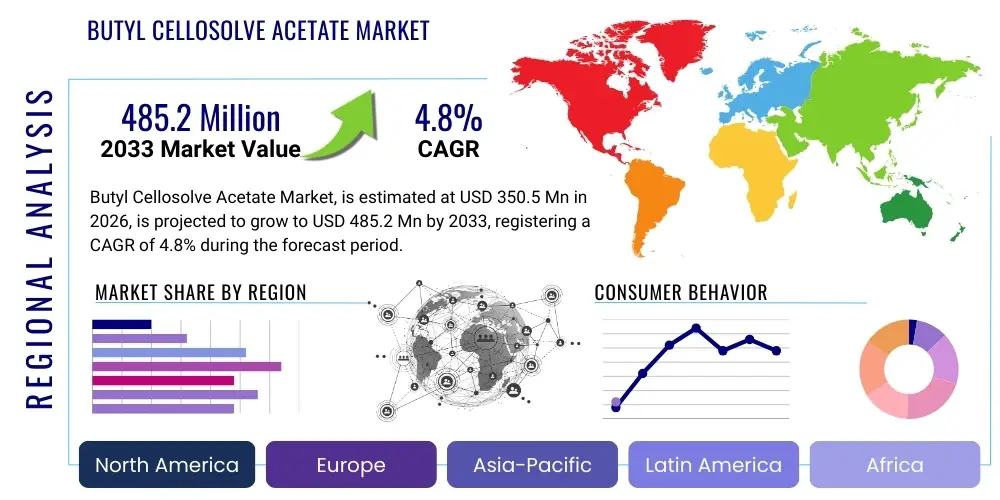

Butyl Cellosolve Acetate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437794 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Butyl Cellosolve Acetate Market Size

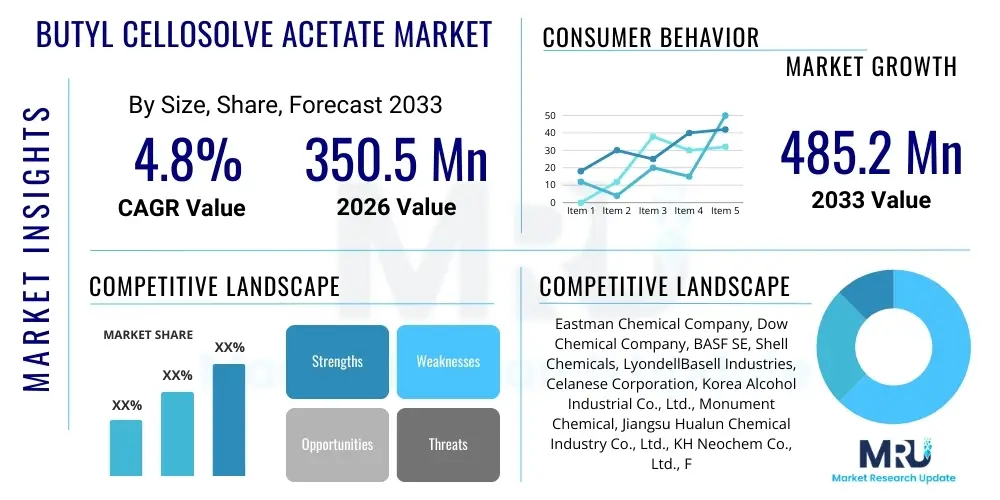

The Butyl Cellosolve Acetate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 485.2 Million by the end of the forecast period in 2033.

Butyl Cellosolve Acetate Market introduction

Butyl Cellosolve Acetate (BCA), also known chemically as 2-butoxyethyl acetate, is a colorless liquid characterized by its mild, fruity odor and exceptional solvency power. It serves primarily as a high-performance, slow-evaporating solvent with high dilution ratio and good flow-out properties, making it indispensable across various industrial applications. BCA is derived from the reaction between ethylene oxide and n-butanol, followed by esterification with acetic acid. Its chemical structure allows it to effectively dissolve a wide range of natural and synthetic resins, including epoxies, acrylics, and alkyds, which are critical components in the formulation of coatings and inks. The stability and low volatility of BCA ensure optimal film formation and leveling properties in surface treatment applications.

The primary applications driving the demand for BCA are the coatings, paints, and protective finishes sectors. It is extensively used in high-solid automotive coatings, coil coatings, and wood lacquers where controlled evaporation rates and strong solvency are essential for achieving smooth, durable finishes. Furthermore, its excellent compatibility with other organic solvents and water-based systems makes it a crucial coalescent and viscosity modifier. Beyond coatings, BCA finds significant utility in the printing ink industry, particularly for gravure and flexographic inks, where it enhances pigment dispersion and controls drying time on diverse substrates. The chemical cleaning industry also utilizes BCA formulations due to its ability to dissolve difficult oil and grease residues.

Key market drivers fueling the expansion of the Butyl Cellosolve Acetate market include rapid urbanization, leading to increased construction activities and demand for protective and decorative paints, especially in the Asia Pacific region. The rising production volumes in the automotive industry, which relies heavily on high-quality BCA-based OEM and refinish coatings, further stimulate growth. Additionally, the inherent benefits of BCA, such as superior gloss retention and enhanced film hardness, continue to position it favorably against substitute solvents, particularly in applications demanding premium performance. However, regulatory scrutiny regarding VOC emissions poses a persistent challenge, pushing manufacturers towards developing lower-VOC formulations or exploring bio-based alternatives, which simultaneously creates innovation opportunities within the existing market framework.

Butyl Cellosolve Acetate Market Executive Summary

The Butyl Cellosolve Acetate market exhibits steady growth, primarily propelled by the robust expansion of the global construction and automotive sectors, particularly in emerging economies. Major business trends emphasize product reformulation aimed at reducing Volatile Organic Compound (VOC) content to comply with stringent environmental regulations, driving innovation towards high-solids and waterborne coating systems where BCA acts as an effective coalescing agent. Strategic acquisitions and vertical integration among major chemical producers are prominent, securing raw material supply (ethylene oxide and n-butanol) and optimizing production efficiencies to maintain competitive pricing. The shift towards sustainable manufacturing practices and the development of bio-based solvent precursors are key long-term investment areas for market leaders, ensuring future compliance and market relevance.

Regionally, the Asia Pacific (APAC) market dominates both consumption and production volumes, largely attributed to rapid industrialization, infrastructure development in China and India, and the proliferation of local automotive manufacturing hubs. North America and Europe, while mature, focus intensely on premium, low-emission coatings, thus maintaining high value consumption of BCA, often utilizing it in highly specialized industrial applications like aerospace and marine coatings. Segment trends underscore the paints and coatings application segment as the largest revenue generator, demanding consistent supply of high-purity BCA. Simultaneously, the cleaning and electronics segments are growing rapidly, driven by industrial maintenance needs and the requirement for precise, residue-free cleaning agents in semiconductor manufacturing, diversifying the overall market demand profile.

AI Impact Analysis on Butyl Cellosolve Acetate Market

User queries regarding the impact of Artificial Intelligence (AI) on the Butyl Cellosolve Acetate market center around themes of optimizing synthesis processes, improving supply chain resilience, and predicting volatile raw material pricing. Users are concerned about how machine learning can be leveraged to manage inventory of hazardous materials like BCA effectively, and whether AI-driven formulation platforms can accelerate the shift towards low-VOC products by precisely predicting solvent performance metrics. Key expectations revolve around using AI for predictive maintenance in large-scale production facilities to ensure consistent quality and output, and utilizing advanced analytics to forecast demand fluctuations across diverse end-use sectors (automotive vs. construction), thereby maximizing operational efficiency and minimizing waste inherent in traditional batch production models.

- AI optimizes reaction conditions in BCA synthesis, enhancing yield and purity while reducing energy consumption.

- Machine learning algorithms predict fluctuations in raw material costs (n-butanol, acetic acid, ethylene oxide), enabling proactive procurement strategies.

- Predictive maintenance schedules, managed by AI, reduce downtime in complex chemical processing units.

- AI-driven simulation tools accelerate the development of new low-VOC coating formulations utilizing BCA, meeting regulatory demands faster.

- Advanced logistics planning and supply chain optimization using AI ensure efficient, secure transportation of bulk BCA shipments globally.

- AI analytics facilitate personalized customer formulation recommendations based on specific substrate and performance requirements, enhancing market penetration.

DRO & Impact Forces Of Butyl Cellosolve Acetate Market

The Butyl Cellosolve Acetate market is influenced by dynamic internal and external forces. Key drivers include the strong demand from the automotive refinish market for high-quality solvents that ensure superior gloss and flow, alongside burgeoning infrastructure and real estate developments globally, particularly in Asia. However, the market faces significant restraints, primarily regulatory pressures imposing stringent limits on VOC emissions, necessitating substantial R&D investment in compliance technologies. Opportunities arise from the increasing adoption of high-solids and powder coatings where BCA remains a critical additive, and the potential expansion into emerging applications such as electronics manufacturing and specialized industrial cleaning. These factors collectively create a competitive landscape where innovation in greener production methods and strategic regional expansion dictate success, shaping the overall trajectory and profitability of market participants.

Drivers are strongly linked to industrial expansion. The global shift towards performance-driven coatings in aerospace, marine, and industrial maintenance sectors requires solvents that can withstand harsh environmental conditions, a role perfectly suited for BCA due to its inherent stability and high flash point. The increasing preference for durable, long-lasting coatings in infrastructure projects, such as bridges and pipelines, further solidifies its demand base. Furthermore, BCA's efficacy as a coupling agent in waterborne systems allows formulators to bridge the gap between performance demands and environmental mandates, maintaining its relevance even as the industry pivots away from traditional solvent-based systems.

The main restraining factor is the ongoing pressure from agencies like the EPA and REACH to reduce toxic air contaminants. This drives the search for direct replacements or requires manufacturers to invest heavily in advanced capture and treatment technologies. However, this challenge simultaneously creates a vital opportunity: the development of specialty, high-ppurity BCA grades optimized for use in complex, low-emission formulations that command premium pricing. The market impact forces dictate that companies focusing on operational sustainability, securing stable, cost-effective raw material procurement, and exhibiting flexibility in reformulation will capture market share. The high impact force of substitution risk (driven by ethanol-based or bio-based solvent alternatives) necessitates continuous product differentiation based on superior technical performance.

- Drivers:

- Increased demand from the rapidly expanding architectural and decorative coatings industry, driven by global construction activities.

- Superior solvency and low evaporation rate make it ideal for high-performance automotive OEM and refinish coatings.

- Growth in printing and packaging industries requiring high-quality gravure and flexographic inks.

- Effective coalescing properties in waterborne coating systems, bridging the performance gap with traditional solvents.

- Restraints:

- Strict governmental regulations concerning VOC emissions and hazardous air pollutants (HAPs) in North America and Europe.

- Volatility in the prices of key petrochemical feedstocks, including n-butanol and ethylene oxide.

- Availability and increasing market penetration of potential substitute solvents, particularly bio-based alternatives.

- Opportunities:

- Development of high-purity grades for sensitive electronics and semiconductor cleaning applications.

- Expansion into specialized industrial applications such as aerospace and marine maintenance coatings.

- Technological advancements in green chemistry leading to sustainable, low-carbon production methods for BCA.

- Impact Forces:

- High regulatory scrutiny (VOC limits) forcing formulation changes (Medium-High Impact).

- Strong raw material supply chain integration among leading manufacturers (Medium Impact).

- End-user demand for high-durability, premium finishes (High Impact).

Segmentation Analysis

The Butyl Cellosolve Acetate market is primarily segmented based on purity level, application type, and regional geography, reflecting the varied requirements of industrial users. Purity segmentation often dictates suitability for specialized applications, such as high-purity grades required for electronics manufacturing versus technical grades used in general industrial cleaning. The application analysis confirms the dominance of the paints and coatings sector, which consumes the largest volume due to BCA's role in controlling viscosity and enhancing the flow of complex resin systems. Understanding these segmentations is critical for market players to tailor their production, distribution, and marketing strategies, focusing resources on high-growth segments like specialized inks or demanding regional markets like APAC.

- By Purity Type:

- Technical Grade

- High Purity/Electronic Grade

- By Application:

- Paints and Coatings (Architectural, Automotive OEM, Automotive Refinish, Industrial, Marine)

- Printing Inks (Flexographic and Gravure)

- Industrial Cleaners and Degreasers

- Adhesives and Sealants

- Chemical Intermediates and Solvents in Pharmaceuticals

- By End-Use Industry:

- Construction

- Automotive

- Electronics and Semiconductors

- Printing and Packaging

- Others (Aerospace, Marine)

Value Chain Analysis For Butyl Cellosolve Acetate Market

The value chain for Butyl Cellosolve Acetate begins with the upstream procurement of essential petrochemical raw materials: n-butanol, ethylene oxide, and acetic acid. Since BCA is a derivative of these commodity chemicals, the upstream segment is characterized by reliance on large petrochemical complexes and sensitivity to global crude oil and natural gas prices, which directly impact production costs. Key activities at this stage involve securing long-term contracts for feedstock supply, often leading to vertical integration by major chemical producers to mitigate volatility and ensure consistent supply quantity and quality. The manufacturing phase involves proprietary esterification processes, demanding strict quality control and adherence to environmental and safety standards due to the nature of the reactants. Efficiency and yield optimization in this stage determine the final cost competitiveness of BCA.

The midstream phase encompasses the manufacturing and initial distribution of the finished BCA product. Producers utilize centralized or regional production facilities, focusing on achieving specific purity levels (technical vs. electronic grade). Distribution channels are critical, handling the storage and transportation of BCA, which often requires specialized tankers and compliance with international hazardous goods shipping regulations. Distribution occurs through two main channels: direct sales, where large volume purchasers (e.g., major coating manufacturers) receive shipments directly from the producer, facilitating customized logistics and bulk discounts; and indirect sales, involving regional distributors, specialty chemical traders, and local agents who cater to smaller volume users and geographically dispersed clients, providing localized inventory management and technical support.

The downstream segment involves the incorporation of BCA into finished products by end-use manufacturers and subsequent delivery to the final consumer. End-users, such as major paint companies (Sherwin-Williams, PPG) or printing ink manufacturers (Sun Chemical), rely on BCA for its functional attributes in their formulations. Their demand is highly inelastic regarding quality but sensitive to price fluctuations. The market dynamics are characterized by rigorous quality testing at the downstream level to ensure the final product meets regulatory and performance standards. The efficiency of the distribution network, particularly the ability of distributors to handle just-in-time delivery for high-volume manufacturing clients, significantly affects the overall profitability and efficiency of the entire BCA value chain, ultimately reaching consumers via hardware stores, automotive repair centers, or industrial supply chains.

Butyl Cellosolve Acetate Market Potential Customers

The primary potential customers and buyers of Butyl Cellosolve Acetate are large-scale manufacturers operating within industrial sectors requiring high-performance solvents, coalescents, and chemical intermediates. Key buyers include global paint and coating giants who consume vast quantities of BCA for their architectural, industrial maintenance, and automotive finish product lines. These customers demand consistent, high-purity supply, often procured under long-term supply agreements. Another significant customer base consists of manufacturers of printing inks, specifically those producing flexographic and gravure inks for high-speed packaging and publication printing, where precise drying control is paramount.

Secondary but rapidly growing customer segments include specialized industrial cleaning and degreasing formulators, particularly those servicing heavy machinery, aerospace components, and electronic assemblies where mild yet powerful solvency is required. Furthermore, major chemical companies utilize BCA as a chemical intermediate in the synthesis of specialized resins and plasticizers. Geographically, potential customers are concentrated in heavily industrialized areas, particularly manufacturing clusters in China, India, Western Europe (Germany, France), and North America, where regulatory compliance and product performance are equally critical purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 485.2 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eastman Chemical Company, Dow Chemical Company, BASF SE, Shell Chemicals, LyondellBasell Industries, Celanese Corporation, Korea Alcohol Industrial Co., Ltd., Monument Chemical, Jiangsu Hualun Chemical Industry Co., Ltd., KH Neochem Co., Ltd., Fuxin Chemical Co., Ltd., China Petroleum and Chemical Corporation (Sinopec), PCC Group, Jiangnan Chemical Industry Co., Ltd., Chang Chun Group, Lotte Chemical Corporation, Solvay S.A., Ashland Global Holdings Inc., Taminco (a subsidiary of Eastman), Mitsubishi Chemical Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Butyl Cellosolve Acetate Market Key Technology Landscape

The technological landscape of the Butyl Cellosolve Acetate market is predominantly focused on improving synthesis efficiency, enhancing product purity, and, critically, developing greener, more sustainable manufacturing routes. The traditional method for producing BCA involves the etherification of ethylene glycol followed by esterification, or directly reacting ethylene oxide with n-butanol to form butyl cellosolve (ethylene glycol mono-n-butyl ether), which is then acetylated using acetic acid or acetic anhydride. Recent technological advancements center around optimizing catalyst systems—moving from homogeneous acid catalysts to heterogeneous catalysts—to increase reaction selectivity, reduce processing temperatures and pressures, thereby lowering energy costs and minimizing waste streams, aligning with global green chemistry initiatives.

A significant area of technological innovation involves refining and purification technologies, particularly for producing Electronic Grade BCA. This ultra-high purity grade, essential for cleaning sensitive components in semiconductor and flat panel display manufacturing, requires sophisticated distillation and membrane separation techniques to remove trace impurities, heavy metals, and moisture to parts per billion levels. Companies are investing in continuous process flow reactors over traditional batch processing to achieve higher throughput, better consistency, and smaller manufacturing footprints. Furthermore, digitalization is increasingly integrated into production, employing advanced process control (APC) systems to monitor reaction variables in real-time, ensuring optimal yield and prompt quality adjustments.

In response to regulatory demands, the market is witnessing R&D focused on utilizing bio-based feedstocks derived from renewable resources like cellulosic biomass or sugar fermentation for n-butanol and acetic acid production. Although currently minor in scale, this technological pivot aims to reduce the petrochemical dependency of BCA, future-proofing the solvent against volatility in fossil fuel markets and enhancing its appeal in environmentally conscious supply chains. Overall, the key technology strategy involves a dual focus: optimizing existing high-volume production for cost and purity, and pioneering sustainable chemical processes to secure long-term regulatory compliance and environmental stewardship.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for Butyl Cellosolve Acetate, driven primarily by the colossal expansion of the construction and infrastructure sectors in China, India, and Southeast Asian nations. The region is characterized by substantial domestic production capacity, often benefiting from lower operating costs and flexible regulatory environments compared to the West. High demand for automotive OEM coatings, coupled with increased consumption of printing inks due to the thriving packaging industry, fuels volume growth. While environmental regulations are tightening, the sheer scale of industrial output keeps BCA consumption high. Key investment areas include expanding manufacturing hubs in coastal regions and penetrating new industrial clusters in Tier 2 and Tier 3 cities.

- North America: North America is a mature market distinguished by a strong emphasis on high-performance and specialty applications, particularly in the aerospace, marine, and specialized industrial maintenance segments. Market growth here is stable and value-driven rather than volume-driven. Strict enforcement of VOC emission standards (led by agencies like the EPA and state-level bodies like CARB) mandates the use of BCA predominantly in highly controlled, low-VOC or high-solids formulations, including its function as a high-efficiency coalescent in compliant waterborne paints. Major consumers are concentrated in the US and Canada, focusing on premium-quality goods, necessitating high-purity product grades and robust supply chain reliability.

- Europe: The European market is highly regulated, primarily governed by the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) framework, which influences product handling, usage limits, and substitution efforts. Despite regulatory challenges, Europe remains a crucial consumer due to its robust automotive manufacturing base (Germany, France) and specialized industrial coatings sector. Demand is increasingly centered on sophisticated coating systems requiring complex solvent blends, where BCA offers optimal performance. Manufacturers in this region prioritize efficiency and sustainability, often leading global efforts in developing bio-based alternatives and optimizing production via continuous processing technologies to meet stringent environmental metrics.

- Latin America (LATAM): The LATAM region, led by Brazil and Mexico, demonstrates moderate growth potential, supported by revitalized construction projects and growing automotive assembly operations. Market dynamics are highly sensitive to economic stability and currency fluctuations. BCA demand largely serves domestic architectural coatings and industrial paints. While regulatory frameworks are less stringent than in Europe, the region often relies on imports or local blending operations by multinational companies, making efficient regional logistics and localized distribution critical success factors.

- Middle East and Africa (MEA): MEA is a niche, yet expanding market, heavily influenced by petrochemical production in the Middle East and significant infrastructure projects in the GCC countries. The demand is primarily focused on protective coatings necessary for the oil and gas infrastructure, maritime applications, and the burgeoning real estate sector. South Africa represents the largest consumption hub in Africa. The region’s growth trajectory is tied to global oil prices and governmental spending on diversification projects, driving the need for durable, anti-corrosion BCA-based paint systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Butyl Cellosolve Acetate Market.- Eastman Chemical Company

- Dow Chemical Company

- BASF SE

- Shell Chemicals

- LyondellBasell Industries

- Celanese Corporation

- Korea Alcohol Industrial Co., Ltd.

- Monument Chemical

- Jiangsu Hualun Chemical Industry Co., Ltd.

- KH Neochem Co., Ltd.

- Fuxin Chemical Co., Ltd.

- China Petroleum and Chemical Corporation (Sinopec)

- PCC Group

- Jiangnan Chemical Industry Co., Ltd.

- Chang Chun Group

- Lotte Chemical Corporation

- Solvay S.A.

- Ashland Global Holdings Inc.

- Taminco (a subsidiary of Eastman)

- Mitsubishi Chemical Corporation

Frequently Asked Questions

Analyze common user questions about the Butyl Cellosolve Acetate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Butyl Cellosolve Acetate primarily used for in industry?

BCA is predominantly used as a high-performance, slow-evaporating solvent and coalescing agent in the formulation of protective and decorative coatings, including automotive finishes, industrial paints, and specialized printing inks. Its key benefit is promoting excellent film flow and gloss retention.

How does VOC regulation impact the future demand for BCA?

Stringent VOC regulations require manufacturers to limit solvent usage. While this poses a restraint, BCA remains critical as an efficient coalescent in high-solids and waterborne systems, meaning its role shifts from a primary solvent to a high-efficiency additive, sustaining demand in compliant formulations.

Which geographical region holds the largest market share for BCA?

The Asia Pacific (APAC) region currently holds the largest market share, driven by extensive construction activities, rapid industrialization, and high volumes of automotive manufacturing and printing ink production, particularly in economic centers like China and India.

What are the main raw materials required for manufacturing Butyl Cellosolve Acetate?

The primary feedstocks required for BCA synthesis are petrochemical derivatives: n-butanol, ethylene oxide, and acetic acid. Price volatility in these upstream commodity markets directly influences the production cost and pricing structure of BCA.

Is Butyl Cellosolve Acetate classified as a hazardous chemical?

Yes, BCA is generally classified as a combustible liquid with moderate flammability and specific health hazards. Consequently, its manufacturing, storage, and transportation are subject to strict regulatory oversight, necessitating specialized handling protocols and compliance with international hazardous goods standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager