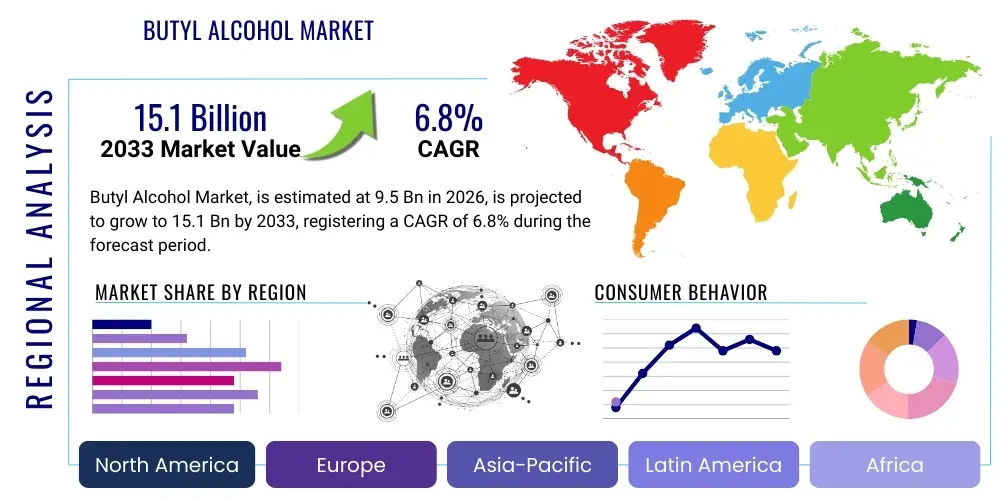

Butyl Alcohol Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439807 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Butyl Alcohol Market Size

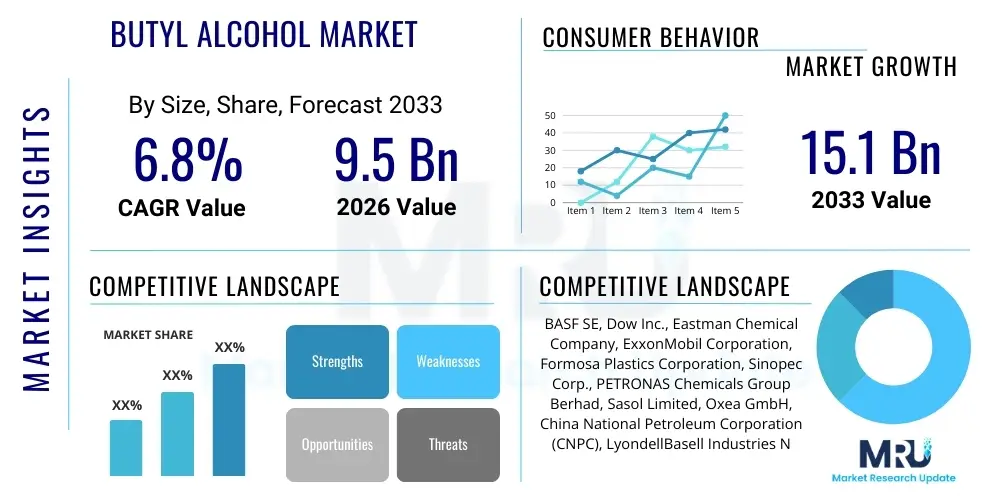

The Butyl Alcohol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 9.5 billion in 2026 and is projected to reach USD 15.1 billion by the end of the forecast period in 2033. This robust growth is primarily driven by the escalating demand from various end-use industries, particularly paints and coatings, adhesives, and the automotive sector, which continue to expand globally. The market's valuation reflects its critical role as a versatile chemical intermediate and solvent across a multitude of manufacturing processes, underpinned by ongoing industrialization and urbanization trends in emerging economies. The forecasted expansion indicates sustained investment in production capacities and a focus on developing more sustainable and efficient synthesis routes to meet future industrial requirements.

Butyl Alcohol Market introduction

The Butyl Alcohol market encompasses a vital segment of the global chemical industry, dealing with the production, distribution, and consumption of various isomers of butanol. Butyl alcohol, a four-carbon alcohol, primarily exists in four isomeric forms: n-butanol (normal butanol), isobutanol (2-methyl-1-propanol), sec-butanol (butan-2-ol), and tert-butanol (2-methylpropan-2-ol), each possessing distinct chemical properties and applications. Among these, n-butanol and isobutanol are the most commercially significant, largely due to their extensive use as industrial solvents and chemical intermediates. These compounds are renowned for their excellent solvency power, low volatility, and high boiling points, making them indispensable across a wide array of manufacturing processes.

Major applications for butyl alcohol isomers span across diverse sectors. In the paints and coatings industry, they function as effective solvents for resins, lacquers, and enamels, improving flow, leveling, and drying characteristics. The automotive industry utilizes butyl alcohol derivatives in the production of brake fluids, hydraulic fluids, and as fuel additives, particularly isobutanol for its potential as a biofuel or blending component. Furthermore, butyl alcohols serve as crucial intermediates in the synthesis of esters (e.g., butyl acetate, dibutyl phthalate), acrylates, glycol ethers, and other specialty chemicals that find use in plastics, pharmaceuticals, cosmetics, and agrochemicals. The benefits of butyl alcohol include its versatility, biodegradability in certain forms, and its ability to enhance product performance in various formulations.

Several driving factors propel the growth of the Butyl Alcohol market. Foremost among these is the burgeoning demand from the construction sector, particularly in developing nations, leading to increased consumption of paints, coatings, and adhesives. The expansion of the automotive industry, coupled with the rising production of vehicles, further fuels demand for butyl alcohol-based products. Additionally, the growing emphasis on sustainable and bio-based chemical production presents a significant driver, with ongoing research and commercialization efforts focused on producing butanol through fermentation processes from renewable feedstocks. Technological advancements in production efficiency and the continuous development of new applications also contribute significantly to the market's sustained growth momentum.

Butyl Alcohol Market Executive Summary

The Butyl Alcohol market is experiencing robust expansion, propelled by significant business trends, dynamic regional developments, and evolving segment demands. Globally, the industry is witnessing a strategic shift towards more sustainable production methods, with a notable increase in investments in bio-based butanol technologies aimed at reducing reliance on petrochemical feedstocks and mitigating environmental impact. This trend is driven by stringent environmental regulations and growing consumer preference for eco-friendly products. Furthermore, consolidation activities, including mergers and acquisitions, are shaping the competitive landscape as key players seek to enhance their market share, optimize operational efficiencies, and expand their product portfolios to cater to diverse industrial needs. Innovation in catalytic processes to improve yield and purity of butanol isomers also represents a crucial business trend, ensuring a steady supply for high-growth applications. The market's overall trajectory is positive, reflecting its foundational importance in numerous industrial value chains.

Regional trends indicate that the Asia Pacific (APAC) region continues to dominate the Butyl Alcohol market, primarily due to rapid industrialization, burgeoning construction activities, and the expansive growth of automotive and manufacturing sectors in countries like China, India, and Southeast Asia. This region benefits from favorable government policies supporting manufacturing and the availability of abundant raw materials. North America and Europe, while mature markets, are experiencing growth driven by demand for specialty chemicals, the adoption of advanced coatings, and a strong push towards bio-based chemical production, supported by significant R&D investments. Latin America and the Middle East & Africa (MEA) are emerging as significant growth hubs, fueled by increasing infrastructure development, urbanization, and a rise in manufacturing capabilities, creating new avenues for butyl alcohol consumption.

In terms of segment trends, the n-butanol type continues to hold the largest market share, predominantly owing to its extensive use as a solvent in paints, coatings, and as a chemical intermediate for butyl acrylate and butyl acetate production. However, isobutanol is gaining traction, particularly in the fuel sector as a blending agent and in the production of specialty chemicals due to its superior performance characteristics in specific applications. The application segment for chemical intermediates remains the largest, underscoring butyl alcohol's pivotal role in synthesizing downstream derivatives used in a wide array of products. The paints and coatings end-use industry segment consistently drives demand, followed closely by the automotive and construction sectors. There is a noticeable shift towards high-performance and environmentally compliant formulations, necessitating advanced butyl alcohol derivatives, thereby influencing the innovation landscape across all segments.

AI Impact Analysis on Butyl Alcohol Market

The integration of Artificial Intelligence (AI) across industrial sectors is increasingly influencing traditionally stable markets like Butyl Alcohol, addressing common user questions related to efficiency, sustainability, and predictive capabilities. Users are frequently inquiring about how AI can optimize production processes, minimize waste, and enhance safety protocols within butanol manufacturing plants. There is significant interest in AI's role in improving supply chain resilience, predicting market demand fluctuations, and facilitating the development of novel bio-based butanol synthesis pathways. Key themes emerging from these inquiries include the potential for AI to drive down operational costs, ensure consistent product quality, and accelerate R&D efforts towards more environmentally friendly production methods, thereby making the butanol industry more competitive and sustainable in the long run. Users anticipate that AI will provide smarter resource management and quicker adaptation to market changes.

- AI-driven process optimization: AI algorithms can analyze vast datasets from production facilities to identify inefficiencies, predict equipment failures, and optimize reaction parameters, leading to improved yields and reduced energy consumption in butanol synthesis.

- Enhanced supply chain management: AI can forecast demand patterns with greater accuracy, optimize logistics, and manage inventory levels, thereby reducing lead times, minimizing stockouts, and ensuring a stable supply of butyl alcohol to end-users.

- Accelerated R&D for bio-based production: AI and machine learning tools can significantly speed up the discovery and optimization of microbial strains and fermentation processes for sustainable, bio-based butanol production, reducing the time and cost associated with traditional R&D.

- Predictive maintenance and safety: AI-powered sensors and analytics can monitor plant machinery for potential malfunctions, enabling proactive maintenance and preventing costly downtime or safety hazards in butyl alcohol manufacturing facilities.

- Quality control and assurance: AI can be employed for real-time monitoring of product quality during production, detecting deviations from specifications and ensuring consistency, which is crucial for high-purity butyl alcohol applications.

DRO & Impact Forces Of Butyl Alcohol Market

The Butyl Alcohol market is shaped by a complex interplay of drivers, restraints, and opportunities, alongside significant impact forces that dictate its growth trajectory and competitive landscape. Key drivers include the escalating demand from robust end-use industries such as paints and coatings, where butyl alcohol serves as an essential solvent improving product performance, and the thriving automotive sector which utilizes butanol derivatives in various applications. Furthermore, the rapid pace of industrialization and urbanization in emerging economies, particularly in Asia Pacific, continues to fuel the consumption of butyl alcohol-based products, driving capacity expansions and technological advancements in production. The increasing focus on sustainable chemical production and the development of bio-based butanol through fermentation also act as a significant growth catalyst, opening new avenues for market players.

However, the market faces several notable restraints that could impede its growth. The inherent volatility of crude oil prices directly impacts the cost of petrochemical feedstocks used in conventional butanol production, leading to price fluctuations and uncertainties for manufacturers and consumers alike. Additionally, stringent environmental regulations governing Volatile Organic Compound (VOC) emissions pose challenges for butanol usage in certain solvent applications, pushing industries towards lower-VOC alternatives or more compliant formulations. Health and safety concerns associated with the handling and storage of butyl alcohol, due to its flammability and potential irritant properties, necessitate strict compliance measures, adding to operational complexities and costs. Competition from substitute solvents, although limited in specific high-performance applications, also presents a persistent restraint.

Amidst these challenges, significant opportunities are emerging that promise to redefine the Butyl Alcohol market. The most prominent opportunity lies in the continued development and commercialization of sustainable and bio-based butanol production routes, which offer a compelling alternative to petrochemical-derived butanol and align with global sustainability goals. Expanding into high-growth emerging markets, which are still undergoing significant infrastructural development and industrial expansion, offers untapped potential for increased consumption across various sectors. Furthermore, ongoing technological advancements in catalytic processes and process intensification aim to improve the efficiency, selectivity, and cost-effectiveness of butanol synthesis, making production more competitive. The increasing adoption of butyl alcohol in niche applications, such as specialty chemicals, high-performance polymers, and as an environmentally friendlier fuel oxygenate, also presents avenues for market diversification and value addition, ensuring long-term growth prospects for the industry.

Segmentation Analysis

The Butyl Alcohol market is meticulously segmented to provide a granular understanding of its diverse components and dynamics, offering insights into various product types, applications, and end-use industries. This segmentation is crucial for identifying key growth areas, understanding competitive landscapes, and tailoring strategic approaches. The market is broadly categorized based on the specific isomer of butanol, the primary purpose for which it is used, and the industries that consume it. This detailed breakdown allows for a comprehensive analysis of demand-supply scenarios, technological innovations impacting specific segments, and the influence of regional economic factors on consumption patterns. Each segment demonstrates unique growth drivers and market characteristics, reflecting the versatile nature of butyl alcohol across its extensive value chain.

- By Type

- n-Butanol

- Isobutanol

- tert-Butanol

- sec-Butanol

- By Application

- Solvents

- Chemical Intermediates

- Acrylates

- Glycol Ethers

- Butyl Acetate

- Plasticizers

- Other Esters

- Fuel and Fuel Additives

- Other Applications (including pharmaceuticals, cosmetics, food flavorings, automotive chemicals)

- By End-Use Industry

- Paints & Coatings

- Adhesives & Sealants

- Automotive

- Construction

- Pharmaceuticals

- Cosmetics & Personal Care

- Food & Beverages

- Textiles

- Agrochemicals

- Other Industries

Value Chain Analysis For Butyl Alcohol Market

A comprehensive value chain analysis of the Butyl Alcohol market illuminates the intricate sequence of activities involved from raw material sourcing to the delivery of the final product to end-users, highlighting critical stages and interdependencies. The upstream analysis primarily involves the procurement of key feedstocks, which for conventional butanol production, are predominantly propylene derived from crude oil refining and syngas (carbon monoxide and hydrogen) obtained from natural gas or coal. Companies like chemical majors often integrate backward into cracker operations or have long-term supply agreements for these raw materials, ensuring cost stability and supply security. The efficiency of these upstream processes, including energy consumption and conversion rates in the oxo synthesis or fermentation routes, significantly impacts the overall cost structure and environmental footprint of butanol production. Continuous efforts are made to optimize these raw material conversions through advanced catalysis and process engineering, reducing reliance on volatile fossil fuels and exploring bio-based alternatives.

Moving downstream, butyl alcohol is processed and distributed to a diverse range of industries where it acts as a crucial intermediate or solvent. Downstream activities involve further processing into derivatives such as butyl acetate, butyl acrylate, glycol ethers, and various plasticizers, which are then utilized in formulating paints, coatings, adhesives, plastics, and pharmaceuticals. This stage is characterized by a wide array of specialized chemical manufacturers who leverage butanol's versatile properties to create value-added products tailored to specific application requirements. The effectiveness of this downstream segment is heavily dependent on market demand from these end-use sectors, product innovation, and the ability to meet stringent quality and regulatory standards. Research and development in downstream applications focus on developing high-performance, sustainable, and compliant products that align with evolving consumer preferences and environmental mandates.

The distribution channel for Butyl Alcohol and its derivatives is multifaceted, involving both direct sales and indirect channels through a network of distributors and regional hubs. Major producers often engage in direct sales to large industrial customers, ensuring bulk delivery and personalized technical support. For smaller volume clients or those in geographically dispersed markets, indirect distribution channels play a vital role, leveraging local warehousing, logistics expertise, and customer relationships. These distributors typically handle inventory management, regional transportation, and sometimes even blending or repackaging services. The efficiency and reach of these distribution networks are critical for timely delivery, cost-effectiveness, and market penetration. Both direct and indirect channels are continuously optimized through advanced supply chain management systems and strategic partnerships to ensure seamless product flow from production facilities to the final end-user, minimizing delays and maximizing customer satisfaction in a globally competitive market.

Butyl Alcohol Market Potential Customers

The Butyl Alcohol market serves a diverse array of potential customers across numerous industrial sectors, underlining its foundational role in the global chemical economy. The primary end-users and buyers of butyl alcohol and its derivatives are manufacturers operating in industries that require high-performance solvents, chemical intermediates, or specific functional additives. This broad customer base includes large multinational corporations, medium-sized enterprises, and specialized chemical producers, each leveraging butanol for distinct applications tailored to their product lines. The consistent demand from these varied sectors ensures a stable and expanding market for butyl alcohol producers, necessitating ongoing innovation and supply chain resilience to meet dynamic customer needs and preferences across different geographic regions.

Key segments of potential customers include companies in the paints and coatings industry, where butyl alcohol is extensively used as a solvent for various resins, lacquers, varnishes, and enamels, contributing to improved flow, leveling, and drying properties. Manufacturers of adhesives and sealants are also significant buyers, utilizing butanol derivatives to formulate products with desired viscosity, adhesion strength, and drying rates for applications in construction, automotive, and packaging. The automotive sector, encompassing vehicle manufacturers and aftermarket suppliers, consumes butyl alcohol in the production of brake fluids, hydraulic fluids, and as components in fuel blends, particularly isobutanol as a potential biofuel or oxygenate to enhance combustion efficiency and reduce emissions. These customers prioritize consistent quality and compliance with stringent performance and environmental standards.

Beyond these major sectors, the pharmaceutical industry represents a crucial customer segment, employing butyl alcohol as a solvent for drug synthesis, purification processes, and in the formulation of certain pharmaceutical products. Cosmetic and personal care manufacturers utilize butanol derivatives as solvents, emulsifiers, and dispersants in a wide range of products, from fragrances to nail polishes. The food and beverage industry finds niche applications for butyl alcohol, primarily as a flavoring agent or an extraction solvent in specific processes. Furthermore, manufacturers of plastics, plasticizers, and specialty chemicals rely heavily on butyl alcohol as a building block for synthesizing a variety of esters and other chemical compounds that impart desirable properties to their final products. This extensive customer landscape underscores butyl alcohol's indispensable contribution to modern manufacturing and consumer goods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 15.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow Inc., Eastman Chemical Company, ExxonMobil Corporation, Formosa Plastics Corporation, Sinopec Corp., PETRONAS Chemicals Group Berhad, Sasol Limited, Oxea GmbH, China National Petroleum Corporation (CNPC), LyondellBasell Industries N.V., Mitsubishi Chemical Corporation, LG Chem Ltd., Wanhua Chemical Group Co., Ltd., SABIC, Zhejiang Satellite Petrochemical Co., Ltd., Daesung Industrial Co., Ltd., KH Neochem Co., Ltd., Braskem S.A., Ineos Group Holdings S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Butyl Alcohol Market Key Technology Landscape

The Butyl Alcohol market is characterized by a dynamic technological landscape, driven by continuous innovation aimed at enhancing production efficiency, reducing environmental impact, and diversifying feedstock sources. Traditionally, the predominant technology for butanol production has been the oxo synthesis (hydroformylation) process, also known as the Reppe process, which involves the catalytic reaction of propylene with syngas (carbon monoxide and hydrogen). This process yields n-butyraldehyde and isobutyraldehyde, which are then hydrogenated to produce n-butanol and isobutanol, respectively. Advances in this conventional route focus on improving catalyst selectivity and activity, optimizing reaction conditions to maximize yield, and developing more energy-efficient separation and purification techniques. This includes the use of highly active rhodium-based catalysts and advanced reactor designs that minimize byproduct formation and enhance overall process economics. The reliability and established infrastructure of oxo synthesis continue to make it a cornerstone of butanol production, but sustainability pressures are prompting exploration into alternative methods.

A significant and rapidly evolving segment of the technology landscape is centered around the development and commercialization of bio-based butanol production, primarily through fermentation processes. This innovative approach utilizes renewable feedstocks such as corn, sugarcane, lignocellulosic biomass, and even industrial waste gases as carbon sources for microbial fermentation, predominantly employing Clostridium bacteria strains. The Acetone-Butanol-Ethanol (ABE) fermentation process, historically significant, is being revisited and optimized with advanced metabolic engineering and genetic modification techniques to enhance butanol titers, yields, and solvent tolerance of microorganisms. This bio-butanol technology offers a sustainable alternative to petrochemical routes, significantly reducing the carbon footprint and reliance on fossil fuels. Key technological challenges being addressed include improving fermentation efficiency, reducing downstream separation costs (e.g., via in-situ product recovery methods like gas stripping or membrane separation), and scaling up production to industrial levels economically.

Beyond oxo synthesis and bio-fermentation, other emerging technologies and process enhancements are also contributing to the Butyl Alcohol market. These include advancements in dehydration technologies for producing butenes from bio-butanol, which can then be used to synthesize other chemicals. Additionally, research is ongoing in direct synthesis routes from ethanol or other biomass-derived intermediates, seeking to streamline the production process and further reduce costs. Catalytic advancements, such as heterogeneous catalysis and solid acid catalysts, are being explored for selective butanol production and purification. Furthermore, process intensification, digitalization, and the application of AI and machine learning for predictive modeling and real-time optimization of existing and new butanol plants are becoming increasingly important. These technological innovations collectively aim to make butanol production more cost-effective, environmentally friendly, and responsive to fluctuating market demands, ensuring the long-term viability and growth of the industry.

Regional Highlights

- Asia Pacific (APAC): The APAC region stands as the largest and fastest-growing market for Butyl Alcohol, primarily driven by rapid industrialization, urbanization, and robust growth in the construction, automotive, and manufacturing sectors, particularly in China, India, and Southeast Asian countries. The presence of numerous large-scale chemical production facilities and a growing consumer base for paints, coatings, adhesives, and plastics significantly fuels demand. Government initiatives supporting local manufacturing and infrastructure development further propel the market.

- North America: This region represents a mature yet steadily growing market for Butyl Alcohol, characterized by advanced industrial infrastructure and a strong emphasis on research and development. Demand is sustained by the well-established automotive, construction, and chemical industries. A notable trend in North America is the increasing investment in bio-based butanol production technologies, driven by environmental regulations and a focus on sustainable chemical manufacturing.

- Europe: Europe is another significant market, driven by its sophisticated chemical industry, stringent environmental standards, and a strong push towards sustainable and circular economy practices. While growth may be slower compared to APAC, the demand for high-performance coatings, advanced materials, and specialty chemicals keeps the market robust. The region is at the forefront of adopting bio-based solutions and optimizing existing production processes for greater efficiency and lower emissions.

- Latin America: This region is experiencing considerable growth in the Butyl Alcohol market, spurred by expanding industrialization, particularly in Brazil, Mexico, and Argentina. Increasing investments in infrastructure projects, a growing automotive manufacturing base, and rising disposable incomes contributing to consumer goods demand are key drivers. The market here benefits from a rich agricultural base that supports potential bio-based feedstock development.

- Middle East and Africa (MEA): The MEA region is emerging as a significant market, fueled by ongoing infrastructure development, diversification efforts away from oil economies, and growing manufacturing capabilities. Countries in the GCC region, alongside South Africa, are investing in chemical production capacities and downstream industries. Demand for paints, coatings, and construction materials, alongside the expansion of automotive and industrial sectors, underpins market expansion in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Butyl Alcohol Market.- BASF SE

- Dow Inc.

- Eastman Chemical Company

- ExxonMobil Corporation

- Formosa Plastics Corporation

- Sinopec Corp.

- PETRONAS Chemicals Group Berhad

- Sasol Limited

- Oxea GmbH

- China National Petroleum Corporation (CNPC)

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- LG Chem Ltd.

- Wanhua Chemical Group Co., Ltd.

- SABIC

- Zhejiang Satellite Petrochemical Co., Ltd.

- Daesung Industrial Co., Ltd.

- KH Neochem Co., Ltd.

- Braskem S.A.

- Ineos Group Holdings S.A.

Frequently Asked Questions

Analyze common user questions about the Butyl Alcohol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Butyl Alcohol and what are its primary uses?

Butyl alcohol, also known as butanol, is a four-carbon alcohol available in various isomeric forms such as n-butanol, isobutanol, sec-butanol, and tert-butanol. It is primarily used as an industrial solvent in paints, coatings, and adhesives due to its excellent solvency and low volatility. Additionally, it serves as a critical chemical intermediate in the production of esters, acrylates, glycol ethers, and plasticizers, finding applications in the automotive, pharmaceutical, and cosmetic industries.

What are the main drivers of growth for the Butyl Alcohol market?

The primary drivers include the escalating demand from end-use industries like paints & coatings, automotive, and construction, particularly in rapidly industrializing regions. The increasing use of butyl alcohol as a versatile chemical intermediate and the growing emphasis on developing sustainable, bio-based butanol production methods also significantly contribute to market expansion.

What are the key types of Butyl Alcohol and their distinct applications?

The main types are n-butanol and isobutanol. n-Butanol is widely used as a solvent in lacquers and enamels and as an intermediate for butyl acetate and butyl acrylate. Isobutanol is often preferred in some coating formulations for improved flow and gloss, and it is gaining traction as a potential biofuel or fuel additive due to its higher octane rating and lower vapor pressure compared to ethanol.

What challenges or restraints does the Butyl Alcohol market face?

Key challenges include the volatility of crude oil prices, which directly impacts the cost of petrochemical feedstocks for conventional butanol production. Additionally, stringent environmental regulations concerning Volatile Organic Compound (VOC) emissions pose a restraint, pushing industries towards lower-VOC alternatives. Health and safety concerns associated with handling butanol also add to operational complexities.

What is the future outlook for bio-based Butyl Alcohol production?

The future outlook for bio-based butanol is highly promising. Driven by sustainability mandates and advancements in biotechnology, researchers and companies are increasingly investing in fermentation processes using renewable feedstocks. This offers a greener alternative to traditional petrochemical routes, aiming to reduce carbon footprint and reliance on fossil fuels, making bio-butanol a significant growth opportunity and a key focus for market diversification and innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Butyl Alcohol (1-Butanol) Market Statistics 2025 Analysis By Application (Fermentation, Chemical Synthsis), By Type (Biobutanol, Chemical Butanol), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Butyl Alcohol (1-Butanol) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Biobutanol, Chemical Butanol), By Application (Biofuel, Synthetic Raw Materials, Solvent, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager