specialists. Business models are evolving to include mobility-as-a-service (MaaS) offerings and leasing options, making the high upfront cost of electric buses more accessible to transit operators globally, thus accelerating fleet modernization.

Regionally, Asia Pacific currently dominates the market, driven by massive public investment in China and India to curb air pollution and facilitate rapid urbanization, positioning APAC as the primary manufacturing and consumption hub for electric buses. Europe is witnessing significant growth, largely due to ambitious decarbonization targets set by the European Union and strong supportive legislation such as the Clean Vehicles Directive, leading to rapid electrification across major European cities. North America, while historically focused on traditional school buses, is experiencing a sharp uptick in electric bus procurement, fueled by federal funding programs aimed at improving school district infrastructure and reducing environmental impact in communities.

Segment trends highlight the dominance of the City/Transit Bus application segment, which is the primary beneficiary of urbanization and electrification initiatives. Within fuel types, the Battery Electric Vehicle (BEV) segment is projected to achieve the highest CAGR, fundamentally reshaping the competitive landscape. Furthermore, segmentation based on technology indicates increasing adoption of highly connected buses featuring predictive maintenance capabilities and sophisticated telematics, optimizing operational uptime and reducing lifetime ownership costs for fleet managers globally.

AI Impact Analysis on Bus Manufacturing Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Bus Manufacturing Market frequently revolve around how AI can enhance operational efficiency, guarantee passenger safety in autonomous or semi-autonomous environments, and optimize the complex manufacturing process itself. Users are keenly interested in the feasibility and timeline for fully autonomous public transit routes, the role of AI in predictive maintenance to minimize fleet downtime, and the economic implications of integrating sophisticated machine learning algorithms into vehicle design and operation. There is also a significant concern regarding data privacy and cybersecurity measures required to protect the vast amounts of operational and passenger data generated by AI-enabled bus fleets.

The analysis reveals that AI’s primary influence is multifaceted, spanning the entire value chain from design to deployment. In manufacturing, AI optimizes complex tasks such as material flow management, robotic assembly, and quality control through visual inspection, significantly lowering production error rates and speeding up cycle times. Operationally, AI-driven fleet management systems utilize historical and real-time data to optimize routes, predict rider demand, and manage energy consumption in electric buses, ensuring maximum efficiency and battery life preservation. These advancements address key user concerns about cost reduction and system reliability.

Furthermore, AI is crucial for the development of Advanced Driver-Assistance Systems (ADAS) and eventual Level 4 autonomy. AI algorithms process sensor data from LiDAR, radar, and cameras to enable features like collision avoidance, automatic emergency braking, and precise docking. For manufacturers, AI allows for generative design and simulation, drastically reducing the time required for prototyping new bus models, particularly those featuring novel electric architectures. This integration of AI is not merely an enhancement but a foundational necessity for developing the smart, sustainable urban mobility systems of the future.

- AI-Driven Predictive Maintenance: Utilizes machine learning models analyzing vehicle telemetry data (vibrations, temperatures, charging cycles) to anticipate component failures, thereby minimizing unexpected downtime and optimizing repair scheduling.

- Autonomous Vehicle Development: AI is foundational for perception, decision-making, and control systems required for Level 3 and Level 4 autonomous bus operations, enhancing safety and route adherence.

- Manufacturing Optimization: Implementation of AI in smart factories to enhance production line efficiency, automate quality inspection, and optimize inventory management for complex components like batteries and sensors.

- Route and Fleet Optimization: AI algorithms analyze rider data, traffic patterns, and weather conditions to dynamically adjust routes and schedules, maximizing passenger throughput and minimizing empty runs.

- Energy Management Systems: AI optimizes battery charging and discharge cycles in electric buses, extending battery lifespan and ensuring vehicles are optimally charged for peak operational periods based on predicted route demands.

DRO & Impact Forces Of Bus Manufacturing Market

The dynamics of the Bus Manufacturing Market are dictated by a powerful interplay between market drivers, inherent restraints, and burgeoning opportunities, collectively assessed as impact forces. Primary drivers center on global regulatory mandates pushing for zero-emission vehicles (ZEVs) and sustained public sector investment aimed at improving urban air quality and public transit accessibility. The rapid electrification trend acts as a major driver, compelling manufacturers to rapidly innovate and scale up production capabilities for battery-electric and fuel cell buses, significantly supported by consumer preference for sustainable transport options.

Restraints primarily stem from the economic and infrastructural challenges associated with this transition. The initial capital expenditure for purchasing electric buses remains significantly higher than conventional models, posing a hurdle, particularly for smaller municipal operators. Furthermore, the required investment in installing comprehensive and compatible charging infrastructure (depot charging and on-route charging) presents a substantial logistical and financial constraint. Supply chain volatility, especially concerning key battery minerals and semiconductors, also introduces risks to production continuity and price stability.

Opportunities are abundant in emerging technological landscapes, particularly the integration of autonomous driving technologies which promise future operational cost savings through reduced labor dependency. Moreover, the vast untapped potential in developing nations for expanding public transportation networks provides significant long-term growth avenues. Successful navigation of these forces requires strategic commitment to R&D, focusing on reducing battery costs, improving charging standards, and developing robust, interconnected digital ecosystems for fleet management and passenger services. These impact forces collectively define the market's direction, favoring sustainable, digitally advanced solutions.

Segmentation Analysis

The Bus Manufacturing Market segmentation provides granular insights into demand patterns across various vehicle types, energy sources, operational capacities, and end-user requirements. The market is fundamentally segmented by Fuel Type (Diesel, Electric, Hybrid, Fuel Cell), which is currently the most dynamic segment due to the energy transition. Segmentation by Application (City/Transit Bus, School Bus, Coach/Intercity Bus) highlights distinct procurement cycles and technical requirements based on typical operating environments and passenger demographics. Understanding these segments is critical for manufacturers to align production capabilities with evolving regulatory and end-user needs, ensuring targeted product development and market penetration strategies.

The segmentation by Seating Capacity (15-30 Seats, 31-50 Seats, Above 50 Seats) directly correlates with the required passenger volume and is crucial for planning urban high-density routes versus regional or dedicated transport services like school runs. Furthermore, segmentation by Body Type (Conventional, Transit/Low Floor, Double Decker) informs design and accessibility standards, with low-floor transit buses dominating urban centers due to their superior accessibility features catering to diverse passenger groups. The rapid shift toward electric powertrains across all these application and size categories is the defining characteristic of the current market structure, driving significant resource allocation towards BEV variants in all segments.

- By Fuel Type:

- Diesel (Facing gradual phase-out but dominant in older fleets and certain emerging markets)

- Gasoline (Minimal market share, mostly smaller shuttle buses)

- Electric (Battery Electric Vehicles (BEV), Fuel Cell Electric Vehicles (FCEV) – highest growth segment)

- Hybrid (Provides transitional efficiency gains, relevant in specific high-duty cycle applications)

- By Application:

- City/Transit Bus (High frequency, high capacity, primary segment for electrification)

- School Bus (Mandated safety standards, significant governmental procurement, increasingly electrified)

- Coach/Intercity Bus (Long-distance travel, focused on comfort and luggage capacity, slower adoption of full electrification)

- Others (e.g., Airport Shuttle, Corporate/Staff Transport)

- By Seating Capacity:

- 15-30 Seats (Minibuses/Shuttles)

- 31-50 Seats (Standard mid-size buses)

- Above 50 Seats (High-capacity buses, Articulated, Double Decker)

- By Body Type:

- Conventional (Traditional engine placement, often school buses)

- Transit/Low Floor (Optimized for rapid passenger boarding/alighting in urban areas)

- Double Decker (High-capacity solution for metropolitan centers)

Value Chain Analysis For Bus Manufacturing Market

The value chain for the Bus Manufacturing Market begins with upstream activities, primarily involving the sourcing of raw materials, essential components, and increasingly sophisticated technological subsystems. Upstream suppliers are responsible for providing high-grade steel and aluminum for chassis and body construction, propulsion systems (ICE, electric motors, power electronics), and, most critically, battery packs and management systems for electric buses. The quality and cost efficiency of these sourced components, particularly batteries from specialized global suppliers, directly influence the final product's performance, price, and competitive positioning. Supply chain resilience, especially in the context of geopolitical tensions and mineral extraction challenges, is a key concern at this stage.

Midstream processes involve the actual manufacturing and assembly, encompassing chassis fabrication, body building, system integration (including telematics, HVAC, and ADAS), and final vehicle testing and homologation. This phase is characterized by significant capital investment in highly automated assembly lines, particularly for manufacturers scaling up electric vehicle production. Distribution channels then link the manufactured buses to the end-users. Direct channels often involve large, long-term contracts negotiated directly between the Original Equipment Manufacturer (OEM) and municipal transit authorities or major private fleet operators, offering bespoke configurations and comprehensive maintenance packages.

Indirect channels involve authorized dealerships and distributors who cater primarily to smaller fleet operators, regional school districts, and specialized transport providers, offering sales, financing, and after-sales support. Downstream activities focus heavily on after-market services, including maintenance, repair, spare parts supply (crucial for maximizing vehicle uptime), and, increasingly, battery disposal or second-life usage management, which is a critical new segment within the electric bus value chain. The profitability in the downstream segment is highly dependent on effective digital connectivity and predictive maintenance capabilities integrated into the vehicles.

Bus Manufacturing Market Potential Customers

Potential customers for the Bus Manufacturing Market are highly diverse, spanning governmental, educational, and commercial sectors, each with distinct requirements regarding vehicle specifications, capacity, and procurement criteria. Public transit authorities and municipal governments represent the largest segment of end-users globally. These customers typically require high-capacity, durable, low-emission city buses (often low-floor transit models) procured through large, multi-year tenders, prioritizing total cost of ownership (TCO), reliability, and adherence to stringent public accessibility and environmental standards mandated by regional legislation.

The educational sector, comprising both public school districts and private institutions, constitutes a specialized customer base primarily focused on safety and compliance regulations. In North America, school districts are major buyers of the iconic yellow school bus, with procurement increasingly shifting towards electric models supported by federal and state grants aimed at student health and safety. These customers prioritize robust construction, specialized safety features, and simplified maintenance protocols, often managed through dedicated state contracts.

Commercial operators, including private coach companies, intercity bus services, tourism agencies, and corporate fleet managers, form the third major customer group. These buyers prioritize passenger comfort, aesthetic design, long-range capabilities, and cost efficiency over extended routes. As the market evolves, these commercial entities are also focusing on technological integration, demanding features like advanced infotainment systems, reliable onboard connectivity, and premium interior fittings, seeking competitive advantages in the leisure and business travel segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 73.5 Billion |

| Growth Rate | 6.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daimler AG (Daimler Buses), Volvo Group (Volvo Buses), Yutong Group, BYD Company, Ashok Leyland, Tata Motors, Scania AB, Blue Bird Corporation, New Flyer Industries (NFI Group), King Long United Automotive Industry, VDL Groep, MAN Truck & Bus, Solaris Bus & Coach, Gillig LLC, Proterra, Van Hool, Zhongtong Bus, Alexander Dennis Limited (ADL), Marcopolo SA, Hyundai Motor Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bus Manufacturing Market Key Technology Landscape

The technology landscape within the Bus Manufacturing Market is defined by disruptive innovations primarily concentrated in propulsion, connectivity, and safety. The shift from internal combustion engine (ICE) technology to Battery Electric Vehicle (BEV) and Fuel Cell Electric Vehicle (FCEV) platforms represents the most critical technological transformation. This requires expertise in high-voltage battery architecture, thermal management systems, and specialized electric powertrain components, fundamentally changing the engineering and assembly processes. FCEVs, while nascent, hold significant potential for long-range intercity coaches where rapid refueling and extended operational range are prerequisites, leveraging proton exchange membrane (PEM) fuel cell technology.

Beyond propulsion, digital technologies such as the Internet of Things (IoT) and telematics are becoming standard features. Modern buses are equipped with numerous sensors transmitting real-time operational data, enabling advanced fleet management capabilities. These systems facilitate predictive maintenance by monitoring component health, optimize driving behavior for energy efficiency, and provide real-time location and occupancy tracking. Furthermore, the integration of 5G connectivity is crucial for supporting sophisticated onboard services like high-speed passenger Wi-Fi and Over-The-Air (OTA) software updates for vehicle systems, enhancing the passenger experience and reducing service costs for operators.

Safety technology continues to evolve rapidly, moving toward autonomous features (ADAS Level 2 and 3). Key technologies include sophisticated sensor fusion techniques combining data from radar, LiDAR, and cameras to enable features like pedestrian detection, lane departure warning, and adaptive cruise control. Manufacturers are also focusing on cybersecurity technologies to protect interconnected vehicular systems from remote attacks, particularly as buses become increasingly reliant on external network connections and cloud-based data services. These technological advancements collectively drive higher average selling prices and superior operational performance.

Regional Highlights

Regional dynamics play a paramount role in shaping the global Bus Manufacturing Market, largely due to variations in regulatory environments, urbanization rates, and available public funding for transit infrastructure. Asia Pacific (APAC) stands as the dominant market both in terms of volume and electric vehicle deployment, primarily driven by China's aggressive policy support and massive domestic consumption. Countries like India and Southeast Asian nations are rapidly expanding their urban fleets to manage burgeoning populations, providing immense scope for both conventional and electric bus adoption, fueled by investments in smart city projects.

Europe represents a highly mature and innovation-focused market characterized by strict emission standards (Euro VI and local ZEV zones) and strong public commitment to climate neutrality. Governments and transit agencies across Western and Northern Europe are rapidly transitioning to electric and fuel cell buses, with robust procurement targets set for the next decade. This region is a leader in adopting advanced technologies, including sophisticated telematics, high-quality manufacturing, and advanced driver assistance systems (ADAS), emphasizing energy efficiency and passenger accessibility.

North America is dominated by the demand for school buses and conventional transit buses, but is now experiencing a strong, policy-driven pivot toward electrification, particularly supported by significant federal infrastructure funding packages. The market is concentrated, with a few major players holding significant market share, and procurement processes are highly standardized. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets, where growth is currently linked to infrastructure investment related to new metro systems and large urban projects. While electrification is slower in these regions due to infrastructure constraints, demand for affordable, reliable conventional and hybrid buses remains strong.

- Asia Pacific (APAC): Dominant market share and production hub; strong governmental push for mass EV adoption in China; rapidly expanding public transit networks in India and Southeast Asia; focus on cost-effective, high-volume production.

- Europe: High growth driven by strict environmental regulations (ZEV zones); rapid transition to electric and fuel cell technologies; focus on high-specification, technologically advanced, and accessible vehicles; significant public procurement mandates.

- North America: Large specialized market for school buses and transit vehicles; substantial recent federal funding driving electric bus fleet transition; focus on safety standards, reliability, and domestic manufacturing capabilities.

- Latin America (LATAM): Growth tied to urban infrastructure projects and regional economic stability; demand concentrated in major cities (e.g., São Paulo, Santiago); gradual introduction of hybrid and electric solutions alongside conventional fleets.

- Middle East and Africa (MEA): Emerging market potential driven by investments in megacities (e.g., NEOM); increasing need for climate-controlled transit solutions; slower adoption of full electrification due to high infrastructure cost barriers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bus Manufacturing Market.- Daimler AG (Daimler Buses)

- Volvo Group (Volvo Buses)

- Yutong Group

- BYD Company

- Ashok Leyland

- Tata Motors

- Scania AB

- Blue Bird Corporation

- New Flyer Industries (NFI Group)

- King Long United Automotive Industry

- VDL Groep

- MAN Truck & Bus

- Solaris Bus & Coach

- Gillig LLC

- Proterra (now part of Volvo)

- Van Hool

- Zhongtong Bus

- Alexander Dennis Limited (ADL)

- Marcopolo SA

- Hyundai Motor Company

Frequently Asked Questions

Analyze common user questions about the Bus Manufacturing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the transition in the bus manufacturing market?

The transition is primarily driven by stringent global environmental regulations, particularly government mandates establishing Zero-Emission Vehicle (ZEV) targets and substantial public investment aimed at modernizing urban public transport fleets to combat climate change and improve local air quality.

How does the total cost of ownership (TCO) compare between electric and diesel buses?

While the initial purchase price of an electric bus remains significantly higher than a comparable diesel model, the Total Cost of Ownership (TCO) over the vehicle's lifespan is becoming competitive or even lower for electric buses due to substantially reduced fuel (electricity) costs, lower maintenance requirements, and supportive government subsidies.

Which region dominates the global bus manufacturing market volume?

Asia Pacific (APAC), specifically led by China, dominates the global bus manufacturing market volume and is the largest consumer and producer of electric buses globally, primarily due to massive government industrial support and high urbanization rates.

What major technological advancement is most impacting modern bus design?

The most impactful technological advancement is the integration of advanced battery technology and electric powertrains, closely followed by sophisticated telematics systems, IoT connectivity for predictive maintenance, and the ongoing implementation of Advanced Driver-Assistance Systems (ADAS) for improved safety.

What are the key constraints faced by manufacturers during the market transition?

Key constraints include the high capital expenditure required for establishing robust charging infrastructure, securing a stable supply of critical battery raw materials, and managing the technological complexity associated with integrating new software and electrical architectures into traditional manufacturing processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager