Butylene Carbonate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436139 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Butylene Carbonate Market Size

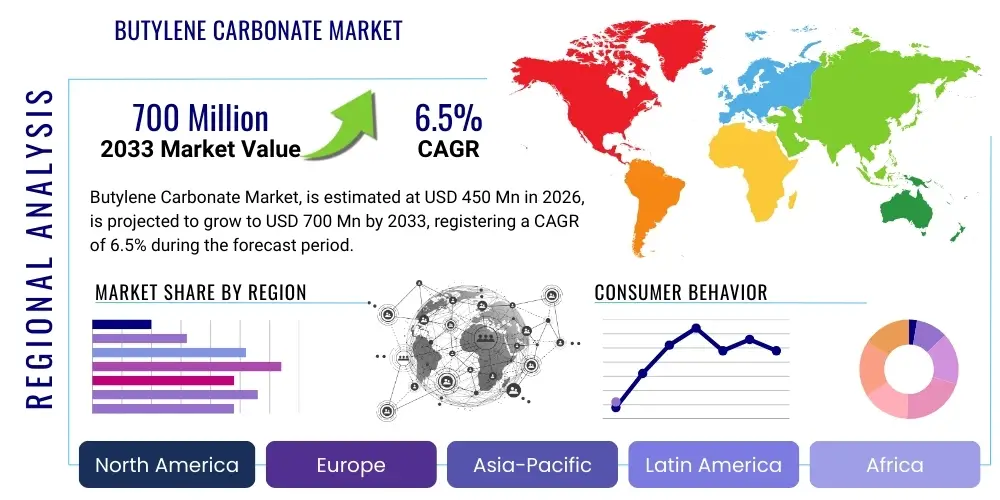

The Butylene Carbonate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 700 Million by the end of the forecast period in 2033.

Butylene Carbonate Market introduction

Butylene Carbonate (BC), specifically 4-ethyl-1,3-dioxolan-2-one, is a crucial organic compound characterized by its high dielectric constant, low viscosity, and excellent thermal stability. Functioning primarily as a high-performance polar aprotic solvent, BC is indispensable in various sophisticated chemical processes and advanced material applications. The primary market driver for BC remains its fundamental role as a solvent component within the electrolyte formulations of lithium-ion (Li-ion) batteries. Its ability to efficiently dissolve lithium salts and ensure stable ion transport is critical for enhancing battery performance, including energy density and cycle life, thereby directly linking its growth trajectory to the burgeoning electric vehicle (EV) and grid storage sectors.

Beyond the high-growth battery sector, Butylene Carbonate is increasingly utilized as a reactive diluent and chemical intermediate in the production of polycarbonates, polyurethanes, and specialized coatings. Its low toxicity profile and favorable environmental characteristics are positioning it as a preferred substitute for conventional, less sustainable solvents in several industrial applications, driving its adoption in green chemistry initiatives. Furthermore, BC acts as a plasticizer and viscosity modifier in specific polymer formulations, granting enhanced physical properties to end products such as adhesives and sealants. The versatility and superior solvency power of Butylene Carbonate underscore its significance within the specialty chemical landscape, necessitating continuous research into high-purity synthesis methods to meet stringent battery-grade requirements.

The core benefits driving market demand include its efficacy in improving battery safety and stability, particularly under high-temperature conditions. As the global transition towards sustainable energy solutions accelerates, driven by stringent governmental mandates and consumer demand for high-performance electronics and electric mobility, the demand for high-purity Butylene Carbonate is set to intensify. Major applications span electric mobility (EVs, e-bikes), consumer electronics (smartphones, laptops), and large-scale renewable energy storage systems. The market’s continued expansion is intricately tied to advancements in Li-ion battery technology and the scale-up of giga-factories globally, demanding consistent supply chain resilience and purity standards for this critical solvent.

Butylene Carbonate Market Executive Summary

The Butylene Carbonate market is experiencing robust momentum, primarily fueled by unprecedented global investment in electric vehicle manufacturing and sustainable energy infrastructure, which are highly reliant on lithium-ion batteries. Key business trends indicate a significant push towards vertical integration among major chemical suppliers, aiming to secure high-purity BC feedstock crucial for battery electrolyte production. Furthermore, strategic partnerships between Butylene Carbonate producers and battery manufacturers are becoming commonplace to stabilize supply chains and meet rigorous technical specifications, especially purity levels reaching 99.99%. Technological innovation is focusing on developing more efficient, lower-cost synthesis routes for BC, often involving catalytic processes utilizing CO2, aligning with carbon capture and utilization (CCU) sustainability goals.

Regionally, the Asia Pacific (APAC) dominates the market, largely driven by the concentration of global battery manufacturing hubs (especially in China, South Korea, and Japan) and significant government support for the EV ecosystem. North America and Europe, however, are exhibiting the highest growth rates, spurred by ambitious regional policies like the European Green Deal and U.S. Inflation Reduction Act, which incentivize localized battery and supply chain production. This shift is creating new demand centers outside of traditional APAC manufacturing zones, prompting major global players to explore capacity expansions in Western geographies to mitigate geopolitical supply risks and reduce long-distance logistics costs associated with hazardous chemical transport.

In terms of segmentation, the Battery Grade segment is the most dominant and fastest-growing category, commanding a substantial premium due to the demanding purity requirements essential for high-performance battery electrolytes. The Industrial Grade segment, encompassing uses in solvents, plasticizers, and chemical intermediates, maintains steady growth, largely driven by applications in high-end coatings and specialized polymer synthesis where BC acts as an effective non-toxic solvent. End-use segmentation confirms the overwhelming dominance of the Electronics and Energy Storage sector, though the Coatings and Polymers sector provides crucial stability and diversification for Butylene Carbonate producers, highlighting the compound’s dual role as both a specialty battery material and a versatile industrial chemical.

AI Impact Analysis on Butylene Carbonate Market

Common user questions regarding AI's impact on the Butylene Carbonate market predominantly center on how artificial intelligence can optimize the complex chemical synthesis process, enhance quality control for battery-grade materials, and predict raw material price volatility. Users are highly interested in AI’s role in material discovery—specifically, identifying novel electrolyte solvent mixtures that incorporate Butylene Carbonate to improve battery performance metrics like charge rate and thermal resilience. The consensus theme is that AI will not replace the need for Butylene Carbonate but will act as a force multiplier, significantly improving efficiency, reducing waste in the production lifecycle, and accelerating the development of next-generation electrolyte systems utilizing BC, thereby solidifying its essential status in the energy transition supply chain through optimized manufacturing and R&D.

- AI-driven optimization of BC synthesis routes: Enhancing catalyst selection and reaction conditions (temperature, pressure) to maximize yield and purity, minimizing energy consumption during large-scale production.

- Predictive quality control (PQC): Utilizing machine learning algorithms to analyze real-time chromatographic data and impurity profiles, ensuring immediate detection and correction to maintain the stringent 99.99% purity required for battery grade BC.

- Supply chain risk management: AI platforms predicting fluctuations in key raw material costs (e.g., 1,2-Butanediol or propylene carbonate feedstock) and optimizing logistics for the safe, timely transport of hazardous chemicals like Butylene Carbonate.

- Accelerated R&D in electrolyte formulation: Employing AI/ML to screen thousands of potential electrolyte additive combinations involving Butylene Carbonate, rapidly identifying optimal mixtures that improve ionic conductivity and reduce solid electrolyte interphase (SEI) instability in Li-ion cells.

- Automated process monitoring: Implementation of industrial IoT and AI interfaces for continuous, autonomous monitoring of BC manufacturing plants, reducing human error and improving operational uptime and safety compliance.

DRO & Impact Forces Of Butylene Carbonate Market

The Butylene Carbonate market is powerfully influenced by the demand elasticity of the lithium-ion battery sector, acting as the primary driver, contrasted sharply by the persistent challenge of maintaining ultra-high purity standards at commercial scale, which acts as a key restraint. The enormous opportunity lies in expanding the compound's use in environmentally benign industrial solvent applications, capitalizing on regulatory pushbacks against traditional hazardous organic solvents. These forces, when synthesized, create a high-impact environment where rapid technological advancement in battery chemistry and stringent purity demands simultaneously drive innovation and constrain market entry, necessitating significant capital expenditure for purification infrastructure.

Drivers include the exponential growth in Electric Vehicle (EV) adoption worldwide, supported by tightening emission regulations and national electrification goals, which directly translates to increased demand for BC-containing electrolytes. Furthermore, the rising deployment of grid-scale energy storage solutions (ESS) for renewable energy integration provides a massive, stable demand base. Restraints primarily involve the complex and energy-intensive purification process required to achieve battery-grade Butylene Carbonate (requiring extremely low moisture and halogen content), which elevates production costs. Additionally, the fluctuating prices of precursor chemicals, often tied to global petrochemical cycles, introduce supply chain instability.

Opportunities center on diversification into non-battery applications, particularly in advanced polymer synthesis where BC’s unique solvent properties can be leveraged. Specific opportunities also exist in developing next-generation battery chemistries, such as solid-state or semi-solid electrolytes, where Butylene Carbonate derivatives or optimized blends may play a critical transitional role. The impact forces are exceptionally high; the industry is currently undergoing fundamental structural shifts due to aggressive capacity expansion in battery manufacturing, making stability of supply, purity, and competitive pricing paramount for market success and long-term viability.

Segmentation Analysis

The Butylene Carbonate market segmentation provides a granular view of how the compound is categorized based on purity level, which dictates its ultimate use, and the specific applications consuming it. The crucial distinction is drawn between battery-grade and industrial-grade BC. Battery-grade BC demands ultra-high purification, making it suitable for sensitive electrochemical environments, while industrial-grade BC serves a broader spectrum of chemical synthesis, coating, and cleaning requirements where the purity threshold is less restrictive. This differential in purity profoundly impacts pricing, production technology employed, and supply chain logistics, defining distinct competitive landscapes within the overall market structure.

The market is predominantly segmented by Grade (Battery Grade and Industrial Grade) and Application (Electronics & Energy Storage, Coatings & Polymers, Pharmaceutical, and Others). The Electronics & Energy Storage segment, driven by Li-ion battery manufacturing, represents the largest share, consistently outpacing other sectors in growth due to ongoing global electrification trends. Understanding these segment dynamics is vital for market players to prioritize investment, focusing heavily on enhancing high-volume, high-purity production capabilities tailored for the energy storage supply chain, while simultaneously maintaining efficient production lines for the more stable industrial segments that offer revenue diversification.

- By Grade:

- Battery Grade (Purity > 99.95%)

- Industrial Grade (Purity 99.5% - 99.9%)

- By Application:

- Electronics and Energy Storage (Li-ion Electrolytes)

- Coatings and Polymers (Reactive Diluent, Monomer)

- Pharmaceutical (Solvent, Intermediate)

- Others (Cleaning Agents, Fine Chemical Synthesis)

Value Chain Analysis For Butylene Carbonate Market

The Butylene Carbonate value chain is characterized by a high degree of integration between upstream feedstock suppliers and specialized downstream manufacturers, emphasizing purity maintenance throughout the process. Upstream, the supply is driven by petrochemical intermediates, primarily 1,2-Butanediol or Propylene Carbonate derivatives, which are then reacted with carbon dioxide (often via catalytic synthesis) to produce crude BC. The efficiency and cost of these upstream processes heavily influence the final product price, and geopolitical stability in petroleum sourcing regions remains a critical risk factor. Upstream complexity is focused on achieving reliable and cost-effective conversion processes, often utilizing proprietary catalytic systems.

The core manufacturing stage involves the synthesis and, critically, the multi-stage purification of crude Butylene Carbonate, particularly for battery-grade material. This purification step—often involving complex distillation, moisture removal, and filtration technologies—is the most value-adding activity, transforming standard chemical output into a premium, highly specialized battery component. Downstream, the value chain diverges, with direct sales channels dominating the battery electrolyte manufacturing segment (OEMs requiring large volumes and technical support) and indirect distribution channels (specialty chemical distributors) serving smaller volumes for the coatings, polymers, and pharmaceutical markets.

The distribution channel logistics are complex due to Butylene Carbonate's classification as a flammable liquid, necessitating specialized handling, storage, and transport compliance. Direct distribution ensures tighter quality control and reduces contamination risk for battery-grade material, facilitating immediate technical liaison between the producer and the battery cell manufacturer. Indirect channels, managed by chemical distributors, focus on consolidating smaller orders, providing localized inventory, and managing regulatory paperwork for industrial consumers. Effective supply chain management must balance the need for rapid, high-volume delivery to giga-factories with the strict regulatory requirements for hazardous chemical transport across international borders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 700 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitsubishi Chemical Group, BASF SE, Oriental Union Chemical Corporation, Shandong Shida Shenghua Chemical Group Co., Ltd., Zibo Hailian Chemical Co., Ltd., Empower Materials, TCI Chemicals (India) Pvt. Ltd., Tokyo Chemical Industry Co., Ltd., Alfa Aesar (Thermo Fisher Scientific), Zhejiang Jiangshan Chemical Co., Ltd., L&L Technology, Dow Chemical Company, Huntsman Corporation, Nanjing Sanle Chemical Industry Co., Ltd., Solventis, Liaoning Oxiranchem, Ltd., MGC (Mitsubishi Gas Chemical Company, Inc.), Korea Petrochemical Ind. Co. Ltd., Sigma-Aldrich (Merck KGaA), and Jiangsu Baina Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Butylene Carbonate Market Potential Customers

The primary and most high-value customers for Butylene Carbonate are manufacturers of lithium-ion battery electrolytes and cell producers globally, especially those focused on the high-end electric vehicle and utility-scale energy storage markets. These customers require Butylene Carbonate (alongside components like ethylene carbonate, dimethyl carbonate, and lithium hexafluorophosphate) in consistently high volumes and, crucially, with exceptionally rigorous purity specifications (battery grade). Their purchasing decisions are driven less by marginal cost savings and more by supply reliability, long-term contractual agreements, and the supplier's proven capability to meet zero-defect standards for electrochemical performance.

Secondary customer segments include specialty chemical formulators and polymer manufacturers. These end-users utilize industrial-grade BC as a versatile, low-VOC (volatile organic compound) solvent in paint and coating formulations, where it acts as a coalescing agent or reactive diluent. In the polymer industry, it serves as a monomer precursor for specific polycarbonates and polyurethanes, requiring stable chemical properties. These buyers are typically focused on balancing price with consistent quality suitable for industrial processes, often sourcing through specialized chemical distributors rather than direct purchase from BC manufacturers.

Furthermore, fine chemical and pharmaceutical companies represent niche but important segments, leveraging BC's polarity and solvency power as a reaction solvent or intermediate in complex synthetic pathways. These customers prioritize regulatory compliance, traceable sourcing, and batch-to-batch consistency. The evolving regulatory landscape encouraging the replacement of toxic solvents ensures that demand from these secondary sectors remains robust, offering diversification opportunities for Butylene Carbonate suppliers beyond the highly volatile and specialized battery sector.

Butylene Carbonate Market Key Technology Landscape

The technological landscape of the Butylene Carbonate market revolves around two primary areas: efficient synthesis and ultra-purification. Current synthesis methods often involve the transesterification of ethylene carbonate or propylene carbonate with 1,2-butanediol, or the direct reaction of 1,2-butanediol with carbon dioxide using specialized heterogeneous catalysts. Key technological advancements are focused on developing catalyst systems, particularly those based on zinc, aluminum, or supported organometallic compounds, that enable high conversion rates and selectivity under milder reaction conditions. The goal is to enhance overall energy efficiency and reduce the formation of unwanted byproducts, minimizing the downstream purification burden and improving the final yield of high-purity BC.

The purification technology is perhaps the most critical determinant of success, especially in the battery-grade segment. Achieving the requisite purity (less than 10 ppm total impurities, with stringent limits on water content and halide ions) necessitates sophisticated, multi-stage distillation columns, often combined with molecular sieves, proprietary drying agents, and specialized filtration techniques in ultra-clean environments. Technological innovation here focuses on continuous monitoring using advanced analytical instruments (like high-performance chromatography) integrated with process control systems to ensure real-time impurity removal and compliance with battery manufacturing specifications. Failures in purification can lead to catastrophic battery performance degradation, making investment in proprietary, rigorous purification infrastructure paramount.

A burgeoning technological trend involves the sustainable synthesis of Butylene Carbonate through Carbon Capture and Utilization (CCU) technologies. By utilizing waste or captured CO2 as a reactant feedstock, manufacturers can achieve significant environmental advantages and potentially stabilize raw material costs, insulating the process from fossil fuel price volatility. While still maturing, this technology is strategically vital for companies aiming for low-carbon production processes. Furthermore, research into novel solvent blends and BC derivatives focuses on materials science innovation to improve electrolyte performance metrics, such as extending the operational temperature range and enhancing the safety profile of future lithium-ion battery chemistries, securing the long-term technological relevance of Butylene Carbonate.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC, led by China, South Korea, and Japan, holds the largest market share due to its overwhelming concentration of global Li-ion battery manufacturing capacity (giga-factories) and electronics production hubs. Government subsidies supporting EV manufacturing and renewable energy storage projects in countries like China and India further solidify the region's position as both the largest producer and consumer of Butylene Carbonate. The regional market structure is characterized by intense price competition and continuous investment in high-volume production capabilities to serve the rapidly expanding local and export battery market.

- North America (NA) Accelerated Growth: North America is poised for the fastest growth, driven by massive investments incentivized by the US Inflation Reduction Act (IRA). This legislation is rapidly localizing the EV and battery supply chain, creating unprecedented demand for domestically or regionally sourced battery-grade Butylene Carbonate. This growth is fostering new production facility announcements and joint ventures between chemical suppliers and major automotive OEMs to secure local supply resilience and mitigate reliance on APAC imports.

- Europe (EU) Strategic Localization: Europe is a key growth region, motivated by the ambitious European Green Deal and associated regulatory pressures to electrify transport and build energy independence. The region is witnessing a strategic push to establish local Butylene Carbonate production capabilities to serve the emerging 'Battery Belt' of giga-factories across Germany, Hungary, and Scandinavia. The focus in Europe is heavily skewed toward sustainability, demanding suppliers adopt green chemistry and CCU methods for BC production.

- Latin America (LATAM) Emerging Potential: While currently small, LATAM holds emerging potential, particularly in countries with significant lithium reserves (Chile, Argentina, Brazil). As these countries scale up their mining and processing capabilities, establishing local battery component manufacturing, including electrolyte solvent production, will become a strategic priority, though implementation faces infrastructure and investment hurdles.

- Middle East and Africa (MEA) Niche Demand: The MEA market segment is characterized by niche demand, primarily serving specialty chemical and industrial solvent requirements rather than large-scale battery production. However, strategic investments in renewable energy infrastructure and the localization of certain manufacturing industries in the Gulf Cooperation Council (GCC) countries suggest modest long-term growth potential for industrial-grade BC.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Butylene Carbonate Market.- Mitsubishi Chemical Group

- BASF SE

- Oriental Union Chemical Corporation

- Shandong Shida Shenghua Chemical Group Co., Ltd.

- Zibo Hailian Chemical Co., Ltd.

- Empower Materials

- TCI Chemicals (India) Pvt. Ltd.

- Tokyo Chemical Industry Co., Ltd.

- Alfa Aesar (Thermo Fisher Scientific)

- Zhejiang Jiangshan Chemical Co., Ltd.

- L&L Technology

- Dow Chemical Company

- Huntsman Corporation

- Nanjing Sanle Chemical Industry Co., Ltd.

- Solventis

- Liaoning Oxiranchem, Ltd.

- MGC (Mitsubishi Gas Chemical Company, Inc.)

- Korea Petrochemical Ind. Co. Ltd.

- Sigma-Aldrich (Merck KGaA)

- Jiangsu Baina Chemical Co., Ltd.

- Capchem Technology Co., Ltd.

- Guangzhou Tinci Materials Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Butylene Carbonate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Butylene Carbonate primarily used for in the rapidly growing battery sector?

Butylene Carbonate (BC) is critically used as a high-performance polar aprotic solvent component in the electrolyte solution of lithium-ion batteries. Its high dielectric constant and stability are essential for efficiently dissolving lithium salts (like LiPF6) and ensuring stable, long-lasting ion transport, crucial for high-energy-density EV batteries.

How does the required purity level of Butylene Carbonate affect its production cost and supply chain?

The requirement for battery-grade Butylene Carbonate (often >99.99% purity) necessitates extensive and energy-intensive multi-stage purification processes, including high-vacuum distillation and complex moisture removal. This process significantly increases production costs and requires specialized, dedicated manufacturing infrastructure, creating high barriers to entry for new suppliers.

Which geographical region dominates the consumption and production of Butylene Carbonate, and why?

The Asia Pacific (APAC) region, specifically East Asia (China, South Korea, Japan), dominates both the production and consumption of Butylene Carbonate. This dominance is directly attributed to the region’s established leadership in global lithium-ion battery manufacturing and the high concentration of electric vehicle and consumer electronics production facilities.

Is Butylene Carbonate considered an environmentally friendly solvent, and what are its alternative applications?

Yes, Butylene Carbonate is often viewed favorably due to its low toxicity profile and status as a low-VOC (volatile organic compound) solvent. Beyond batteries, its alternative applications include serving as a reactive diluent in specialized coatings and polymers, and as a solvent or intermediate in the synthesis of fine chemicals and pharmaceuticals.

What are the primary technological challenges facing Butylene Carbonate manufacturers today?

The main challenges involve developing more cost-effective and energy-efficient synthesis routes (ideally utilizing captured CO2) and continuously improving ultra-purification technologies to meet increasingly stringent battery performance specifications required by next-generation Li-ion chemistries. Maintaining supply chain stability amidst volatile raw material pricing is also a major operational hurdle.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager