Butyl Acrylate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432482 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Butyl Acrylate Market Size

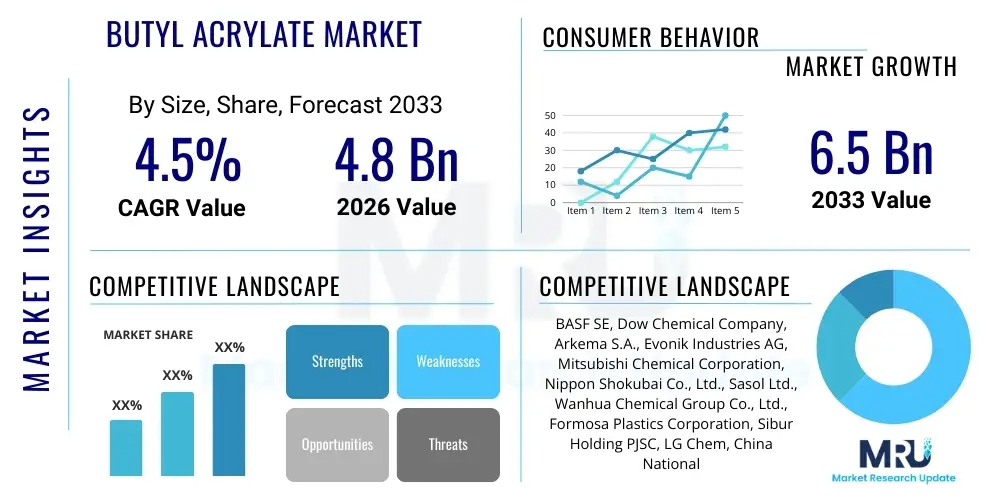

The Butyl Acrylate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Butyl Acrylate Market introduction

Butyl Acrylate (BA) is a crucial chemical intermediate, primarily valued for its utility in synthesizing polymers and resins. This clear, colorless liquid is the ester of n-butanol and acrylic acid, possessing low viscosity and high reactivity, which makes it an indispensable monomer in the chemical industry. Its key functionality lies in imparting properties such as durability, weather resistance, adhesion strength, and low-temperature flexibility to the resultant polymers. The versatility of BA allows it to be used in homo-polymers and co-polymers, catering to a diverse range of industrial applications, particularly those requiring superior film formation and binding capabilities. The general market trajectory is heavily influenced by construction, automotive, and textile sectors.

Major applications of Butyl Acrylate span across paints and coatings, adhesives and sealants, textiles, and plastics. In the coatings industry, BA derivatives are fundamental components in producing waterborne and solvent-based architectural and industrial coatings, enhancing resistance to abrasion and environmental degradation. The increasing shift towards sustainable and low-VOC (Volatile Organic Compound) coating solutions, especially in developed economies, further amplifies the demand for BA, as it is utilized in formulating compliant, high-performance binders. Its efficacy in providing strong, long-lasting adhesion also solidifies its position in the rapidly expanding adhesives market, driven by packaging and assembly requirements.

Key driving factors supporting the market growth include robust expansion in the global construction sector, particularly in Asia Pacific, necessitating high volumes of protective and decorative coatings. Furthermore, technological advancements in polymerization techniques are continually expanding the application scope of BA into specialized areas, such as superabsorbent polymers (SAPs) and synthetic rubber formulations. The inherent benefits of BA—such as cost-effectiveness, high reactivity, and the ability to enhance polymer performance—ensure its sustained relevance as a foundational building block in the chemical value chain, overriding short-term volatility in raw material prices.

Butyl Acrylate Market Executive Summary

The global Butyl Acrylate market is characterized by moderate but consistent growth, underpinned predominantly by surging infrastructural investments in emerging economies and the parallel demand for high-performance specialty chemicals. The market structure is highly dependent on the downstream consumption patterns of the paints and coatings, and adhesives and sealants industries, which collectively account for the largest share of BA utilization. Business trends indicate a strong move towards capacity expansion, especially among major manufacturers in the APAC region, aiming to capitalize on lower production costs and proximity to burgeoning end-user markets. Strategic alliances focusing on sustainable production methods, such as utilizing bio-based acrylic acid precursors, are emerging as key competitive differentiators, signaling a long-term shift towards greener chemical manufacturing practices.

Regionally, Asia Pacific maintains undisputed market leadership, fueled by intensive construction activities, rapid urbanization, and significant expansion of the automotive and textile manufacturing bases in countries like China, India, and Southeast Asian nations. North America and Europe, while representing mature markets, are focusing heavily on regulatory compliance, driving demand for innovative, low-VOC Butyl Acrylate grades used in environmentally friendly formulations. Latin America and the Middle East & Africa are experiencing accelerated demand growth, driven by localized infrastructure projects and increasing industrialization, although their total market share remains smaller compared to the established regions. Fluctuations in the price of crude oil and propylene, the primary feedstocks, pose intermittent challenges to regional profitability and supply chain stability.

Segment trends reveal that the Paints & Coatings application segment remains the largest consumer, driven by both decorative and protective coatings in industrial settings. However, the Adhesives & Sealants segment is poised for the fastest growth, benefiting from increasing usage in packaging, consumer electronics, and automotive manufacturing requiring lightweighting solutions. Within the product grades, Technical Grade Butyl Acrylate dominates volume sales due to its widespread applicability in bulk chemical processes, while High Purity Grade is witnessing robust demand growth driven by specialized medical and electronics applications requiring stringent quality control and minimized impurities. Manufacturers are investing in process improvements to ensure consistent high-purity production to capture this premium market segment.

AI Impact Analysis on Butyl Acrylate Market

User queries regarding the impact of Artificial Intelligence (AI) on the Butyl Acrylate market primarily revolve around operational efficiency, supply chain resilience, and predictive capabilities in R&D and quality control. Users are keen to understand how AI algorithms can optimize complex, multi-stage chemical synthesis processes, especially in managing the highly exothermic and sensitive reaction conditions required for BA production. Key themes include leveraging machine learning for feedstock price prediction—critical given the volatility of crude oil derivatives—and deploying advanced robotics and vision systems to automate quality inspection and handling of the final product. Expectations are high that AI will significantly reduce batch-to-batch variability and improve energy utilization across manufacturing plants, directly impacting production costs and sustainability metrics.

The application of AI extends significantly into the supply chain and logistics domain, addressing common concerns regarding timely delivery and inventory management of this critical intermediate. Predictive maintenance, utilizing sensor data and machine learning, allows manufacturers to anticipate equipment failures, drastically reducing unexpected downtime and maximizing plant utilization rates. Furthermore, AI-driven demand forecasting provides Butyl Acrylate producers with a more accurate outlook on consumption by downstream industries (like construction and automotive), enabling optimized production planning and reduced inventory holding costs. This technological integration transforms the BA market from traditional chemical manufacturing into a data-driven process industry, enhancing overall market responsiveness.

In the innovation space, AI is accelerating the development of new, specialized Butyl Acrylate co-polymers. Algorithms can screen vast libraries of potential monomer combinations and reaction conditions to identify optimal formulations for specific end-use requirements, such as enhanced UV stability or superior adhesion to novel substrates. This rapid R&D capability, powered by computational chemistry and AI, will shorten time-to-market for next-generation coatings and adhesives, making the BA market more agile and competitive. Ultimately, the adoption of AI promises enhanced safety protocols, streamlined operations, and a more sustainable manufacturing footprint for Butyl Acrylate production globally.

- Enhanced Process Optimization: AI algorithms manage reaction parameters (temperature, pressure, feed rates) in real-time to maximize yield and purity of Butyl Acrylate, minimizing energy consumption.

- Predictive Maintenance: Machine learning models analyze operational data to forecast equipment failures, increasing plant uptime and reducing costly emergency repairs.

- Supply Chain Resilience: AI-driven logistics optimization ensures efficient routing and inventory management, mitigating risks associated with feedstock volatility and transport delays.

- R&D Acceleration: Computational chemistry and AI simulation platforms accelerate the discovery of novel BA-based polymer formulations for specialized applications.

- Demand Forecasting: Advanced analytics accurately predict downstream consumption patterns in key industries (Paints, Adhesives), enabling precise production scheduling.

- Quality Control Automation: Vision systems and sensors monitored by AI ensure high consistency and purity of the final Butyl Acrylate product, meeting stringent industry standards.

DRO & Impact Forces Of Butyl Acrylate Market

The Butyl Acrylate market dynamics are shaped by a complex interplay of robust demand from end-user sectors, volatile raw material costs, and increasingly stringent environmental regulations. The primary Drivers revolve around rapid infrastructure development and the expanding use of waterborne coatings, particularly in Asia Pacific, which boosts the consumption of BA as a key co-monomer. Restraints mainly stem from the heavy dependence on petrochemical feedstocks (propylene and crude oil), leading to unpredictable pricing structures and profitability challenges. Opportunities lie predominantly in the shift towards bio-based BA production and the development of specialized, high-performance grades targeting premium applications in electronics and medical devices. These forces collectively dictate investment strategies, production capacities, and regional market penetration efforts by major global players.

Key Drivers include the undeniable growth of the construction sector globally, especially for residential and commercial infrastructure, necessitating durable protective and decorative coatings. Butyl Acrylate’s intrinsic properties, such as excellent film hardness, elasticity, and resistance to hydrolysis, make it ideal for these applications. The increasing preference for eco-friendly and low-VOC coating systems—where BA is used extensively in water-based polymer emulsions—acts as a significant market accelerant, particularly in North America and Europe where regulatory pressures are highest. Furthermore, the automotive sector’s sustained recovery and the increasing production of lightweight vehicles drive demand for advanced adhesives and sealants derived from BA, crucial for improving fuel efficiency and safety standards.

Restraints are heavily linked to supply chain vulnerability and feedstock price swings. The manufacturing of acrylic acid (a BA precursor) relies heavily on propylene, a derivative of crude oil refining. Geopolitical instability and fluctuations in global crude oil prices directly translate into cost pressures for BA producers, often leading to squeezed profit margins and unstable pricing for end-users. Additionally, the increasing environmental scrutiny and regulatory mandates related to the handling and emissions of acrylate monomers can necessitate substantial capital investment in advanced pollution control technologies, which can particularly impact smaller and regional manufacturers, thus constraining overall market expansion. Despite these challenges, the inherent demand growth allows the market to generally absorb the costs, albeit with periodic volatility.

Opportunities are substantial, revolving around innovation in sustainability and application specialization. The development of bio-based acrylic acid, derived from renewable sources such as carbohydrates, presents a major opportunity to decouple BA production from petrochemical volatility and satisfy corporate sustainability goals. Secondly, unexplored growth potential exists in emerging applications, such as high-purity BA for medical devices, drug delivery systems, and advanced composite materials, offering higher profitability compared to bulk commodity markets. Finally, increasing adoption of specialized BA derivatives in the solar energy and wind energy industries (for panel lamination and protective coatings) provides a niche but rapidly expanding market pathway for diversification.

- Drivers:

- Accelerated growth in global construction and infrastructure spending.

- Rising demand for high-performance, waterborne, and low-VOC coatings and adhesives.

- Expanding utilization in textiles and synthetic leather manufacturing.

- Technological advancements leading to improved polymer performance.

- Restraints:

- Volatility and high costs of key raw materials (Propylene and Crude Oil derivatives).

- Stringent environmental regulations concerning monomer handling and storage.

- Overcapacity in certain regions leading to periodic price erosion.

- Opportunities:

- Development and commercialization of bio-based Butyl Acrylate production routes.

- Expansion into specialized, high-purity applications (e.g., medical, electronics).

- Increasing adoption of BA derivatives in renewable energy infrastructure coatings.

- Impact Forces Analysis:

- Bargaining Power of Suppliers: Moderate to High, due to concentrated feedstock suppliers (petrochemical companies).

- Bargaining Power of Buyers: Moderate, due to the commodity nature of Technical Grade BA, but low for specialized grades.

- Threat of New Entrants: Low to Moderate, due to high capital requirements and complex regulatory compliance hurdles.

- Threat of Substitutes: Low, as Butyl Acrylate offers a unique and cost-effective balance of performance properties difficult to replicate, though other acrylates (e.g., Ethyl Acrylate) serve as partial substitutes in specific low-cost applications.

- Competitive Rivalry: High, characterized by large, integrated global players competing intensely on price, capacity utilization, and regional market share.

Segmentation Analysis

The Butyl Acrylate market is strategically segmented based on application, grade, and end-use industry, reflecting the diverse requirements of downstream consumers. The application segmentation highlights the dominant role of the coatings sector, where BA is crucial for film formation and durability, contrasting with its use in adhesives and sealants, where its function is primarily strength and flexibility enhancement. Grade segmentation differentiates between technical grade, used for high-volume, general industrial applications, and high-purity grade, which commands a premium for use in sensitive areas like electronics and healthcare, where minimal impurities are non-negotiable for product performance and regulatory compliance. Understanding these segment dynamics is vital for producers to align their manufacturing capabilities and market penetration strategies.

The application landscape demonstrates a clear hierarchy, with Paints & Coatings being the primary consumption base, driving the majority of global volume. Within this segment, the shift from solvent-based systems to waterborne formulations strongly favors BA, given its compatibility and performance benefits in aqueous dispersions. The Adhesives & Sealants segment is rapidly gaining ground, fueled by the demand for pressure-sensitive adhesives (PSAs) used in tapes and labels, and structural adhesives in the automotive and aerospace industries. Other segments, including textile sizing and finishings, chemical synthesis (intermediate for cross-linking agents), and leather processing, constitute specialized, though smaller, market niches that provide diversification opportunities for BA manufacturers.

Geographically, market segmentation often aligns with the maturity of regional industrial sectors and local environmental regulations. For instance, the demand structure in mature markets like Western Europe and North America emphasizes high-purity, specialty BA monomers compliant with strict VOC regulations, whereas the demand in rapidly industrializing regions like Southeast Asia focuses more on cost-effective, technical-grade BA to support booming infrastructure development and general manufacturing. This regional variation requires manufacturers to maintain flexible supply chains and product portfolios, addressing both the commodity volume needs of emerging markets and the specialized performance requirements of developed economies, ensuring continuous market relevance across diverse global economic conditions.

- By Application:

- Paints & Coatings (Architectural Coatings, Industrial Coatings, Automotive Coatings)

- Adhesives & Sealants (Pressure Sensitive Adhesives, Construction Adhesives, Automotive Sealants)

- Chemical Synthesis (Intermediate for other Acrylates and Polymers)

- Textiles (Sizing Agents, Finishing Agents)

- Plastics and Lubricant Additives

- Others (Paper, Leather, Superabsorbent Polymers)

- By Grade:

- Technical Grade

- High Purity Grade

- By End-Use Industry:

- Construction

- Automotive

- Packaging

- Textile

- Electronics

- Medical

Value Chain Analysis For Butyl Acrylate Market

The Butyl Acrylate value chain commences with the upstream sourcing of raw materials, primarily crude oil and natural gas derivatives, which yield propylene. Propylene is then oxidized to produce acrylic acid, which subsequently reacts with n-butanol through esterification to yield Butyl Acrylate. The crucial dependency on petrochemical feedstocks means that raw material costs represent the largest component of production expenses, making efficient upstream sourcing and long-term supply contracts critical for maintaining competitive pricing. Any disruption or volatility in the global petrochemical market immediately ripples through the BA production costs, necessitating robust hedging and inventory strategies by primary manufacturers.

The manufacturing and distribution phases form the midstream of the value chain. Large, integrated chemical companies typically manage the entire process from acrylic acid production to final BA monomer synthesis, leveraging economies of scale. Distribution channels are varied, including direct sales to major industrial consumers (e.g., large coating manufacturers), and indirect sales through specialized chemical distributors who serve smaller and geographically dispersed end-users. The logistics involving BA are stringent, as it is a hazardous chemical requiring stabilization agents and specialized storage and transport infrastructure to prevent premature polymerization. Efficiency in managing this logistical complexity directly translates into reduced delivery times and enhanced customer satisfaction.

The downstream segment encompasses the conversion of the BA monomer into various polymers and resins utilized by end-user industries. Major buyers include formulators of paints, coatings, and adhesives, who use BA as a foundational component to achieve desired physical properties in their final products. The consumption patterns are highly diversified, but concentrated within the construction and automotive sectors. Direct channels are preferred for high-volume transactions with major industrial players, fostering closer collaboration on product specification and quality. Indirect channels, involving third-party distributors, are essential for penetrating regional markets and servicing smaller, specialized batch requirements, ensuring market access across the entire spectrum of potential customers.

Butyl Acrylate Market Potential Customers

The primary consumers of Butyl Acrylate are large-scale industrial manufacturers and specialized chemical formulators across multiple high-growth sectors. The most significant customer base resides within the coatings industry, specifically companies manufacturing architectural, marine, and protective industrial paints. These customers utilize BA to improve the performance characteristics, durability, and low-temperature flexibility of their waterborne emulsions and solvent-based systems. Additionally, major manufacturers of pressure-sensitive adhesives, tapes, and specialty sealants form a critical customer segment, relying on BA for its superior adhesion and tackiness properties in demanding applications like automotive assembly and packaging.

Another rapidly growing segment of potential customers includes companies involved in the textile and leather finishing industries. Here, BA-derived polymers are employed as binding agents and sizing compounds, enhancing the drape, durability, and water resistance of fabrics and leather goods. Furthermore, the burgeoning demand for specialized chemical synthesis intermediates means that various chemical producers and polymerizers who require monomers for creating advanced cross-linking agents, dispersants, and other complex chemical building blocks are significant buyers. The increasing focus on sustainability also identifies companies investing in bio-based or high-purity chemical processes as attractive potential customers for specialized BA grades.

In essence, the buyer landscape is concentrated yet diverse, ranging from multinational chemical giants formulating mass-market consumer goods to niche players creating highly specialized industrial components. Key purchasing criteria for these end-users include product consistency (purity and stabilization), reliable supply chain management, competitive pricing, and compliance with stringent quality and safety certifications. Establishing strong, long-term relationships with global coatings and adhesives corporations is paramount for Butyl Acrylate suppliers seeking high-volume, stable revenue streams, while targeting specialized polymerizers offers opportunities for capturing higher value through premium products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow Chemical Company, Arkema S.A., Evonik Industries AG, Mitsubishi Chemical Corporation, Nippon Shokubai Co., Ltd., Sasol Ltd., Wanhua Chemical Group Co., Ltd., Formosa Plastics Corporation, Sibur Holding PJSC, LG Chem, China National Petroleum Corporation (CNPC), ExxonMobil Chemical, TCI Chemicals, Jiling Chemical Group, Showa Denko K.K., Hexion Inc., Lotte Chemical Corporation, Hanwha Chemical, Shandong Kaitai Petrochemical Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Butyl Acrylate Market Key Technology Landscape

The manufacturing of Butyl Acrylate primarily relies on the esterification of acrylic acid with n-butanol, a well-established and highly optimized industrial process. The core technological focus currently centers on enhancing catalyst efficiency, improving yield rates, and minimizing energy consumption through process intensification. Advanced catalytic technologies, including the use of solid acid catalysts instead of traditional liquid homogeneous catalysts, are gaining traction. Solid catalysts offer benefits such as easier separation, reduced corrosion, and minimized waste streams, contributing directly to lower operating costs and a reduced environmental footprint. Continuous process monitoring and control using sophisticated sensors and automation are also essential technological elements ensuring consistent product quality and safety in these large-scale production environments.

A significant area of technological evolution is the growing research and development into sustainable and bio-based production routes. Currently, acrylic acid is predominantly derived from petrochemical sources (propylene), but technological breakthroughs are enabling the commercial viability of bio-based acrylic acid production, typically derived from fermentation of renewable feedstocks like glucose or glycerol. While these bio-based routes face challenges in terms of cost competitiveness and scale compared to conventional methods, ongoing investment in biocatalysis and advanced fermentation techniques is steadily closing the gap. The adoption of bio-based BA is critical for producers aiming to meet evolving environmental regulations and satisfy demand from end-users committed to incorporating bio-content into their supply chains.

Furthermore, technology related to product stabilization and handling is crucial. Butyl Acrylate monomers are susceptible to spontaneous polymerization (gelling) during storage and transport, which requires the use of inhibitors (stabilizers). Continuous technological refinement in inhibitor selection and dosage, alongside innovations in transport vessel design (temperature control and oxygen management), ensures the stability and safety of the product until it reaches the end-user. The overall technology landscape is characterized by marginal, continuous improvements in conventional processes coupled with transformative research into alternative, sustainable feedstock pathways, ensuring both operational efficiency and future compliance with environmental directives.

Regional Highlights

Regional dynamics within the Butyl Acrylate market are highly divergent, driven by varying levels of industrialization, regulatory frameworks, and construction expenditure across the globe. Asia Pacific (APAC) dominates the market both in terms of production capacity and consumption volume. This leadership is primarily attributed to explosive growth in the construction sector, rapid urbanization, and extensive government investment in infrastructure across major economies such as China, India, and Southeast Asian nations. APAC manufacturers benefit from lower operating costs and proximity to feedstock supply, enabling them to service both regional demand and global export requirements efficiently. The sheer scale of the automotive and textile industries in this region further cements its position as the engine of global BA demand.

North America and Europe represent mature, high-value markets characterized by stringent environmental regulations, particularly concerning VOC emissions. Consumption in these regions is stable and characterized by a strong demand for specialized, high-purity, and low-VOC compliant grades of Butyl Acrylate, crucial for high-performance architectural coatings and automotive refinishing applications. Market growth in these regions is less reliant on new infrastructure build-out and more focused on refurbishment, specialized industrial coatings, and the development of sustainable polymer solutions. European producers are often pioneers in adopting bio-based and advanced chemical recycling technologies to meet the European Union's ambitious sustainability goals, driving technological rather than volume growth.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as high-potential growth regions. In LATAM, market growth is fueled by increasing industrialization, expanding domestic manufacturing capabilities, and significant investments in residential and commercial construction. In the MEA region, large-scale infrastructure projects associated with urbanization, coupled with expanding chemical and petrochemical capacities (particularly in Saudi Arabia and the UAE), are stimulating local demand for BA. While these regions currently hold smaller market shares, favorable demographics and economic diversification efforts are expected to generate above-average demand growth rates throughout the forecast period, requiring global producers to establish robust regional distribution networks.

- Asia Pacific (APAC): Dominates the market due to massive urbanization, high construction activity, and significant presence of textile and automotive manufacturing hubs (China, India). Focus on volume production and infrastructure coatings.

- North America: Mature market characterized by steady demand for high-performance and specialty BA products. Strict regulatory focus drives the adoption of low-VOC and waterborne formulations.

- Europe: Growth driven by compliance mandates and sustainable innovation. High demand for bio-based and high-purity BA grades for niche applications, emphasizing circular economy principles in chemical usage.

- Latin America (LATAM): Emerging market with growth tied to expanding residential construction and industrial output, particularly in Brazil and Mexico.

- Middle East & Africa (MEA): Growth stimulated by large-scale infrastructure and industrial diversification projects, supported by localized petrochemical expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Butyl Acrylate Market.- BASF SE

- Dow Chemical Company

- Arkema S.A.

- Evonik Industries AG

- Mitsubishi Chemical Corporation

- Nippon Shokubai Co., Ltd.

- Sasol Ltd.

- Wanhua Chemical Group Co., Ltd.

- Formosa Plastics Corporation

- Sibur Holding PJSC

- LG Chem

- China National Petroleum Corporation (CNPC)

- ExxonMobil Chemical

- TCI Chemicals

- Jiling Chemical Group

- Showa Denko K.K.

- Hexion Inc.

- Lotte Chemical Corporation

- Hanwha Chemical

- Shandong Kaitai Petrochemical Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Butyl Acrylate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Butyl Acrylate primarily used for?

Butyl Acrylate (BA) is predominantly used as a chemical intermediate in the production of polymers and resins. Its largest applications are in manufacturing high-performance paints, coatings, and adhesives/sealants, where it enhances durability, water resistance, and adhesion strength, especially in waterborne formulations.

Which region dominates the global Butyl Acrylate market consumption?

The Asia Pacific (APAC) region currently dominates the global Butyl Acrylate market consumption. This dominance is driven by rapid infrastructural development, high growth in the construction sector, and extensive manufacturing bases for textiles and automotive components in countries like China and India.

What are the main drivers of market growth for Butyl Acrylate?

The key drivers for market growth include the accelerated expansion of the global construction and infrastructure industries, the increasing regulatory preference for low-VOC and waterborne coating technologies, and sustained demand from the packaging and automotive sectors for advanced adhesives.

How does raw material volatility affect the Butyl Acrylate industry?

Butyl Acrylate production is highly dependent on petrochemical feedstocks, primarily propylene derived from crude oil. Volatility in crude oil and propylene prices directly impacts the cost of acrylic acid, leading to fluctuating production costs and potential profitability challenges for BA manufacturers.

What is the significance of bio-based Butyl Acrylate technologies?

Bio-based Butyl Acrylate, derived from renewable resources like carbohydrates, is highly significant as it offers a strategic opportunity for manufacturers to reduce their dependence on volatile petrochemical feedstocks, improve environmental profiles, and meet the growing corporate demand for sustainable chemical inputs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ethylene Butyl Acrylate Market Size Report By Type (Ethyl Acrylate, 2-Ethyl Hexyl Acrylate, Methyl Acrylate), By Application (Packaging, Plastics, Paints and Polymers, Textiles, Leather, Surface Coatings, Adhesives, Paper & Pulp, Automotive,, Construction, Personal Care, Electrical & Electronics, Industrial), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Butyl Acrylate Market Statistics 2025 Analysis By Application (Plastic Sheet, Textiles, Coatings, Adhesive), By Type (High Purity, Common purity), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- N-Butyl Acrylate Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Above 99.9%, 99.5%-99.9%, Less than 99.5%), By Application (Adhesives, Coatings, Plastics, Textiles, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Butyl Acrylate (Cas 141-32-2) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (High Purity (99.5%), Common purity (99%)), By Application (Plastic Sheet, Textiles, Coatings, Adhesive, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager