Business Valuation Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433522 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Business Valuation Service Market Size

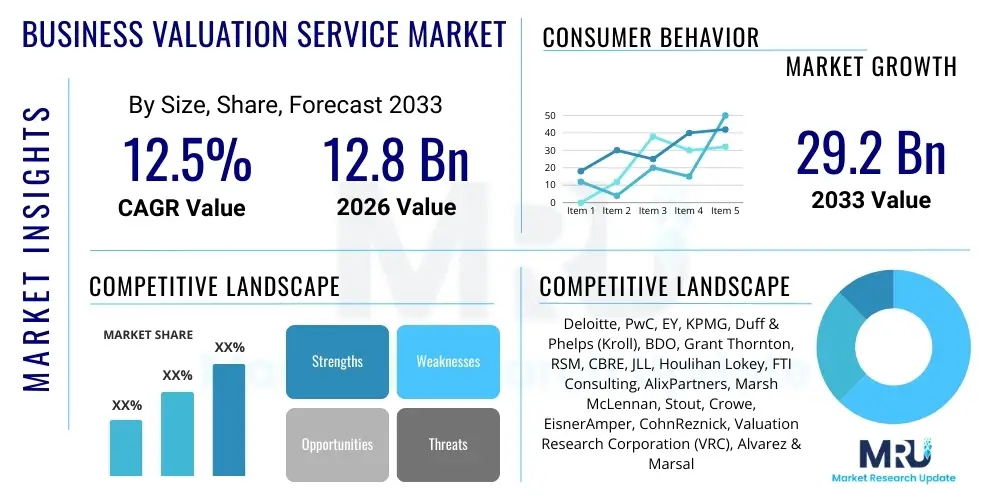

The Business Valuation Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $12.8 Billion in 2026 and is projected to reach $29.2 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by a global surge in mergers and acquisitions (M&A) activity, increasingly complex regulatory environments, and the critical need to accurately assess intangible assets such as intellectual property (IP), brand recognition, and advanced technological platforms. Valuation services are indispensable for strategic financial planning, transactional integrity, and compliance adherence across diverse international jurisdictions.

Business Valuation Service Market introduction

The Business Valuation Service Market encompasses professional financial advisory services aimed at determining the economic value of an owner's interest in a business, specific assets, or securities. These services provide essential data points for financial reporting, litigation support, tax compliance, corporate restructuring, and, most prominently, M&A transactions. Key driving factors include heightened regulatory scrutiny, particularly around ASC 805 (Business Combinations) and ASC 350 (Intangibles – Goodwill and Other), which mandate fair value measurements. Furthermore, the global economy's transition toward knowledge-based industries has amplified the importance of intangible asset valuation, making expert service providers crucial for assessing future earnings potential accurately. The core product description involves providing expert opinions on value based on methodologies like the income approach, market approach, and asset approach.

Major applications of business valuation services span across compliance obligations, corporate strategy, and transactional execution. In compliance, valuations are essential for financial statement reporting (e.g., goodwill impairment testing), tax purposes (estate and gift tax planning, transfer pricing), and regulatory submissions. Strategically, businesses utilize these services to inform capital budgeting decisions, assess investment potential, and structure joint ventures. Benefits derived from engaging valuation experts include enhanced stakeholder trust through objective financial reporting, optimized transactional pricing during acquisitions or divestitures, and reduced legal and tax risks associated with non-compliant valuations. The continuous globalization of businesses and the need for cross-border financial comparability further fuels demand.

The market is defined by several key characteristics, including fragmentation among specialized boutiques and consolidation among the Big Four accounting firms, who dominate high-end, complex assignments. Driving factors include sustained interest rates facilitating M&A financing, increased private equity activity requiring robust portfolio valuation, and the digital transformation necessitating the valuation of unique digital assets and data monetization potential. The demand is particularly acute in dynamic sectors like technology, healthcare, and biotech, where intellectual capital far outweighs tangible assets. The necessity for independent, expert opinions underpins the entire ecosystem, ensuring impartiality and defensibility of value conclusions in legal and regulatory contexts.

Business Valuation Service Market Executive Summary

The Business Valuation Service Market is experiencing robust growth fueled primarily by global instability necessitating frequent impairment testing and a high volume of complex corporate transactions. Current business trends indicate a significant pivot towards technology-enabled valuation methods, including the integration of predictive analytics and machine learning to handle vast datasets and accelerate modeling precision. Key market drivers involve the necessity for compliance with evolving international accounting standards, such as IFRS and US GAAP, especially regarding fair value measurements and impairment assessments. Service providers are increasingly specializing in niche areas like cryptocurrency valuation, SPAC valuation, and complex derivative pricing, reflecting the changing landscape of enterprise value components. The sustained activity in private markets and venture capital cycles demands continuous valuation updates, driving recurring revenue streams for market players.

Regional trends highlight North America as the dominant market, driven by its sophisticated capital markets, highly regulated financial environment (SEC mandates), and the concentration of high-value M&A deals, particularly in the technology sector. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, propelled by the rapid economic expansion of countries like India and China, increasing IPO activity, and maturing regulatory frameworks that require international standard compliance. Europe remains a steady market, characterized by complex cross-border transactions and strict tax regulations (e.g., BEPS framework compliance), demanding intricate transfer pricing valuation services. Emerging economies in Latin America and MEA are seeing growth due to infrastructure development and foreign direct investment, requiring localized asset and enterprise valuation expertise.

Segment trends demonstrate the Intangible Asset Valuation segment achieving the highest CAGR, primarily due to the increasing recognition of intellectual property (IP) as the core value driver for modern businesses. The End-User segment shows Large Enterprises maintaining the largest market share due to complex reporting requirements and frequent M&A activities, while Small and Medium-sized Enterprises (SMEs) are rapidly adopting services for strategic planning, succession planning, and fundraising efforts. The shift towards recurring valuation engagements, rather than one-off assignments, particularly in private equity portfolio valuations and ongoing impairment testing, underscores a crucial service model evolution towards continuous monitoring and advisory roles.

AI Impact Analysis on Business Valuation Service Market

User inquiries about the influence of Artificial Intelligence (AI) on the Business Valuation Service Market frequently revolve around themes of data integrity, methodology standardization, and potential job displacement among junior analysts. Common questions focus on whether AI can fully automate valuation models, how machine learning (ML) algorithms handle qualitative factors unique to a business (e.g., management quality, brand loyalty), and the regulatory acceptance of AI-derived fair value conclusions. Users are particularly concerned about the 'black box' nature of advanced AI models undermining the transparency required for audit scrutiny. The underlying expectation is that AI will primarily enhance efficiency and accuracy in data gathering and comparable analysis, rather than replacing the strategic judgment and narrative interpretation currently provided by seasoned valuation professionals.

The immediate impact of AI is focused on streamlining the burdensome data collection and processing phases. Automated data scraping, normalization of comparable transaction multiples, and instantaneous adjustments for market volatility are becoming standard tools. This efficiency gain allows valuation experts to dedicate more time to complex, judgment-intensive aspects, such as deriving appropriate discount rates, projecting non-linear growth scenarios, and crafting the narrative defense of the value conclusion. Furthermore, AI-powered predictive models are proving highly effective in sensitivity analysis and scenario planning, offering clients a broader range of potential valuation outcomes based on defined risk variables, thereby enhancing the robustness of the final report.

However, AI integration is not without limitations. The subjective nature of certain valuation adjustments, particularly those relating to control premiums, marketability discounts, or synergy projections in M&A, still requires profound human judgment and industry expertise. AI struggles to interpret novel market discontinuities or regulatory shifts without historical precedent. Therefore, the market dynamic is evolving into a hybrid model where AI handles the quantitative heavy lifting (AEO/GEO driven data extraction and analysis), providing foundational insights, while human analysts provide the critical qualitative interpretation, contextual defense, and ultimate responsibility for the fairness opinion, ensuring auditability and professional rigor. AI acts as a sophisticated tool for augmenting, not substituting, the valuation expert.

- AI automates data collection, cleaning, and normalization for comparable company analysis (CCA).

- Machine Learning models enhance forecasting accuracy for discounted cash flow (DCF) projections.

- Predictive analytics supports real-time market risk assessment and sensitivity testing.

- Increased efficiency in handling high volumes of data related to tangible asset appraisal and depreciation schedules.

- Standardization of routine valuation tasks, lowering the cost base for service providers.

- The development of specialized natural language processing (NLP) tools to extract value-relevant clauses from contracts and legal documents.

- AI aids in identifying and quantifying intangible assets like proprietary algorithms and customer databases.

DRO & Impact Forces Of Business Valuation Service Market

The Business Valuation Service Market is shaped by a confluence of powerful drivers (D), significant restraints (R), and expansive opportunities (O), which collectively exert substantial impact forces on market dynamics. The primary driver is the accelerating frequency and complexity of mergers, acquisitions, and divestitures globally, each requiring multiple layers of valuation for pricing, integration, and regulatory compliance. Simultaneously, stringent financial reporting requirements, particularly the emphasis on fair value accounting across jurisdictions (IFRS 13, FASB ASC 820), compel companies to seek external, objective valuation expertise continually. The shift towards enterprise value being dominated by intangible assets, which are inherently difficult to quantify, further drives demand for specialized services.

However, the market faces notable restraints, chiefly the shortage of highly skilled, credentialed valuation professionals capable of handling complex cross-border or industry-specific assignments (e.g., valuing biotech pipelines or digital platforms). Furthermore, the high cost associated with premium valuation services, particularly for smaller enterprises, can act as a barrier to entry, leading some SMEs to rely on internal, less robust estimates. Economic volatility also poses a restraint; during periods of severe downturns, M&A activity can slow significantly, and while impairment testing increases, overall transaction-driven revenue may decline. The inherent subjectivity in valuation methodologies, leading to disputes between management, auditors, and regulators, also creates a perpetual pressure point on the market.

Opportunities abound, driven by the emergence of new asset classes, such as digital currencies, blockchain applications, and environmental, social, and governance (ESG) related assets, all requiring novel valuation frameworks. The increasing global focus on tax transparency and enforcement of transfer pricing rules (e.g., OECD's BEPS initiative) mandates consistent, defensible valuations for intercompany transactions, providing a steady growth opportunity in specialized tax valuation services. Moreover, the accelerating rate of digital transformation offers opportunities for service providers to leverage proprietary data analytics and AI tools, improving service delivery efficiency, scalability, and depth of analysis, thereby creating a competitive advantage and addressing cost concerns. The market impact forces emphasize external regulatory pressure and internal technological innovation as the primary catalysts for structural change and growth.

Segmentation Analysis

The Business Valuation Service Market is comprehensively segmented based on Type of Asset, End-User size, and Industry Vertical. This segmentation provides clarity on the diverse needs driving demand across the global economy. The market's complexity necessitates specialization, with firms focusing heavily on either tangible assets (like real estate and machinery) or, increasingly, intangible assets (like patents, trademarks, and goodwill). The distinction in services provided to large multinational corporations versus small, privately held businesses reflects differences in regulatory burden and purpose—large firms often require valuations for complex financial reporting and multi-billion-dollar transactions, while SMEs typically seek services for succession planning, shareholder disputes, or localized financing needs. The industry vertical perspective highlights variances in valuation methodologies; for instance, technology firms prioritize income and market approaches, whereas manufacturing might rely more heavily on asset-based metrics.

- Type of Asset: Intangible Asset Valuation, Tangible Asset Valuation, Business Interest Valuation (Equity), Debt Valuation, Financial Instrument Valuation (Derivatives).

- End-User: Large Enterprises, Small and Medium-sized Enterprises (SMEs).

- Industry Vertical: Banking, Financial Services, and Insurance (BFSI), IT & Telecom, Manufacturing, Real Estate and Construction, Healthcare and Life Sciences, Consumer Goods and Retail, Energy and Utilities, Professional Services.

Value Chain Analysis For Business Valuation Service Market

The value chain for business valuation services starts with upstream activities focused on data acquisition and technology development. Upstream includes developers of proprietary valuation software, providers of specialized financial data feeds (e.g., transaction databases, economic forecasting tools), and professional credentialing bodies that standardize quality and expertise. The efficiency and accuracy of upstream data directly influence the quality of the final valuation report. Service providers invest heavily in proprietary data management systems and analytical platforms (often integrating AI/ML) to handle the initial stage of information gathering and normalization, which is critical for supporting the valuation methodology applied downstream.

The core service provision forms the middle part of the value chain, where the actual valuation methodology (Income, Market, or Asset Approach) is applied, analysis is performed, and the final valuation conclusion is drafted. This involves highly skilled valuation analysts, industry specialists, and certified public accountants. Distribution channels are predominantly direct, meaning firms interact directly with the client (the end-user). However, indirect channels also play a crucial role; these include referral networks from investment banks, legal firms, accounting auditors (in non-audit roles), and private equity funds, which frequently outsource valuation needs, particularly for portfolio monitoring and complex financial instruments.

Downstream activities involve report finalization, presentation to management and boards, and often, defense of the valuation opinion during audits, regulatory reviews, or litigation. Post-valuation support is increasingly important, including ongoing monitoring for impairment testing and regulatory updates, especially for public companies. The key differentiator in the downstream segment is the quality of the narrative and the defensibility of the conclusions. Strong distribution relies on established reputation and deep relationships with key financial intermediaries, reinforcing the crucial role of both direct professional engagement and indirect referrals from advisory ecosystem partners.

Business Valuation Service Market Potential Customers

The primary consumers (End-User/Buyers) of business valuation services are highly diverse, spanning private individuals requiring estate planning to multi-national corporations executing complex cross-border acquisitions. Large enterprises represent the most significant segment, driven by mandatory annual requirements such as goodwill impairment testing, purchase price allocation (PPA) following acquisitions, and complex tax compliance (e.g., transfer pricing documentation). These large entities require ongoing, complex valuations across multiple jurisdictions and asset types, making them high-value, recurring clients for top-tier valuation firms. Strategic corporate decisions, including IPOs, joint ventures, and capital raises, universally rely on external valuation expertise.

Small and Medium-sized Enterprises (SMEs) constitute a rapidly growing customer base, primarily utilizing valuation services for succession planning, shareholder buyouts, securing bank financing, and litigation support related to divorce or commercial disputes. While their transactions are smaller in scale, the sheer volume of SMEs globally ensures a consistent and expanding demand, particularly as regulatory awareness increases. Furthermore, financial institutions, including commercial banks, private equity firms, and hedge funds, are major buyers. Private equity funds, in particular, require quarterly or semi-annual portfolio company valuations for investor reporting and fund compliance, leading to sustained, predictable demand cycles.

Beyond the corporate sphere, government agencies and judicial bodies represent distinct, specialized customers. Tax authorities frequently commission valuations for estate and gift tax audits or for assessing property taxes. Courts require valuation experts for litigation support, acting as independent experts in shareholder disputes, breach of contract cases, or calculating economic damages. Legal firms, acting as intermediaries, consistently engage valuation professionals to bolster their cases, highlighting the critical role of defensible and objective expert testimony in the judicial system. This broad client spectrum underscores the market's resilience against economic fluctuations, as different customer groups drive demand for varied reasons (transactional vs. regulatory compliance).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.8 Billion |

| Market Forecast in 2033 | $29.2 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deloitte, PwC, EY, KPMG, Duff & Phelps (Kroll), BDO, Grant Thornton, RSM, CBRE, JLL, Houlihan Lokey, FTI Consulting, AlixPartners, Marsh McLennan, Stout, Crowe, EisnerAmper, CohnReznick, Valuation Research Corporation (VRC), Alvarez & Marsal |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Business Valuation Service Market Key Technology Landscape

The technological landscape of the Business Valuation Service Market is rapidly transforming, moving away from reliance on static spreadsheets and manual data compilation towards integrated, dynamic platforms powered by advanced computing. Key technology adoption focuses on enhancing data aggregation, improving modeling accuracy, and ensuring the auditability of complex assumptions. Central to this transformation are robust data management systems (DMS) that can ingest, cleanse, and normalize vast volumes of market, financial, and transactional data instantaneously. These systems integrate with specialized financial databases (e.g., Bloomberg, Refinitiv) and proprietary M&A transaction databases, providing real-time comparable data crucial for the market approach to valuation, thereby significantly reducing the time spent on fundamental research.

Furthermore, the widespread adoption of cloud-based valuation software and financial modeling tools allows for collaborative, scalable, and secure execution of complex DCF (Discounted Cash Flow) and Monte Carlo simulations. These tools often incorporate predictive analytics and machine learning algorithms designed to identify patterns in market multiples, optimize risk adjustments, and rapidly test the sensitivity of the valuation conclusion against multiple macroeconomic scenarios. For instance, ML is increasingly used to model the probability distribution of future cash flows for early-stage technology companies, where historical data is sparse. This technological shift addresses the market's need for faster turnaround times and demonstrably rigorous analysis, crucial for meeting tight regulatory and transactional deadlines.

Blockchain technology, while still nascent in direct application, presents a key technological opportunity, especially in the valuation of digital assets and the creation of immutable transaction records for verifiable asset ownership. Additionally, robotic process automation (RPA) is being implemented for repetitive tasks such as document processing, preparing standard disclosures, and performing routine calculation checks, freeing up highly paid analysts for high-judgment tasks. The integration of Visualization Tools also plays a vital role, allowing valuation conclusions and underlying assumptions to be presented to clients and auditors in clear, interactive formats, enhancing transparency and aiding in the effective defense of the derived value opinion.

Regional Highlights

North America: North America, led by the United States, holds the dominant market share, characterized by its deep, liquid capital markets and highly developed ecosystem of investment banking, private equity, and venture capital. The stringent regulatory environment mandated by the SEC (Securities and Exchange Commission) and FASB drives continuous demand for compliance-driven valuations, particularly for fair value reporting, goodwill impairment, and complex financial instruments. The region is a hotbed for M&A activity, especially in technology and biopharma, necessitating frequent, high-stakes transactional valuations. Canadian and Mexican markets contribute significantly, often requiring cross-border expertise for compliance with US-based investors and standards. The early and widespread adoption of advanced valuation technology also solidifies North America's leadership position.

Europe: Europe represents a mature and highly fragmented market, driven primarily by tax optimization strategies and complex cross-border ownership structures. The implementation of IFRS (International Financial Reporting Standards) across many member states necessitates rigorous fair value measurements. Transfer pricing valuation services are particularly prominent due to the OECD's BEPS (Base Erosion and Profit Shifting) framework, which demands defensible valuation documentation for intercompany transactions spanning multiple tax jurisdictions. Key regional contributors include the UK, Germany, and France. Economic diversity across the EU means valuation firms must possess expertise tailored to varying national laws, accounting practices, and specific industry sectors, especially in automotive, industrial manufacturing, and banking.

Asia Pacific (APAC): The APAC region is the fastest-growing market, propelled by rapid economic liberalization, massive infrastructure development, and increasing foreign direct investment, particularly in India, China, and Southeast Asia. The rise in domestic IPOs and increasing regulatory pressure to align local accounting practices with international standards (IFRS) are key drivers. While regulatory compliance is less uniform than in North America, the sheer volume of emerging market transactions, especially in technology and consumer electronics, creates immense opportunity. Valuation professionals here often deal with unique challenges related to valuing state-owned enterprises, complex joint venture structures, and rapidly appreciating real estate assets, requiring specialized local market knowledge.

Latin America and Middle East & Africa (MEA): These regions show promising growth, driven by privatization efforts, large-scale energy and infrastructure projects, and increasing global financial integration. Latin American markets require services for restructuring, inflation adjustments, and complex debt valuation, often linked to volatile macroeconomic conditions. The MEA region, particularly the GCC countries, is experiencing demand fueled by economic diversification initiatives away from oil dependency, leading to increased M&A activity in non-oil sectors like tourism, financial services, and renewable energy. Compliance with international financial standards is a significant driver in these regions as they seek foreign capital investment, necessitating credible, externally audited valuations.

- North America (Dominant): High concentration of M&A, strict SEC/FASB mandates, dominance in technology sector valuations (IP, goodwill).

- Asia Pacific (Fastest Growth): Rapid industrialization, increasing adherence to IFRS, significant growth in Chinese and Indian capital markets, infrastructure valuation needs.

- Europe: Driven by sophisticated tax valuation (transfer pricing, BEPS), complex cross-border transactions, and IFRS fair value requirements.

- Latin America: Demand stemming from economic volatility, corporate restructuring, and debt valuation complexities.

- Middle East & Africa (MEA): Fueled by economic diversification, infrastructure projects, and requirements for foreign direct investment compliance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Business Valuation Service Market.- Deloitte

- PwC (PricewaterhouseCoopers)

- EY (Ernst & Young)

- KPMG

- Duff & Phelps (Kroll)

- BDO

- Grant Thornton

- RSM

- CBRE

- JLL (Jones Lang LaSalle)

- Houlihan Lokey

- FTI Consulting

- AlixPartners

- Marsh McLennan (Mercer)

- Stout

- Crowe

- EisnerAmper

- CohnReznick

- Valuation Research Corporation (VRC)

- Alvarez & Marsal

Frequently Asked Questions

Analyze common user questions about the Business Valuation Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the current growth of the Business Valuation Service Market?

The primary driver is the significant increase in global Mergers & Acquisitions (M&A) activity coupled with stricter regulatory demands from accounting bodies (like FASB and IFRS) for mandatory fair value measurements, particularly concerning the valuation of intangible assets and mandatory goodwill impairment testing.

How is technology, specifically AI, influencing the accuracy and delivery of valuation services?

AI and Machine Learning are enhancing accuracy by automating data aggregation, comparable analysis, and complex forecasting models (like DCF simulations). This reduces human error in data processing and speeds up turnaround times, allowing professionals to focus on strategic judgment and narrative defense of the final valuation opinion.

Which segment of asset valuation is expected to exhibit the fastest growth over the forecast period?

Intangible Asset Valuation (including Intellectual Property, proprietary software, and brand recognition) is projected to be the fastest-growing segment, driven by the shift towards knowledge-based economies where non-physical assets constitute the majority of enterprise value.

Why is North America the dominant region in the global Business Valuation Service Market?

North America's dominance stems from its highly sophisticated and heavily regulated capital markets, high volume of technology M&A deals, and strict adherence to GAAP and SEC filing requirements that necessitate regular, independent, and defensible external valuations for compliance purposes.

What is the main challenge faced by valuation firms regarding highly specialized services like transfer pricing?

The main challenge is maintaining highly skilled talent capable of navigating complex, frequently changing international tax regulations (such as the OECD BEPS initiative) across multiple jurisdictions, ensuring valuation consistency and minimizing the risk of multi-jurisdictional tax disputes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager