Buy Now Pay Later Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432404 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Buy Now Pay Later Services Market Size

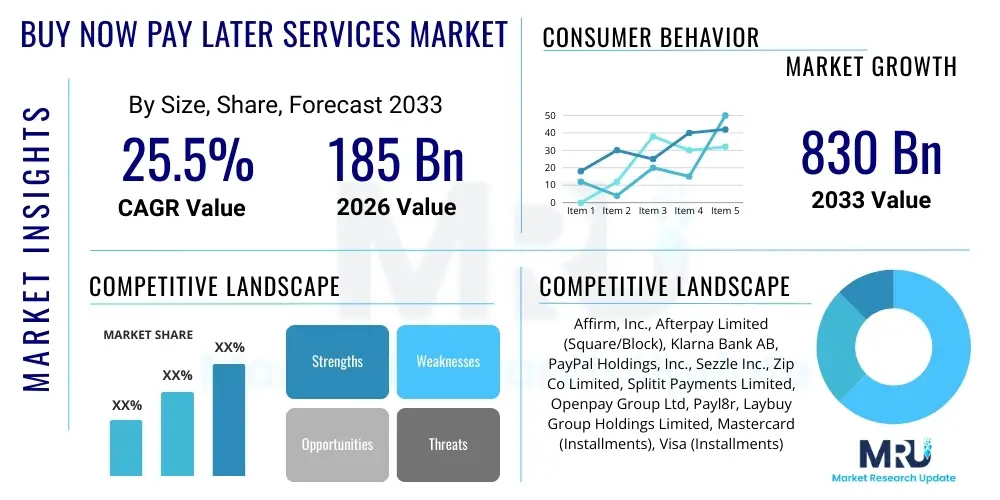

The Buy Now Pay Later Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033. The market is estimated at $185 Billion USD in 2026 and is projected to reach $830 Billion USD by the end of the forecast period in 2033.

Buy Now Pay Later Services Market introduction

The Buy Now Pay Later (BNPL) services market encompasses deferred payment solutions offered primarily at the point of sale, enabling consumers to purchase goods or services immediately and pay in fixed installments over a short duration, often without incurring interest. These short-term financing options are typically integrated into e-commerce checkouts and increasingly utilized in physical retail environments, revolutionizing consumer credit access. Key BNPL products include pay-in-four models and longer-term installment plans, fundamentally shifting the paradigm of consumer debt from traditional credit cards to more flexible, transparent, and manageable micro-loans.

Major applications of BNPL services span across high-growth sectors such as retail (fashion, electronics, home goods), travel, and healthcare. The primary benefits driving consumer adoption include enhanced affordability, especially for younger demographics wary of traditional credit mechanisms, and a streamlined checkout experience that contributes significantly to reduced cart abandonment rates for merchants. For retailers, BNPL acts as a potent sales conversion tool, increasing average order value (AOV) and customer loyalty by lowering the immediate financial hurdle associated with purchases.

Driving factors underpinning the market's explosive growth include the global surge in e-commerce adoption, particularly post-pandemic, which necessitates seamless digital payment options. Furthermore, the high penetration of smartphones and widespread access to digital banking services facilitate instantaneous credit decisions and transaction processing. The aversion of Millennials and Generation Z to accumulating high-interest credit card debt further propels the demand for transparent, zero-interest installment options provided by leading BNPL platforms.

Buy Now Pay Later Services Market Executive Summary

The BNPL market is characterized by robust business trends centered on global expansion, strategic partnerships between providers and major payment networks (Visa, Mastercard), and diversification into new verticals like B2B services and large-ticket healthcare financing. Providers are heavily focused on leveraging data analytics and proprietary credit scoring algorithms to manage risk and maintain profitability in a highly competitive landscape. A significant trend involves consolidation, as larger fintech firms or traditional financial institutions acquire specialized BNPL players to integrate these services into broader banking ecosystems, preparing for impending regulatory changes.

Regionally, North America and Asia Pacific dominate the market trajectory. North America exhibits high per-capita usage and mature merchant integration, though it faces increasing scrutiny from financial regulators regarding consumer protection. The Asia Pacific region is a primary growth engine, fueled by vast unbanked populations, rapid mobile commerce adoption, and strong government pushes for digital payments, particularly in countries like India and Southeast Asia. European growth remains steady, driven by strong established players, but is heavily influenced by the stringent consumer credit regulations set forth by EU authorities, prioritizing responsible lending practices.

Segment trends reveal that the 'Retail/E-commerce' application segment maintains the largest market share, but the 'Healthcare' and 'Travel' segments are exhibiting the fastest growth rates, signaling diversification beyond traditional goods. In terms of service type, the 'Zero-Interest Installment' model is currently the most popular among consumers due to its transparent cost structure, though interest-bearing, longer-term plans are gaining traction for higher-value purchases, indicating market maturity and the bridging of consumer gaps previously addressed only by personal loans.

AI Impact Analysis on Buy Now Pay Later Services Market

User questions regarding AI's impact on BNPL services predominantly center on themes of fairness, risk management accuracy, and the speed of decision-making. Consumers and industry stakeholders are frequently asking: "How is AI preventing fraud and mitigating rising default rates?" and "Will AI algorithms lead to fairer credit access for those underserved by traditional finance, or will they exacerbate algorithmic bias?" There is also intense interest in AI's role in personalizing payment plans and automating compliance checks. The consensus theme is that AI is indispensable for scaling BNPL operations, particularly by optimizing the balance between frictionless consumer experience and robust financial integrity, although ethical deployment remains a key concern.

The core application of Artificial Intelligence (AI) and Machine Learning (ML) in the BNPL market lies in dynamic credit risk assessment. Traditional credit scoring is often inadequate for the rapid, small-ticket transactions characterizing BNPL. AI systems ingest vast quantities of non-traditional data—such as transactional history, device details, and behavioral patterns—to generate highly accurate, instantaneous risk profiles. This rapid assessment is crucial for maintaining the promise of a seamless checkout experience while minimizing exposure to bad debt, a major vulnerability for BNPL providers operating on slim margins.

Furthermore, AI significantly enhances operational efficiency and customer engagement. On the operational front, sophisticated predictive analytics are used for early identification of potential delinquencies, allowing for proactive, tailored intervention strategies before a user defaults. For customer interaction, AI powers conversational bots and automated service platforms, handling routine inquiries about payment schedules or disputes, thereby reducing reliance on costly human call centers. This AI-driven automation is critical for BNPL companies aiming to achieve rapid, low-cost scalability across multiple global markets.

- AI optimizes real-time fraud detection and anomaly scoring using deep learning models.

- Machine Learning algorithms enable personalized dynamic credit limits and repayment schedules tailored to individual user behavior.

- AI automates regulatory compliance checks across different jurisdictions, ensuring adherence to responsible lending mandates.

- Predictive modeling enhances collection efficiency by forecasting likelihood of default and optimizing communication timing.

- Natural Language Processing (NLP) improves customer service through intelligent chatbots and automated dispute resolution systems.

DRO & Impact Forces Of Buy Now Pay Later Services Market

The BNPL market is propelled by strong Drivers related to consumer shifts and digital penetration, countered by significant Restraints primarily stemming from regulatory uncertainty and the inherent risk of consumer over-indebtedness. Opportunities exist in market expansion into untapped demographics and sectors. The overall Impact Forces are high, signifying that external environmental factors, particularly technological evolution and legislative responses, exert a powerful and immediate influence on market structure and growth trajectory.

Key drivers include the global expansion of e-commerce, which offers BNPL providers a massive, ready-to-integrate platform for their services. Additionally, the increasing dissatisfaction among young consumers with complex, high-interest credit card debt pushes them toward the transparent, installment-based BNPL model. High impact forces are driven by the network effects inherent in BNPL platforms: as more major retailers integrate a provider, the service becomes more valuable and visible to consumers, accelerating adoption across the entire ecosystem.

However, the market faces significant restraints. The principal challenge is the growing regulatory scrutiny worldwide, with governments debating whether BNPL should be classified as consumer credit subject to the same strict lending laws as traditional banks. Increased regulation could mandate complex affordability checks, slowing down the frictionless checkout process—the core competitive advantage of BNPL. Furthermore, high default rates, particularly during economic downturns, pose a material financial risk to providers, requiring continuous refinement of risk assessment models and potentially necessitating higher merchant fees or stricter underwriting, which could impact user growth.

- Drivers: Rapid e-commerce growth; increasing consumer preference for flexible, transparent micro-loans; high mobile wallet penetration.

- Restraints: Growing regulatory pressure and potential classification as consumer debt; risks associated with consumer over-indebtedness and high delinquency rates; increasing competition leading to margin compression.

- Opportunities: Expansion into B2B payments (B2B BNPL); adoption in high-value services like healthcare and education; geographic expansion into emerging markets (LATAM, MEA).

- Impact Forces: High. Market trajectory is heavily dictated by speed of technological innovation (AI/ML deployment) and governmental regulatory frameworks.

Segmentation Analysis

The BNPL market is primarily segmented by Channel, Application, and Business Model. The analysis confirms that digital channels remain the dominant revenue source, reflecting the market’s origin in e-commerce, but there is substantial strategic emphasis on expanding into physical retail environments through integrated point-of-sale (POS) systems and card integrations. Application segmentation highlights the critical role of retail and consumer electronics, while the underlying business model differentiation—zero-interest versus interest-bearing plans—dictates profitability and regulatory exposure for providers.

Understanding these segment dynamics is crucial for investment strategy. For instance, the transition towards interest-bearing models for larger purchases (e.g., above $1,000) shows market maturation, enabling providers to access higher-margin revenue streams. Simultaneously, the success of the zero-interest 'Pay-in-Four' model in retail is highly dependent on merchant subsidization, making robust merchant acquisition and retention a key performance indicator for providers operating in that segment.

- By Channel:

- Online (E-commerce Integration)

- Offline (In-store POS Integration)

- By Application:

- Retail and Consumer Goods (Fashion, Apparel, Home Furnishings)

- Electronics

- Healthcare and Wellness

- Travel and Hospitality

- Media and Entertainment

- Others (Education, Auto Services)

- By Service Model:

- Zero-Interest Installments (Pay-in-Four)

- Interest-Bearing Longer-Term Plans

- By End User:

- Individual Consumers

- B2B (Business-to-Business)

Value Chain Analysis For Buy Now Pay Later Services Market

The BNPL value chain is characterized by a high degree of integration between fintech platforms and the merchant ecosystem. Upstream analysis focuses on the data providers and technological infrastructure that supply credit assessment tools, KYC verification, and transaction processing APIs—elements critical for instantaneous underwriting. This upstream efficiency directly determines the speed and accuracy of the service offered at the point of sale. Key stakeholders include data aggregators, AI/ML developers, and core banking system providers.

Downstream activities are dominated by merchant acquisition and consumer interaction. Distribution channels are predominantly direct-to-consumer via integrated e-commerce plug-ins (indirect distribution through platforms like Shopify or Magento) and direct integration into specific retailer checkouts. The flow involves the consumer initiating a purchase, the BNPL platform instantly assessing risk and underwriting the loan, paying the merchant immediately (minus a transaction fee), and subsequently managing the consumer’s repayment schedule and collection process. This immediate payment to the merchant is the critical value proposition supporting high merchant fees.

The distinction between direct and indirect distribution channels impacts market penetration speed. Direct integrations with large, single-brand retailers offer high volume but require bespoke development. Indirect distribution, utilizing third-party payment gateways or e-commerce platform partnerships, provides rapid scalability across thousands of smaller and medium-sized enterprises (SMEs). Managing debt collection and recovery is the final crucial downstream step, which is increasingly outsourced or managed using sophisticated AI-driven communication strategies to minimize default losses.

Buy Now Pay Later Services Market Potential Customers

The primary customer base for BNPL services encompasses younger, digitally native demographics, specifically Millennials and Gen Z, who often possess insufficient traditional credit history or actively seek to avoid accumulating high-interest credit card debt. These consumers value transparency, flexibility, and a seamless digital experience. They typically use BNPL for discretionary purchases in the $50 to $1,000 range, optimizing cash flow management without resorting to high-cost payday loans or revolving credit.

Secondary, yet rapidly growing, customer segments include individuals with thin credit files or those who are unbanked or underbanked, particularly in emerging markets where BNPL acts as a necessary gateway to modern commerce. Furthermore, older, affluent consumers are increasingly utilizing BNPL for budgeting purposes and taking advantage of promotional zero-interest terms for high-ticket items like luxury goods, home renovations, or elective medical procedures, using it as a cash flow management tool rather than a necessity.

Merchants, particularly those in competitive retail sectors, constitute another crucial customer type. They adopt BNPL not as a payment method per se, but as a mechanism for driving higher sales conversion rates, increasing Average Order Value (AOV), and boosting customer lifetime value (CLV). Merchants pay a transaction fee for this service, viewing it as a marketing and retention expense rather than a pure processing fee, as it directly impacts their top-line revenue growth.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185 Billion USD |

| Market Forecast in 2033 | $830 Billion USD |

| Growth Rate | CAGR 25.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Affirm, Inc., Afterpay Limited (Square/Block), Klarna Bank AB, PayPal Holdings, Inc., Sezzle Inc., Zip Co Limited, Splitit Payments Limited, Openpay Group Ltd, Payl8r, Laybuy Group Holdings Limited, Mastercard (Installments), Visa (Installments), GreenSky, Humm Group Limited, Atome, FinAccel (Kredivo), Opy (Openpay), PayBright (Affirm), Jifiti. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Buy Now Pay Later Services Market Key Technology Landscape

The technological backbone of the BNPL market is defined by three interconnected pillars: advanced Application Programming Interfaces (APIs), sophisticated machine learning models, and secure, scalable cloud infrastructure. Robust APIs are essential for seamless, low-latency integration into thousands of merchant platforms and existing payment gateways, allowing BNPL options to be presented instantly and accurately at the digital point of sale. Without highly optimized APIs, the key benefit of frictionless checkout would be compromised, leading to consumer drop-off. Furthermore, specialized APIs are necessary to connect with credit bureaus, identity verification services, and alternative data providers in real-time.

Machine Learning (ML) constitutes the core competitive technology, particularly in credit underwriting and risk mitigation. Providers utilize deep learning models to process heterogeneous data sets—including device fingerprints, transaction velocity, and geographic location—to generate instant decisions on applicant eligibility and appropriate credit limits. This reliance on ML not only speeds up the approval process but also allows BNPL providers to extend credit effectively to segments traditionally excluded by outdated FICO scoring systems, fundamentally challenging the existing financial infrastructure. Continuous model training is necessary to adapt to evolving fraud tactics and shifting consumer repayment behaviors.

Blockchain and distributed ledger technology (DLT) are emerging technologies that hold significant promise for the BNPL sector, particularly in enhancing transparency and facilitating cross-border transactions. While not yet mainstream, DLT could provide a tamper-proof record of consumer repayment histories, potentially leading to a globally recognized, standardized 'BNPL credit score.' Furthermore, the pervasive integration with mobile payment technologies (digital wallets like Apple Pay and Google Pay) and dedicated mobile applications is crucial, as the majority of BNPL transactions originate from mobile devices, demanding high performance, robust security protocols, and intuitive user interfaces optimized for mobile commerce.

Regional Highlights

The regional dynamics of the Buy Now Pay Later Services Market exhibit substantial variance based on consumer credit maturity, e-commerce penetration, and regulatory posture.

- North America (NA): Represents a highly mature market characterized by rapid growth driven by the dominance of key players like Affirm and Block (Afterpay). Adoption is high across all retail sectors, and penetration is moving aggressively into physical retail. Key market relevance lies in technological innovation, particularly in AI-driven credit scoring, but the region faces high scrutiny from the Consumer Financial Protection Bureau (CFPB) regarding fees, disclosure, and potential consumer harm. The U.S. remains the largest single market globally for transaction volume.

- Europe: The European market is fragmented but highly developed, led by established giants like Klarna. The key highlight is the balance between innovation and strong regulatory frameworks (e.g., in the UK and Sweden), which often prioritize stricter consumer protection standards, potentially leading to higher compliance costs for providers but fostering greater consumer trust and sustainable growth. Germany and the UK are primary markets, with significant potential remaining in Southern and Eastern Europe.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by explosive e-commerce adoption, a large young population, and significant pockets of underbanked consumers. Countries like Australia (early adopter), India, and Indonesia show immense potential. Market relevance is defined by its role in providing financial inclusion and leveraging local mobile wallet ecosystems. Regulatory environments are mixed, ranging from supportive financial digitalization policies to cautious approaches to debt accumulation.

- Latin America (LATAM): This region is characterized by high rates of credit card aversion, significant mobile commerce usage, and inflationary economies, making BNPL an attractive financing alternative. Growth is accelerating, particularly in Brazil and Mexico, but providers must navigate challenges related to currency volatility and varying levels of digital infrastructure quality.

- Middle East and Africa (MEA): Growth is nascent but promising, particularly in the GCC (Gulf Cooperation Council) nations which have high purchasing power and digital penetration (e.g., UAE, Saudi Arabia). The challenge lies in adapting services to comply with Islamic finance principles (Sharia compliance), requiring non-interest-based models, which aligns naturally with many zero-interest BNPL structures, presenting a unique growth opportunity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Buy Now Pay Later Services Market.- Affirm, Inc.

- Afterpay Limited (Square/Block)

- Klarna Bank AB

- PayPal Holdings, Inc.

- Sezzle Inc.

- Zip Co Limited

- Splitit Payments Limited

- Openpay Group Ltd

- Laybuy Group Holdings Limited

- Mastercard (Installments)

- Visa (Installments)

- GreenSky

- Humm Group Limited

- Atome

- FinAccel (Kredivo)

- Opy (Openpay)

- PayBright (Affirm)

- Jifiti

- Alipay

- TendoPay

Frequently Asked Questions

Analyze common user questions about the Buy Now Pay Later Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the BNPL Market?

The Buy Now Pay Later Services Market is projected to grow at a robust CAGR of 25.5% between 2026 and 2033, driven primarily by increasing e-commerce penetration and shifting consumer preferences away from traditional credit.

What are the primary risks associated with the expansion of Buy Now Pay Later services?

The primary risks include increasing governmental regulatory scrutiny, particularly concerning adequate consumer disclosure and affordability checks, and the inherent financial risk posed by rising default and delinquency rates, which can impact provider profitability.

How is Artificial Intelligence (AI) fundamentally changing BNPL credit scoring?

AI is utilizing sophisticated machine learning models to analyze non-traditional and transactional data in real-time, enabling instantaneous and highly personalized credit decisions at the point of sale, thereby minimizing fraud and extending credit to thin-file consumers.

Which geographical region is currently experiencing the fastest growth in the BNPL market?

The Asia Pacific (APAC) region is demonstrating the fastest market growth, fueled by rapid mobile commerce adoption, vast unbanked populations accessing digital credit, and supportive financial digitalization initiatives in countries like India and Indonesia.

What are the key differences between the Zero-Interest and Interest-Bearing BNPL models?

Zero-Interest BNPL (typically Pay-in-Four) generates revenue primarily from merchant fees and late fees, offering consumers a cost-free solution if payments are timely. Interest-Bearing models, typically used for larger ticket items, generate revenue through consumer interest charged over a longer repayment period, resembling traditional installment loans.

Is the B2B sector a viable growth opportunity for BNPL providers?

Yes, the B2B sector represents a significant growth opportunity, offering business customers flexible payment terms for inventory and supplies. B2B BNPL addresses cash flow constraints for SMEs and leverages the BNPL technology stack to digitize archaic invoicing and credit processes.

How does BNPL impact merchant revenue and sales conversion?

BNPL services are proven to significantly increase Average Order Value (AOV) by making higher-priced items more accessible, and they substantially reduce cart abandonment rates by offering a flexible payment option at checkout, directly boosting merchant sales conversion.

What role do APIs play in the success of BNPL services?

APIs (Application Programming Interfaces) are critical, facilitating seamless, low-latency integration between the BNPL platform and thousands of disparate e-commerce systems and payment gateways, ensuring the service is presented instantly and accurately to consumers without disrupting the checkout flow.

Are traditional financial institutions entering the BNPL market?

Yes, traditional financial institutions (banks and payment networks like Visa and Mastercard) are actively entering the BNPL space, either through launching proprietary installment products integrated into existing credit cards or through strategic acquisitions of specialized fintech BNPL firms.

How are providers attempting to mitigate the risk of consumer over-indebtedness?

Providers are implementing measures such as stricter initial credit checks, soft limits on the number of concurrent loans an individual can hold across their platform, and utilizing AI models for early identification and proactive intervention regarding potential delinquency markers.

What factors contribute to the high adoption rate among Generation Z consumers?

Gen Z consumers favor BNPL due to its transparency, aversion to traditional high-interest revolving credit, and alignment with digital-first shopping habits. The quick, low-commitment nature of the Pay-in-Four model aligns well with their cash flow management preferences.

How will regulatory classification of BNPL as consumer credit affect the market?

If uniformly classified as consumer credit, BNPL providers will likely face mandatory stringent affordability checks (know-your-customer regulations), potentially slowing down the transaction speed and increasing operational compliance costs, thereby challenging the low-friction user experience.

In which application segment is BNPL expected to see the highest growth?

While retail remains the largest segment, the Healthcare and Travel application segments are expected to see the highest growth rates as consumers increasingly seek installment options for high-value elective procedures, dental work, and flight bookings.

What is the significance of mobile integration for the BNPL market?

Mobile integration is paramount, as the majority of BNPL transactions occur via mobile devices. Robust, secure, and user-friendly mobile applications and seamless integration with mobile wallets are essential for maintaining user engagement and transaction velocity.

What is the role of technology in BNPL debt collection?

Technology, specifically predictive analytics and AI-driven communication platforms, optimizes debt collection by analyzing user behavior to determine the most effective timing and method for contact, maximizing recovery rates while minimizing the use of traditional, costly collection agencies.

What constitutes the upstream segment of the BNPL value chain?

The upstream segment primarily includes data infrastructure providers, specialized risk and fraud prevention software vendors, KYC/AML verification services, and the core banking platform providers that enable real-time fund transfers and account management.

How does BNPL profitability differ between regions?

Profitability varies regionally due to diverse merchant fee structures, regional default rates, and the cost of regulatory compliance. Developed markets like the US often sustain high profitability through large transaction volumes, while emerging markets present higher risk but significantly higher potential scalability.

Are there regional differences in the preferred BNPL service model?

Yes, the Pay-in-Four model dominates North America and Australia for consumer retail, whereas Europe (especially Germany and Sweden) shows a higher affinity for invoicing or pay-later models (30-60 days deferred payment), influenced by specific cultural preferences and market history.

What is the key driver attracting merchants to adopt BNPL solutions?

The key driver is the immediate and measurable increase in conversion rates and the ability to move high-value inventory by breaking the cost barrier for consumers, treating the BNPL transaction fee as a necessary cost of sales rather than just a payment processing expense.

How is DLT/Blockchain relevant to the future of the BNPL market?

DLT could enhance market transparency, particularly in cross-border transactions, and potentially facilitate the creation of immutable, universally accessible consumer repayment histories, leading to more standardized and fairer credit access globally.

What is the estimated market size for Buy Now Pay Later services in 2033?

The global BNPL Services Market is projected to reach an estimated value of $830 Billion USD by the end of the forecast period in 2033, reflecting substantial and sustained market expansion.

Which end-user segment is driving the latest market innovation?

While individual consumers drive volume, the B2B segment is driving the latest innovation, demanding sophisticated underwriting models and larger credit lines to facilitate supply chain financing and inventory purchases through flexible installment payment arrangements.

What impact did the COVID-19 pandemic have on the BNPL market?

The pandemic acted as a major catalyst, accelerating the shift towards e-commerce and digital payments globally. Consumers sought flexible budgeting options during financial uncertainty, leading to an unprecedented surge in BNPL adoption and merchant integration.

How do BNPL providers manage liquidity to pay merchants instantly?

Providers rely on robust funding mechanisms, including secured credit facilities, partnerships with institutional lenders, and sometimes securitization of their loan portfolios, ensuring they have sufficient capital to disburse funds to merchants immediately upon consumer approval.

What are the primary challenges for BNPL expansion into emerging markets?

Challenges include low digital literacy among certain segments, high rates of cash-based economies, unreliable digital identity verification infrastructure, and the need to tailor offerings to address varying levels of mobile and internet penetration.

How do BNPL providers ensure data security and privacy for users?

Providers must adhere to strict global data protection regulations (like GDPR and CCPA) and deploy advanced encryption, tokenization, and multi-factor authentication methods to protect sensitive financial and personal information stored within their proprietary cloud infrastructure.

What are the major applications of BNPL services outside of traditional retail?

Major non-retail applications include financing for education (tuition payments), home services (repairs, maintenance), and automotive services (parts and repairs), expanding BNPL's utility beyond purely discretionary spending.

Why is partnership with payment networks (Visa/Mastercard) crucial for BNPL providers?

Partnerships with global payment networks are crucial as they enable BNPL solutions to be offered in offline, physical retail environments via existing card infrastructure, dramatically expanding the serviceable market and competition against traditional card-issuing banks.

How do providers manage cross-border transactions and currency risk?

Managing cross-border risk involves utilizing specialized payment processors and treasury management services, often necessitating local banking licenses or partnerships to manage currency fluctuations and comply with jurisdiction-specific payment regulations efficiently.

What is the impact of BNPL on traditional credit card usage?

BNPL is serving as a deflationary force on traditional credit card usage, especially among younger consumers, who view BNPL as a more budget-friendly and less debt-accumulating alternative for managing short-term consumer financing needs.

How do BNPL platforms utilize behavioral economics to drive repayment compliance?

Platforms use behavioral nudges, such as timely and transparent reminders, gamification of repayment schedules, and clear visualization of remaining balances, encouraging consumers to maintain timely payments and avoid late fees, optimizing collection efforts.

What is the market relevance of Latin America (LATAM) in the BNPL sector?

LATAM holds high market relevance due to a large, digitally active, yet often underbanked population, creating a substantial demand gap for accessible short-term credit solutions that BNPL providers are rapidly capitalizing on, particularly in Brazil and Mexico.

Which segment of the BNPL market is most sensitive to changes in interest rates?

The Interest-Bearing Longer-Term Plans segment is most sensitive to interest rate changes, as providers in this segment rely on competitive cost of capital. Fluctuations directly impact their borrowing costs and, consequently, the attractiveness of their lending rates to consumers.

What is the primary function of the downstream segment in the BNPL value chain?

The primary function of the downstream segment is focused on consumer engagement, repayment management, debt collection, and merchant relationship management, ensuring smooth operation of the installment cycle post-purchase.

Why is transparency a key competitive factor for BNPL services?

Transparency is a key competitive factor because it builds consumer trust, distinguishing BNPL from opaque traditional credit products. Clear fee structures and installment schedules are essential for attracting Millennials and Gen Z who prioritize ethical and straightforward financial products.

What are the main technology challenges facing BNPL providers in 2026?

In 2026, main technology challenges include continuous refinement of ML models to counter increasingly sophisticated fraud, achieving seamless integration across fragmented global e-commerce platforms, and scaling infrastructure rapidly while maintaining low transaction latency.

How is the BNPL market responding to the threat of rising global inflation?

In response to inflation, BNPL providers are focusing on promoting their services as necessary budgeting tools to spread out high purchase costs. However, they must simultaneously tighten underwriting criteria to mitigate the higher default risks associated with economic downturns and rising cost of living.

What is the role of key companies like Klarna and Afterpay in market consolidation?

Major companies like Klarna and Afterpay (Block) are driving market consolidation by either acquiring smaller, geographically focused BNPL providers or integrating their services into vast existing ecosystems (like Square/Block), thereby expanding their vertical and geographic reach.

How do BNPL services specifically benefit small and medium-sized enterprises (SMEs)?

BNPL benefits SMEs by enhancing their ability to compete with larger retailers, offering essential financing options without requiring the SME to manage the credit risk internally, leading to increased sales and improved cash flow.

What is the current regulatory outlook for BNPL services in North America?

The current regulatory outlook in North America points toward stricter oversight, potentially requiring providers to adopt standardized disclosures, conduct more rigorous consumer affordability assessments, and report payment data to credit bureaus to enhance consumer protection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager