Busway-Bus Duct Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434174 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Busway-Bus Duct Market Size

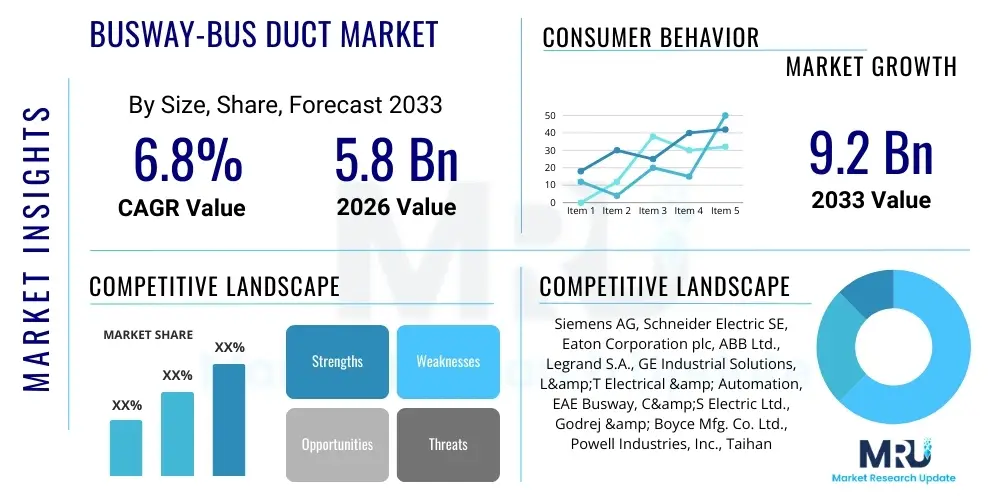

The Busway-Bus Duct Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.2 Billion by the end of the forecast period in 2033.

Busway-Bus Duct Market introduction

The Busway-Bus Duct Market encompasses the manufacturing, distribution, and utilization of prefabricated electric power distribution systems designed to transport high-current electricity safely and efficiently within industrial, commercial, and utility environments. These systems serve as a critical alternative to traditional cable and conduit wiring, offering superior flexibility, thermal management, and space optimization, particularly in facilities requiring large amounts of power delivery such as factories, high-rise buildings, and data centers. The core product involves insulated conductors (copper or aluminum) encased within a grounded metallic housing, facilitating modular installation and easy scalability for evolving power demands. Major applications include vertical power risers in skyscrapers, primary horizontal distribution in sprawling industrial complexes, and integrated power feeds within advanced manufacturing lines.

The principal benefits derived from deploying busway systems include enhanced safety due to standardized construction and superior fault containment, rapid installation times significantly reducing construction timelines, and the ability to handle high current ratings with minimal voltage drop. Furthermore, the inherent modularity allows for easy tap-offs and modifications without major system downtime, distinguishing bus ducts as highly adaptable electrical infrastructure assets. These systems are increasingly favored in environments demanding high reliability and precision power control.

The market is currently being driven by several macro-economic and technological factors. Rapid global urbanization necessitates complex power distribution within dense mega-structures, while the continuous digital transformation fuels exponential growth in hyperscale data center construction, which requires high-density and reliable power solutions that busways effectively provide. Furthermore, stringent global fire and safety regulations increasingly favor the contained and non-flammable characteristics of modern bus duct insulation systems over bundled cables, contributing significantly to market momentum.

Busway-Bus Duct Market Executive Summary

The Busway-Bus Duct market is experiencing robust expansion, fundamentally propelled by accelerating investments in infrastructure modernization and the global data center boom. Key business trends indicate a strong industry focus on product innovation, particularly the integration of Internet of Things (IoT) sensors and digital monitoring capabilities to create 'Smart Busways' that enhance predictive maintenance and power quality management. Manufacturers are also prioritizing sustainable materials and modular designs to improve installation efficiency and comply with green building standards. The competitive landscape is characterized by strategic partnerships and M&A activities aimed at expanding geographical reach and capturing specialized application markets, such as electric vehicle charging infrastructure power backbones.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by unprecedented infrastructure development in countries like China, India, and Southeast Asian nations, driven by rapid industrialization and escalating residential construction. North America and Europe, while mature, demonstrate steady demand, primarily driven by the replacement of aging electrical infrastructure and substantial private sector investments in next-generation hyperscale data centers. Government initiatives promoting smart city development and renewable energy integration further solidify regional demand across mature markets, favoring high-efficiency busway systems designed for demanding operational profiles.

Segment trends reveal that the sandwich bus duct segment dominates due to its compact design, superior fault withstand capability, and suitability for high current applications, making it ideal for data centers and critical power environments. Copper conductors maintain a premium position in applications requiring optimal performance and minimal thermal rise, although aluminum conductors are gaining share in commercial and utility projects where cost optimization is a priority. The industrial sector remains the largest consumer segment, yet the commercial sector, especially IT and telecom infrastructure, exhibits the fastest CAGR, signaling a strategic shift in market focus toward digital economy enabling infrastructure.

AI Impact Analysis on Busway-Bus Duct Market

Artificial Intelligence (AI) is transforming the Busway-Bus Duct market by integrating advanced diagnostic and optimization capabilities into the power distribution network, moving systems beyond passive power conduits into active, intelligent assets. Common user questions frequently address the efficacy of AI in predicting insulation failures, detecting subtle hot spots before they become critical issues, and optimizing load distribution dynamically to ensure peak operational efficiency. Users are concerned about the complexity and cost associated with integrating machine learning algorithms with existing sensor infrastructure, alongside paramount requirements for cybersecurity given the criticality of the electrical network. Expectations are high regarding AI's ability to minimize unplanned downtime, which is extremely costly in sectors like semiconductors and data centers, by providing highly accurate, real-time condition monitoring and fault pattern recognition that human analysis often misses. This intelligence significantly enhances the value proposition of modern busway systems.

The core application of AI involves processing massive data streams generated by integrated current, voltage, temperature, and vibration sensors embedded within the busway system. AI models establish baseline operating profiles and flag anomalies that signify impending mechanical or electrical stress, allowing maintenance teams to intervene proactively. This shift from time-based preventative maintenance to condition-based predictive maintenance significantly extends the useful life of the infrastructure while maximizing uptime. Furthermore, AI can optimize energy flow pathways, balancing loads across parallel busway segments during peak demand cycles to reduce energy losses and ensure optimal system health across the entire installation. This advanced level of control positions busway systems as essential components of truly smart grid and building management ecosystems.

The long-term influence of AI will necessitate significant changes in manufacturing and installation protocols, requiring standardized communication interfaces and robust embedded processing power within the busway components themselves. Manufacturers are beginning to offer AI-as-a-Service subscriptions bundled with their high-end busway products, focusing on delivering actionable insights rather than just raw data. This strategic development is crucial for maintaining competitive advantage, particularly in specialized markets such as hyperscale data centers and high-reliability hospitals, where the assurance of predictive failure detection is a non-negotiable requirement for system selection and deployment.

- AI-driven predictive maintenance significantly reduces catastrophic failure risks.

- Real-time anomaly detection optimizes thermal management and load balancing.

- Enhanced system diagnostics extend asset lifespan and maximize Mean Time Between Failures (MTBF).

- Integration requires standardized sensor interfaces and robust cybersecurity measures.

- AI facilitates transition from fixed schedules to condition-based maintenance strategies.

DRO & Impact Forces Of Busway-Bus Duct Market

The dynamics of the Busway-Bus Duct market are shaped by a complex interplay of drivers (D), restraints (R), and opportunities (O), collectively acting as significant impact forces. Key drivers include the exponential growth in global data consumption necessitating massive expansion of data centers, which rely heavily on high-capacity and reliable power distribution systems. Moreover, rapid global urbanization and the resultant surge in high-rise commercial and residential construction worldwide inherently drive demand for space-efficient and scalable busway systems to manage vertical power transmission efficiently. Stringent regulatory mandates concerning electrical safety and fire containment in public and commercial infrastructure further accelerate the adoption of standardized bus duct systems over traditional, fire-prone cable bundles.

However, the market's expansion is tempered by notable restraints. The primary impediment remains the relatively high initial capital investment required for busway systems compared to conventional cable and conduit installations, often deterring small and medium-sized enterprises (SMEs). Additionally, complexity in standardization across different regional markets and a perceived shortage of highly skilled labor specialized in busway design and installation in specific developing regions pose operational challenges. Market resistance also arises from deep entrenchment of traditional wiring practices, requiring substantial educational efforts to highlight the long-term total cost of ownership (TCO) benefits of busway deployment.

Opportunities for high growth are primarily vested in the development and widespread commercialization of smart busway technologies incorporating IoT sensors, leading to robust condition monitoring and integration with sophisticated building management systems (BMS). Furthermore, the burgeoning demand for reliable power infrastructure supporting renewable energy integration (solar, wind farms) and the massive deployment of electric vehicle (EV) charging stations necessitate reliable high-current feeders, opening new application verticals for modular bus duct solutions. These combined impact forces dictate a sustained market trajectory towards higher capacity, greater intelligence, and enhanced system resilience, defining the next generation of electrical power infrastructure.

Segmentation Analysis

The Busway-Bus Duct market is meticulously segmented based on several technical and application-oriented criteria, enabling precise market sizing and strategic targeting. The segmentation reveals critical trends, such as the persistent demand for robust copper conductors in mission-critical environments due to superior conductivity, contrasted by the emerging adoption of aluminum conductors, particularly in large industrial projects where cost efficiency offsets slight performance differences. Furthermore, segmentation by insulation type, distinguishing between air-insulated and sandwich-type busways, highlights the preference for compact sandwich construction in space-constrained, high-density environments like modern data centers, while air-insulated systems remain relevant in traditional industrial settings requiring lower current ratings.

Analysis by end-user application demonstrates the industrial sector (e.g., manufacturing, oil and gas, utilities) remains foundational to demand, consuming high-amperage systems for machinery power distribution. However, the commercial sector, encompassing IT and Telecom (data centers), healthcare, and office complexes, is exhibiting the highest growth rate, driven by continuous infrastructure expansion and the increasing need for resilient vertical power distribution. Segmentation by current rating (low, medium, high) confirms the market shift towards high current ratings (above 1000 Amperes), directly correlating with the power-intensive requirements of modern digital infrastructure and mega-factories across Asia and North America, indicating where future research and development should be concentrated for optimal returns.

- Conductor Material: Copper, Aluminum

- Insulation Type: Air Insulated, Sandwich Bus Duct, Sandwiched Segregated Phase (SSP)

- Current Rating: Lighting (Below 400A), Low Power (400A-1000A), Medium Power (1000A-4000A), High Power (Above 4000A)

- End-User Application: Industrial (Manufacturing, Process, Utilities), Commercial (Data Centers, Office Buildings, Healthcare, Hospitality), Transportation (Metros, Rail, Airports)

Value Chain Analysis For Busway-Bus Duct Market

The value chain for the Busway-Bus Duct market starts with crucial upstream activities, involving the procurement and processing of fundamental raw materials. This includes securing high-purity copper and aluminum rods for conductors, acquiring specialized insulation materials such as non-hygroscopic epoxy resins and fire-retardant films, and sourcing steel or aluminum sheets for the external casing. The efficiency and pricing stability of these raw material markets significantly influence the final manufacturing cost. Manufacturers must maintain robust supply chain relationships to ensure material quality compliance (especially conductivity and thermal properties) and manage volatile commodity price fluctuations, which directly impact profit margins and product competitiveness.

Midstream activities are centered on the core manufacturing and assembly process, where design optimization, thermal modeling, and rigorous quality control are paramount. Key players focus on developing modular components, standardized joint systems, and advanced insulation application techniques (like vacuum encapsulation) to improve system reliability and reduce installation complexity. Differentiation is achieved through specialized engineering services, offering customized solutions for complex industrial layouts and critical infrastructure projects, ensuring compliance with global electrical standards such as IEC and UL. Research and development investments are heavily focused on smart features, enhancing monitoring capabilities and system connectivity to Building Management Systems.

Downstream analysis covers distribution, installation, and post-sales services. Distribution channels utilize a mix of direct sales forces for large, complex utility or industrial projects, where expert consultation is mandatory, and indirect channels relying on certified distributors and electrical wholesalers for standardized products and commercial building applications. Specialized electrical contractors and engineering procurement construction (EPC) firms play a crucial role in installation, requiring specific training due to the technical nature of high-current installations. Post-sales support, including maintenance contracts and spare parts inventory management, is a growing revenue stream, increasingly involving remote diagnostics facilitated by integrated monitoring technology.

Busway-Bus Duct Market Potential Customers

The primary consumers and end-users of Busway-Bus Duct systems span across sectors that necessitate high-capacity, flexible, and reliable electrical power distribution infrastructure. In the industrial segment, key buyers include major manufacturers in the automotive industry, demanding flexible overhead distribution for robotic production lines, as well as heavy process industries like metals, mining, and petrochemicals, where continuous power flow at high current ratings is essential for operational continuity and safety. These customers prioritize robustness, high short-circuit withstand ratings, and durable insulation capable of resisting harsh environmental conditions.

In the commercial domain, the most dynamic and fastest-growing customer group is the Information Technology and Telecommunications sector, particularly operators of hyperscale and colocation data centers. These facilities are characterized by extremely high power density requirements (often exceeding 20 kW per rack) and necessitate adaptable power tap-offs to accommodate rapid changes in server load and layout. For these customers, Busway systems offer superior modularity and faster deployment times compared to traditional cabling, making them the preferred backbone for mission-critical power distribution. The ability to rapidly scale capacity is a significant deciding factor for this customer segment.

Furthermore, developers of large infrastructural projects such as high-rise office towers, modern hospitals, shopping malls, and large airports represent steady, substantial customers. In these structures, busway systems efficiently handle the massive vertical power transmission needs through dedicated risers, offering better fire containment and space utilization compared to conventional cable trays. Utility providers and energy companies investing in smart grid components and large-scale renewable energy generation facilities (e.g., solar farms requiring high-capacity interconnections) are also emerging as significant buyers, seeking reliable, weather-resistant outdoor busway solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, Schneider Electric SE, Eaton Corporation plc, ABB Ltd., Legrand S.A., GE Industrial Solutions, L&T Electrical & Automation, EAE Busway, C&S Electric Ltd., Godrej & Boyce Mfg. Co. Ltd., Powell Industries, Inc., Taihan Electric Wire Co., Ltd., DB&S BUSWAY SDN BHD, K-LINE, Ltd., Zhejiang Huayi Electric Co., Ltd., Efapel, Starline Busway, Furukawa Electric Co., Ltd., Rittal GmbH & Co. KG, Amphenol Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Busway-Bus Duct Market Key Technology Landscape

The technological evolution within the Busway-Bus Duct market is primarily focused on achieving higher performance specifications, enhancing safety features, and incorporating digitalization for operational intelligence. A major advancement is the widespread adoption of the sandwich-type bus duct configuration, which minimizes the spacing between conductors, thereby substantially reducing inductive reactance and voltage drop, leading to superior efficiency in high-current transfer. Furthermore, manufacturers are continually improving insulation technology, utilizing specialized epoxy encapsulation techniques and advanced fire-retardant materials that enhance short-circuit withstand ratings and ensure superior thermal performance under sustained maximum load conditions, meeting rigorous standards for fire safety in critical infrastructure.

The integration of Information and Communication Technology (ICT) is rapidly defining the modern busway landscape. This includes embedding highly accurate current transformers (CTs), non-contact temperature sensors (like infrared sensors), and digital communication modules directly into the busway segments and tap-off units. This technological shift enables real-time monitoring of power quality, localized temperature hot spots, and system load profiles. Such data is critical for predictive maintenance analytics, allowing operators to preemptively address potential failure points, thereby increasing system uptime and reducing maintenance costs associated with manual inspections, a central tenet of smart factory and smart building management systems.

Beyond internal monitoring, technological focus is also placed on improving modularity and connection reliability. Innovations in joint and connection technologies, such as patented torque-controlled bolted joints and flexible connectors designed to absorb building movement and thermal expansion, minimize the risk of high-resistance connections—a common cause of electrical failure. Moreover, advancements in conductor surface treatments and plating technologies are being utilized to minimize resistance losses at joints. The increasing requirement for integration with distributed generation sources (like rooftop solar) and large energy storage systems is also driving the development of specialized, bidirectional bus duct solutions capable of handling complex power flows efficiently and reliably.

Regional Highlights

Global demand for Busway-Bus Duct systems shows considerable variation driven by regional economic development, infrastructural maturity, and regulatory environments.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, primarily due to intense industrialization, unprecedented levels of infrastructure development (transport, utilities), and rapid urbanization across major economies like China, India, and Southeast Asia. The proliferation of mega-factories, coupled with substantial investments in data center parks to meet escalating digital consumption, ensures high demand for reliable, high-capacity busway systems. Government initiatives focused on modernizing power grids and promoting smart city development further solidify the region's dominant market position.

- North America: North America represents a mature yet high-value market, characterized by stringent safety regulations and a strong focus on infrastructure renewal. Demand is largely fueled by the continuous expansion of hyperscale and edge data centers, which require customized, high-amperage busway solutions. Furthermore, the retrofitting of aging commercial and industrial facilities with modern, energy-efficient busway systems to reduce operational losses is a significant driver, especially in high-density metropolitan areas demanding highly reliable power infrastructure.

- Europe: The European market maintains a steady growth trajectory, strongly supported by regulatory pushes toward energy efficiency, sustainability (Green Deal objectives), and the modernization of industrial plants (Industry 4.0). Key demand areas include the construction of advanced manufacturing facilities, significant investment in high-speed rail networks, and the requirement for robust power supply in highly reliable environments such as hospitals and complex research facilities. Germany and the UK are primary consumers, focusing on technologically advanced, fire-safe systems.

- Middle East and Africa (MEA): The MEA region is emerging as a high-potential market, driven by massive investments in large-scale infrastructure projects, particularly in the GCC countries, including new smart cities, extensive airport expansions, and major commercial developments. Oil and gas infrastructure also requires specialized busway systems designed to withstand challenging environmental conditions. The increasing penetration of data centers in hubs like the UAE and Saudi Arabia further stimulates high-capacity bus duct adoption.

- Latin America: This region presents localized growth opportunities, primarily concentrated in Brazil and Mexico, driven by foreign direct investment in manufacturing and the expansion of the commercial sector. Market uptake is gradual, influenced by economic stability and the pace of regulatory adoption, but significant potential exists in energy generation projects and localized industrial modernization programs that require reliable medium-voltage power distribution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Busway-Bus Duct Market.- Siemens AG

- Schneider Electric SE

- Eaton Corporation plc

- ABB Ltd.

- Legrand S.A.

- GE Industrial Solutions

- L&T Electrical & Automation

- EAE Busway

- C&S Electric Ltd.

- Godrej & Boyce Mfg. Co. Ltd.

- Powell Industries, Inc.

- Taihan Electric Wire Co., Ltd.

- DB&S BUSWAY SDN BHD

- K-LINE, Ltd.

- Zhejiang Huayi Electric Co., Ltd.

- Efapel

- Starline Busway (Universal Electric Corporation)

- Furukawa Electric Co., Ltd.

- Rittal GmbH & Co. KG

- Amphenol Corporation

Frequently Asked Questions

Analyze common user questions about the Busway-Bus Duct market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of busway systems over traditional cable and conduit systems?

Busway systems offer superior advantages including higher current carrying capacity with lower voltage drop, significantly reduced installation time due to their modular, prefabricated design, enhanced flexibility for load tap-offs and modifications, and superior safety characteristics due to robust metallic enclosures providing better fire containment and mechanical protection.

Which end-user segment is driving the highest growth rate in the Busway-Bus Duct Market?

The Commercial end-user segment, specifically the Information Technology and Telecommunications sub-segment (i.e., hyperscale and colocation data centers), is currently driving the highest growth rate. This demand stems from the critical need for scalable, high-density power distribution systems that can be rapidly deployed to support increasing server rack power requirements.

How does the integration of IoT and AI affect the maintenance of busway infrastructure?

IoT and AI integration transforms busway maintenance from reactive or time-based to predictive and condition-based. Embedded sensors monitor parameters like temperature and current in real-time. AI algorithms analyze this data to detect anomalies and predict potential failures before they occur, optimizing maintenance schedules, maximizing uptime, and reducing operational costs associated with unexpected outages.

What are the key technical differences between copper and aluminum conductors in busway systems?

Copper conductors offer higher conductivity, lower volume resistivity, and superior mechanical strength, making them preferable for mission-critical, high-performance applications where minimal voltage drop and compactness are essential. Aluminum conductors are significantly lighter and generally more cost-effective, making them highly suitable for long runs in large industrial or commercial projects where initial capital cost is a primary consideration, provided adequate sizing compensates for lower conductivity.

Which regional market holds the highest growth potential for Busway-Bus Duct vendors?

The Asia Pacific (APAC) region, driven by continuous, large-scale infrastructural investments, rapid industrial expansion, and mass deployment of commercial structures and data center parks in countries like China and India, holds the highest current and projected growth potential for Busway-Bus Duct vendors throughout the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager