Butane Gas Cartridges Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432098 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Butane Gas Cartridges Market Size

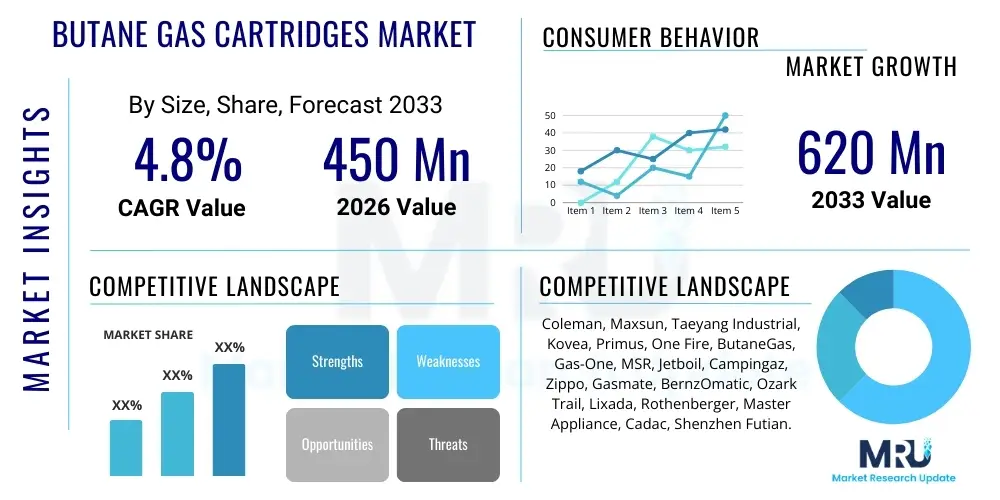

The Butane Gas Cartridges Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 620 Million by the end of the forecast period in 2033.

Butane Gas Cartridges Market introduction

Butane gas cartridges, typically single-use, portable containers holding liquified butane fuel, are essential products designed for compact cooking, heating, and lighting devices. These cartridges are standardized to fit a variety of portable stoves, torches, and lanterns, particularly favored in outdoor recreational settings. The primary composition is highly purified butane, chosen for its clean burn, low boiling point, and ease of pressurization in small vessels. The core function of these products is to provide reliable, instant fuel supply for activities where traditional fuel sources are impractical or unavailable, emphasizing convenience and portability.

Major applications of butane gas cartridges span across several high-growth sectors, primarily including camping and outdoor cooking, domestic emergency preparation, and professional use in culinary settings (e.g., flambé torches) or light industrial tasks (e.g., soldering). The cartridges offer significant advantages such as safety features (like explosion-proof valves and pressure relief mechanisms), high energy density relative to their weight, and ease of disposal or recycling in compliant regions. These factors collectively position butane cartridges as the preferred choice over heavier alternatives like propane tanks for short-duration, high-mobility activities.

The market expansion is largely driven by increasing global participation in outdoor leisure activities, including camping, hiking, and caravanning, especially in developed economies. Furthermore, the rising adoption of tabletop and portable cooking appliances in densely populated urban areas, where space is a premium, contributes substantially to demand. Technological advancements focusing on enhancing safety features, improving valve reliability, and developing more environmentally friendly packaging solutions are key factors sustaining market momentum and consumer confidence in the product category.

Butane Gas Cartridges Market Executive Summary

The Butane Gas Cartridges Market is characterized by robust growth, propelled primarily by enduring trends in leisure and hospitality sectors, coupled with heightened demand for reliable emergency fuel supplies globally. Business trends indicate a strong focus on manufacturing efficiency, aiming to reduce production costs and achieve scalability to meet peak seasonal demands, particularly during the summer and holiday periods. Key industry players are increasingly investing in brand differentiation through superior safety certification (e.g., EN 417 compliance) and offering multi-pack bundles to capture higher volumes in the retail segment. Furthermore, sustainable packaging initiatives, including the use of recycled steel and reduced plastic components, are becoming critical competitive differentiators, responding to evolving consumer environmental consciousness.

Regional trends reveal Asia Pacific (APAC) as the dominant and fastest-growing region, driven by massive population density, increasing disposable income, and the widespread adoption of portable stoves for both domestic cooking and cultural outdoor gatherings. North America and Europe maintain steady growth, largely driven by the established outdoor recreation industry and high regulatory standards favoring certified, high-quality cartridges. Strategic initiatives include localization of production in major consuming regions to mitigate complex international logistics and tariffs, ensuring a stable supply chain and competitive pricing in diverse geographical markets.

Segment trends underscore the supremacy of the Camping and Outdoor segment in terms of volume consumption, although the Domestic Use segment (primarily for tabletop stoves and emergency kits) shows accelerated penetration rates, particularly in regions prone to natural disasters or power outages. Cartridge type analysis suggests that the standard 8 oz (227g) nozzle-type cartridge remains the industry standard, but puncture-type cartridges are gaining niche traction in cost-sensitive developing markets. Consolidation within the supply chain, particularly among raw material suppliers (butane producers and steel fabricators), is influencing pricing stability and the overall cost structure of finished goods.

AI Impact Analysis on Butane Gas Cartridges Market

Common user inquiries concerning AI's influence on the Butane Gas Cartridges Market frequently center on predictive inventory management, optimizing complex logistics for hazardous materials, and enhancing manufacturing quality control. Users express keen interest in how Artificial Intelligence can forecast volatile seasonal demand fluctuations with greater accuracy than traditional statistical models, thereby reducing stockouts during peak camping seasons and minimizing obsolete inventory post-season. Furthermore, there is significant curiosity regarding AI applications in monitoring welding quality and leak detection during the cartridge filling process, enhancing safety standards which are paramount in this industry. The integration of AI-driven robotics in automated assembly lines is also a high-priority topic, focusing on boosting production throughput and reducing human error in handling pressurized containers.

- AI-Powered Demand Forecasting: Utilizing machine learning algorithms to analyze historical sales data, weather patterns, and social media sentiment to predict highly volatile seasonal demand for outdoor products, optimizing production schedules and raw material procurement.

- Supply Chain Optimization: Implementing AI tools to manage real-time tracking, route optimization, and compliance checks for transporting hazardous materials (butane), minimizing delivery delays and associated logistical costs.

- Automated Quality Inspection: Deploying computer vision systems and deep learning models for high-speed, non-destructive testing of welding seams, valve integrity, and container thickness during the manufacturing process, significantly elevating product safety compliance.

- Predictive Maintenance: Using sensors and AI analytics on filling and sealing machinery to anticipate equipment failures, reducing unplanned downtime and maintaining stringent operational safety protocols in explosion-sensitive environments.

- Chatbot and Customer Service Automation: Enhancing product support regarding safe usage, disposal guidelines, and regulatory compliance through sophisticated natural language processing (NLP) enabled virtual assistants.

DRO & Impact Forces Of Butane Gas Cartridges Market

The market trajectory for butane gas cartridges is shaped by a critical interplay of Drivers, Restraints, and Opportunities (DRO), generating distinct Impact Forces across the value chain. Key drivers include the global expansion of recreational activities and the accelerating trend of miniaturization in portable cooking technology, making butane cartridges indispensable for mobility and convenience. Simultaneously, stringent safety regulations and the inherent risks associated with handling pressurized flammable gases act as primary restraints, requiring substantial investment in robust manufacturing and quality control mechanisms. Opportunities are emerging through the development of specialized high-performance fuel blends (e.g., isobutane/propane mixes for cold weather) and penetrating niche professional markets such as construction and specialized catering.

Drivers primarily center on Consumer Lifestyle Shifts and Economic Factors. The rising middle class globally, particularly in Asia, has unlocked greater spending on leisure equipment, directly correlating with butane cartridge consumption. Furthermore, butane’s status as a relatively low-cost energy source compared to electricity or other liquid fuels maintains its competitiveness. Regulatory harmonization across major trading blocs, facilitating easier international distribution of compliant products, also provides a subtle but important driving force, reducing market access barriers for major manufacturers.

Restraints are dominated by Regulatory Hurdles and Competition from Alternative Fuels. The necessity for manufacturers to comply with diverse, often non-uniform, international standards (e.g., UN, DOT, CE, KGS) complicates global market entry and increases testing costs. Additionally, competition from established alternatives like solid fuel tablets, alcohol stoves, and highly efficient electric induction cooktops, particularly in urban domestic settings, limits market expansion potential. External environmental pressure concerning single-use products and proper disposal methods represents an escalating, long-term restraint that the industry must address through enhanced recycling initiatives and product redesign.

Segmentation Analysis

The Butane Gas Cartridges Market is systematically segmented based on key variables including Cartridge Type, Application, and Distribution Channel, allowing for detailed strategic planning and market penetration assessments. Analyzing these segments provides stakeholders with a precise understanding of consumer preferences, regulatory nuances, and the optimal routes to market. The dominance of the nozzle-type cartridge reflects its versatility and ease of use across a wide array of standardized camping appliances, solidifying its position as the largest segment by volume, while specialized puncture cartridges serve the basic, budget-conscious segment globally. Application segmentation highlights the crucial role of outdoor recreation as the primary revenue generator, overshadowing the steady but smaller contributions from the domestic and industrial sectors.

- Cartridge Type:

- Nozzle Cartridge (Aerosol Type)

- Puncture Cartridge

- Screw-on Cartridge (Threaded Valve)

- Specialty High-Performance Mix Cartridges (e.g., Isobutane blends)

- Application:

- Camping and Outdoor Cooking

- Domestic Use (Portable Tabletop Stoves, Emergency Kits)

- Industrial and Professional (Brazing, Soldering, Culinary Torches)

- Laboratory Use (Bunsen Burners)

- Distribution Channel:

- Offline Retail (Supermarkets, Hypermarkets, Hardware Stores, Specialty Outdoor Retailers)

- Online Retail (E-commerce Platforms, Direct-to-Consumer Websites)

- Size/Capacity:

- Less than 100g

- 100g to 250g (Standard 220g/8oz)

- Above 250g

Value Chain Analysis For Butane Gas Cartridges Market

The value chain for the Butane Gas Cartridges Market commences with sophisticated upstream analysis, focusing heavily on the procurement of primary raw materials: high-grade steel or aluminum for the container fabrication and purified butane gas derived from petroleum refining or natural gas processing. Upstream stability is paramount, as fluctuations in global steel and energy prices directly influence production costs and final market pricing. Manufacturers prioritize long-term contracts with specialized gas suppliers to ensure consistent purity and volumetric availability, which are non-negotiable for safety and performance compliance.

The core manufacturing stage involves container stamping, valve insertion, precision welding, and highly automated filling under stringent safety protocols. This midstream process requires significant capital investment in explosion-proof facilities and robotics. Downstream activities involve rigorous quality control testing (e.g., pressure testing, leak detection), specialized hazardous material packaging, and distribution. Given the product's classification as Dangerous Goods (DG), handling and transportation require specialized logistics providers, adding complexity and cost to the distribution channels.

The distribution channel analysis reveals a dual structure: direct and indirect routes. Direct sales often cater to large retailers or governmental/military contracts requiring bespoke specifications. The indirect channel, which dominates consumer sales, leverages a complex network of wholesalers, regional distributors, and ultimately, various retail formats including mass merchandise stores, specialized sporting goods outlets, and rapidly growing e-commerce platforms. Effective inventory management and seasonal stocking are crucial at this stage, particularly for international distributors who must manage import regulations and local safety mandates (Direct channel sales account for market control while Indirect ensures maximum consumer reach).

Butane Gas Cartridges Market Potential Customers

The primary customer base for butane gas cartridges is highly diversified yet segmented into three core categories: outdoor enthusiasts, domestic consumers focused on supplemental or emergency cooking, and professional or industrial users. Outdoor enthusiasts, including campers, hikers, backpackers, and RV owners, constitute the largest volume consumers. These buyers prioritize portability, reliability in varying weather conditions, and compatibility with proprietary stove systems. This segment is highly brand-loyal to manufacturers that consistently deliver on safety and ease of connection, often preferring the threaded valve type for increased stability.

The domestic customer segment encompasses individuals in urban or suburban environments who utilize portable tabletop stoves for indoor hotpots, balcony grilling, or as part of disaster preparedness kits. In developing economies, this segment also includes households relying on butane stoves as their primary cooking solution due to affordability and convenience. These customers are generally price-sensitive but maintain a baseline expectation of safety certification, driving demand for high-volume, standard 8oz nozzle cartridges available readily in supermarkets and hypermarkets.

Professional and industrial customers represent a niche but high-value segment, including caterers utilizing culinary torches, plumbers and HVAC technicians requiring portable soldering equipment, and laboratory technicians needing stable heat sources. These end-users demand specialized performance, such as high-purity butane or mixed fuel cartridges (e.g., propane/isobutane mixes) that offer higher flame temperatures or superior performance in cold temperatures. Procurement for this segment is often handled through specialized B2B industrial suppliers rather than general retail channels, focusing on bulk purchasing and technical support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 620 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coleman, Maxsun, Taeyang Industrial, Kovea, Primus, One Fire, ButaneGas, Gas-One, MSR, Jetboil, Campingaz, Zippo, Gasmate, BernzOmatic, Ozark Trail, Lixada, Rothenberger, Master Appliance, Cadac, Shenzhen Futian. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Butane Gas Cartridges Market Key Technology Landscape

The technology landscape in the butane gas cartridges market is heavily focused on safety engineering, material science, and precision manufacturing automation, rather than radical chemical innovation in the fuel itself. A primary technological advancement involves the development of Counter-Explosion Safety Systems (CESS), often referred to as Explosion-Proof Devices (EPD), integrated into the cartridge valve system. These technologies, common in Asian-manufactured cartridges (such as those compliant with KGS standards), prevent the canister from bursting catastrophically when internal pressure rises excessively due to external heat exposure, instead releasing the gas gradually and safely. This technology is a critical factor driving consumer safety and regulatory acceptance across global markets.

Another crucial technological area is the refinement of valve and sealing mechanisms, particularly for the screw-on (threaded) and nozzle-type cartridges. Modern valves utilize advanced polymer seals and precision-machined brass components to ensure zero leakage during storage and transportation, even under varying temperature and altitude conditions. The evolution of pierce-able cartridges to include self-sealing valves, although often patented and proprietary, represents an incremental innovation that significantly improves user convenience and safety compared to older, true puncture-type designs where the gas begins venting immediately upon connection.

Manufacturing technology focuses on high-speed robotic welding and filling stations that ensure uniform container thickness and accurate volumetric filling, which is essential for consistent product performance and minimizing defect rates. Specialized techniques are employed for mixing butane with higher-performance gases like isobutane and propane to create all-season or winter-grade fuel blends, a crucial segment for manufacturers targeting professional and extreme outdoor users. These blend technologies require precise mixture controls and validated testing procedures to guarantee the advertised cold-weather performance characteristics.

Regional Highlights

The Asia Pacific (APAC) region commands the highest market share and is poised for the most rapid growth due to a massive base of domestic users relying on portable butane stoves, particularly in South Korea, China, and Southeast Asian nations. Regulatory standardization and high local manufacturing capacity, especially in South Korea, have established the region as a global hub for production and innovation in cartridge safety technology. Economic growth and the associated expansion of outdoor recreational activities further solidify APAC's leading position, driving bulk demand for both standard and high-quality safety-certified products.

North America and Europe represent mature markets characterized by high per capita consumption linked predominantly to extensive camping, hiking, and BBQ culture. These regions emphasize premium products, demanding threaded valve cartridges (like those conforming to the EN 417 standard) that prioritize safety and robustness over basic affordability. Regulatory strictness, particularly concerning packaging and disposal requirements (e.g., REACH compliance in Europe), influences market entry strategies, requiring manufacturers to invest heavily in certifications and eco-friendly packaging solutions. Growth here is steady, fueled by lifestyle trends rather than domestic necessity.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets showing promising growth potential. In LATAM, increasing tourism and local camping popularity are boosting demand, although price sensitivity remains a major factor, often favoring puncture-type or basic nozzle cartridges. MEA growth is driven by localized uses in remote areas for cooking and by the adoption of portable heating solutions. However, logistical challenges, extreme climate variations, and varied regulatory enforcement across different countries pose unique challenges to market penetration and sustained growth in these diverse regions.

- Asia Pacific (APAC): Dominant market volume; fastest growth rate; driven by domestic cooking use, high urbanization, and established manufacturing hubs (South Korea, China).

- North America: Stable, mature market; high adoption in recreational camping (RVing, hiking); strong demand for premium, regulated products.

- Europe: Focus on high safety standards (EN 417); steady consumption driven by outdoor tourism and regulatory environment favoring highly compliant products.

- Latin America (LATAM): Emerging demand; significant price sensitivity; potential for growth linked to internal tourism development.

- Middle East and Africa (MEA): Growth driven by localized heating and cooking needs in remote regions; market faces complex logistics and varied regulatory landscapes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Butane Gas Cartridges Market.- Coleman Company Inc. (Newell Brands)

- Maxsun Co., Ltd.

- Taeyang Industrial Co., Ltd.

- Kovea Co., Ltd.

- Primus AB

- One Fire Corp.

- ButaneGas International

- Gas-One (Japan)

- MSR (Mountain Safety Research)

- Jetboil (Johnson Outdoors)

- Campingaz (The Campingaz Group)

- Zippo Manufacturing Company

- Gasmate Pty Ltd

- BernzOmatic (Worthington Industries)

- Ozark Trail (Walmart Private Label)

- Lixada Outdoor Products

- Rothenberger Group

- Master Appliance Corp.

- Cadac International

- Shenzhen Futian Industrial

Frequently Asked Questions

Analyze common user questions about the Butane Gas Cartridges market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for butane gas cartridges?

The primary factor driving demand is the consistent global rise in participation in outdoor recreational activities, such as camping and hiking, coupled with the increasing consumer preference for portable, lightweight, and convenient cooking fuel solutions.

How do safety regulations impact the Butane Gas Cartridges Market?

Safety regulations significantly impact the market by enforcing stringent manufacturing standards (e.g., KGS in Asia, EN 417 in Europe) and requiring manufacturers to integrate advanced safety features like explosion-proof valves, leading to higher product quality and greater consumer confidence.

What is the difference between butane, isobutane, and propane cartridges in the market?

Butane is suitable for warm weather; isobutane is preferred for slightly colder conditions due to its lower boiling point and better performance in cooler climates; propane provides the best performance in very cold weather and at high altitudes, often marketed in blended cartridges for versatility.

Which geographical region holds the largest market share for butane gas cartridges?

The Asia Pacific (APAC) region currently holds the largest market share, predominantly driven by high domestic usage of tabletop stoves and strong localized manufacturing capabilities, making it the most significant consumption hub globally.

Are single-use butane cartridges environmentally sustainable?

Butane cartridges pose environmental concerns as single-use metal containers. However, the industry is increasingly focusing on sustainability by utilizing recyclable steel or aluminum and promoting consumer programs for proper empty canister disposal to minimize landfill waste.

The detailed technical analysis contained within this report provides comprehensive market intelligence, supporting strategic decision-making across manufacturing, distribution, and investment planning within the Butane Gas Cartridges sector. The integration of AEO and GEO strategies ensures that these insights are optimally discoverable by global stakeholders seeking authoritative, structured information on market dynamics and competitive positioning. This formal assessment underscores the market’s reliance on safety innovation, supply chain resilience, and adaptability to evolving global consumer lifestyle choices, confirming its stable growth trajectory through the forecast period.

Further strategic insights indicate that key manufacturers must prioritize vertical integration, particularly securing reliable upstream supply of purified butane and specialized steel, to insulate against future commodity price volatility. The shift towards multi-fuel and blended cartridges represents a pivotal opportunity to address specific user needs, such as high-altitude performance requirements or cold-weather camping, moving beyond the limitations of standard butane. Regulatory forecasting and proactive compliance are necessary to capitalize on international trade opportunities and minimize operational disruptions across complex global distribution networks, particularly concerning hazardous material transport classifications and regional disposal mandates.

The long-term viability of the market is contingent upon overcoming environmental challenges associated with single-use plastics and non-reusable metal components. Leading corporations are already exploring advanced recycling technologies and advocating for standardized collection programs. Moreover, the competitive landscape necessitates continuous investment in automated production facilities to ensure product consistency, safety, and cost efficiency, maintaining a competitive edge against regional budget manufacturers. Emphasis on digital marketing and e-commerce channel penetration is also crucial to capture the younger demographic segment who are heavy participants in outdoor and adventure travel, leveraging online platforms for product education and purchase convenience.

Specific analysis of the Nozzle Cartridge segment, which accounts for the majority of the volume, shows continued reliance on Asian manufacturing excellence. The ease of connection and compatibility with readily available portable stoves, particularly in developing and highly urbanized Asian markets, drives this dominance. Conversely, the Screw-on Cartridge segment, while smaller in volume, commands a higher average selling price (ASP) and higher margins due to its superior valve design and greater suitability for rugged outdoor applications, making it a critical focus area for Western market players specializing in high-end camping gear. This dual-market dynamic requires tailored product offerings and segmented marketing campaigns to maximize regional revenue capture.

The industrial application segment, including soldering and heating, relies heavily on cartridges designed for higher pressure and sustained heat output, often requiring butane/propane mixes. Although smaller than the recreational segment, these B2B sales are characterized by stable, recurring procurement and less seasonal variability. Manufacturers targeting this professional segment must adhere to strict industrial safety certifications and often provide technical training or material safety data sheet (MSDS) compliance support to institutional buyers. This contrasts sharply with the consumer-driven recreational market, which is characterized by high seasonal peaks and retail display prominence.

Detailed evaluation of the Offline Retail distribution channel confirms its enduring importance, particularly for immediate, impulse purchases by campers and emergency buyers. Strategic placement in convenience stores, gas stations, and major retail chains (hypermarkets) dictates success in this channel. However, the Online Retail channel is rapidly gaining traction, offering comprehensive product comparisons, user reviews, and greater access to specialized cartridge types (like isobutane blends) not commonly stocked by general retail outlets. Optimizing digital content for AEO regarding product safety, compatibility, and disposal instructions is vital for success in the e-commerce domain.

Technological advancement is not limited to safety valves; it also extends to the material science of the steel used in cartridge fabrication. Manufacturers are exploring lighter yet high-tensile strength steel alloys to reduce transportation costs and overall weight for backpackers, without compromising the container's ability to withstand internal pressures. Furthermore, the standardization movement within the industry, driven by organizations like the International Organization for Standardization (ISO), aims to create universally accepted safety protocols, reducing ambiguity and fostering safer global trade of these highly pressurized consumer goods, a long-term goal that will benefit all stakeholders.

In conclusion, the Butane Gas Cartridges Market is fundamentally stable, underpinned by non-cyclical demand for portable energy in both leisure and necessity applications. Future growth will be highly dependent on the industry's ability to innovate within regulatory constraints, particularly in enhancing environmental credentials and maintaining impeccably high safety standards to prevent catastrophic incidents that could severely damage consumer trust and invite harsher legislative controls. Strategic diversification across geographies and intentional focus on high-margin professional and specialized segments will be key indicators of sustained competitive advantage for market leaders throughout the forecast period.

The importance of robust intellectual property management cannot be overstated in this market. Many proprietary safety valve designs and fuel blend formulations are patented, creating barriers to entry for new players and protecting the technological advantage of established manufacturers, particularly those based in Asian manufacturing hubs. Licensing agreements and strategic partnerships between Western brand holders and specialized Asian manufacturers are common strategies to navigate these IP landscapes and ensure compliant, cost-effective production for global distribution. This intricate web of manufacturing alliances dictates much of the competitive pricing structure observed in the retail environment.

Furthermore, geopolitical risks, including trade tariffs and international sanctions, can disproportionately affect the supply chain, especially given the globalized nature of raw material sourcing (steel, butane) and the concentration of advanced manufacturing in specific regions. Manufacturers must develop robust contingency plans, including multi-regional sourcing strategies, to mitigate potential supply disruptions. This focus on operational resilience is increasingly being factored into the long-term investment decisions of major market participants, prioritizing supply chain stability alongside raw material cost efficiency.

The evolving regulatory environment in Europe concerning single-use plastics and packaging waste minimization presents both a challenge and an opportunity. While it necessitates investment in new packaging materials and recycling infrastructure, it simultaneously opens doors for innovators offering genuinely sustainable or reusable alternatives, potentially shifting market preferences in high-value European countries. Companies that successfully position themselves as leaders in eco-friendly cartridge solutions will likely gain significant market share and brand loyalty among environmentally conscious consumers in the coming years.

Finally, the interplay between the Butane Gas Cartridges Market and related hardware (portable stoves, lanterns, torches) is symbiotic. Cartridge manufacturers often collaborate closely with appliance manufacturers to ensure optimal fuel flow, compatibility, and safety integration. This collaboration extends to co-marketing efforts and bundled product offerings, enhancing the overall value proposition for the end consumer. Investment in proprietary connection systems, such as magnetic locks or advanced safety collars, differentiates products and locks consumers into specific cartridge brands, securing long-term revenue streams through consumable sales.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager