Butt Fusion Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432279 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Butt Fusion Machines Market Size

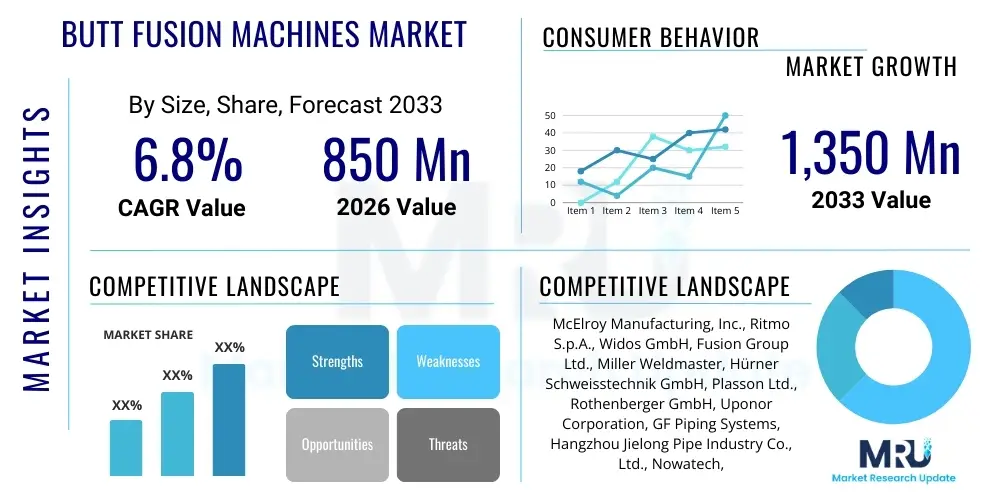

The Butt Fusion Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033. This consistent expansion is primarily driven by the increasing global adoption of polyethylene (PE) and polypropylene (PP) piping systems, particularly in large-scale infrastructure projects related to water distribution, wastewater management, and natural gas conveyance. The durability, chemical resistance, and cost-effectiveness of plastic pipes necessitate the use of reliable joining methods like butt fusion, thereby sustaining robust demand for advanced fusion machinery.

The market valuation reflects the rising investment in modernizing existing infrastructure across developing and developed economies. Butt fusion technology offers superior leak-proof joints compared to mechanical fittings, which is crucial for maximizing efficiency and minimizing environmental impact in utility networks. Furthermore, technological advancements leading to the development of automated and semi-automatic butt fusion machines are contributing significantly to higher productivity on job sites, reducing reliance on manual skill, and ensuring consistent joint quality, which subsequently drives the average selling price and overall market revenue.

Butt Fusion Machines Market introduction

The Butt Fusion Machines Market encompasses the design, manufacturing, and distribution of specialized equipment used to thermally join the ends of thermoplastic pipes, predominantly those made from polyethylene (PE), polypropylene (PP), and polyvinylidene fluoride (PVDF). These machines operate by precisely aligning pipe ends, heating them using a controlled heating plate until a molten state is achieved, and then fusing them under high pressure, creating a permanent, homogenous, and leak-proof joint that is often stronger than the pipe itself. The equipment ranges from small manual units used for minor repairs to large hydraulic and fully automatic machines capable of fusing pipes with diameters exceeding 1,600 mm, catering to diverse infrastructural needs globally.

Major applications for butt fusion technology are concentrated in critical infrastructure sectors. This includes the extensive installation of municipal water supply and sewerage pipelines, long-distance natural gas distribution networks, mining slurry lines, and industrial chemical process piping. The primary benefits driving the adoption of butt fusion include the resultant joint's exceptional tensile strength, chemical inertness, resistance to corrosion, and longevity, significantly reducing maintenance costs over the system's lifespan. These characteristics make PE piping and butt fusion essential for sustainable resource management and critical utility operations worldwide.

The market is predominantly driven by global urbanization trends and the resultant demand for new and rehabilitated water and gas utilities. Government regulations emphasizing leak reduction and pipeline integrity, particularly in the energy sector, further accelerate the replacement of aging metal infrastructure with modern plastic pipelines. Technological factors such as enhanced data logging capabilities, GPS integration, and automated pressure control systems within the latest butt fusion machines are crucial driving factors, ensuring quality assurance and compliance with stringent industry standards, thus solidifying the market's growth trajectory.

Butt Fusion Machines Market Executive Summary

The Butt Fusion Machines Market is experiencing sustained growth, characterized by significant shifts towards automation and digital integration driven by the imperative for enhanced joint quality and operational efficiency. Current business trends indicate a strong focus on developing medium to large diameter hydraulic machines, crucial for high-pressure applications in oil, gas, and major water transmission lines. Key players are strategically investing in telematics and data recording technologies embedded within the machinery, allowing operators and engineers to remotely monitor fusion parameters, ensuring traceability and adherence to international ISO standards. This emphasis on smart, traceable fusion processes represents a critical competitive advantage and a central theme in market evolution.

Regionally, the market dynamics are heavily influenced by infrastructure spending patterns. Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive government investments in smart city development, water treatment facilities, and pipeline expansion in countries like China and India. North America and Europe, while mature markets, exhibit steady demand driven by pipeline replacement cycles and stringent environmental regulations favoring leak-proof PE systems. Conversely, regions like the Middle East and Africa (MEA) are seeing rapid adoption driven by new oil and gas projects and urbanization, necessitating robust, large-diameter fusion equipment for utility conveyance in often challenging environments.

Segment trends reveal that the hydraulic segment dominates revenue share due to its capability to handle the high pressures and large diameters required for municipal and industrial projects. However, the fully automatic segment is projected to grow at the fastest pace, capturing increasing interest from contractors seeking minimized human error and maximum repeatability. By application, the water and wastewater utilities sector remains the largest consumer, but the natural gas distribution sector is exhibiting accelerated demand, spurred by global efforts to modernize gas pipeline infrastructure and reduce fugitive emissions, necessitating high-precision fusion machinery.

AI Impact Analysis on Butt Fusion Machines Market

Common user questions regarding AI's influence on the Butt Fusion Machines Market often revolve around predictive maintenance, real-time quality control, and the potential for autonomous operation. Users frequently inquire: "Can AI predict machine failures before they occur?" "How can AI verify joint integrity beyond standard pressure tests?" and "Will AI integration reduce the skill requirements for operators?" The core theme emerging from these inquiries is a strong expectation that AI will transition butt fusion from a process reliant on fixed parameters and operator skill to a self-optimizing, diagnostic, and preventative operation. Concerns center on data security, the cost of implementing AI-enabled machinery upgrades, and potential regulatory hurdles for validating AI-verified joint quality, suggesting a high user interest in tangible benefits delivered through enhanced reliability and documented quality assurance.

- AI-Powered Predictive Maintenance: Algorithms analyze historical fusion cycle data (temperature, pressure, time) and operational metrics (motor loads, sensor readings) to forecast potential mechanical failures, enabling proactive servicing and minimizing costly downtime on critical infrastructure projects.

- Real-Time Joint Quality Monitoring: Machine learning models utilize visual data (thermal imaging, specialized cameras) and sensor input during the fusion process to instantly detect subtle anomalies, such as melt irregularities or contamination, providing immediate feedback and ensuring adherence to stringent quality metrics.

- Automated Parameter Optimization: AI systems can dynamically adjust fusion parameters based on environmental conditions (ambient temperature, pipe material batch variations) to ensure optimal joint formation, surpassing the limitations of fixed pre-set programs.

- Enhanced Data Logging and Traceability: AI facilitates sophisticated data aggregation and analysis, creating comprehensive, immutable digital records for every fused joint, significantly improving regulatory compliance and reducing liability risks associated with pipeline failures.

- Operator Skill Augmentation: AI provides smart guidance and alerts to novice operators, ensuring correct procedures are followed, standardizing output quality across different skill levels, and thereby addressing industry concerns about labor shortages and inconsistent craftsmanship.

DRO & Impact Forces Of Butt Fusion Machines Market

The Butt Fusion Machines Market is subject to a complex interplay of Drivers, Restraints, and Opportunities, collectively shaping its trajectory and competitive landscape. Key drivers include aggressive global infrastructure spending, particularly in emerging economies focused on modernizing water, sanitation, and gas distribution networks. The inherent advantages of polyethylene piping—specifically its flexibility, longevity, and superior resistance to environmental stress cracking and seismic activity—fundamentally drive the demand for reliable butt fusion technology. Furthermore, increasing regulatory emphasis on reducing non-revenue water (NRW) losses and minimizing methane leakage in gas pipelines mandates the use of leak-proof fusion joints, providing a consistent upward pressure on market growth.

However, the market faces notable restraints. The initial high capital investment required for purchasing and maintaining large-diameter hydraulic and automatic fusion machinery can be prohibitive for smaller contractors, especially in developing regions. Additionally, the need for specialized training and certified operators poses a continuous challenge; improper fusion techniques remain a leading cause of joint failure, sometimes undermining confidence in plastic pipe systems. Economic volatility and fluctuation in commodity prices, particularly for raw steel components used in machine fabrication, also introduce cost unpredictability, restraining procurement budgets for end-users.

Opportunities for expansion are abundant, centered around the rapid commercialization of automated and smart fusion technologies integrating GPS, data logging, and cloud connectivity. The growing adoption of trenchless technology and horizontal directional drilling (HDD) necessitates robust, flexible pipe systems that are ideally suited for butt fusion, opening up new specialized application segments. Moreover, the increasing focus on sustainable construction practices and the use of recycled or bio-based thermoplastic materials will require adaptive fusion technologies, creating significant market opportunities for manufacturers who can innovate equipment capable of handling these new material compositions with guaranteed joint integrity.

Segmentation Analysis

The Butt Fusion Machines Market segmentation provides a granular view of equipment utilization and demand patterns across various industries, pipe sizes, and operational mechanisms. Analyzing these segments is essential for manufacturers to tailor product development, pricing strategies, and regional distribution efforts. Key segmentation areas include machine type (reflecting the level of automation and power source), pipe diameter (differentiating between small, medium, and large-scale infrastructure projects), and application sector (identifying primary consumption drivers like water utilities versus mining operations).

The segmentation by machine type highlights the ongoing industry transition towards higher efficiency; while manual machines offer affordability for small-scale applications, hydraulic and fully automatic machines command the majority market share, driven by their superior control, repeatability, and capacity for fusing large-diameter, high-pressure pipes critical for major pipelines. Segmentation by end-user illustrates the strong influence of the municipal sector (water and gas), which requires durable, reliable machinery for expansive networks, contrasting with the often more specialized, heavy-duty requirements of the mining and industrial sectors.

Furthermore, geographic segmentation is crucial, recognizing that demand for specific machine types varies regionally; for example, North America emphasizes high-throughput, data-logging enabled machines for regulatory compliance, while rapidly industrializing Asian countries prioritize a balance between cost-effectiveness and capacity for large infrastructure projects. Understanding these segment dynamics is vital for effective market penetration and sustaining long-term competitive advantage in the specialized butt fusion equipment sector.

- By Machine Type:

- Manual Butt Fusion Machines

- Hydraulic Butt Fusion Machines

- Semi-Automatic Butt Fusion Machines

- Fully Automatic Butt Fusion Machines

- By Pipe Diameter Capability:

- Small Diameter (up to 160 mm)

- Medium Diameter (160 mm to 630 mm)

- Large Diameter (Above 630 mm)

- By End-User Industry:

- Water and Wastewater Utilities

- Oil and Gas Distribution (Natural Gas, LNG)

- Mining and Slurry Transport

- Industrial Piping (Chemical, HVAC)

- Construction and Landfill

- By Application:

- New Pipeline Installation

- Pipeline Repair and Maintenance

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Butt Fusion Machines Market

The value chain for the Butt Fusion Machines Market begins with upstream activities focused on raw material sourcing and precision component manufacturing. Key inputs include high-grade steel and aluminum alloys for the machine frame, hydraulic components (pumps, valves, cylinders), heating elements, and sophisticated electronic control units (ECUs). Manufacturers rely heavily on specialized suppliers for robust hydraulic systems and sensors that ensure precise pressure and temperature control. Ensuring the quality and durability of these upstream components is critical, as they directly influence the reliability and lifespan of the butt fusion equipment, which operates under harsh construction site conditions.

The core manufacturing and assembly stage involves integrating the hydraulic power pack, clamping systems, facers, and heating plates, followed by rigorous quality assurance testing, calibration, and software programming (especially for automated models). Distribution channels are multifaceted, utilizing both direct and indirect routes. Direct sales are common for large, specialized hydraulic machines, often involving direct negotiations with major pipeline contractors, governmental agencies, and utility companies who require customization and comprehensive after-sales support and training. This allows manufacturers to maintain higher margins and direct control over customer relationships.

Indirect distribution relies on a global network of authorized distributors, specialized equipment rental companies, and regional dealers. These partners manage inventory, offer local service and repair facilities, and provide essential training programs to end-users, extending the manufacturer's reach into smaller or geographically dispersed markets. Downstream analysis focuses on the end-user application—pipeline construction, repair, and maintenance—where the machine's efficiency, reliability, and data-logging capabilities translate directly into project profitability and regulatory compliance. The demand is ultimately driven by the scale and frequency of global pipeline infrastructure projects.

Butt Fusion Machines Market Potential Customers

The primary customers and end-users of butt fusion machines are organizations engaged in the installation, operation, and maintenance of large-scale thermoplastic piping systems across various utility and industrial sectors. Municipal water and wastewater departments represent a foundational customer base, continuously investing in machinery for extending or rehabilitating urban water mains and sewage networks to combat leakage and ensure public health safety. These entities often require reliable, large-diameter hydraulic machines capable of high operational consistency.

Another crucial customer segment is the oil and gas industry, specifically utility companies responsible for natural gas distribution and transmission. Given the regulatory scrutiny over methane emissions, these companies seek highly accurate, data-logging butt fusion equipment to ensure impeccable joint integrity for PE gas pipelines. Furthermore, specialized heavy industries, including mining, where PE pipes are used for slurry transport and leach solutions, and chemical processing plants demanding high corrosion resistance, are significant, albeit niche, buyers of durable fusion equipment.

Finally, general civil engineering contractors and specialized pipeline construction firms constitute a high-volume purchasing segment. These firms acquire or rent a diversified fleet of butt fusion machines, ranging from small manual units for service connections to automated machines for mainline installation, to execute large government and private infrastructure projects. Rental houses also play a critical role, serving smaller contractors who require flexible access to high-cost machinery without the burden of full ownership.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McElroy Manufacturing, Inc., Ritmo S.p.A., Widos GmbH, Fusion Group Ltd., Miller Weldmaster, Hürner Schweisstechnik GmbH, Plasson Ltd., Rothenberger GmbH, Uponor Corporation, GF Piping Systems, Hangzhou Jielong Pipe Industry Co., Ltd., Nowatech, Worldpoly, TEGA Engineering, Chevron Pipe Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Butt Fusion Machines Market Key Technology Landscape

The technological landscape of the Butt Fusion Machines Market is rapidly evolving, driven by the need for enhanced process control, repeatability, and data management. The primary technological innovation centers around the integration of microprocessor control systems within hydraulic machines. These systems, often branded as automated or data-logging technology, move beyond simple pressure and time regulation. They incorporate sophisticated algorithms that guide the operator through the fusion process, monitor ambient temperature and material temperature, and automatically record all critical fusion parameters (time, temperature, pressure, bead size) into a secure, tamper-proof memory or cloud database.

Furthermore, significant advancements have been made in heating plate technology, including the adoption of non-stick, durable materials and precise thermal distribution mechanisms to ensure uniform melting across the pipe ends, irrespective of diameter size. The development of remote monitoring capabilities, often utilizing cellular or satellite connectivity, allows project managers to track the status, location (via GPS), and compliance of every fusion joint in real-time. This digital integration is crucial for contractors working on large-scale, geographically dispersed infrastructure projects, providing an unprecedented level of quality control and operational transparency.

A key differentiator in modern machinery is the continuous improvement of the clamping and alignment systems. High-precision hydraulic alignment systems are now standard on large machines, minimizing pipe misalignment—a major cause of joint failure. Emerging technologies include induction heating for faster, cleaner pipe end melting, although traditional resistance heating remains prevalent. The overall trend is towards machine intelligence (AI integration as noted previously) and highly intuitive user interfaces that require minimal training, effectively democratizing the highly precise process of high-pressure butt fusion and guaranteeing superior, verifiable joint quality.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC is the fastest-growing and largest regional market, driven by monumental infrastructure investments, especially in water security and natural gas grid expansion across China, India, and Southeast Asia. Rapid urbanization necessitates vast new piping systems, creating immense demand for medium and large-diameter hydraulic butt fusion machines. Government initiatives, such as China’s Sponge City program and India’s focus on clean drinking water provision, heavily rely on durable, high-density polyethylene (HDPE) pipes, thus underpinning market growth.

- North America (NA) Focus on Compliance and Replacement: The North American market is mature but highly sophisticated, characterized by stringent regulatory requirements, particularly concerning gas pipeline integrity and environmental protection. Demand is primarily driven by the replacement of aging metallic infrastructure and the requirement for data-logging fusion equipment (often mandate) to ensure regulatory compliance and complete traceability of joints. The market favors high-automation, high-precision hydraulic machines.

- Europe Market Stability and Sustainability: Europe exhibits stable growth, highly influenced by sustainability goals and strict environmental directives regarding leakage prevention. Western European countries emphasize advanced, energy-efficient fusion technologies and often prioritize renting over purchasing. Eastern European markets show increasing adoption driven by EU-funded infrastructure modernization projects focused on upgrading water and gas distribution networks.

- Middle East and Africa (MEA) Project Acceleration: The MEA region is experiencing accelerated demand, primarily linked to massive oil and gas transportation projects, desalination plants, and rapid urban development in Gulf Cooperation Council (GCC) countries. The market requires robust, durable machinery capable of operating in extreme temperatures and often demands the largest diameter machines for high-volume water and fuel lines.

- Latin America (LATAM) Infrastructure Catch-Up: LATAM represents a promising growth region, driven by inadequate existing infrastructure, particularly in water and sanitation. Investment is growing across countries like Brazil and Mexico, leading to increased procurement of cost-effective, medium-sized hydraulic butt fusion machines for essential utility installations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Butt Fusion Machines Market.- McElroy Manufacturing, Inc.

- Ritmo S.p.A.

- Widos GmbH

- Fusion Group Ltd.

- Hürner Schweisstechnik GmbH

- Plasson Ltd.

- Rothenberger GmbH

- Uponor Corporation

- GF Piping Systems

- Hangzhou Jielong Pipe Industry Co., Ltd.

- Nowatech

- Worldpoly

- TEGA Engineering

- Wuxi Suda New Material Technology Co., Ltd.

- Weldon Global Inc.

- TRIC Tools, Inc.

- Chevron Pipe Systems

- Pipeson AB

- Caldertech International Ltd.

- Garratt-Callahan

Frequently Asked Questions

Analyze common user questions about the Butt Fusion Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for large-diameter butt fusion machines?

The increasing global investment in major municipal and industrial infrastructure projects, particularly high-volume water transmission lines and long-distance natural gas pipelines, is the primary driver demanding large-diameter hydraulic butt fusion equipment.

How do automated butt fusion machines improve pipeline joint quality?

Automated machines minimize human intervention by controlling temperature, pressure, and time precisely, ensuring parameters adhere strictly to predefined standards, and automatically logging data for quality verification and reducing the likelihood of operator error.

Which end-user segment utilizes the largest volume of butt fusion machines globally?

The Water and Wastewater Utilities sector is the largest end-user segment, consistently driving high demand for butt fusion machines for installing and maintaining extensive networks of polyethylene (PE) water mains and sewage pipes.

What are the typical lifespan and maintenance requirements for hydraulic butt fusion equipment?

A well-maintained hydraulic butt fusion machine can have an operational lifespan exceeding 15 years. Key maintenance involves regular calibration of pressure and temperature sensors, inspection of hydraulic hoses and fluid levels, and replacement of consumables like heating plate coatings and facer blades.

What is the significance of data logging in modern butt fusion technology?

Data logging is crucial for quality assurance and regulatory compliance. It provides an irrefutable digital record of every joint’s fusion parameters, ensuring traceability, verifying that the joint meets ISO standards, and minimizing contractor liability in the event of pipeline failure.

Are butt fusion machines compatible with all thermoplastic pipe materials?

While highly effective for high-density polyethylene (HDPE), medium-density polyethylene (MDPE), and polypropylene (PP), butt fusion machines require specific adjustments and parameter settings (often optimized by the machine’s control unit) to handle different thermoplastic types and wall thicknesses, such as PVDF.

How does the integration of GPS functionality benefit pipeline contractors using fusion equipment?

GPS integration ensures the precise geographic location of every completed fusion joint is automatically recorded in the data log. This feature streamlines quality control audits, facilitates accurate mapping of installed pipelines, and aids in faster pinpointing during future maintenance or repair operations.

What restraint is most challenging for the butt fusion machine market in emerging economies?

The high initial capital investment required for purchasing modern, large-diameter hydraulic and fully automatic butt fusion equipment remains the most significant financial restraint for smaller contractors and utilities in emerging economies.

How are environmental regulations influencing the demand for butt fusion technology?

Strict environmental regulations, particularly those aimed at reducing non-revenue water (leakage in water systems) and methane emissions (fugitive gas leaks), necessitate highly reliable, leak-proof joints achievable only through advanced butt fusion techniques, thereby increasing market demand.

What is the role of rental companies in the butt fusion machine value chain?

Rental companies serve as a critical indirect distribution channel, providing contractors, especially those undertaking short-term or specialized projects, flexible access to high-cost machinery without the need for large capital expenditure, thus expanding market accessibility.

What technological advancements are enhancing portability and field use of fusion machines?

Key advancements include the use of lightweight, high-strength aluminum alloys, battery-powered hydraulic packs for remote sites without grid access, and compact, modular designs that simplify transport and setup in challenging terrain or congested urban environments.

In which region is the demand for pipeline replacement cycles the primary market driver?

North America and Europe, as mature markets, primarily rely on extensive pipeline replacement cycles, upgrading decades-old metallic or less reliable piping with modern, butt-fused PE systems to meet current safety and efficiency standards.

What differentiates Semi-Automatic from Fully Automatic butt fusion machines?

Semi-automatic machines require the operator to manually control the pressure application stages (heating, cooling, soaking) following system prompts, whereas fully automatic machines manage the entire process cycle, including pressure and temperature adjustments, without continuous operator input.

How does the mining sector's demand for butt fusion equipment differ from the water sector?

The mining sector often demands machines capable of fusing pipes for abrasive slurry transport and high-pressure chemical lines, requiring extremely durable equipment and precise joints to withstand severe operating conditions, often involving high resistance to chemical corrosion.

What competitive strategy is prominent among leading butt fusion machine manufacturers?

Leading manufacturers prioritize technological differentiation through advanced data logging, cloud connectivity, and the development of proprietary automation systems to ensure verifiable joint quality, offering training and comprehensive after-sales support as a key competitive advantage.

What are the critical upstream components in the butt fusion machine value chain?

Critical upstream components include specialized hydraulic systems (pumps and cylinders), precision-machined steel and aluminum frames, advanced temperature control sensors, and microprocessors used in the electronic control units (ECUs) for automation.

How is AI expected to influence predictive maintenance in this market?

AI is anticipated to analyze historical operational data to predict potential component wear or hydraulic system failures before they occur, optimizing maintenance scheduling, reducing unplanned downtime, and extending the effective service life of the machinery.

Which application segment shows the fastest anticipated growth rate?

The Natural Gas Distribution segment is expected to show one of the fastest growth rates, driven by global mandates to modernize gas grids, reduce fugitive methane emissions, and expand gas access using high-integrity, butt-fused PE piping systems.

What risks are associated with improper butt fusion techniques?

Improper techniques, such as incorrect temperature, insufficient cleaning, or misalignment, lead to joint failure, resulting in costly leaks, pipeline system compromises, potential environmental hazards, and project delays.

Why is the Butt Fusion process preferred over mechanical couplings for critical pipelines?

Butt fusion creates a homogenous, permanent, and leak-proof joint that possesses the same physical properties as the pipe material itself, offering superior strength, chemical resistance, and long-term durability compared to mechanical couplings, which are potential points of failure.

What role does the 'facer' play in the butt fusion process?

The facer is a specialized tool integrated into the machine that shaves the ends of the pipes parallel and clean, ensuring that the entire surface area of both pipe ends makes perfect contact with the heating plate and subsequently fuses uniformly under pressure.

Which factors contribute to the high cost of large diameter fusion machines?

High costs stem from the substantial hydraulic power requirements, the need for robust, precision-machined components to handle enormous clamping forces, and the integration of sophisticated electronic controls and data acquisition systems required for quality assurance on critical pipeline projects.

How is the move towards renewable energy systems impacting the market?

The shift to renewables indirectly drives demand by increasing the installation of specialized piping systems for geothermal loops and biomass transport, both of which often utilize PE piping requiring precise butt fusion.

What is the competitive landscape characterized by in the Butt Fusion Machines Market?

The competitive landscape is dominated by a few global players known for innovation and quality (e.g., McElroy, Ritmo, Widos), alongside numerous regional manufacturers, particularly in APAC, competing primarily on price and localized service support.

Why is the Middle East and Africa (MEA) demanding large diameter machinery specifically?

MEA demands large diameter machines due to extensive infrastructure projects, particularly in oil and gas pipelines, high-capacity water desalination transfer systems, and major civil works in rapidly expanding urban centers that require high flow rates.

What is the significance of the cooling time in the butt fusion cycle?

The cooling time is critical; it is the period during which the fused joint is held under pressure, allowing the molten material to solidify and crystallize. Incorrect cooling time can severely compromise the structural integrity and long-term strength of the joint.

Which segment is expected to show the fastest technological adoption?

The Large Diameter hydraulic segment (above 630 mm) is expected to show the fastest technological adoption, as the high stakes associated with large critical pipelines necessitate the maximum use of automation, data logging, and predictive diagnostics.

How do global steel price fluctuations affect the market?

Since butt fusion machines are constructed predominantly from steel and aluminum alloys, global steel price fluctuations directly impact the upstream manufacturing costs, potentially leading to increased procurement prices for end-users and volatility in machine pricing.

What challenges do manufacturers face regarding the standardization of fusion procedures?

Manufacturers face the challenge of designing equipment that can accommodate varied international and regional standards (such as ISO, DVS, ASTM) while ensuring that the automated controls consistently guide operators toward compliant fusion results across diverse environmental conditions.

What are the key benefits of using PE pipes that necessitate butt fusion?

PE pipes offer superior corrosion resistance, flexibility (allowing for HDD installation), light weight, and a long service life, all of which are maximized when joined using leak-proof, high-strength butt fusion technology.

How does the market address the issue of operator training and certification?

Manufacturers and distributors provide extensive, mandatory training programs covering machine operation, procedure verification, and data logging protocols. Certification ensures operators understand proper fusion mechanics, minimizing the risk of costly joint failures.

What is the average CAGR expected for the automatic machine segment?

The fully automatic machine segment is anticipated to exhibit a CAGR potentially above the market average, driven by demand for process repeatability, reduced labor requirements, and guaranteed quality assurance in critical applications.

Why is robustness a crucial design feature for butt fusion equipment?

Butt fusion machines often operate in harsh, challenging environments such as remote construction sites, trenches, or extreme weather conditions; hence, robust construction is essential to ensure operational reliability and longevity under continuous heavy use.

Which material property is the fusion machine optimizing during the heating phase?

The machine optimizes the heating phase to achieve a precise molten state (melt flow index) on the pipe ends, ensuring the polymer chains are ready to intermingle and form a permanent, homogenous bond under controlled pressure.

What impact does urbanization have on the market in Asia Pacific?

Rapid urbanization in APAC fuels demand for new municipal infrastructure, leading to large-scale procurement of butt fusion machines necessary for installing vast, reliable water and gas utility networks to support growing city populations.

How do manufacturers ensure the accuracy of the pressure application?

Manufacturers use high-precision electronic transducers and closed-loop hydraulic systems linked to microprocessors, ensuring the fusion pressure is maintained precisely at the calculated force required for the specific pipe diameter and wall thickness throughout the critical cooling phases.

What is the forecasted market size in USD for the Butt Fusion Machines Market by 2033?

The Butt Fusion Machines Market is forecasted to reach approximately USD 1,350 Million by the end of the forecast period in 2033, reflecting sustained global infrastructure investment.

What competitive edge do machines with integrated telematics offer?

Telematics (GPS tracking and cellular data transmission) offers a competitive edge by allowing manufacturers to provide proactive maintenance, fleet management services, and real-time compliance reporting to large utility clients, enhancing overall operational efficiency.

In the Value Chain, why is direct distribution preferred for large machines?

Direct distribution is preferred for large, high-value hydraulic machines because it allows manufacturers to provide customized technical specifications, specialized on-site training, and direct long-term maintenance contracts, bypassing intermediary complexities.

What emerging technology might replace traditional resistance heating plates in the future?

Induction heating technology is an emerging alternative that might replace traditional resistance heating plates, offering faster heating cycles and potentially cleaner surfaces, though it requires specialized coils and power controls.

How does pipeline diameter segmentation influence machine complexity?

As the pipe diameter increases (e.g., above 630 mm), the complexity of the machine increases exponentially, requiring significantly higher clamping forces, more sophisticated hydraulic controls, and more powerful facing equipment to maintain alignment and fusion quality.

What is the most significant opportunity related to sustainability in this market?

The greatest sustainability opportunity lies in developing adaptive fusion technology capable of efficiently and reliably fusing pipes made from recycled thermoplastic materials or new bio-based polymers, supporting circular economy goals.

How do butt fusion machines address the challenge of non-revenue water (NRW) in municipal systems?

By creating superior, leak-proof, and corrosion-resistant joints, butt fusion significantly reduces the potential for water leakage in distribution networks, directly combating high rates of non-revenue water loss experienced by municipal utilities.

What impact does the horizontal directional drilling (HDD) technique have on butt fusion machine demand?

HDD requires long, continuous lengths of flexible pipe (typically PE), which must be joined reliably prior to installation. This technique significantly increases the demand for high-throughput, large-diameter butt fusion machines capable of preparing long pipeline segments.

Which continent is characterized by stable demand driven mainly by replacement cycles?

Europe is primarily characterized by stable demand driven by the replacement and modernization of existing utility infrastructure, adhering to stringent regional standards for environmental safety and system efficiency.

What distinguishes the manual segment from the hydraulic segment in terms of application?

Manual butt fusion machines are typically used for fusing smaller diameter pipes and service connections where clamping forces are manageable, while hydraulic machines are essential for large-diameter, high-pressure mains requiring substantial, precisely controlled force.

How do machine controls ensure the pipe ends are properly faced before heating?

Modern machine controls often integrate sensors that confirm the correct force and duration of the facing process, verifying that the pipe ends are flat and parallel before allowing the heating sequence to commence, ensuring optimal joint quality.

What is the primary concern for users regarding the implementation of AI in fusion?

A primary concern is the validation and regulatory acceptance of AI-verified joint integrity. Users need assurance that AI predictions and quality assessments meet established international pipeline construction standards and codes.

How does the market mitigate the impact of operator skill variability?

The market mitigates skill variability through increased automation, where the machine manages critical parameters, and through integrated guidance systems and robust, data-logging features that standardize the fusion process regardless of the operator's experience level.

What is the estimated Compound Annual Growth Rate (CAGR) for the market?

The Butt Fusion Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033.

Which factor makes PE pipes and butt fusion essential for natural gas distribution?

The exceptional long-term integrity and leak-proof nature of butt-fused PE joints are essential for natural gas distribution, as they effectively mitigate fugitive methane emissions, addressing critical regulatory and environmental concerns.

What is the key advantage of a homogeneous butt-fused joint?

The key advantage is that the resulting joint is integral to the pipeline, often possessing higher tensile strength and the same chemical and corrosion resistance properties as the parent pipe material, eliminating weak points inherent in mechanical joints.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Butt Fusion Machines Market Statistics 2025 Analysis By Application (Oil & Gas, Water Supply, Chemical Industry, Others), By Type (Automatic, Semi-Automatic, Manual), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Butt Fusion Machines Market Statistics 2025 Analysis By Application (Oil & Gas, Water Supply, Chemical Industry), By Type (Automatic, Semi-Automatic, Manual), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Industrial Butt Fusion Machines Market Statistics 2025 Analysis By Application (Oil & Gas, Water Supply, Chemical Industry), By Type (Automatic, Semi-Automatic, Manual), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager