Butyl Extruder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432462 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Butyl Extruder Market Size

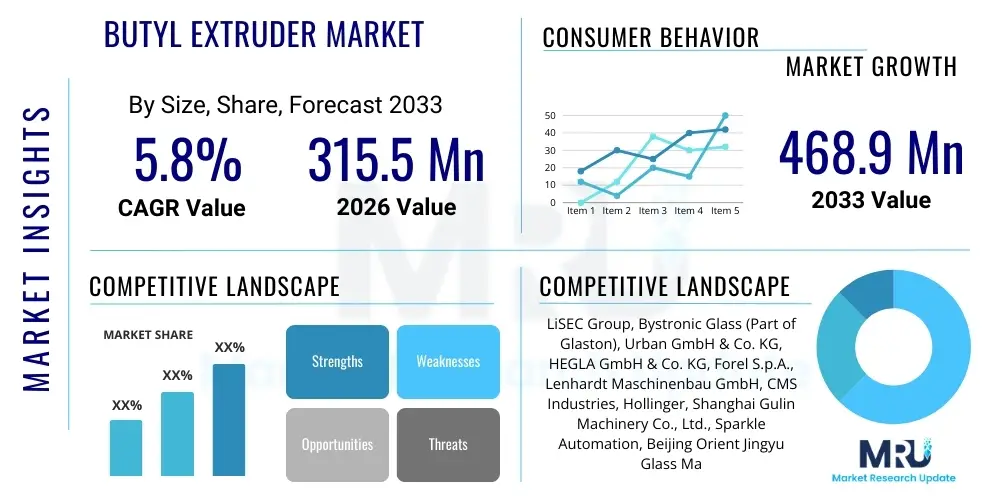

The Butyl Extruder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 315.5 Million in 2026 and is projected to reach USD 468.9 Million by the end of the forecast period in 2033.

Butyl Extruder Market introduction

The Butyl Extruder Market revolves around specialized machinery essential for the manufacturing of high-quality insulating glass (IG) units and specific sealing applications in the automotive sector. Butyl extruders are engineered systems designed to apply a precise, uniform bead of primary sealant (butyl rubber) onto the spacer frames of IG units, providing an initial moisture and gas barrier crucial for the longevity and thermal performance of the window. This equipment is fundamental to maintaining the integrity of the sealed airspace within double or triple pane windows, meeting stringent energy efficiency standards globally. The core function of the machine is to melt and extrude the thermoplastic butyl sealant material at controlled temperatures and pressures, ensuring perfect adhesion to various frame materials such as aluminum, stainless steel, or composites.

The primary application driving the demand for butyl extruders is the rapidly expanding insulating glass manufacturing sector. Modern construction practices heavily favor energy-efficient building envelopes, necessitating the widespread adoption of high-performance windows. Butyl extruders offer significant benefits to manufacturers, including enhanced production speed, superior sealant consistency, and reduced material waste compared to manual application methods. The precision offered by automated butyl extrusion systems directly translates into improved product quality and reduced failure rates of IG units, positioning these machines as vital assets for window fabricators aiming for high volume and quality output.

Key factors driving market growth include increasing governmental regulations mandating energy conservation in residential and commercial buildings, particularly in North America and Europe. Furthermore, advancements in automation technology, allowing for seamless integration of extruders into larger IG production lines, are improving operational efficiencies and justifying the initial capital investment. The continuous innovation in butyl material formulations, requiring specialized extrusion capabilities, also supports the demand for technologically advanced machinery, thereby sustaining robust market expansion throughout the forecast period.

Butyl Extruder Market Executive Summary

The global Butyl Extruder Market is characterized by moderate growth, primarily fueled by the accelerating transition towards energy-efficient building codes and the subsequent increase in demand for high-performance insulating glass (IG) units. Business trends indicate a strong industry focus on automation and digitalization, where manufacturers are increasingly investing in fully automatic butyl extrusion lines capable of handling diverse spacer types and sizes with minimal manual intervention. This shift is driven by the necessity to reduce labor costs, enhance sealing precision, and boost overall throughput to meet large-scale construction demands. Competitive strategies emphasize offering integrated production solutions, bundling extruders with washing machines, and pressing lines, thereby providing turnkey solutions to IG fabricators.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive urbanization, infrastructure development, and rising awareness regarding sustainable building practices in countries like China and India. North America and Europe maintain leading positions, primarily due to established stringent energy efficiency standards and the high rate of residential window replacement and refurbishment projects. Segment trends highlight the dominance of fully automatic butyl extruders over semi-automatic variants, driven by the push for high volume manufacturing and consistent quality. Furthermore, the application segment is overwhelmingly dominated by the insulating glass industry, though niche growth opportunities exist within specialized automotive glass assembly.

Overall, the market trajectory is positive, reflecting the essential nature of butyl extrusion technology in the modern fenestration industry. The synthesis of technological advancements, particularly those enabling faster cycle times and better material utilization, coupled with favorable regulatory environments globally, positions the Butyl Extruder Market for sustained expansion. Key stakeholders are prioritizing R&D efforts focusing on improving machine responsiveness, integrating Industry 4.0 concepts for predictive maintenance, and ensuring compatibility with next-generation high-performance sealants.

AI Impact Analysis on Butyl Extruder Market

User queries regarding AI integration in the Butyl Extruder Market frequently center on themes of predictive maintenance, optimization of extrusion parameters, and quality control automation. Users are particularly interested in how Artificial Intelligence can minimize material waste, reduce machine downtime, and ensure flawless application consistency across high-volume production runs. Key concerns often revolve around the complexity of integrating AI algorithms with existing legacy machinery and the necessary training required for operational staff. The consensus expectation is that AI will transform butyl extrusion from a manual or semi-automated process into a highly autonomous system capable of self-correction and continuous performance improvement, thereby dramatically increasing the efficiency and reliability of insulating glass manufacturing lines.

AI technology integration in butyl extrusion systems is poised to revolutionize operational efficiency by enabling real-time monitoring and adjustment capabilities. Machine learning algorithms can analyze vast datasets concerning temperature, pressure, sealant viscosity, and ambient humidity simultaneously, predicting potential application defects before they occur. This proactive approach ensures optimal sealant bead geometry and thickness, drastically reducing the rejection rate of high-cost insulating glass units. Furthermore, computer vision systems, powered by AI, can instantly detect microscopic flaws in the applied butyl sealant, providing immediate feedback for process adjustments, which is critical for compliance with rigorous industry standards like EN 1279.

The adoption of AI-driven predictive maintenance (PdM) is a significant trend, allowing manufacturers to move beyond time-based or reactive maintenance schedules. AI models analyze sensor data (vibration, thermal profiles, energy consumption) to forecast equipment failure, optimizing maintenance schedules precisely when required. This capability extends the lifespan of expensive components, minimizes unforeseen downtime, and ensures that the high-temperature systems within the extruder operate within peak efficiency parameters. Such integration enhances the overall asset utilization rate, providing a strong competitive advantage to IG manufacturers utilizing these advanced extrusion systems.

- AI-driven Predictive Maintenance (PdM) extends component lifespan and reduces unplanned downtime by forecasting equipment failure.

- Real-time parameter optimization through Machine Learning algorithms ensures consistent bead application, minimizing material waste.

- Computer Vision systems powered by AI perform instantaneous quality control checks on sealant application, identifying and reporting defects immediately.

- Integration of smart sensors allows for continuous monitoring of butyl viscosity and temperature, leading to self-adjusting extrusion rates.

- AI supports energy optimization by fine-tuning heating element cycles based on real-time production requirements and ambient conditions.

- Automated fault diagnosis reduces troubleshooting time, enabling faster return to operational status following minor interruptions.

DRO & Impact Forces Of Butyl Extruder Market

The market dynamics for Butyl Extruders are heavily influenced by the global push for sustainability in construction, balanced against inherent operational complexities and high initial investment thresholds. Strong regulatory drivers, particularly the adoption of stricter U-factor and R-value requirements for building envelopes, directly stimulate demand for the machinery required to produce superior insulating glass (IG) units. However, the high capital expenditure associated with purchasing and implementing sophisticated, fully automatic extrusion lines acts as a significant barrier, especially for smaller-scale fabricators. Opportunities arise from technological advancements, such as the increasing demand for triple-glazed units and the integration of Industry 4.0 principles, allowing manufacturers to enhance efficiency and product quality. These conflicting and reinforcing factors create a dynamic environment where market growth is robust but highly sensitive to macroeconomic conditions and construction expenditure levels.

Drivers are centered on the necessity for improved energy performance in buildings globally. The escalating cost of energy, coupled with governmental incentives and mandatory standards for energy-efficient windows, ensures continuous investment in IG production equipment. Furthermore, the rising prominence of automated manufacturing processes across various industries mandates the replacement of older, less precise semi-automatic extruders with high-speed, fully integrated models. The increasing usage of complex spacer systems (e.g., warm edge spacers) necessitates precision application capabilities that only modern butyl extruders can reliably provide, securing their role as indispensable components in the fenestration supply chain.

Restraints primarily concern the financial commitment required. Butyl extruders, particularly top-tier automated systems, represent a substantial capital outlay, which can deter entry or expansion in emerging markets. Additionally, the operational requirement for specialized maintenance knowledge and high-purity butyl sealant materials introduces complexities that affect overall running costs. Economic volatility, particularly in the housing and commercial construction sectors, can lead to delayed capital equipment purchases, temporarily constraining market expansion. Managing the temperature-sensitive butyl material and ensuring zero contamination throughout the extrusion process also presents ongoing operational challenges.

Opportunities are emerging from niche applications and advanced manufacturing techniques. The growing preference for complex architectural glass, requiring bespoke shapes and larger sizes of IG units, drives demand for highly flexible and programmable extruders. Furthermore, the integration of automation technologies like robotics and AI allows manufacturers to achieve unprecedented levels of precision and throughput. The move towards fully integrated production lines, where the extruder is seamlessly linked to the washing and pressing stages, presents manufacturers with opportunities to offer superior, streamlined production solutions, catering to the growing need for high efficiency in large-scale glass fabrication facilities.

Drivers

- Strict Governmental Regulations Pertaining to Energy Efficiency: Mandates for lower U-values in new constructions and refurbishment projects globally.

- Surging Demand for Insulating Glass (IG) Units: Increased adoption of double and triple glazing in residential and commercial sectors.

- Technological Advancements in Automation: Integration of fully automatic, high-speed extruders enhancing precision and throughput.

- Increasing Popularity of Warm Edge Spacer Technology: Requires high-precision butyl application capabilities for optimal performance.

Restraints

- High Initial Capital Investment: Significant cost associated with purchasing advanced, automated butyl extruder machinery.

- Volatility in Construction Sector Investment: Economic downturns or slowdowns in housing starts directly impact equipment purchasing decisions.

- Requirement for Specialized Maintenance Personnel: Complexity of machinery demands skilled labor for optimal operation and upkeep.

Opportunities

- Expansion into Emerging Markets: Rapid infrastructure development and rising energy efficiency standards in Asia Pacific and Latin America.

- Adoption of Industry 4.0 and AI Integration: Implementation of smart manufacturing processes for predictive maintenance and process optimization.

- Demand for Customized and Oversized Architectural Glass: Requires flexible and highly programmable extrusion systems.

Segmentation Analysis

The Butyl Extruder Market is primarily segmented based on the level of automation (Type), the end-use application, and the geographic region. Understanding these segments is crucial for stakeholders to identify key growth areas and tailor their product offerings effectively. The segmentation by Type, specifically the distinction between Automatic and Semi-Automatic machines, is the most crucial differentiator in terms of market value and technological advancement, reflecting the industry's shift towards high-speed, integrated production environments. Automatic extruders command a larger market share due to their ability to provide consistent sealing quality at much higher volumes, essential for serving the massive demand from large-scale IG unit fabricators.

Application segmentation reveals the fundamental reliance of the market on the Insulating Glass industry, which is the dominant consumer of butyl extrusion technology. While other applications, such as specialized sealing in automotive glass and certain construction component manufacturing, exist, the overwhelming driver remains the production of energy-efficient windows for both residential and commercial buildings. The need for primary sealing (butyl) and secondary sealing (polyurethane or silicone) in IG units makes the butyl extruder an indispensable piece of equipment, directly linking the market's health to global construction trends and regulatory mandates for thermal efficiency.

Geographically, market segmentation highlights the varying levels of technology adoption and maturity across regions. While Europe and North America possess mature markets characterized by replacement demand and stringent quality requirements, Asia Pacific is experiencing explosive growth driven by massive new construction volumes and increasing adoption of Western building standards. This geographical diversity necessitates specialized sales and distribution strategies, often requiring suppliers to offer a range of machinery types, from robust, highly customized automatic systems for developed markets to more cost-effective, durable semi-automatic options suitable for emerging industrial setups.

- By Type:

- Automatic Butyl Extruders

- Semi-Automatic Butyl Extruders

- By Application:

- Insulating Glass Manufacturing (IG Units)

- Automotive Glass Sealing

- Other Industrial Sealing Applications

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Butyl Extruder Market

The value chain for the Butyl Extruder Market begins with the upstream analysis, encompassing the sourcing and manufacturing of critical components and materials. Key inputs include high-precision mechanical parts (e.g., pumps, nozzles, heating elements, frames), advanced electronic control systems (PLCs, HMI interfaces), and raw materials like steel and specialized alloys for robust construction. Suppliers of highly specialized butyl sealants—which must be compatible with the extrusion machinery—also form a crucial part of the upstream segment. Efficiency and quality control at this stage significantly influence the final performance and reliability of the extruder machine.

The manufacturing and assembly phase involves complex mechanical engineering and integration of sophisticated heating and pressure control systems. Manufacturers of butyl extruders focus heavily on R&D to enhance machine precision, speed, and flexibility to handle various spacer types (aluminum, stainless steel, warm edge). Distribution channels are critical, typically involving a combination of direct and indirect sales. Direct sales are often preferred for large, customized, or fully integrated automatic lines, allowing manufacturers to provide specialized installation, training, and post-sales service directly. Indirect channels utilize regional distributors and agents, particularly in fragmented or geographically dispersed markets, who manage inventory and provide localized technical support.

The downstream analysis focuses on the end-users: insulating glass fabricators, specialized window manufacturers, and automotive glass assemblers. The performance of the butyl extruder directly impacts the quality and energy rating of the final product (IG unit). Post-sales services, including maintenance, spare parts supply, and technical upgrades, constitute a significant portion of the downstream value. The effectiveness of the service network is a key competitive differentiator, ensuring minimal downtime for IG production lines. The synergy between high-quality equipment manufacturing and reliable maintenance support defines the overall value delivered to the end consumer, ultimately affecting the longevity and thermal efficiency of installed windows.

Butyl Extruder Market Potential Customers

The primary consumers and buyers of Butyl Extruder systems are entities deeply entrenched in the glass processing and fenestration industries. These include large, multinational insulating glass (IG) manufacturers who operate high-volume, automated production lines demanding multiple, sophisticated extrusion systems capable of 24/7 operation. These major players prioritize speed, precision, and integration capabilities (e.g., compatibility with robotic handling systems and full synchronization with washing and pressing equipment). Their buying decisions are driven by total cost of ownership (TCO) and long-term reliability.

A second significant customer group comprises smaller, localized window and door fabricators. While these customers may opt for smaller, semi-automatic, or entry-level automatic extruders, their demand is steady, driven by local construction booms or specialized regional requirements. Their purchasing criteria often emphasize affordability, ease of use, and local service accessibility rather than absolute maximum throughput. These customers represent an essential segment in emerging markets where capital investment constraints are more pronounced.

Finally, specialized end-users in the automotive and architectural glass sectors, which require butyl sealing for components outside of standard IG units, form a niche but growing customer base. Automotive glass manufacturers use extruders for bonding and sealing certain laminated structures or specialized panoramic roofs, prioritizing precision for regulatory compliance and aesthetic quality. These buyers require highly specialized nozzles and pressure controls tailored for non-standard applications and materials, indicating a preference for customizable machine solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 315.5 Million |

| Market Forecast in 2033 | USD 468.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LiSEC Group, Bystronic Glass (Part of Glaston), Urban GmbH & Co. KG, HEGLA GmbH & Co. KG, Forel S.p.A., Lenhardt Maschinenbau GmbH, CMS Industries, Hollinger, Shanghai Gulin Machinery Co., Ltd., Sparkle Automation, Beijing Orient Jingyu Glass Machinery, SCM Group, Jinan Lijiang Glass, Shandong Huashu Automation, Qinhuangdao Jinhu Glass Equipment, Foshan Shunde Shengda Glass Machinery, Wuxi Jinchang Machinery, Yuntian Machine, ZHJ Machinery, Dalian Huarui Heavy Industry Group Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Butyl Extruder Market Key Technology Landscape

The Butyl Extruder Market is rapidly evolving technologically, moving away from simple mechanical extrusion towards integrated, digitally controlled sealing solutions. A critical technological focus is on enhancing the precision and stability of the extrusion process, particularly concerning temperature control and pressure uniformity. Modern machines utilize advanced PID control loops and multiple independent heating zones to maintain the butyl sealant at its optimal processing temperature throughout the entire path, from the melting tank to the application nozzle. This meticulous thermal management is essential because butyl rubber is highly viscous and sensitive to temperature fluctuations, which can otherwise compromise the integrity of the applied bead and the overall quality of the insulating glass unit.

Another dominant trend is the integration of highly sophisticated sensing and closed-loop feedback systems. Contemporary extruders feature laser or optical sensors that continuously measure the width and thickness of the applied butyl bead in real-time. This data is fed back instantly to the Programmable Logic Controller (PLC) which automatically adjusts the pump speed and nozzle pressure to ensure perfect, consistent coverage, regardless of slight variations in the spacer frame geometry or material batch. Furthermore, the adoption of flexible nozzle systems, often incorporating servo-motor control, allows for rapid and precise switching between different spacer widths and profiles without requiring extensive manual recalibration, significantly boosting manufacturing flexibility.

The convergence of Butyl Extruder technology with Industry 4.0 principles, including connectivity and data exchange, marks the frontier of innovation. Modern systems are equipped with Ethernet and proprietary protocols to communicate seamlessly with upstream (washing machine) and downstream (pressing line) equipment, enabling full line synchronization and centralized control. This connectivity also facilitates remote diagnostics, allowing manufacturers to monitor machine performance globally, preempt maintenance issues, and push software updates. The development of specialized extruders capable of handling increasingly complex sealant formulations, such as those used with highly flexible warm edge spacers, further underscores the ongoing commitment to advancing both machine mechanics and intelligent control systems within the market landscape.

Key technological advancements include the development of vacuum systems integrated into the extrusion head to prevent air entrapment within the sealant, ensuring a void-free, highly dense butyl layer. This feature is particularly crucial for maximizing the moisture barrier properties of the IG unit. Moreover, the adoption of touch-screen Human-Machine Interfaces (HMIs) with intuitive graphical user interfaces (GUIs) simplifies operation, troubleshooting, and recipe management, allowing operators to easily store and recall parameters for various IG configurations. The shift towards solvent-free cleaning methods and materials within the extruder infrastructure also addresses environmental and worker safety concerns, reflecting a broader industry trend towards sustainable manufacturing practices.

Finally, the growing capability of extruders to manage dual-sealant applications, where the butyl is applied precisely alongside the secondary sealant (polysulfide, silicone, or polyurethane), represents a critical innovation for high-end IG production. These synchronized systems ensure optimal curing and bonding between the two sealants, maximizing the long-term durability and thermal performance of the finished glass unit. The continuous focus on minimizing heat loss, maximizing material use through precise dosing mechanisms, and ensuring compatibility with diverse spacer materials (including plastics and composites) defines the current technological competitive landscape.

Regional Highlights

The Butyl Extruder Market exhibits substantial regional variation in terms of maturity, growth drivers, and demand for specific machine types. North America and Europe, representing highly mature markets, are characterized by stringent energy efficiency regulations (e.g., Passive House standards in Europe and Energy Star in North America) which necessitate the constant production of high-quality, often triple-glazed, insulating glass units. Demand here is typically driven by the need for replacement machinery, technological upgrades to handle warm edge spacers, and the push for full automation to combat high labor costs. European manufacturers, being pioneers in IG technology, often demand the most flexible and highly precise automatic systems.

Asia Pacific (APAC) is currently the most dynamic region, demonstrating the highest growth rates due to unprecedented levels of construction activity, driven by rapid urbanization and infrastructure expansion, especially in emerging economies such as China, India, and Southeast Asian nations. While the initial market phase saw high demand for semi-automatic and entry-level automatic extruders, there is a clear trend towards adopting advanced, high-speed automatic lines as local manufacturers scale up to meet international quality standards and handle large-volume projects. The sheer size of the housing and commercial real estate market in China alone makes APAC a critical growth engine for the butyl extruder market, focusing primarily on volume output and increasingly on energy conservation.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets for butyl extruders. Demand in MEA is bolstered by significant infrastructure investments, particularly in the Gulf Cooperation Council (GCC) countries, where high ambient temperatures necessitate robust, thermally efficient glazing systems. LATAM's growth is more sporadic, tied closely to national economic performance and specific regional construction booms, yet the underlying need to meet modern building codes is slowly transitioning demand from manual sealing processes to mechanized extrusion systems. In both regions, market entry is often facilitated through partnerships with local distributors who can provide necessary technical support and training specific to the regional operating environments and climate challenges.

- North America: Market maturity, strong demand driven by residential renovation and stringent energy standards (Energy Star). Focus on high-throughput, integrated automation systems.

- Europe: High adoption of advanced technologies like warm edge spacing and triple glazing. Market driven by strict EU energy directives and replacement cycles for sophisticated machinery.

- Asia Pacific (APAC): Highest growth potential, fueled by massive urbanization, infrastructure development, and growing adoption of high-performance glass in new construction. Demand transitioning rapidly from semi-automatic to fully automatic systems.

- Latin America (LATAM): Developing market with increasing awareness of energy efficiency. Demand is growing steadily, focusing on reliable, moderately priced automatic extruders for mid-sized fabricators.

- Middle East & Africa (MEA): Growth stimulated by large commercial and residential projects (e.g., smart cities in the GCC). Climate demands robust sealing technology to handle extreme temperatures, driving demand for high-quality, durable extruders.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Butyl Extruder Market.- LiSEC Group

- Bystronic Glass (Part of Glaston)

- Urban GmbH & Co. KG

- HEGLA GmbH & Co. KG

- Forel S.p.A.

- Lenhardt Maschinenbau GmbH

- CMS Industries

- Hollinger

- Shanghai Gulin Machinery Co., Ltd.

- Sparkle Automation

- Beijing Orient Jingyu Glass Machinery

- SCM Group

- Jinan Lijiang Glass

- Shandong Huashu Automation

- Qinhuangdao Jinhu Glass Equipment

- Foshan Shunde Shengda Glass Machinery

- Wuxi Jinchang Machinery

- Yuntian Machine

- ZHJ Machinery

- Dalian Huarui Heavy Industry Group Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Butyl Extruder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Butyl Extruder and its primary function in the glass industry?

A Butyl Extruder is a specialized machine used to precisely apply butyl rubber sealant onto the spacer frames of insulating glass (IG) units. Its primary function is to create the essential primary seal, which acts as a highly effective barrier against moisture vapor penetration and gas leakage, ensuring the long-term thermal performance of the finished window.

Which factors are primarily driving the growth of the Automatic Butyl Extruder segment?

The growth of the Automatic Butyl Extruder segment is driven primarily by increasing global energy efficiency regulations, the rising demand for high-volume IG production, and the necessity for superior sealing consistency to minimize costly product defects and maintain product certification standards.

How does the integration of Industry 4.0 affect Butyl Extruder operations?

Industry 4.0 integration, including AI and IoT sensors, allows Butyl Extruders to achieve real-time process monitoring, predictive maintenance, and seamless synchronization with other machines on the IG production line, leading to significant reductions in operational downtime and material waste.

Which geographic region presents the highest growth opportunities for Butyl Extruder manufacturers?

The Asia Pacific (APAC) region presents the highest growth opportunities, primarily driven by rapid urbanization, massive infrastructural projects, and the increasing governmental mandate to adopt modern, energy-efficient building standards in countries such as China and India.

What is the typical lifespan and maintenance requirement for a modern Butyl Extruder machine?

A well-maintained modern Butyl Extruder can have a lifespan exceeding 15 to 20 years. Key maintenance requirements involve regular calibration of heating elements and pressure systems, cleaning of the application nozzles, and periodic replacement of hydraulic and electrical components, often facilitated now by remote diagnostic tools.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager