Butyl Methacrylate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437626 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Butyl Methacrylate Market Size

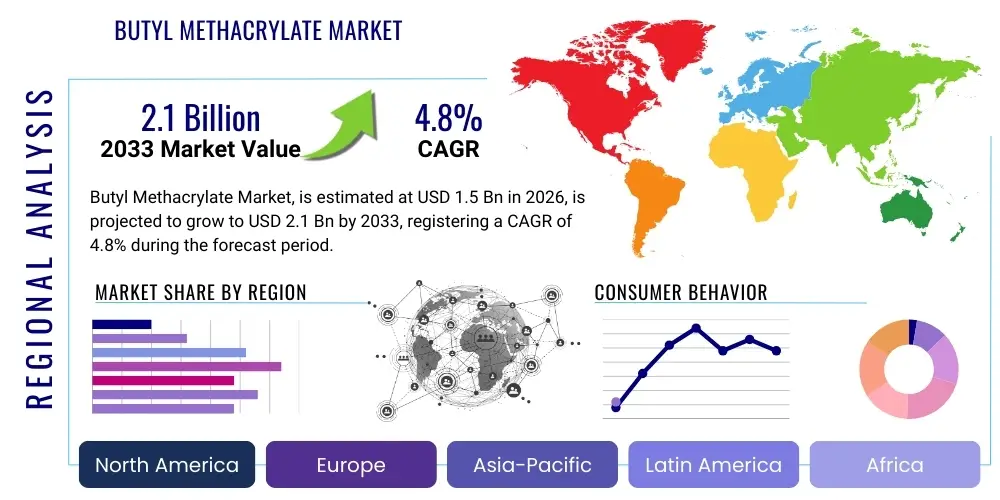

The Butyl Methacrylate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033.

Butyl Methacrylate Market introduction

Butyl Methacrylate (BMA) is a colorless liquid monomer characterized by its low volatility, excellent resistance to water, alkalis, and acids, and superior binding properties. This versatile chemical compound is primarily utilized as a key building block in the production of polymers and resins, which find extensive application across various industrial sectors. Derived typically from methacrylic acid and n-butanol, BMA serves as a crucial intermediate in the synthesis of homopolymers and copolymers, offering tailored physical properties such as hardness, adhesion, and flexibility to end products. Its chemical structure, featuring a methacrylate functional group, allows for rapid polymerization, making it highly valuable in time-sensitive manufacturing processes.

Major applications of BMA polymers include architectural and automotive coatings, high-performance industrial adhesives and sealants, and impact modifiers for plastics like PVC. In coatings, BMA provides superior gloss retention, weatherability, and resistance to abrasion, positioning it as a preferred material over traditional acrylic monomers in demanding outdoor applications. Furthermore, BMA is integral in the formulation of specialized products such as textile sizing agents and synthetic resins used in dental and medical composites. The demand for BMA is closely correlated with the growth of the construction and automotive industries globally, where lightweight materials and durable surface finishes are paramount.

The primary driving factors propelling the Butyl Methacrylate market include the increasing global adoption of waterborne and powder coating technologies, where BMA plays a stabilizing role, complying with stringent environmental regulations regarding Volatile Organic Compounds (VOCs). The benefits of utilizing BMA include enhanced durability, low glass transition temperature (Tg) providing flexibility, and excellent compatibility with a wide range of solvents and other monomers. As urbanization accelerates and infrastructure development continues, particularly in emerging economies, the sustained demand for high-quality protective and aesthetic materials will secure BMA's market growth trajectory.

Butyl Methacrylate Market Executive Summary

The Butyl Methacrylate market is defined by robust growth, primarily stemming from escalating demand in the Asia Pacific region, driven by massive infrastructure spending and the burgeoning automotive manufacturing sector. Business trends indicate a strong shift toward sustainable production methods, with leading manufacturers investing heavily in bio-based BMA alternatives to align with global green chemistry initiatives and consumer preferences for eco-friendly products. Mergers, acquisitions, and strategic long-term supply agreements are common competitive strategies aimed at securing raw material access, stabilizing pricing, and expanding geographic footprint, particularly into specialized segments like high-purity electronics coatings.

Regional trends clearly highlight Asia Pacific (APAC) as the undisputed dominant region, leveraging its position as the global hub for coatings, textiles, and automotive manufacturing. North America and Europe, while mature, demonstrate stable, incremental growth primarily driven by regulatory-induced replacement cycles, where older, high-VOC coatings are phased out in favor of BMA-based low-VOC formulations. The Middle East and Africa (MEA) are emerging areas, showing increased BMA consumption tied to large-scale construction projects and localized industrialization efforts, suggesting future potential driven by petrochemical expansion.

Segmentation trends reveal that the coatings application segment maintains the largest market share due to its expansive use in architectural, protective, and marine coatings, demanding high UV and water resistance. However, the plastic additives segment, specifically BMA usage in PVC modification to enhance impact strength, is poised for the fastest growth, fueled by the rising adoption of engineering plastics in electric vehicles and consumer electronics. In terms of product type, high-purity BMA, essential for advanced electronics and optical applications, commands a premium and is seeing rapid adoption rates, pushing technological innovation in purification processes.

AI Impact Analysis on Butyl Methacrylate Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can optimize the complex, high-volume production of Butyl Methacrylate, focusing on minimizing operational costs, enhancing product purity, and predicting supply chain disruptions. Key concerns revolve around the potential for AI-driven predictive maintenance to reduce unplanned downtime in polymerization reactors and whether ML algorithms can accurately forecast fluctuating raw material costs (especially crude oil derivatives) to inform procurement strategies. Expectations are high regarding the integration of AI for advanced quality control, enabling real-time spectral analysis to monitor polymerization kinetics and ensure batch consistency, particularly for specialized, high-purity grades required by the semiconductor and aerospace industries. This suggests users view AI not just as an analytical tool, but as a crucial element for achieving operational excellence and maintaining competitive advantage in a highly capital-intensive market.

- AI-driven optimization of reaction parameters to maximize BMA yield and minimize energy consumption during esterification.

- Predictive maintenance systems utilizing ML to forecast equipment failure, increasing plant uptime and operational efficiency.

- Enhanced supply chain visibility and risk management through AI modeling of global logistics and raw material price volatility.

- Automated quality control using vision systems and ML for real-time monitoring of BMA purity and stability in polymerization processes.

- Simulation and modeling of new BMA copolymer formulations, accelerating R&D cycles for niche application coatings.

- Optimization of inventory levels by forecasting demand fluctuations across diverse end-use markets (automotive vs. construction).

DRO & Impact Forces Of Butyl Methacrylate Market

The Butyl Methacrylate market is propelled by robust drivers, including burgeoning demand from the construction and automotive sectors for protective coatings and high-performance adhesives, alongside a regulatory push in developed economies favoring low-VOC solvent alternatives, where BMA excels. However, the market faces significant restraints, primarily centered around the volatility of key raw material prices, particularly n-butanol and methacrylic acid, which are derivatives of crude oil, introducing inherent cost instability and impacting manufacturer margins. Despite these restraints, substantial opportunities exist in the development and commercialization of bio-based BMA derived from sustainable sources, tapping into the growing consumer and industrial preference for sustainable chemistry solutions, offering long-term market differentiation and regulatory compliance.

Impact forces dynamically shape the competitive landscape. High supplier bargaining power, driven by the consolidated nature of raw material production (methacrylic acid), places upward pressure on BMA pricing. Simultaneously, buyer bargaining power is moderate; while BMA is essential, substitution risks exist in certain low-end coating applications (e.g., replacement by styrene or vinyl acetate monomers). The threat of new entrants is relatively low due to the high capital expenditure required for establishing production facilities and the complex regulatory framework governing chemical manufacturing. Furthermore, technological innovation in polymerization catalysts and process efficiency acts as a significant positive impact force, allowing established players to achieve greater economies of scale and higher purity grades required for sensitive electronics applications.

Specific market dynamics include the rise of specialized applications requiring ultra-high purity BMA, such as in photoresists and optical polymers. This demand necessitates advanced purification technologies, representing both a challenge and an opportunity for manufacturers. Regulatory impact remains profound; for example, stringent environmental standards in the EU (REACH) and North America drive innovation towards safer, more sustainable BMA production and usage, constantly remodeling the market’s technological trajectory and ensuring that compliant, high-quality products command market preference.

Segmentation Analysis

The Butyl Methacrylate market segmentation provides a critical view of consumption patterns, technological requirements, and geographical demand concentration. The market is broadly categorized based on purity level, application, and end-use industry, reflecting the diverse functional requirements of this monomer across industrial and consumer product manufacturing. Understanding these segments is vital for producers to tailor production capabilities and for distributors to optimize logistics, ensuring that the appropriate grade of BMA, ranging from standard industrial grade to high-purity electronic grade, meets specific client needs across different sectors.

Application segmentation reveals where the functional properties of BMA—such as its low Tg and excellent weatherability—are most valued. Coatings consistently dominate the volume share, but adhesives and sealants demonstrate higher value growth due to the stringent performance demands in automotive and construction bonding. The distinction between segments is becoming increasingly blurred as advanced co-polymerization techniques allow BMA to be utilized in multi-functional formulations, such as combining protective coating properties with specialized binding characteristics in textile finishes.

End-use industry segmentation directly links BMA demand to macro-economic drivers. The automotive sector, specifically the transition toward electric vehicles which rely heavily on specialized lightweight and durable coatings for battery packs and chassis, represents a crucial growth area. Similarly, the rapid expansion of construction activities in emerging economies fuels demand for exterior paints and concrete sealants, cementing BMA’s role as a staple chemical intermediate critical for global infrastructure development and modernization efforts.

- By Purity

- Standard Grade BMA (Used in bulk industrial coatings and non-critical applications)

- High Purity BMA (Used in optical materials, medical devices, and electronics)

- By Application

- Coatings (Architectural, Automotive, Marine, Industrial Protective Coatings)

- Adhesives and Sealants (Pressure-Sensitive Adhesives, Anaerobic Adhesives)

- Plastic Additives and Modifiers (PVC Impact Modification)

- Textile and Leather Processing

- Others (Dental Materials, Medical Resins, Optical Fibers)

- By End-Use Industry

- Automotive and Transportation

- Construction and Infrastructure

- Electronics and Electrical

- Consumer Goods

- Others (Medical, Aerospace)

Value Chain Analysis For Butyl Methacrylate Market

The Butyl Methacrylate value chain is complex, starting with the production of basic petrochemical feedstocks and extending through intermediate chemical synthesis, polymerization, formulation, and finally, distribution to diverse end-use industries. Upstream activities involve the production of core raw materials: Methacrylic Acid (MAA) and n-Butanol, which are derived primarily from crude oil or natural gas. The consolidation among MAA producers grants them considerable price-setting power, defining the cost structure for BMA manufacturers. The manufacturing step, involving the esterification of MAA with n-Butanol, is highly capital-intensive and requires specialized chemical engineering expertise, dictating high barriers to entry.

Downstream activities focus on the transformation of the BMA monomer into functional polymers, resins, and specialized formulations. Formulators, such as major coatings and adhesives companies, are key value-adders, customizing BMA polymers for specific performance requirements—like UV resistance in automotive clear coats or enhanced flexibility in sealants. The margin accretion is often higher in the downstream segment, where product specialization and intellectual property surrounding formulation techniques create differentiation. This downstream influence drives technological demands back towards monomer producers for higher purity and better molecular weight control.

Distribution channels for BMA are structured into direct sales to large, integrated customers (e.g., major coatings manufacturers like PPG or Sherwin-Williams) and indirect distribution through chemical distributors and specialized traders for smaller users and niche markets. Direct channels offer greater price control and technical service collaboration, while indirect channels provide wider market reach and efficient small-batch logistics. The shift towards global procurement mandates efficient, reliable cross-border logistics, making distributors with robust international networks critical for market penetration and managing regional supply-demand imbalances, especially in the fast-growing APAC region.

Butyl Methacrylate Market Potential Customers

Potential customers for Butyl Methacrylate are diverse, spanning multiple industrial sectors that require high-performance polymeric materials. The primary end-users are large multinational chemical and coating formulators, who purchase BMA in bulk to synthesize acrylic resins used in paints, varnishes, and protective sealants for construction and automotive maintenance. These buyers prioritize product consistency, competitive pricing, and secure, long-term supply contracts, often engaging directly with large BMA manufacturers to ensure quality control for their extensive global supply chains.

Beyond the core coatings industry, key customers include manufacturers of plastic modifiers, particularly those involved in producing durable PVC products, piping, and window profiles, where BMA enhances impact strength and weather resistance. The electronics and medical sectors represent high-value, albeit lower volume, customers demanding ultra-high purity BMA for specialized applications such as contact lenses, dental restorative materials, and lithography resins. These specialized buyers focus less on volume pricing and more on stringent quality documentation, regulatory compliance, and consistent trace impurity levels, leading to premium market pricing for these grades.

Furthermore, textile and leather processing companies use BMA-based emulsions for finishing and sizing, requiring specific polymerization kinetics suitable for fabric treatment processes. The buyer profile in this segment is shifting towards sustainable solutions, increasingly seeking bio-based BMA alternatives. Overall, the target buyer is characterized by a high degree of technical sophistication and operates in industries heavily regulated by performance, safety, and environmental standards, making BMA a mission-critical raw material rather than a commodity input.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries AG, BASF SE, Mitsubishi Chemical Corporation, Nippon Shokubai Co., Ltd., Dow Inc., LG Chem, Formosa Plastics Corporation, Arkema S.A., SIBUR Holding PJSC, Kuraray Co., Ltd., Wanhua Chemical Group Co., Ltd., Fushun Petrochemical Company, Shandong Huayi Chemical Co., Ltd., Zhejiang Runtu Co., Ltd., Jiangsu Jurong Chemical Co., Ltd., Dairen Chemical Corporation, Monument Chemical, Sasol Limited, Hebei Yijin Chemical Co., Ltd., Qingdao Sanhuan Pigment Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Butyl Methacrylate Market Key Technology Landscape

The Butyl Methacrylate market is defined by continuous technological advancements focused primarily on improving polymerization efficiency, achieving higher purity levels, and developing sustainable production pathways. Traditional BMA production relies on the sulfuric acid-catalyzed esterification of methacrylic acid (MAA) with n-butanol. However, modern manufacturing is shifting towards highly efficient, low-waste catalytic processes. Key innovations include the adoption of solid acid catalysts, such as ion-exchange resins, which eliminate the corrosive byproducts associated with sulfuric acid, simplify downstream purification, and reduce overall environmental impact, thereby aligning with green chemistry principles.

Furthermore, technology is crucial in enabling the high-purity grades required for demanding applications like photoresists and optical polymers. Advanced purification techniques, including highly efficient fractional distillation and specialized membrane separation technologies, are essential to remove trace impurities (e.g., color bodies, stabilizers, and unreacted feedstocks) which can negatively impact the performance of final electronic components. Process monitoring technologies, leveraging real-time spectroscopic analysis and sophisticated control systems, are integrated to ensure narrow distribution parameters and consistent batch quality, crucial for maintaining vendor trust in sensitive sectors.

Looking ahead, the development of bio-based BMA represents a significant technological frontier. Researchers are exploring methods to derive MAA and n-Butanol from renewable resources, such as biomass or fermentation products, using biotechnology and enzymatic catalysis. This shift promises to insulate producers partially from petrochemical price volatility and enhance the sustainability profile of the final product, potentially opening up new market segments driven by stringent environmental procurement policies. Investment in innovative reactor design, particularly continuous flow reactors, is also gaining traction for achieving greater throughput and better thermal control during the highly exothermic polymerization process.

Regional Highlights

Regional dynamics heavily influence the Butyl Methacrylate market, reflecting disparities in manufacturing base, regulatory environment, and infrastructure development pace. Asia Pacific (APAC) dominates the global market, both in production capacity and consumption volume. This dominance is attributable to the region's expansive manufacturing sectors, particularly in China, India, and South Korea, which serve as global hubs for automotive production, electronics assembly, and rapid urbanization demanding vast quantities of architectural and protective coatings. Regulatory standards in APAC are evolving but often less restrictive than in Western markets, facilitating large-scale, cost-effective production, though there is a growing trend towards adopting stricter VOC regulations mirroring European standards.

North America and Europe represent mature markets characterized by steady, value-driven demand. Consumption in these regions is heavily focused on high-quality, specialized BMA derivatives compliant with stringent environmental mandates like the EU’s REACH regulation and the EPA’s standards in the US. The market growth here is primarily driven by innovation in low-VOC, solvent-free, and UV-curable coating formulations, where BMA plays a critical role in optimizing performance without compromising regulatory compliance. The automotive refinish and high-end industrial maintenance sectors are key consumers, prioritizing durability and aesthetic quality.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging as high-potential growth territories. In LATAM, particularly Brazil and Mexico, industrial expansion and infrastructure projects drive localized demand for coatings and adhesives. The MEA region, capitalizing on its vast petrochemical resources, is witnessing increasing investment in downstream chemical conversion capabilities, aiming to reduce reliance on imported chemical intermediates. The demand in MEA is primarily linked to large-scale construction, oil and gas infrastructure protection, and diversification initiatives, offering sustained long-term consumption opportunities for BMA products, supported by favorable energy input costs for production.

- Asia Pacific (APAC): Market leader due to rapid industrialization, massive construction boom, and automotive manufacturing dominance in China, India, and ASEAN countries. High demand for general and specialized coatings.

- North America: Stable market focused on high-performance coatings, adhesives, and sealants. Growth driven by stricter VOC regulations favoring BMA-based low-solvent systems. Key markets include the US and Canada.

- Europe: Highly regulated market with a strong emphasis on sustainability and bio-based alternatives. Demand is robust in automotive OEM coatings, high-end architectural paints, and specialty polymers, driven by REACH compliance.

- Latin America (LATAM): Emerging market showing significant potential tied to regional infrastructure development and growth in the automotive assembly sector, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Growth driven by heavy investment in construction, oil and gas infrastructure, and localized chemical production capacity expansion, focusing on protective and industrial coatings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Butyl Methacrylate Market.- Evonik Industries AG

- BASF SE

- Mitsubishi Chemical Corporation

- Nippon Shokubai Co., Ltd.

- Dow Inc.

- LG Chem

- Formosa Plastics Corporation

- Arkema S.A.

- SIBUR Holding PJSC

- Kuraray Co., Ltd.

- Wanhua Chemical Group Co., Ltd.

- Fushun Petrochemical Company

- Shandong Huayi Chemical Co., Ltd.

- Zhejiang Runtu Co., Ltd.

- Jiangsu Jurong Chemical Co., Ltd.

- Dairen Chemical Corporation

- Monument Chemical

- Sasol Limited

- Hebei Yijin Chemical Co., Ltd.

- Qingdao Sanhuan Pigment Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Butyl Methacrylate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Butyl Methacrylate (BMA) in industry?

BMA is predominantly used as a monomer in the production of polymers for coatings, adhesives, and sealants. Its key applications include automotive clear coats due to its excellent gloss retention and weatherability, as well as impact modifiers for plastics like PVC to enhance durability and resilience.

Which raw materials are essential for the production of Butyl Methacrylate?

The two critical feedstocks for BMA synthesis are Methacrylic Acid (MAA) and n-Butanol. The pricing and availability of these materials, which are largely derived from petrochemical sources (crude oil or natural gas), significantly influence the production cost of BMA.

How do environmental regulations impact the Butyl Methacrylate market growth?

Strict environmental regulations, particularly those limiting Volatile Organic Compounds (VOCs) in coatings (e.g., EU's Industrial Emissions Directive), positively drive the demand for BMA. BMA facilitates the production of low-VOC and waterborne formulations, positioning it as a compliant and preferred alternative to traditional solvent-heavy monomers.

Which geographic region currently dominates the global BMA market?

The Asia Pacific (APAC) region holds the largest market share for BMA, driven by massive consumption in key end-use industries, including infrastructure development, electronics manufacturing, and high-volume automotive production, particularly in China and India.

What is the future outlook regarding bio-based Butyl Methacrylate?

Bio-based BMA represents a major future opportunity. Research efforts are focused on developing commercially viable methods to produce MAA and n-Butanol from renewable biomass. This innovation aims to reduce reliance on petrochemicals, stabilize costs, and cater to growing market demand for sustainable chemical inputs.

In-Depth Market Dynamics and Competitive Landscape

The Butyl Methacrylate market, while seemingly mature, is undergoing structural shifts influenced by sustainability mandates and regional manufacturing repositioning. Competition is intensely focused on achieving economies of scale in production, particularly among Asian giants who benefit from lower energy costs and proximity to end-use markets. However, Western players differentiate themselves by focusing on high-purity, specialty-grade BMA for niche markets such as medical devices and semiconductor materials, where technical expertise and consistent quality documentation command significant price premiums. The competitive strategy revolves less around raw monomer pricing and more around integrated solutions, including customized copolymer blends and technical support for complex formulation challenges faced by coatings customers.

Consolidation remains a characteristic feature of the competitive landscape. Large integrated chemical companies often control the entire production chain, from basic petrochemical intermediates (MAA) to the final BMA monomer, granting them resilience against commodity price fluctuations. Smaller, regional players often thrive by targeting specific application niches or by offering superior logistics and regional distribution capabilities. Technological supremacy in catalyst development and process safety is a non-negotiable factor; manufacturers must continually invest in upgrading facilities to meet evolving safety standards and improve yield, making high capital investment a significant barrier to the entry of new competitors.

A key trend impacting future dynamics is the push for localization. Geopolitical risks and the need for resilient supply chains are prompting major end-users (e.g., automotive companies) to demand BMA supply from localized manufacturing bases, reducing reliance on long-distance imports. This localization pressure is stimulating investment in new BMA production capacities outside of traditional manufacturing centers, particularly in Southeast Asia and parts of North America, creating new opportunities for market expansion but also fragmenting the global supply structure. Furthermore, the development of functional monomers that can partially substitute BMA in specific applications keeps market participants vigilant regarding product differentiation and technological superiority.

Regulatory and Policy Environment

The Butyl Methacrylate market operates under a complex tapestry of international and regional regulations primarily concerning environmental protection, occupational health and safety, and chemical substance registration. In regions like the European Union, the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation dictates rigorous testing and dossier submission for BMA, ensuring its safe use throughout the supply chain. Compliance with REACH is mandatory for market access and often drives product reformulation efforts, focusing on minimizing exposure risks and classifying substances accurately. Similar frameworks exist in other developed markets, such as the Toxic Substances Control Act (TSCA) in the United States, which also requires exhaustive assessment of new and existing chemical risks.

Beyond chemical registration, BMA usage is heavily regulated in its end applications, especially coatings. Regulations concerning Volatile Organic Compounds (VOCs) are particularly influential. Directives in North America and Europe mandate the reduction of solvents in paints and varnishes, which directly favors BMA-based polymer systems that can be formulated into high-solids, powder, or waterborne systems. Producers must continuously monitor changes in these VOC limits, as compliance failure can severely restrict market access. This regulatory environment acts as a driver for innovation, forcing producers to continually enhance the sustainability and safety profile of their products.

International conventions, such as those related to marine coatings and food contact materials, also impose specific requirements on BMA derivatives. For marine applications, BMA polymers must demonstrate exceptional anti-fouling and corrosion resistance properties without releasing toxic substances into the marine environment. In food packaging, specific BMA polymers must meet purity standards mandated by agencies like the FDA and EFSA. These varied, sector-specific regulatory requirements necessitate that BMA manufacturers maintain highly sophisticated quality assurance protocols and traceability systems, adding significant operational costs but simultaneously raising the barrier to entry for non-compliant suppliers.

Long-Term COVID-19 Impact on BMA Market

The COVID-19 pandemic initially caused severe supply chain disruptions and a temporary reduction in demand, particularly in the automotive and architectural construction sectors due to lockdowns and project postponements. However, the long-term impact analysis suggests a fundamental shift rather than a sustained downturn. The pandemic accelerated the trend towards digitalization in manufacturing and logistics, prompting BMA producers to invest in resilient, geographically diverse supply chains. The initial shock highlighted vulnerabilities related to reliance on single-source suppliers in certain geographic regions, leading to diversification strategies that are reshaping global trade flows for chemical intermediates.

Furthermore, the pandemic spurred increased focus on hygiene, leading to rising demand for durable, easy-to-clean coatings and materials used in healthcare, public transport, and residential settings. This enhanced focus on surface protection and antimicrobial properties has stimulated demand for high-performance polymers, including BMA derivatives, which offer superior durability and chemical resistance in high-traffic environments. The subsequent global stimulus packages, particularly those aimed at infrastructure renewal and green energy transition, are providing a strong, sustained boost to key BMA consuming sectors, such as construction and specialized electrical components (EV batteries and renewables).

The acceleration of remote work and the subsequent residential renovation boom also created a localized surge in demand for architectural coatings and adhesives, benefiting BMA consumption in developed economies. While raw material cost volatility remained a significant post-pandemic challenge, the overall market trajectory for BMA has been reinforced by its essential role in manufacturing durable, low-VOC products necessary for post-pandemic economic recovery and sustainable urban development. Manufacturers are now prioritizing inventory optimization and increasing regional stock levels to buffer against future black swan events, fundamentally altering traditional just-in-time logistics models in the chemical industry.

Future Outlook and Growth Opportunities

The future outlook for the Butyl Methacrylate market is optimistic, underpinned by sustained growth in core application sectors and the emergence of specialized, high-value opportunities. The ongoing urbanization trends in Asia, Africa, and Latin America necessitate massive investment in infrastructure, ensuring continued volume demand for BMA in protective and architectural coatings. Beyond volume, the premium segment—driven by high-purity BMA used in advanced display technologies (OLEDs, touchscreens) and precision medical devices—is expected to command superior growth rates, reflecting technological advancement and increasing complexity in consumer electronics and healthcare.

A key structural growth opportunity lies in the transition to sustainable and circular economy models. The commercial scaling of bio-based BMA, derived from non-fossil carbon sources, offers manufacturers a significant competitive edge in meeting corporate sustainability goals and accessing green public procurement markets. Investment in specialized functional monomers that copolymerize effectively with BMA to create tailored material properties (e.g., specific adhesion promoters or temperature resistance enhancers) will also unlock new applications in demanding aerospace and industrial repair markets. Strategic R&D focused on UV-curable and electron-beam curable BMA formulations will capture market share currently dominated by conventional thermal-cure systems, offering faster processing times and lower energy consumption.

Furthermore, geographic diversification remains a core strategy. As production shifts to maintain supply chain resilience, establishing production hubs in regions like Southeast Asia or localized specialty production in North America will be crucial. Manufacturers must capitalize on the increasing digitalization of industrial processes to optimize plant efficiencies, ensuring cost competitiveness while maintaining the strict quality required by global standards. The ability to navigate the complex raw material supply landscape and successfully transition to more sustainable production techniques will define market leadership in the next decade, ensuring BMA remains a cornerstone monomer in the specialty chemical industry.

The adoption of advanced manufacturing techniques, such as continuous processing systems over traditional batch reactors, is set to revolutionize production efficiency and consistency. Continuous flow chemistry minimizes thermal gradients and offers superior control over polymerization, leading to BMA polymers with narrower molecular weight distributions—a crucial requirement for high-end optical and electronic applications. This technological shift, coupled with rising demand from the burgeoning electric vehicle battery industry for specialized thermal management and protective coatings, solidifies the robust long-term growth prospects for Butyl Methacrylate.

To capitalize on these growth opportunities, companies are increasingly forming collaborative partnerships with end-users and technology providers. For instance, partnerships with major automotive manufacturers can provide BMA producers with early insight into future material specifications, enabling proactive development of tailored polymer solutions. Similarly, engaging with waste management and recycling technology firms is essential for exploring chemical recycling pathways for BMA-based polymers, aligning with circular economy objectives and ensuring the long-term viability of the product line in environmentally conscious markets. This focus on vertical integration through strategic alliances will be vital for unlocking niche market value.

Specific market segments that offer accelerated growth include the use of BMA in 3D printing resins, where its properties contribute to desirable characteristics like reduced shrinkage and high resolution in photopolymerization applications. The biomedical sector continues to be a high-margin area, particularly for BMA polymers used in biocompatible adhesives and drug-delivery systems. The continuous search for materials that offer high performance under extreme conditions (e.g., high temperature, strong chemical exposure) in industrial maintenance and marine environments ensures that BMA remains a monomer of choice for developing advanced protective solutions that extend the lifecycle of assets.

Innovation in polymerization processes, focusing on minimizing residual monomer content, is critical for achieving high compliance standards in sensitive consumer contact applications. Manufacturers are also exploring different co-monomers to combine BMA's weather resistance with other functional properties, such as flame retardancy or enhanced electrical insulation, thereby expanding its utility beyond traditional coatings. The commitment of leading market players to sustainable chemistry, reflected in their efforts to reduce energy consumption during synthesis and transition to renewable feedstocks, will be the ultimate differentiator in a market increasingly sensitive to environmental footprint.

The increasing regulatory harmonization across major trade blocs, while initially challenging, ultimately creates a predictable market environment that rewards compliance and investment in high-quality production. Companies capable of consistently meeting the most stringent global standards, such as those related to low toxicity and high purity, will gain preferential access to multinational customers. This drive for compliance fosters innovation in analytical chemistry and process safety, ensuring that the Butyl Methacrylate supply chain operates at peak efficiency and adheres to the highest global safety metrics.

Finally, the growing industrial applications in solar and wind energy sectors present a substantial opportunity. BMA-based polymers are utilized in protective coatings for turbine blades and photovoltaic panels, offering resistance to UV degradation and harsh environmental conditions. As global investment in renewable energy accelerates, the demand for these durable, specialized coatings is expected to surge, providing a reliable and expanding market segment for BMA producers who successfully tailor their products to these specific performance requirements. This diversification into green technology applications ensures BMA's relevance in the future industrial landscape.

The convergence of advanced materials science and manufacturing technology, such as the integration of smart sensors into BMA production facilities, is creating a new era of optimized output. These sensors monitor various parameters like temperature, pressure, and catalyst activity in real-time, feeding data into AI/ML models that dynamically adjust process variables. This level of precision is crucial for maintaining the extremely tight specifications required for specialty BMA, ensuring batch-to-batch consistency that is critical for aerospace and high-definition electronic applications. Companies that successfully implement these Industry 4.0 standards will realize significant cost savings and capture the high-end market share.

Moreover, strategic pricing and supply chain management in response to fluctuating raw material costs will be paramount for competitive success. Producers are increasingly hedging raw material purchases and entering into long-term fixed-price contracts to buffer against market volatility originating from the energy sector. This financial sophistication, combined with robust operational efficiencies achieved through technological upgrades, is necessary for maintaining profitable margins while supplying large volume markets such as architectural coatings, which are highly price-sensitive. The capability to offer stable, competitive pricing regardless of upstream energy market fluctuations is becoming a core strategic advantage.

In summary, the Butyl Methacrylate market is poised for expansion driven by regulatory compliance, technological breakthroughs in sustainability and purity, and robust demand from high-growth end-use sectors like electronics and sustainable infrastructure. Success will depend on geographical manufacturing agility, investment in advanced process control technologies, and the capacity to develop high-performance, specialized polymer formulations that address the complex material challenges of the modern industrial world, securing its critical position within the global chemical hierarchy.

The market faces ongoing pressure regarding sustainability, which is transforming procurement policies across sectors. Large corporations, particularly in automotive and consumer goods, are setting ambitious targets for reducing their carbon footprint, necessitating that their suppliers, including BMA producers, demonstrate verified environmental performance. This creates a market premium for certified sustainable or bio-based BMA, pushing manufacturers to invest in Life Cycle Assessment (LCA) tools to transparently document their environmental impact from cradle to gate, thus integrating sustainability reporting into their core competitive strategy.

Another crucial element driving future growth is the increasing sophistication of coating application techniques. The shift toward robotically applied coatings in automotive manufacturing demands BMA polymers with highly controlled rheology and rapid curing times. Manufacturers must therefore tailor BMA compositions to meet the exact specifications of advanced application equipment, ensuring smooth flow, minimal overspray, and flawless surface finish, thereby bridging the gap between chemical production and advanced industrial robotics. This partnership between chemistry and engineering accelerates demand for specialized BMA grades.

The globalization of construction standards, particularly the push for longer-lasting, more resilient building materials to combat climate change effects, bolsters the demand for BMA-based exterior sealants and protective paints. BMA's inherent resistance to UV light, moisture, and temperature fluctuations makes it ideal for these applications, particularly in regions prone to extreme weather conditions. Meeting these rigorous standards requires continuous refinement of BMA polymer architecture to maximize cross-linking density and minimize degradation over decades of exposure, reinforcing the market's focus on high-performance formulations.

Finally, market consolidation, particularly through horizontal integration where major players acquire smaller specialty manufacturers, is expected to continue. This strategy allows larger firms to quickly gain access to niche technologies, specialized product portfolios (like high-purity medical-grade BMA), and key distribution networks in rapidly growing regions. While this increases market concentration, it also drives investment and efficiency across the consolidated entities, ultimately strengthening the BMA market's capacity to serve diverse, technologically demanding global industries effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Butyl Methacrylate Market Statistics 2025 Analysis By Application (Paints and Coatings, Adhesives and Sealants, Printing and Ink, Acrylic Copolymer), By Type (n-Butyl Methacrylate, i-Butyl Methacrylate), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Poly Butyl Methacrylate Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Suspension Polymerization, Solution Copolymerization), By Application (Automobile Materials, Food, Pharmaceutical, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager