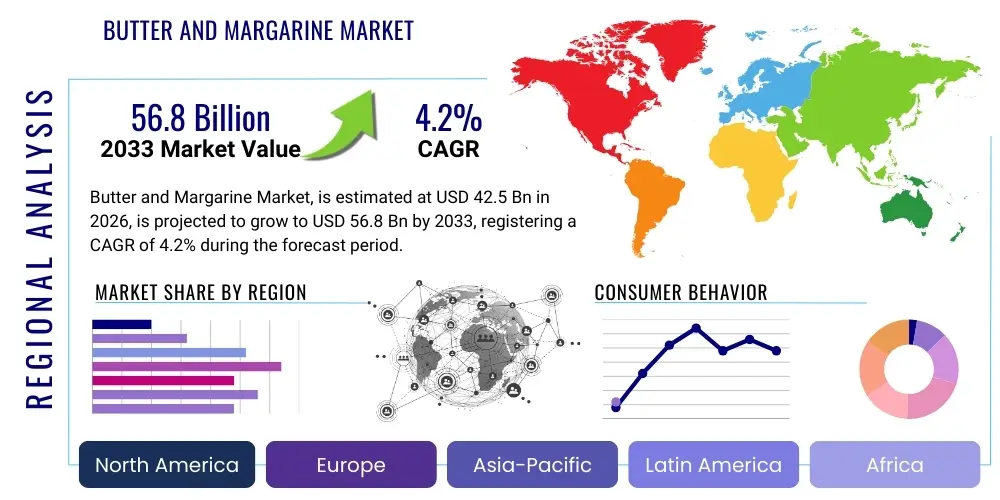

Butter and Margarine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439190 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Butter and Margarine Market Size

The Butter and Margarine Market is experiencing steady growth, driven by evolving consumer dietary preferences, the rise of plant-based alternatives, and increasing demand from the bakery and confectionery industries globally. Traditional butter maintains its premium status, fueled by clean-label and natural ingredient trends, while margarine benefits from versatility, cost-effectiveness, and advancements in healthy formulations (e.g., reduced saturated fats, added sterols). The balance between traditional dairy consumption and the surge in vegan and flexitarian diets dictates the dynamic landscape of this essential food staples sector.

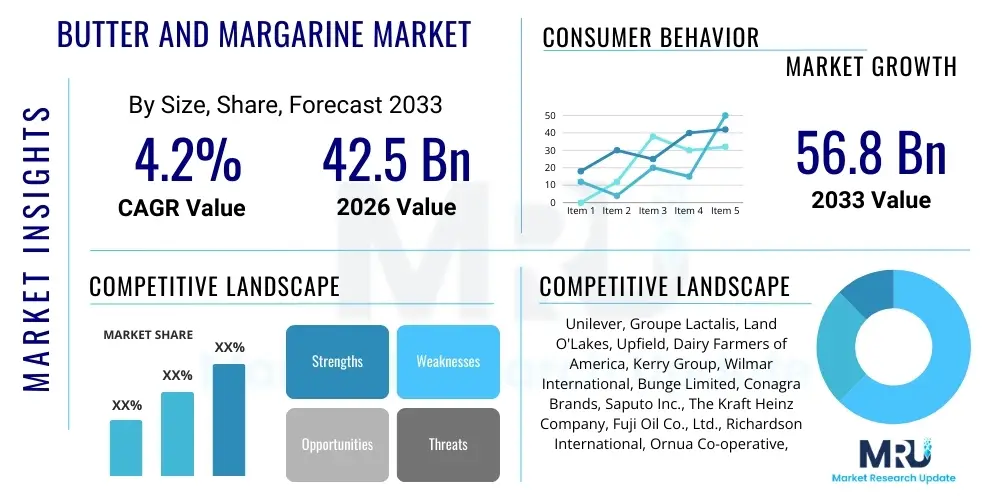

The global market for butter and margarine is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.2% between 2026 and 2033. The market is estimated at USD 42.5 Billion in 2026 and is projected to reach USD 56.8 Billion by the end of the forecast period in 2033. This consistent growth trajectory is supported by rapid urbanization in emerging economies, leading to higher consumption of processed foods, and significant innovation in product offerings, including specialized cooking fats, spreads with specific nutritional benefits, and functional ingredients designed for industrial food production.

Butter and Margarine Market introduction

The Butter and Margarine Market encompasses a wide range of fat-based products essential for household consumption, professional cooking, and large-scale industrial food manufacturing. Butter, derived exclusively from dairy cream, is valued for its rich flavor and natural composition, predominantly utilized in high-end culinary applications, baking, and direct consumption. Margarine, an emulsion primarily consisting of vegetable oils and water, serves as a versatile, cholesterol-free, and often cost-effective substitute, finding extensive application in the baking, confectionery, and processed food sectors due to its superior functional properties like spreadability and emulsification capabilities.

Major applications of these products span breakfast spreads, baking ingredients, frying mediums, and as key components in sauces and flavor bases. The driving factors for market expansion include sustained population growth, increased disposable income in Asian and Latin American regions, and a consumer shift towards convenient, ready-to-use food ingredients. Furthermore, manufacturers are continually innovating to meet health trends, offering reduced-fat, high-omega, and fortified products, ensuring that both butter and margarine categories remain relevant in modern dietary paradigms, providing texture, flavor, and essential fatty acids.

The primary benefits associated with market growth include enhanced food palatability and texture contribution, along with the provision of fat-soluble vitamins (A, D, E, K). The dairy butter segment is capitalizing on the trend toward natural, minimally processed foods, positioning itself as a premium product. Conversely, the margarine segment is driven by accessibility and nutritional modification capabilities, allowing manufacturers to cater to specific dietary requirements such as non-dairy, low-saturated fat, or cholesterol-reducing formulas, thereby ensuring broad market penetration across diverse socio-economic groups globally.

Butter and Margarine Market Executive Summary

The global Butter and Margarine market is characterized by intense competition and dynamic shifts in product composition driven by consumer health consciousness and sustainability goals. Key business trends include the aggressive expansion of plant-based spreads, which are rapidly eroding the traditional market share of dairy butter, particularly in Western markets. Leading manufacturers are focusing heavily on mergers and acquisitions to integrate novel ingredient technologies, such as microalgae oils and advanced fermentation techniques, to improve the texture and nutritional profile of non-dairy options while maintaining desirable mouthfeel. Supply chain resilience, particularly concerning volatile dairy commodity prices and fluctuating vegetable oil markets, remains a critical operational focus for maximizing profitability and ensuring stable product pricing.

Regionally, the market presents a dichotomy. North America and Europe lead in innovation and premiumization, witnessing high uptake of specialty and functional spreads marketed with health claims (e.g., heart-healthy, high fiber). Conversely, the Asia Pacific (APAC) region is the fastest-growing market, primarily fueled by rising per capita consumption due to rapid urbanization, increasing middle-class populations, and the adoption of Western dietary patterns in countries like China and India. Economic factors, such as rising disposable income, directly translate into higher demand for both affordable margarine and premium imported butter products, establishing APAC as the primary growth engine for the forecast period.

Segmentation trends highlight the dominance of the blends and margarine segment by volume, favored by industrial users for consistency and cost efficiency. However, the unsalted butter segment is projected to exhibit the fastest revenue CAGR, driven by professional culinary demand and increased at-home baking activities globally. In terms of distribution, e-commerce channels are gaining substantial traction, especially for premium and niche products, offering consumers greater access to specialized, imported, or organic options that might not be available in standard retail outlets. The increasing regulatory scrutiny on trans-fat content continues to shape product innovation, pushing all manufacturers towards healthier, non-hydrogenated formulations.

AI Impact Analysis on Butter and Margarine Market

Users commonly inquire about how Artificial Intelligence (AI) can optimize the complex supply chain and formulation processes within the butter and margarine industry. Key questions revolve around predictive modeling for volatile commodity prices (dairy, vegetable oils), optimizing blending ratios for functional spreads, and leveraging AI to enhance quality control during emulsification and crystallization stages. Consumers are also interested in AI's role in personalizing nutritional spreads based on individual health data or localized dietary trends. The overarching concern is whether AI can simultaneously lower production costs, improve ingredient traceability, and accelerate the development of healthier, more sustainable product lines.

AI adoption is poised to revolutionize the operational efficiency and new product development lifecycle within the butter and margarine industry. Specifically, machine learning algorithms are being applied to analyze vast datasets pertaining to sensory characteristics, ingredient interactions, and consumer feedback, enabling faster and more accurate iteration of product recipes. This predictive modeling minimizes waste and reduces the time required for sensory panel testing, accelerating time-to-market for novel spreads. Furthermore, AI-driven demand forecasting is critical for managing perishable inventory (dairy) and optimizing warehousing, particularly for temperature-sensitive products, enhancing overall supply chain responsiveness to sudden market shifts.

Beyond internal operations, AI is crucial for sustainability efforts. It assists in optimizing resource utilization, such as energy consumption in churning and chilling processes, and improves agricultural inputs by analyzing climate data to optimize feed composition for dairy cows, indirectly affecting butter quality and production costs. For margarine producers, AI helps identify optimal sourcing strategies for sustainable palm or soybean oil alternatives, ensuring compliance with environmental, social, and governance (ESG) standards demanded by modern consumers and regulatory bodies.

- AI-driven Predictive Analytics: Optimizing sourcing of raw materials (dairy fats, vegetable oils) based on real-time commodity pricing and minimizing financial risk.

- Formula Optimization: Using machine learning to determine ideal fat/water ratios, emulsifier concentrations, and crystallization profiles for desired texture and spreadability.

- Quality Control Automation: Implementing computer vision and sensor data analysis to detect deviations in color, consistency, or moisture content during production.

- Personalized Nutrition: Developing algorithms for recommending or formulating customized spreads based on consumer dietary restrictions, health goals, or flavor profiles.

- Sustainable Sourcing Optimization: AI assists in tracing and verifying the sustainability credentials of vegetable oil supply chains, particularly palm and soy derivatives.

DRO & Impact Forces Of Butter and Margarine Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), significantly shaped by the underlying Impact Forces of consumer health trends and regulatory requirements. A major driver is the accelerating demand for plant-based and vegan spreads, particularly among younger, health-conscious demographics, which pushes manufacturers to invest heavily in functional non-dairy alternatives. Coupled with this is the robust and steady demand from the global food service and industrial bakery sector, where margarine and blends are preferred for their cost-efficiency, functional consistency, and extended shelf life, ensuring stable bulk purchasing volumes.

However, significant restraints include the volatile and often high pricing of key raw materials, especially dairy cream and specific vegetable oils, which compress profit margins and necessitate constant adjustment in retail pricing, potentially deterring price-sensitive consumers. Furthermore, negative consumer perceptions regarding the high saturated fat content in traditional butter and the historical association of margarine with unhealthy trans fats pose a substantial image challenge. Regulatory pressure, particularly strict global mandates banning or severely limiting industrial trans fats, requires ongoing, costly reformulation efforts across the entire margarine sector, constraining manufacturing flexibility.

Opportunities for growth are abundant in geographical expansion, targeting rapidly urbanizing markets in Asia Pacific and Latin America where per capita consumption of processed spreads is accelerating. Innovation in functional foods represents another key opportunity, focusing on products fortified with omega-3 fatty acids, phytosterols, and specialized vitamins, catering to specific health-conscious niches. Strategic alliances focusing on sustainable ingredient sourcing and circular economy practices also offer long-term competitive advantages and resonate strongly with modern ethical consumption trends. Impact forces, therefore, include changing governmental standards on nutritional labeling and the pervasive influence of social media on dietary trends, which can quickly popularize or stigmatize product categories.

Segmentation Analysis

The Butter and Margarine market is extensively segmented based on product type, application, form, source, and distribution channel, reflecting the diverse needs of both consumers and industrial end-users. Understanding these segments is crucial as manufacturers prioritize innovation in areas like plant-based fats and specialized butter types. Product type segmentation distinguishes between traditional dairy butter, conventional margarine, blends (combining butter and margarine), and specialized spreads (e.g., coconut oil-based, avocado oil-based). The market for blends and spreads is experiencing rapid growth due to their optimized balance of texture, flavor, and price, bridging the gap between premium butter and commodity margarine.

Segmentation by application reveals that the industrial food processing sector, encompassing bakery, confectionery, and savory snacks, constitutes the largest volume consumer, relying heavily on margarine for its consistent performance metrics in recipes. Conversely, the household or retail segment, segmented by usage (baking, spreading), often drives demand for premium, small-batch, and flavored butter products, favoring quality and perceived health benefits. Source-based segmentation is becoming increasingly relevant, differentiating between animal-based fats (dairy) and various vegetable sources (soy, palm, sunflower, olive, rapeseed), directly addressing consumer preferences related to diet (veganism) and sustainability concerns.

Furthermore, segmentation by form (solid blocks, tubs/spreads, liquids/bottled) directly impacts convenience and usage patterns, with spreads dominating the retail sector due to ease of use. Geographic segmentation emphasizes distinct regional consumption habits; for example, North America and Europe show a higher inclination toward organic and specialized vegetable oil spreads, while emerging markets prioritize cost-effective margarine and basic dairy butter blocks. These nuanced segments enable targeted marketing strategies and product development tailored to specific consumer requirements and regional culinary traditions.

- By Product Type:

- Butter (Salted, Unsalted, Clarified/Ghee)

- Margarine (Hard, Soft, Liquid)

- Spreads and Blends (Fat Spreads, Dairy Spreads)

- By Source:

- Animal (Dairy)

- Plant-Based (Palm, Soybean, Rapeseed, Sunflower, Coconut, Olive)

- By Application:

- Bakery and Confectionery

- Spreads and Toppings

- Sauces and Savory Dishes

- Processed Foods

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Food Service (Horeca)

- Industrial Sales

Value Chain Analysis For Butter and Margarine Market

The value chain for the Butter and Margarine Market begins with the upstream procurement of raw materials, which is bifurcated into dairy farming for butter production and oilseed cultivation/refining for margarine and spreads. Upstream analysis for butter involves managing dairy inputs, including feed quality, herd health, and milk collection logistics, which significantly influence the final product quality and consistency. For margarine, the upstream process involves sourcing diverse vegetable oils (such as palm, soy, and rapeseed), followed by extensive refining, bleaching, and deodorization processes to ensure food safety and preparation for hydrogenation or interesterification, depending on the desired physical properties.

The midstream phase focuses on manufacturing, where complex processes like churning (for butter), emulsification, pasteurization, chilling, and crystallization occur. This stage is capital-intensive and requires rigorous quality control, especially concerning texture, melting point, and stability. Packaging and logistics form a critical intermediate step, requiring specialized temperature-controlled environments to maintain product integrity, particularly for chilled butter and soft spreads. Manufacturing efficiency, yield optimization, and reducing energy consumption are key performance indicators in this midstream value activity.

Downstream analysis centers on distribution and market reach. The distribution channel is multilayered, involving direct sales to large industrial customers (e.g., major bakery chains), indirect sales through wholesalers and distributors to the food service sector (hotels, restaurants, catering), and mass retail distribution via supermarkets, convenience stores, and the burgeoning e-commerce channel. The downstream success is driven by effective brand management, promotional activities, and ensuring robust cold chain infrastructure to deliver products safely to the final consumer or industrial user. Direct-to-consumer online sales, while small in volume, offer higher margins for premium and specialty products.

Butter and Margarine Market Potential Customers

The potential customer base for the Butter and Margarine Market is remarkably broad, spanning professional, industrial, and retail consumer segments globally. Industrial customers represent the largest bulk buyers, primarily comprising large-scale commercial bakeries and confectionery manufacturers that require high volumes of consistent, functional fats for dough lamination, flavor enhancement, and extending shelf life of baked goods. Processed food manufacturers, including makers of frozen meals, snacks, and prepared mixes, also rely on margarine and blends for cost-effective fat inclusion and improved product texture, seeking specific formulations tailored for their processing requirements.

The food service industry—encompassing hotels, restaurants, catering operations (HORECA)—constitutes a second major buyer segment, demanding versatile fats for cooking, frying, and spreading. Chefs often prefer high-quality dairy butter for flavor in savory applications and specialized shortening or high-stability margarine for deep frying and pastry production. These buyers prioritize consistency, bulk packaging options, and reliable supply chains to maintain operational standards and menu consistency, often purchasing through specialized food service distributors.

Finally, the retail consumer forms the most diversified segment, segmented by usage (spreading vs. baking), dietary preference (vegan, keto, conventional), and health goals (low-fat, fortified). These consumers purchase through various channels, ranging from traditional grocery stores to online platforms. Modern trends indicate a growing demand among retail buyers for products with clean labels, ethically sourced ingredients, and specific nutritional enhancements, driving the uptake of organic butter and novel plant-based spreads.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 42.5 Billion |

| Market Forecast in 2033 | USD 56.8 Billion |

| Growth Rate | 4.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Unilever, Groupe Lactalis, Land O'Lakes, Upfield, Dairy Farmers of America, Kerry Group, Wilmar International, Bunge Limited, Conagra Brands, Saputo Inc., The Kraft Heinz Company, Fuji Oil Co., Ltd., Richardson International, Ornua Co-operative, Puratos Group, Vandemoortele N.V., AAK AB, Arla Foods, Fonterra Co-operative Group, Good Food Holdings |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Butter and Margarine Market Key Technology Landscape

The technological landscape of the Butter and Margarine market is centered around improving texture, enhancing nutritional profiles, and ensuring microbial safety, while also driving efficiency in production. Key advancements include the sophisticated application of interesterification and fractionation techniques for vegetable oils, which allows manufacturers to achieve specific melting points and solid fat content (SFC) curves without relying on traditional, trans-fat-producing hydrogenation. This ensures that modern margarine and spreads offer superior physical properties, such as excellent spreadability right out of the refrigerator, meeting consumer expectations for convenience and health standards.

For butter production, technology focuses primarily on optimizing the continuous churning process through advanced temperature control and shear rate manipulation, ensuring precise moisture dispersion and crystalline structure formation, critical for achieving desired flavor release and texture stability. Furthermore, ultrafiltration and pasteurization technologies continue to evolve, enhancing the microbiological safety and extending the shelf life of dairy-based products. Novel encapsulation technologies are also being utilized to incorporate sensitive functional ingredients, such as vitamins, omega-3 fatty acids, or phytosterols, ensuring their stability and bioavailability within the fat matrix without compromising flavor.

Innovation also permeates the analytical and quality assurance domain. Advanced spectroscopic techniques (e.g., Near-Infrared Spectroscopy, NMR) are increasingly integrated into production lines for real-time monitoring of fat content, moisture levels, and solid fat indices. This high-precision, non-destructive testing allows for immediate process adjustments, minimizing batch variations and waste. Furthermore, sustainable technology adoption, such as energy-efficient crystallization units and closed-loop water systems in processing plants, reflects the industry's commitment to reducing its environmental footprint in response to consumer and regulatory pressure.

Regional Highlights

North America: This region is characterized by high consumer awareness regarding health and wellness, driving significant demand for premium butter products, organic spreads, and fortified margarine (e.g., cholesterol-reducing formulas). The U.S. market, in particular, showcases robust innovation in the plant-based sector, with a proliferation of products utilizing alternative sources such as avocado, oat, and almond fats. Regulatory compliance, especially concerning labeling transparency and trans-fat elimination, is strictly enforced, leading manufacturers to continually reformulate products. The region also maintains a strong industrial demand from the large food processing and food service sectors, favoring functional blends and consistent high-quality fats.

Europe: Europe represents a mature market with a high per capita consumption of both butter and margarine, though consumer trends are highly polarized. Western Europe demonstrates a strong preference for high-quality, regionally sourced dairy butter (PDO status) and innovative sustainable spreads, driving demand for clean-label and locally produced goods. Eastern European countries, while seeing increased demand for premium butter, still maintain a high volume consumption of cost-effective margarine and blends. Environmental sustainability and ethical sourcing are paramount in product selection across the continent, prompting companies to implement stringent supply chain audits, especially for palm oil derivatives.

Asia Pacific (APAC): APAC is the fastest-growing market globally, primarily driven by rising populations, increasing disposable incomes, and rapid urbanization that shifts dietary patterns toward convenience and processed foods. China and India are the dominant growth hubs, exhibiting high demand for both affordable margarine for industrial use (bakery sector) and imported, high-quality butter products for the rapidly expanding middle class. Local cultural preferences, such as the consumption of Ghee (clarified butter) in South Asia, also define specific sub-segments. Investment in local manufacturing capacity for vegetable oil refining and processing is accelerating to meet this surging, price-sensitive demand.

- North America: High penetration of plant-based and specialty organic spreads; stringent trans-fat regulations; strong emphasis on functional foods.

- Europe: Mature market with strong regional butter traditions; leading innovation in sustainable and non-GMO vegetable oil spreads; robust demand for clean labels.

- Asia Pacific (APAC): Fastest market growth driven by urbanization and industrial bakery expansion; significant demand for cost-effective margarine and traditional dairy products like Ghee.

- Latin America (LATAM): Growth tied to recovering economies; increasing industrial application; moderate shift towards fortified products and specialized blends.

- Middle East and Africa (MEA): Growing demand fueled by population increase and expanding retail infrastructure; significant reliance on imported dairy butter and locally produced ghee and specialized spreads.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Butter and Margarine Market.- Unilever

- Groupe Lactalis

- Land O'Lakes

- Upfield

- Dairy Farmers of America (DFA)

- Kerry Group

- Wilmar International

- Bunge Limited

- Conagra Brands

- Saputo Inc.

- The Kraft Heinz Company

- Fuji Oil Co., Ltd.

- Richardson International

- Ornua Co-operative

- Puratos Group

- Vandemoortele N.V.

- AAK AB

- Arla Foods

- Fonterra Co-operative Group

- Good Food Holdings (Miyoko's Kitchen)

Frequently Asked Questions

Analyze common user questions about the Butter and Margarine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift towards plant-based margarine and spreads?

The market shift is primarily driven by consumer focus on health and sustainability. Consumers are increasingly seeking non-dairy alternatives due to lactose intolerance, concerns over saturated fat in dairy butter, and ethical/environmental considerations related to dairy farming. Innovations in vegetable oil processing now allow plant-based spreads to match the functional performance and texture of traditional butter, accelerating consumer acceptance.

How significant is the role of trans-fat legislation in shaping product development?

Trans-fat legislation is highly significant and acts as a major market restraint and driver for innovation. Strict global regulations, particularly the FDA ban on partially hydrogenated oils (PHOs), force manufacturers to rely on advanced technologies like interesterification and fractionation to create solid fats without generating harmful industrial trans fats, completely redefining the formulation landscape for modern margarine and spreads.

Which geographical region exhibits the highest growth potential for the Butter and Margarine Market?

The Asia Pacific (APAC) region is projected to show the highest growth potential during the forecast period. This acceleration is fueled by increasing disposable income, rapid urbanization, expansion of the organized retail sector, and burgeoning demand from the industrial bakery and confectionery segments in major economies like China and India.

What are the primary challenges faced by butter producers regarding raw material sourcing?

Butter producers face the primary challenge of extreme volatility and high costs in sourcing high-quality dairy cream. Commodity price fluctuations are often unpredictable, impacting production costs and requiring sophisticated risk management strategies. Additionally, ensuring consistent quality of dairy inputs across different seasons and geographical regions remains a persistent logistical challenge.

How are advancements in food technology improving the functionality of modern spreads?

Technological advancements, including precise control over crystallization and emulsification processes, allow manufacturers to engineer spreads with customized melting profiles and spreadability. This ensures products perform optimally across different applications (e.g., flaky pastry, sandwich spreading) and enables the successful incorporation of functional ingredients like omega fatty acids and specialized vitamins without flavor degradation.

What distinguishes the industrial application segment from the retail segment in terms of product demand?

The industrial segment prioritizes functional consistency, cost efficiency, and specific performance attributes such as stability during baking, preferring bulk, high-tolerance margarine or blends. The retail segment, conversely, emphasizes convenience (spreadability), perceived health benefits (low-fat, organic), flavor profile, and premium ingredients, favoring smaller packaging and specialized butter or non-dairy spreads.

In the value chain, where does the highest value addition occur for premium butter products?

For premium butter, the highest value addition occurs early in the upstream process through ethical and quality-focused dairy farming practices (e.g., grass-fed, A2 milk) and in the midstream manufacturing phase through specialized churning and flavor development techniques. Downstream branding and marketing that convey provenance and quality also add significant value at the retail level.

What impact do sustainability concerns have on the sourcing of vegetable oils for margarine?

Sustainability concerns have a massive impact, particularly regarding palm and soy oil sourcing, which are frequently linked to deforestation. This drives manufacturers to invest in certified sustainable sourcing (RSPO certification for palm oil) and research novel, less environmentally taxing alternatives like algae-based oils, reflecting a growing consumer preference for eco-friendly products.

How is digitalization impacting the distribution channels of butter and margarine?

Digitalization, particularly through e-commerce platforms and quick-commerce models, is rapidly expanding the reach of specialty and premium brands that bypass traditional retail shelf space. This allows niche organic butter and imported spreads to reach consumers efficiently, enhancing market fragmentation and increasing competitive pressure on mainstream brands to adapt their online presence and logistics.

What role do private label brands play in the butter and margarine market dynamics?

Private label brands, offered by major retail chains, exert substantial pressure on branded products by providing cost-effective alternatives across both butter and margarine categories. They capture significant market share among price-sensitive consumers, often mirroring branded product innovations (e.g., introducing their own vegan spreads) but at a lower price point, forcing major brand players to heavily rely on premiumization and specialized R&D to justify higher pricing.

What is Ghee and how does it fit into the global butter market structure?

Ghee is clarified butter, traditionally used in South Asian and Middle Eastern cuisines. It is essentially pure butterfat, created by simmering butter to remove water and milk solids. Ghee commands a premium segment within the global butter market due to its high smoke point, extended shelf life (no refrigeration required), and perceived health benefits in specific consumer groups, particularly in the APAC and MEA regions.

Why is the industrial bakery segment a crucial consumer for margarine over butter?

The industrial bakery segment favors margarine due to its functional advantages, particularly consistent performance in lamination (e.g., puff pastry), specific melting points necessary for large-scale production, and superior shelf stability. Furthermore, margarine provides a significantly lower and more stable cost basis compared to volatile dairy butter prices, allowing large manufacturers to maintain consistent margins.

How do nutritional fortification trends influence the competitive landscape?

Nutritional fortification significantly increases the competitive edge of spreads and margarine brands. Products fortified with essential nutrients like Vitamin D, Omega-3 fatty acids, and plant sterols (for cholesterol management) are positioned as value-added or functional foods, enabling companies to capture health-focused consumers willing to pay a premium for perceived health benefits, differentiating them from basic commodity fats.

What challenges exist in extending the shelf life of soft spreads compared to butter blocks?

Soft spreads, due to their higher moisture content and complex emulsion structure (water-in-oil), present greater microbiological challenges than solid butter blocks. Maintaining emulsion stability and preventing microbial spoilage requires highly effective pasteurization, precise water activity control, and often the use of targeted preservatives, especially when stored outside of ideal cold chain conditions.

How does clean labeling affect packaging and ingredients in the market?

Clean labeling mandates simple, recognizable ingredient lists, forcing manufacturers to eliminate artificial colors, flavors, and complex stabilizers, especially in premium butter and organic spreads. This trend also influences packaging, favoring recyclable materials and clear visual cues that highlight natural sourcing and minimal processing, directly appealing to modern consumer transparency demands.

What differentiates blended spreads from standard margarine in terms of consumer appeal?

Blended spreads, which often combine dairy butter (typically 10-50%) with vegetable oils, offer consumers a balance between the desirable flavor profile of butter and the superior spreadability and cholesterol benefits of margarine. They appeal to consumers seeking a compromise on cost and health, providing a 'best of both worlds' product experience that conventional margarine often fails to replicate in taste.

How does the shift towards keto and low-carb diets influence butter consumption?

The popularity of high-fat, low-carbohydrate diets, such as Keto, positively influences the consumption of high-fat dairy butter. Butter is often utilized heavily in these diets as a primary energy source, driving demand for pure, full-fat butter varieties, sometimes even leading to the use of butter in non-traditional formats like 'bulletproof' coffee.

What impact does climate change risk have on the vegetable oil supply chain for margarine?

Climate change poses significant risks to the vegetable oil supply chain, as extreme weather events (droughts, floods) impact yields of crucial crops like soybeans, palm, and rapeseed. This volatility necessitates geographical diversification of sourcing and increased reliance on predictive analytics to ensure stable supply and pricing for margarine manufacturers.

Describe the role of interesterification technology in modern margarine production.

Interesterification is a key enzymatic or chemical process used to rearrange the fatty acids within vegetable oils. Crucially, it changes the physical properties (melting point, texture) of the fat without the use of hydrogenation, thus enabling the creation of stable, solid fats suitable for margarine production while avoiding the formation of unhealthy trans fats, meeting contemporary health standards.

How is packaging innovation enhancing product visibility and shelf appeal?

Packaging innovation focuses on functional convenience, utilizing tamper-evident seals, easy-to-open lids, and sustainable materials (e.g., fully recyclable tubs). Aesthetically, premium butter packaging emphasizes craft and origin, while margarine packaging often uses bright, colorful designs to highlight nutritional claims, ensuring high visibility in competitive refrigerated display cases.

What is the significance of the solid fat content (SFC) curve in fat analysis?

The Solid Fat Content (SFC) curve is critical as it measures the percentage of solid fat present at various temperatures. Manufacturers use the SFC curve to precisely engineer spreads that have ideal spreadability at refrigerated temperatures and melt appropriately on the palate or during baking, ensuring consistent product quality and functional performance across diverse applications.

Why are specialized animal fats, such as water buffalo butter, gaining niche market interest?

Specialized animal fats, particularly water buffalo butter (used for high-fat content products like specific Ghee), are gaining niche interest due to their unique flavor profiles, higher fat content, and regional authenticity. They appeal to discerning consumers seeking premium, differentiated products, especially within ethnic and artisanal food segments that prioritize traditional ingredient sourcing.

How do manufacturers manage the risk associated with allergen contamination in co-production facilities?

Manufacturers manage allergen risk through strict operational protocols, including dedicated production lines for dairy-free products, rigorous cleaning validation procedures, and thorough ingredient segregation. Clear labeling and allergen testing are paramount to protect consumers and maintain compliance in facilities that produce both dairy-based butter and plant-based margarine products.

What are the primary factors driving consumer interest in organic butter products?

Consumer interest in organic butter is primarily driven by perceived health benefits (e.g., higher Omega-3 content from grass-fed cows), ethical concerns regarding animal welfare (grazing requirements), and the avoidance of pesticides and synthetic hormones associated with non-organic farming. This segment supports premium pricing and appeals to affluent, environmentally conscious consumers.

What role does flavor technology play in the development of non-dairy spreads?

Flavor technology is critical for non-dairy spreads, as vegetable oils often lack the characteristic dairy notes of butter. Manufacturers employ natural flavors, fermentation extracts, and specialized yeast cultures to mimic the buttery taste, rich aroma, and mouthfeel, enhancing the overall sensory experience and driving acceptance among traditional butter consumers transitioning to vegan alternatives.

How do regulatory bodies classify the difference between butter, margarine, and blends?

Regulatory bodies typically classify products based on minimum milkfat content: Butter must contain a high percentage of milkfat (e.g., 80% in many regions). Margarine is defined by its primary content of non-dairy fats (vegetable oils). Blends are clearly labeled products combining both milkfat and vegetable fats, falling into a distinct category with specific labeling requirements detailing the fat ratio.

What is the influence of social media on emerging butter and margarine trends?

Social media platforms heavily influence emerging trends by quickly popularizing unique usage patterns (e.g., specific baking recipes, butter boards), specialized brands, or diet-specific recommendations (e.g., vegan substitutes). This dynamic necessitates that brands maintain rapid response marketing strategies and engage directly with consumer dialogue surrounding usage, health, and ingredients.

Why is the HORECA segment crucial for high-volume, standardized margarine sales?

The HORECA (Hotel, Restaurant, Catering) segment is vital because it requires high-volume, standardized fats with guaranteed performance, low cost, and bulk packaging. Margarine and functional blends meet these criteria effectively, offering chefs and caterers reliability and cost control for deep frying, baking, and large-scale food preparation where flavor differentiation from premium butter is not always necessary.

How do manufacturers optimize the color of margarine to resemble butter?

Manufacturers optimize the color of margarine, which is naturally white or grey, by incorporating food-grade coloring agents. Commonly used natural additives include beta-carotene and annatto, which provide the yellowish hue resembling natural butter, enhancing consumer acceptance and perception of quality, particularly important for spreading applications.

What are the long-term projections regarding the market share split between dairy butter and non-dairy spreads?

Long-term projections indicate that while dairy butter will maintain its premium revenue share, primarily driven by flavor and artisanal appeal, non-dairy spreads (margarine and vegan alternatives) are expected to capture an increasing share of the volume, especially in high-growth, price-sensitive industrial sectors and among mainstream retail consumers focused on value and plant-based diets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager