Butyl Adhesives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435517 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Butyl Adhesives Market Size

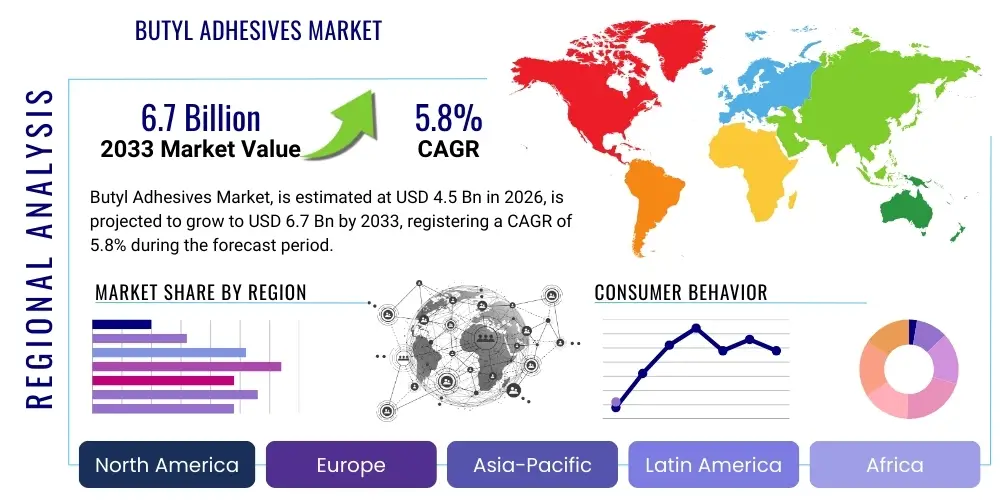

The Butyl Adhesives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Butyl Adhesives Market introduction

The Butyl Adhesives Market encompasses specialized chemical compounds formulated using butyl rubber polymers, renowned for their exceptional moisture barrier properties, high tack, flexibility, and sealing capabilities. These adhesives are primarily used in applications requiring superior resistance to water vapor, weathering, and temperature fluctuations. Butyl rubber, a copolymer of isobutylene and isoprene, provides the foundation for these durable sealants and tapes, making them essential materials in diverse industrial sectors.

Major applications of butyl adhesives span the construction, automotive, packaging, and infrastructure industries. In construction, they are critical for sealing window units, roofing membranes, and foundational joints, offering long-term protection against water ingress and air leaks. The automotive sector relies on butyl tapes and sealants for vibration dampening, panel bonding, and headlight assembly sealing, capitalizing on their viscoelastic nature and heat resistance. Their versatility ensures sustained performance in demanding environments, making them a preferred solution over conventional sealants in many high-specification uses.

Key benefits driving market adoption include outstanding impermeability to gases and moisture, excellent adhesion to various substrates (including metals, glass, and plastics), and superb sound and vibration dampening characteristics. The increasing global focus on energy efficiency in buildings mandates better sealing solutions, directly fueling the demand for high-performance butyl adhesives. Furthermore, the growth of the electric vehicle (EV) market and the rising necessity for lightweight and durable bonding solutions in modern manufacturing processes further solidify the strategic importance of the butyl adhesives market.

Butyl Adhesives Market Executive Summary

The Butyl Adhesives Market is poised for stable expansion, driven fundamentally by robust growth in the global construction sector, particularly in emerging economies focused on infrastructure development and green building mandates. Business trends indicate a strong shift towards bio-based and solvent-free butyl formulations to comply with stringent environmental regulations and meet consumer demand for safer products. Manufacturers are increasingly investing in research and development to enhance the thermal stability and application ease of butyl sealants, seeking competitive advantages in high-volume industries like automotive and solar energy panel manufacturing.

Regionally, Asia Pacific maintains market dominance due to accelerated industrialization, massive residential construction projects, and the presence of major manufacturing hubs, particularly in China and India. North America and Europe, while mature markets, are experiencing growth driven by the renovation and refurbishment of existing infrastructure and the rapid adoption of advanced butyl technologies for electric vehicle battery sealing and lightweight automotive construction. Regional trends highlight divergent regulatory pressures, with European markets emphasizing high sustainability and low VOC content, thereby influencing formulation changes.

Segment trends reveal that the solvent-based butyl adhesive segment currently holds significant market share, though hot melt butyl formulations are projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to their faster processing times and elimination of volatile organic compounds (VOCs). The automotive application segment is expected to be the fastest-growing end-user, propelled by the transition to electric vehicles which require specialized sealing solutions for battery packs and noise reduction applications. Furthermore, the construction application segment continues to be the largest consumer, underscoring the foundational role of butyl sealants in building envelopes and roofing systems globally.

AI Impact Analysis on Butyl Adhesives Market

Common user inquiries regarding AI in the Butyl Adhesives market center on optimizing formulation complexity, predicting material performance under various stress conditions, and enhancing quality control during manufacturing. Users are keen to understand how AI-driven predictive maintenance can reduce downtime in adhesive production lines and how machine learning algorithms can accelerate the development of novel, high-performance butyl copolymers. The key themes revolve around leveraging AI for faster material discovery, ensuring precise regulatory compliance tracking, and creating hyper-personalized adhesive solutions for niche industrial applications, ultimately minimizing material waste and maximizing operational efficiency.

- AI algorithms enable accelerated screening and testing of new butyl polymer formulations, significantly reducing R&D cycles.

- Machine learning models predict the long-term viscoelastic performance and aging characteristics of butyl adhesives under extreme temperature and moisture conditions.

- AI-powered quality control systems utilize computer vision to detect microscopic flaws in manufactured butyl tapes and sealants, ensuring product consistency.

- Predictive maintenance analytics optimize butyl adhesive production equipment scheduling, minimizing unplanned downtime and maximizing throughput.

- Supply chain visibility tools integrated with AI optimize raw material procurement (isobutylene and isoprene) based on fluctuating global commodity prices and demand forecasts.

DRO & Impact Forces Of Butyl Adhesives Market

The Butyl Adhesives Market growth is primarily driven by the increasing application scope in energy-efficient building systems and the automotive industry’s shift toward lightweight materials and electric mobility. However, the market faces significant restraints, notably the volatile pricing of key petrochemical raw materials and the environmental scrutiny related to synthetic polymers. This volatility introduces considerable financial risk for manufacturers, necessitating agile sourcing strategies. The primary opportunity lies in developing bio-based or partially bio-derived butyl alternatives that maintain the required performance specifications while addressing sustainability concerns and regulatory mandates.

Key drivers include regulatory mandates enforcing stringent building codes requiring superior air and moisture barriers, thereby increasing the use of high-performance butyl tapes and sealants in roofing and fenestration. The rapid expansion of solar panel installations globally also demands specialized butyl adhesives for secure framing and moisture protection. The shift towards solvent-free, hot-melt butyl formulations mitigates environmental impact, serving both as a driver for new product adoption and a response to regulatory restraints concerning VOC emissions, particularly in North America and Europe.

The impact forces influencing this market relate heavily to substitution threats from alternative polymers, such as silicone and polyurethane, which offer competitive advantages in specific high-temperature or high-flexibility applications. Nonetheless, butyl’s superior impermeability remains a powerful intrinsic advantage, especially in water barrier applications. Furthermore, the market's response to geopolitical instability affecting petrochemical supply chains and the need for innovation in application methods—such as automated dispensing systems—will determine the long-term competitive landscape.

Segmentation Analysis

The Butyl Adhesives Market is systematically segmented based on formulation type, end-user industry, and specific application method. Analysis of these segments is crucial for understanding distinct market dynamics and investment pockets. Key formulation types include solvent-based, hot-melt, and water-based adhesives, with increasing focus on the latter two due to environmental benefits. The market is primarily dominated by the construction and automotive sectors, although packaging, aerospace, and general assembly sectors offer significant secondary growth avenues, each demanding tailored performance characteristics from the butyl compounds.

- Segmentation by Formulation Type:

- Solvent-Based Butyl Adhesives

- Hot Melt Butyl Adhesives

- Water-Based Butyl Adhesives

- Segmentation by Application:

- Sealing and Waterproofing

- Taping and Joining

- Damping and Vibration Control

- Insulation

- Segmentation by End-User Industry:

- Construction (Residential, Commercial, Infrastructure)

- Automotive (Body, Trim, Headlights, EV Batteries)

- Packaging (Flexible and Rigid)

- Aerospace

- General Industrial Assembly

- Segmentation by Product Form:

- Tapes

- Sealants (Cartridges, Bulk)

Value Chain Analysis For Butyl Adhesives Market

The value chain for the Butyl Adhesives Market begins with the upstream segment, focusing on the procurement and processing of raw materials, primarily isobutylene and isoprene, which are derived from petrochemical feedstocks. Major petrochemical companies dominate this upstream segment, influencing pricing volatility that directly impacts adhesive manufacturers. Further processing involves polymerization to create butyl rubber, which is then compounded with various additives such as tackifiers, plasticizers, fillers (like carbon black), and stabilizers to achieve desired adhesive properties specific to end-user requirements. The quality and stable supply of these upstream components are critical determinants of final product cost and performance.

The midstream segment involves the adhesive manufacturers who compound, formulate, and convert the butyl rubber into final products such as tapes, sealants, and cartridges. This phase requires significant technical expertise in chemical formulation and specialized manufacturing equipment. Differentiation at this stage is achieved through superior formulation performance, targeting specific niches like extreme temperature resistance or high shear strength. Key industry players focus on process optimization and integrating sustainable manufacturing practices to minimize waste and energy consumption, essential for maintaining regulatory compliance and cost-effectiveness.

The downstream segment encompasses the distribution channel, which moves products from manufacturers to end-users. Distribution relies on a mix of direct sales channels—especially for large industrial clients (e.g., major automotive OEMs or construction contractors)—and indirect channels utilizing specialized distributors, wholesalers, and retailers. These distributors often provide technical support and inventory management tailored to local market needs. Direct sales are prevalent for high-volume, customized industrial orders, whereas indirect channels serve the fragmented construction and DIY markets. Efficient logistics and product availability near construction sites and manufacturing clusters are paramount for successful market penetration.

Butyl Adhesives Market Potential Customers

Potential customers for butyl adhesives are highly diverse, spanning major industries that require durable, moisture-resistant bonding and sealing solutions. The primary end-users are large-scale construction companies involved in commercial and residential developments, utilizing butyl sealants for weatherproofing building envelopes, roofing, and window installation. Infrastructure projects, particularly tunneling and bridge construction, also constitute a significant buying segment due to the material's superior water barrier capabilities. These buyers prioritize product longevity, ease of application, and compliance with local building standards.

Another crucial customer segment is the automotive manufacturing industry. Original Equipment Manufacturers (OEMs) use butyl tapes extensively for noise, vibration, and harshness (NVH) reduction in vehicle cabins, as well as for sealing critical components like headlights, taillights, and body seams. The surging demand for Electric Vehicles (EVs) creates a specialized segment where butyl adhesives are vital for sealing and protecting battery packs from moisture and thermal shock, where durability and thermal management properties are non-negotiable purchasing criteria.

Furthermore, packaging manufacturers, particularly those producing specialized moisture-sensitive packaging or medical device packaging, utilize butyl formulations for their excellent barrier properties. Industrial assemblers and solar panel manufacturers represent growing customer bases, requiring high-adhesion sealants for photovoltaic module assembly. Customer requirements across all sectors converge on performance reliability, environmental safety (low VOCs), and cost-effectiveness tailored for high-volume production efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | H.B. Fuller, Henkel AG, Sika AG, 3M Company, Bostik (Arkema Group), DuPont, ExxonMobil Chemical, Wacker Chemie AG, Mapei S.p.A., RPM International Inc., Franklin International, Tremco Illbruck, Berry Global Inc., Trelleborg AB, Dow Inc., Adhesives Research Inc., Kömmerling Chemische Fabrik GmbH, Scapa Group plc, Ashland Global Holdings Inc., Sealants, Adhesives & Specialties (SAS) Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Butyl Adhesives Market Key Technology Landscape

The Butyl Adhesives market is undergoing continuous technological evolution, focusing primarily on enhancing application efficiency, improving environmental performance, and tailoring material properties for specialized industrial demands. A significant technological shift involves the development of advanced hot melt butyl systems, which allow for faster setting times and eliminate the need for solvents, thus aligning with global VOC reduction targets. These hot melt technologies require specialized blending and extrusion equipment to handle the high viscosity of butyl rubber while maintaining formulation consistency and high production speeds demanded by automotive and insulating glass manufacturers.

Another critical area of innovation is the introduction of reactive butyl formulations. While traditional butyl adhesives are non-reactive (physical setting), hybrid or modified butyl systems incorporating silyl-modified polymers (SMPs) or similar technologies offer enhanced cross-linking capabilities. This results in sealants with superior ultimate strength, improved adhesion to challenging substrates, and better resistance to UV degradation and extreme weathering. Such advancements broaden the application scope of butyl materials beyond standard sealing, moving them into structural or semi-structural bonding roles, particularly in construction and transportation where longevity is paramount.

Furthermore, automation and precise dispensing technology are becoming integral to the market landscape. Manufacturers are investing in robotic application systems for butyl tapes and sealants, particularly in high-volume settings like vehicle assembly lines and large-scale prefabrication facilities. This technology ensures uniform bead size, accurate placement, and minimal material waste, significantly boosting productivity and quality assurance. Research into nanocomposite fillers is also gaining traction, aiming to improve the mechanical strength, thermal conductivity, and barrier properties of butyl adhesives without compromising their inherent flexibility and tackiness.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market due to aggressive growth in the construction and infrastructure sectors, especially in China, India, and Southeast Asian nations. Rapid urbanization and massive manufacturing activities, coupled with lower labor costs, position APAC as both the largest producer and consumer of butyl adhesives.

- North America: Characterized by high demand for advanced, high-performance butyl products driven by strict energy efficiency standards in building codes (e.g., airtightness mandates). Significant growth is observed in the automotive sector, focusing on EV battery sealing and lightweighting initiatives.

- Europe: A mature but highly regulated market, with growth steered by stringent environmental legislation emphasizing low VOC (Volatile Organic Compound) and sustainable formulations. The renovation and refurbishment segment and specialized industrial applications (e.g., insulating glass units) are primary demand drivers.

- Latin America (LATAM): Exhibits steady growth fueled by residential construction and expansion in industrial manufacturing, particularly in Brazil and Mexico. Market uptake is influenced by economic stability and increasing foreign direct investment in infrastructure.

- Middle East and Africa (MEA): Growth is tied to large-scale infrastructure and construction mega-projects (e.g., in the GCC states). The region requires butyl adhesives that can withstand extreme temperatures and harsh environmental conditions, driving demand for specialized, high-performance formulations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Butyl Adhesives Market.- H.B. Fuller

- Henkel AG

- Sika AG

- 3M Company

- Bostik (Arkema Group)

- DuPont

- ExxonMobil Chemical

- Wacker Chemie AG

- Mapei S.p.A.

- RPM International Inc.

- Franklin International

- Tremco Illbruck

- Berry Global Inc.

- Trelleborg AB

- Dow Inc.

- Adhesives Research Inc.

- Kömmerling Chemische Fabrik GmbH

- Scapa Group plc

- Ashland Global Holdings Inc.

- Sealants, Adhesives & Specialties (SAS) Group

Frequently Asked Questions

Analyze common user questions about the Butyl Adhesives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of butyl adhesives over silicone or polyurethane sealants?

Butyl adhesives offer superior gas and moisture impermeability, making them unmatched for applications requiring an absolute vapor barrier, such as roofing membranes and insulating glass units. They also possess excellent tack and viscoelastic properties for damping applications.

How is the growth of the electric vehicle (EV) sector impacting the butyl adhesives market?

The EV sector significantly increases demand for specialized butyl sealants, primarily for protecting and sealing large battery packs against moisture, thermal fluctuations, and vibration, ensuring long-term performance and safety of the power units.

Which formulation type of butyl adhesive is projected to grow the fastest?

Hot melt butyl adhesives are projected to exhibit the highest CAGR. This growth is driven by manufacturing efficiency, rapid application speed, and the absence of volatile organic compounds (VOCs), making them environmentally preferable and compliant with modern regulations.

What are the major challenges faced by manufacturers in the Butyl Adhesives Market?

The primary challenge is the volatility and dependency on petrochemical raw material pricing (isobutylene and isoprene). Additionally, meeting increasingly strict global environmental standards regarding VOC content requires continuous investment in developing solvent-free and water-based formulations.

In which region is the demand for butyl adhesives highest, and why?

Asia Pacific (APAC) holds the largest market share due to unparalleled rapid expansion in infrastructure development, massive residential and commercial construction projects, and large-scale automotive and industrial production centers, particularly concentrated in East and South Asia.

The extensive application portfolio of butyl adhesives, characterized by their unique ability to create effective moisture and gas barriers, secures their indispensable role across global industries. The market trajectory is fundamentally linked to sustainable construction practices and advancements in high-technology manufacturing processes, particularly in the electrification of transportation. Strategic investment in low-VOC formulations and advanced dispensing technologies will define competitive success in the coming forecast period. The increasing global regulatory emphasis on energy efficiency in buildings directly correlates with higher demand for durable, high-performance butyl sealing solutions, thereby stabilizing the market against general economic fluctuations.

Furthermore, the segmentation analysis reveals that while construction remains the dominant end-user, the rapid innovation cycle within the automotive sector, driven by NVH requirements and battery security needs in EVs, will provide the most dynamic growth opportunities. Manufacturers capable of providing highly customized, hybrid butyl solutions that bridge the gap between traditional sealing and advanced bonding will be positioned favorably. Regional differences in market maturity and regulatory environment necessitate a tailored approach to distribution and product offering, especially when navigating the divergence between the established environmental mandates in Europe and the high-volume demand patterns of the APAC region.

The value chain remains highly susceptible to upstream petrochemical pricing, urging manufacturers to establish long-term supply agreements and explore alternative, non-petroleum-derived feedstocks to mitigate risk and improve cost stability. Downstream, the effectiveness of indirect distribution channels in providing readily available product stock and localized technical support is paramount for serving the fragmented construction contractor base. Technological advancements focusing on automation in application methods will be critical for high-volume industrial clients, emphasizing speed and precision as key determinants of adoption.

The competitive landscape is defined by the presence of large multinational chemical conglomerates capable of integrated production from raw materials to final products, offering a wide array of adhesive technologies. Smaller, specialized firms often differentiate themselves by focusing on niche, high-specification markets, such as specialty tapes for aerospace or highly regulated medical packaging. Sustained R&D efforts aimed at achieving superior thermal stability and improved adhesion to next-generation materials like advanced composites and specialized plastics will be essential for maintaining relevance and capturing new market share within the global industrial framework.

Finally, continuous monitoring of macroeconomic trends, particularly infrastructure spending and automotive sales figures across key geographies, will provide crucial indicators for forecasting regional demand shifts. The movement towards solvent-free solutions is not merely a compliance issue but an opportunity for market leaders to establish premium product lines that appeal to environmentally conscious builders and manufacturers worldwide. The integration of data analytics and AI into quality control and formulation optimization further underscores the industry’s commitment to high precision and predictable performance, solidifying the long-term growth prospects of the butyl adhesives market.

The market for butyl adhesives exhibits resilience owing to their intrinsic material advantages—namely, superior moisture barrier properties and exceptional long-term elasticity—which are non-negotiable requirements in critical applications such as roofing and automotive sealing. The ongoing global trend toward optimizing energy consumption in buildings, enforced through increasingly stringent government regulations, acts as a primary, persistent driver of demand. This demand is focused on high-quality sealants that prevent air leakage and moisture ingress, areas where butyl formulations excel compared to many competitive polymer systems.

In terms of product innovation, the industry is witnessing a significant shift towards environmentally benign products. The development and commercialization of water-based and 100% solid hot melt butyl systems are pivotal. These formulations not only address environmental mandates by reducing or eliminating VOC emissions but also offer operational benefits such as quicker processing times in industrial settings. This technological pivot is crucial for maintaining market share in highly regulated regions like Europe and North America, and for appealing to corporate customers committed to sustainability goals.

Geographically, while Asia Pacific drives volume due to raw construction scale, North America and Europe lead in value and technological sophistication. This regional divergence means that marketing and sales strategies must be highly customized. In Western markets, the focus is often on high-performance renovation, specialized industrial applications (e.g., HVAC insulation and prefabrication), and high-margin products. Conversely, in APAC, the emphasis is on achieving cost-effective solutions for large infrastructure projects and high-volume consumer goods assembly. Understanding these regional needs is vital for comprehensive market penetration and sustained revenue growth.

The interaction between the Butyl Adhesives market and related industries, such as insulating glass manufacturing and roofing membrane production, is highly symbiotic. Any innovation or regulatory change in these adjacent sectors directly influences the specifications and demand for butyl products. For example, the trend towards larger, more complex insulating glass units in modern architecture necessitates butyl sealants with enhanced durability, adhesion, and UV resistance, prompting adhesive manufacturers to continuously upgrade their product portfolios to meet these evolving requirements. This interdependency ensures steady technological advancement within the butyl adhesives value chain.

Addressing the inherent restraint related to raw material price volatility requires sophisticated procurement and risk management strategies. Manufacturers are exploring backward integration or establishing strategic alliances with petrochemical suppliers to secure consistent and competitively priced inputs. Furthermore, the diversification of the product portfolio to include hybrid polymers that potentially use less butyl rubber while retaining critical performance attributes provides a hedging mechanism against high raw material costs, ensuring profitability margins remain stable even during periods of commodity market turbulence.

The future success of the Butyl Adhesives market hinges on its ability to leverage digitalization, particularly in the realm of customized manufacturing and predictive performance modeling. Using AI to simulate long-term aging effects and optimize blend ratios can drastically cut development costs and time-to-market for specialized sealants required in niche high-reliability applications, such as aerospace and high-speed rail. These advancements transform the industry from a reliance on traditional chemical processing to a technology-driven manufacturing sector, enhancing its resilience and adaptability.

Investment patterns indicate a strong inclination towards bolstering production capacity in key manufacturing hubs within Asia, while simultaneously dedicating research resources in Europe and North America to develop next-generation bio-based and smart adhesive formulations. This dual strategy allows companies to capitalize on both volume-driven and value-driven segments of the global market, positioning them strategically for long-term growth and mitigating the risks associated with dependency on a single geographical market or product line.

In summary, the Butyl Adhesives Market is characterized by steady growth underpinned by fundamental application needs in construction and automotive sectors. Navigating raw material challenges and successfully transitioning to sustainable, high-performance, solvent-free formulations are the primary strategic imperatives for market stakeholders over the forecast period. The unique material properties of butyl rubber ensure its continued relevance, even as competitive materials vie for market share in specialized bonding applications.

The market's resilience is also supported by its integral role in renewable energy infrastructure. The proliferation of photovoltaic (PV) solar panels demands specialized sealing solutions to protect the sensitive internal components from moisture ingress and mechanical stress over decades of operation. Butyl adhesives are frequently chosen for their proven durability and impermeability in this harsh outdoor application, solidifying a critical, high-growth segment outside of traditional construction and automotive uses. This expansion into green technology markets further diversifies revenue streams and provides insulation against cyclical downturns in traditional manufacturing.

Finally, the growing trend of modular construction and prefabrication globally accelerates the adoption of high-speed application solutions like hot melt butyl systems. Prefabricated components require adhesives that offer immediate tack and rapid curing or setting to maintain efficient assembly line speeds. Butyl tapes and seals meet this requirement effectively, supporting the shift away from slow, site-applied sealants towards factory-controlled, high-precision bonding techniques, thereby confirming their status as a preferred material for industrialized construction processes.

The rigorous demands of modern regulatory environments, particularly those pertaining to fire safety and chemical exposure, continuously pressure manufacturers to refine butyl adhesive compositions. Research efforts are ongoing to incorporate flame retardants and utilize non-toxic fillers without compromising the essential barrier properties or long-term flexibility of the rubber compound. Successfully meeting these dual demands of safety and performance will be a key differentiator, enabling market leaders to secure contracts in sensitive high-value sectors such as public infrastructure and specialized medical device manufacturing.

Moreover, the digitalization of the material supply chain, facilitated by technologies like IoT and blockchain, is starting to improve traceability and authenticity of high-performance butyl products, which is crucial in sectors where counterfeiting can lead to catastrophic structural or safety failures (e.g., aviation or critical infrastructure). Enhanced transparency throughout the value chain not only ensures quality control but also strengthens consumer trust in premium butyl adhesive offerings, further justifying investment in advanced production methodologies.

The emphasis on circular economy principles is subtly influencing the butyl adhesives market. While butyl is inherently difficult to recycle due to its cross-linked nature, researchers are exploring methods for chemical decomposition or alternative end-of-life solutions. The development of reusable or chemically decomposable adhesive systems, even if based on butyl hybrids, represents a significant long-term opportunity to align with overarching global sustainability mandates and gain a competitive edge in environmentally conscious markets.

In conclusion, the Butyl Adhesives market trajectory is stable and positive, underpinned by essential functions in high-growth, regulated industries. Strategic focus on innovation—specifically in hot melt technology, bio-based inputs, and digital manufacturing integration—is paramount for maximizing market potential and navigating the intrinsic challenges related to raw material sourcing and stringent environmental compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager