Business Intelligence and Analytics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433729 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Business Intelligence and Analytics Market Size

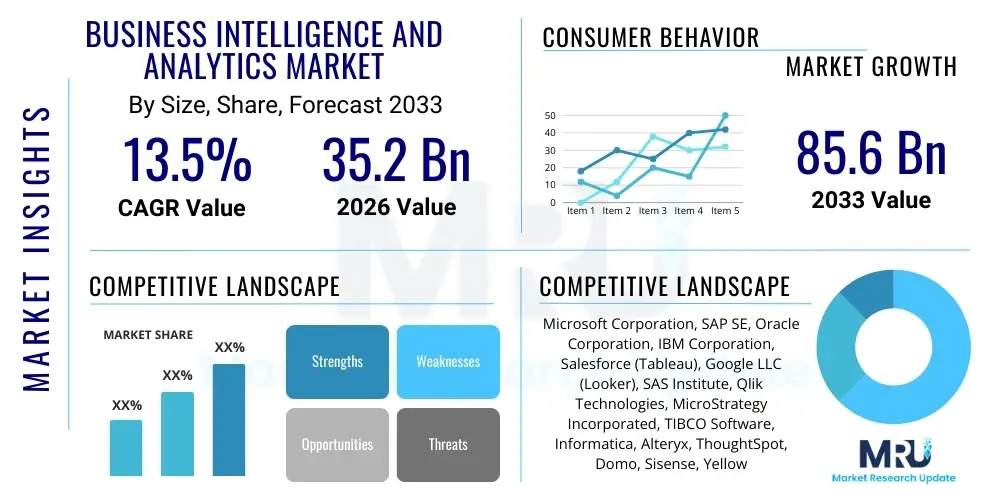

The Business Intelligence and Analytics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033. The market is estimated at USD 35.2 Billion in 2026 and is projected to reach USD 85.6 Billion by the end of the forecast period in 2033.

Business Intelligence and Analytics Market introduction

The Business Intelligence (BI) and Analytics Market encompasses a broad range of software, tools, and methodologies designed to collect, process, analyze, and visualize data, enabling organizations to make informed, strategic decisions. These solutions transform raw data into actionable insights, covering everything from real-time operational metrics to long-term strategic forecasting. Core components include data warehousing, reporting tools, online analytical processing (OLAP), and sophisticated predictive modeling. The rapid proliferation of data sources, including IoT devices, social media, and transactional systems, has made BI and analytics indispensable for maintaining a competitive edge across virtually all industry verticals.

Key applications of BI and analytics span performance management, customer relationship management (CRM), supply chain optimization, and fraud detection. Businesses utilize these tools not just for descriptive analysis (what happened), but increasingly for diagnostic (why it happened), predictive (what will happen), and prescriptive (what should be done) analysis. The primary benefits realized by adopting BI platforms include improved operational efficiency, enhanced customer satisfaction through personalized experiences, better risk management, and the ability to rapidly identify new market opportunities. The shift towards cloud-based deployments and self-service BI platforms is democratizing data access, allowing non-technical users to generate insights without relying heavily on IT departments.

Major driving factors fueling market expansion include the exponential growth in big data volume, the escalating need for real-time data processing capabilities, and the increasing focus on data governance and compliance, particularly in regulated industries like finance and healthcare. Furthermore, competitive pressures necessitate immediate access to performance metrics, pushing companies globally to invest heavily in advanced analytical infrastructure. The integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) within BI suites is creating sophisticated capabilities, moving the market beyond simple reporting into true intelligent decision support systems.

Business Intelligence and Analytics Market Executive Summary

The Business Intelligence and Analytics market is characterized by robust growth, driven primarily by the global digital transformation agenda and the imperative for data-driven decision-making. Key business trends indicate a strong migration toward cloud-native BI solutions, offering superior scalability, flexibility, and reduced total cost of ownership compared to traditional on-premise setups. Self-service BI continues to gain traction, empowering citizen data scientists and business users, thereby decentralizing the analytical process. Furthermore, embedded analytics, integrating BI functionalities directly into operational applications, is becoming a standard expectation, streamlining workflows and accelerating insight generation at the point of action. Competitive strategies are increasingly focused on hyper-personalization of BI tools and integrating advanced features such as Natural Language Processing (NLP) for simplified querying.

Regionally, North America maintains its dominance due to high technology adoption rates, the presence of major BI vendors, and significant investment in advanced data infrastructure across sectors like BFSI and IT. However, Asia Pacific (APAC) is projected to exhibit the fastest growth rate, fueled by aggressive digital adoption in emerging economies like India and China, coupled with government initiatives promoting smart cities and digital governance. Europe is characterized by stringent data protection regulations, particularly GDPR, which necessitates advanced data governance features within BI platforms, driving demand for specialized compliance solutions. The Middle East and Africa (MEA) and Latin America are showing increasing maturity, particularly in the oil and gas and telecommunications sectors, rapidly adopting cloud-based BI to manage large-scale operations and consumer data.

In terms of segment trends, the Software component segment holds the largest market share, but the Services segment (including consulting and implementation) is growing at a faster pace as organizations require expert support for complex data integration and platform deployment. Among deployment types, Cloud BI is overtaking on-premise solutions due to scalability and cost advantages. By application, customer analytics and predictive maintenance are experiencing the fastest uptake, as companies prioritize customer experience optimization and minimizing operational downtime. Small and Medium Enterprises (SMEs) represent a rapidly expanding user base, increasingly leveraging affordable, subscription-based BI offerings that were once accessible only to large enterprises, indicating a widening market scope.

AI Impact Analysis on Business Intelligence and Analytics Market

Common user questions regarding the impact of AI on the Business Intelligence and Analytics market frequently revolve around themes such as the automation of data preparation, the necessity of programming skills for complex analysis, and the potential displacement of traditional data analysts. Users are keen to understand how AI enables predictive and prescriptive analytics beyond standard reporting and the extent to which Machine Learning (ML) can improve data quality and security. Key concerns often focus on the ‘explainability’ (XAI) of AI-driven insights, particularly in regulatory contexts, and the integration complexity of advanced AI models into existing BI infrastructure. Based on this analysis, the key themes summarize that AI is fundamentally shifting BI from descriptive historical reporting to automated, forward-looking intelligence, requiring vendors to focus heavily on intuitive user interfaces, ethical AI frameworks, and seamless, self-optimizing data pipelines.

AI’s influence is profound, transforming BI tools into intelligent systems. Machine Learning algorithms are increasingly utilized for automating repetitive tasks such as data cleansing, transformation, and feature engineering, significantly reducing the time spent on data preparation and improving data reliability. Furthermore, AI fuels predictive modeling, allowing businesses to forecast future trends, customer behaviors, and potential risks with a degree of accuracy previously unattainable. This shift empowers decision-makers to move beyond reacting to events to proactively shaping outcomes through data-informed strategies. The integration of Natural Language Processing (NLP) is also revolutionizing user interaction, allowing business users to query data and generate complex reports using simple, conversational language.

The strategic deployment of AI within the BI ecosystem leads to higher accuracy in decision-making and operational optimization. For instance, anomaly detection powered by AI automatically flags unusual patterns in large datasets, crucial for real-time fraud prevention and system monitoring. Moreover, AI is central to advanced personalization, where algorithms analyze vast amounts of customer data to recommend tailored products or services, thereby enhancing customer lifetime value. As the reliance on automated insights grows, vendors are prioritizing explainable AI (XAI) capabilities, ensuring transparency regarding how complex algorithms arrive at their conclusions, thus building trust and facilitating compliance with industry regulations. This evolution confirms that AI is not just an add-on but the core engine driving the next generation of BI platforms.

- AI automates data preparation and cleansing processes, ensuring higher data quality and reducing manual effort.

- Machine Learning models enable sophisticated predictive and prescriptive analytics capabilities.

- Natural Language Processing (NLP) facilitates conversational BI, making data querying accessible to non-technical users.

- AI enhances anomaly detection for real-time risk mitigation and fraud identification.

- Integration of Explainable AI (XAI) is critical for transparency and regulatory compliance in complex analytical outputs.

- Intelligent systems recommend optimal visualizations and dashboards based on user behavior and data characteristics.

- AI drives hyper-personalization in customer analytics and marketing campaigns.

DRO & Impact Forces Of Business Intelligence and Analytics Market

The Business Intelligence and Analytics Market is primarily driven by the escalating volume and complexity of big data, compelling organizations to adopt sophisticated tools for actionable insights. Restraints largely stem from high initial deployment costs, data privacy concerns, and the significant shortage of skilled data scientists and analysts capable of fully utilizing complex BI platforms. Opportunities abound in the expansion of cloud-based, self-service BI tools targeting Small and Medium Enterprises (SMEs) and the application of advanced analytics in emerging areas like IoT and edge computing. These forces collectively shape the market: the pervasive need for data-driven decisions acts as the primary driver, while the complexity and talent deficit impose friction, pushing innovation toward more automated and intuitive solutions, such as AI-enhanced platforms and low-code/no-code BI environments.

Drivers include the widespread digital transformation efforts across industries, requiring real-time performance monitoring and benchmarking, and the pressure from global competition mandating operational excellence achieved through data optimization. The emergence of affordable and scalable cloud solutions (SaaS BI) further lowers the barrier to entry, accelerating adoption among mid-sized companies. Restraints involve the inherent challenges associated with integrating disparate data sources, ensuring data security in multi-cloud environments, and achieving user acceptance for new, sometimes complex, analytical workflows. The ongoing global economic uncertainty can also cause organizations to postpone large-scale, long-term BI implementation projects, preferring phased rollouts or tactical investments over comprehensive platform overhauls.

Key opportunities are centered on expanding the market footprint through domain-specific BI applications, such as dedicated solutions for clinical trials in healthcare or energy grid optimization in utilities. The increasing adoption of 5G technology will accelerate real-time data flow, necessitating more powerful streaming analytics capabilities. Impact forces demonstrate that technology evolution, particularly the fusion of AI with analytics, has a high impact magnitude, constantly resetting competitive standards. Economic factors, such as globalization and the need for supply chain resilience, also exert significant influence, demanding robust BI tools for strategic planning and risk assessment. Regulatory changes, especially concerning data sovereignty and consumer privacy, act as both a restraint (compliance cost) and an opportunity (demand for specialized governance tools).

Segmentation Analysis

The Business Intelligence and Analytics Market is comprehensively segmented based on component, deployment model, application, organization size, and industry vertical. This stratification allows for a granular understanding of market dynamics, revealing varying growth rates and adoption patterns across different user profiles and technological requirements. The component segmentation distinguishes between software platforms (the core tools) and services (essential for implementation and maintenance). Deployment models highlight the crucial industry shift from traditional on-premise installations to highly scalable and flexible cloud-based solutions. Furthermore, segmenting by application demonstrates the diverse uses of BI, ranging from financial performance management to optimizing customer experience, while vertical segmentation identifies primary end-user industries driving specific demands, such as BFSI requiring high security and retail needing rapid operational insights.

Segmentation by organization size—Large Enterprises versus SMEs—is particularly insightful, showcasing the divergent needs for complexity and pricing. Large organizations often require bespoke, robust enterprise solutions, whereas SMEs prefer scalable, pay-as-you-go SaaS models. The fastest-growing segment often revolves around predictive and prescriptive applications, indicating a strategic shift toward using data to inform future actions rather than merely documenting past results. Geographical segmentation remains vital, illustrating market maturity and regulatory influences, with North America leading in overall adoption but Asia Pacific showing accelerated expansion due to ongoing industrialization and technology infrastructure development.

- By Component:

- Software (Platform and Tools)

- Services (Consulting, Integration and Deployment, Support and Maintenance)

- By Deployment Model:

- On-Premise

- Cloud (Public, Private, Hybrid)

- By Application:

- Customer Analytics

- Financial Performance Management

- Sales and Marketing Analytics

- Supply Chain Optimization

- Risk and Compliance Management

- Operational Analytics

- By Organization Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecommunication

- Healthcare and Life Sciences

- Retail and E-commerce

- Manufacturing

- Government and Defense

- Others (Energy, Education, etc.)

Value Chain Analysis For Business Intelligence and Analytics Market

The Value Chain for the Business Intelligence and Analytics Market begins with upstream activities focused on data infrastructure and technology development. This stage involves hardware manufacturers, data storage providers, and core software platform developers who create the foundational tools and algorithms (e.g., database management systems, data warehousing solutions, and core analytical engines). Upstream success is highly dependent on innovation in cloud computing, data security, and efficient data ingestion capabilities. Key players in this phase include cloud service providers and specialized data platform vendors, whose advancements dictate the performance and scalability of the entire BI ecosystem.

The midstream phase involves the transformation of raw infrastructure into usable BI solutions. This includes the development of specific BI tools, visualization software, and integration services. Independent Software Vendors (ISVs) play a critical role here, focusing on user interface design, embedding AI/ML capabilities, and ensuring connectivity across disparate enterprise systems. Data preparation and governance tools are essential components in this stage, ensuring data quality before analysis. Effective partnership between infrastructure providers and application developers is paramount for delivering cohesive, end-to-end analytical solutions.

Downstream activities are dominated by distribution channels and end-user adoption. Distribution primarily occurs through direct sales channels for large enterprise contracts and indirect channels, such as channel partners, system integrators, and resellers, particularly for localized deployment and servicing SMEs. System integrators are crucial as they tailor generic BI platforms to meet specific organizational needs, offering specialized consulting and deployment expertise. Direct distribution is common for Software-as-a-Service (SaaS) models, where vendors maintain a direct relationship with the user base, often providing continuous updates and support, making the distribution channel highly optimized for recurring revenue models and enhanced customer relationship management.

Business Intelligence and Analytics Market Potential Customers

Potential customers for Business Intelligence and Analytics solutions encompass a vast array of organizations globally, characterized by their need to process large volumes of data for strategic advantage. These customers, or end-users/buyers, are organizations across all sizes—from micro-SMEs needing simple dashboards to multinational conglomerates requiring sophisticated, real-time predictive modeling. In the BFSI sector, key buyers are executives focused on risk assessment, compliance, and fraud detection, demanding high security and regulatory reporting capabilities. In healthcare, buyers include hospital administrators and pharmaceutical researchers needing to optimize patient care pathways, manage operational efficiency, and accelerate clinical trial analysis.

The retail and e-commerce sector represents highly motivated buyers, utilizing BI for demand forecasting, inventory management, customer segmentation, and personalized marketing campaigns to drive sales growth. Manufacturing companies rely on BI to monitor supply chain health, perform predictive maintenance on machinery (reducing downtime), and optimize production line efficiency. Government agencies are increasingly adopting BI for managing public resources, optimizing logistics, and enhancing citizen services, though procurement cycles often differ significantly from private sector purchasing patterns, prioritizing long-term vendor stability and security certifications.

Crucially, the rise of self-service BI platforms has expanded the potential customer base within an organization beyond the IT department and dedicated data science teams. Today, functional managers across finance, marketing, human resources, and operations are primary consumers of BI reports and dashboards. The shift toward subscription-based, modular BI tools makes sophisticated analytics affordable and accessible, ensuring that even technology-averse SMEs and departments with limited dedicated IT resources become significant potential customers, driving volume growth in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.2 Billion |

| Market Forecast in 2033 | USD 85.6 Billion |

| Growth Rate | 13.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Microsoft Corporation, SAP SE, Oracle Corporation, IBM Corporation, Salesforce (Tableau), Google LLC (Looker), SAS Institute, Qlik Technologies, MicroStrategy Incorporated, TIBCO Software, Informatica, Alteryx, ThoughtSpot, Domo, Sisense, Yellowfin BI, Board International, Teradata, Information Builders, Amazon Web Services (AWS) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Business Intelligence and Analytics Market Key Technology Landscape

The technological landscape of the Business Intelligence and Analytics market is undergoing rapid transformation, defined by the convergence of several high-impact innovations. Cloud Computing platforms, specifically hyper-scalers like AWS, Azure, and Google Cloud, form the backbone of modern BI, enabling elastic scalability, high availability, and pay-as-you-go pricing models crucial for managing massive datasets. This shift to cloud-native architectures supports modern data warehousing solutions (e.g., Snowflake, Databricks) that decouple storage and compute, offering unprecedented performance for complex analytical queries. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is moving BI beyond historical analysis, facilitating automated insight generation, predictive forecasting, and pattern recognition, which are essential for competitive differentiation.

Another pivotal technology is Self-Service BI, characterized by intuitive drag-and-drop interfaces and visual data preparation tools. This allows business users, rather than dedicated data scientists, to perform sophisticated analysis, democratizing data access. Furthermore, mobile BI applications are becoming standard, enabling decision-makers to access real-time dashboards and reports on smart devices, supporting critical decision-making irrespective of location. Data visualization techniques have also matured, utilizing complex charts, heatmaps, and geospatial analysis to make complex data interpretable quickly, significantly improving the speed of insight extraction and communication.

Finally, the growing volume of real-time data from IoT devices and streaming sources necessitates advanced stream processing and in-memory computing technologies. These technologies enable organizations to analyze data instantly as it is generated, crucial for applications like fraud detection, algorithmic trading, and predictive maintenance. Edge analytics, processing data closer to the source rather than relying solely on centralized cloud infrastructure, is gaining momentum, reducing latency and bandwidth requirements. Additionally, the increasing emphasis on data governance and data lineage tools, often mandated by regulations like GDPR and CCPA, ensures that the underlying technology stack supports transparent data flows and robust compliance frameworks throughout the analytical lifecycle.

Regional Highlights

Geographical segmentation reveals distinct maturity levels and growth trajectories across global markets, influencing vendor strategies and investment priorities. North America, comprising the United States and Canada, currently dominates the global BI and Analytics market. This dominance is attributable to the region's early adoption of advanced technologies, the presence of major BI market leaders, high IT spending across industries like BFSI, retail, and technology, and a sophisticated data ecosystem that readily embraces cloud and AI integration. The market here is characterized by demand for highly specialized, regulatory-compliant, and deep-learning-based analytical solutions, maintaining high growth despite its large base.

Europe represents the second-largest market, marked by robust regulatory scrutiny. The General Data Protection Regulation (GDPR) has been a significant driver, compelling organizations to invest in sophisticated BI platforms that offer detailed data governance, lineage tracking, and compliance reporting capabilities. Western European nations (Germany, UK, France) are key markets, focusing on leveraging BI for industrial optimization (Industry 4.0) and digital transformation in the public sector. The maturity of the European market drives demand for modernization and the replacement of legacy BI systems with agile, cloud-native alternatives, particularly within the financial and pharmaceutical sectors.

Asia Pacific (APAC) is forecast to be the fastest-growing region throughout the forecast period. This rapid expansion is fueled by massive digital transformation initiatives in countries such as China, India, Japan, and South Korea, coupled with significant investments in IT infrastructure and cloud services. Increasing internet penetration and the proliferation of mobile usage are generating enormous datasets, particularly in e-commerce and telecommunications, necessitating immediate investment in analytical capabilities. Government focus on smart cities, digital governance, and centralized data strategies further accelerates BI adoption, transitioning the region from reliance on basic reporting tools to adopting advanced predictive analytics rapidly.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets, showing consistent growth driven by resource management and operational efficiency requirements. LATAM’s growth is concentrated in the financial services and mining sectors, focusing on risk analytics and performance optimization. The MEA region, particularly the UAE and Saudi Arabia, is undergoing large-scale economic diversification projects (e.g., Vision 2030), fueling substantial infrastructure and technology spending. The deployment model preference in these regions often leans toward scalable, cloud-based BI solutions, as they bypass the need for heavy initial capital investment in on-premise infrastructure, making them attractive to growing regional enterprises and international firms expanding their presence.

- North America: Market leader due to high technology adoption, major vendor presence, and significant investments in AI-driven analytics across BFSI and Tech sectors.

- Europe: Driven by strict regulatory requirements (GDPR) and demand for BI tools supporting industrial automation (Industry 4.0) and compliance reporting.

- Asia Pacific (APAC): Fastest-growing region, fueled by massive digital transformation, e-commerce growth, and aggressive government technology investments in China and India.

- Latin America (LATAM): Growing adoption in financial services, resource management, and telecommunications sectors, favoring scalable cloud deployments.

- Middle East and Africa (MEA): Growth driven by economic diversification projects and large infrastructure investments requiring operational efficiency and real-time performance monitoring.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Business Intelligence and Analytics Market.- Microsoft Corporation

- SAP SE

- Oracle Corporation

- IBM Corporation

- Salesforce (Tableau)

- Google LLC (Looker)

- SAS Institute

- Qlik Technologies

- MicroStrategy Incorporated

- TIBCO Software

- Informatica

- Alteryx

- ThoughtSpot

- Domo

- Sisense

- Yellowfin BI

- Board International

- Teradata

- Information Builders (TIBCO)

- Amazon Web Services (AWS)

Frequently Asked Questions

Analyze common user questions about the Business Intelligence and Analytics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Business Intelligence and Analytics Market?

The Business Intelligence and Analytics Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 13.5% between the years 2026 and 2033, driven primarily by the global demand for data-driven strategic planning and increased adoption of cloud-based solutions.

How is Artificial Intelligence (AI) currently influencing BI tool functionality?

AI significantly enhances BI functionality by automating complex data preparation tasks, integrating predictive and prescriptive analytics capabilities, and enabling conversational querying through Natural Language Processing (NLP), making sophisticated insights accessible to non-technical business users.

Which deployment model is experiencing the fastest growth in the BI and Analytics market?

The Cloud deployment model, including public, private, and hybrid cloud solutions, is experiencing the fastest growth due to its superior scalability, cost efficiency, reduced infrastructure complexity, and accessibility for Small and Medium Enterprises (SMEs) via SaaS offerings.

What are the primary challenges hindering the growth of the BI and Analytics market?

Key challenges include the high initial costs associated with large-scale enterprise implementation, growing complexity related to data security and governance, difficulty integrating disparate legacy data sources, and a persistent global shortage of highly skilled data science and analytical professionals.

Which industry vertical is the largest consumer of Business Intelligence solutions?

The Banking, Financial Services, and Insurance (BFSI) industry vertical is consistently the largest consumer of Business Intelligence solutions, driven by critical needs for regulatory compliance, fraud detection, risk modeling, and enhanced customer relationship management and personalization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Restaurant Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Restaurant Business Intelligence and Analytics Software, Restaurant Inventory Management and Purchasing Software, Restaurant Management Software, Restaurant Scheduling Software), By Application (Large Enterprises, SMEs), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Business Intelligence and Analytics Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (BI platforms, CPM Suite, Advanced and Predictive Analytics, Content Analytics, Analytics Application), By Application (Government, BFSI, IT & Telecom, Manufacturing, Education, Media & Entertainment, Energy & Power, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager